Attached files

| file | filename |

|---|---|

| 8-K - 8-K - LABORATORY CORP OF AMERICA HOLDINGS | form8-kmay2013pptannualmee.htm |

2013 ANNUAL MEETING OF STOCKHOLDERS MAY 8, 2013 | BURLINGTON, NC

This slide presentation contains forward-looking statements which are subject to change based on various important factors, including without limitation, competitive actions in the marketplace and adverse actions of governmental and other third-party payors. Actual results could differ materially from those suggested by these forward-looking statements. Further information on potential factors that could affect the Company’s financial results is included in the Company’s Form 10-K for the year ended December 31, 2012, and subsequent SEC filings. FORWARD LOOKING STATEMENT 2

3 LABCORP A PREMIER HEALTHCARE SERVICES COMPANY A Premier Healthcare Services Company Strong Financial Fundamentals Attractive Market Superior Execution Five Pillar Strategy Clear Mission

We Will Be a Trusted Knowledge Partner for Stakeholders, Leading to Growth in Our Business and Continued Creation of Shareholder Value We Will Achieve This Mission by Continuing to Execute Our Five Pillar Strategy MISSION STATEMENT 4

Deploy Capital to Investments That Enhance Our Business and Return Capital to Shareholders FIVE PILLAR STRATEGY PILLAR ONE 5

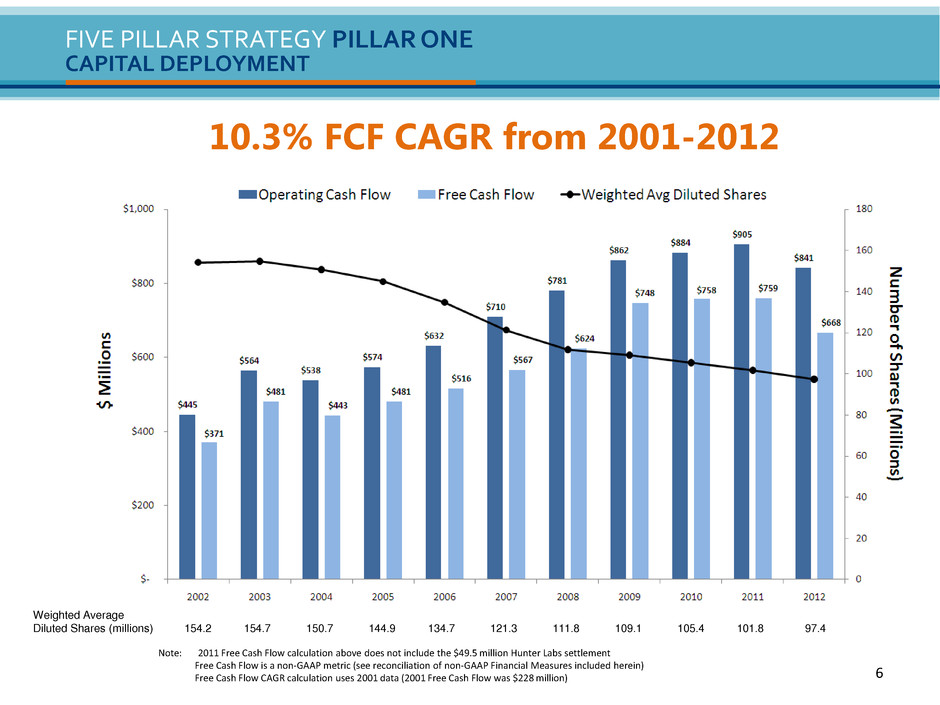

Cash Flow Trends Note: 2011 Free Cash Flow calculation above does not include the $49.5 million Hunter Labs settlement Free Cash Flow is a non-GAAP metric (see reconciliation of non-GAAP Financial Measures included herein) Free Cash Flow CAGR calculation uses 2001 data (2001 Free Cash Flow was $228 million) 10.3% FCF CAGR from 2001-2012 Weighted Average Diluted Shares (millions) 154.2 154.7 150.7 144.9 134.7 121.3 111.8 109.1 105.4 101.8 97.4 FIVE PILLAR STRATEGY PILLAR ONE CAPITAL DEPLOYMENT 6

*GENZYME GENETICSSM and its logo are trademarks of Genzyme Corporation and used by Esoterix Genetic Laboratories, LLC, a wholly-owned subsidiary of LabCorp, under license. Esoterix Genetic Laboratories and LabCorp are operated independently from Genzyme Corporation. Five-Year Capital Snapshot • Acquisitions: Genzyme Genetics*, Orchid Cellmark, MEDTOX Scientific • Approximately $2.1 billion of share repurchase since 2008 • Approximate 50/50 split between acquisitions and share repurchase since 2008 FIVE PILLAR STRATEGY PILLAR ONE CAPITAL DEPLOYMENT 7 LabCorp Capital Deployment Quest Diagnostics 2008 2009 2010 2011 2012 Total Cash from Operating Activities 780.9$ 862.4$ 883.6$ 855.6$ 841.4$ 4,223.9$ Total Capital Deployed 839.2$ 603.6$ 1,650.0$ 927.9$ 1,025.4$ 5,046.1$ Capital Expenditures 156.7$ 114.7$ 126.1$ 145.7$ 173.8$ 717.0$ % Total Capital Deployed 19% 19% 8% 16% 17% 14% Cash Us d for Acquisitions 348.9$ 215.9$ 1,185.8$ 138.3$ 335.1$ 2,224.0$ % Total Capital Deployed 42% 36% 72% 15% 33% 44% Cash Used for Share Repurchase 333.6$ 273.0$ 338.1$ 643.9$ 516.5$ 2,105.1$ % Total Capital Deployed 40% 45% 20% 69% 50% 42% Source: SEC Fil ings

Enhance IT Capabilities To Improve Physician and Patient Experience FIVE PILLAR STRATEGY PILLAR TWO 8

LabCorp Beacon™ Platform • Rich web portal and mobility framework o Physician, Patient and Payor portals o Mobility solutions • Enhanced Efficiency and Service o Online appointment scheduling o Express Orders o AccuDraw™ o Integrated results, enhanced reports • Lab Analytics o One-click trending of patient, test and population o View lab history • Services Oriented Architecture o Rules based engines o Content aggregation o Plug in model for seamless integration with practice workflow o Scalable, big data model 9 FIVE PILLAR STRATEGY PILLAR TWO ENHANCE IT CAPABILITIES

Continue to Improve Efficiency to Offer the Most Compelling Value in Laboratory Services FIVE PILLAR STRATEGY PILLAR THREE 10

Our Focus on Efficiency • Constant focus on cost structure • Standardization o Lab platforms, instruments and processes o Billing system • Supply chain optimization • Automation of pre-analytics • Facility rationalization • Propel splitting and sorting robotics 11 FIVE PILLAR STRATEGY PILLAR THREE IMPROVE EFFICIENCY

Scientific Innovation At Appropriate Pricing FIVE PILLAR STRATEGY PILLAR FOUR 12

Companion diagnostics and personalized medicine • IL-28B • BRAF V600E metastatic melanoma (Zelboraf) • Vysis ALK Break Apart FISH probe (XALKORI) • K-RAS • HLA-B* 5701 • EGFR Mutation Analysis • HCV GenoSure® NS3/4A • PhenoSense®, PhenoSense GT® • HERmark® • SNP Microarray-Oncology • CYP 450 2C19 Women’s health • ROMA • Nuswab STD testing on a single swab • Expanded Vaginosis and Candida testing • Expanded options for HPV DNA testing • Age-based guideline testing initiative for HPV • Non-Invasive Prenatal Screening Our core competencies in science, IT and personalized medicine make LabCorp an attractive partner for drug development 13 FIVE PILLAR STRATEGY PILLAR FOUR SCIENTIFIC INNOVATION AT APPROPRIATE PRICING

Development of Knowledge Services FIVE PILLAR STRATEGY PILLAR FIVE 14

15 FIVE PILLAR STRATEGY PILLAR FIVE EVOLUTION OF HEALTHCARE DELIVERY Fundamental Changes in Healthcare “Center of Gravity” • Health systems • IDNs • ACOs • PCMHs • Mega-physician practices • Managed care collaborations with and ownership of all of the above

16 CLEAR MISSION A TRUSTED KNOWLEDGE PARTNER A Trusted Partner to Healthcare Stakeholders, Providing Knowledge to Optimize Decision Making, Improve Health Outcomes and Reduce Treatment Costs ACQUISITIONS IT CAPABILITIES SCIENCE OTHER INPUTS BEACONLBS LITHOLINK/CDS INTERPRETATION EDUCATIONAL TOOLS

1. Excluding the $0.25 per diluted share impact of restructuring and other special charges and the $0.27 per diluted share impact from amortization in 2007; excluding the $0.44 per diluted share impact of restructuring and other special charges and the $0.31 per diluted share impact from amortization in 2008; excluding the ($0.09) per diluted share impact of restructuring and other special charges and the $0.35 per diluted share impact from amortization in 2009; excluding the $0.26 per diluted share impact of restructuring and other special charges and the $0.43 per diluted share impact from amortization in 2010; excluding the $0.72 per diluted share impact of restructuring and other special charges, the $0.03 per diluted share impact from a loss on the divestiture of assets and the $0.51 per diluted share impact from amortization in 2011; excluding the $0.29 per diluted share impact of restructuring and other special charges and the $0.54 per diluted share impact from amortization in 2012 2. EPS, as presented represents adjusted, non-GAAP financial measures. Diluted EPS, as reported in the Company’s Annual Report were: $3.93 in 2007; $4.16 in 2008; $4.98 in 2009; $5.29 in 2010; $5.11 in 2011; and $5.99 in 2012 3. 2008 revenue includes a $7.5 million adjustment relating to certain historic overpayments made by Medicare for claims submitted by a subsidiary of the Company Revenue and Adjusted EPS Excluding Amortization Growth: 2007 – 2012 1,2,3 EXCELLENT PERFORMANCE 17 $4.068 $4.513 $4.695 $5.004 $5.542 $5.671 2007 2008 2009 2010 2011 2012 $4.45 $4.91 $5.24 $5.98 $6.37 $6.82 2007 2008 2009 2010 2011 2012 Adjusted EPS Excluding Amortization Revenue ($Billions)

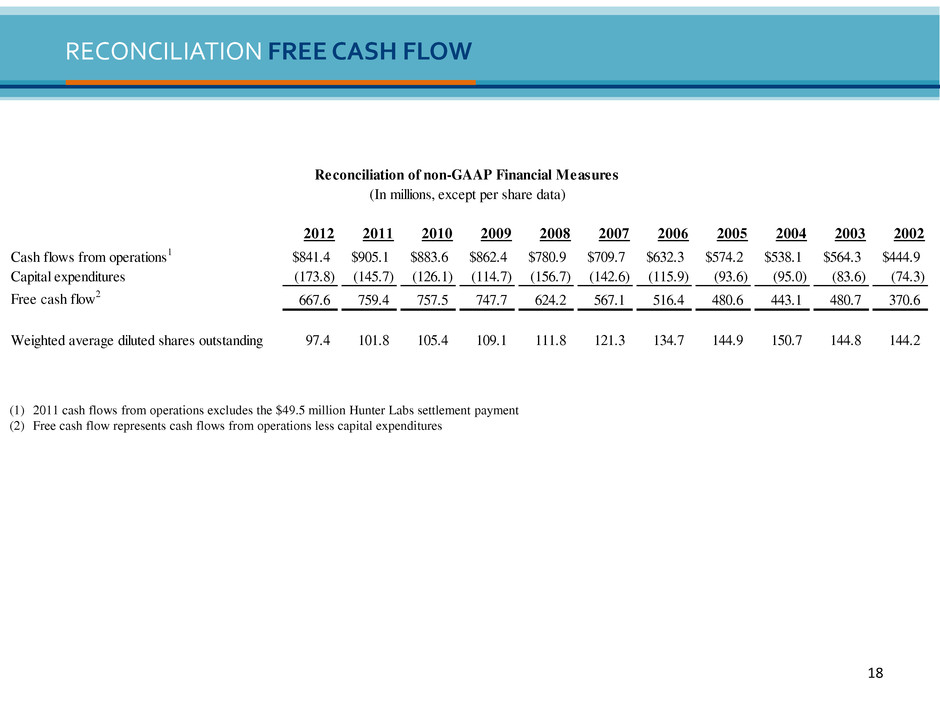

Reconciliation of Free Cash Flow (1) 2011 cash flows from operations excludes the $49.5 million Hunter Labs settlement payment (2) Free cash flow represents cash flows from operations less capital expenditures 2012 2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 Cash flows from operations1 841.4$ 905.1$ 883.6$ 862.4$ 780.9$ 709.7$ 632.3$ 574.2$ 538.1$ 564.3$ 444.9$ Capital expenditures (173.8) (145.7) (126.1) (114.7) (156.7) (142.6) (115.9) (93.6) (95.0) (83.6) (74.3) Free cash flow2 667.6 759.4 757.5 747.7 624.2 567.1 516.4 480.6 443.1 480.7 370.6 Weighted average diluted shares outstanding 97.4 101.8 105.4 109.1 111.8 121.3 134.7 144.9 150.7 144.8 144.2 Reconciliation of non-GAAP Financial Measures (In millions, except per share data)RECONCILIATION FREE CASH FLOW 18