Attached files

| file | filename |

|---|---|

| 8-K - 8-K - PROVIDENT FINANCIAL SERVICES INC | d526424d8k.htm |

| EX-99.1 - EX-99.1 - PROVIDENT FINANCIAL SERVICES INC | d526424dex991.htm |

1

Annual Meeting

Annual Meeting

of Stockholders

of Stockholders

April 25, 2013

April 25, 2013

Exhibit 99.2 |

Certain

statements contained herein are "forward-looking statements" within the meaning of Section 27A of the Securities

Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Such forward-looking

statements may be identified by reference to a future period or periods, or by the use of

forward-looking terminology, such as "may," "will," "believe,"

"expect,"

"estimate,"

"anticipate,"

"continue,"

or

similar

terms

or

variations

on

those

terms,

or

the

negative

of

those

terms. Forward-looking statements are subject to numerous risks and uncertainties,

including, but not limited to, those related to the economic environment, particularly in

the market areas in which Provident Financial Services, Inc. (the “Company”)

operates, competitive products and pricing, fiscal and monetary policies of the U.S. Government, changes in

government regulations affecting financial institutions, including regulatory fees and capital

requirements, changes in prevailing interest rates, acquisitions and the integration of

acquired businesses, credit risk management, asset-liability management, the

financial and securities markets and the availability of and costs associated with sources of liquidity.

The Company cautions readers not to place undue reliance on any such forward-looking

statements, which speak only as of the

date

made.

The

Company

also

advises

readers

that

the

factors

listed

above

could

affect

the

Company's

financial

performance and could cause the Company's actual results for future periods to differ materially

from any opinions or statements expressed with respect to future periods in any current

statements. The Company does not undertake and specifically declines any obligation to

publicly release the result of any revisions which may be made to any forward- looking

statements to reflect events or circumstances after the date of such statements or to reflect the occurrence of

anticipated or unanticipated events.

A detailed discussion of factors that could affect our results is included in our SEC filings,

including the “Risk Factors” section of our Annual Report on Form 10-K for

the year ended December 31, 2012. 2

Forward Looking Statements |

Superior

Markets Consistent Performance

Valuable Deposit Franchise

Proven Asset Generator

Capable Risk Manager

Shareholder Focused

3

Why PFS? |

New

Jersey’s oldest state chartered bank Over 75 branch offices

Wealth Management and Trust Administration Services

Well capitalized under current regulatory standards

Ten year history of quarterly cash dividends to stockholders

No TARP

No dilutive stock offerings

No bulk NPA sales or debt restructurings

4

Company Highlights |

5

Total Return |

6

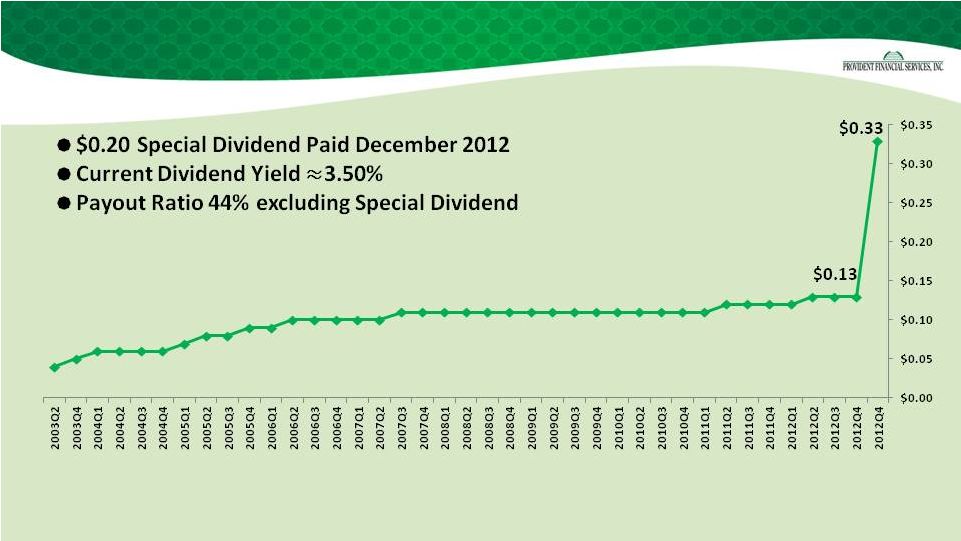

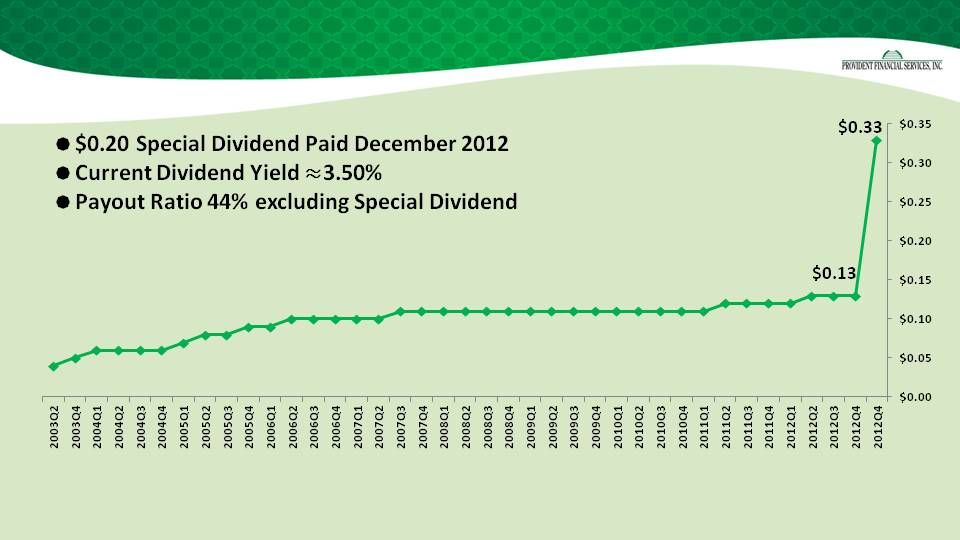

Dividend History |

7

2012: A Record Setting Year

2012

Change vs. 2011

Total Assets

$7.3 B

$186 M

2.6%

Loans

$4.9 B

$251 M

5.4%

Total Deposits

$5.4 B

$272 M

5.3%

Non-Interest Bearing Deposits

$864 M

$166 M

24.0% |

8

2012: A Record Setting Year

2012

Change vs. 2011

Net Income

$67 M

$10 M

17.3%

EPS

$1.18

$0.17

16.8%

ROAA

0.94%

0.11%

13.3%

ROATE

10.88%

1.07%

10.9% |

9

*Excludes impact of $152.5 million of Goodwill impairment in 2009.

A Longer View: Structural Gains

2012

2009

Net Interest Margin

3.38%

3.06%

Loans/Deposits

90.4%

89.5%

Net Revenues

$261M

$212M

Provision for Loan Losses

$16M

$30M

Net Income

$67M

$31M* |

10

Asset Quality 5 Quarter Trend

$135,351

$134,783

$129,141

$119,586

$111,463

1.91%

1.89%

1.81%

1.65%

1.53%

4 Q 2011

1 Q 2012

2 Q 2012

3 Q 2012

4 Q 2012

NPAs

NPAs/Assets |

$6.8 B

$7.3 B

11

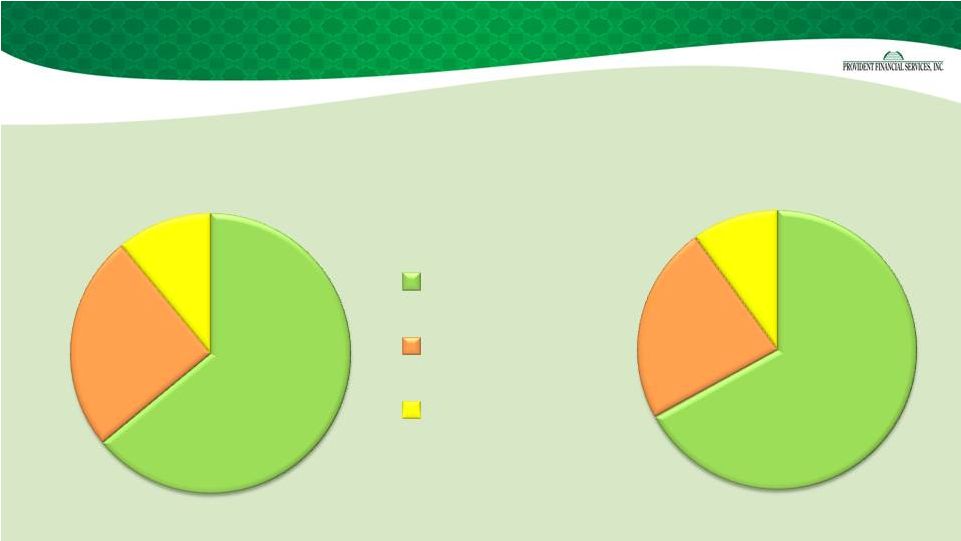

A Longer View: Structural Gains

64%

25%

11%

2009

67%

23%

10%

2012

Loans

Investments

Other

Asset Composition |

12

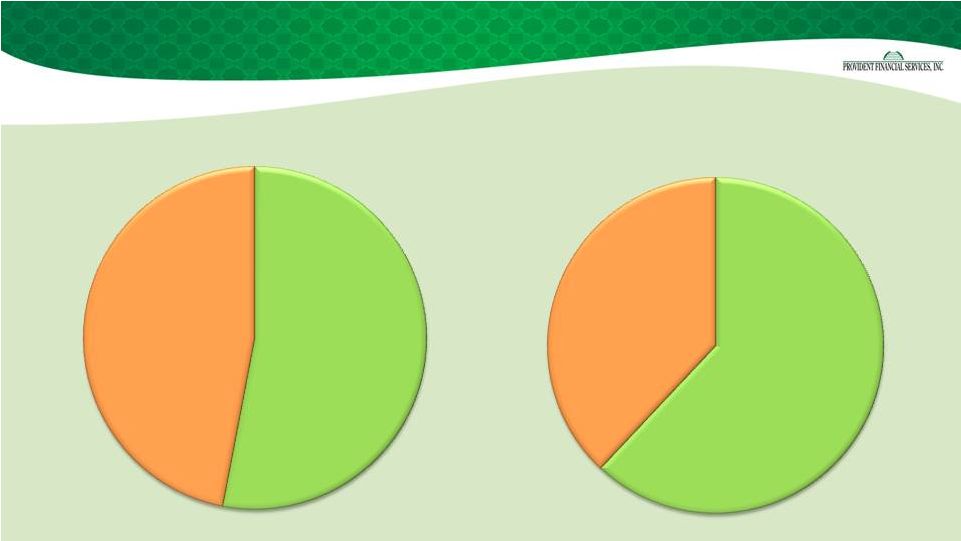

A Longer View: Structural Gains

Loan Composition

Commercial

$2.3B

53%

Consumer

$2.1B

47%

2009

Commercial

$3.1B

62%

Consumer

$1.8B

38%

2012 |

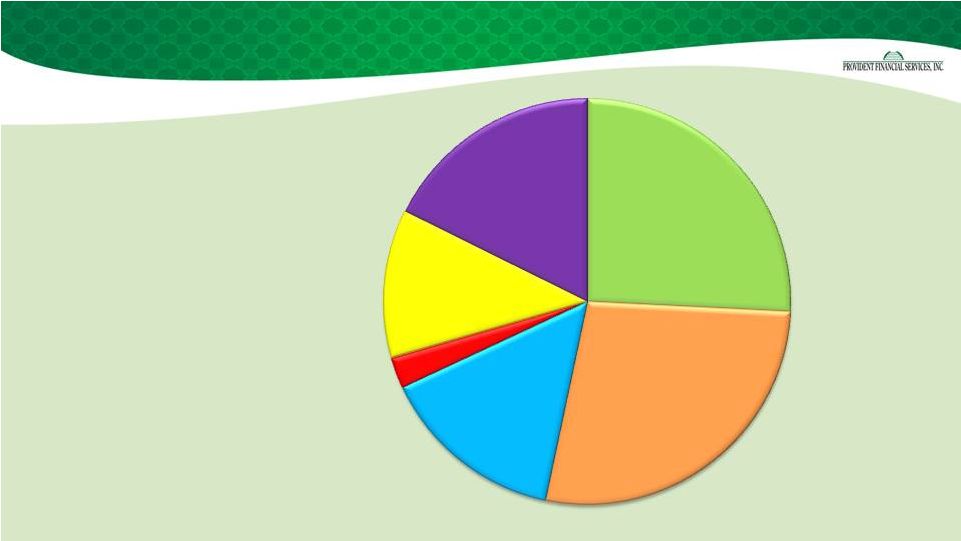

Total Loans:

$4.9 Billion Average Loan Yield: 4.58%

13

Loan Portfolio –

12/31/12

1-4

Residential

26%

CRE

27%

Multi-family

15%

Construction

2%

Consumer

12%

C&I

18% |

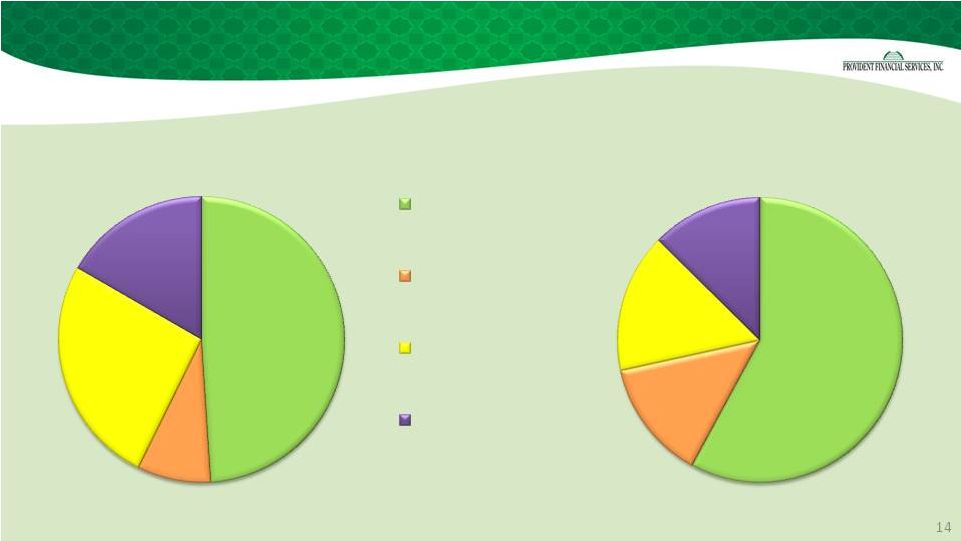

14

A Longer View: Structural Gains

Funding / Earning Assets

47%

8%

25%

16%

2009

55%

13%

15%

12%

2012

Interest Bearing

Core Deposits

Non

-Interest

Bearing Deposits

Time Deposits

Borrowings |

15

* Not meaningful

Provident

Consolidated

Bank

PFS

Tangible Common Equity

*

9.00%

Tier 1 Leverage

7.80%

8.93%

Tier 1 Risk-Based Capital

11.08%

12.68%

Total Risk-Based Capital

12.33%

13.93%

Capital Ratios –

12/31/12 |

16

Capital flexibility

Recent additions to lending teams in Middle Market /

Consumer / Healthcare / CRE

Technology enhancements

Sandy stimulus

Accelerating economic recovery

Opportunities |

17

COMMITMENT

YOU CAN COUNT ON. |