Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Federal Home Loan Bank of Topeka | d524938d8k.htm |

Exhibit 99.1

Remarks at 2013 Annual Management Conference

Andrew J. Jetter, President and C.E.O.

Federal Home Loan Bank of Topeka

April 25, 2013

Slide 1

It is my pleasure to welcome you to our 2013 Management Conference. I hope you enjoyed Herm Edwards’ thoughts on leadership. I’m sure you will enjoy the rest of the conference just as much.

As you have heard me say before, I can take little credit for the high quality of this conference other than to appreciate my good fortune in working with so many outstanding people. So let me thank all of the staff who worked so hard to put on this educational, interesting and fun conference. Great job! Thank you!

My primary reason for talking to you today is to give you an update on your Federal Home Loan Bank. You are both our customers and our owners. We exist to provide financial products to you and we measure our performance based on how well we serve you.

Before I get into my presentation, I want to thank you for having elected an outstanding board of directors. They provide diligent oversight to FHLB’s strategies, policies and activities. Most importantly, they are your voice to management, letting us know what is and what is not important to the membership. We have 11 of our 15 directors in attendance today. Let me introduce them to you.

Our two newest directors – Kent Needham from The First Security Bank in Overbrook, Kansas, and Tom Olson, Jr., from Points West Community Bank in Julesburg, Colorado - are both with us today.

Your other directors in attendance include:

| • | Board Chairman Bridge Cox, Ardmore, Oklahoma |

| • | Harley Bergmeyer, Wilber, Nebraska |

| • | Jim Hamby, Ada, Oklahoma |

| • | Skip Hove, Lincoln, Nebraska |

| • | Jane Knight, Wichita, Kansas |

| • | Neil McKay, Topeka, Kansas |

| • | Mark O’Connor, Lakewood, Colorado |

| • | Mark Schifferdecker, Girard, Kansas |

| • | Bruce Schriefer, Wichita, Kansas |

SLIDE 2:

Today, I’d like to cover three topics with you. First, an overview of our performance in 2012.

Second, a brief review of the performance of the FHLBank system.

Page 1

And finally, I want to address the state of the mortgage finance and GSE reform.

SLIDE 3:

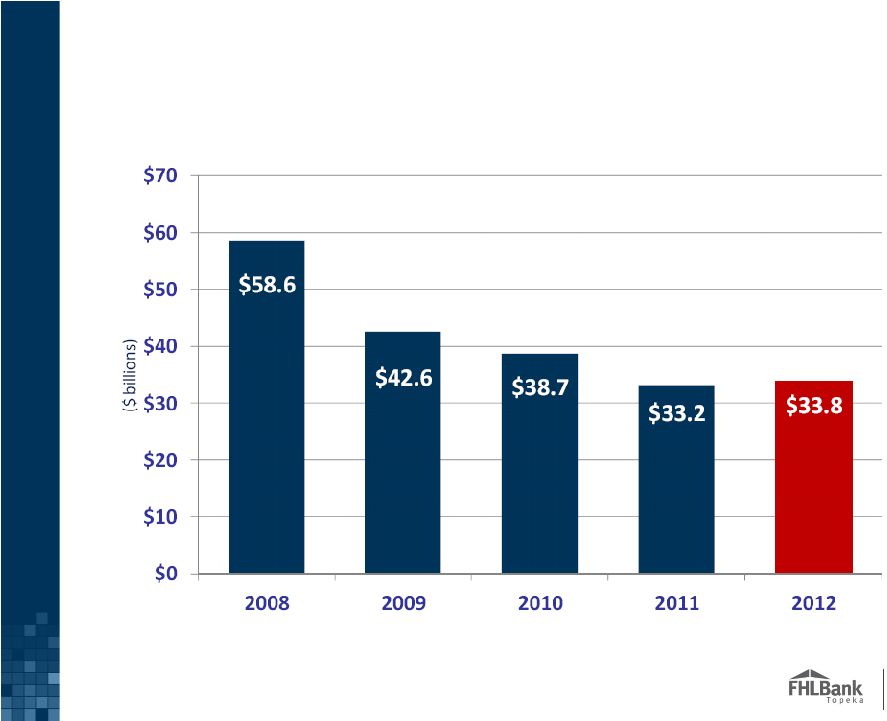

At year-end 2012, our total assets were just under $34 billion – up slightly from last year. This followed several years of decline which was largely driven by decreases in advance balances.

SLIDE 4:

Advance business stood at $16.6 billion at the end of 2012, down 5% from 2011. Advances have declined since the height of the financial crisis in 2008 when the Federal Home Loan Banks stepped in to provide the liquidity needed by our members. As liquidity on your balance sheets rose, your need for advances decreased.

We continue to work to identify profitable and lower risk strategies where our members can use our advances to fund loans on their balance sheets. In fact, we have a number of breakout sessions focused on lending strategies, including one Friday morning led by Wil Osborn and David Harris titled, “Get in the Game with FHLBank’s Portfolio Lending Strategy.”

SLIDE 5:

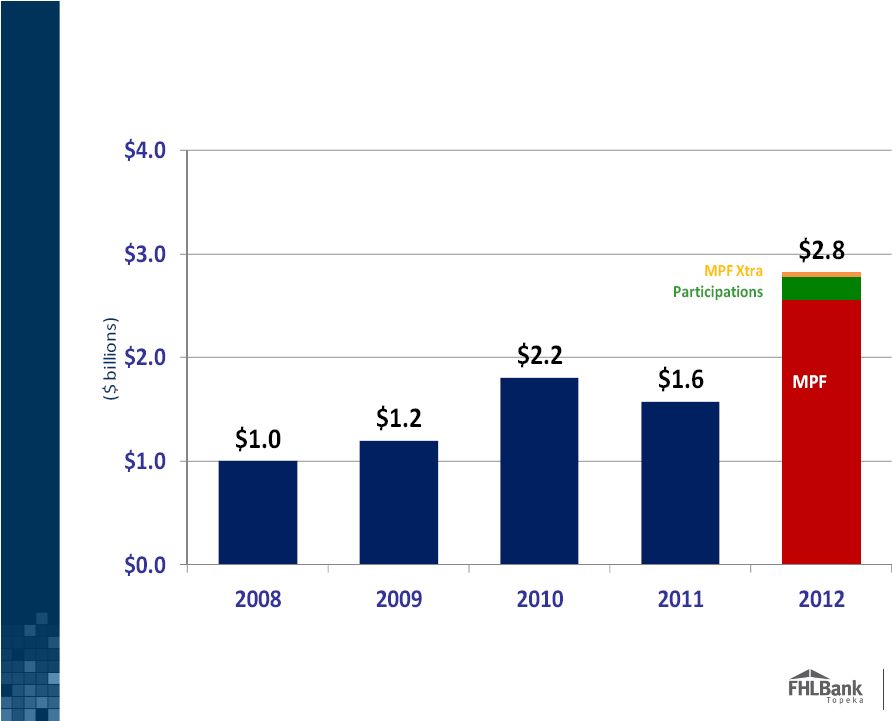

Our Mortgage Partnership Finance Program, referred to as MPF, has proven to be an outstanding success. Large volumes are being sold into the Program, and more members are signing up to become participating financial institutions, or PFIs. Our members are excited about the MPF Program because it allows them to sell on favorable terms, while also getting paid for their underwriting expertise. The size of our MPF portfolio has grown significantly over the last few years and has been a major contributor to our strong profitability. At year-end 2012, our MPF assets totaled just under $6 billion.

However, there are limits to the size of the fixed rate mortgage portfolio that we will carry on our balance sheet. So, we have been actively pursuing different strategies to moderate the growth of our MPF portfolio. One of those strategies is to offer MPF Xtra, a service in which we effectively aggregate mortgages to be sold to Fannie Mae. We began offering MPF Xtra late last year and processed $34 million in volume through that program in 2012. And we are continuing to sign up PFIs for this program.

We have also reached out to other Federal Home Loan Banks to gauge their interest in participating in our MPF production. During the fourth quarter of last year, we participated $231 million of our MPF production to the FHLBank of Indianapolis. And finally, we continue to evaluate the option of selling some of our MPF portfolio as we did in 2011.

SLIDE 6:

However, our overriding objective for our MPF Program is to serve as a mortgage outlet for you and keep these balance sheet management efforts invisible. We continue to believe the MPF Program is a superior “skin-in-the-game” mortgage origination model that provides enormous benefits to both member community financial institutions and FHLBank.

This chart shows the volume of mortgages that we have aggregated from you over the past five years. In 2012, we aggregated $2.8 billion of mortgages. We kept some; we participated some to another FHLBank; and we passed through some to Fannie through our MPF Xtra program.

We believe that serving as an aggregator of mortgage loans for our members is an important role for FHLBank Topeka and one that may become even more relevant as we look at the future of Fannie and Freddie and the evolution of a new mortgage finance system in this country.

Page 2

SLIDE 7:

We reported income on a GAAP basis of $110 million in 2012, up from $77 million in 2011. However, there are a variety of items that make year over year comparisons on a GAAP basis difficult. So we also use adjusted income – a non-GAAP measure – to evaluate the quality of our ongoing earnings.

We remove from GAAP income the volatile effects of derivatives accounting. We also remove what we would term nonrecurring items. These are items that we don’t believe are representative of the future performance of the Bank such as prepayment fees. For a more thorough definition of adjusted income, I refer you to our 10-K annual report filed with the Securities and Exchange Commission.

After we take into account all of these adjustments, we have a better comparative measure of our profitability. For 2012, our adjusted income was $130 million – about level with 2011.

As a result of this solid performance, we paid out dividends of 3.5% on our Class B capital stock and 0.25% on our Class A capital stock.

SLIDE 8:

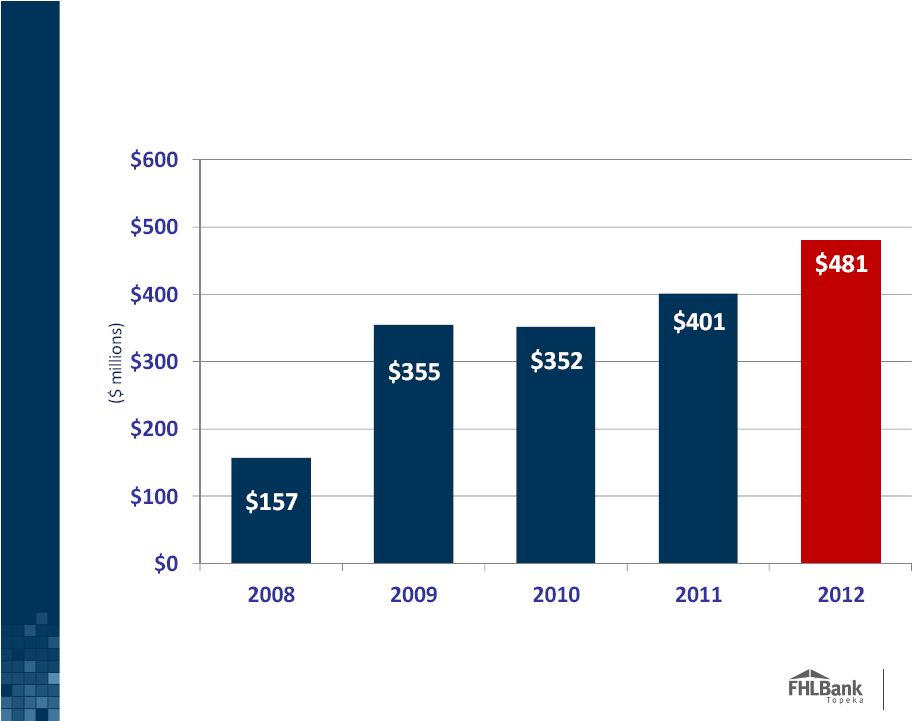

Retained earnings is a critical component of capital for us as it is more stable than member capital which rises and falls with advance activity. During 2012, retained earnings increased to $481 million.

When we satisfied our obligation under REFCorp in mid-2011, the 12 FHLBanks entered into a Joint Capital Enhancement agreement.

Essentially, we agreed to augment retained earnings through the establishment of a Restricted Retained Earnings account. Each year we direct 20% of our earnings into this account and will do so until the balance reaches 1% of consolidated obligations. At year-end, we had $28 million in Restricted Retained Earnings.

Page 3

SLIDE 9:

Total capital stood at $1.7 billion at the end of 2012 and our total capital ratio was 5.1% - well above the minimum requirement of 4.0%.

SLIDE 10:

Now, on to FHLBank System numbers. You’ll see that total assets were $763 billion at year-end 2012, nearly level with 2011 following declines since 2008.

SLIDE 11:

Total System advances at the end of 2012 were $426 billion – up 2%, but less than half of year-end 2008 near the height of the financial crisis.

SLIDE 12:

Total mortgage loans declined to $49 billion.

The decline principally relates to several FHLBanks that have stopped purchasing loans for their portfolio. During 2012, there were five FHLBanks that purchased over $1 billion in mortgage loans from members: Des Moines, Cincinnati, Boston, Indianapolis, and, of course, Topeka.

SLIDE 13:

During 2012, the FHLBanks aggregated over $18 billion in mortgage originations from our members – primarily from community financial institutions.

This represents 1% of the $1.8 trillion in U.S. mortgage originations in 2012 and shows the important role the FHLBanks can serve for our community financial institutions as a mortgage aggregator.

Whether we aggregate to hold in our portfolio, participate to other FHLBanks or pass through to securitization sponsors today – or develop the capacity to pass on to other members and investors in the future - our role as a mortgage aggregator is very important.

SLIDE 14:

The System earned $2.6 billion last year on a GAAP income basis - a strong performance with a profitable year for every one of the 12 FHLBanks.

SLIDE 15:

Total retained earnings rose to over $10 billion at the end of 2012. This growth in permanent capital is a source of strength for the FHLBanks.

Restricted Retained Earnings for the system was $716 million. And as I mentioned earlier, 20% of our earnings are placed into this account annually.

Page 4

SLIDE 16:

At the end of 2012, System capital totaled $43 billion with a total capital ratio of 5.6%.

SLIDE 17:

Next let’s turn to the mortgage finance market and GSE reform.

At $10 trillion, the mortgage market is second only in size to the stock market. So it is important that mortgage finance reform is successful – and done right.

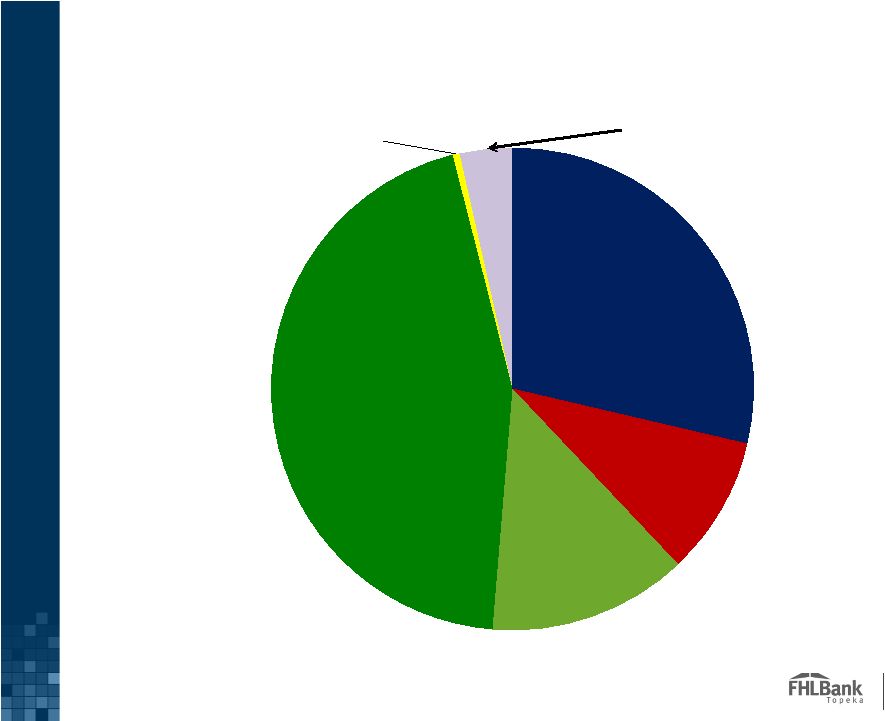

We use this chart to show who bears the credit risk of mortgage loans. The numbers are as of December 31, 2012.

The “green” shaded slices represent mortgages that the federal government backstops. This totals $5.7 trillion, or 58% of all residential mortgage assets. This includes Fannie, Freddie, Ginnie Mae, FHA, VA and other government programs.

The “blue” shaded slice represents mortgages that financial institutions such as yours, hold on their books. This totals $2.8 trillion, or 29% of the total.

The “red” slice shows mortgage loans underlying Private Label MBS securities. This totals $920 billion, or 9% of the total. I should note that this market effectively dried up shortly after the start of the financial crisis.

The FHLBanks are the small “yellow” slice with $49 billion, or 1/2 of 1% of the market.

These roles – portfolio lending, securitization and the federal government’s imprint - have changed dramatically over the past 50 years.

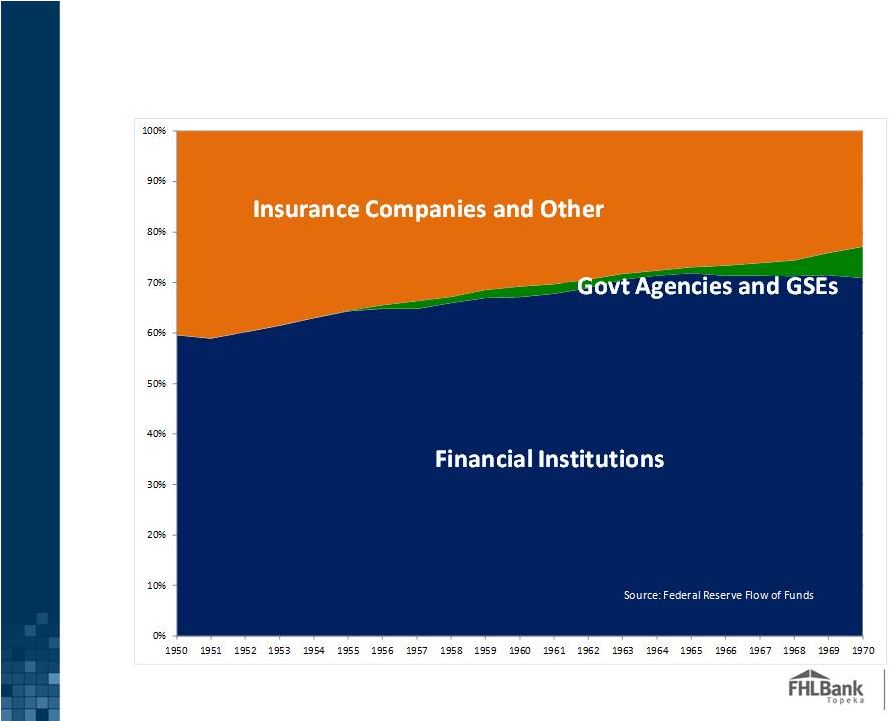

SLIDE 18:

Historically, the mortgage market existed only because the savings and loans, banks and insurance companies held these loans in their portfolios.

The “orange” shaded area is insurance companies and other non-banking firms. They held 40% of mortgage assets in the early 1950s, declining to 30% by the end of the 1960s.

The “blue” shaded area are savings and loans, banks and other financial institutions. They dominated the market with over 60% to 70% of the mortgage assets held on their books.

The “green” shaded area shows primarily the government programs at that time which were FHA and VA.

The FHA was created in 1934. And the “original” Fannie Mae was formed in 1938 for the sole purpose of purchasing FHA insured loans in a secondary market capacity.

Page 5

In 1968, the “original” Fannie Mae was subsequently partitioned into two separate entities. Ginnie Mae was created for government guaranteed programs and the “current” Fannie Mae was established to provide a secondary market for conventional mortgages.

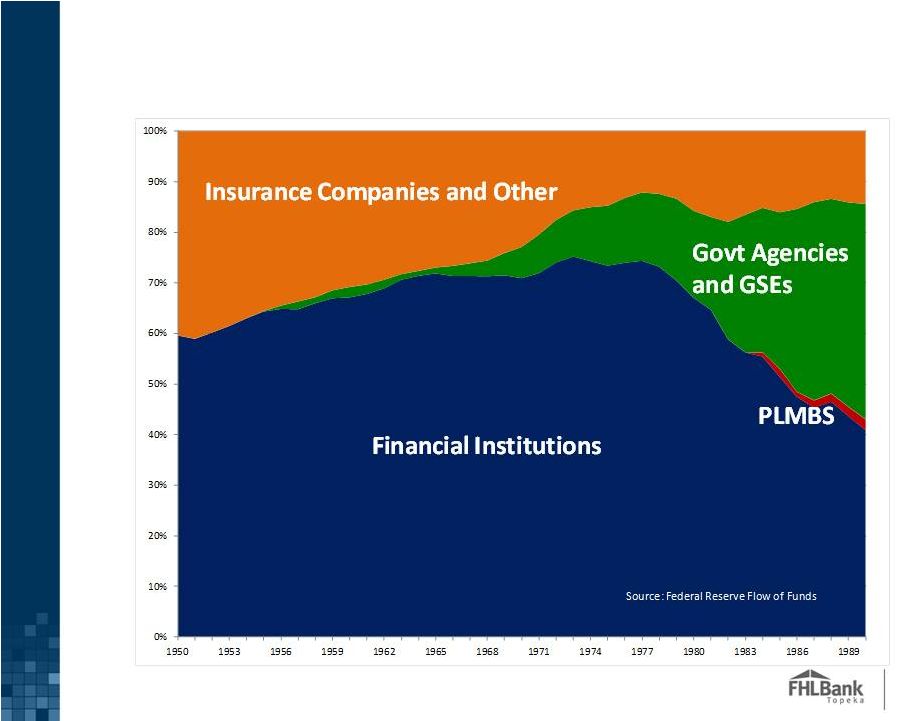

SLIDE 19:

As we add on the 1970s and the 1980s, we start to see the emergence of the secondary mortgage market, securitizations, and the decline of portfolio lending.

Ginnie Mae brought the first mortgage-backed security to market in 1970; Freddie Mac, which was created in 1970 to be the secondary market for savings and loans, issued its first MBS in 1971; and it was not until 1981 that Fannie Mae issued its first MBS.

By the end of the 1980s, financial institutions held only 40% of the mortgage loans directly in their portfolio. And insurance companies and others dropped to approximately 20% of the market.

Fannie and Freddie began to hold more significant positions through their securitizations and guarantees of mortgage loans.

And there was a very small amount of private label MBS entering the market during this period.

SLIDE 20:

As we take this chart into the 1990s through 2012, we see the growing influence and dependence on securitization, the implicit federal guarantee on Fannie & Freddie MBS, and the growth in Ginnie Mae issuance.

We saw strong growth in privately-issued MBS at the height of the mortgage boom, but we ultimately realized what was packaged in those securities.

And since the financial crisis in 2008, we have seen portfolio lending declining with nearly complete dependence on Fannie, Freddie and Ginnie Mae securitizations with their implicit or explicit federal guarantees.

SLIDE 21:

So with securitization, there was a much larger capacity to absorb mortgage assets.

In and of itself, that would not have been bad.

But that capacity was filled with loans that were poorly structured and where there was an erosion of underwriting standards.

On this chart, we see Subprime loans jumped to market shares of over 20% from 2004 to 2006 – nearly triple what they were historically.

Page 6

If the economy or housing prices turn downward – which they did, then these loans would deteriorate rapidly.

And – as we know, they did.

SLIDE 22:

And when we look at what is happening to the various channels for mortgage originations, we see similar trends.

When mortgage lending was viewed as a strategic growth opportunity, the wholesale and broker channel – shown in “red” here – increased significantly. It was all about volumes – no longer about quality.

And now – after the mortgage finance market meltdown, we see the larger banks exiting the wholesale and broker channels. And we see some more restrictive approaches to the correspondent markets.

Most financial institutions – large and small – are focusing on their retail branch network within their local markets for mortgage originations.

SLIDE 23:

As the debate on how to reform the mortgage finance system progresses, it is noteworthy to look at where the mortgage loan problems hit hardest.

This chart shows the trends in delinquent and nonaccrual mortgage loans since 2001.

From 2001 through 2006, the loan quality remained strong with loans 30 or more days delinquent or on non-accrual representing approximately 2% of loans.

Then, as the impact of the poor product structures and undisciplined underwriting hit, we see rising delinquencies for both the Top 100 Banks – shown in “red” here – and Community Banks – shown in “blue”.

It is interesting that the larger banks had such substantially higher delinquency ratios than did community financial institutions. Many of these institutions determined that mortgage lending on a national basis was a solid, profitable – and low-risk – growth strategy.

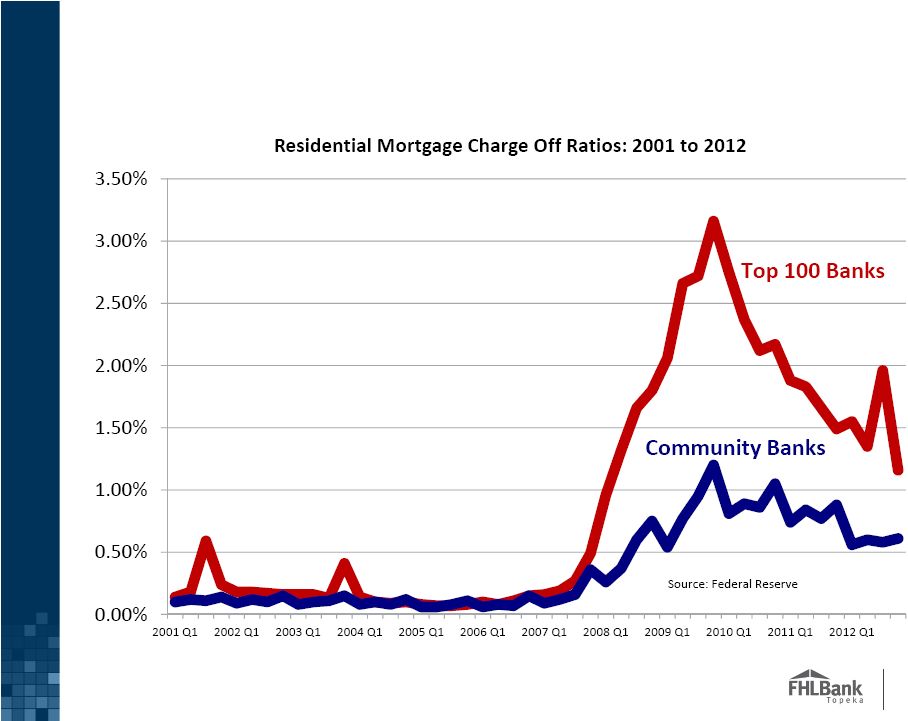

SLIDE 24:

And here we look at similar data – but on charge off rates for banks and thrifts.

Here we see the same trends – high quality product structure and disciplined underwriting resulted in low charge off rates for years.

But once banks deviated from those standards, the loan quality deteriorated dramatically.

Page 7

Again, the community financial institutions – where mortgage lending is done as a relationship business – maintained much stronger portfolios. They still had a rise in charge off ratios, but not nearly as significant as the Top 100 banks.

These charts are important as it reminds us as to what were the principal causes of the financial crisis – dramatic loosening of underwriting and product standards.

SLIDE 25:

When we look at the issue of mortgage finance and GSE reform, the Administration and Treasury proposal from February 2011 should serve as the baseline with all other proposals trying to re-shape this plan.

The high level principles are sound.

The role of the federal government should be to assure a strong and stable financial system; provide balanced regulatory oversight and consumer protection; and promote a level playing field for all participants, including community financial institutions.

Treasury views the private sector to be the primary source for mortgage credit and to bear all credit risk.

Treasury left the door slightly ajar for the possibility for federal catastrophic backup.

SLIDE 26:

Treasury proposes that the FHA and VA return to their traditional roles of serving low—to moderate-income families and first-time homebuyers.

They propose the wind down of Fannie & Freddie. And they indicate their intent to strengthen the banking and financial sectors’ capital and elevate their balance sheet liquidity.

On the subject of the FHLBanks, Treasury acknowledged their importance in supporting community financial institutions.

These principles all make sense, but, as always, the devil will be in the details as reform proposals are put on the table for discussion and debate.

SLIDE 27:

So how is the wind down of Fannie & Freddie going?

We have seen the Finance Agency direct both firms to gradually raise their guarantee fees.

The Finance Agency has also announced that the back office functions at Fannie and Freddie will be merged and placed into an independent company.

And as a major component of their strategic plan, both firms are jointly building a new securitization platform that would be available as a utility for other companies to use.

Page 8

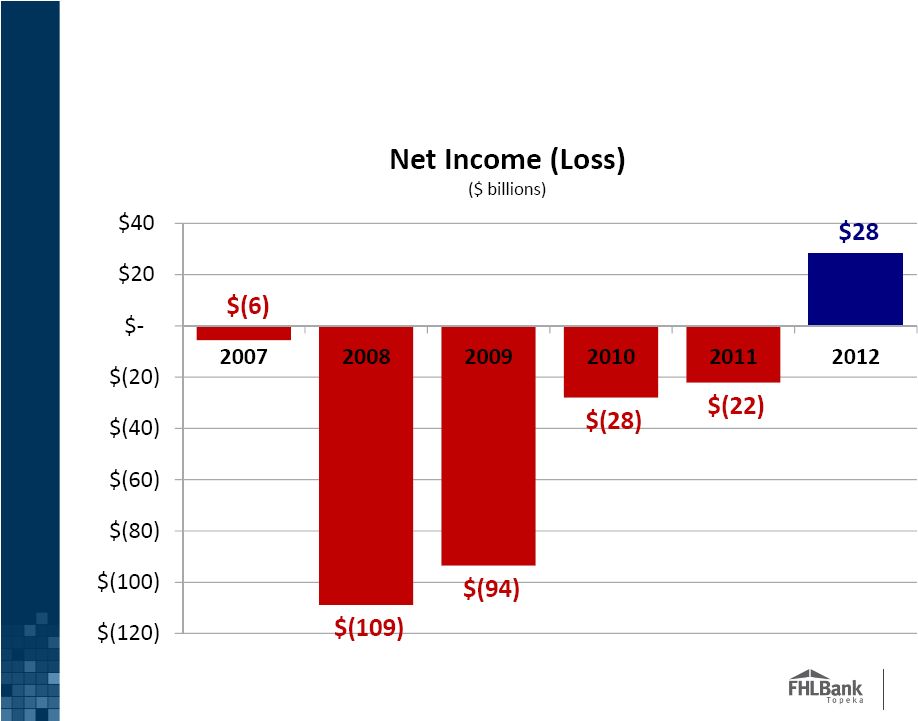

SLIDE 28:

Both Fannie & Freddie have turned profitable in 2012 – earning combined profits of $28 billion. Compare that to the previous five years where they had a combined loss of nearly $259 billion.

If the firms are profitable and sending cash to the U.S. Treasury, will there still be an urgency to wind them down?

We will have to wait and see.

SLIDE 29:

So what are the keys to mortgage market reform?

We know that we can return to sound mortgage product structures and disciplined underwriting immediately. For many community financial institutions, this is not even a change.

We do need to see a reasonable approach to reforming regulatory oversight and a rational approach to consumer protection. I am not certain that this is necessarily the situation today.

SLIDE 30:

I think almost everyone agrees we need to reduce the role of the federal government and increase private capital. But to what extent?

A central issue in this debate is the need for a federal catastrophic guarantee for mortgage-backed securities. Is a federal guarantee required to preserve the traditional 30-year, freely prepayable, fixed rate mortgage? Is a federal guarantee required to maintain the “to-be-announced” or TBA market?

Many observers have already responded to the question of the need for a federal guarantee with an emphatic “yes.” One only need to look at the various mortgage finance reform proposals. They suggest using private sector entities to bear the “credit risk” associated with the mortgages. However, they seem to all suggest that mortgage-backed securities need to be guaranteed by the Federal Government. Some have even called for an FDIC-like insurance fund to guarantee MBS.

A variety of arguments are marshaled to support the need for a federal guarantee. I’ve already mentioned the 30 year mortgage and the TBA market. Others suggest that a federal guarantee is necessary to equalize access to the secondary market across all mortgage originators. It is also said a government guarantee is necessary to ensure the availability of mortgage credit in times of a market disruption.

I personally believe the largest driver in this debate is the desire to simply keep mortgage rates as low as possible. Very understandably, those involved in the development of housing and the marketing of housing want rates low. And those concerned with the affordability of housing want rates low. Everyone seems to see lower mortgage rates as a worthwhile goal.

Page 9

However, we need to step back and ask ourselves whether a federal guarantee covering most of the mortgages made in this country is what we want. Is it in the best interest of the country? Even closer to home, is a government guarantee of most of the mortgages made in this country good for community financial institutions? I believe the answer is “no” to both questions.

Recently I had the opportunity to discuss mortgage finance reform with Ed DeMarco, director of the Federal Housing Finance Agency. The FHFA regulates both Fannie Mae and Freddie Mac, as well as the Federal Home Loan Banks. I have tremendous respect for Director DeMarco and the steps he is taking to reform the mortgage finance system in the absence of Congressional action.

One thing we agreed on was the need to consider carefully the notion that a government guarantee was necessary to a well functioning secondary market for properly underwritten mortgage loans. He testified before the U.S. Senate last week and this excerpt from the testimony is very much worth reviewing.

Director DeMarco testified: “I have been observing a developing ‘consensus’ among private market participants that the conforming conventional mortgage market cannot operate without the American taxpayer providing the ultimate credit guarantee for most of the market. As I have noted, that clearly is one policy outcome, but I do not believe it is the only outcome to be considered that can give our country a strong housing finance system. I believe that our country and our financial system are stronger than that. I believe it is possible to rebuild a secondary mortgage market that is deep, liquid, and competitive; that is subject to appropriate supervision and regulation, and will operate without an ongoing reliance on taxpayers or, at least, a greatly reduced reliance on taxpayers, if that is what we set our minds to accomplishing.”

Very strong words from Director DeMarco. It is not often you are able to quote a federal regulator saying perhaps we are all better served by a smaller role for government.

I know Director DeMarco is a big believer in community financial institutions and he is working hard to reform the mortgage finance system in a way that supports them having a significantly greater role in the mortgage market. I believe Ed DeMarco is one of the best friends that community financial institutions have in Washington these days and we need to carefully listen to what he is proposing.

So I say, let’s step back from those that start with the assumption that a federal guarantee is required and look at other options that will support a stronger, healthier, more diversified mortgage finance system, one that reduces the role of the American taxpayer, and one that allows community financial institutions to play a much greater role in the housing finance system in this country.

SLIDE 31:

Finally, what about your FHLBank?

The Federal Home Loan Banks have a very compelling story to tell. They have come through the financial crisis in good shape. There is a strong resiliency in the System that is ultimately derived from the strength of our members. The FHLBanks were the first up to the plate when the financial system was desperate for liquidity. And it was really the FHLBanks that kept the banking system working until the U.S. Government and the Federal Reserve were finally able to engage.

Page 10

In short, the Federal Home Loan Banks have an impressive record to share. We are the GSE that worked. We are the GSE that needed no bailout from the U.S. Government. We are the GSE who proved that it could come to the aid of the banking system. I see us coming to the GSE reform table from a position of strength and a track record that is nothing less than impressive. And rest assured we are working hard to ensure that every member of Congress knows and appreciates our story.

First, we need to continue to do what we do best – provide liquidity at any time to our members through our advances.

But, as importantly, we do need to evolve as the mortgage finance markets change and as your needs change. Perhaps furthering our role as a mortgage aggregator brings important value to some or most of you.

We need to recognize that we have a great story to tell and that we can be a significant part of the solution. Today, we are engaged in an active dialogue across the Federal Home Loan Bank System to reach consensus on what mortgage finance market and GSE reform means to the System and how the System should embrace reform to further our goal of enhancing the System’s franchise value to our members.

This has been an on-going process and will continue to be an inclusive one and I’m sure you will have plenty of opportunity to be involved in this discussion. We continue to work closely with national and local trade organizations and reach out for input from our members. Your representatives serve on our board of directors. Working together, we have the power to accomplish great things and I’m excited about the important role we can and will play in the future.

SLIDE 32:

Again, thank you so much for your business and your support. Thank you for coming out to the conference this year. And please don’t hesitate to let us know what we can do for you.

Page 11

FHLBANK

TOPEKA Annual Management Conference

Andy Jetter

|

President & CEO

April 25, 2013 |

OVERVIEW

FHLBank Topeka Financial Highlights

FHLBank System Financial Highlights

Update on Mortgage Finance and GSE

Reform

2 |

FHLBank Topeka:

Trends In Total Assets 3 |

FHLBank Topeka:

Trends In Advances 4 |

FHLBank Topeka:

Trends In Mortgage Assets 5 |

6

FHLBank Topeka: Mortgages Aggregated |

FHLBank Topeka:

Trends In Income 7

Adjusted Income = GAAP net income adjusted for the impact of: (1) AHP and REFCORP

assessments; (2) market value changes on derivatives (excludes net interest

settlements related to derivatives not qualifying for hedge accounting); and (3) other items

excluded because they are not considered a part of our routine operations or ongoing

business model, such as prepayment fees, gain/loss on retirement of debt,

gain/loss on mortgage loans held for sale and gain/loss on securities. |

FHLBank Topeka:

Trends In Retained Earnings 8 |

FHLBank Topeka:

Trends In Total Capital 9 |

FHLBank System:

Trends In Total Assets 10 |

FHLBank System:

Trends In Advances 11 |

FHLBank System:

Trends In Mortgage Assets 12 |

13

FHLBank System: Mortgages Aggregated |

FHLBank System:

Trends In GAAP Income 14

Per Office of Finance Combined Report |

FHLBank System:

Trends In Retained Earnings 15 |

FHLBank System:

Trends In Total Capital 16 |

U.S. Residential

Mortgages - $9.9 trillion

17

Financial

Institutions,

$2.84

PLMBS,

$0.92

Govt Agency

Portfolio

(includes

MBS), $1.24

GSE

Portfolio

(includes

MBS), $4.44

FHLBank,

$0.05

All Other,

$0.41

Source: Federal Reserve Flow of Funds Report

$ trillions |

Portfolio Lending

Dominates 1950 to 1970 18 |

Securitization

Takes Hold in 1970s and 1980s 19 |

Today, Agency and

GSE MBS Dominate Market 20 |

Subprime Lending

Increases 21 |

Origination

Channels Shift Pre- and Post-Crisis

22 |

Residential

Mortgage Delinquency Rises 23 |

Residential

Mortgage Charge Offs Jump 24 |

Department of

Treasury Reform Proposal Role of Federal Government

–

Assure strong and stable financial system

–

Provide oversight and consumer protection

–

Promote level playing field among all participants

–

Primary source of mortgage credit

–

Bears most –

if not all, risk of loss

–

Possible federal catastrophic MBS P&I guarantee

25

Private Sector Capital |

Department of

Treasury Reform Proposal Role of FHFA, VA and USDA

Wind down Fannie & Freddie

Strengthen banking and financial sectors

Ensure FHLBanks support community financial

institutions

26

–

Return to traditional roles

–

Low-

to moderate-income; first-time homeowners

–

Increase g-fees to bring in private capital

–

Increase capital (Basel III)

–

More regulatory oversight (Dodd Frank) |

Status of Wind

Down of Fannie & Freddie Continue to Raise Guarantee Fees

Merging Back Offices

Building New Securitization Platform

Combined 2012 Earnings of $28 billion

Final Resolution of Fannie and Freddie Uncertain

27

–

$(258) billion in losses 2007 to 2011

–

Mission Accomplished! |

Fannie &

Freddie Turn Profitable 28 |

29

Keys to Mortgage Market Reform

Accomplishable now:

Sound mortgage product structures

Disciplined underwriting standards

Accomplishable near-term:

Reasonable regulatory oversight

Rational consumer protection

Promote level playing field among all participants |

30

Keys to Mortgage Market Reform

Difficult, but accomplishable issues:

Reduce federal government risk

Bring private capital into mortgage markets

Questions to resolve:

Need for federal catastrophic MBS guarantee

Ability to obtain mortgages during times of severe

market disruption |

Future Role of

FHLBanks What is our Primary Mission?

–

Liquidity provider for community lenders

Don’t jeopardize primary mission!

Leverage the unique strengths and needs of

membership

Continue to pursue initiatives that provide value

to members

–

Expand pass-through programs

–

Consider ways to leverage AMA program as aggregator

–

Provide assets to members

31 |

THANK YOU

Thanks for joining us today.

32 |