Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - Puissant Industries, Inc. | Financial_Report.xls |

| EX-32.1 - CERTIFICATION - Puissant Industries, Inc. | psnt_ex321.htm |

| EX-31.1 - CERTIFICATION - Puissant Industries, Inc. | psnt_ex311.htm |

| EX-32.2 - CERTIFICATION - Puissant Industries, Inc. | psnt_ex322.htm |

| EX-31.2 - CERTIFICATION - Puissant Industries, Inc. | psnt_ex312.htm |

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

For the fiscal year ending December 31, 2012

Commission file number: 333-178280

PUISSANT INDUSTRIES INC.

(Exact name of Registrant as specified in its charter)

|

Florida

|

27-0543309

|

|

|

(State of Incorporation)

|

(I.R.S. Employer Identification No.)

|

520 Whitley Street, PO Box 1263, London, KY 40741

(Address of principal executive offices)

606-864-3161

(Registrant’s telephone number, including area code)

All Correspondence to:

Frederick M. Lehrer, Esq.

Attorney and Counselor at Law

285 Uptown Blvd, 402

Altamonte Springs, Florida

Office: (321) 972-8060

Cell: (561) 706-7646

E-Fax: (561) 423-3753

Email: flehrer@securitiesattorney1.com

Website: www.securitiesattorney1.com

Securities registered pursuant to Section 12(b) of the Exchange Act: None

Securities registered pursuant to Section 12(g) of the Exchange Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the past 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer

|

o |

Accelerated filer

|

o |

|

Non-accelerated filer

|

o |

Smaller reporting company

|

x |

|

(Do not check if a smaller reporting company)

|

|||

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes x No ¨

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold: $2.00.

The number of shares of the Registrant’s common stock issued and outstanding as of April 13, 2013 was 6,644,200 shares.

Documents Incorporated by Reference

The exhibits incorporated by reference to this Form 10-K are denoted in our Exhibit table on page 29.

TABLE OF CONTENTS

|

Page

|

|||||

|

PART I

|

5 | ||||

|

Item 1

|

Business

|

5 | |||

|

Item 1A

|

Risk Factors

|

12 | |||

|

Item 1B

|

Unresolved Staff Comments

|

12 | |||

|

Item 2

|

Properties

|

12 | |||

|

Item 3

|

Legal Proceedings

|

17 | |||

|

Item 4

|

Mine Safety Disclosures

|

18 | |||

|

PART II

|

|||||

|

Item 5

|

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

18 | |||

|

Item 6

|

Selected Financial Data

|

20 | |||

|

Item 7

|

Management’s Discussion and Analysis of Financial Condition and Results of Operation

|

20 | |||

|

Item 7A

|

Quantitative and Qualitative Disclosures About Market Risk.

|

21 | |||

|

Item 8

|

Financial Statements and Supplementary Data.

|

F-1 | |||

|

Item 9

|

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure

|

22 | |||

|

Item 9A

|

Controls and Procedures

|

22 | |||

|

Item 9B

|

Other Information

|

22 | |||

|

PART III

|

23 | ||||

|

Item 10

|

Directors, Executive Officers and Corporate Governance

|

23 | |||

|

Item 11

|

Executive Compensation

|

24 | |||

|

Item 12

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

26 | |||

|

Item 13

|

Certain Relationships and Related Transactions, and Director Independence

|

27 | |||

|

Item 14

|

Principal Accountant Fees and Services

|

29 | |||

|

PART IV

|

|||||

|

Item 15

|

Exhibits and Financial Statement Schedules

|

29 | |||

|

SIGNATURES

|

32 | ||||

2

DEFINITIONS

The following defined terms are used in this report.

References to Puissant Industries, Inc., a Florida corporation, are referred to herein as “we”, “our” or “us”, unless the context provides for otherwise.

GLOSSARY OF TERMS

Unless otherwise indicated in this report, natural gas volumes are stated at the legal pressure base of the state or geographic area in which the reserves are located at 60 degrees Fahrenheit. Crude oil and natural gas equivalents are determined using the ratio of six Mcf of natural gas to one barrel of crude oil, condensate or natural gas liquids. The following definitions shall apply to the technical terms used in this report.

Terms used to describe quantities of crude oil and natural gas:

“Bbl” – barrel or barrels.

“BOE” – barrels of crude oil equivalent.

“Mcf” – thousand cubic feet of gas.

“MMbtu” – million British thermal units.

“MMcf” – million cubic feet of gas.

“MMcfpd” – million cubic feet of gas per day.

“NGL” – natural gas liquids.

Terms used to describe our interests in wells and acreage:

Natural gas is converted into barrels of oil equivalent based on six Mcf of gas to one barrel of crude oil or other liquid hydrocarbons.

Development well is a well drilled within the proved area of an oil or natural gas field to the depth of a stratigraphic horizon known to be productive.

Exploratory well is a well drilled to find and produce oil or natural gas reserves in an unproved area, to find a new reservoir in a field previously found to be productive of oil or gas in another reservoir, or to extend a known reservoir.

Field is an area consisting of a single reservoir or multiple reservoirs all grouped on or related to the same individual geological structural feature or stratigraphic condition.

PV-10, a non-GAAP measure, is the pre-tax present value, discounted at 10% per year, of estimated future net cash flows from the production of proved reserves, computed by applying sales prices in effect as of the dates of such estimates and held constant throughout the productive life of the reserves (except for consideration of price changes to the extent provided by contractual arrangements), after deducting the estimated future costs to be incurred in developing, producing and abandoning the proved reserves (computed based on current costs and assuming continuation of existing economic conditions.) We believe PV-10 to be an important measure for evaluating the relative significance of our natural gas and oil properties. PV-10 is computed on the same basis as the standardized measure of discounted future net cash flows but without deducting income taxes. We further believe investors and creditors may utilize our PV-10 as a basis for comparison of the relative size and value of our reserves to other companies. However, PV-10 is not a substitute for the standardized measure.

3

Productive well is a well that is producing or is capable of production, including natural gas wells awaiting pipeline connections to commence deliveries and oil wells awaiting connection to production facilities.

Proved reserves are the estimated quantities of oil and gas, which, by analysis of geoscience and engineering data, can be estimated with reasonable certainty to be economically producible – from a given date forward, from known reservoirs, and under existing economic conditions, operating methods, and government regulations. Reservoirs are considered proved if shown to be economically producible by either actual production or conclusive formation tests. See Regulation S-X, Rule 4-10(a)(22)-(26), (Reg. § 210.4-10) available on the Internet at www.sec.gov/divisions/corpfin/ecfrlinks.shtml.

Proved developed reserves are the portion of proved reserves that has an expectation of recovery through existing wells with existing equipment and operating methods or in which the cost of the required equipment is relatively minor compared to the cost of a new well.

Proved undeveloped reserves are the portion of proved reserves that are expected to be recovered from new wells on undrilled acreage, or from existing wells where a relatively major expenditure is required for recompletion.

Working interest is the operating interest that gives the owner the right to drill, produce and conduct operating activities on the property and a share of production.

Workover is operations on a producing well to restore or increase production.

4

PART I

Item 1. Business

GENERAL

Corporate Overview.

On July 6, 2009, we incorporated in Wyoming as American Resource Management, Inc. On March 17, 2011, we changed our domicile to the State of Florida and simultaneously changed our name to Puissant Industries, Inc. Our principal offices are located at 520 Whitley Street, P.O. Box 1263, London, Kentucky 40741. Our telephone number is 606-864-3161. We currently do not have a website, although we plan to develop one during our fiscal quarter ending June 30, 2013.

Business Description.

We are engaged in oil and gas exploration and development activities in fractured shale formations located in Eastern Kentucky.

To date, our operations have consisted of the following:

i. our acquisition of a 100% working interest and approximately 85% net revenue interest in 39 shut-in wells, with and estimated 28 miles of natural gas pipeline;

ii. commenced recompletion of old wells and connecting wells to our existing pipeline;

iii. located Seminole Energy Services to purchase our natural gas obtained from recompleting 26 existing wells;

iv. sold 148,285 Mcf of gas obtaining approximate revenues of $410,008 through December 31, 2012, for an average price per Mcf of about $2.77. We had lease operating expenses (LOE) of approximately $0.53 per Mcf.

v. our acquisition of the surface mineral and property rights to 100 acres and subsurface rights to 175 acres in Clay County Kentucky.

On or about January 15, 2005, Sovereign One, Inc., a company controlled by Mark Holbrook, our Chief Executive Officer; McCrome International, Inc., a company controlled by our director, Cora J Holbrook and Logos Resources, Inc., a company controlled by Marshall Holbrook, our Director entered into an agreement with A.D.I.D. Corporation, a Kentucky corporation controlled by Marshall Holbrook ("A.D.I.D.") whereby A.D.I.D. agreed to acquire oil and gas leases and properties and assign such oil and gas leases and properties entities as specified by Sovereign One Inc., McCrome International, Inc., and Logos Resources, Inc. Mark Holbrook and Cora Holbrook are married to one another and Marshall Holbrook is their son.

In exchange for our issuance of an aggregate of 5,250,000 shares of our common stock representing 1,750,000 common shares to each Sovereign One Inc., McCrome International, Inc. and Logos Resources, Inc., A.D.I.D. assigned the following interests to us:

5

(i) on August 9, 2010, 100% ownership in: (a) 34,000 of 2-inch natural gas pipeline and 60,000 feet of 4-inch natural gas pipeline, compressor stations, right of ways and easements located in Clay and Laurel Counties, Kentucky; and (b) 59,000 feet of 2-inch natural gas pipeline and 10,000 feet of 4-inch natural gas pipeline, compressor stations, right of ways and easements located in Whitley County, Kentucky; and

(ii) on February 15, 2010, a 100% working interest and an 85% net revenue interest of 39 oil and gas wells and leases in Kentucky wells (the “Wells”).

This working interest gives us the ability to explore for and to produce and own oil, gas or other minerals from the Wells. As the working interest owner, we bear the exploration, development, and operating costs from the property. The net revenue interest provides us with approximately 85% of the proceeds from any oil and gas production on the Wells after payment of all operating and development costs.

We own 100% of ARM Operating Company (“ARM”), a Kentucky corporation, which manages all of our oil and gas properties and oversees the operation, development, and maintenance of all our oil and gas wells, leases, and reserve activities. ARM will be registered as the operator of wells with all relevant governmental agencies, and it will be responsible for maintaining production and maintenance reports for all of our wells and facilities. Our officers and Board of Directors make all decisions concerning ARM.

We file periodic reports with the Securities and Exchange Commission (“SEC”) on Forms 10-Q and 10-K. These forms, are available free of charge at sec.gov. Materials filed with the SEC may also be read at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. Information on the operation of the Public Reference Room may be obtained by calling the SEC at 1-800-SEC-0330.

Business Strategy

Our business strategy is to create value for our shareholders by growing reserves, production and cash flow on a cost-efficient basis. Key elements of our strategy include:

• Developing and exploiting our existing properties. Development of our existing position in the Appalachian Basin Devonian Shale is our primary objective. We plan to continue to concentrate our capital expenditures in the Devonian Shale, where we believe our current acreage position provides an attractive return on the capital employed on a multi-year drilling program.

• Maintain Long-Life Reserve Base. We focus our acreage acquisition and development activities on resources that target long-life gas and oil reserves. Long-life gas and oil reserves provide a more stable growth platform than short-life reserves. Long-life reserves reduce reinvestment risk as they lessen the amount of reinvestment capital deployed each year to replace production. Long-life crude oil and natural gas reserves will also assist us in minimizing costs as stable production makes it easier to build and maintain operating economies of scale.

• Disciplined Financial Approach. Our goal is to remain financially strong, yet flexible, through the prudent management of our balance sheet and active management of commodity price volatility. We will manage the development and operation of the properties and locate third parties to drill a prospect on an as needed basis.

For further information regarding our Business, please see our Property Section at page 12 to page 17.

6

Industry and Economic Factors.

We will face many factors inherent in the oil and gas industry, including widely fluctuating oil and gas prices, cyclical and volatile markets and difficulties in predicting future price movements difficult. While revenues will be a function of both production and prices, wide swings in prices will have the greatest impact on our results of operations.

Operations in the oil and gas industry entail significant complexities. Our oil and gas properties have past histories of production even though production ceased prior to our obtaining any interest in the non-productive properties. The production records can serve as the basis for evaluation of potential future production using new technologies; however, such evaluation is difficult if not impossible to determine conclusively the amount of oil and gas, the cost of development, or the rate at which oil and gas may be produced.

Market for Oil and Gas Production.

Both the state and federal governments regulate the market for oil and gas production. The overall market is mature and, with the exception of gas, all producers in a producing region will receive the same price. If we locate oil reserves it will be pumped from wells and stored in tanks at the well site where for the purchaser normally to pick up.

Natural gas will be gathered through connections between our gas wells and our pipeline transmission system. Gas purchasers would pay us 100 percent of the sale proceeds of our oil and gas each month for the previous month’s sales. We will be responsible for all distributions. There is no standard price for gas and oil and gas and oil prices will fluctuate with the seasons and the general market conditions.

Competition.

The oil and gas industry is highly competitive. Our competitors and potential competitors include major oil companies and independent producers of varying sizes, all of which are engaged in the acquisition of producing properties and the exploration and development of prospects and most of which have greater financial resources and revenues.

Governmental Regulation.

General

The production and sale of oil and gas is subject to regulation by state, federal, and local authorities. In most areas, there are statutory provisions regulating the production of oil and natural gas under administrative agencies may set allowable rates of production and enact rules in connection with the operation and production of such wells, ascertain and determine the reasonable market demand of oil and gas, and adjust allowable rates.

Our operations are subject to extensive and continually changing regulations because legislation affecting the oil and natural gas industry is under constant review for amendment and expansion. Many departments and agencies, both federal and state, are authorized by statute to issue and have issued rules and regulations binding on the oil and natural gas industry and its individual participants. The failure to comply with such rules and regulations can result in large penalties and may negatively affect our operations. The regulatory burden on this industry increases our cost of doing business and, therefore, affects our potential profitability.

All of our well interests and non-producing properties are located onshore in the United States. Oil and natural gas production is subject to various taxes, such as gross production taxes and, in some cases, ad valorem taxes.

7

The State of Kentucky and other states require permits for drilling operations, drilling bonds and reports concerning operations and impose other regulations relating to the exploration for and production of oil and natural gas. These states also have regulations addressing conservation matters, including provisions for the unitization or pooling of oil and natural gas properties and the regulation of spacing, plugging and abandonment of wells. These regulations vary from state to state. As previously discussed, we rely on our well operators to comply with governmental regulations.

Various aspects of our oil and natural gas operations are regulated by agencies of the federal government. The Federal Energy Regulatory Commission (“FERC”) pursuant to the Natural Gas Act of 1938 and the Natural Gas Policy Act of 1978 (“NGPA”) generally regulates the transportation of natural gas in interstate commerce. The intrastate transportation and gathering of natural gas (and operational and safety matters related thereto) may be subject to regulation by state and local governments.

Federal Energy Regulatory Commission's ("FERC") jurisdiction over interstate natural gas sales was substantially modified by the NGPA under which FERC continued to regulate the maximum selling prices of certain categories of natural gas sold in “first sales” in interstate and intrastate commerce. Effective January 1, 1993, however, the Natural Gas Wellhead Decontrol Act (the “Decontrol Act”) deregulated natural gas prices for all “first sales” of natural gas. Because “first sales” include typical wellhead sales by producers, all natural gas produced from our natural gas properties is sold at market prices, subject to the terms of any private contracts in effect. The Decontrol Act did not affect FERC’s jurisdiction over natural gas transportation.

Sales of natural gas are affected by intrastate and interstate natural gas transportation regulation. Beginning in 1985, FERC adopted regulatory changes that have significantly altered the transportation and marketing of natural gas. These changes were intended by FERC to foster competition by transforming the role of interstate pipeline companies from wholesale marketers of natural gas to the primary role of natural gas transporters. As a result of the various omnibus rulemaking proceedings in the late 1980s and the individual pipeline restructuring proceedings of the early to mid-1990s, interstate pipelines must provide open and nondiscriminatory transportation and transportation-related services to all producers, natural gas marketing companies, local distribution companies, industrial end users and other customers seeking service. Through similar orders affecting intrastate pipelines that provide similar interstate services, FERC expanded the impact of open access regulations to intrastate commerce.

More recently, FERC has pursued other policy initiatives that have affected natural gas marketing. Most notable are: (1) permitting the large-scale divestiture of interstate pipeline-owned natural gas gathering facilities to affiliated or non-affiliated companies; (2) further development of rules governing the relationship of the pipelines with their marketing affiliates; (3) the publication of standards relating to the use of electronic bulletin boards and electronic data exchange by the pipelines to make transportation information available on a timely basis and to enable transactions to occur on a purely electronic basis; (4) further review of the role of the secondary market for released pipeline capacity and its relationship to open access service in the primary market; and (5) development of policy and promulgation of orders pertaining to its authorization of market-based rates (rather than traditional cost-of-service based rates) for transportation or transportation-related services upon the pipeline’s demonstration of lack of market control in the relevant service market.

As a result of these changes, sellers and buyers of natural gas have gained direct access to the particular pipeline services they need and are able to conduct business with a larger number of counter parties. These changes generally have improved the access to markets for natural gas while substantially increasing competition in the natural gas marketplace. The effect of future regulations by FERC and other regulatory agencies cannot be predicted.

Sales of oil are not regulated and are made at market prices. The price received from the sale of oil is affected by the cost of transporting it to market. Much of that transportation is through interstate common carrier pipelines. Effective January 1, 1995, FERC implemented regulations generally grandfathering all previously approved interstate transportation rates and establishing an indexing system for those rates by which adjustments are made annually based on the rate of inflation, subject to certain conditions and limitations. Over time, these regulations tend to increase the cost of transporting oil by interstate pipelines, although some annual adjustments may result in decreased rates for a given year. These regulations have generally been upheld on judicial review. Every five years, FERC will examine the relationship between the annual change in the applicable index and the actual cost changes experienced by the oil pipeline industry.

8

Transportation

There are no material permits or licenses required beyond those currently held by us or incident to our operations. We can make sales of oil, natural gas and condensate at market prices, which are not subject to price controls at this time. The price that we receive from the sale of any oil and gas we locate will be affected by our ability to transport and the cost of transporting these products to market. Under applicable laws, FERC regulates the construction of natural gas pipeline facilities, and the rates for transportation of these products in interstate commerce. Effective as of January 1, 1995, FERC implemented regulations establishing an indexing system for transportation rates for oil. These regulations could increase the cost of transporting oil to the purchaser.

Regulation of Drilling and Production

Our proposed drilling and production operations are subject to regulation under a wide range of state and federal statutes, rules, orders and regulations. Among other matters, these statutes and regulations govern the:

• amounts and types of substances and materials that may be released into the environment;

• discharge and disposition of waste materials;

• reclamation and abandonment of wells and facility sites; and

• remediation of contaminated sites.

In order to comply with these statutes and regulations, we are required to obtain permits for drilling operations, drilling bonds, and reports concerning operations. Kentucky laws contain provisions for the unitization or pooling of oil and natural gas properties, the establishment of maximum rates of production from oil and natural gas wells, and the regulation of the spacing, plugging, and abandonment of wells.

Environmental Regulations

Because we are directly involved in the extraction and use of natural resources, we are subject to various federal, state and local laws and regulations regarding environmental and ecological matters. Compliance with these laws and regulations may necessitate significant capital outlays; however, to date, our cost of compliance has been immaterial. We do not believe the existence of these environmental laws, as currently written and interpreted, will materially hinder or adversely affect our business operations; however, there can be no assurances of future events or changes in laws, or the interpretation of laws, governing our industry.

The various state, local and federal environmental laws and regulations, including the Oil Pollution Act of 1990, Federal Water Pollution Control Act, and Toxic Substances Control Act, affect our operations. The Comprehensive Environmental, Response, Compensation, and Liability Act (“CERCLA”) and comparable state statutes impose strict, joint and several liabilities on owners and operators of sites and on persons who disposed of or arranged for the disposal of “hazardous substances” found at such sites. It is not uncommon for the neighboring landowners and other third parties to file claims for personal injury and property damage allegedly caused by the hazardous substances released into the environment. The Federal Resource Conservation and Recovery Act (“RCRA”) and comparable state statutes govern the disposal of “solid waste” and “hazardous waste” and authorize the imposition of substantial fines and penalties for noncompliance. Although CERCLA currently excludes petroleum from its definition of “hazardous substance,” state laws affecting our operations may impose cleanup liability relating to petroleum and petroleum related products. In addition, although RCRA classifies certain oil field wastes as “non-hazardous,” such exploration and production wastes could be reclassified as hazardous wastes thereby making such wastes subject to more stringent handling and disposal requirements.

9

Generally, environmental laws and regulations govern the discharge of materials into the environment or the disposal of waste materials, or otherwise relate to the protection of the environment. The following activities are subject to stringent environmental regulations:

|

•

|

drilling;

|

|

|

•

|

development and production operations;

|

|

|

•

|

activities in connection with storage and transportation of oil and oil and gas; and

|

|

|

•

|

use of facilities for treating, processing or otherwise handling oil and gas and wastes.

|

Violations are subject to reporting requirements, civil penalties and criminal sanctions. As with the industry generally, compliance with existing regulations increases our overall business costs, which are difficult to determine. Such areas affected include:

|

•

|

unit production expenses primarily related to the control and limitation of air emissions and the disposal of produced water;

|

|

|

•

|

capital costs to drill exploration and development wells resulting from expenses primarily related to the management and disposal of drilling fluids and other oil and natural gas exploration wastes; and

|

|

|

•

|

capital costs to construct, maintain and upgrade equipment and facilities and remediate, plug, and abandon inactive well sites and pits.

|

Environmental regulations historically have been subject to frequent change by regulatory authorities. Therefore, we are unable to predict the ongoing cost of compliance with these laws and regulations or the future impact of such regulations on operations. However, we do not believe that changes to these regulations will have a significant negative impact on the development of our oil and gas properties.

Any discharge of oil and gas into the environment could subject us to substantial expense, including both the cost to comply with applicable regulations pertaining to the cleanup of releases of hazardous substances into the environment and claims by neighboring landowners and other third parties for personal injury and property damage. We do not maintain insurance for protection against environmental liabilities.

Research and Development

We will spend some funds on research and development; however, since our inception we have spent no funds on research on development.

Employees

We currently have three full-time employees who are our officers and directors and who are a family relationship to one another, as follows: (a) Mark Holbrook, our Chief Executive Officer/Director; (B) Cora Holbrook, our Chief Financial Officer/Director; and (c) Marshall Holbrook, our Vice President/Director. We intend to retain the services of consultants on a contract basis to assist on our mineral claims andto assist with preparation of financial statements and reserve reports.

Executive Offices

Our executive offices are currently located at 520 Whitley Street, P.O. Box 1263, London, Kentucky 40741 and our telephone number is 606-864-3161. We have 5 offices at our executive offices composed of 1520 square feet. We pay $850 per month for lease of our offices. Our lease agreement expires on December 1, 2014.

Legal Proceedings

We are not currently a party to any legal proceedings, and we are not aware of any pending or potential legal actions.

Proprietary Rights

We do not have any proprietary rights.

10

Competitive Business Conditions

The oil and natural gas industry is highly competitive, particularly in the search for new oil and natural gas reserves. Many factors affect our competitive position and the market for its products that are beyond its control. Some of these factors include the quantity and price of foreign oil imports, changes in prices received for its oil and natural gas production, business and consumer demand for refined oil products and natural gas, and the effects of federal and state regulation of the exploration for, production of and sales of oil and natural gas. Changes in existing economic conditions, political developments, weather patterns and actions taken by OPEC and other oil-producing countries have a dramatic influence on the price Puissant receives for its oil and natural gas production.

Sources and Availability of Raw Materials

The existence of recoverable oil and natural gas reserves in commercial quantities is essential to the ultimate realization of value from our mineral and leasehold acreage. These mineral and leasehold properties are the raw materials to our business. The production and sale of oil and natural gas from the our properties is essential to provide the cash flow necessary to sustain our ongoing viability. We reinvest a portion of our cash flow to purchase oil and natural gas mineral and leasehold acreage to assure the continued availability of acreage with which to participate in exploration, drilling and development operations and, subsequently, the production and sale of oil and natural gas. This participation in exploration and production activities and purchase of additional acreage is necessary to continue to supply us with the raw materials with which to generate additional cash flow. Mineral and leasehold acreage purchases are made from many owners. We do not rely on any particular companies or persons for the purchases of additional mineral and leasehold acreage.

Patents, Trademarks, Licenses, Franchises and Royalty Agreements.

We do not own any patents, trademarks, licenses or franchises. Royalty agreements on producing oil and natural gas wells stemming from our ownership of mineral acreage generate a portion of our revenues. These royalties are tied to ownership of mineral acreage and this ownership is perpetual, unless sold by us. Royalties are due and payable to us whenever oil and/or natural gas is produced and sold from wells located on our mineral acreage.

Material Agreements.

June 1, 2011 Agreement with A.D.I.D.

Effective June 1, 2011, we entered into a Well Services Agreement with A.D.I.D. Corporation, a Kentucky corporation controlled by our Vice President and Director, Marshall Holbrook (“A.D.I.D.”). Under the agreement terms, A.D.I.D. agrees to act as the operator of our oil and gas wells, pipelines, compressor station and leases. A.D.I.D.’ s The agreement expires upon the earlier of: (i) the expiration of the productive life of our wells, pipelines and leases: (ii) six months after the resignation of A.D.I.D. who may resign at any time; (iii) A.D.I.D. being removed for gross negligence, willful misconduct, a material breach or inability to perform its obligations under the agreement.

Agreement with Margaret Reep

On August 1, 2011, we entered into an agreement with Margaret Reep, whereby we acquired the below ground mineral and property rights to 175 acres in Clay County Kentucky in exchange for $25,000. The agreement provided for a $1,000 down payment, with the $24,000 balance to be paid in twelve monthly payments of approximately $2,077, which includes interest at 7% per annum, which we paid in full. We made our last payment to Margaret Reep in October 1, 2012 and in full payment for the mineral and property rights, Margaret Reep executed a Release of Promissory Note Mortgage on the same date relieving us from any further indebtedness pertaining to this agreement.

Agreement with Debra Adams

On October 13, 2011, we entered into an agreement with Debra Adams, whereby we acquired the surface mineral and property rights including timber, coal and all other minerals to 100 acres in Clay County, Kentucky for $50,000. The Agreement provided for a $500 down payment, with the balance of $49,500 to be paid in 120 payments of approximately $575, which includes interest at 7% per annum.

Agreement with Seminole Energy Services, LLC

On September 20, 2011, we entered into a contract for the purchase and sale of natural gas with Seminole Energy Services, L.L.C. (“Seminole”). This agreement provides that Seminole agrees to purchase from us up to a maximum of 1000 MMBtus (million British thermal units) per day out of the production of gas from our wells on our leasehold properties located in the Eastern Kentucky region.

11

We will sell our gas to Seminole and while we are responsible for delivery to the delivery point, Seminole is responsible for gas after our delivery point. We have approximately 28 miles of gathering line to connect our wells to Seminole’s gathering and treatment facility. 26 of our wells are now connected to this system.

Seminole will pay us spot price for the gas that it purchases from us. Seminole and we have agreed to net any payments due us under the contract on the 25th day of the month following the month of delivery.

Either party upon 30 days notice may terminate the agreement.

Item 1A. Risk Factors

As a smaller reporting company, we are not required to include risk factors in our Form 10-K; nonetheless, you may review risk factors at sec.gov as contained in our S-1 Registration Statement and our Form 10-K for the period ending December 31, 2011.

Special Information Regarding Forward Looking Statements.

Some of the statements in this Annual Report on Form 10-K are “forward-looking statements.” These forward-looking statements involve certain known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by these forward-looking statements. These factors include, among others, the factors set forth above under “Risk Factors.” The words “believe,” “expect,” “anticipate,” “intend,” “plan,” and similar expressions identify forward-looking statements. We caution you not to place undue reliance on these forward-looking statements. We undertake no obligation to update and revise any forward-looking statements or to publicly announce the result of any revisions to any of the forward-looking statements in this document to reflect any future or developments. Because our securities are considered “penny stocks”, the Private Securities Litigation Reform Act of 1995 is unavailable to us.

Item 1B. Unresolved Staff Comments

None.

Item 2. Properties

Our Executive Offices

Our executive offices, which are composed of 1500 square feet, are currently located at 520 Whitley Street, P.O. Box 1263, London, Kentucky 40741 and our telephone number is 606-864-3161. We pay monthly rent of $ 850.00 for this location.

Our Oil and Gas Properties

Our oil and gas interests are for properties are located in Laurel, Clay and Whitley Counties in Kentucky. We hold a 100% working interest and approximately 85% Net Revenue interest in 3935 total acres, 390 Acres Developed and 2040 undeveloped acres in Clay and Laurel Counties and 1505 Total acres leased, 455 Acres Developed and 1050 undeveloped in Whitley County.

We hold oil and gas interests to the Raccoon Mountain Field in Clay and Laurel Counties, Kentucky. Within the Raccoon Mountain Field, we own 100% working interests and approximately 85 % net revenue interest to 21 wells and 17.79 miles of natural gas pipeline including one compressor station and sales connection.

We hold oil and gas interests to Wofford, Woodbine and Rockholds Fields located in Whitley County. Within the Wofford Field, we own 100% working interests and approximately 85 % net revenue interest to 11 wells with approximately 7.39 miles of natural gas pipeline and one compressor station with sales tap. Within the Woodbine Field, we own 100% working interests and approximately 85 % net revenue interest to 4 wells and approximately 4.36 miles of natural gas pipeline, one compressor station and sales tap. Within the Rockholds Field, we own 3 wells and approximately 1.33 miles of natural gas pipeline, one compressor station with sales tap.

12

Acreage and Wells Summary.

The following table sets forth our acreage, which consists of only developed and undeveloped oil and natural gas leases:

|

Undeveloped Acreage(1)(2)(5)

|

Developed Acreage(2)

|

Total

|

||||||||||||||||||||||

|

Property

|

No of Wells

|

Gross(3)

|

Net(4)

|

Gross(3)

|

Net(4)

|

|||||||||||||||||||

|

Clay and Laurel County-Total

|

21 |

|

|

|

|

|

||||||||||||||||||

| Shut In | 8 | |||||||||||||||||||||||

| Non-Shut In | 13 | 2040 | 2040 | 390 | 390 | 2430 | ||||||||||||||||||

|

Racoon Mountain Field

|

||||||||||||||||||||||||

|

Whitley County-Total

|

18 | |||||||||||||||||||||||

| Shut In | 5 | |||||||||||||||||||||||

| Non-Shut In | 13 | 1050 | 1050 | 455 | 455 | 1505 | ||||||||||||||||||

|

Wofford Field

|

||||||||||||||||||||||||

|

Woodbine Field

|

||||||||||||||||||||||||

|

Rockholds Field

|

||||||||||||||||||||||||

|

TOTAL(5)

|

39 | 3090 | 3090 | 845 | 845 | 3935 | ||||||||||||||||||

___________

|

(1)

|

Developed acres are acres spaced to productive wells.

|

|

(2)

|

Undeveloped acres are acres on which wells have not been drilled or completed to a point that would permit the production of commercial quantities of natural gas or oil, regardless of whether such acreage contains proved reserves.

|

|

(3)

|

A gross acre is an acre in which a working interest is owned. The number of gross acres is the total number of acres in which a working interest is owned.

|

|

(4)

|

A net acre is deemed to exist when the sum of the fractional ownership working interests in gross acres equals one. The number of net acres is the sum of the fractional working interests owned in gross acres expressed as whole numbers and fractions thereof.

|

13

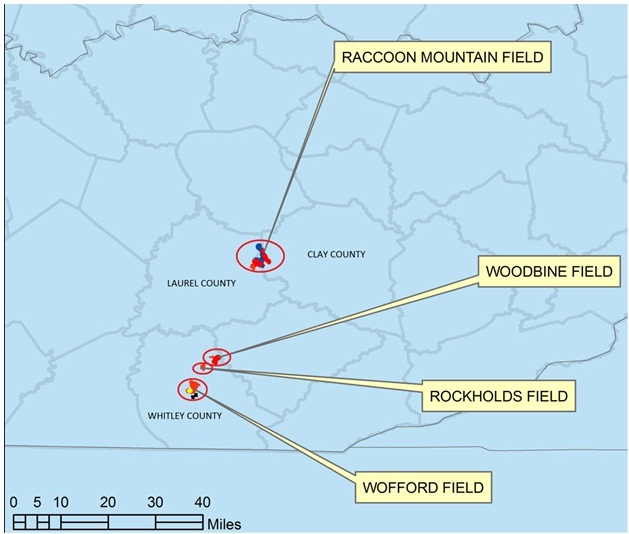

PUISSANT INDUSTRIES, INC.

PROPERTIES LOCATION MAP

CLAY, LAUREL AND WHITLEY COUNTIES, KENTUCKY

Raccoon Mountain Field.

The Raccoon Mountain Field is located in the Laurel and Clay Counties of Kentucky. Within this Field, we own 21 wells and with about 17.79 miles of natural gas pipeline including one compressor station and sales tap in the Raccoon Mountain Field.

14

On August 1, 2011, we hold the below ground mineral and property rights to 175 acres in the Raccoon Mountain Field in Clay County Kentucky.

On October 13, 2011, we hold the surface mineral and property rights, including timber, surface, coal and surface minerals to 100 acres in the Raccoon Mountain Field in Clay County, Kentucky.

Wofford Field.

The Wofford Field is located in Whitley County, Kentucky. Within this Field, we own 11 wells and approximately 7.39 miles of natural gas pipeline and one compressor station with sales tap.

Woodbine Field.

Within the Woodbine Field, we own 4 wells with about 4.36 miles of natural gas pipeline, one compressor station and sales tap. This field is located in Whitley County, Kentucky.

Rockholds Field.

Within the Rockholds Field, we own 3 wells and about 1.33 miles of natural gas pipeline and one compressor station with sales tap. This Field is located in Whitley County, Kentucky. The pipeline infrastructure within this area is not fully developed and will need to be expanded along with future acreage acquisition.

Report by Independent Engineering Firm

An independent petroleum-engineering firm provided the following information with respect to the proved reserves attributable to our Properties as of December 31, 2012.

|

Proved

Developed

Producing

|

Proved

Undeveloped

|

Total

Proved

|

|||||||||||||

|

Net Reserves

|

|||||||||||||||

|

Natural Gas

|

-MMcf

|

3,004.348 | 11,839.560 | 14,843.908 | |||||||||||

|

Oil / Condendsate

|

-Mbbl

|

39.317 | 137.606 | 176.923 | |||||||||||

|

Income Data

|

|||||||||||||||

|

Future Gross Revenue

|

-M$ | 10,152.982 | 38,494.999 | 48,647.980 | |||||||||||

|

Deductions

|

-M$ | 2,477.669 | 9,849.277 | 12,326.946 | |||||||||||

|

Future Net Income

|

|||||||||||||||

|

Undiscounted

|

-M$ | 7,675.312 | 28,645.722 | 36,321.034 | |||||||||||

|

Discounted @10% (Net Present Value)

|

-M$ | 4,402.887 | 13,681.708 | 18,084.595 | |||||||||||

15

The foregoing estimated proved reserve data was prepared using unweighted average first-day-of-the-month prices for the year ended December 31, 2012. The Securities and Exchange Commission (SEC) pricing guidelines were used to set the oil and gas prices. An oil price of $94.71 per barrel (Bbl) and a gas price of $2.752 per million British Thermal Unit (MMbtu) were used in this study. The prices were adjusted for energy content, price differentials, and other expenses as needed.

Our proved natural gas reserves were 14.843 billion cubic feet (Bcf), or 2.473 million barrels of oil equivalent (BOE) (1Bbl = 6 Mcf basis). The proved oil reserves were .177 million barrels, for a total of 2.650 million barrels of oil equivalent (BOE). The Net Present Value, discounted at 10%, of the estimated future net cash flow before income taxes (PV-10) of our total proved reserves at December 31, 2012 was $18.084 million.

There are many uncertainties inherent in estimating quantities and values of proved reserves and projecting future rates of production and timing of development. The reserve data set forth herein, although prepared by an independent petroleum engineer in a manner customary in the industry, are estimates only, and the actual quantities and values of oil and gas are likely to differ from the estimated amounts set forth herein. In addition, the reserve estimates for our properties will be affected by future changes in sales prices of oil and gas produced. Other than those filed with the SEC, our estimated reserves have not been filed with or included in any reports to any federal agency.

Description of Securities

The following description is a summary of the material terms of the provisions of our Articles of Incorporation and Bylaws, exhibits of which were included in our S-1 registration statement, which was declared effective on October 28, 2011.

Common Stock.

We are authorized to issue 90,000,000 shares of common stock, $0.001 par value per share, and 10,000,000 shares of preferred stock. As of the date of this report on Form 10-K there are 6,615,400 of our common stock issued and outstanding held by 46.

Preferred Stock.

We are authorized to issue 10,000,000 shares of blank check preferred stock, no shares of which are issued and outstanding. The rights terms and preferences of our preferred stock have not been established and can be designated at any time by the majority vote of our Board of Directors without a vote of our shareholders.

16

Warrants.

From September 25, 2010 through March 29, 2011, we offered and sold $64,000 of convertible promissory notes with attached warrants to 25 persons. Each note was converted into common shares at the price $.50 per. Under the terms of the convertible note agreement six months after a qualifying transaction we became obligated to grant each note holder 1500 warrants for every $500 invested. Under the terms of paragraph 3 of the note, we became required to issue the warrants upon the closing of a Qualifying Transaction, which is defined as a purchase of, formation of, merger with, and/or acquisition of a corporate entity with equity securities. A qualifying transaction occurred upon our filing articles of incorporation with the state of Florida on March 17, 2011 when we changed our domicile from Wyoming to Florida because we caused the formation of a corporate entity with equity securities. As such on September 17, 2011, we granted each note holder 1500 warrants for every $500 invested for an aggregate of 192,000 warrants. The warrant holder may exercise each one (1) warrant into one (1) common share at the price of $1.00 per share from March 17, 2012 until the close of business on the date which is two years after the date of the holder’s convertible note.

On or about August 15, 2012, we terminated the issuance of the warrants and provided an equal number of restricted shares to each of the 25 holders, as more fully detailed on page 19. As such, we have no warrants outstanding.

Florida Anti-Takeover Laws.

As a Florida corporation, we are subject to certain anti-takeover provisions that apply to public corporations under Florida law. Section 607.0901 of the Florida Business Corporation Act, or the Florida Act, provides that a publicly held Florida corporation may not engage in a broad range of business combinations or other extraordinary corporate transactions with an interested shareholder without the approval of the holders of two-thirds of the voting shares of the corporation (excluding shares held by the interested shareholder), unless:

(i) The transaction is approved by a majority of disinterested directors before the shareholder becomes an interested shareholder;

(ii) the interested shareholder has owned at least 80% of the corporation’s outstanding voting shares for at least five years preceding the announcement date of any such business combination;

(iii) the interested shareholder is the beneficial owner of at least 90% of the outstanding voting shares of the corporation, exclusive of shares acquired directly from the corporation in a transaction not approved by a majority of the disinterested directors; or

(iv) The consideration paid to the holders of the corporation’s voting stock is at least equal to certain fair price criteria.

An interested shareholder is defined as a person who, together with affiliates and associates, beneficially owns more than 10% of a corporation’s outstanding voting shares. We have not made an election in our amended Articles of Incorporation to opt out of Section 607.0901.

Additionally, we are subject to Section 607.0902 of the Florida Act which prohibits the voting of shares in a publicly held Florida corporation that are acquired in a control share acquisition unless (i) our board of directors approved such acquisition prior to its consummation or (ii) after such acquisition, in lieu of prior approval by our board of directors, the holders of a majority of the corporation’s voting shares, exclusive of shares owned by officers of the corporation, employee directors or the acquiring party, approve the granting of voting rights as to the shares acquired in the control share acquisition. A control share acquisition is defined as an acquisition that immediately thereafter entitles the acquiring party to 20% or more of the total voting power in an election of directors.

Item 3. Legal Proceedings

We are not a party to any pending legal proceeding. We are not aware of any pending legal proceeding to which any of our officers, directors, or any beneficial holders of 5% or more of our voting securities are adverse to us or have a material interest adverse to us.

17

Item 4. Mine Safety Disclosure

Inapplicable. We do not operate any mines and are not subject to Section 1503 of the Dodd-Frank Wall Street Reform and Consumer Protection Act in so far as Section 1503’s disclosure requirement that a reporting issuer of a coal or other mine to disclose, among other things, mine safety violations, citations and orders related to the mine being operated.

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Market Information

Our common shares are quoted on the OTC Markets inter-dealer quotation system under the symbol, PSST. There is no established public trading market for our securities and a regular trading market may not develop, or if developed, may not be sustained. A shareholder in all likelihood, therefore, will be unable to resell his or her securities should he or she desire to do so when eligible for public resales. Furthermore, it is unlikely that a lending institution will accept our securities as pledged collateral for loans unless a regular trading market develops.

The following table sets forth the range of high and low bid quotations for our common stock for each of the periods indicated as reported by the OTCBB. These quotations reflect inter-dealer prices, without retail mark-up, markdown or commission and may not necessarily represent actual transactions. Our common stock became quoted on the OTCBB on our about May 15, 2012.

|

Fiscal Year Ending December 31, 2012

|

||||||||

|

Quarter Ended

|

High $

|

Low $

|

||||||

|

December 31, 2012

|

$ | 0.02 | $ | 0.02 | ||||

|

September 30, 2012

|

$ | 0.17 | $ | 0.17 | ||||

|

June 30 2012

|

$ | 0.25 | $ | 0.25 | ||||

|

March 31, 2012

|

N/A | N/A | ||||||

|

Fiscal Year Ending December 31, 2011

|

||||||||

|

Quarter Ended

|

High $

|

Low $

|

||||||

|

December 31, 2011

|

N/A | N/A | ||||||

|

September 30, 2011

|

N/A | N/A | ||||||

|

June 30, 2011

|

N/A | N/A | ||||||

|

March 31, 2011

|

N/A | N/A | ||||||

Penny Stock Considerations

Our shares will be "penny stocks", as that term is generally defined in the Securities Exchange Act of 1934 to mean equity securities with a price of less than $5.00. Thus, our shares will be subject to rules that impose sales practice and disclosure requirements on broker-dealers who engage in certain transactions involving a penny stock.

Under the penny stock regulations, a broker-dealer selling a penny stock to anyone other than an established customer must make a special suitability determination regarding the purchaser and must receive the purchaser's written consent to the transaction prior to the sale, unless the broker-dealer is otherwise exempt.

In addition, under the penny stock regulations, the broker-dealer is required to:

|

•

|

Deliver, prior to any transaction involving a penny stock, a disclosure schedule prepared by the Securities and Exchange Commission relating to the penny stock market, unless the broker-dealer or the transaction is otherwise exempt;

|

|

•

|

Disclose commissions payable to the broker-dealer and our registered representatives and current bid and offer quotations for the securities;

|

18

|

•

|

Send monthly statements disclosing recent price information pertaining to the penny stock held in a customer's account, the account's value, and information regarding the limited market in penny stocks; and

|

|

•

|

Make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser's written agreement to the transaction, prior to conducting any penny stock transaction in the customer's account.

|

Because of these regulations, broker-dealers may encounter difficulties in their attempt to sell shares of our Common Stock, which may affect the ability of our shareholders to sell their shares in the secondary market, and have the effect of reducing the level of trading activity in the secondary market. These additional sales practice and disclosure requirements could impede the sale of our securities. In addition, the liquidity for our securities may be decreased, with a corresponding decrease in the price of our securities. Our shares in all probability will be subject to such penny stock rules and our shareholders will, in all likelihood, find it difficult to sell their securities.

Sales of our common stock under Rule 144

6,644,200 shares of our common shares are currently eligible for resale under Rule 144. In general, persons holding restricted securities, including affiliates, must hold their shares for a period of at least six months and persons who are affiliates must file a Form 144 with the SEC prior to sale, may not sell more than one percent of the total issued and outstanding shares in any 90-day period, and must resell the shares in an unsolicited brokerage transaction at the market price. If substantial amounts of our common stock become available for resale under Rule 144, prevailing market prices of our common stock will be reduced.

Dividends

We have not declared any cash dividends on our common stock since our inception and do not anticipate paying such dividends in the foreseeable future. We plan to retain any future earnings for use in our business. Any decisions as to future payments of dividends will depend on our earnings and financial position and such other facts, as the Board of Directors deems relevant.

Securities Authorized for Issuance under Equity Compensation Plans

On December 7, 2011, we registered 200,000 shares of our common stock on Form S-8 under the Securities Act of 1933. As of April 13, 2013, we issued 190,000 shares registered to professionals and consultants in exchange for professional services to be rendered in 2012.

On or about August 15, 2012, we terminated the issuance of the warrants and provided an equal number of restricted shares to each of the 25 holders. As such, we have no warrants outstanding.

On August 15, 2012, our Board of Directors unanimously issued a resolution to eliminate warrant agreements with 25 persons and entities, and in lieu of the issuance of warrants, issue an equal number of restricted shares of our common stock to each of the following prior warrant holders: (a) 15,000 shares to Robert and Roxaline Weaver; (b) 30,000 shares to Robert and Jeanette Nail; (c) 15,000 shares to Emily S. Holbrook; (d) 10,500 shares to Sovereign One, Inc.; (e) 10,500 shares to McCrome International, Inc.; (e) 10,500 shares to Logos Resources; (f) 15,000 shares to Velimir Jurisic; (g) 15,000 shares to Dale Bradshaw and Pamela Shepp; (h) 15,000 shares to Robert and Karen Ketchum; (i) 15,000 shares to Robert and Christa Ketchum; (j) 15,000 shares to Thaddeus and Patty Vance; (k) 15,000 shares to Richard and Kathryn Heard; (l) 600 shares to Isabelle Holbrook; (m) 1200 shares to Roxaline Bewley; (n) 600 shares to Brianna Hinds; (o) 600 shares to Emma Holbrook Irrevocable Trust; (p) 600 shares to Victoria Bewley; (q) 600 shares to Grayson Simonetti; (r) 600 shares to Garrett Blair White Irrevocable Trust; (s) 1600 shares to E, Bennett and I. Elizabeth Robinson; (t) 750 shares to Bonnie Valentine; (u) 1200 shares to Anthony Akers; (v) 750 shares to Anthony Akers; (w) 750 shares to Gina Sears; and (x) 750 shares to Tistan James Hall.

19

On December 15, 2012, we issued 136,800 restricted common stock shares to each of the following as consideration for various equipment: (a) Sovereign One, Inc., an entity under the control of our President/Director, Mark Holbrook; (b) Logos Resources, Inc., an entity under the control of our Vice President/Director, Marshall Holbrook; and (c) McCrome International, Inc., an entity under the control of our Chief Financial Officer/Director, Cora J. Holbrook.

We relied upon Sections 4(2) and 4(6) of the Securities Act of 1933 and Rule 506 of Regulation D thereunder, as amended (“the Act”) in connection with the offer and sale of the notes and the common shares issued in conversion of the notes. We believe these exemptions were available because:

|

·

|

our officers and director had a pre-existing relationship with each person;

|

|

·

|

the certificates were marked with a restrictive legend setting forth the restrictions on transferability; and

|

|

·

|

each investor or their representative was an accredited investor.

|

Item 6. Selected Financial Data

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operation

Results of operations

Year Ended December 31, 2012 compared to the year ended December 31, 2011

For the year ended December 31, 2012, we generated $439,991 in total revenues, $416,412 in oil and gas production and $23,679 in royalty income. For the year ended December 31, 2011, we generated $327,987 in total revenues, $327,984 that was derived form oil and gas production and $0 from royalty revenue. Our revenues increased by $112,004 or 34% from 2011 to 2012 representing an increase specifically of $88,425 in oil and gas production and an increase of $23,579 in royalty revenues. We reported no revenue activity for the year ended December 31, 2010. For the year ended December 31, 2012 and 2011, we incurred operating expenses of $480,131 and $289,483, respectively, an increase of $190,648, or an increase of 65%. This increase in operating expenses is primarily attributable to an increase of $190,648 in our administrative expenses from 2011 to 2012. During the second half of the year ended December 31, 2011, we began early stage implementation of our planned operations and began generating revenue and incurring operating and administrative expenses required to support the generation of revenue, which has continued throughout 2012.

For the year ended December 31, 2012, we reported a net loss of $44,103 and for the year ended December 31, 2011 and for the period ended December 31, 2011, we reported net income of $37,659. Our net losses during FY 2012 compared to a net gain during FY 2011 are primarily attributable to the increase in our administrative expenses of $190,648 from 2011 to 2012. For the year ended December 31, 2010, we did not conduct revenue-generating business.

Liquidity

At December 31, 2012, we had total current assets of $378,808, consisting of $20,625 in cash, $48,183 in accounts receivable, and $310,000 in prepaid expenses for professional services to be rendered in 2012. Total current liabilities at December 31, 2012 were $38,623, consisting of $30,778 of accounts and accrued expenses payable, $3845 of notes payable (current portion) and $4,000 due to related parties. At December 31, 2012, we had positive working capital of $340,185.

20

Our material sources and uses of cash for the year ended December 31, 2012 and 2011 are as follows:

|

2012

|

2011

|

|||||||

|

Cash (used in) operating activities

|

$ | (223,081 | ) | (16,783 | ) | |||

|

Property acquisition - down payment

|

(1,500 | ) | ||||||

|

Proceeds from sale of common stock

|

1,900 | |||||||

| Proceeds from issuance of bonds payable – related parties | 28,000 | |||||||

|

Proceeds from related party loans, net

|

10,557 | |||||||

|

Payments on notes payable

|

(23,702 | ) | (5,034 | ) | ||||

|

Proceeds from issuance of convertible promissory notes

|

(37,000 | ) | ||||||

|

Increase in cash

|

7,654 | 44,443 | ||||||

Our net losses of $44,103 are primarily attributable to $370,148 of administrative expenses plus $30,908 of depreciation, deletion and amortization. For the year ended December 31, 2011, our income of $38,504 was attributable to our revenues of $327,987 offset by a lesser amount of expenses of $289,483.

Item 7A. Quantitative and Qualitative Disclosures about Market Risk.

Not Applicable

We do not have any market risk sensitive instruments that we hold or trade currently or for purposes other than trading or at the end of the fiscal year ended December 31, 2012.

21

Item 8. Financial Statements and Supplementary Data

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Years Ended December 31, 2012

Board of Directors and Shareholders

Puissant Industries, Inc.

Columbia, Kentucky 42728

I have audited the accompanying balance sheets of Puissant Industries, Inc. ("the Company") as of December 31, 2012 and 2011 and the statements of operations, stockholders' equity, and cash flows for the years then ended. These financial statements are the responsibility of the Company's management. My responsibility is to express an opinion on these financial statements based on my audit.

I conducted my audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that I plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatements. I was not engaged to perform an audit of its internal control over financial reporting. My audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company's internal control over financial reporting. Accordingly, I express no such opinion. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. I believe that my audits provide a reasonable basis for my opinion.

In my opinion, these financial statements present fairly, in all material respects, the financial position of Puissant Industries, Inc. as of December 31, 2012 and 2011 and the results of its operations and its cash flows for the years then ended in conformity with accounting principles generally accepted in the United States.

/s/ Patrick Rodgers, CPA, PA

Patrick Rodgers, CPA, PA

Altamonte Springs, Florida

April 13, 2013

F-1

|

Puissant Industries, Inc.

|

||||||||||

|

Consolidated Statements of Financial Condition

|

|

December 31,

|

||||||||

|

2012

|

2011

|

|||||||

|

ASSETS

|

||||||||

|

Current assets

|

||||||||

|

Cash

|

$ | 20,625 | $ | 26,160 | ||||

|

Accounts receivable

|

48,183 | 42,653 | ||||||

|

Prepaid expenses

|

310,000 | 320,000 | ||||||

|

Total current assets

|

378,808 | 388,813 | ||||||

|

Properties and equipment at cost, based on successful

|

||||||||

|

efforts method:

|

||||||||

|

Producing oil and natural gas properties

|

343,875 | 78,121 | ||||||

|

Non-producing oil and natural gas properties

|

56,521 | - | ||||||

| 400,396 | 78,121 | |||||||

|

Less: accumulated depreciation, depletion, and amortization

|

30,908 | - | ||||||

| 369,488 | 78,121 | |||||||

|

Net properties and equipment

|

||||||||

| 78,121 | 78,121 | |||||||

|

Total assets

|

$ | 748,296 | $ | 466,934 | ||||

|

LIABILITIES AND STOCKHOLDERS' EQUITY

|

||||||||

|

Current liabilities

|

||||||||

|

Accounts and accrued expenses payable

|

$ | 30,778 | $ | 12,211 | ||||

|

Notes payable, current portion

|

3,845 | 21,764 | ||||||

|

Due related parties

|

4,000 | 4,000 | ||||||

|

Total current liabilities

|

38,623 | 37,975 | ||||||

|

Long-term debt

|

||||||||

|

Bonds payable - related parties

|

28,000 | - | ||||||

|

Notes payable, less current portion

|

41,495 | 47,278 | ||||||

|

Total liabilities

|

108,118 | 85,253 | ||||||

|

Stockholders' equity

|

||||||||

|

Preferred stock, $0.001 par value; 10,000,000 authorized,

|

||||||||

|

none outstanding at December 31, 2011

|

||||||||

|

Common stock, $0.001 par value; 90,000,000 shares

|

||||||||

|

authorized, 6,644,200 and 5,941,800 issued and outstanding at

|

||||||||

|

December 31, 2012 and 2011, respectively

|

6,644 | 5,942 | ||||||

|

Paid-in capital

|

885,097 | 583,199 | ||||||

|

Accumulated deficit

|

(251,563 | ) | (207,460 | ) | ||||

|

Total stockholders' equity (deficit)

|

640,178 | 381,681 | ||||||

|

Total liabilities and stockholders' equity

|

$ | 748,296 | $ | 466,934 | ||||

The accompanying footnotes are an integral part of these financial statements.

F-2

|

Puissant Industries, Inc.

|

|||

|

Consolidated Statements of Operations

|

|

Year Ended

|

||||||||

|

December 31,

|

||||||||

|

2012

|

2011

|

|||||||

|

Revenues:

|

||||||||

|

Oil and gas production

|

$ | 416,412 | $ | 327,987 | ||||

|

Royalty income

|

23,579 | - | ||||||

| 439,991 | 327,987 | |||||||

|

Costs and Expenses

|

||||||||

|

Lease operating expenses

|

79,075 | 166,235 | ||||||

|

Administrative expenses

|

370,148 | 123,248 | ||||||

|

Depreciation, depletion, and amortization

|

30,908 | - | ||||||

|

Total costs and expenses

|

480,131 | 289,483 | ||||||

|

Net loss loss from operations

|

(40,140 | ) | 38,504 | |||||

|

Other income (expense)

|

||||||||

|

Interest expense

|

(3,963 | ) | (845 | ) | ||||

|

Total other expenses

|

(3,963 | ) | (845 | ) | ||||

|

Income (loss) before income taxes

|

(44,103 | ) | 37,659 | |||||

|

Provision for income taxes

|

- | - | ||||||

|

Net income (loss)

|

$ | (44,103 | ) | $ | 37,659 | |||

|

Net loss per weighted share,

|

||||||||

|

basic and fully diluted

|

$ | (0.007 | ) | $ | 0.010 | |||

|

Weighted average number of common

|

||||||||

|

shares outstanding, basic and fully diluted

|

6,096,765 | 5,695,764 | ||||||

The accompanying footnotes are an integral part of these financial statements.

F-3

|

Puissant Industries, Inc.

|

|

Consolidated Statements of Changes in Stockholders' Equity

|

|

Additional

|

Common

|

|||||||||||||||||||||||||||||||

|

Preferred Stock

|

Common Stock

|

Paid-in

|

Stock

|

Accumulated

|

||||||||||||||||||||||||||||

|

Shares

|

Amount

|

Shares

|

Amount

|

Capital

|

Subscribed

|

Deficit

|

Total

|

|||||||||||||||||||||||||

|

Balance, December 31, 2010

|

- | - | 50,000 | $ | 50 | $ | 3,191 | $ | - | $ | (245,119 | ) | $ | (241,878 | ) | |||||||||||||||||

|

Shares issued in connection

|

||||||||||||||||||||||||||||||||

|

with conversion of notes payable

|

128,000 | 128 | 63,872 | 64,000 | ||||||||||||||||||||||||||||

|

Shares issued in exchange

|

- | |||||||||||||||||||||||||||||||

|

for land leases

|

5,200,000 | 5,200 | (5,200 | ) | - | |||||||||||||||||||||||||||

|

Share issued in exchange for

|

||||||||||||||||||||||||||||||||

|

professional services

|

320,000 | 320 | 159,680 | 160,000 | ||||||||||||||||||||||||||||

|

Shares issued for services rendered

|

80,000 | 80 | 39,920 | 40,000 | ||||||||||||||||||||||||||||

|

Sale of common stock for cash

|

3,800 | 4 | 1,896 | 1,900 | ||||||||||||||||||||||||||||

|

Shares issued in exchange for

|

||||||||||||||||||||||||||||||||

|

professional services

|

160,000 | 160 | 319,840 | 320,000 | ||||||||||||||||||||||||||||

|

Net income (loss)

|

37,659 | 37,659 | ||||||||||||||||||||||||||||||

|

Balance, December 31, 2011

|

- | - | 5,941,800 | 5,942 | 583,199 | - | (207,460 | ) | 381,681 | |||||||||||||||||||||||

|

Shares issued in exchange for

|

||||||||||||||||||||||||||||||||

|

professional services

|

100,000 | 100 | 199,900 | 200,000 | ||||||||||||||||||||||||||||

|

Shares issued in connection

|

||||||||||||||||||||||||||||||||

|

with purchase of support equipment

|

410,400 | 410 | 102,190 | 102,600 | ||||||||||||||||||||||||||||

|

Shares issued in exchange for

|

192,000 | 192 | (192 | ) | - | |||||||||||||||||||||||||||

|

warrants

|

||||||||||||||||||||||||||||||||

|

Net income (loss)

|

(44,103 | ) | (44,103 | ) | ||||||||||||||||||||||||||||

|

Balance, December 31, 2012

|

- | - | 6,644,200 | $ | 6,644 | $ | 885,097 | $ | - | $ | (251,563 | ) | $ | 640,178 | ||||||||||||||||||

The accompanying footnotes are an integral part of these financial statements.

F-4

|

Puissant Industries, Inc.

|

|

Consolidated Statements of Cash Flows

|

|

For the Years Ended December 31, 2012 and 2011

|

|

Year Ended

|

||||||||

|

December 31,

|

||||||||

|

2012

|

2011

|

|||||||

|

Cash flows from operations

|

||||||||

|

Net income (loss)

|

$ | (44,103 | ) | $ | 37,659 | |||

|

Adjustments to reconcile income (loss) to cash provided by

|

||||||||

|

(used in) operating activities:

|

||||||||

|

Depreciation and depletion

|

44,107 | - | ||||||

|

Changes in operating assets and liabilities:

|

||||||||

|

Accounts receivable

|

(5,530 | ) | (42,653 | ) | ||||

|

Prepaid expenses

|

210,000 | - | ||||||

|

Accounts and accrued expenses payable

|

18,567 | (15,789 | ) | |||||

| - | 4,000 | |||||||

|

Net cash provided by (used in) operating activities

|

223,041 | (16,783 | ) | |||||

|

Cash flows from investing activities

|

||||||||

|

Additions to oil and gas properties

|

(219,675 | ) | (1,500 | ) | ||||

|

Net cash used by financing activities

|

(219,675 | ) | (1,500 | ) | ||||

|

Cash flows from investing activities

|

||||||||

|

Payment on notes payable

|

(23,702 | ) | (5,034 | ) | ||||

|

Proceeds from sale of common stock

|

- | 1,900 | ||||||

|

Proceeds from related party loans, net

|

- | 10,577 | ||||||

|

Proceeds from issuance of convertible promissory notes

|

- | 37,000 | ||||||

|

Proceeds from issuance of bonds payable-related parties

|

28,000 | - | ||||||

|

Net cash provided by invewsting activities

|

4,298 | 44,443 | ||||||

|

Net increase (decrease) in cash

|

7,664 | 44,443 | ||||||

|

Cash, beginning of period

|

26,160 | - | ||||||

|

Cash, end of period

|

$ | 33,824 | $ | 26,160 | ||||

|

Supplemental disclosure of cash flow information:

|

||||||||

|

Cash paid during the period for:

|

||||||||

|

Income taxes

|

$ | - | $ | - | ||||

|

Interest

|

$ | 845 | $ | 845.00 | ||||

|

Non-cash investing and financing transactions:

|

||||||||

|

Issuance of 128,000 shares of common stock in

|

||||||||

|

connection with conversion of notes payable

|

$ | 64,000 | $ | 64,000 | ||||

|

Issuance of 320,000 shares of common stock in conection

|

||||||||

|

with convesion of liability to issue stock, a liability incurred

|

||||||||

|

in exchange for professional services

|

$ | 160,000 | $ | 160,000 | ||||

|

Issuance of 80,000 common shares in connection with conversion

|

||||||||

|

of liability to issue stock, a liability incurred in exchange

|

||||||||

|