Attached files

| file | filename |

|---|---|

| EX-32 - EXHIBIT 32 - Greenpower International Group Ltd | v341320_ex32.htm |

| EX-31 - EXHIBIT 31 - Greenpower International Group Ltd | v341320_ex31.htm |

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 : |

| For the fiscal year ended December 31, 2012 |

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

000-54424

Commission file number

GREENPOWER INTERNATIONAL GROUP LTD.

(Exact name of registrant as specified in its charter)

| Delaware | 45-1877342 |

| (State or other jurisdiction of | (I.R.S. Employer Identification No.) |

| incorporation or organization) |

1311 South Bromley Avenue

West Covina, California 91790

(Address of principal executive offices) (zip code)

Registrant's telephone number, including area code: 312/622-7670

Securities registered pursuatn to Section 12(b) of the Act: None

| Securities registered pursuant to Section 12(g) of the Exchange Act: | Common Stock |

| $.0001 par value per share | |

| (Title of class) |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act ¨ Yes x No

Inidcate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ¨ Yes x No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

x Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (Section 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

x Yes ¨ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (Section 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

x Yes ¨ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer", "accelerated filer", "non-accelerated filer", and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

| Large Accelerated filer | ¨ | Accelerated filer | ¨ | |

| Non-accelerated filer | ¨ | Smaller reporting company | x | |

| (do not check if smaller reporting company) | ||||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

¨ Yes x No

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant's most recently completed second fiscal quarter. $ 0

Indicate the number of shares outstanding of each of the registrant's classes of common stock as of the latest practicable date.

| Class | Outstanding at April 1, 2013 | |

| Common Stock, par value $0.0001 | 21,000,000 shares |

Documents incorporated by reference:

In February 2012 the Registrant filed, pursuant to the Securities Act of 1933, a registration statement on Form S-1 and an amendment to such registration statement in January 2013 for the sale of up to 11,000,000 shares of its common stock by the holders thereof and simultaneously filed, pursuant to the Securities Exchange Act of 1934, a Report on Form 8-K and amendments to such report in January and February, 2013. Information contained in those filings may contain additional information and is incorporated by reference herein.

PART I

| ITEM 1. | BUSINESS |

History

Greenpower International Group Limited (the "Company" or the "Registratrant")(formerly Boxwood Acquisition Corporation) was incorporated on April 20, 2011 under the laws of the State of Delaware to engage in any lawful corporate undertaking, including but not limited to, selected mergers and acquisitions. On June 2, 2011, the Company filed a registration statement on Form 10 pursuant to the Securities Exchange Act of 1934 by which it registered its class of common stock pursuant to such Act.

On February 10, 2012, the Company effected the acquisition of Greenpower International Group Limited of the British Virgin Islands ("Greenpower BVI") through the exchange of 10,000,000 shares of the Company's common stock for all the outstanding shares of Greenpower BVI (50,000 shares) (the "Acquisition") by which Greenpower BVI became a wholly-owned subsidiary of the Company. Greenpower BVI was incorporated in the British Virgin Islands on September 16, 2011.

Prior to the Acquisition, Greenpower Delaware had no ongoing business or operations and was established for the purpose of completing a business combination with a target company, such as Greenpower BVI.

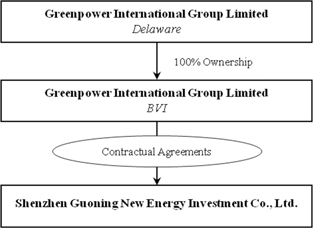

Through contractual arrangements, Greenpower BVI has management and voting control of Shenzhen Guoning New Energy Investment Co., Ltd, an operating company formed under the laws of Guangdong, China (“Guoning”), through a variable investment entity structure. By virtue of the Acquisition, the Company has management and voting control of Guoning and the operations of the Company and its business are conducted through Guoning. The Company does not, however, own the equity of Guoning, and instead exercises its control in Guoning through the variable investment entity structure involving Greenpower BVI.

Other than through its relationship with Guoning, the Company has no material assets or revenues.

| 2 |

Business and Operations

At December 31, 2012, the Company had sustained operating losses of $2,071,715. The Company's auditors have issued a report raising substantial doubt about the Company's ability to continue as a going concern. The Company's continuation as a going concern is dependent on management's ability to develop profitable operations and/or obtain additional financial from its stockholders or third parties. The consolidated financial statements included in this Report, assume that the Company will continue as a going concern.

The Company (through Guoning with which the Company has a contractual relationship) is in the business of energy management with the primary objective of commercializing energy-saving lighting products and services, primarily in China. The Chinese government is sponsoring tax and other government incentives for companies to enter into energy management contracts (“EMC”). The Company has availed itself of these benefits beginning in 2012. The Company receives two major tax benefits: (1) For the first three years, 100% waiver of all business enterprise income taxes for income generated from the EMC business. For the following three years, this waiver will be 50% of all enterprise business income taxes for income generated from the EMC business. (2) No circulation tax (including value-added tax and business tax) in operating the EMC business line. In a typical EMC agreement, an industrial business or large user of electricity hires a company to manage their electrical use.

The Company presently focuses on entering into EMCs with outdoor advertising (billboard) companies, particularly pillar billboard lighting, essentially replacing the traditional lights on the outdoor advertising with LED lights. The Company (through Guoning) receives a share of the reduction in the electrical bill received by the customer. The Company (through Guoning) also sells LED lights to consumers and businesses via direct sales or wholesale to other retailers.

The Company’s LED business model focuses essentially on energy performance sharing via replacing customers’ current illumination equipment with energy efficient LED lights and charges based on an agreed percentage of monthly utility bills saved. The Company provides customers with LED lights free-of-charge in exchange for entering into five-year or six-year EMC contracts whereby the Company will be entitled to a percentage of the energy savings achieved by the customer on a decreasing scale year–over-year. In the first year, the Company will typically receive 85% of the energy savings, with its share thereafter decreasing by five percentage points (5%) each year over the following four or five years.

In addition to the EMC contract business, the Company serves as a distributor of LED bulbs and light sets. To date, the Company’s LED product sales have generated revenue for the Company and such future revenue may exceed the Company’s EMC revenue over the short term. The Company, through Greenpower BVI, may enter into additional LED sales contracts for sales outside of China.

| 3 |

The Company entered into its first contract for EMC services in 2011 and at the time of this Report has not completed its performance under such contract. During 2012, the Company entered into 75 EMC contracts. The Company is marketing its EMC services to smaller customers and anticipates that such market will result with continuous orders by those customers for lighting products.

The Company has also begun to bid on EMC contracts that are outside the billboard lighting marketplace. In addition, the Company has only recently begun to enter into LED product sales contracts. Both the EMC and the LED business lines are still unproven and the Company is a new entrant to both markets. Moreover, the EMC service model is a new concept that was just recently introduced to the marketplace, and accordingly, this market has limited history and no long-term track record. The Company is currently in the process of developing new products, such as LED lights for tunnels, street lights and fishing boat lights (underwater).

The Company plans to expand its presence in the market with branch offices and distributorships. The Company anticipates that additional offices will add to the direct sales of LED lights as well as promoting the EMC business.

Guoning has established a branch office structure in order to develop and encourage contractor partners to provide timely and comprehensive services to localized customers in order to promote Guoning.

The Company has 15 branch locations. The Company has entered into written agreements with 17 regional distributors to provide showrooms, six of which have set up the actual showroom locations. All distributorships and the showrooms have entered into written contractual agreements with Guoning to act in their respective capacities.

Based on arrangements with the showrooms (which the Company entered through Guoning), the showrooms are proposed for several core functions, including: (a) offering a unique experience of high-end technology products to customers who run businesses involved in energy conservation; and (b) product marketing (i.e. users can experience products from Guoning directly to see the effects of energy conservation). Guoning authorizes use of the Company’s logo(s) and insignia, and that the showrooms manage products from Guoning. Further, the showrooms are expected to be responsible for their own respective management, financial affairs and operations. The showroom agents are expected to purchase products from Guoning directly and then sell these products in order to make a profit and/or sell products of Guoning on a traditional commission-based arrangement. The Company undertakes comprehensive training in the showrooms.

Guoning opens branch offices based on marketing conditions that it perceives to be beneficial for its business combined with the need for Guoning to efficiently develop its business across China. Opening branch offices allows Guoning an efficient means to enter regional markets by working in cooperation with local individuals that are more familiar with the regional conditions (e.g. geography, marketing, etc.).

| 4 |

The Company plans to market directly to the customer without substantial use of traditional media or advertising campaigns. The Company plans to reach target customers directly through limited, targeted media activities. For example, recently, Guoning released a promotion in a major media magazine in China to reach significant expressway customers that are likely to read this publication. In addition, Guoning was a title sponsor of the World Miss Pageant Conference in China. The Company also plans other targeted advertising and media blitzes that are likely to directly reach target customers for the Company’s products.

Products

The primary products of the Company are LED lights, specifically for outdoor billboards. The primary service of the Company is the EMC or Energy Management Contract. The Company provides customers with energy efficient and high quality LED lighting at no cost in exchange for a contract that gives the Company a share of the Company’s energy savings.

The Company customizes high-power LED floodlights for the outdoor advertisement lighting market. Compared to products of the same category, the advantages of the Company’s LED projector are the following:

| · | Better heat elimination. Al-Mg alloy heat elimination technology is used to keep working temperatures low, which could reduce heat impact on related electronics, less lumen and longer product life. |

| · | Better sealing: New sealing technologies are applied and fulfill the requirement of precision equipment. |

| · | Better lighting: latest lens technology is used to control projection range, which reduces lighting inefficiency and improves illumination and uniformity. |

| · | Better coloring: the color rendering index reaches above 80 for the Company’s advertising projector, providing better coloring. |

| · | Better stability: core equipment white LED lamp are supplied by Cree America, therefore the product performance is stable. |

| · | Better power saving: Guoning LED floodlight uses 66W to replace 400W (real power consumption 460W) lamp. Most of the LED floodlights in the market use 110W lamp, hence the Company’s LED floodlight is the best power saving projector in the market. |

The Company’s Guoning ‘Ouruishi” series LED lighting product offers several product features. There are 9 categories and 30 types of LED lighting products from ‘Ouruishi’ series product line, such as LED sensor lamp, human sensor swift, LED scenery lamp, LED daylight lap, sensory halogen lamp, sensory scenery lamp, LED sensory night lamp, LED sensory lamp, LED high power projector.

| 5 |

Guoning ‘Ouruishi’ series of lighting products use imported LED lighting source, and have qualities such as no UV, no infrared, no radiation, soft lighting effect, no strobe, frequent starting, and are a green environmental friendly lighting source. In addition, such series of lighting products have qualities such as strong anti-shock, anti-dust, low power consumption, low voltage, low heat, low lighting temperature, and safe to use. The LED lighting belongs to a solid lighting source, epoxy resin sealed, fixed lighting component, without problems of filament burning, heat deposit, and declined lumen. Its lighting time could reach 30,000 to 50,000 hours, which is 30 times of normal lamp, equals to non-stoppable lighting time above 3 years.

The compared performance between the Company’s LED floodlight and products from same category and 400 watt metal are as follows (with same lighting effect): The time to start the LED light is only a few seconds, whereas the 400W large facility usually requires several minutes. The LED product has lower power driven, low power consumption (single tube 0.05W), higher lighting efficiency (98%). LED lamp conserves 60%-80% of energy than traditional lamp, and it is easier to install and durable. It could work under any situation and environment. Also, the lighting stays within range whereas with bigger lamps it is dispersed, wasting light.

The Company attempts to ensure that each product fully complies with the quality requirements before reaching the marketplace through strict testing and experiment by its laboratory specialized team and technical personnel. Guoning also sends formal listed products over to the national testing institutions (China quality authentication center) to assess various technical parameters and ensure that the applied products conform to the state standards. Guoning also ensures quality supervision of the purchasing process by conducting third party supervision – notably, Guoning asks manufacturers to provide comprehensive inspection reports issued by inspection agency, include inspection of parts, qualifications of former supply chain and quality certificates. In addition, the technical team from Guoning strictly supervises production according to the cooperation agreement in place with the third party. With respect to procurement procedures of raw materials, Guoning and manufacturers have strict quality assurance agreements, and the quality of products and its components are indentified by institution of authentication.

Variable Investment Entity

The Company employed a variable investment entity (“VIE”) structure with Guoning. The VIE structure has the benefit of decreased operational costs and more flexibility in business. Without the VIE structure, Guoning would have substantially increased operating costs. For example, the Company would need to relocate its operations to an area designated for Foreign Owned Companies and the rents in those locations are substantially more expensive. In addition, such a designation would have included Guoning’s branch office locations as well. Further, employee costs, license costs and tax costs would also be increased substantially without use of a VIE structure. The Company believes that it would simply be at a competitive disadvantage if it did not employ the VIE structure with Guoning.

| 6 |

Variable Investment Entity Structure

The Variable Investment Entity Structure (the “VIE Structure”) is commonly used by Chinese companies that encounter legal prohibitions on foreign ownership of their businesses. Currently, the Company is not aware of any prohibition under applicable PRC law that precludes the Company from using a direct ownership (e.g. as a wholly owned subsidiary of Greenpower Delaware) structure with Guoning. The Company has nevertheless elected to use and maintain the VIE Structure in organizing its business and overall corporate structure.

The services fees that Guoning will pay to Greenpower BVI are calculated under the following method: Guoning provides the Company a monthly financial statement which is then reviewed and verified by the Company. If Guoning shows a net income loss for the month, then no monthly service fee is paid. If Guoning shows a net income gain/profit, then that income/profit will be paid to the Company. To date, no money has been paid to the Company. For the purposes of calculating whether Guoning made a profit or a loss, US GAAP standards are being used.

On October 26, 2011, the shareholders of Guoning entered into a set of variable investment entity agreements (“VIE Agreements”) with Greenpower BVI. The VIE Agreements specify, among other things, that: (1) Greenpower BVI will provide Guoning with guidance and instructions on daily operations, financial management and employment issues; (2) Greenpower BVI shall have the right to appoint or remove Guoning’s directors and officers; (3) Guoning will pledge its accounts receivable and all of its assets to Greenpower BVI; (4) Guoning will not sell, assign, transfer or encumber any assets or interests value at 100 RMB or more, without the written consent of Greenpower BVI; and (5) Guoning will pay 100% of its net revenue to Greenpower BVI for each fiscal year during the term. The term of the foregoing provisions is for 100 years and may be extended at the option of Greenpower BVI for an additional 100 years. In connection with the VIE Agreements, Guoning also granted an irrevocable power of attorney to Greenpower BVI specifying that the latter shall have full authority to act as the former’s attorney in fact for any and all lawful purposes.

The VIE Agreements also grant an exclusive option to Greenpower BVI to purchase any or all of the equity interest in Guoning at any time in next 100 years (subject to extension for an additional 100-year term by Greenpower BVI). In addition, pursuant to the VIE Agreements, all of the shareholders of Guoning have pledged all of their equity interests in Guoning to Greenpower BVI for a term of 100 years (subject to extension for an additional 100-year term by Greenpower BVI). Further, all of the shareholders of Guoning also executed an irrevocable proxy granting Greenpower BVI the right to exercise all of the voting rights in Guoning in the place and stead of the Guoning shareholders. The term of the proxy is for 100 years, subject to extension for an additional 100 years at the option of Greenpower BVI. The pledge agreements have been registered with the proper PRC Authorities, and an “Enterprise Shares Pledge Notice” was issued by the Shenzen Market Supervisory Authority.

| 7 |

On February 6, 2012, in conjunction with the VIE Agreements, Greenpower BVI and Guoning entered into an exclusive business cooperation agreement that provides that Greenpower BVI shall be the exclusive service provider to Guoning and will provide complete technical support, business support and related consulting services. In consideration for such services, Greenpower BVI is entitled to receive fees equal to 100% of the net income of Guoning, such fees being due and payable on a monthly basis. Pursuant to the exclusive business cooperation agreement, Greenpower BVI also has exclusive and proprietary rights and interests in all rights, ownership, interests and intellectual properties arising out of or created during the performance of the agreement, including, but not limited to, copyrights, patents, patent applications, software, technical secrets, trade secrets and others.

On February 6, 2012, in conjunction with the VIE Agreements, each shareholder of Guoning entered into an exclusive option agreement that allows Greenpower BVI to purchase additional shares of Guoning. Greenpower BVI paid 10 RMB to each shareholder for the option to purchase such shareholder’s equity interest in Guoning. Subject to Chinese laws and regulations, Greenpower BVI may exercise the option upon written notice to the shareholder. Unless an appraisal is required by applicable Chinese law, the purchase price of the interests shall be RMB 1.00 or the lowest price allowed by applicable laws and regulations. Greenpower BVI may elect to make payment for any equity interest (upon option exercise) by cancelling any outstanding loan amount owed by the applicable shareholder to Greenpower BVI. The exclusive option agreement is effective for 10 years, and may be renewed at the election of Greenpower BVI.

On February 6, 2012, in conjunction the exclusive business cooperation agreement and the VIE Agreements, each shareholder entered into a pledge agreement to ensure that Guoning fully performs its obligations under the exclusive business cooperation agreement. Each shareholder pledged to Greenpower BVI all of the shareholders’ equity interest in Guoning as security for the performance of that agreement by Guoning.

On February 6, 2012, in conjunction with the above-referenced agreements, each shareholder also entered into a power of attorney granting Greenpower BVI the right to act on behalf of the shareholder as the shareholder’s agent and attorney with respect to all matters concerning the shareholder’s shares in Guoning, including (without limitation) to: attend shareholders’ meetings of Guoning, exercise all of the shareholder’s rights (including voting rights) in Guoning, and designating and appointing the executive director, supervisor, the chief executive officer and other senior management members of Guoning.

The Company is considering an alternate structure or amendments to the VIE Agreements based on the formation of a wholly foreign owned entity (“WFOE”) in China. This WFOE has been formed in Hong Kong and is in the process of obtaining authorization. The WFOE would be 100% equity owned by Greenpower BVI. Such alternate structure or amendments would affect Guoning and Greenpower BVI as subject entities that are involved in the VIE Agreements.

| 8 |

The purpose and effect of the VIE Agreements is to provide Greenpower BVI (which was acquired by the Company) with all of the management and control of Guoning. While Greenpower BVI does not actually own at present all of the equity and shares in Guoning, the purpose and effect of the VIE Agreements is to instill in Greenpower BVI total management and voting control of Guoning for all material purposes.

The Company’s structure related to Guoning was instituted as a method of containing costs and to provide the Company with options to possibly conduct business in those fields where there is foreign ownership restrictions currently or in the future. The Company has analyzed that its operating expenses (General & Administrative / Sales & Marketing) for the Company would be two to three times greater operating under a direct equity subsidiary structure verses a contractual arrangement with Guoning. The increased operating expense in a direct equity subsidiary structure was determined to represent a less favorable economic model for the Company’s overall success.

Employees

As of the date of this report, the two executive officers of the Company are its only employees.

Guoning has approximately 70 employees across its organization, in sales and marketing, service, finance and strategic development.

Each employee is full-time and receives a monthly salary and other benefits (as are required pursuant to applicable Chinese law). All employees are provided access to Company health plans, 401(k)-type endowment plans, unemployment insurance provisions and housing allowances, as is required in each instance by applicable Chinese law. In addition, certain employees receive group life insurance benefits through the Company.

Key officers of Guoning also have full-time written employment agreements in effect that govern their employment relationship with Guoning.

Guoning also has over 15 independent distributors who have been engaged to provide services at various locations. The distributors are typically charged with sales and marketing activities and may earn commissions for their efforts.

Subsidiaries

Greenpower BVI is a wholly owned subsidiary of the Company. The Company has no other subsidiaries, except that Guoning has been consolidated for purposes of the Company’s accounting. Greenpower BVI has management and voting control over Guoning, which comprises the core operations of the Company.

| 9 |

Reports to Security Holders

The Company has filed a registration statement on Form S-1, under the Securities Act of 1933, with the Securities and Exchange Commission with respect to the sale of shares of its common stock by the holders thereof.

In 2011, the Company (as Boxwood Acquisition Corporation) filed a Form 10 registration statement pursuant to the Securities Exchange Act of 1934 and is a reporting company pursuant such Act and files with the Securities and Exchange Commission quarterly and annual reports and management shareholding information. The Company intends to deliver a copy of its annual report to its security holders, and will voluntarily send a copy of the annual report, including audited financial statements, to any registered shareholder who requests the same.

The Company's documents filed with the Securities and Exchange Commission may be inspected at the Commission's principal office in Washington, D.C. Copies of all or any part of any filing may be obtained from the Public Reference Section of the Securities and Exchange Commission, 100 F Street N.E., Washington, D.C. 20549. Call the Commission at 1-800-SEC-0330 for further information on the operation of the public reference rooms. The Securities and Exchange Commission also maintains a web site at http://www.sec.gov that contains reports, proxy statements and information regarding registrants that file electronically with the Commission. All of the Company’s filings may be located under the CIK number 0001522211.

| ITEM 2. | PROPERTIES |

The corporate headquarters of the Company are located in West Covina, California.

The operating headquarters of the Company through Guoning are located in Shenzhen, Guangdong Province, China. The Company has entered into a three-year lease for approximately 5,000 square feet of office at a cost of approximately 20,000 RMB per month. Currently, approximately 50 employees work from such location.

Guoning also leases an office/warehouse consisting of approximately 3,000 square feet. This facility normally has three employees and is used to store promotional material and temporary storage of products for local delivery. The lease cost of this facility is approximately 1,500 RMB per month.

Guoning also has 15 branch offices that are typically leased office spaces of approximately 100 square meters staffed with employees. These branch offices are located in the following provinces: Guangdong, Guizhou, Hainan, Hunan, Jiangsu, Shandong, Shanxi, Sichuan, Hubei, Fujian, Guangxi, Zhajing, Jiangri, Auhui, Hunan and Shanxi.

| ITEM 3. | LEGAL PROCEEDINGS |

There are no pending, threatened or actual legal proceedings in which the Company or any subsidiary is a party.

| 10 |

| ITEM 4. | MINE SAFETY DISCLOSURES |

Not applicable.

PART II

| ITEM 5. | MARKET FOR REGISTRANT'S COMMON EQUITY, RELATE STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

There is no public market for the Company’s common stock.

The Company is authorized to issue 500,000,000 shares of common stock, par value $0.0001, of which 21,000,000 shares are outstanding as of the date of this Report. The Company is also authorized to issue 20,000,000 shares of preferred stock, par value $0.0001, of which no shares were outstanding as of the date of this Report.

The Company has filed with the Securities and Exchange Commission a registration statement on Form S-1 pursuant to the Securities Act of 1933 for the offer and sale up to 11,000,000 shares of common stock at owned by current shareholders.

On June 2, 2011, the Company filed a registration statement on Form 10 pursuant to the Securities Exchange Act of 1934 by which it registered its class of common stock pursuant to such Act.

The Company has issued the following securities in the last three (3) years. Such securities were issued pursuant to exemptions from registration under Section 4(2) of the Securities Act of 1933, as amended, as transactions by an issuer not involving any public offering, as noted below. Each of these transactions was issued as part of a private placement of securities by the Company in which (i) no general advertising or solicitation was used, and (ii) the investors purchasing securities were acquiring the same for investment purposes only, without a view to resale.

| Date | Name | Number of Shares | ||

| April 20, 2011 | Tiber Creek Corporation | 10,000,000 (9,750,000 Redeemed) | ||

| April 20, 2011 | MB Americus, LLC | 10,000,000 (9,750,000 Redeemed) |

On October 31, 2011, the Company, as part of its change in control, issued 10,500,000 shares of its common stock to 50 individuals all of whom except one are residents of the People's Republic of China. Such securities were issued pursuant to exemptions from registration under Section 4(2) of the Securities Act of 1933, as amended, as transactions by an issuer not involving any public offering.

| 11 |

On February 10, 2012, the Company issued an aggregate of 10,000,000 shares to 50 shareholders of Greenpower International Group Limited, a company incorporated in the British Virgin Islands through the exchange of such 10,000,000 shares of voting common stock of Greenpower Delaware for all the outstanding shares of Greenpower BVI at an exchange ratio of 200 shares of Greenpower Delaware for each share of Greenpower BVI. All the shareholders, except one, of Greenpower BVI are residents of the People's Republic of China.

On January 3, 2013, the Company cancelled 1,300,000 shares of common stock that were previously issued to Lili Bell. On January 3, 2013, the Company issued 1,300,000 shares of common stock to Jiong Zhang.

| ITEM 6. | SELECTED FINANCIAL DATA. |

There is no selected financial data required to be filed for a smaller reporting company.

| ITEM 7. | MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

The following discussion and analysis of financial condition and results of operations, relating to the audited consolidated financial statements of the Company for the fiscal year ended December 31, 2012 and 2011, should be read in conjunction with the consolidated financial statements, including the related notes, appearing in Item 8 of this Annual Report on Form 10-K. Those statements in the following discussion that are not historical in nature should be considered to be forward looking statements that are inherently uncertain. Actual results and the timing of the events may differ materially from those contained in these forward looking statements due to a number of factors, including those discussed in the “Cautionary Note on Forward Looking Statements” set forth elsewhere in this Annual Report.

Forward-Looking Statements

Certain statements made in this Report are "forward-looking statements" (within the meaning of the Private Securities Litigation Reform Act of 1995) regarding the plans and objectives of management for future operations. Such statements involve known and unknown risks, uncertainties, and other factors that may cause actual results, performance, or achievements of Greenpower International Group Limited ("we", "us", "our," or the "Company") to be materially different from any future results, performance, or achievements expressed or implied by the forward-looking statements. The forward-looking statements included herein are based on current beliefs, assumptions, and expectations, and are subject to numerous risks and uncertainties. The Company's plans and objectives are based, in part, on assumptions of the continuing expansion of business. Assumptions relating to the foregoing involve judgments with respect to, among other things, future economic, competitive and market conditions, and future business decisions, all of which are difficult or impossible to predict accurately, and many of which are beyond the control of the Company. Although the Company believes its assumptions underlying the forward-looking statements are reasonable, it cannot guarantee future results, levels of activity, performance, or achievements. These forward-looking statements are made as of the date of this report, and the Company assumes no obligation to update these forward-looking statements whether as a result of new information, future events, or otherwise, other than as required by law. In light of these assumptions, risks, and uncertainties, the forward-looking events discussed in this report might not occur and actual results and events may vary significantly from those discussed in the forward-looking statements.

| 12 |

Overview

Greenpower International Group Limited (the "Company", "we", "our"), formerly Boxwood Acquisition Corporation, was incorporated on April 20, 2011 under the laws of the State of Delaware to engage in any lawful corporate undertaking, including, but not limited to, selected mergers and acquisitions. The Company was formed to provide a method for a foreign or domestic private company to become a reporting company with a class of securities registered under the Securities Exchange Act of 1934. The Company has transitioned from a development stage company to a commercialized entity. The Company has developed several revenue sources and is seeking to expand upon those sources going forward.

On February 10, 2012, the Company effected the acquisition of Greenpower International Group Limited of British Virgin Islands (“Greenpower BVI”) through the exchange of 10,000,000 shares of voting common stock of Company for all the 50,000 outstanding shares of Greenpower BVI at an exchange ratio of 200 shares of the Company for each share of Greenpower BVI (the "Acquisition"). Greenpower BVI was incorporated in the British Virgin Islands on September 16, 2011. As a result of the Acquisition, the Company has taken over the operations and business plan of Greenpower BVI, which has management and voting control over Shenzhen Guoning New Energy Investment Co., Ltd, an operating Chinese company that serves as an electrical-use manager and LED lights distributor in China (“Guoning”), through a variable investment entity ("VIE") structure pursuant to contractual agreements dated October 26, 2011 and subsequently strengthened in February 2012.

The Company is in the business of energy management, with the primary objective of commercializing highly efficient energy-saving LED lighting products and services. The Chinese government is sponsoring tax and other government incentives for companies to enter into energy management contracts (“EMC”). A typical EMC is an agreement whereby an industrial business or large user of electricity hires a company to manage their electrical use. The Company presently focuses on entering into EMCs with outdoor advertising (billboard) companies, essentially replacing the traditional lights on the outdoor advertising with LED lights. The Company receives a share of the reduction in the electrical bill received by the customer. A total of 76 agreements have been entered into as of the date hereof and physical property has been purchased, designed and installed in regard to such business. Further, these contracts are delivering the contractually agreed upon lease payments and income to the Company. Furthermore, the Company also sells LED bulbs and light sets to consumers and businesses via direct sales or wholesale to other retailers and distributors.

| 13 |

The Company entered into its first contract for EMC services in 2011, and has started its performance under such contract. During fiscal year 2012, the Company has successfully added many other EMC contracts, and as of the date of this Report has approximately 80 EMC agreements in effect. Moreover, the Company believes that since the EMC service contract model is a new concept that was just recently introduced to the marketplace, the market has limited history and no long-term track record on which to base its performance.

Critical Accounting Policies and Estimates

While the Company's significant accounting policies are more fully described in Note 2 of its financial statements under the Financial Statements section “Note 2 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES”, the Company believes that the following accounting policies are the most critical in fully understanding and evaluating this discussion and analysis:

Use of estimates - Management's discussion and analysis of the Company's financial condition and results of operations are based on the financial statements, which have been prepared in accordance with accounting principles generally accepted in the United States (“GAAP”). The preparation of these consolidated financial statements requires the Company to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements as well as the reported net sales and expenses during the reporting periods. On an ongoing basis, the Company evaluates estimates and assumptions. The Company bases estimates on historical experience and various other factors that it believes are reasonable under the circumstances, the results of which form the basis for making judgments about the carrying value of assets and liabilities that are not readily apparent from other sources. Actual results may differ from these estimates under different assumptions or conditions.

Revenue recognition - The Company recognizes revenue in accordance with FASB ASC No. 605 from product sales or services rendered when the following four revenue recognition criteria are met: persuasive evidence of an arrangement exists, delivery has occurred or services have been rendered, the selling price is fixed or determinable, and collectability is reasonably assured. Returns and exchanges require approval from senior management and are on a case-by-case basis. We review and estimate the rates of return and exchange based on historical data and customer specific experience. Historically, returns and exchanges have been insignificant. The majority of our revenues are derived from three sources. Our revenue recognition policies vary based upon these revenue sources:

Sales of products - Most of the Company's products are shipped directly to the customer at FOB Destination. Revenue is recognized when product is delivered to the customer, when all delivery documents have been signed by the receiving customer, and ownership has passed to the customer. The Company considers the terms of each arrangement to determine the appropriate accounting treatment.

| 14 |

Investment in direct financing lease The Company’s leasing operations consist primarily of leasing LED lights in connection with our EMC business. The LED lights are leased under five to six year direct finance leases. The Company uses the direct financing method of accounting to record income from direct financing leases. At the inception of the leases, the Company records the net investment in leases, which consists of the sum of the minimum lease payments, initial direct costs, and unguaranteed residual value (gross investment) less the unearned income. The difference between the gross investment and the cost of the leased equipment is recorded as unearned income at the inception of the lease.

Revenue for direct financing leases is recognized as the unearned income is amortized over the life of the lease using the effective interest method. The amortization of unearned income is a component of lease revenue in our consolidated statements of operations. We review our direct financing lease arrangements for credit risk. Such review includes consideration of the credit rating and financial position of the lessee. Generally, when a lease is more than 90 days delinquent (when more than three monthly payments are owed), the lease is classified as being on non-accrual and the Company stops recognizing leasing income on that date. Payments received on leases in non-accrual status generally reduce the lease receivable. Leases on non-accrual status remain classified as such until there is sustained payment performance that, in our judgment, would indicate that all contractual amounts will be collected in full.

The Company defers initial direct costs incurred to originate leases in accordance with applicable accounting guidance. The initial direct costs deferred are part of the investment in leasing operations and are amortized to leasing income using the interest method. Initial direct costs include commissions and costs associated with credit evaluation, recording guarantees and other security arrangements, documentation and transaction closing. Residual values reflect the estimated amounts to be received at lease termination from lease extensions, sales or other dispositions of leased equipment. The leased equipment residual values are based on management’s best estimate.

Commission From time to time the Company facilitates the sale of products to markets both inside and outside of China. As such, the Company recognizes contractually agreed revenue based upon the delivery of products to an end user customer. Revenue from these types of agreements is recognized when the transaction is substantially finished and upon receipt of the commission payment, net of any related cost.

Inventory - Inventory is stated at the lower of cost or market. Cost is determined on a weighted average basis. The Company estimates net realizable value based on intended use, current market value and inventory aging analyses. The Company writes down the inventory for estimated obsolescence or unmarketable inventory equal to the difference between the cost of the inventory and the estimated market value based upon assumptions about future demand and market conditions. Inventory inherited from the prior entity of Guoning was fully reserved in the prior year.

| 15 |

Foreign currency translation - The reporting currency is the U.S. dollar. The functional currency of Guoning is the local currency, Renminbi (“RMB”). For consolidation purposes, the financial statements of Guoning are translated into United States dollars (“USD”) in accordance with ASC 830, Foreign Currency Matters, using year-end rates of exchange for assets and liabilities, and average rates of exchange for the period for revenues, costs, and expenses and historical rates for equity. Translation adjustments resulting from the process of translating the local currency financial statements into U.S. dollars are included in determining comprehensive income. The exchange rates in effect as of December 31, 2012 and 2011 were RMB 1.00 for USD $0.1605 and USD $0.1589, respectively. The average exchange rates for the year and the period from September 16, 2011 (inception) through December 31, 2011 were RMB 1.00 for USD $0.1585 and USD $0.1547, respectively. At December 31, 2012 and 2011, the cumulative translation adjustment of $12,635 and $31,688, respectively, was classified as an item of accumulated other comprehensive income in the stockholders’ equity section of the consolidated balance sheets. There was no significant fluctuation in the exchange rate for the conversion of RMB to USD after the balance sheet date.

Recent Accounting Policies

See Note 3 of our financial statements that describe the impact, if any, from the adoption of Recent Accounting Pronouncements.

Results of Operations and Financial Condition

Comparison of the Fiscal Year Ended December 31, 2012 to December 31, 2011

Net revenue for the year ending December 31, 2012 was $708,913 compared with $34,483 for the period from September 16, 2011 (Inception) through December 31, 2011. The increase in net revenue of approximately $674,000 or 1956% is a result of the Company’s development and expansion of its business in the market since inception in late 2011. Cost of revenue for the year ended December 31, 2012 was $233,279, compared to $14,687 for the period ended December 31, 2011. All costs are relevant to sales of light products.

Selling expenses for the year ending December 31, 2012 and the period from September 16, 2011 (Inception) through December 31, 2011 were $713,609 and $34,801, respectively. The significant increase of approximately $679,000 or 1951% in selling expense was primarily due to the Company’s investment in expansion of the market. General and administrative expenses for the reporting period in fiscal 2012 and 2011 were $1,425,182 and $385,587, respectively, an increase of approximately $1,040,000 or 270%. The main reason for the increase was attributable to the Company’s business development and the commitment to its EMC contracts, which required an increase in personnel expenses, in addition to increased costs to maintain a public reporting company.

| 16 |

Net investment in direct financing leases as of December 31, 2012 and 2011 was $538,435 and $71,119, respectively. This increase is due to a growth in the number of EMC contracts. Inventory net of obsolescence reserve went up from $83,144 as of December 31, 2011 to $569,207 as of December 31, 2012. This change mainly came from LED bulbs and light sets inventory purchased for stock sales and the new EMC contracts initiated in 2012, and was funded primarily by the change in accounts payable, notes payable to related parties, and short term borrowings. Accounts payable as of December 31, 2012 and 2011 was $617,656 and $17,852, respectively; notes payable to related party and short term borrowings was $432,577 and $844,604 as of December 31, 2012, respectively, and were both zero at December 31, 2011.

Liquidity and Capital Resources

The Company's cash and cash equivalents were $37,037 as of December 31, 2012, compared to $76,850 as of December 31, 2011, a decrease of approximately $40,000 or 52%. The main reason for the decrease was due to the increase in outflow of net cash used in operating activities during fiscal 2012. A summary of cash flows for the reporting period of fiscal 2012 and 2011 is as follows:

| From September 16, 2011 | ||||||||

| For the Year Ended | (Inception) to | |||||||

| December 31, 2012 | December 31, 2011 | |||||||

| Operating activities | $ | (1,756,802 | ) | $ | (1,265,155 | ) | ||

| Investing activities | (5,470 | ) | (67,410 | ) | ||||

| Financing activities | 1,721,485 | (301,677 | ) | |||||

| Effect of change in exchange rate on cash | 974 | (18,721 | ) | |||||

| Net change in cash during the period | $ | (39,813 | ) | $ | (1,652,963 | ) | ||

Cash flows used in operating activities were $1,756,802 during 2012, as compared to $1,265,155 in the prior year. The increase of approximately $492,000 or 39% in the use of cash was resulted from the increased losses from operations and changes in operating assets and liabilities, primarily from the purchase of inventory and an increase in lease payment receivable and unearned income. As discussed the above, we incurred significant operating expenditures in selling and general and administrative expense since inception in 2011 for the Company’s business development and the commitment to its EMC contracts, which required an increase in personnel expenses, in addition to increased costs to maintain a public reporting company.

Cash used in investing activities was $5,470 for the year ended December 31, 2012, as compared to $67,410 during the period from Inception to December 31, 2011. Cash flows in investing activities came from purchase and disposal of equipment during each period.

Cash flows provided by financing activities were $1,721,485 in 2012, compared to $301,677 used in the prior year. Our financing in 2012 came from capital contributions, notes payable to related parties, and short term borrowings. See Note 9 and 11 of the Notes to the Consolidated Financial Statements.

| 17 |

As of December 31, 2012, we had working capital deficit of approximately $1,519,000. Since December 31, 2011, our working capital has continued to decline as a result of continuing losses from operations. In order to maintain our current level of operations, we will require additional working capital from either cash flow from operations or from the sale of our equity or debt securities. If we are unable to acquire additional working capital, we will be required to significantly reduce our current level of operations. The report of our independent registered public accounting firm for the fiscal year ended December 31, 2012 states that due to our losses from operations and lack of working capital there is substantial doubt about our ability to continue as a going concern.

The Company expects to generate additional revenues through its EMC business model. Together with revenue from LED bulbs and light set sales, as well as commission income, the Company expects to provide increased liquidity. The Company expects to review strategic partnerships and additional sources of financing as part of the solution for increased liquidity. However, there can be no guarantees that such funds will be available on commercially reasonable terms, if at all. If such financing is not available on satisfactory terms, we may be unable to continue our business as desired and operating results will be adversely affected.

Commitment – Issuance of Common Stock

Pursuant to a Joint Development, Customization and Equity Allocation Contract on LED Advertising Lamp (“Agreement”) with one supplier, dated September 25, 2011, the Company is obligated to grant up to 10 million shares, prorated based on the total outstanding common shares of the Company (of a 2% ratio, 10,000,000 of the 500,000,000 authorized), two officers of the supplier for all product patent rights, trademark rights, software copyright and the domestic marketing exclusivity rights applied by the supplier and subsequently granted to Guoning. In November 2012, the supplier transferred those 12 approved patents to Guoning. Since there are 21,000,000 shares of common stock currently outstanding, the Company is obligated to issue 420,000 shares to the supplier. The Chairman of the Company will transfer his existing shares to the supplier instead of the Company issuing new shares. The Company estimates that the transfer/issuance of shares would tentatively occur near the end of 2013. See Note 7 of the Notes to the Consolidated Financial Statements.

Contractual Obligations and Off-balance Sheet Arrangements

Contractual Obligations

As a "smaller reporting company" as defined by Item 10 of Regulation S-K, the Company is not required to provide information required by this Item.

| 18 |

Off-balance Sheet Arrangements

The Company has no off-balance sheet arrangements that are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that is deemed by our management to be material to investors.

| ITEM 8. | FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA |

The consolidated financial statements for the year ended December 31, 2012 for Greenpower International Group, Inc. are attached to this Report.

| ITEM 9. | CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE |

The Company had no disagreements on any matter of accounting principle or practice, financial statement disclosure or audit scope or procedure with its accountant.

| ITEM 9A. | CONTROLS AND PROCEDURES |

Pursuant to Rules adopted by the Securities and Exchange Commission. the Company carried out an evaluation of the effectiveness of the design and operation of its disclosure controls and procedures pursuant to Exchange Act Rules. This evaluation was done as of the end of the fiscal year under the supervision and with the participation of the Company's principal executive officer and principal financial and accounting officer. There have been no significant changes in internal controls or in other factors that could significantly affect internal controls subsequent to the date of the evaluation. Based upon that evaluation, they believe that the Company's disclosure controls and procedures are effective in gathering ,analyzing and disclosing information needed to ensure that the information required to be disclosed by the Company in its periodic reports is recorded, summarized and processed timely. The officers are directly involved in the day-to-day operations of the Company.

Management's Report of Internal Control over Financial Reporting

The Company is responsible for establishing and maintaining adequate internal control over financial reporting in accordance with the Rule 13a-15 of the Securities Exchange Act of 1934. The Company's president and principal financial and accounting officer conducted an evaluation of the effectiveness of the Company's internal control over financial reporting as of December 31, 2012, based on the criteria establish in Internal Control Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission. Based on this evaluation, management concluded that the Company's internal control over financial reporting was effective as of December 31, 2012, based on those criteria. A control system can provide only reasonably, not absolute, assurance that the objectives of the control system are met and no evaluation of controls can provide absolute assurance that all control issues have been detected.

| 19 |

Anton & Chia, the independent registered public accounting firm, has not issued an attestation report on the effectiveness of the internal control over financial reporting.

Changes in Internal Control Over Financial Reporting

The Company has not made any changes during the fourth fiscal quarter that materially affect, or are reasonably likely to materially affect, its internal control over financial reporting.

| ITEM 9B. | OTHER INFORMATION |

There is no information required to be disclosed on Form 8-K during the fourth quarter covered by this Form 10-K not otherwise reported.

PART III

| ITEM 10. | DIRECTORS, EXECUTIVE OFFICERS, AND CORPORATE GOVERNANCE |

As of December 31, 2012, the directors and officers of the Company are as follows:

The following table sets forth information regarding the members of the Company’s board of directors and its executive officers. Listed below are certain key members of the Guoning management team:

| Name | Age | Position | Year Commenced | |||

| Jiong Zhang | 45 | Chairman of the Board | 2011 | |||

| Yong Luo | 50 | Director | 2011 | |||

| Xiaoping Liu | 50 | Chief Executive Officer and Director | 2011 | |||

| Hui Li | 46 | Chief Financial Officer | ||||

| Mu Qing Wang | 51 | Chief Supervisor of Guoning | ||||

| Ling Yu Zhou | 36 | Supervisor, Guoning Research | ||||

| Jiang Li Wu | 35 | Financial Manager of Guoning |

Jiong Zhang serves as the Chairman of the Board of Directors of the Company. He is also currently the Chairman of the Board of Guoning. Mr. Zhang was the founder of Muren, a predecessor to Guoning (Mr. Zhang currently has no involvement or association with Muren). Mr. Zhang has been involved in the development and production of LED smart energy saving lighting and is very familiar with the industry and its market. Mr. Zhang graduated from Hunan (China) Institute of Finance and Economics.

| 20 |

Yong Luo serves as a member of the Board of Directors of the Company, and was formerly Chief Financial Officer for the Company. Mr. Luo has more than 15 years of experience in marketing, management and business operations. He was instrumental in the development and use of a caller ID telephone for Shenzhen Kang Meisi Communication Co., Ltd. which the company attributes to significantly impacting a large increase in its production value. He is also currently the Chairman of the Board of Global Lock Safety (International) Group Co., Ltd. Under his direction and control, Global Lock Safety (International) Group Co., Ltd. was successfully listed on the London Stock Exchange in 2011. He is also currently a member of the Board of Directors of Guoning. Mr. Luo graduated from Hunan (China) Hengyang Normal University.

Xiaoping Liu serves as the Chief Executive Officer and a Director of the Company. Mr. Liu is also the Managing Director of Guoning. After retiring from serving as a general manager of a government owned company, Mr. Liu founded a culture communication company. As a corporate planner, Mr. Liu has consulted with many companies and successfully planned and marketed several famous brand names such as "Haier Products Marketing plans""Chain of Cooperative Planning and Program of Qingdao Beef Company" and "China Rural Credit Cooperative Association". Mr. Liu is currently the Chief Executive Officer of Guoning. Mr. Liu graduated from Hunan (China) Communication Polytechnic.

Hui Li serves as the Chief Financial Officer of the Company. Prior to that, she was the Manager of Finance at Shenzhen Huali Pharmaceutical Co., Ltd. during 2006 to 2011. Previously, from 1996 to 2006, she was with Shenzhen Tongren, a public accounting firm, as the audit project manager, who is charged with audit planning, on-site audit process control and audit report issuance. Formerly, Ms. Li was with Hainan Sanya Hexi Urban Credit Cooperatives as a Manager of the Financial Department during 1993 to 1996. Prior to that, from 1989 to 1993, she worked as an accountant at Hunan Xiangtan Bureau of Grain. Ms. Li graduated from Hunan Institute of Finance and Economics in 1989, has a Bachelor degree of Economics, and obtained CPA in China in 1994. Ms. Li has limited experience with U.S. GAAP, and therefore, the Company must rely on consultants and other outside experts in order to ensure compliance with U.S. GAAP issues.

Mu Qing Wang serves as Chief Supervisor of Guoning, in charge of strategic planning and management of the Company. He is also currently the Director of Chinese Region of Asian industry fund center (Hong Kong) and chief research analyst and editor of Industry Intelligence. He has thirty years of work experience among various fields in software development, high-tech product trading, management consultancy (strategic management, membership service), capital operation and industry education. He was graduated from Beijing University, majoring in technology information.

Ling Yu Zhou serves as Supervisor of the Guoning Research team. His key responsibility is to maintain the leadership in technology and ensure the establishment of product quality management system. He previously worked in core technology development for LED Lamp for General Electrics. He performed substantial experiences in LED technology and research, mastered advanced LED product information, and managed to tackle several technology research topics. He obtained his doctorate degree in electronics commerce research from Business School of Chinese University of Hong Kong, and master degree in engineering from Taiwan University.

| 21 |

Jiang Li Wu serves as Financial Manager of Guoning, and is in charge of corporate financial management. She has comprehensive knowledge in financial management and is experienced in accounting practices, financial and taxation regulations, financial analysis and financial planning, and budget planning and cost control model building.

Director Independence

Pursuant to Rule 4200 of The NASDAQ Stock Market one of the definitions of an independent director is a person other than an executive officer or employee of a company. The Company's Board of Directors has reviewed the materiality of any relationship that each of the directors has with the Company, either directly or indirectly. Based on this review, the Board has determined that there are no independent directors at the present time.

Committees and Terms

The Board of Directors has not established any committees of the Board.

Conflicts of Interest

There are no binding guidelines or procedures for resolving potential conflicts of interest. Failure by management to resolve conflicts of interest in favor of the Company could result in liability of management to the Company. However, any attempt by shareholders to enforce a liability of management to the Company would most likely be prohibitively expensive and time consuming.

Code of Ethics

The Company has not at this time adopted a Code of Ethics pursuant to rules described in Regulation S-K. The Company intends to adopt a Code of Ethics to provide a manner of conduct. The Company anticipates that at the time the Company completes its initial public offering of securities, it will adopt such a code.

Corporate Governance

The Company does not have a nominating nor audit committee of the board of directors. The board of Directors consists of three directors. The Company may propose creating committees of its board of directors, including both a nominating and an audit committee, in the future.

| 22 |

| ITEM 11. | EXECUTIVE COMPENSATION |

Remuneration of Officers: Summary Compensation Table

| NonEquity | Nonqualified | |||||||||||||||||||||||||||||||||||

| Incentive | Deferred | All Other | ||||||||||||||||||||||||||||||||||

| Stock | Option | Plan Com- | Compensa- | Compen- | ||||||||||||||||||||||||||||||||

| Name and Principal | Year | Salary | Bonus | Awards | Awards | pensation | -tion Earnings | sation | Total | |||||||||||||||||||||||||||

| Jiong Zhang | 2012 | $ | 57,059 | 0 | 0 | 0 | 0 | 0 | 0 | $ | 57,059 | |||||||||||||||||||||||||

| Chairman of the Board | ||||||||||||||||||||||||||||||||||||

| Xiaoping Liu | 2012 | $ | 57,059 | 0 | 0 | 0 | 0 | 0 | 0 | $ | 57,059 | |||||||||||||||||||||||||

| Chief Executive Officer | ||||||||||||||||||||||||||||||||||||

| Hui Li | 2012 | $ | 16,167 | 0 | 0 | 0 | 0 | 0 | 0 | $ | 16,167 | |||||||||||||||||||||||||

| Chief Financial Officer | ||||||||||||||||||||||||||||||||||||

| Yong Luo | 2012 | $ | 57,059 | 0 | 0 | 0 | 0 | 0 | 0 | $ | 57,059 | |||||||||||||||||||||||||

| Director | ||||||||||||||||||||||||||||||||||||

| 23 |

Description of Compensation Table

The data presented above is presented as of December 31, 2012 with respect to officers of the Company based on their roles at Guoning. The Board may allocate salaries and benefits to the officers in its sole discretion, subject to applicable employment agreements with the respective officers. No such person is subject to a compensation plan or arrangement that results from resignation, retirement, or any other termination of employment with Greenpower Delaware or from a change in control of Greenpower Delaware or a change in responsibilities following a change in control. The members of the Board may receive, if the Board so decides, a fixed fee and reimbursement of expenses, for attendance at each regular or special meeting of the Board, although no such program has been adopted to date.

Employment Agreements

Greenpower Delaware does not have any outstanding employment agreements with its officers or employees.

Guoning has entered into employment agreements with certain of its employees and officers, including three to six year employment contracts that include monthly compensation and deferred compensation.

Anticipated Officer and Director Remuneration

Greenpower Delaware intends to pay annual salaries to all of its employees and an annual stipend to its directors when, and if, it completes a primary public offering for the sale of securities (i.e. a public offering raising capital for the Company). At such time, Greenpower Delaware anticipates offering cash and non-cash compensation to other employees and directors. In addition, the Company may also offer additional benefits to employees in its sole and absolute discretion.

| 24 |

| ITEM 12. | SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS. |

The following table sets forth information as of the date of this report regarding the beneficial ownership of the Company’s common stock by each of its executive officers and directors, individually and as a group and by each person who beneficially owns in excess of five percent of the common stock after giving effect to any exercise of warrants or options held by that person.

| Number of Shares of | Percent | |||||||||

| Name | Position | Common Stock | of Class (1)(2) | |||||||

| Jiong Zhang | Chairman of the Board | 7,273,600 | 35 | % | ||||||

| Yong Luo | Director | 4,840,000 | 23 | % | ||||||

| Xiaoping Liu | Chief Executive Officer, Director | 4,840,000 | 23 | % | ||||||

| Hui Li | Chief Financial Officer | 0 | 0 | % | ||||||

| Moxiang Li | 5% shareholder | 1,000,000 | 5 | % | ||||||

| Shenzhen, China | ||||||||||

| Difan Zhong | 5% shareholder | 1,000,000 | 5 | % | ||||||

| Xiangtan, China | ||||||||||

| Total owned by officers and directors | 16,953,600 | 81 | % | |||||||

(1) Based upon 21,000,000 shares outstanding.

(2) Each of the listed persons is registering a certain number of shares in the S-1 registration statement simultaneously filed by the Company. Once such registration statement becomes effective each of these persons will offer such shares that are contained in that registration statement for sale. Assuming sale of such shares, the noted officers/director would own the following reduced percentages of the outstanding shares: Jiong Zhang 16%, Yong Luo 12%, Xiaoping Liu 12%, and the total owned by officers and directors would be 39%.

| ITEM 13. | CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS AND DIRECTOR INDEPENDENCE |

James Cassidy, a partner in the law firm which acts as counsel to the Company, is the sole owner and director of Tiber Creek Corporation which owns 250,000 shares of the Company's common stock.

| 25 |

| ITEM 14. | PRINCIPAL ACCOUNTING FEES AND SERVICES. |

Audit Fees

The aggregate fees incurred for each of the last two years for professional services rendered by the independent registered public accounting firm for the audits of the Company's annual financial statements and review of financial statements included in the Company's Form 10-K and Form 10-Q reports and services normally provided in connection with statutory and regulatory filings or engagements were as follows:

| December 31, 2011 | December 31, 2012 | |||||

| $ | 750 | 114,400 | ||||

Tax Fees

The Company incurred $0 for tax related services.

All Other Fees

The Company does not currently have an audit committee serving and as a result its board of directors performs the duties of an audit committee. The board of directors will evaluate and approve in advance, the scope and cost of the engagement of an auditor before the auditor renders audit and non-audit services. The Company does not rely on pre-approval policies and procedures.

PART IV

| ITEM 15. | EXHIBITS, FINANCIAL STATEMENT SCHEDULES |

There are no financial statement schedules nor exhibits filed herewith. The exhibits filed in earlier reports, the Company's Form 10, the Company's Form 8-K and Registration Statement on Form S-1 are incorporated herein by reference.

| 26 |

FINANCIAL STATEMENTS

Greenpower International Group Limited AND SUBSIDIARy

CONSOLIDATED FINANCIAL STATEMENTS

December 31, 2012 and 2011

| 27 |

index to CONSOLIDATED financial statements

| Page | ||

| Report of Independent Registered Public Accounting Firm | 2 | |

| Consolidated Balance Sheets at December 31, 2012 and 2011 | 3 | |

| Consolidated Statements of Operations and Comprehensive Loss for the Year Ended December 31, 2012 and the Period from September 16, 2011 (Inception) through December 31, 2011 | 4 | |

| Consolidated Statements of Changes in Stockholders’ Equity for the for the Period from September 16, 2011 (Inception) through December 31, 2012 | 5 | |

| Consolidated Statements of Cash Flows for the Year Ended December 31, 2012 and the Period from September 16, 2011 (Inception) through December 31, 2011 | 6 | |

| Notes to Consolidated Financial Statements | 7-20 |

| F-1 |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and Stockholders of

Greenpower International Group Limited and Subsidiary

We have audited the accompanying consolidated balance sheets of Greenpower International Group Limited and Subsidiary (the "Company"), as of December 31, 2012 and 2011, and the related consolidated statements of operations and comprehensive loss, changes in stockholders’ equity and cash flows for the year ended December 31, 2012, and for the period from September 16, 2011 (Inception) through December 31, 2011. These consolidated financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these consolidated financial statements based on our audits.

We conducted our audits in accordance with standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the consolidated financial statements are free of material misstatement. The Company was not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of Company's internal control over financial reporting. Accordingly, we express no such opinion. Our audits include examining, on a test basis, evidence supporting the amounts and disclosures in the consolidated financial statements. Our audits also include assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the consolidated financial position of the Company as of December 31, 2012 and 2011, and the consolidated results of its operations and its cash flows for the year ended December 31, 2012 and for the period from September 16, 2011 (Inception) to December 31, 2011 in conformity with accounting principles generally accepted in the United States of America.

As discussed in Note 2, the consolidated financial statements were prepared in accordance with Financial Accounting Standards Board Accounting Standard Codification (ASC) Topic 810 and related subtopics related to the consolidation of variable interest entities.

The accompanying consolidated financial statements have been prepared assuming that the Company will continue as a going concern. As shown in the consolidated financial statements, the Company has incurred an accumulated deficit of $2,071,715 from September 16, 2011 (Inception) to December 31, 2012. This raises substantial doubt about the Company’s ability to continue as a going concern. Management's plans concerning these matters are also described in Note 2, which includes the raising of additional equity financing. The consolidated financial statements do not include any adjustments that might result from the outcome of this uncertainty.

/s/ Anton & Chia, LLP

Newport Beach, California

April 15, 2013

| F-2 |

| GREENPOWER INTERNATIONAL GROUP LIMITED AND SUBSIDIARY |

| CONSOLIDATED BALANCE SHEETS |

| December 31, | December 31, | |||||||

| 2012 | 2011 | |||||||

| ASSETS | ||||||||

| Cash | $ | 37,037 | $ | 76,850 | ||||

| Accounts receivable, net | 99,952 | - | ||||||

| Net investment in direct financing leases – current, net of unearned income | 52,423 | 5,844 | ||||||

| Advances to related parties | 9,232 | 317,899 | ||||||

| Prepaid expense | 26,060 | 55,000 | ||||||

| Inventory, net | 569,207 | 83,144 | ||||||

| Other receivable | 18,843 | 40,770 | ||||||

| Total current assets | 812,754 | 579,507 | ||||||

| Deposits | 52,720 | 19,554 | ||||||

| Net investment in direct financing leases – noncurrent, net of unearned income | 486,012 | 65,275 | ||||||

| Advances to supplier | 1,605,110 | 1,588,840 | ||||||

| Equipment, net | 63,410 | 97,274 | ||||||

| Total noncurrent assets | 2,207,252 | 1,770,943 | ||||||

| Total Assets | $ | 3,020,006 | $ | 2,350,450 | ||||

| LIABILITIES AND STOCKHOLDERS' EQUITY | ||||||||

| Accounts payable | $ | 617,656 | $ | 17,852 | ||||

| Accrued liabilities | 187,152 | 120,070 | ||||||

| Due to related parties | - | 3,223 | ||||||

| Advance sales receipts | 128,422 | - | ||||||

| Short term borrowings | 844,604 | - | ||||||

| Notes payable to related parties | 432,577 | - | ||||||

| Taxes payable | 36,092 | 1,735 | ||||||

| Other payable | 84,895 | 3,972 | ||||||

| Total current liabilities | 2,331,398 | 146,852 | ||||||

| Total Liabilities | 2,331,398 | 146,852 | ||||||

| Stockholders' Equity | ||||||||

| Preferred stock, $0.0001 par value, 20,000,000 shares authorized; none outstanding | - | - | ||||||

| Common stock, $0.0001 par value, 500,000,000 shares authorized; 21,000,000 shares issued and outstanding (2011 – 10,000,000 shares) (1) | 2,100 | 1,000 | ||||||

| Discount on common stock issued to founders (1) | (1,000 | ) | (1,000 | ) | ||||

| Additional paid-in capital (1) | 2,714,900 | 2,572,503 | ||||||

| Accumulated other comprehensive income | 44,323 | 31,688 | ||||||

| Accumulated deficit | (2,071,715 | ) | (400,593 | ) | ||||

| Total Stockholders' Equity | 688,608 | 2,203,598 | ||||||

| Total Liabilities and Stockholders' Equity | $ | 3,020,006 | $ | 2,350,450 | ||||

(1) The December 31, 2011 capital accounts of the Company have been retroactively restated to reflect the equivalent number of common shares based on the exchange ratio of the merger transaction. See Note 2.

The accompanying notes are an integral part of these consolidated financial statements

| F-3 |

| Greenpower International Group Limited AND SUBSIDIARy |

| CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS |

| From September 16, 2011 | ||||||||

| For the Year Ended | (Inception) to | |||||||

| December 31, 2012 | December 31, 2011 | |||||||

| Revenue, net | ||||||||

| Products | $ | 388,090 | $ | 25,189 | ||||

| Leases | 228,006 | 9,294 | ||||||

| Commision | 92,589 | - | ||||||

| Other | 228 | - | ||||||

| Total revenue, net | 708,913 | 34,483 | ||||||

| Cost of revenue | ||||||||

| Products | 233,279 | 14,687 | ||||||

| Total cost of revenue | 233,279 | 14,687 | ||||||

| Gross profit | 475,634 | 19,796 | ||||||

| Operating expenses: | ||||||||

| Selling expense | 713,609 | 34,801 | ||||||