Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Cyalume Technologies Holdings, Inc. | v339973_8k.htm |

| EX-99.1 - EXHIBIT 99.1 - Cyalume Technologies Holdings, Inc. | v339973_ex99-1.htm |

…to become a global player in the non - lethal defense market Investor Presentation March 26, 2013

Safe Harbor Statement This presentation may contain forward - looking statements relating to the development of Cyalume Technologies’ products and services and future operation results, including statements regarding the Company that are subject to certain risks and uncertainties that could cause actual results to differ materially from those projected . The words "believe," "expect," "anticipate," "intend," variations of such words, and similar expressions, identify forward - looking statements, but their absence does not mean that the statement is not forward looking . These statements are not guarantees of future performance and are subject to certain risks, uncertainties, and assumptions that are difficult to predict . Factors that could affect the Company's actual results include the progress and costs of the development of products and services and the timing of the market acceptance . Any forward - looking statements contained herein speak only as of the date hereof . The Company undertakes no obligation to update or review any forward - looking statements . This presentation contains disclosure of EBITDA for certain periods, which may be deemed to be a non - GAAP financial measure within the meaning of Regulation G promulgated by the Securities and Exchange Commission . Management believes that EBITDA, or earnings before interest, taxes, depreciation and amortization, is an appropriate measure of evaluating operating performance and liquidity, because it reflects the resources available for strategic opportunities including, among others, investments in the business and strategic acquisitions . EBITDA may not be comparable to similarly titled measures reported by other companies . EBITDA is not a recognized term under U . S . GAAP, and EBITDA should be considered in addition to, and not as substitutes for, or superior to, operating income, cash flows, revenues, or other measures of financial performance prepared in accordance with generally accepted accounting principles . EBITDA is not a completely representative measure of either the historical performance or, necessarily, the future potential of Cyalume . 2

Cyalume Overview 3 • Cyalume is a researcher, developer and manufacturer of highly specialized non - lethal Chemiluminescent and chemical products • Diverse product suite: chemical lighting solutions, non - pyrotechnic explosion simulation products, non - explosive munitions • Technology provides for safer, more effective training solutions for militaries and law enforcement agencies • Patent portfolio: over 50 issued / more pending • Strong IP providing competitive advantage in every initiative • Manufacturing facilities: West Springfield (MA), Aix - en - Provence (France), and Bound Brook (NJ) • Customers include:

Cyalume’s Product Portfolio Chemiluminescent & Reflective Products Cyalume is the world leader in the research, design, development and production of Chemiluminescent and Reflective products. CyMunitions Cyalume is the world leader in the development and production of Non - Pyrotechnic, Non - Dud Producing, Environmentally - Friendly Tactical and Training Ammunition Payloads. Tactical & Training Solutions Provides innovative and realistic Explosion Effects Simulators and Live Training Solutions to military, government and law enforcement agencies around the world. Cyalume Specialty Products Is a researcher, developer and manufacturer of highly specialized chemical products. 4

Experienced Management Team Leading New Vision • In April 2012, Zivi Nedivi brought in as CEO to streamline the business, establish accountability across business units and drive sales growth • Formerly as CEO of Kellstrom Aerospace, a public company in the commercial and military aerospace aftermarket business, he grew sales from $9mm to $330mm, EBITDA from $2mm to $87mm, and EPS from $0.10 to $1.48 from 1995 - 1999 • In September 2012 Dale Baker, former CEO of Aviation Sales, a public provider of aircraft and engine parts, was brought in to be COO, bringing leadership and experience in successfully growing businesses and extensive M&A transaction Timing of turn around: • Realignment of the Company structure was completed by the end of Q2’12 • Initial results of the turn around were evident in Q3’12 • 2012 revenues of $38.6 million, or 11.4% ahead of 2011 • Further gains anticipated in 2013 5

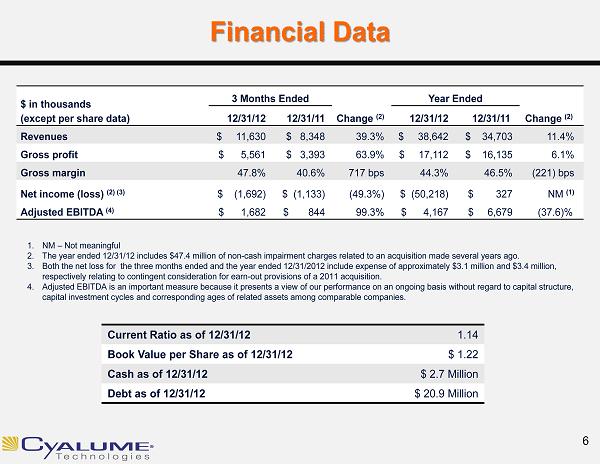

Financial Data Current Ratio as of 12/31/12 1.14 Book Value per Share as of 12/31/12 $ 1.22 Cash as of 12/31/12 $ 2.7 Million Debt as of 12/31/12 $ 20.9 Million 6 $ in thousands (except per share data) 3 Months Ended Change (2) Year Ended Change (2) 12/31/12 12/31/11 12/31/12 12/31/11 Revenues $ 11,630 $ 8,348 39.3% $ 38,642 $ 34,703 11.4% Gross profit $ 5,561 $ 3,393 63.9% $ 17,112 $ 16,135 6.1% Gross margin 47.8% 40.6% 717 bps 44.3 % 46.5% (221) bps Net income (loss) (2 ) (3) $ (1,692) $ (1,133) (49.3%) $ (50,218) $ 327 NM (1) Adjusted EBITDA (4) $ 1,682 $ 844 99.3% $ 4,167 $ 6,679 ( 37.6)% 1. NM – Not meaningful 2. The year ended 12/31/12 includes $47.4 million of non - cash impairment charges related to an acquisition made several years ago. 3. Both the net loss for the three months ended and the year ended 12/31/2012 include expense of approximately $3.1 million and $3 .4 million, respectively relating to contingent consideration for earn - out provisions of a 2011 acquisition. 4. Adjusted EBITDA is an important measure because it presents a view of our performance on an ongoing basis without regard to c api tal structure, capital investment cycles and corresponding ages of related assets among comparable companies.

2012 Year - End Results & Initial Expectations for 2013 7 Q4’12 • Revenues of $11.6 million - 39.3% ahead of $8.3 million reported for Q4’11 - 15% ahead of $10.1 million reported for Q3’12 2012 Full Year • Revenues of $38.6 million - 11.4% ahead of $34.7 million reported for 2011 2013 Full Year • Excluding any acquisitions, further improvement of top and bottom lines is expected due to : - A meaningful pipeline of new product launches and upgrades of existing ones - Strategies to enter new markets and expand presence in certain existing markets - Possible new business partnerships • Quarterly performance may vary - Q1 is expected to be a weak quarter due to seasonality and timing of contract awards • M&A activities could further accelerate growth and profitability

$30,000 $32,000 $34,000 $36,000 $38,000 $40,000 $42,000 TTM Revenue Monthly TTM Revenue Major initiatives were taken and strategies were put in place to turn around the business 8

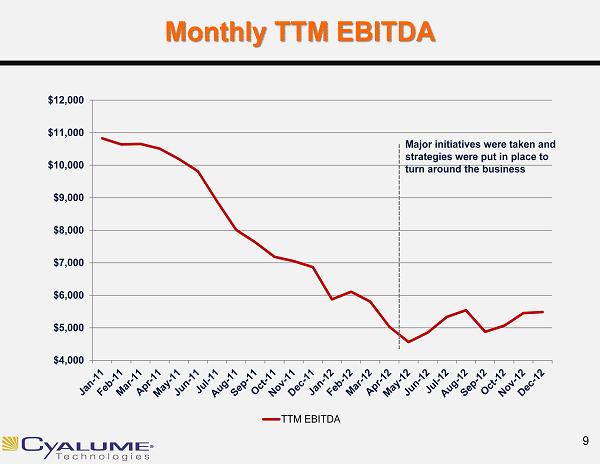

$4,000 $5,000 $6,000 $7,000 $8,000 $9,000 $10,000 $11,000 $12,000 TTM EBITDA Monthly TTM EBITDA Major initiatives were taken and strategies were put in place to turn around the business 9

Global Reach: Customers in +50 countries 10 Cyalume offices Cyalume manufacturing centers

Unique Technology • Pioneered chemical light development 40 years ago • Reliable, military - approved ammunition training technology is environmentally friendly, does not produce dangerous, toxic duds and eliminates risk of range fires in training areas • Versatile chemistry can be integrated into a wide array of form factors for use in various tactical applications • In - house specialty chemicals manufacturer • Non - pyrotechnic devices allow for realistic simulated explosions without risk of injury 11

Business Units Chemiluminescent & Reflective Products CyMunitions Tactical & Training Solutions Cyalume Specialty Products 12

13 Product Lines Chemical Light • Light sticks – 1.5 inch mini’s to 15 inch sticks • Visi - pad, Circles, Personal Marker Light, SOS, Wrist Bands, & Accessories • Tri - pods, Flare Alternatives Surface Trip Flare, S.E.E. System & Light Stations Reflective Products • Retro Reflective Photoluminescent Belts and Tape • US IR Flags, Glint Tape & ¾ inch squares • Triple Trim, Exit signs, Helmet Stickers, numbers & letters (limited) Intrusion Detection IR Traceable Power ( idIRt ) Chemiluminescent & Reflective Products

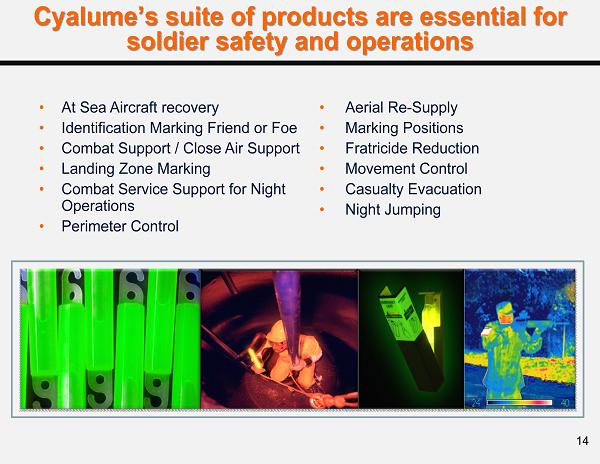

• At Sea Aircraft recovery • Identification Marking Friend or Foe • Combat Support / Close Air Support • Landing Zone Marking • Combat Service Support for Night Operations • Perimeter Control • Aerial Re - Supply • Marking Positions • Fratricide Reduction • Movement Control • Casualty Evacuation • Night Jumping Cyalume’s suite of products are essential for soldier safety and operations 14

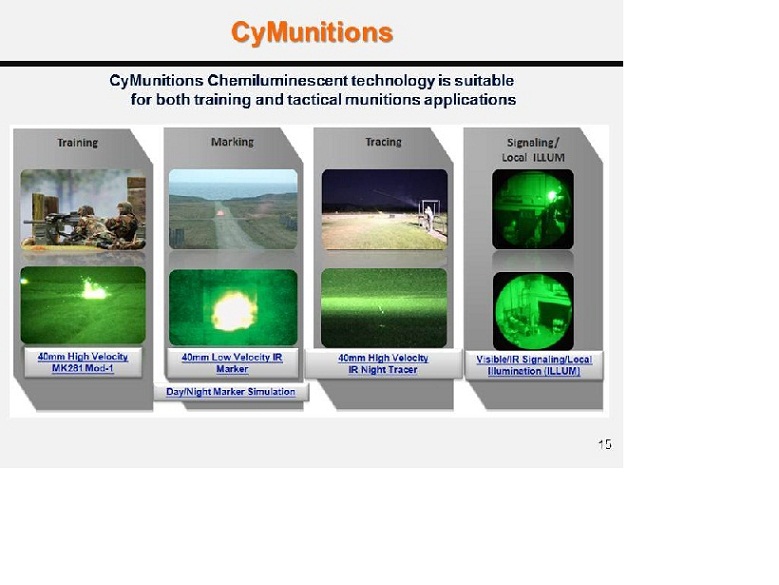

CyMunitions Chemiluminescent technology is suitable for both training and tactical munitions applications CyMunitions 15

Explosion Effects Simulators • Adds enhanced realism to training exercises for soldiers and SWAT teams • Non - pyrotechnic and safe at detonation point allows for immediate proximity to devices IED Simulator Pressure Sensitive Landmine Hand grenade Tactical & Training Solutions 16 Services Battlefield Effects Teams – Scenario Planning • Opposing force and civilian actors New Equipment and Special Unit Training • IED recognition • Tactical urban defense • Entry point control Cultural Roleplaying/Foreign Language Speaker Services Prime contractor providing services at Ft. Hood

Cyalume Specialty Products is a researcher, developer and manufacturer of highly specialized chemical products. 17 Cyalume Specialty Products

Cyalume Specialty Products manufactures and produces: • Pharmaceutical raw materials for use in drug products • Specialized cosmetic ingredients • Polymeric resins for use in military aerospace applications • Pharmaceutical polymers for use in specialized medical devices • Active ingredients for pre - operative skin prep for use in surgery • Active ingredients for nutraceutical products • Chemical light products 18 Cyalume Specialty Products

Defense Industry Backdrop • Declining military budgets and uncertainty in related development programs as deployments decrease • Thousands of companies from large to small are affected • Differentiation with real IP and competitive advantages is becoming a survival factor • Niche segments still showing considerable growth » Riot control » Domestic law enforcement » Non - lethal munitions technology & accessories » Lawful Interception, Cyber Defense 19

Market is Large and Ripe for Consolidation Industry wide issues….. • Numerous companies, big and small are lacking capital and new programs to sustain growth, and are facing declining customer budgets and fierce competition • Funding uncertainty is reducing M&A activity, which when combined with declining performance, is limiting the number of qualified buyers • Consolidating the growing niche markets of the industry represents an opportunity for value creation ….. An opportunity for Cyalume 20

Consolidation Strategy & Vision • Utilize Cyalume platform as a public company with strong management, experienced in operations and M&A, and significant IP, to be an industry consolidator in the space • Continue to optimize operations and make strategic acquisitions to create scale and shareholder value Acquisition targets 21 Companies which have proprietary IP Companies in niche markets that are growing both domestically and internationally Companies that will leverage Distribution Channels and acquired IP to generate competitive advantages

Contact Investor Relations The Equity Group Inc. Lena Cati Lcati@equityny.com Tel: 212 836 - 9611 22

…to become a global player in the non - lethal defense market Investor Presentation March 26, 2013