Attached files

| file | filename |

|---|---|

| 8-K - 8-K - TRANSATLANTIC PETROLEUM LTD. | d505348d8k.htm |

| EX-99.1 - EX-99.1 - TRANSATLANTIC PETROLEUM LTD. | d505348dex991.htm |

4Q12

Preliminary Financial and

Operations Review

March 19, 2013

Exhibit 99.2 |

Forward Looking

Statements Outlooks,

projections,

estimates,

targets,

and

business

plans

in

this

presentation

or

any

related

subsequent

discussions

are

forward-looking

statements.

Actual

future results, including TransAtlantic Petroleum Ltd.’s own production growth and mix;

financial results; the amount and mix of capital expenditures; resource additions

and

recoveries;

finding

and

development

costs;

project

and

drilling

plans,

timing,

costs,

and

capacities;

revenue

enhancements

and

cost

efficiencies;

industry margins; margin enhancements and integration benefits; and the impact of technology

could differ materially due to a number of factors. These include market

prices

for

natural

gas,

natural

gas

liquids

and

oil

products;

estimates

of

reserves

and

economic

assumptions;

the

ability

to

produce

and

transport

natural

gas,

natural

gas

liquids

and

oil;

the

results

of

exploration

and

development

drilling

and

related

activities;

economic

conditions

in

the

countries

and

provinces

in

which

we

carry

on

business,

especially

economic

slowdowns;

actions

by

governmental

authorities,

receipt

of

required

approvals,

increases

in

taxes,

legislative

and regulatory initiatives relating to fracture stimulation activities, changes in

environmental and other regulations, and renegotiations of contracts; political

uncertainty, including actions by insurgent groups or other conflict; the negotiation and

closing of material contracts; shortages of drilling rigs, equipment or oilfield

services;

and

other

factors

discussed

here

and

under

the

heading

“Risk

Factors"

in

our

Annual

Report

on

Form

10-K

for

the

year

ended

December

31,

2011 and our Quarterly Report on Form 10-Q for the quarters ended March 31, 2012, June 30,

2012 and September 30, 2012 available at our website at

www.transatlanticpetroleum.com

and

www.sec.gov.

See

also

TransAtlantic’s

2011

audited

financial

statements

and

the

accompanying

management

discussion

and analysis. Forward-looking statements are based on management’s knowledge and

reasonable expectations on the date hereof, and we assume no duty to update these

statements as of any future date. The information set forth in this presentation does

not constitute an offer, solicitation or recommendation to sell or an offer to buy any securities of the

Company. The information published herein is provided for informational purposes only. The

Company makes no representation that the information and opinions

expressed

herein

are

accurate,

complete

or

current.

The

information

contained

herein

is

current

as

of

the

date

hereof,

but

may

become

outdated

or

subsequently may change. Nothing contained herein constitutes financial, legal, tax, or other

advice. The SEC has generally permitted oil and gas companies, in their filings with the

SEC, to disclose only proved reserves that a company has demonstrated by actual

production or conclusive formation tests to be economically and legally producible under existing economic and operating conditions. We may use the

terms

“estimated

ultimate

recovery,”

“EUR,”

“probable,”

“possible,”

and

“non-proven”

reserves,

“prospective

resources”

or

“upside”

or

other

descriptions

of

volumes

of

resources

or

reserves

potentially

recoverable

through

additional

drilling

or

recovery

techniques

that

the

SEC’s

guidelines

may

prohibit

us

from

including in filings with the SEC. These estimates are by their nature more speculative than

estimates of proved reserves and accordingly are subject to substantially greater risk

of being actually realized by the Company. There is no certainty that any portion of estimated prospective resources will be discovered.

If discovered, there is no certainty that it will be commercially viable to produce any

portion of the estimated prospective resources. BOE

is

derived

by

converting

natural

gas

to

oil

in

the

ratio

of

six

thousand

cubic

feet

(Mcf)

of

natural

gas

to

one

barrel

(bbl)

of

oil.

Boe

may

be

misleading,

particularly if used in isolation. A BOE conversion ratio of 6 Mcf: 1 bbl is based on an

energy equivalency conversion method primarily applicable at the burner tip and does

not represent a value equivalency at the wellhead. 2 |

Company

Overview TransAtlantic Petroleum Ltd. is an international energy company engaged in the

acquisition, development, exploration, and production of crude oil and natural gas in

Turkey, Bulgaria and Romania. 3

NYSE-AMEX:

Toronto:

TAT

TNP

Share

Price

(1)

:

$1.01

Market Cap

(1)

:

$372.6 million

Enterprise Value

(1)

:

$390.6 million

Proved Reserves

(2)

:

11.6 MMboe

SEC PV10

(3)

:

$511.0 million

(1)

Priced as of market close on 3/15/2013.

(2)

Reflects DeGoyler and MacNaughton (“D&M”) reserve report, effective 12/31/2012

based on $108.30/barrel and $8.94/Mcf. (3)

Please see slide 25 for a reconciliation of our PV10 to our standardized measure.

Executive Management

Chairman & CEO:

N. Malone Mitchell, 3rd

President:

Ian J. Delahunty

VP, CFO:

Wil F. Saqueton

VP, Legal:

Jeffrey S. Mecom

$0.00

$0.50

$1.00

$1.50

$2.00

$2.50

$3.00

$3.50

$4.00

$4.50 |

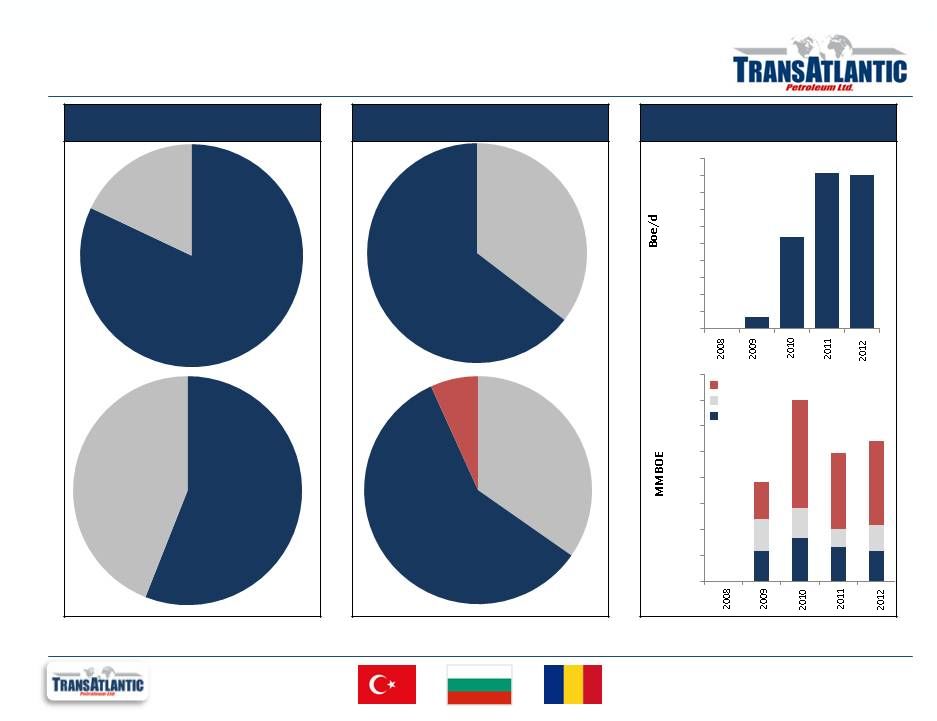

Asset

Characteristics 4

(1)

Reflects DeGolyer and MacNaughton (“D&M”) reserve report, effective 12/31/2012

based on $108.30/barrel and $8.94/Mcf. BOE conversions are calculated by the Company.

Natural

Gas

18%

Oil

82%

Undeveloped

44%

Developed

56%

Oil

65%

Natural

Gas

35%

Selmo

59%

Thrace

35%

Other

7%

Growth Profile

5,000

Reserve

Profile

4Q12 Production

Profile

(1)

0

10

20

30

40

50

60

70

Possible

Probable

Proved

0

500

1,000

1,500

2,000

2,500

3,000

3,500

4,000

4,500

(1)

80 |

Delayed

10-K 5

As

announced

in

our

Press

Release

yesterday,

TransAtlantic

needs

additional

time

to

file

our

2012

Form

10-K, and we have filed Form 12b-25 which provides an additional 15 days to file our

Form 10-K •

Time extension is due to prior period errors that relate to the allocation of well costs to

our depletion schedule

during

the

years

2009

through

2011,

which

result

in

the

understatement

of

depletion

expense

recorded

on

the

Company’s

financials

for

the

years

2009

through

2012.

Note

that

depletion

expense

is

a

non-cash item.

•

We

are

working

with

our

independent

registered

public

accounting

firm

to

evaluate

the

impact

of

these

prior

period errors on both the current and prior period financial statements.

•

Management and the Board of Directors have already initiated a process to hire a third party

accounting consultant to assist and supplement the in-house accounting staff with a

thorough review of all prior period accounting and documentation.

|

Preliminary 4Q12

Financials 6

•

Until we file the 10-K, we can only provide limited financial information

•

We expect fourth quarter Net Loss from Continuing Operations to be between $20 to $25

million •

The fourth quarter included exploration, abandonment and impairment charges of approximately

$24 million largely driven by dry holes on several high risk exploration wells

including Konak-1 ($9.5mm) and Durukoy-1 ($6.3mm) and impairment of value on

several of our unproved property licenses ($7.7mm)

•

We expect fourth quarter Adjusted EBITDAX from Continuing Operations to be between $22 to $24

million •

As of December 31, 2012

•

Cash balance of $14.8 million

•

Long-term debt of $32.8 million

•

No short-term debt

•

Credit facility availability of $26.9 million |

2013 CapEx and

Operating Plan 7

$131 Million Capital Budget

•

Within current cash flow, cash on hand, and credit availability.

•

Accelerate with consummation of a joint venture

Southeast Turkey

•

Drill horizontal wells to increase productivity.

•

Expand 2012 discoveries (Goksu, Bahar, and Alibey).

•

Drill off-structure to evaluate resource play prospectivity.

•

3D seismic of Molla blocks (Bahar, Goksu, and Ambar).

Northwest Turkey –

Thrace Basin

•

Tekirdag

development

project

–

low

risk

gas

production

growth

–

normal

pressure

gradient.

•

Hayrabolu

–

Eight

exploration

and

delineation

wells

–

overpressured

below

1,500

meters.

•

Final exploitation of Edirne blocks (NW Thrace).

•

Limited development within TPAO joint blocks as they "learn" unconventional

potential. •

3D on structure near Thrace area “kitchen.”

Other

•

Sivas

Basin

–

First

half

of

2013.

•

Bulgaria –

Resume activity summer 2013. |

Management

Transition 8

Success

of

horizontal,

unconventional

plays

drive

increased

need

for

drilling

and

completions

team

managed and staffed with team leaders with heavy experience in horizontal drilling,

multi-stage fracture design, and North American activity pace.

Key

New

Hires/Promotions:

Ian

Delahunty,

President

–

Completions

engineer,

US

&

international

experience

with

Schlumberger,

Oxy

and

TransAtlantic.

Mitch

Whatley,

VP-Drilling

–

Drilling

engineer,

extensive

horizontal

experience

with

Pioneer

(Eagle

Ford),

Encana

(Haynesville and Deep Bossier), and additional industry experience with Marathon and

Sidewinder Drilling. Justin

Davis,

VP-Engineering

–

Completions

engineer,

extensive,

multi-basin,

unconventional

experience

with

Riata, SandRidge, TransAtlantic and Viking.

Darcy

Dorscher,

VP-Production

&

Facilities

–

Engineer,

extensive

international

experience

in

Canada,

India,

Kazakhstan, Madagascar, Qatar, and Turkey.

Geological

&

Geophysical

–

Relocated

senior

personnel

to

Dallas. |

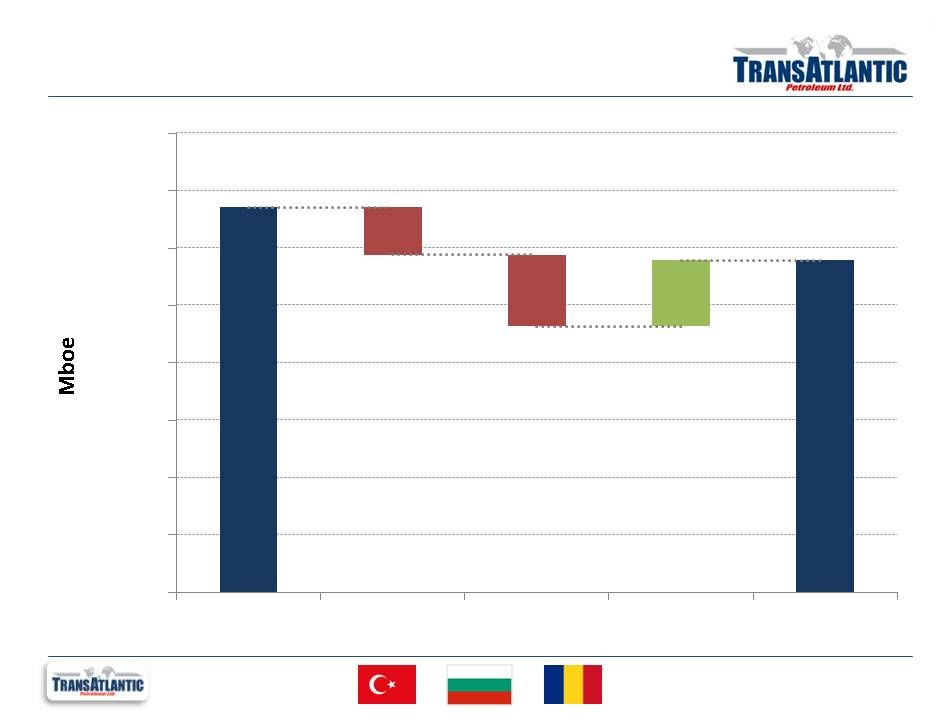

1P Reserves

Roll-forward 9

YE2011

Production

Revisions

Discoveries

YE2012

0

2,000

4,000

6,000

8,000

10,000

12,000

14,000

16,000 |

Year-end 3P

Reserves Profile and Comparison 10

*Hatched area represents increased 2P/3P independent reserves evaluation disclosed by Valeura

Energy, which benefitted from three additional weeks of study/review. 0

5,000

10,000

15,000

20,000

25,000

30,000

35,000

2011 Gas

2012 Gas*

2011 Oil

2012 Oil

1P

2P

3P |

Turkey: Activity

Overview 11

Thrace Basin

Region Summary:

Conventional and tight natural gas

production with upside potential from

deep intervals and technological

application.

Proved Reserves:

11.1 Bcf

(1)

4Q12 Production:

9.2 MMcf/d

Thrace Basin

Southeast

Central

Southeast

Region Summary:

Conventional oil production provides low

decline base. Conventional and

unconventional upside opportunities.

Proved Reserves:

9.7 MMboe

(1)

4Q12 Production:

2.9 Mboe/d

Central

Region Summary:

Frontier basins offer under-explored, high

potential, oil and gas opportunities

Proved Reserves:

0.0 MMboe

4Q12 Production:

0.0 Mboe/d

Overview

Region Summary:

Over 4 million acres in an under-explored

region with attractive fiscal terms.

Extension of prolific Syrian and Iraqi oil

fields in the southeast and established

natural gas play in the northwest.

Proved Reserves:

11.6 MMboe

(1)

4Q12 Production:

4.4 Mboe/d

(1)

Reflects DeGolyer and MacNaughton (“D&M”) reserve report, effective 12/31/2012

based on $108.30/barrel and $8.94/Mcf. BOE conversions are calculated by the Company. |

Molla:

Demonstrating Stacked Pay Potential 12

Demonstrated

horizontal success

with Goksu 3H over

300 BOPD after ~5

months of production.

Vertical discovery

(Bahar-1) IP after

frac at ~600 BOPD.

Horizontal currently

drilling.

Tested 150 BOPD

(Bahar-1).

Two cores taken. |

Molla-area

Gravity Map 13

*

DeGolyer & McNaughton as of 12/31/2012

Goksu:

2P Reserves:

2.9 MMbbls*

Field discoveries align well with gravity data. Meaningful running room whether structural or

stratigraphic. Kastel Field:

EUR 15 MMbbls

Bahar:

2P Reserves:

2.5 MMbbls* |

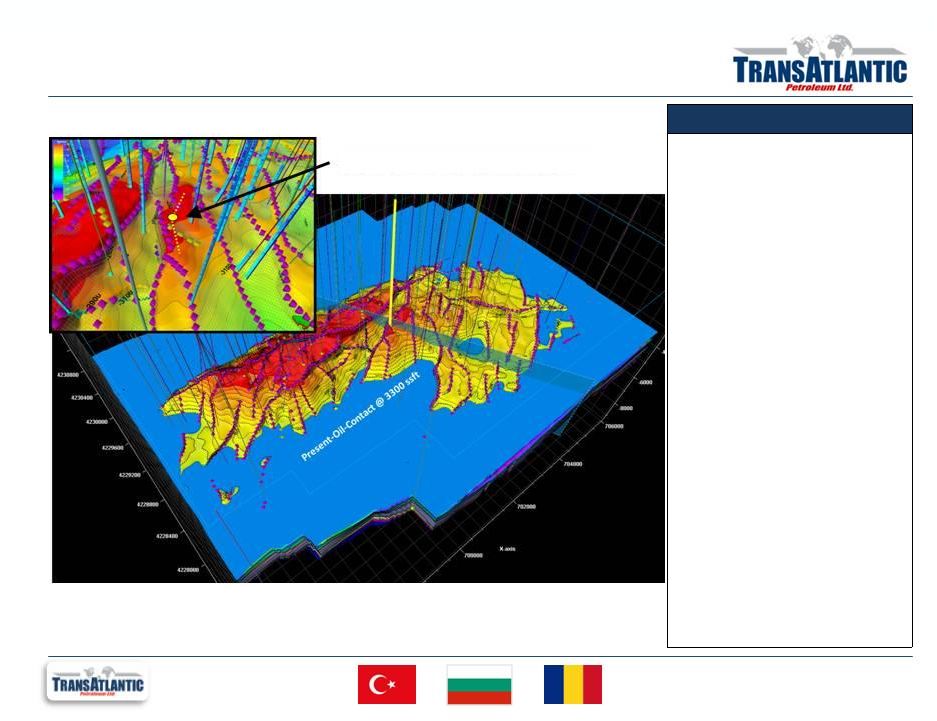

Molla: Mardin

Potential and Goksu Discovery 14

*

DeGolyer & McNaughton as of 12/31/2012.

Molla: Mardin

Overview

Mardin

Formation

Fractured Cretaceous carbonate present across

the region.

Initial vertical discoveries bolstered by recent

application of horizontal drilling processes.

Total 1P reserves of 0.6 MMbbls*.

Total 2P reserves of 2.9 MMbbls*.

Goksu-3H

Flowing over 300 BOPD after almost 5 months

of production.

TransAtlantic’s first horizontal completion,

1,600 foot lateral.

Drilled and completed for approximately $3.5

million.

Goksu-2

Cumulative production nearing 60,000 Bbls.

Initial flow rates were 400-500 BOPD in

February 2012.

Put on 16/64”

choke.

Stable FTP of 240 psi. |

Molla: Mardin

Reserves 15

*

DeGolyer & McNaughton as of 12/31/2012. |

Molla: Mardin

Horizontal – Ambar Structure

16 |

Molla: Bedinan

and Hazro Discovery 17

*

DeGolyer & McNaughton as of 12/31/2012.

Molla: Bedinan & Hazro Overview

Conventional targets immediately above and below Dadas

with prospectivity demonstrated via recent discovery well.

Bedinan Formation

Hazro Formation

Shut-in while Hazro tested (150 bopd)

Analog Hazro well 27 km north of Bahar-1 with EUR of 1.4

mmbo and 14 bcf.

Bahar-1 (TAT operated discovery well) -

Hazro tested 150

BOPD.

Sandstone directly above the Dada

Shale.

Horizontal offset currently drilling designed for multi-

stage frac completion.

Bedinan produced ~600 BOPD (+ high BTU gas) after

frac.

TAT operated vertical discovery well with 50’

of net pay

Normal pressure gradient in southern (shallower) part

of the basin at Arpatepe field (25 kms south). Arpatepe

Field EUR’s of 200mbo –

400mbo with acid stimulation.

Overpressured in central and northern parts of basin.

Sandstone immediately below the Dada

Shale.

Total 2P reserves of 2.5 MMbbls* including 2.1 MMbbls

from the Bedinan and 400 Mbbls from the Hazro.

Total 1P Reserves of 1.4 MMbbls* including 1.0 MMbbls

from the Bedinan and 400 Mbbls from the Hazro.

Bahar-1 |

Molla: Bedinan

Horizontal – Cataksu-1H

18

Bahar-2H

Drilling Curve Now

Cataksu-1H

Next well in program. Lateral

trajectory TBD. |

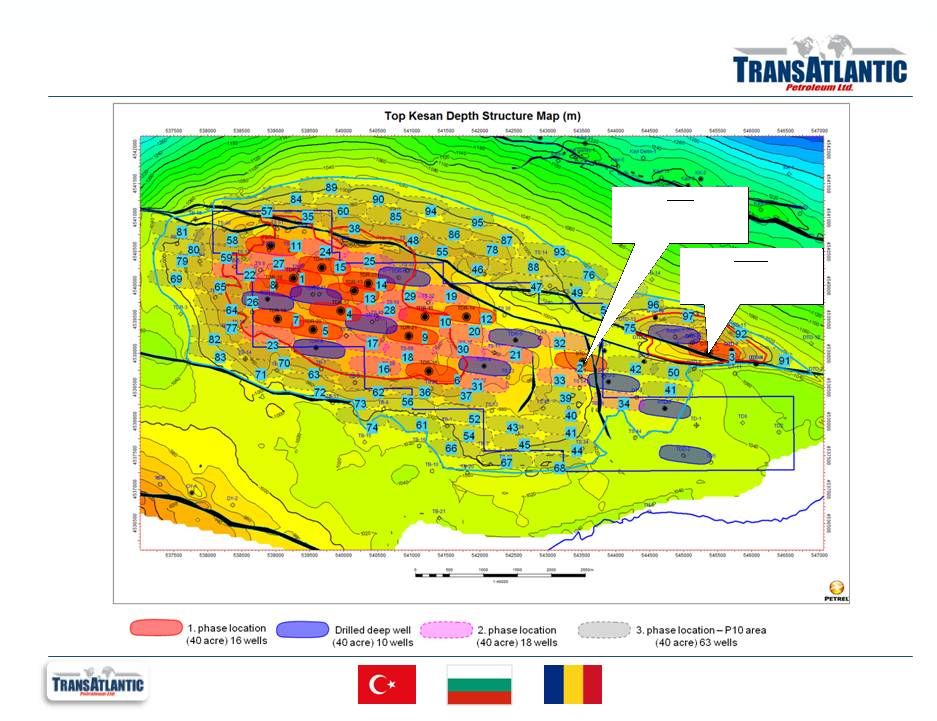

Selmo

Remapping 19

Selmo Overview

•

Extensive work has been done

to remap and model Selmo to

identify bypassed oil due to the

extremely fractured nature of

the field.

•

New dynamic model

incorporates updated

substructure mapping with

production and pressure

histories to determine the areas

of the field that will most

benefit from a horizontal drilling

campaign.

•

We believe horizontal wellbores

will allow pressure drawdown

that is more uniform across the

length of the wellbore and

prevent water coning or

premature breakthrough of

water.

•

2013 budget provides for 4

horizontal wells in the Middle

Sinan Dolomite (MSD) and 1

horizontal well in the Lower

Sinan Dolomite (LSD).

Example Selmo Horizontals |

New License

Applications 20

Acquired or applied for

seven new licenses

totaling over 550k acres. |

Thrace Basin

– Mezardere Formation

21

New

basin-wide

map

provides

better

understanding

of

source,

kitchen,

trap,

and

pressure

dynamics.

TEKIRDAG |

Thrace Basin

Frac: Tekirdag Development Program 22

Development Program Characteristics:

•

Initial 88-well development program covering approximately 5,000 acres of the Tekirdag

Field Area. •

Plan 17 wells in Tekirdag area and 8 wells in Hayrabolu during 2013.

•

Two rig drilling program carries activity into 2015.

•

Gross

well

costs

expected

to

range

between

$2.0

million

and

$3.0

million,

depending

upon

total

depth

and

completion design.

•

Gross

expected

ultimate

recovery

expected

to

exceed

70

Bcf

(1)

.

(1) Internal estimate prepared 10/1/12

Tekirdag

Hayrabolu |

Thrace Basin

Frac: Tekirdag Development Program 23

DTD-19

5-stage frac, flowing back

with early choked gas rate

> 1 MMcf/d

BTD-5

4-stage frac, flowing back

with early choked gas rate

~ 1 MMcf/d |

Thrace Basin

Frac: Hayrabolu Trend 24

11,000 prospective acres

Yildirim-1

2-stage frac, drilling out plugs.

Pre-frac instantaneous flow

rate of 1.8MMcf/d

Kazanci-5

Deepest zone unsuccessful

Hayrabolu-10

Drilling

Kazanci-5 |

EBITDAX

Reconciliation 25

For the three months ended

(in millions)

Dec 31, 2012

Adjusted EBITDAX from continuing operations

$22.0

–

$24.0

Subtract:

Interest and other, net

$1.2

Income tax expense

2.6

Depreciation, depletion, and amortization

11.3-14.3

Accretion of asset retirement obligation

0.1

Exploration, abandonment, and impairment

24.4

Seismic and other exploration

2.4

Other items

2.2

Net loss from continuing operations

($25.2)

–

($20.2)

* Totals may not sum due to independent rounding

This presentation references estimated EBITDAX, which is a non-GAAP financial measure that

represents earnings from continuing operations before income taxes, interest,

depreciation, depletion, amortization, impairment, abandonment and exploration expense.

The Company believes EBITDAX assists management and investors in

comparing the Company’s performance and ability to fund capital expenditures and working

capital requirements

on

a

consistent

basis

without

regard

to

depreciation,

depletion

and

amortization,

impairment

of

natural

gas

and

oil

properties

and

exploration

expenses,

which

can vary significantly from period to period. In addition, management uses EBITDAX as a

financial measure to evaluate the Company’s operating performance. EBITDAX is

also widely used by investors and rating agencies.

EBITDAX is not a measure of financial performance under GAAP. Accordingly, it should not

be considered as a substitute for net income, income from operations, or cash flow

provided by operating activities prepared in accordance with GAAP. Information regarding

income taxes, interest, depreciation, depletion, amortization, impairment, abandonment

and exploration expense is unavailable on a forward looking basis. Net income, income from operations, or cash flow provided by operating activities may vary

materially from EBITDAX. Investors should carefully consider the specific items included

in the computation of EBITDAX. The Company has disclosed EBITDAX to permit a

comparative analysis of its operating performance and debt servicing ability relative to other

companies. |

Hedge

Profile 26

As of 12/31/2012

775

622

0

831

726

1,016

$100.25

$99.63

$88.44

$0

$25

$50

$75

$100

$125

$150

0

250

500

750

1,000

1,250

1,500

2013

2014

2015

way Collars

Collars

Floor/Ceiling Mid-

point

3- |

PV10

Reconciliation 27

The

PV-10

value

of

the

estimated

future

net

revenue

are

not

intended

to

represent

the

current

market

value

of

the

estimated

oil

and

natural

gas reserves we own. Management believes that the presentation of PV-10, while not a

financial measure in accordance with U.S. GAAP, provides useful information to

investors because it is widely used by professional analysts and sophisticated investors in evaluating oil and

natural gas companies. Because many factors that are unique to each individual company impact

the amount of future income taxes estimated to be paid, the use of a pre-tax

measure is valuable when comparing companies based on reserves. PV-10 is not a measure of

financial or operating performance under U.S. GAAP. PV-10 should not be considered as an

alternative to the standardized measure as defined under U.S. GAAP.

US $ thousands

Total PV 10:

$511,075

Future income taxes:

(106,411)

Discount of future income taxes at 10% per annum:

31,213

Standardized measure:

$435,880

The

following

table

provides

a

reconciliation

of

our

PV10

to

our

standardized

measure: |

Investor Contact

Information Chad W. Potter, CFA

VP –

Finance / Investor Relations

(214) 265-4746

chad.potter@tapcor.com

Wil F. Saqueton

VP –

Chief Financial Officer

(214) 265-4743

wil.saqueton@tapcor.com

Ian Delahunty

President

(214) 265-4780

Ian.delahunty@tapcor.com

16803 Dallas Parkway

P.O. Box 246

Addison, TX 75001-0246

28 |