Attached files

| file | filename |

|---|---|

| 8-K - STW RESOURCES HOLDING CORP. | stw8kmar112013.htm |

| EX-10.3 - STW RESOURCES HOLDING CORP. | ex10-3.htm |

| EX-10.2 - STW RESOURCES HOLDING CORP. | ex10-2.htm |

| EX-99.1 - STW RESOURCES HOLDING CORP. | ex99-1.htm |

| EX-10.1 - STW RESOURCES HOLDING CORP. | ex10-1.htm |

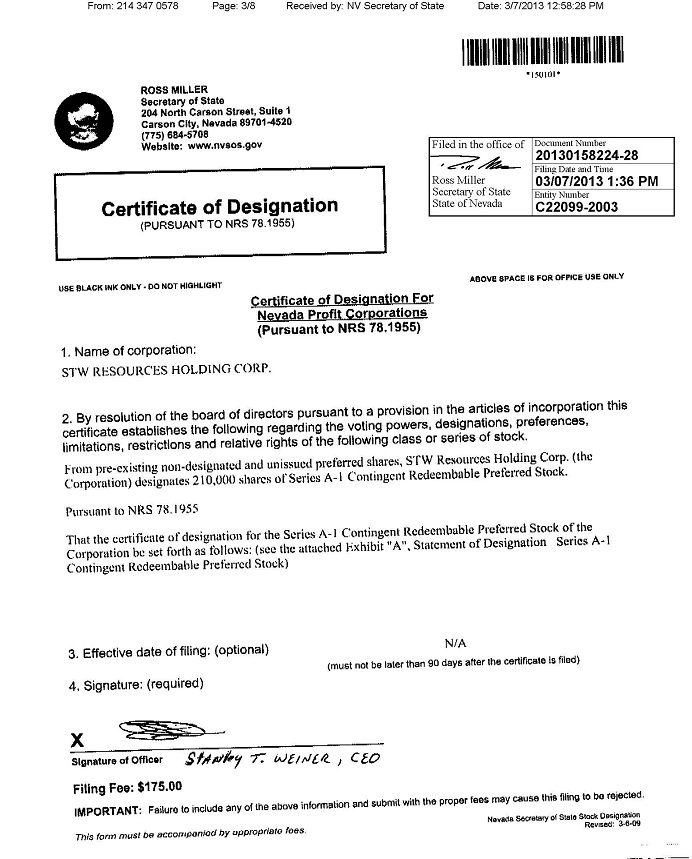

Exhibit 3.1

-1-

EXHIBIT A

Statement of Designation

Series A-l Contingent Redeembable Preferred Stock

The designation of, the number of shares constituting, and the rights, preferences, privileges and restrictions relating to, the Series A-1 Convertible Preferred Stock of the Corporation (also referred to as the "Company") are as follows:

|

1.

|

Designation and Authorized Shares. The Corporation shall be authorized to issue up to 210,000 shares of Series A-1 Preferred Stock, par value $0.001 per share (the "Series A-1 Preferred Stock").

|

|

2.

|

Stated Value. The stated value of each issued share of Series A-1 Preferred Stock shall be deemed to be $2.40 (the "Stated Value").

|

|

3.

|

Voting. Except as otherwise expressly required by law, each holder of Series A-1 Preferred Stock shall be entitled to vote on all matters submitted to shareholders of the Corporation and shall be entitled to one vote for each share common stock deliverable upon conversion of the Series A-I Preferred Stock owned at the record date for the determination of shareholders entitled to vote on such matter or, if no such record date is established, at the date such vote is taken or any written consent of shareholders is solicited. Except as otherwise required by law, the holders of shares of Series A-1 Preferred Stock shall vote together with the holders of Common Stock on all matters and shall not vote as a separate class.

|

|

4.

|

Dividend Provisions. 16% per annum, cumulative, (10% cash and 6% paid-in-kind PIK) payable quarterly in arrears, in preference to the holders of Common Stock of the Company (the "Common").

|

|

5.

|

Liquidation. In the event of any liquidation, dissolution or winding up of the Company, the holders of Series A-1 Preferred will be entitled to receive, prior and in preference to the holders of the Common, an amount equal to two (2) times the original purchase price for the Series A-1 Preferred, plus all declared and unpaid dividends for each such share of Preferred (the "Preferred Preference").

|

A sale of all or substantially all of the assets of the Company or a merger or consolidation of the Company with or into any other company, other than (i) a consolidation with a wholly-owned subsidiary of the Company, (ii) a merger effected exclusively to change the domicile of the Company, or (iii) an equity financing in which the Company is the surviving corporation, will be treated as a liquidation, dissolution or winding up of the Company, when such acquiring company subsequent to the transaction owns a majority of the merged company.

-2-

|

(a)

|

Right to Convert; Beneficial Ownership Limitation. Each share of Series A-1 Preferred Stock shall be convertible at the option of the Holder thereof, at any time and from time to time from and after the original issue date into that number of shares of Common Stock determined by dividing the Stated Value by the Conversion Price. For purposes of this Section, the conversion price for the Series A-1 Preferred Stock shall equal $0.12 (the "Conyersion Price"). The Corporation shall not effect any conversion of the Series A-1 Preferred Stock, and the Holder shall not have the right to convert any portion of the Preferred Stock to the extent that after giving effect to such conversion, the Holder (together with the Holder's affiliates), as set forth on the applicable Notice of Conversion, would beneficially own in excess of 9.9% of the number of shares of the Common Stock Outstanding immediately after giving effect to such conversion. Beneficial ownership shall be calculated in accordance with Section 13(d) of the Securities and Exchange Act. To ensure compliance with this restriction, the Holder will be deemed to represent to the Corporation each time it delivers a Notice of Conversion that such Notice of Conversion has not violated the restrictions set forth in this paragraph and the Corporation shall have no obligation to verify or confirm the accuracy of such determination. In determining the number of outstanding shares of Common Stock, the Holder may rely on the number of outstanding shares of Common Stock as reflected in the most recent of the following: (A) the Corporation's most recent Form 10-Q or l0-K, as the case may be, (B) a more recent public announcement by the Corporation or (C) any other notice by the Corporation or the Corporation's transfer agent setting forth the number of shares of Common Stock Outstanding. In any case, the number of outstanding shares of Common Stock shall be determined after giving effect to the conversion or exercise of securities of the Corporation, including the Preferred Stock, by the Bolder or its affiliates since the date as of which such number of outstanding shares of Common Stock was reported. This restriction may not be waived.

|

|

(b)

|

Mechanics of Voluntary Conversion. To convert Series A-1 Preferred Stock into full shares of Common Stock on any date (the "Voluntary Conyersion Date"), the Holder thereof shall (A) transmit by facsimile (or otherwise deliver), for receipt on or prior to 5:00 p.m., Eastern Time on such date, a copy of a fully executed notice of conversion in the form attached hereto as Annex A (the "Conversion Notice"), to the Corporation.Upon receipt by the Corporation of the Conversion Notice, the Corporation or its designated transfer agent (the "Transfer Agent "), as applicable, shall, within three (3) business days following the date of receipt by the Corporation, issue and surrender to a common carrier for overnight delivery to the address as specified in the Conversion Notice, a certificate, registered in the name of the Holder or its designee, for the number of shares of Common Stock to which the Holder shall be entitled. If the number of shares of Preferred Stock represented by the Preferred Stock Certificate(s) submitted for conversion is greater than the number of shares of Series A l Preferred Stock being converted, then the Corporation shall, as soon as practicable and in no event later than three (3) business days after receipt of the Preferred Stock Certificate(s) and at the Corporation's expense, issue and deliver to the holder a new Preferred Stock Certificate representing the number of shares of Series A-1 Preferred Stock not converted.

|

|

(c)

|

Automatic Conversion: Each share of Series A-1 Preferred shall automatically convert into Common, at the then applicable conversion rate, upon the earlier to occur of (i) the closing share price of the Company's common stock being at least $0.75 for 10 consecutive trading days, or (ii) the affirmative consent of the holders of at least a majority of the then outstanding shares of Series A-1 Preferred.

|

|

7.

|

Redemption Provision: Company may, at its option and at any time, and upon providing a 30 days written notice, require the holders of Series A-1 Preferred to sell all of their preferred shares at a redemption price payable in cash equal to the sum of the outstanding principal and accrued but unpaid dividends, if any, multiplied by a factor such that each Holder receives an annualized return of 20%. Notwithstanding anything to the contrary stated above, should the Company redeem the Series A-1 Preferred Shares pursuant to this section 7 within I year of the closing, the holder shall receive a total return on investment of20%.

|

|

8.

|

Put Right: Each holder of the Series A-l Preferred may, at their option and at any time after 12 months of the final closing of this offering, require the Company to purchase all of the preferred shares held by such holder at a price payable in cash equal to the sum of the outstanding principal and accrued but unpaid dividends, if any, multiplied by a factor such that each Holder receives an annualized return of 20%.

|

-3-

|

9.

|

Event of Default: Upon the occurrence of an Event of Default (as defined below), the dividend rate shall increase to eighteen percent (18%) per annum, of which 12% is payable in cash and 6% PIK (the "Default Rate") until such time as the Event of Default is cured. Each of the following events shall constitute a default by the Company (an "Event of Default"):

|

|

(a)

|

Failure to pay dividends when due.

|

|

(b)

|

The Company shall make an assignment for the benefit of creditors, or apply for or consent to the appointment of a receiver or trustee for it or for a substantial part of its property or business; or such receiver or trustee shall otherwise be appointed.

|

|

(c)

|

Bankruptcy, insolvency, reorganization or liquidation proceedings or other proceedings or relief under any bankruptcy law or any law, or the issuance of any notice in relation to such event, for the relief of debtors shall be instituted by or against the Company.

|

|

(d)

|

The Company's failure to deliver Conversion Shares to the Holder pursuant to conversion of the Series A-1 Preferred Shares.

|

|

(e)

|

In each instance in Section 9.a through 9.d above, the Company shall be given prompt notice of such default by the Holder and shall have thirty (30) days from the date of receipt of such notice to remedy and cure such default. If, after such thirty (30) day period, the default has not been remedied or cured, then such default will give rise to an "Event of Default".

|

|

10.

|

Anti-dilution provisions:

|

|

(1)

|

Adjustments. The Conversion Price of the Series A-I Preferred shall be subject to adjustment, on a broad-based weighted average basis, to prevent price-based dilution in the event that the Company issues additional shares at a purchase price per share less than the then current applicable Conversion Price of the Series A-I Preferred.

|

|

11.

|

Protective Covenants: Consent of the holders of a majority of the outstanding Series A-I Preferred shall be required for: (i) the creation of any new class or series of shares having preference over or on parity with the Series A-1 Preferred with respect to dividends, voting, liquidation preferences, or conversion rights, (ii) the issuance of any distribution or dividend with respect to the Company's capital stock, (iii) any decrease (other than by conversion) or increase in the authorized number of shares of Series A- I Preferred, (iv) any amendment to the Articles of Incorporation or Bylaws affecting the rights, preferences or privileges of the Series A-1 Preferred.

|

|

12.

|

Consolidation, Merger, Etc. In case the Corporation shall enter into any consolidation, merger, combination or other transaction in which the outstanding shares of Common Stock are exchanged for or changed into other stock or securities, cash and/or any other property, then in any such case each share of Series A-1 Preferred Stock shall at the same time be similal'ly exchanged or changed in an amount per share equal to the Conversion Rate times the aggregate amount of stock, securities, cash and/or any other property (payable in kind), as the case may be, into which or for which each share of Common Stock is changed or exchanged.

|

-4-

|

13.

|

Expenses. The issuance of certificates representing shares of Common Stock upon conversion of the Series A- I Preferred Stock shall be made to each applicable shareholder without charge for any excise tax in respect of such issuance. However, if any certificate is to be issued in a name other than that of the holder of record of the Series A-1 Preferred Stock so converted, the person or persons requesting the issuance thereof shall pay to the Corporation the amount of any excise tax which may be payable in respect of any transfer involved in such issuance, or shall establish to the satisfaction of the Corporation that such tax has been paid or is not due and payable.

|

|

14.

|

Limitations on Corporation; Shareholder Consent. So long as any shares of Series A-I Preferred Stock are outstanding, the Corporation shall not, without the affirmative vote or the written consent as provided by law of 80% of the holders of the outstanding shares of Series A-1 Preferred Stock, voting as a class, change the preferences, rights or limitations with respect to the Series A-1 Preferred Stock in any material respect prejudicial to the holders thereof.

|

|

15.

|

Fractional Shares. Series A-1 Preferred Stock may only be issued in whole shares and not in fractions of a share. If any interest in a fractional share of Series A- I Preferred Stock would otherwise be deliverable to a person entitled to receive Series A-I Preferred Stock, the Corporation shall make adjustment for such fractional share interest by rounding up to the next whole share of Series A-1 Preferred Stock.

|

|

16.

|

Record Holders. The Corporation and its transfer agent, if any, for the Series A-1 Preferred Stock may deem and treat the record holder of any shares of Series A-1 Preferred Stock as reflected on the books and records of the Corporation as the sole true and lawful owner thereof for all purposes, and neither the Corporation nor any such transfer agent shall be affected by any notice to the contrary.

|

-5-

ANNEX "A"

NOTICE OF CONVERSION OF SERIES "A-1" PREFERRED SHARES

OF STW RESOURCES HOLDING CORP.

(To be executed by the Registered Holder in order to convert the Series "A-1" Preferred Shares)

TO:

THE CORPORATE SECRETARY OF STW RESOURCES HOLDING, CORP.

The undersigned hereby elects to convert __________ shares out of the __________ shares of Series "A-1" Preferred Shares of stock ofSTW Resources Holding Corp, previously issued to the undersigned in Series "A-1" Preferred Stock Certificate No.____, transmitted with this Notice of Conversion, into __________ shares of Common Stock of STW Resources Holding Corp., according to the terms and conditions set forth in the STW Resources Holding Corp. "Certificate of Designation," filed on March 7, 2013, with the Nevada Secretary of State, a copy of which is attached to this Notice of Conversion, as of the date written below.

Date of Conversion: __________, 201__

Conversion Price: $0.12 per share

Stated Price Per Share of Series "A-1" Preferred: $2.40 per share

Common Stock to be delivered: __________ shares

_____________________________________________________

Signature

Print Name: __________________________________________

Address:

_____________________________________________________

_____________________________________________________

_____________________________________________________