Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

|

[X]

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

For the fiscal year ended December 31, 2014

|

or

|

[ ]

|

TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

For the transition period from __________________ to __________________________

|

|

Commission file number: 000-52654

|

|

STW Resources Holding Corp

|

|

(Exact name of registrant as specified in its charter)

|

|

NEVADA

|

77-1176182

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

|

3424 South County Road 1192

Midland, Texas

|

79706

|

|

(Address of principal executive offices)

|

(Zip Code)

|

|

Registrant's telephone number, including area code:

|

(432) 686-7777

|

Securities registered under Section 12(b) of the Act:

|

Title of each class

|

Name of each exchange on which registered

|

|

None

|

Not applicable

|

Securities registered under Section 12(g) of the Act:

|

Common Stock, $0.001 PER SHARE

|

|

(Title of class)

|

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. [ ] Yes [X] No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. [ ] Yes [X] No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

[ X ] Yes [ ] No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.4.05 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). [ X ] Yes [ ] No

[Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ X ]]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company:

|

Large accelerated filer

|

[ ]

|

Accelerated filer

|

[ ]

|

|

Non-accelerated filer

|

[ ]

|

Smaller reporting company

|

[X]

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). [ ] Yes [X] No

The aggregate market value of the voting and non-voting common stock held by non-affiliates of the Registrant as of June 30, 2014 (the last business day of the Registrant’s most recently completed second fiscal quarter) was approximately $12,894,724.

As of April 2, 2015, the Registrant has 31,683,150 shares of common stock outstanding.

TABLE OF CONTENTS

|

Page No.

|

||

|

Part I

|

||

|

Item 1.

|

2

|

|

|

Item 1A.

|

11

|

|

|

Item 1B.

|

20

|

|

|

Item 2.

|

20

|

|

|

Item 3.

|

20

|

|

|

Item 4.

|

21

|

|

|

Part II

|

||

|

Item 5.

|

22 | |

|

Item 6.

|

23

|

|

|

Item 7.

|

24

|

|

|

Item 7A.

|

33

|

|

|

Item 8.

|

33

|

|

|

Item 9.

|

34

|

|

|

Item 9A.

|

34 | |

|

Item 9B.

|

36

|

|

|

Part III

|

||

|

Item 10.

|

37

|

|

|

Item 11.

|

43

|

|

|

Item 12.

|

49

|

|

|

Item 13.

|

51

|

|

|

Item 14.

|

53

|

|

|

Part IV

|

||

|

Item 15.

|

55

|

|

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

This report contains forward-looking statements. These forward-looking statements are subject to known and unknown risks, uncertainties and other factors which may cause actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. These forward-looking statements include, among others, the following:

|

|

●

|

our ability to raise sufficient working capital necessary to continue to implement our business plan and satisfy our obligations,

|

|

|

●

|

our ability to continue as a going concern,

|

|

|

●

|

our ability to develop revenue producing operations,

|

|

|

●

|

our ability to establish our brand and effectively compete in our target market, and

|

|

|

●

|

risks associated with the external factors that impact our operations, including economic and leisure trends.

|

Forward-looking statements are typically identified by use of terms such as “may”, “could”, “should”, “expect”, “plan”, “project”, “intend”, “anticipate”, “believe”, “estimate”, “predict”, “potential”, “pursue”, “target” or “continue”, the negative of such terms or other comparable terminology, although some forward-looking statements may be expressed differently. The forward-looking statements contained in this report are largely based on our expectations, which reflect estimates and assumptions made by our management. These estimates and assumptions reflect our best judgment based on currently known market conditions and other factors. Although we believe such estimates and assumptions to be reasonable, they are inherently uncertain and involve a number of risks and uncertainties that are beyond our control. In addition, management’s assumptions about future events may prove to be inaccurate. Management cautions all readers that the forward-looking statements contained in this report are not guarantees of future performance, and we cannot assure any reader that such statements will be realized or the forward-looking events and circumstances will occur. Actual results may differ materially from those anticipated or implied in the forward-looking statements. You should consider the areas of risk described in connection with any forward-looking statements that may be made herein. You should also consider carefully the statements under “Risk Factors” and other sections of this report, which address additional factors that could cause our actual results to differ from those set forth in the forward-looking statements. Readers are cautioned not to place undue reliance on these forward-looking statements and readers should carefully review this report in its entirety, including the risks described in “Item 1A. - Risk Factors”. Except for our ongoing obligations to disclose material information under the Federal securities laws, we undertake no obligation to release publicly any revisions to any forward-looking statements, to report events or to report the occurrence of unanticipated events. These forward-looking statements speak only as of the date of this Report, and you should not rely on these statements without also considering the risks and uncertainties associated with these statements and our business.

Unless specifically set forth to the contrary, when used in this Report the terms “STW,” “we”, “our”, the “Company” and similar terms refer to STW Resources Holding Corp., a Nevada corporation and its subsidiaries. In addition, when used herein and unless specifically set forth to the contrary, “2012” refers to the year ended December 31, 2012, “2013” refers to the year ended December 31, 2013 and “2014” refers to the year ended December 31, 2014.

PART I

ITEM 1. DESCRIPTION OF BUSINESS

Corporate History

STW Resources Holding Corp (“STW” or the “Company”, f/k/a Woozyfly Inc. and STW Global Inc.) is a corporation formed to utilize state of the art water reclamation technologies to reclaim fresh water from highly contaminated oil and gas hydraulic fracture flow-back salt water that is produced in conjunction with the production of oil and gas. STW has been working to establish contracts with oil and gas operators for the deployment of multiple water reclamation systems throughout Texas, Arkansas, Louisiana and the Appalachian Basin of Pennsylvania and West Virginia. STW, in conjunction with energy producers, operators, various state agencies and legislators, is working to create an efficient and economical solution to this complex problem. The Company is also evaluating the deployment of water processing technologies in the municipal wastewater industry. The Company is also involved in the desalination of brackish water and seawater for industrial and municipal use.

Subsidiaries

On June 25, 2013, we formed a new subsidiary: STW Energy Services, LLC (“STW Energy”). We maintain a 75% limited interest in STW and the remaining 25% non-controlling interest is held by Crown Financial, LLC, a Texas Limited Liability Company (“Crown” or “Crown Financial”).

Effective June 30, 2013, we formed a new subsidiary: STW Oilfield Construction, LLC (“Oilfield Construction”), a Texas limited liability company. We are the sole member of Oilfield Construction, which is managed by the Company's CEO and COO, as well as one of the Company's directors and an employee of the Company.

Effective September 20, 2013, we formed another new subsidiary: STW Pipeline Maintenance & Construction, LLC (“Pipeline Maintenance”), a Texas limited liability company. The Company is the sole member of Pipeline Maintenance, which is managed by its members.

Effective April 16, 2014, the Company formed another new subsidiary, STW Water Process & Technologies, LLC (“Water Process”), a Texas limited liability company. The Company is the sole member of Water Process, owning 100% of the membership interest in such entity, which is managed by its members.

Overview

The Company, based in Midland, Texas, provides customized water reclamation/processing services. STW’s core expertise is an understanding of water chemistry and its application to the analysis and remediation of complex water reclamation issues. STW provides a complete solution throughout all phases of a water reclamation project including analysis, design, evaluation, implementation and operations.

STW’s expertise is applicable to several market segments including:

|

●

|

Gas shale hydro-fracturing flowback;

|

|

●

|

Oil and gas produced water;

|

|

●

|

Desalination;

|

|

●

|

Brackish water; and

|

|

●

|

Municipal wastewater.

|

Understanding water chemistry is the foundation of STW’s expertise. STW provides detailed chemical analysis of the input stream and the process output that conforms to the various environmental and legal requirements and the needs of the customer. STW becomes an integral part of the water management process and provides a customized solution that encompasses analysis, design and operations including pretreatment and transportation. Simultaneously, STW evaluates the economic impact of this process to the customer. These processes will use technologies that fit our customer’s needs: fixed, mobile or portable; reverse-osmosis, membrane technology, chemical, other technologies and any necessary pre-treatment, post-treatment. STW will also supervise construction, testing and operation of these systems. Our keystone is determining and optimizing the most appropriate technology to effectively and economically address our customers’ particular requirements. As an independent solutions provider, STW is manufacturer-agnostic and is committed to using the right technology demanded by the design process.

Market Opportunities

STW is actively pursuing opportunities in all the major shale formations in Texas. The initial focus, in this sector, is the shale activity in the Permian, Delaware and Eagle Ford basins of Texas.

Unconventional tight oil and gas shales such as the Wolfcamp Shale in West Texas require millions of gallons of fresh water to drill and stimulate a new well. The water returns during the fracture flowback (“frac”) and production (“production”) with salts or total dissolved solids (“TDS”) at levels unfit for human consumption. This flowback or produced water is typically disposed of through various means such as controlled injection into disposal wells. STW will target the frac water market in the tight oil and gas formations first, then subsequently approach the produced water market for oil and gas production.

Oil and gas reservoirs are usually found in porous rocks, which also contain saltwater. Cross linked gel fracture fluids with high “proppant” loading (additives that prop open fissures in the geological formation caused by hydraulic fracturing) have been utilized to fracture these zones in order to gain permeability, allowing the oil and gas to flow to the well bore. The unconventional shale formations have been common knowledge for decades, but the cost of gas production was always considered to be uneconomical. The wells were drilled and fractured with the same crossed linked system as discussed above.

All of the wells were vertical and required stimulation about every three (3) years with a new fracture. Around 2001, the “slick water fracture” technique was developed. This change required larger volumes of fresh water (1.2 million gallons per fracture on a well) to be used in the fracturing process, a friction reducing polymer additive and low concentrations of a proppant in the hydraulic fracture fluid. Wells using this modified technique now can economically produce oil and gas for over eight (8) years without re-stimulation. The fresh water is believed to dissolve salts from the shale over time and open up the natural fractures and fissures in the rock, allowing more oil and gas to be produced. In 2003, horizontal drilling rigs were brought into the Barnett Shale, and the slick water fracture volume increased from one to eight plus million gallons per well. The slick water fracture technique has become the standard for most of the shale formations for stimulation of the wells.

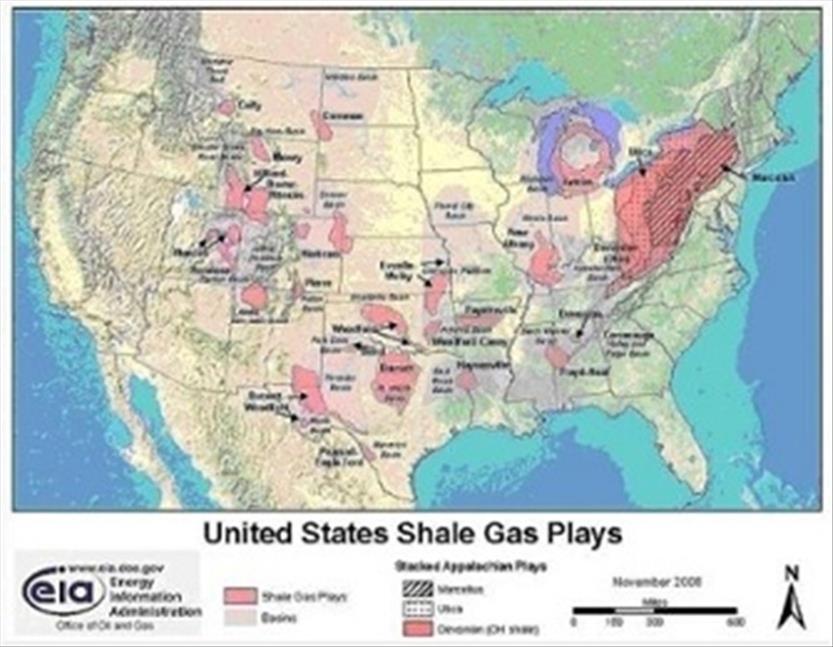

This map illustrates the location of the major shale formations that are discussed below:

Fort Stockton Well Development

On August 4, 2014, we entered into a Cooperation Agreement with the City of Fort Stockton, Texas regarding the development of water well(s) in the Capitan Reef Aquifer Formation. The City of Fort Stockton, Texas ("COFS") owns the surface and ground water rights to several areas of Capitan Reef Aquifer Formation; its existing Capitan Reef Aquifer ("CRA") well is currently drilled to an approximate depth of 3,500 feet (the "Existing CRA Well"). We want to deepen the Existing CRA Well to make it a production water well and/or drill an alternate well, which will be at our own expense, and lease CRA groundwater rights from certain sections of COFS' property. Together, we hope that we can develop a CRA water supply project in the area that will serve to meet the future needs of COFS and the municipal and industrial needs within the region.

Through the Agreement, COFS granted and leased the right to explore for, drill for, produce, transport, and treat groundwater from a specific portion of the CRA to us. We also have the right to drill, deepen and/or rework the Existing CRA Well, at our own expense. Through a Post-Well Study, we shall determine the gallons per day ("GPD") of maximum water capacity of the Existing CRA Well and the quality of the water from such well. If however, the results of the Post-Well Study demonstrate that the Existing CRA Well is not suitable to carry out the purpose of the Agreement, we may drill a second water well, at our own expense, at a location mutually agreed on the related property and then we shall conduct a Post-Well Study on such replacement well. Once the well water meets the contractual specifications, we may sell such water to end users; if the water does not meet such standards, we maintain the right to treat the water to other specific levels or sell as is to industrial end-users. We are responsible for the pipelines and pumping facilities required to transport the water to the end-user.

If the Post-Well Study shows that the well(s) we drilled can produce CRA water at a minimum of 1,200 GPM (the "Critical Criterion") and all regulatory approvals have been obtained, we must pay COFS a $5,000,000 bonus payment and we shall have the right to develop additional wells if we have additional water supply contracts demanding additional production. We shall also pay COFS a 17% royalty of the price we receive per 1,000 gallon of CRA water produced from the well(s). Finally, we are required to provide COFS with 3 million GPD of CRA water at no cost upon their request for delivery of same for their use. For one year following completion of our last post-well study, we have the option to produce and transport the water produced from the CRA (the "Option"); otherwise, the Agreement terminates, unless we pay a monthly royalty of $500 (the "Option Royalty"). We can maintain the Option for three years, so long as we pay the Option Royalty. If we exercise the Option and the wells are capable of producing CRA water for sale, but there are no sales for a consecutive period of 180 days or more, the lease shall terminate unless we pay a monthly royalty of $5,000, which is also only permissible for three years. Other fees payable to COFS include a 7% royalty of the price we receive per 1,000 gallons of CRA water produced and sold from other properties owned by anyone other than COFS within the Pecos County, as a result of our additional right to use existing COFS easements and rights of way within the Pecos County for laying pipelines necessary for the delivery of CRA water produced within such county. COFS agreed to assist us with any negotiations required to procure additional easements and groundwater rights in Pecos County to help us produce and deliver CRA water.

If the Post-Well Study shows that the Critical Criterion has not been met, then we can decide whether or not we want to produce and transport the water. If we decide not to produce, but COFS sells the water from the wells, COFS will reimburse us for some of our expenses related to developing such well; if we decide to produce the water, we will not get any reimbursement. These same options apply if the regulatory approvals have been granted but the permit from the Middle Pecos Groundwater Conservation District does not allow us to transport the full amount we request to use or sell.

Throughout the term of the Agreement, COFS is responsible to maintain insurance for its activities and obtain all property rights related to the activities covered by the Agreement.

Title and ownership of the Existing CRA Well and any other wells we drill on the property shall be transferred to us during the term of the Agreement; upon termination of the Agreement, we shall transfer title back to COFS upon COFS' reimbursement to us of any expenses that are owed.

The term of the Agreement is for 30 years, which shall automatically renew year to year unless terminated by either party upon 60 days written notice after the end of the term. The Agreement provides that we are authorized to maintain and service any contracts to the extent water has been purchased pursuant to a sales agreement with a duration exceeding such 30 year time period and this Agreement shall not terminate during the initial term of any such agreement. We also maintain the right to unilaterally terminate the Agreement related to the initial subject property. So long as we are maintain our obligations under the Agreement, COFS may not terminate the Agreement during certain specific phases of the contemplated transaction. The Agreement requires COFS reimburse us at specified rates and for specified projects if it unilaterally terminates the Agreement during specific time frames.

The Agreement contains covenants that are customary for agreements of this type and provides for indemnification of the parties for losses and expenses arising out of this Agreement.

The Company is currently working to finance the initial project, of which there can be no guarantee. If the Company does not receive adequate funding, it will not be able to carry out the transactions contemplated in the Agreement. The Agreement does not provide for any penalties or defaults if we are unable to carry it out. As of the date of this Report the Company had received funding of over $1.5 million.

The Permian and Delaware Basins in West Texas

Producers in West Texas are facing the same water related problems as other producers are nationwide – a shortage of fresh water due to drought and municipality expansion. There are over 450 drilling rigs working in West Texas using approximately 8+ million gallons of fresh water monthly. The formations are shale and the discovery of several new shale formations. West Texas is considered to be one of the largest and most active oil and gas areas in the United States.

Eagle Ford Shale Formation

The Eagle Ford Shale is a recently discovered formation located in South Texas. The development stage of the field is carried out by drilling thousands of wells annually. This area has limited supplies of fresh water, leading the Company to believe water reclamation will be a required solution in order for producers to access a sufficient supply of frac water in this market. Production of natural gas has been reported at levels in excess of ten (10) million cubic feet (“MMcf”) per day and hundreds of barrels of condensate at some of the wells. The Company expects to intensify its efforts to address this market opportunity.

Produced Water

Shale zones are typically dry geological formations devoid of any formation or connate water, and hence, the fracture flowback water comprises most of water that returns following gas production. Outside of shale formations, where most gas and oil production occurs, there is typically a reservoir of connate water in the production zone that generates “produced” water. Produced water is primarily salty water trapped in the reservoir rock and brought up along with oil and/or gas during production, and is the most common oil field waste. The quality of produced water varies significantly in different parts of the world depending on the geology of the underlying formation.

In a large number of the oil fields in the USA, secondary or tertiary means of handling produced water storage, such as water floods and steam floods, are typically utilized. These are operations where the produced water is used to maintain reservoir pressure, prevent subsidence and sweep the zone to remove the oil. Most of these water floods utilize a fresh water source as a supply so that sufficient volumes are available. As these fields age, more water is required for the flood, so excess contaminated brines concentrate and require disposal. As this water could be reclaimed with STW proprietary systems, STW believes that the market for reclaiming produced water outside the shale reclamation projects represents a considerable opportunity for the Company.

Texas is the largest oil and gas production state in the nation. Like other deep injection well practices in every gas and oil producing region in the world, the same detrimental and resource conservation issues exist. The produced water is unfit for use, poses a threat to the environment and is typically injected into deep injection wells. In accordance with regulations of the Railroad Commission of Texas, water placed in these disposal wells is rendered permanently unavailable for re-use or consumption.

STW believes that the reclaimed water could be utilized for many beneficial purposes, including agricultural and environmental applications as well as re-use in hydraulic fracturing operations. The water reclamation products and services offered by the Company could provide a significant part of the solution to all constituencies concerned.

Brackish Water

World-wide, there are brackish water zones that contain large volumes of water. The water contains dissolved salts in the 0.5 to 2% (3,000 to 20,000 mg/l Total Dissolved Solids (“TDS”)) range and, hence, is unfit for human use. This water can be treated to reduce the TDS below 500 mg/l or 0.05% TDS making the water fit for human consumption. Factors such as decreasing supplies of fresh ground and surface water, increased competition for surface water resources and changes in population/demand centers are driving the need for brackish water for water supply. STW’s potential customers are private companies and municipalities serving fast growing metropolitan areas where demand for water is outpacing the available supply. For example, aquifers in the Texas Gulf Coast region contain a large volume of brackish water (less than 10,000 part per million TDS) that once desalinized will help meet increasing demand in the region.

There are more than 450 drilling rigs operating in West Texas and each one will use approximately 8+ millions gallons of fresh water per month for drilling and fracking wells. In its current form, brackish water is unsuitable for oilfield use. By cleaning the brackish water in an economical way with STW technology, it may be used in the oilfield, which reduces the strain on current fresh water supplies.

Moreover, during one of the worst droughts in U.S. history, the use of treated brackish water has become an extremely popular alternative water source. With STW’s successfully designed and engineered proprietary system, the Company is capable of very economically processing brackish water. For instance, STW is involved in several projects that clean brackish water for municipal golf courses. These types of projects greatly help in the conservation of our fresh water resources.

Process

STW’s proprietary systems and processes are predicated upon a thorough understanding of the customer’s water needs and related issues. This understanding is developed through a series of interactive discussions with the customer followed by data gathering and analysis. STW collects samples at various locations and at different time intervals, which are then tested at independent laboratories and analyzed by STW. Based upon this analysis, STW recommends a solution using the most appropriate technologies, which the Company obtains through the acquisition and financing of such technologies as well as contracts with engineering procurement construction (“EPC”). Finally, STW oversees the EPC process and operates the facility.

STW’s processes are based upon a fundamental understanding of the core issue and developing an appropriate solution using our experience and expertise. For example, such processes include sampling and testing, analysis, design and, where required by customers, implementation and operation. Some of the steps involved are described below:

|

●

|

Determine the inlet water quality and measurement of TDS, hardness, barium, strontium, bromine, sulfate and hydrocarbon concentrations, which are critical.

|

|

●

|

Take multiple samples over time to ensure consistency and accuracy of inlet water quality measurement.

|

|

●

|

Obtain an understanding and analysis of potential uses for the reclaimed water.

|

|

●

|

Conduct a site inspection to determine the various vessels needed such as tanks, pumps, pits, truck offloading racks, and engineering testing of the land.

|

|

●

|

Analyze fluid volumes and their variability over time.

|

|

●

|

Determine the length of time the water needs to be reclaimed at this site.

|

|

●

|

Determine appropriate technology: fixed or mobile, evaporation, reverse osmosis or other.

|

|

●

|

Obtaining permits as needed.

|

|

●

|

Investigate the handling of the concentrated brines and any other residue from the reclamation process.

|

|

●

|

Ascertain disposal options for the residue including potential use of the by-products.

|

Technology

STW has developed relationships with a number of manufacturers that offer “best in class” technologies applicable to its customer base. These technologies include thermal evaporation, membrane technology and reverse osmosis and are available as fixed or mobile units with varying capacities. Various pre and post-treatment options are available as necessary including crystallizers that process very high TDS (>150,000 mg/l).

STW Salttech Dynamic Vapor Recovery (DyVaR) System

STW’s process is capable of handling waters that contain up to 300,000 mg/l TDS, with fresh water recovery rates from 50% to 97%, or greater depending on inlet water quality. The recovered fresh water, or “distillate,” is highly purified water from the evaporative process and has multiple re-use applications. It is particularly applicable in the gas shale and oil production facilities for reclaiming frac and produced waters as well as processing the highly salt laden reject concentrate from reverse osmosis operations with a fresh water recovery rate of 95%-97%.

The technology is scalable and can be deployed as mobile units that can process 72,000+ gallons per day (“gpd”), as portable units that can process 216,000+ gpd, or as fixed central units capable of processing up to 2,880,000+ gpd.

Reverse Osmosis

Waters that are below 34,000 mg/l of TDS and contain low levels of barium, strontium, bromine, and sulfate can be reclaimed through a reverse osmosis unit (“RO”). Reverse osmosis is the process of forcing a solvent from a region of high solute concentration through a semi-permeable membrane into a region of low solute concentration by applying a pressure in excess of the osmotic pressure. The membranes used for reverse osmosis are generally designed to allow only water to pass through while preventing the passage of solutes such as salt ions. This process is best known for its use in desalination (removing the salt from sea water to obtain fresh water), but it has also been used to purify fresh water for medical, industrial and domestic applications. Recovery rates for seawater to drinking water are about 50%.

The reverse osmosis process creates a by-product of concentrated brine with higher TDS. This brine can be processed by our Salttech DyVaR system.

Most oilfield water cannot be processed through an RO membrane because the water contains barium, strontium or bromine. The barium and strontium are very large molecules that plug the membrane and damage or permanently foul the membrane surface. Bromine and other such halogens react with the membrane and destroy its integrity. Although some oil field water could be processed through this technology, a thorough study is required to ensure success. STW will continue to utilize this technology where the water chemistry can be processed through RO membranes without damaging the membrane.

Membrane Bioreactor

A membrane bioreactor (“MBR”) is a water treatment system that combines biological and ultra-filtration technologies. The biological technology is the same process utilized in all sewage treatment facilities. Bacteria are maintained in an aerobic condition that decays the organic materials in the water and oxidizes these organic materials into low molecular weight acids, usually acetic acid. Maintaining the bacteria in an oxygen rich environment prevents mutation or growth of any anaerobic bacteria, which would produce inorganic acids such as hydrogen sulfide.

A filter membrane removes the water fraction from the unit. The membrane provides filtration in the 0.01 microns or lower range, which is enough to remove viruses, bacteria and other colloidal materials. The water exiting the units is potable water and safe for human consumption.

Brine Discharge / Deep Injection Wells

In many gas shale fields, disposal through a deep injection well offers a cost-effective alternative to water reclamation although the method is environmentally questionable. If suitable geology exists, high TDS flowback waters can be disposed by injection into a deep discharge well. There are operative brine discharge wells in each of the major shale formations. The alternative solution is to process the brine with the STW DyVaR system.

Oil and Gas Services

Our subsidiaries, STW Energy, STW Pipeline Maintenance & Construction, and STW Oilfield Construction Services offer a wide range of oilfield and pipeline construction, maintenance and support services. Our services include construction of new poly and steel pipeline for oil, gas or water service and leak repair crews to help combat decaying pipelines in all major production areas. We use top of the line equipment including poly fusion machines that are capable of fusing 3 inch to 24 inch pipe as well as all of the equipment to ditch and lay all types of pipeline. Our employees each have at least 10 years’ experience in the pipeline construction & maintenance industry. Permian basin pipeline infrastructure consists of thousands of miles of steel and poly pipeline already in service that were installed over the past few decades, along with thousands of miles per year of new service pipelines added due to greatly increased production resulting from the use of fracking. Over half of these aging pipelines have countless leaks that cause huge gas losses for midstream companies. Our goal is to provide the best service to mitigate these issues. Pipeline employs qualified laborers with years of experience in the oil patch, and Supervisor/Sales people with particular oil patch knowledge in the Permian and Delaware Basins of West Texas, Eastern New Mexico, and in the Eagle Ford of South Texas.

Product Purchase and Manufacturing license agreement

On June 20, 2014, the Company entered into an exclusive product purchase and manufacturing license agreement with Salttech B.V, (“Salttech”) a company based in the Netherlands. The agreement provides exclusive rights to purchase Salttech’s DyVaR devices which are used to remove salinity from brackish/brine water streams. The agreement grant’s to the Company exclusive United States rights to purchase these products for use in the municipal and oil & gas industries. The agreement also grants to the Company the right of first refusal for this technology in North America.

The initial term of the agreement is for five years and is renewable automatically for five years and every five year period unless terminated by written notice of the parties at least three months before the termination date.

The initial royalty for the first year of the agreement is for $324,000, payable quarterly beginning with the calendar quarter starting July 1, 2014 as follows: Q3 2014 $60,000, Q4 2014 $60,000, Q1 2015 $100,000 and Q2 2015 $104,000. The Company also agreed to pay a continuing royalty of $240,000 per year for years 2-5, plus 3% of the invoice price of any products sold by the Company under the agreement. The Company also agreed to issue 66,667 shares of its common stock in consideration of this agreement.

Expertise & Differentiators

- Experienced and entrepreneurial management

- Unique, high quality and efficient process

- Highly trained, insured workforce

- Newest technology; mobile units

- All inclusive capabilities

Marketing & Sales

STW’s business proposition is to provide comprehensive, necessary water treatment and processing solutions. We work closely with our customers to evaluate their water treatment needs, understand how these may change over time, assess the regulatory and economic factors and design an optimal solution. STW offers a broad array of technical solutions coupled with a service suite and financial structuring options that provide our customers with the ability to obtain a turnkey solution to their wastewater challenges.

Oil and Gas Shale

Most of the oil and gas producers in each of the shale formations are already well known to the Company. STW personnel have developed many, and in some cases, long standing relationships with key personnel responsible for well completion and remedial operations at each gas producer. STW monitors production plans at the producer level, the acreage acquisitions at the shale formations and trends that relate to the demand for water reclamation by region. In addition, the Company maintains detailed databases that monitor drilling permits, rig counts and other key statistics that forecast gas production rates by geography. These activities allow the Company to anticipate demand for its services and to prioritize its sales calling efforts on those producers for whom freshwater supply is an issue or where shale water disposal pose the greatest challenges.

The foundation of the Company’s sales strategy is to become an integral part of its customer’s water management function. This involves identifying and finding solutions to customer needs through a multi-step, consultative approach:

|

·

|

Evaluate drilling program and production expansion plans.

|

|

·

|

Identify and define fracture water supply needs and waste brine generation levels.

|

|

·

|

Study the flowback water volumes and chemistry over time.

|

|

·

|

Generate economic models jointly with producers, with full consideration of all costs of obtaining, utilizing and disposing of the water.

|

|

·

|

Evaluate various water reclamation options, from equipment to logistics and develop financial models for all the options.

|

|

·

|

Provide a customized presentation comparing present practices to all of the options of water reclamation available to the customer for buy-in to the best scenarios.

|

|

·

|

Jointly develop a presentation of the best scenarios for water management (present and future) for use by upper management, and support the presentation as required.

|

|

·

|

Review and determine optimal system design, location and financial structure.

|

|

·

|

Develop a timeline for water reclamation implementation.

|

|

·

|

Execute definitive off-take and/or other agreements satisfactory to all parties.

|

STW is able to facilitate this part of the sales process through its detailed knowledge of oil and gas drilling, fracking and production process and economics, shale formation geology, frac water chemistry, well completion techniques and logistics, and regional regulatory landscapes. This expertise reduces the time required during the evaluative stage of the sales process and fosters a positive working relationship with our customers. STW then works together with its engineering and manufacturing partners to complete the technical solution, develop ancillary system requirements (balance of plant), evaluate cost and operating data, model the financial performance of the system and define remaining project parameters and an installation timeline.

Water reclamation is a new paradigm for oil and gas producers. Educating them about the economic, environmental and political benefits is key to long-term adoption.

Competition

In the oil and gas industry, current fracturing and produced water disposal methods – deep injection wells and surface water disposal – represent the Company’s greatest source of competition.

Legislative and Regulatory

Progressively tighter regulations are demanding a thorough review of the entire water-use cycle in industrial applications with the ultimate goal of encouraging and/or mandating reclamation and re-use of water. STW works closely with Federal, State and local regulators and environmental agencies to share our expertise and knowledge on this complex issue and discuss our views on potential solutions. The Company’s intimate knowledge of this process is a key tool in assisting their customers to gain a better understanding of the legislative and regulatory elements related to water management and advising them of various alternatives.

Employees

As of December 31, 2014, we had 119 full-time or part-time employees. Our executive officers provide certain services dedicated to current corporate and business development activities on an as needed part-time basis.

Company’s Office and Website

Our offices are located at 3424 South County Road 1192, Midland, Texas 79706. Our website address is www.STWresources.com. Information found on our website is not incorporated by reference into this report.

ITEM 1A. RISK FACTORS

Risks Related to Our Business

We have a history of operating losses; we incurred a net loss in both fiscal year 2014 and fiscal year 2013. Our revenues are not currently sufficient to fund our operating expenses, and there are no assurances we will develop profitable operations.

The report of our independent registered public accounting firm on our 2014 consolidated financial statements contains an explanatory paragraph which raises substantial doubt about our ability to continue as a going concern, and we will need additional financing to execute our business plan, fund our operations and to continue as a going concern, which additional financing may not be available on a timely basis, or at all.

We have limited remaining funds to support our operations. We have prepared our consolidated financial statements in this Form 10-K on a going-concern basis, which contemplates the realization of assets and the satisfaction of liabilities in the normal course of business. We will not be able to execute our current business plan, fund our business operations or continue as a going concern long enough to achieve profitability unless we are able to secure additional funds. The Report of Independent Registered Public Accounting Firm on our December 31, 2014, consolidated financial statements includes an explanatory paragraph stating that the recurring losses incurred from operations and a working capital deficiency raise substantial doubt about our ability to continue as a going concern. However, in order to sustain and improve operations, we will need to secure additional funds. If adequate financing is not available, we will not be able to sustain operations. In addition, if one or more of the risks discussed in these risk factors occur or our expenses exceed our expectations, we may be required to raise further additional funds sooner than anticipated.

We will be required to pursue sources of additional capital to fund our operations through various means, including equity or debt financing, funding from a corporate partnership or licensing arrangement or any similar financing. However, we may be unable to obtain such financings on reasonable terms, or at all. Future financings through equity investments are likely to be dilutive to existing stockholders. Also, the terms of securities we may issue in future capital transactions may be more favorable for our new investors. Newly issued securities may include preferences, superior voting rights and the issuance of warrants or other derivative securities, which may have additional dilutive effects. In addition, if we raise additional funds through collaboration and licensing arrangements, we may be required to relinquish potentially valuable rights to our product candidates or proprietary technologies, or grant licenses on terms that are not favorable to us. Further, we may incur substantial costs in pursuing future capital and/or financing, including investment banking fees, legal fees, accounting fees, printing and distribution expenses and other costs. As a result, there can be no assurance that additional funds will be available when needed from any source or, if available, will be available on terms that are acceptable to us. If we are unable to raise funds to satisfy our capital needs prior to the end of 2015, we may be required to cease operations.

STW’s results of operations have not resulted in profitability, and we may not be able to achieve profitability going forward.

STW has a deficit accumulated of $39,112,171 as of December 31, 2014 and had a net loss of $14,756,828 for the year ended December 31, 2014. In addition, as of December 31, 2014, STW had total liabilities of $27,601,280 and total assets of $6,713,243.

Our management is developing plans to alleviate the negative trends and conditions described above. Our business plan is speculative and unproven. There is no assurance that we will be successful in executing our business plan or that even if we successfully implement our business plan, that we will be able to curtail our losses now or in the future. Further, as we are a new enterprise, we expect that net losses will continue and our working capital deficiency will exacerbate.

We have historically been, and may continue to be, heavily reliant upon financing from related parties, which presents potential conflicts of interest that may adversely affect our financial condition and results of operations.

We have historically obtained financing from related parties, including major shareholders, directors and officers, in the form of debt, debt guarantees, factoring facilities and issuances of equity securities, to finance working capital growth. These related parties have the ability to exercise significant control over our financing decisions, which may present conflicts of interest regarding the choice of parties from whom we obtain financing, as well as the terms of financing. No assurance can be given that the terms of financing transactions with related parties are or will be as favorable as those that could be obtained in arms’ length negotiations with third parties.

We will need additional financing, which we may not be able to obtain on acceptable terms, if at all.

The cash resources of the Company are insufficient to meet its planned business objectives without additional financing. These and other factors raise substantial doubt about the Company’s ability to continue as a going concern.

We will require additional financing for our operations, to purchase equipment and to establish a customer base and to pursue our general business plan. We will need to raise additional working capital to continue implementing our business model, to provide funds for marketing efforts, to increase our revenues and for general overhead expenses, including those associated with our reporting obligations under Federal securities laws. We have undertaken steps as part of a plan to improve operations with the goal of sustaining our operations for the next twelve months and beyond. These steps include (a) raising additional capital and/or obtaining financing; (b) executing contracts with oil and gas operators and municipal utility districts; and (c) controlling overhead and expenses. There can be no assurance that the Company can successfully accomplish these steps and it is uncertain that the Company will achieve a profitable level of operations and obtain additional financing.

Management continues seeking additional funds, primarily through the issuance of debt or equity securities for cash to operate our business. Currently, we have no firm commitments for any additional capital. No assurance can be given that any future financing will be available or, if available, that it will be on terms that are satisfactory to the Company. Even if the Company is able to obtain additional financing, it may contain undue restrictions on our operations, in the case of debt financing or cause substantial dilution for our stockholders, in the case of equity financing.

While to date we have relied upon the relationships of our executive officers and shareholders in our capital raising efforts, there are no assurances that these resources will continually be available to us or provide us with sufficient funding. We cannot assure you that we will be able to raise the working capital as needed in the future on terms acceptable to us, if at all. However, if we do not raise funds as needed, then we will not have sufficient funds to complete the purchase of equipment and commercialization of our services and we may not be able to continue to implement our business objectives. As of the date of this Annual Report, we have no firm commitments for additional capital.

We have a significant amount of debt, a portion of which consists of convertible debt that is coming due soon, which could impact our ability to continue implementing our business objectives.

We have incurred indebtedness totaling $27,601,280 as of December 31, 2014, which includes: current liabilities of $24,775,985 which includes $4,523,265 in accounts payable, $4,280,180 in related party payables, the short term portion of the notes payable is $5,890,414, $2,671,843 of sales, payroll taxes, and penalties payable, $208,271 of insurance premium finance contract payable, $1,769,117 in accrued expenses, which principally includes accrued interest on our various debt obligations, $643,777 of accrued compensation, $496,067 of accrued board compensation, $2,783,711 of Fees Payable in Common Stock, $27,000 of stock subscriptions payable, and $802,340 of derivative liability. The non-current portion of the notes payable is $2,825,295 for a total of $8,715,709 in notes payable, including convertible notes. As of December 31, 2014, the total of outstanding 14% convertible notes is $2,296,342 of which $688,210 is in default. We do not have adequate funds to satisfy the outstanding obligations. Unless we are able to restructure some or all of this debt and raise sufficient capital to fund our continued development, our current operations do not generate sufficient cash to pay these obligations, when due. Accordingly, there can be no assurance that we will be able to pay these or other obligations we may incur in the future and it is unlikely that we would be able to continue as a going concern.

As of April 2, 2015, we have $3,701,617 in outstanding convertible notes. We received consent from the holders of approximately 42% of the outstanding principal amount of such notes to extend the maturity date of their notes. Although we continue to seek consent from the remaining note holders, there can be no assurance that we will receive it from any or all of these holders. The notes provide us with a 30 day cure period, but if we are unable to pay the notes when they become due, the note holders maintain the right to demand immediate payment of all outstanding principal and interest or maintain the note at an increased default interest rate of 18% per annum until we remedy the default. If we do not receive consent to extend the maturity date of the notes from the remaining note holders, the notes are not converted into equity or we do not otherwise restructure such debt, our current operations do not generate sufficient cash to pay the interest and principal on these obligations when they become due. Accordingly, there can be no assurance that we will be able to pay these or other obligations which we may incur in the future.

We have limited operating history and we cannot assure you that our business model will be successful in the future or that our operations will be profitable.

Our limited operating history makes it difficult for us to evaluate our future business prospects and make decisions based on those estimates of our future performance. Although formed in 2010 as a corporation providing customized water reclamation technologies and services, we only began to generate revenue from our operations in fiscal year 2013. Accordingly, investors have little operating history with which to evaluate our business model. There can be no assurances whatsoever that we will be able to successfully implement our business model, penetrate our target markets or attain a wide following for our services. We are subject to all the risks inherent in an early stage enterprise and our prospects must be considered in light of the numerous risks, expenses, delays, problems and difficulties frequently encountered in such businesses.

We depend upon key personnel and need additional personnel.

Our success depends on the continuing services of Stanley Weiner, our Chief Executive Officer and director. The loss of Mr. Weiner could have a material and adverse effect on our business operations. Additionally, the success of the Company’s operations will largely depend upon its ability to successfully attract and maintain competent and qualified key management personnel. As with any company with limited resources, there can be no guarantee that the Company will be able to attract such individuals or that the presence of such individuals will necessarily translate into profitability for the Company. Our inability to attract and retain key personnel may materially and adversely affect our business operations.

We must effectively manage the growth of our operations, or our company will suffer.

To manage our growth, we believe we must continue to implement and improve our operational and marketing departments. We may not have adequately evaluated the costs and risks associated with this expansion, and our systems, procedures, and controls may not be adequate to support our operations. In addition, our management may not be able to achieve the rapid execution necessary to successfully offer our products and services and implement our business plan on a profitable basis. The success of our future operating activities will also depend upon our ability to expand our support system to meet the demands of our growing business. Any failure by our management to effectively anticipate, implement, and manage changes required to sustain our growth would have a material adverse effect on our business, financial condition, and results of operations.

We rely on confidentiality agreements that could be breached and may be difficult to enforce.

Although we believe that we take reasonable steps to protect our intellectual property, including the use of agreements relating to the non-disclosure of our confidential information to third parties by our employees, consultants, advisors or others, as well as agreements that provide for disclosure and assignment to us of all rights to the ideas, developments and discoveries of our employees and consultants while we employ them, such agreements can be difficult and costly to enforce. Moreover, although we generally seek to enter into these types of agreements with our consultants, advisors and research collaborators, to the extent that such parties apply or independently develop intellectual property in connection with any of our projects, disputes may arise concerning allocation of the related proprietary rights. If a dispute were to arise, enforcement of our rights could be costly and the result unpredictable.

Despite the protective measures we employ, we still face the risk that: agreements may be breached; agreements may not provide adequate remedies for the applicable type of breach; our trade secrets or proprietary know-how may otherwise become known; our competitors may independently develop similar technology; or our competitors may independently discover our proprietary information and trade secrets.

Our operations are subject to comprehensive regulation, which may cause substantial delays or require capital outlays in excess of those anticipated causing an adverse effect on us.

Our operations are subject to federal, state, and local laws relating to the protection of the environment, including laws regulating removal of natural resources from the ground and the discharge of materials into the environment. Various permits from government bodies are required for our operations to be conducted; no assurance can be given that such permits will be received. Environmental standards imposed by federal, provincial, or local authorities may be changed and any such changes may have material adverse effects on our activities. Moreover, compliance with such laws may cause substantial delays or require capital outlays in excess of those anticipated, thus causing an adverse effect on us. Additionally, we may be subject to liability for pollution or other environmental damages. We generally maintain insurance coverage customary to the industry; however, we are not fully insured against all possible environmental risks. To date, we have not been required to spend any material amount on compliance with environmental regulations. However, we may be required to do so in future and this may affect our ability to expand or maintain our operations.

Risks associated with the collection, treatment and disposal of wastewater may impose significant costs.

Our wastewater collection, treatment and disposal operations of our subsidiaries are subject to substantial regulation and involve significant environmental risks. If collection systems fail, overflow or do not operate properly, untreated wastewater or other contaminants could spill onto nearby properties or into nearby streams and rivers, causing damage to persons or property, injury to aquatic life and economic damages, which may not be recoverable in rates. Liabilities resulting from such damage could adversely and materially affect our business, results of operations and financial condition. Moreover, in the event that we are deemed liable for any damage caused by overflow, our losses might not be covered by insurance policies, and such losses may make it difficult for us to secure insurance in the future at acceptable rates.

We are delinquent in our payroll tax obligations

As of April 2, 2015, we are delinquent in payment of $2,594,128 of federal employee payroll taxes, including withholding, and filing of payroll tax returns and have submitted an application to the Internal Revenue Service to enable us to pay these delinquent taxes over an extended period. Since these payroll tax liabilities include failure to deposit employee trust funds, we may be subject to 100% trust fund penalties for these taxes and have accrued $1,183,202 of these estimated penalties as of December 31, 2014. We cannot assure you that the Internal Revenue Service will accept our application for installment payments or that we will not incur additional fines and penalties for failure to timely file such federal payroll tax returns.

We compete with many larger, well capitalized companies.

We face competition from companies in reclamation of oil and gas wastewater industry that provide similar services to the Company’s. Our competitors may have longer operating histories, greater name recognition, broader customer relationships and industry alliances and substantially greater financial, technical and marketing resources than we do. Our competitors may be able to respond more quickly than we can to new or emerging technologies and changes in customer requirements.

Our business and stock price could be adversely affected if we are not successful in enhancing our management, systems, accounting, controls and reporting performance.

We have experienced, and may continue to experience, difficulties in implementing the management, operations and accounting systems, controls and procedures necessary to support our growth and expanded operations, as well as difficulties in complying with the reporting requirements related to our growth. With respect to enhancing our management and operations team, we may experience difficulties in finding and retaining additional qualified personnel. If such personnel are not available locally, we may incur higher recruiting, relocation and compensation expenses. In an effort to meet the demands of our planned activities in fiscal year 2015 and, thereafter, we may be required to supplement our staff with contract and consultant personnel until we are able to hire new employees. Further, we may not be successful in our efforts to enhance our systems, accounting, controls and reporting performance. All of this may have a material adverse effect on our business, results of operations, cash flows and growth plans as well as our regulatory standing, listing status and stock price.

We will be subject to risks in connection with acquisitions, and the integration of significant acquisitions may be difficult.

Our business plan contemplates significant acquisitions of reserves, properties, prospects, and leaseholds and other strategic transactions that appear to fit within our overall business strategy, which may include the acquisition of asset packages of producing properties or existing companies or businesses operating in our industry. The successful acquisition of producing properties requires an assessment of several factors, including:

|

●

|

recoverable reserves;

|

|

●

|

future oil and natural gas prices and their appropriate differentials;

|

|

●

|

development and operating costs; and

|

|

●

|

Potential environmental and other liabilities.

|

The accuracy of these assessments is inherently uncertain. In connection with these assessments, we perform a review of the subject properties that we believe to be generally consistent with industry practices. Our review will not reveal all existing or potential problems nor will it permit us to become sufficiently familiar with the properties to fully assess their deficiencies and potential recoverable reserves. Inspections may not always be performed on every well, and environmental problems are not necessarily observable even when an inspection is undertaken. Even when problems are identified, the seller may be unwilling or unable to provide effective contractual protection against all or part of the problems. We are not entitled to contractual indemnification for environmental liabilities and acquired properties on an “as is” basis.

Significant acquisitions of existing companies or businesses and other strategic transactions may involve additional risks, including:

|

·

|

diversion of our management’s attention to evaluating, negotiating, and integrating significant acquisitions and strategic transactions;

|

|

·

|

the challenge and cost of integrating acquired operations, information management, and other technology systems, and business cultures with our own while carrying on our ongoing business;

|

|

·

|

difficulty associated with coordinating geographically separate organizations; and

|

|

·

|

the challenge of attracting and retaining personnel associated with acquired operations.

|

The process of integrating operations could cause an interruption of, or loss of momentum in, the activities of our business. Members of our senior management may be required to devote considerable amounts of time to this integration process, which will decrease the time they will have to manage our business. If our senior management is not able to manage the integration process effectively, or if any significant business activities are interrupted as a result of the integration process, our business could be materially and adversely affected.

Risks Related to the Ownership of Our Securities

A small number of shareholders own a significant amount of our common stock, which could limit your ability to influence the outcome of any shareholder vote.

Our executive officers, directors and shareholders holding in excess of five percent (5%) of our issued and outstanding shares, beneficially own over 30% of our common stock as of December 31, 2014. Under our Articles of Incorporation and Nevada law, the vote of a majority of the shares outstanding is generally required to approve most shareholder action. As a result, these shareholders, acting together, would have the ability to control the outcome of matters submitted to our shareholders for approval, including the election of directors and any merger, consolidation or sale of all or substantially all of our assets. In addition, these shareholders, acting together, would have the ability to control the management and affairs of our company. Accordingly, this concentration of ownership might harm the market price of our common stock by:

|

·

|

delaying, deferring or preventing a change in corporate control;

|

|

·

|

impeding a merger, consolidation, takeover or other business combination involving us; or

|

|

·

|

discouraging a potential acquirer from making a tender offer or otherwise attempting to obtain control of us.

|

Outstanding notes and warrants may adversely affect us in the future and cause dilution to existing shareholders.

We may in the future issue our previously authorized and unissued securities, resulting in the dilution of the ownership interests of our present shareholders. We are currently authorized to issue 191,666,667 shares of common stock and 10,000,000 shares of Preferred Stock with such designations, preferences and rights as determined by our Board of Directors, as well as additional classes or series of ownership interests or debt obligations which may be convertible into any class or series of ownership interests in the Company. Such securities may be issued without the approval or other consent of the holders of the Common Stock. As of April 2, 2015, there are 31,683,150 shares of our common stock outstanding and no shares of preferred stock outstanding.

However, as of April 2, 2015, the Company has issued or has authorized the issuance of: (i) notes convertible into an aggregate of 8,304,075 shares of our common stock; (ii) fees payable in common stock of 1,184,425 shares, (iv) stock subscriptions payable of 26,154 shares and (v) warrants to purchase up to an aggregate of 3,634,350 shares of our common stock with exercise prices ranging from $0.12 to $1.80 per warrant. Conversion of the preferred stock or exercise of the warrants may cause dilution in the interests of other shareholders as a result of the additional common stock that would be issued upon conversion or exercise. In addition, sales of our common stock issuable upon exercise of the warrants could have a depressive effect on the price of our stock, particularly if there is not a coinciding increase in demand by purchasers of our common stock.

Any further issuances that may be authorized and issued by the Company, and the conversion and exercise of any preferred stock and warrants, respectively, will increase the number of shares of common stock outstanding, which will have a dilutive effect on the ownership interests of our existing shareholders.

There is a lack of liquidity in our common stock and the price could be volatile when you want to sell your holdings.

Our common stock is currently traded on the OTCQB under the symbol STWS. There is currently only a limited public market for the Company’s common stock and common stock is not actively traded. Moreover, the price of our common stock may be volatile due to numerous factors, many of which are beyond our control that may cause the market price of our common stock to fluctuate significantly. These factors include:

|

·

|

expiration of lock-up agreements;

|

|

·

|

our earnings releases, actual or anticipated changes in our earnings, fluctuations in our operating results or our failure to meet the expectations of financial market analysts and investors;

|

|

·

|

changes in financial estimates by us or by any securities analysts who might cover our stock;

|

|

·

|

speculation about our business in the press or the investment community;

|

|

·

|

significant developments relating to our relationships with our customers or suppliers;

|

|

·

|

stock market price and volume fluctuations of other publicly traded companies and, in particular, those that are in the oil and gas industry;

|

|

·

|

customer demand for our products;

|

|

·

|

investor perceptions of the oil and gas industry in general and our company in particular;

|

|

·

|

the operating and stock performance of comparable companies;

|

|

·

|

general economic conditions and trends;

|

|

·

|

major catastrophic events;

|

|

·

|

announcements by us or our competitors of new products, significant acquisitions, strategic partnerships or divestitures;

|

|

·

|

changes in accounting standards, policies, guidance, interpretation or principles;

|

|

·

|

sales of our common stock, including sales by our directors, officers or significant stockholders; and

|

|

·

|

additions or departures of key personnel.

|

Securities class action litigation is often instituted against companies following periods of volatility in their stock price. This type of litigation could result in substantial costs to us and divert our management’s attention and resources.

Moreover, securities markets may from time to time experience significant price and volume fluctuations for reasons unrelated to operating performance of particular companies. These market fluctuations may adversely affect the price of our common stock and other interests in our company at a time when you want to sell your interest in us.

If securities or industry analysts do not publish research or reports about us or our business, or if they change their recommendations regarding our stock adversely, our stock price and trading volume could decline.

The trading market for our common stock will be influenced by the research and reports that industry or securities analysts publish about us or our business. We do not currently have and may never obtain research coverage by industry or financial analysts. If no or few analysts commence coverage of us, the trading price of our stock would likely decrease. Even if we do obtain analyst coverage, if one or more of the analysts who cover us downgrade our stock, our stock price would likely decline. If one or more of these analysts cease coverage of our company or fail to regularly publish reports on us, we could lose visibility in the financial markets, which in turn could cause our stock price or trading volume to decline.

We have not paid dividends on our common stock in the past and do not expect to pay dividends on our common stock for the foreseeable future. Any return on investment may be limited to the value of our common stock.

No cash dividends have been paid on our common stock. We expect that any income received from operations will be devoted to our future operations and growth. We do not expect to pay cash dividends on our common stock in the near future. Payment of dividends would depend upon our profitability at the time, cash available for those dividends, and other factors as our board of directors may consider relevant. If we do not pay dividends, our common stock may be less valuable because a return on an investor’s investment will only occur if our stock price appreciates.

Our Common Stock is subject to the “penny stock” rules of the Securities and Exchange Commission.

The Securities and Exchange Commission has adopted Rule 15g-9, which establishes the definition of a “penny stock,” for the purposes relevant to us, as any equity security that has a market price of less than $5.00 per share, subject to certain exceptions. The market price of our common stock is less than $5.00 per share and, therefore, it is designated as a “penny stock” according to SEC rules.

This designation requires any broker or dealer selling these securities to disclose certain information concerning the transaction, obtain a written agreement from the purchaser and determine that the purchaser is reasonably suitable to purchase the securities. These rules may restrict the ability of brokers or dealers to sell our common stock and may affect the ability of investors to sell their shares.

Generally, brokers may be less willing to execute transactions in securities subject to the “penny stock” rules. This may make it more difficult for investors to dispose of our common stock and cause a decline in the market value of our stock.

Disclosure also must be made about the risks of investing in penny stocks in both public offerings and in secondary trading and about the commissions payable to both the broker-dealer and the registered representative, current quotations for the securities and the rights and remedies available to an investor in cases of fraud in penny stock transactions. Finally, monthly statements must be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks.

The market for penny stocks has experienced numerous frauds and abuses, which could adversely impact investors in our stock.

Penny stocks are frequent targets of fraud or market manipulation. Patterns of fraud and abuse include:

|

·

|

Control of the market for the security by one or a few broker-dealers that are often related to the promoter or issuer;

|

|

·

|

Manipulation of prices through prearranged matching of purchases and sales and false and misleading press releases;

|

|

·

|

Boiler room practices involving high pressure sales tactics and unrealistic price projections by inexperienced sales persons;

|

|

·

|

Excessive and undisclosed bid-ask differentials and markups by selling broker-dealers; and

|

|

·

|

Wholesale dumping of the same securities by promoters and broker-dealers after prices have been manipulated to a desired level, along with the inevitable collapse of those prices with consequent investor losses.

|

Our management is aware of the abuses that have occurred historically in the penny stock market.

Our publicly filed reports are subject to review by the SEC, and any significant changes or amendments required as a result of any such review may result in material liability to us and may have a material adverse impact on the trading price of the Company’s common stock.

The reports of publicly traded companies are subject to review by the SEC from time to time for the purpose of assisting companies in complying with applicable disclosure requirements. The SEC is required to undertake a comprehensive review of a company’s reports at least once every three (3) years under the Sarbanes-Oxley Act of 2002. SEC reviews may be initiated at any time. We could be required to modify, amend or reformulate information contained in prior filings as a result of an SEC review. Any modification, amendment or reformulation of information contained in such reports could be significant and result in material liability to us and have a material adverse impact on the trading price of the Company’s common stock.

Failure to maintain effective internal controls in accordance with Section 404 of the Sarbanes-Oxley Act could have a material adverse effect on our business and operating results, and shareholders could lose confidence in our financial reporting.

The Sarbanes-Oxley Act requires, among other things, that we maintain effective disclosure controls and procedures and internal controls for financial reporting. For example, Section 404 of the Sarbanes-Oxley Act of 2002 requires that our management report on, the effectiveness of our internal controls structure and procedures for financial reporting. Section 404 compliance may divert internal resources and will take a significant amount of time and effort to complete. We may not be able to successfully complete the procedures and certification and attestation requirements of Section 404 by the time we will be required to do so. If we fail to do so, or if in the future our chief executive officer and chief financial officer determine that our internal controls over financial reporting are not effective as defined under Section 404, we could be subject to sanctions or investigations by the SEC or other regulatory authorities. Furthermore, investor perceptions of our company may suffer, and this could cause a decline in the market price of our common stock. Irrespective of compliance with Section 404, any failure of our internal controls could have a material adverse effect on our stated results of operations and harm our reputation. If we are unable to implement these changes effectively or efficiently, it could harm our operations, financial reporting or financial results.