Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - GAIN Capital Holdings, Inc. | d500331d8k.htm |

| EX-99.1 - EX-99.1 - GAIN Capital Holdings, Inc. | d500331dex991.htm |

4

th

Quarter & Full Year 2012

Financial and Operating Results

March 12, 2013

Exhibit 99.2 |

Special Note Regarding Forward-Looking Information

In addition to historical information, this presentation contains

"forward-looking" statements that reflect management's

expectations for the future. A variety of important factors could cause

results

to

differ

materially

from

such

statements.

These

factors

are

noted

throughout

GAIN

Capital's annual report on Form 10-K, as filed with the Securities and Exchange

Commission on March 15, 2012, and include, but are not limited to, the

actions of both current and potential new competitors, fluctuations in

market trading volumes, financial market volatility, evolving industry

regulations, including changes in regulation of the futures companies, errors or

malfunctions in our systems or technology, rapid changes in technology, effects of

inflation, customer trading patterns, the success of our products and

service offerings, our ability to continue to innovate and meet the demands

of our customers for new or enhanced products, our ability to successfully

integrate assets and companies we have acquired, including the

successful

integration

of

Open

E

Cry,

our

ability

to

effectively

compete

in

the

futures

industry,

changes in tax policy or accounting rules, fluctuations in foreign exchange rates

and commodity prices, adverse changes or volatility in interest rates, as

well as general economic, business, credit and financial market conditions,

internationally or nationally, and our ability to continue paying a

quarterly dividend in light of future financial performance and financing

needs. The forward-looking statements included herein represent GAIN Capital's

views as of the date of this presentation. GAIN Capital undertakes no

obligation to revise or update publicly any forward-looking statement

for any reason unless required by law. 2 |

Overview

Glenn Stevens, CEO |

Full

Year Highlights •

Progress on revenue diversification

–

Commission revenue totaled 13% of FY 2012 revenue vs. 3% in FY 2011

–

Continued growth of institutional business, GTX

–

Only 4 mos. of contribution from newly acquired Futures business, OEC

•

Solid

operating

metrics

in

our

retail

businesses

despite

adverse

market

conditions

–

Funded accounts up 11%

–

Client assets up 44%

•

Strategically managed expenses in our retail OTC business to fund

investments in futures and institutional businesses

•

5% decrease in FY 2012 expenses; $20.8 million (17%) decrease in

retail OTC

operating expenses

•

Active corporate development pipeline

–

Market

consolidator

in

the

U.S.

via

recent

acquisitions

of

GFT

&

FX

Solutions

customer

accounts

–

Experienced acquirer with strong integration skills

–

Aggressively seeking deals that will help scale our businesses

4 |

4

th

Quarter

&

FY

2012

Results

Overview

5

•

Q4 2012 Financial Summary

•

Net Revenue: $32.4 million

•

Net Loss: ($3.8) million

•

Adjusted Net Loss

(1)

: ($3.3) million

•

Adjusted EBITDA

(2)

: ($5.0) million

•

FY 2012 Financial Summary

•

Net Revenue: $151.4 million

•

Net Income: $2.6 million

•

Adjusted Net Income

(1)

: $5.5 million

•

Adjusted EBITDA

(2)

: $11.1 million

•

EPS (Diluted): $0.07

•

Adjusted

EPS

(Diluted)

(3)

:

$0.14

•

Operating Metrics

(4)

•

Total trading volume up 34% to $3.3 trillion

•

Retail volume decreased 17% to $1.3 trillion

•

Institutional volume increased 129% to $2.0 trillion

•

Funded accounts up 11% to 85,099

•

Client assets up 44% to $446.3 million as of December 31, 2012

(Comparisons are referenced to FY 2011)

Adjusted net income is a non-GAAP financial measure that represents our net income excluding

purchase intangible amortization. A reconciliation of net income to adjusted net income is available

in the appendix to this presentation.

Adjusted EBITDA is a non-GAAP financial measure that represents our earnings before

interest, taxes, depreciation, amortization and non-recurring expenses. A reconciliation of net income to

adjusted EBITDA is available in the appendix to this presentation. Reconciliation of EPS to adjusted

EPS is available in the appendix to this presentation.

Definitions for all our operating metrics are available in the appendix to this presentation. (1)

(2)

(3)

(4) |

Market

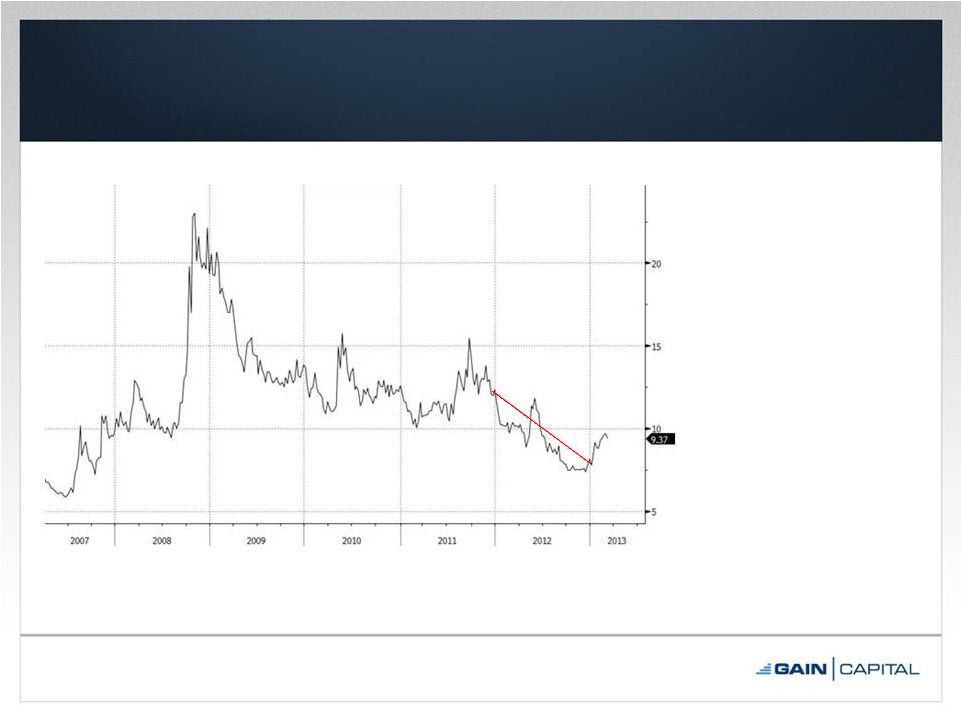

Conditions in 2012 6

Source: JPMorgan’s G7 Volatility Index

•

FX volatility declined

34% in 2012

•

Q4 low point of year;

December levels not

seen since mid 2007

•

Promising trend

reversal in first few

months of 2013,

though volatility still

relatively low vs.

historical levels |

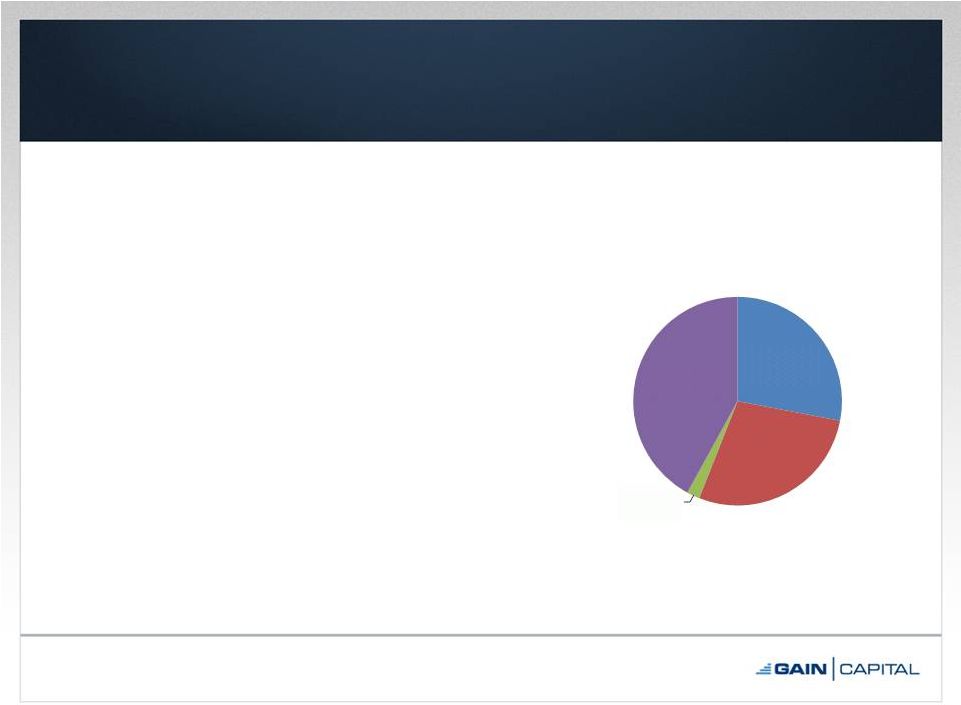

Retail

OTC Business Continues to Evolve •

Geographically diversified business

–

In FY 2012, 28% of retail business from North

America; 51% in FY 2010

–

Presence in key markets; Canada service

launched in 2012

•

Expanded product offering

–

Introduction of TRADE, with over 450 FX &

CFD markets, up from 70 in 2011

–

Additional markets planned for 2013

•

Continued growth in mobile trading

–

64% year-over-year volume growth

–

26% of clients traded on a mobile device in

2012

•

Indirect business 37% of volume in 2012

–

New white label partners from Turkey, US,

Hong Kong, Eastern Europe & New Zealand

7

FY 2012 Retail OTC Volume

North America

28%

Asia-Pac

42%

EMEA

28%

Rest of World

2% |

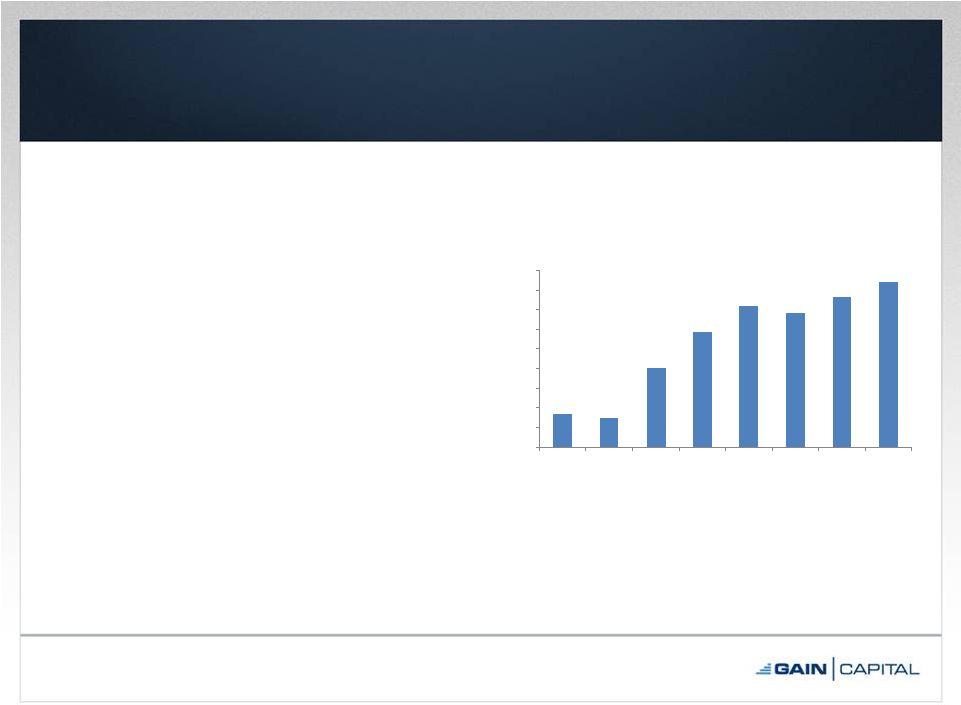

GTX

- Strong Momentum

8

•

Trading volumes continued

steady ramp in 2012

•

Doubled execution desk staff in

Q3

•

Key executive from Knight hired in

Q4 2012 to lead institutional

business

•

Q1 2013 results continue to show

upward trajectory

•

Multi-dealer ECN provides

opportunities in both institutional

and retail OTC markets

$1.7

$1.5

$4.0

$5.9

$7.2

$6.8

$7.6

$8.4

$0.0

$1.0

$2.0

$3.0

$4.0

$5.0

$6.0

$7.0

$8.0

$9.0

Q1 11

Q2 11

Q3 11

Q4 11

Q1 12

Q2 12

Q3 12

Q4 12

Average Daily Volume

Note: Dollars in billions. |

OEC

– Strategic Entry into Futures

9

•

Transaction closed in late Q3 2012

–

Acquired

from

Schwab

&

Co.

for

$9.5

million

(net

of

$2.5

million

cash

received)

•

Continues to show growth in key operating metrics and financials

•

Q1 2013 revenue run-rate trending significantly higher than FY

2012

•

US futures market ripe for further consolidation

–

Increasing regulatory costs impacting smaller firms |

Growth Through M&A

•

GAIN continues to grow its business via M&A

–

Amplifies our expansion into new products, customer segments

or geographies

•

Strength in M&A driven by previous transaction experience

–

6 asset deals in last 3 years (GFT & FX Solutions in last three

months)

–

Acquisition of OEC from Schwab in late 2012

•

Reputation as a fair counterparty with strong integration skills

•

M&A pipeline remains strong in domestic and international

markets

10 |

Financial Review

Daryl Carlough, Interim CFO |

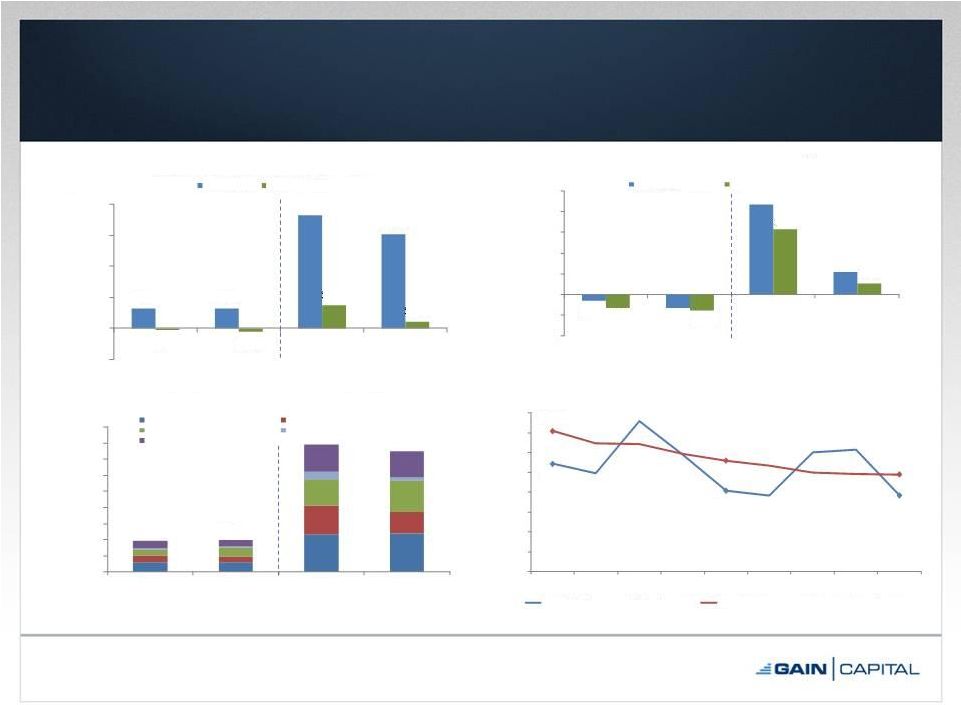

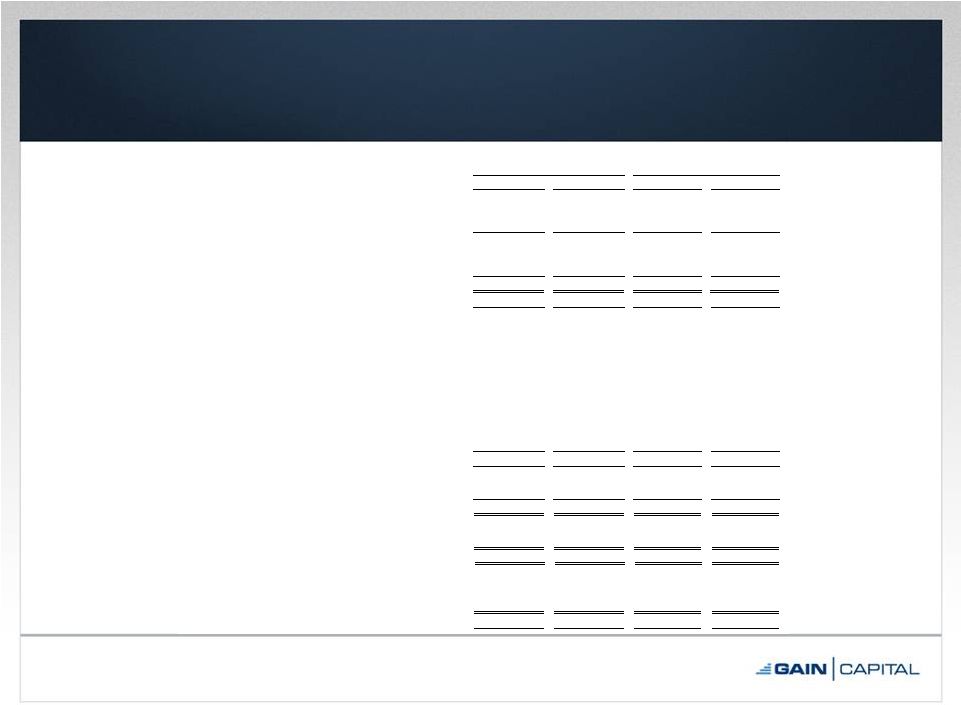

4 Quarter & FY 2012 Financial Results

12

Note: Dollars in millions.

4

Quarter

Full Year

4

Quarter

Full Year

4

th

Quarter

Full Year

$31.6

$32.4

$181.5

$151.4

($3.1)

($5.0)

$36.6

$11.1

($50.0)

$0.0

$50.0

$100.0

$150.0

$200.0

2011

2012

2011

2012

Net Revenue & Adjusted EBITDA

Net Revenue

Adjusted EBITDA

(1)

$38.3

$39.8

$158.2

$150.3

$0

$20

$40

$60

$80

$100

$120

$140

$160

$180

2011

2012

2011

2012

Total Expenses

Comp & Benefits

Marketing

Trading

Purchase Intangible Amort.

All Other

($1.6)

($3.3)

$21.7

$5.5

($3.3)

($3.8)

$15.7

$2.6

($10.0)

($5.0)

$0.0

$5.0

$10.0

$15.0

$20.0

$25.0

2011

2012

2011

2012

GAAP & Adjusted Net Income

(2)

Adjusted Net Income

GAAP Net Income

$108.5

$81.3

$76.6

$141.5

$111.8

$97.9

$0.0

$20.0

$40.0

$60.0

$80.0

$100.0

$120.0

$140.0

$160.0

4Q 10

1Q 11

2Q 11

3Q 11

4Q 11

1Q 12

2Q 12

3Q 12

4Q 12

Retail Trading Revenue per Million

Retail Trading Revenue per Million (Quarterly)

Retail Trading Revenue per Million (Last Twelve Months)

th

th

th

(1)

Reconciliation of net income to adjusted EBITDA is available in the appendix to this presentation. (2)

Reconciliation of net income to adjusted net income available in appendix to this presentation. |

Quarterly Dividend & Share Buyback

•

$0.05 per share quarterly dividend approved

–

Record Date: March 12, 2013

–

Payment Date: March 21, 2013

–

0.4 mm repurchased in 4Q 2012 at an average price of $4.45

13

•

Continue to repurchase shares pursuant to our share buyback

program

•

$8.7mm of shares repurchased LTD |

2013

Opportunities •

Regulatory change creating organic and M&A opportunities for GAIN

due to our scale and strong balance sheet

–

Higher regulatory costs coupled with challenging market conditions creating

opportunities for consolidation in several key markets

–

Potential

loss

of

credit

card

funding

in

US

10%

of

GAIN’s

deposits

in

2012)

–

More active oversight in lightly regulated markets like Cyprus, Malta, etc.

marginalizing many offshore competitors

•

Continued growth in CFD trading volumes among our international

retail customer base

•

Continued growth in emerging markets in Asia Pac and Middle East

•

Leverage cross sell opportunities in complementary futures, retail

OTC and institutional offerings –

strong multi asset product offering

•

Poised to benefit from any improvement in market conditions

14

(~ |

Appendix |

Condensed Consolidated Statements of Operations

16

Note: Unaudited. Dollars in millions, except per share data.

(1)

Non-recurring expenses relating to cost-savings effected in 2Q 2012.

Three Months Ended

Twelve Months Ended

December 31,

December 31,

Revenue

2012

2011

2012

2011

Trading revenue

22.9

$

29.8

$

127.5

$

175.9

$

Commission revenue

7.8

1.4

21.4

4.6

Other revenue

1.6

0.4

2.3

1.8

Total non-interest revenue

32.3

31.6

151.2

182.3

Interest revenue

0.2

0.3

0.6

0.6

Interest expense

(0.1)

(0.3)

(0.4)

(1.4)

Total net interest revenue/(expense)

0.1

-

0.2

(0.8)

Net revenue

32.4

31.6

151.4

181.5

Expenses

Employee compensation and benefits

12.0

11.5

47.5

46.4

Selling and marketing

6.9

8.2

27.0

36.2

Trading expenses and commissions

11.2

7.5

38.0

33.0

General & Administrative

5.1

5.5

20.1

21.8

Depreciation and amortization

1.7

1.0

4.9

3.9

Purchased intangible amortization

0.7

2.5

4.1

8.9

Communication and data processing

2.1

2.0

7.7

7.1

Bad debt provision

0.1

0.1

0.4

0.9

Restructuring

(1)

-

-

0.6

-

Total

39.8

38.3

150.3

158.2

(Loss)/income before tax expense

(7.4)

(6.7)

1.1

23.3

Income tax (benefit)/expense

(3.6)

(3.4)

(1.5)

7.6

Net (Loss)/income

(3.8)

$

(3.3)

$

2.6

$

15.7

$

Basic

(0.11)

$

(0.10)

$

0.08

$

0.46

$

Diluted

(0.11)

$

(0.10)

$

0.07

$

0.40

$

Weighted averages common shares outanding used

in computing earnings per common share:

Basic

35,081,311

34,205,991

34,940,800

34,286,840

Diluted

35,081,311

34,205,991

37,880,208

38,981,792

(Loss)/earnings per common share: |

Consolidated Balance Sheet

17

Note: Unaudited. Dollars in millions.

As of December 31,

2012

2011

ASSETS:

Cash

and

cash

equivalents

36.8

$

60.3

$

Cash and securities held for customers

446.3

310.4

Short term investments

1.4

0.1

Receivables from banks and brokers

89.9

85.4

Property

and

equipment

-

net

of

accumulated

depreciation

11.0

7.5

Prepaid assets

7.7

9.9

Goodwill

9.0

3.1

Intangible

assets,

net

9.9

10.8

Other

assets

17.9

18.1

Total

assets

629.9

$

505.6

$

LIABILITIES AND SHAREHOLDERS' EQUITY:

Payables to customer, brokers, dealers, FCM'S and other regulated entities

446.3

$

310.4

$

Accrued compensation & benefits payable

6.1

4.9

Accrued expenses and other liabilities

12.5

14.9

Income tax payable

1.3

2.6

Note payable

-

7.9

Total

liabilities

466.2

$

340.7

$

Shareholders' Equity

163.7

$

164.9

$

Total

liabilities

and

shareholders'

equity

629.9

$

505.6

$

(1)

Previously the Company presented all of its cash and cash equivalents in “Cash and cash

equivalents” on the Consolidated Balance Sheet. However, in an effort to improve

clarity of presentation and reflect the separation between the cash on hand which correlates to amounts held

on behalf of customers and free cash, the Company has separated all cash and cash equivalents into

“Cash and cash equivalents” and “Cash and securities held

for customers”. (1) |

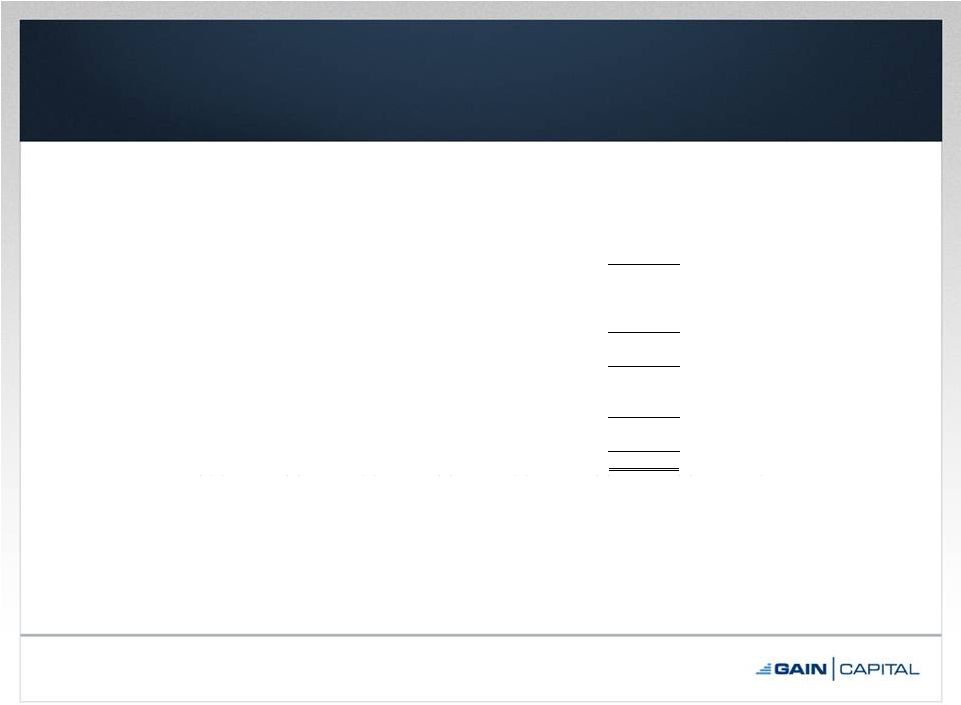

Current Liquidity

18

Note: Dollars in millions.

(1)

Reflects cash that would be received from brokers following the close-out of

all open positions. (2)

Excludes current liabilities of $19.9mm and capital charges associated with open

positions as of 12/31/2012. (3)

The Company has a $50.0mm revolving line of credit. The amount available

varies from time to time due to the terms of financial covenants contained in

the credit facility agreement. As of December 31, 2012, $17.0mm was available.

12/31/2012

Cash and cash equivalents

$36.8

Cash and securities held for customers

446.3

Short term investments

1.4

Receivable from banks and brokers

(1)

89.9

Total Operating Cash

$574.4

Less: Cash and securities held for customers

(446.3)

Free Operating Cash

$128.1

Less: Minimum regulatory capital requirements

(45.6)

Less: Note payable

-

Free

Cash

Available

(2)

$82.5

Add:

Available credit

facility

(3)

17.0

Available Cash & Liquidity

$99.5 |

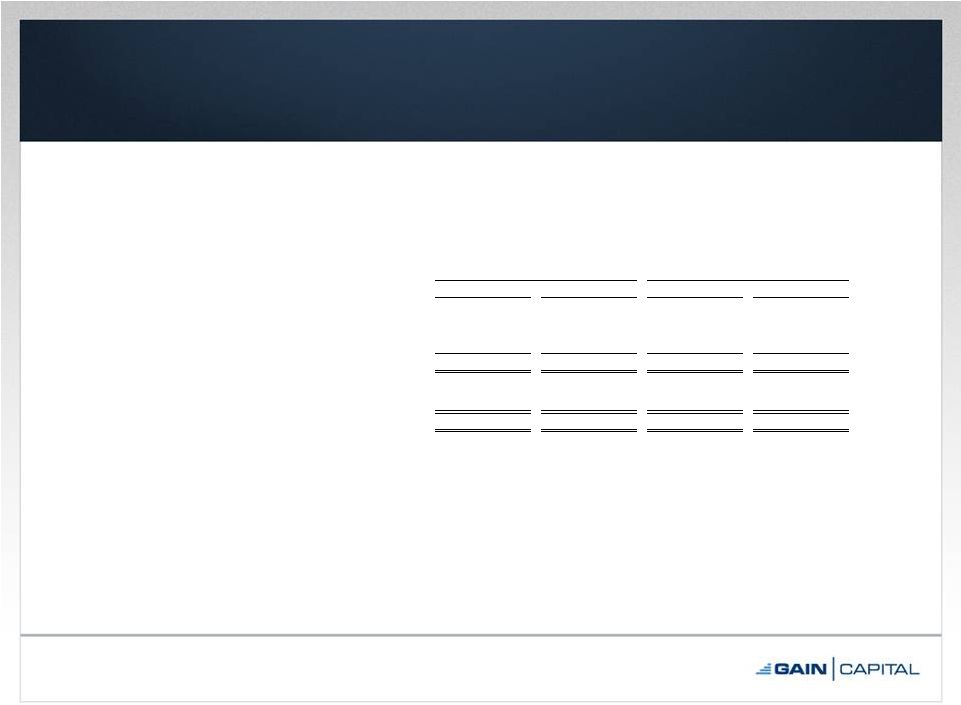

4

th

Quarter & FY 2012 Financial Summary

19

Note: Dollars in millions, except per share data.

(1)

See page 21 for a reconciliation of GAAP net income to adjusted EBITDA.

(2)

See page 20 for a reconciliation of GAAP net income to adjusted net income.

(3)

See page 22 for a reconciliation of GAAP EPS to adjusted EPS.

(4)

Adjusted EBITDA margin is calculated as adjusted EBITDA divided by net revenue (ex.

interest expense on note). 3 Months Ended December 31,

Fiscal Year Ended December 31,

'12 v '11 % Change

2012

2011

2012

2011

4th Quarter

Full Year

Net Revenue

$32.4

$31.6

$151.4

$181.5

3%

(17%)

Interest Expense on Note

-

0.1

0.4

0.5

(100%)

(20%)

Net Revenue (ex. Interest Expense on Note)

$32.4

$31.7

$151.8

$182.0

2%

(17%)

Operating Expenses

37.4

34.8

140.7

145.4

7%

(3%)

Adjusted EBITDA

(1)

($5.0)

($3.1)

$11.1

$36.6

61%

(70%)

GAAP Net (Loss)/Income

($3.8)

($3.3)

$2.6

$15.7

15%

(83%)

(2)

(3.3)

(1.6)

5.5

21.7

106%

(75%)

GAAP EPS (Diluted)

($0.11)

($0.10)

$0.07

$0.40

10%

(83%)

Adjusted EPS (Diluted)

(3)

(0.09)

(0.05)

0.14

0.56

(74%)

Adjusted EBITDA Margin %

(1)(4)

(15.4%)

(9.8%)

7.3%

20.1%

(6 pts)

(13 pts)

Net Income Margin %

(11.7%)

(10.4%)

1.7%

8.7%

(1 pts)

(7 pts)

Adjusted Net Income Margin %

(2)

(10.2%)

(5.1%)

3.6%

12.0%

(5 pts)

(8 pts)

80%

Adjusted Net (Loss)/Income |

Adjusted Net Income & Margin Reconciliation

20

Note: Dollars in millions, except per share data.

Three Months Ended December 31,

Fiscal Year Ended December 31,

2012

2011

2012

2011

Net Revenue

32.4

$

31.6

$

151.4

$

181.5

$

Net (Loss)/income

(3.8)

(3.3)

2.6

15.7

Plus: Purchase intangible amortization (net of tax)

0.5

1.7

2.9

6.0

Adjusted Net (Loss)/Income

(3.3)

$

(1.6)

$

5.5

$

21.7

$

Adjusted (Loss)/Earnings per Share

Basic

(0.09)

$

(0.05)

$

0.16

$

0.63

$

Diluted

(0.09)

$

(0.05)

$

0.14

$

0.56

$

Net Income Margin %

(11.7%)

(10.4%)

1.7%

8.7%

Adjusted Net Income Margin %

(10.2%)

(5.1%)

3.6%

12.0% |

Adjusted

EBITDA

&

Margin

Reconciliation

21

Note: Dollars in millions.

(1)

Non-recurring expenses relating to cost savings effected in 2Q 2012.

(2)

Adjusted EBITDA margin is calculated as adjusted EBITDA divided by net revenue (ex.

interest expense). Three Months Ended December 31,

Fiscal Year Ended December 31,

2012

2011

2012

2011

Net Revenue

32.4

$

31.6

$

151.4

$

181.5

$

Interest Expense on Note

-

0.1

0.4

0.5

Net Revenue (ex. Interest Expense on Note)

32.4

$

31.7

$

151.8

$

182.0

$

Net (loss)/income

(3.8)

$

(3.3)

$

2.6

$

15.7

$

Depreciation & amortization

1.7

1.0

4.9

3.9

Purchase intangible amortization

0.7

2.5

4.1

8.9

Interest expense on note

-

0.1

0.4

0.5

Restructuring

(1)

-

-

0.6

-

Income tax (benefit)/expense

(3.6)

(3.4)

(1.5)

7.6

Adjusted EBITDA

(5.0)

$

(3.1)

$

11.1

$

36.6

$

Adjusted EBITDA Margin %

(2)

(15.4%)

(9.8%)

7.3%

20.1% |

Adjusted EPS (Diluted) Reconciliation

22

(1)

Net of tax.

Three Months Ended December 31,

Fiscal Year Ended December 31,

2012

2011

2012

2011

GAAP (Loss)/Earnings per Share (Diluted)

(0.11)

$

(0.10)

$

0.07

$

0.40

$

Plus: Purchase intangible amortization

(1)

0.02

0.05

0.07

0.16

Adjusted (Loss)/Earnings per Share (Diluted)

(0.09)

$

(0.05)

$

0.14

$

0.56

$

|

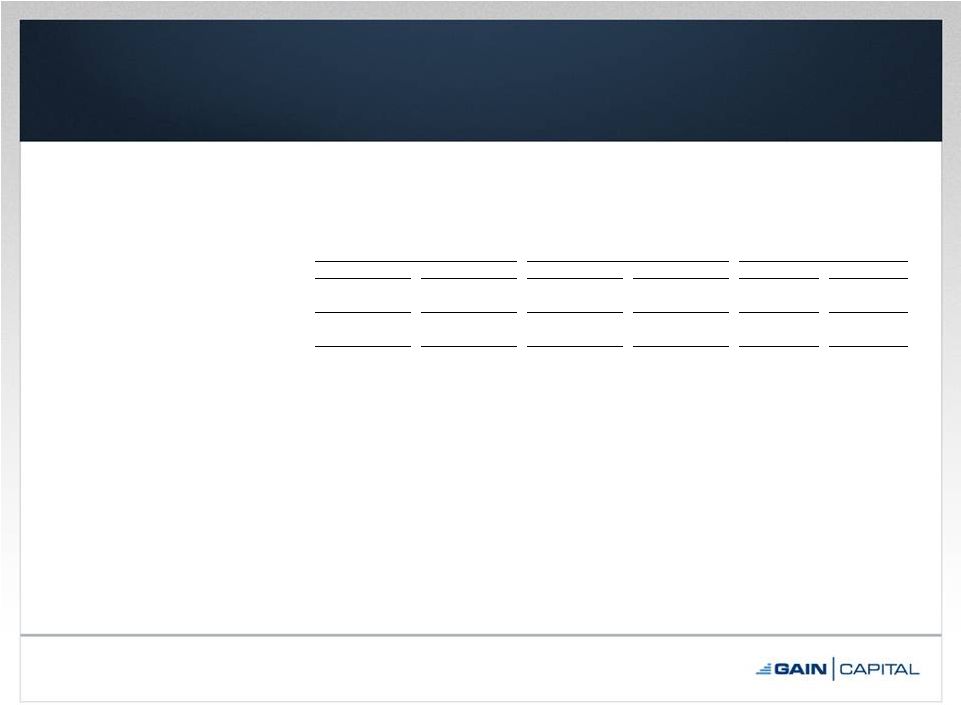

Operating Metrics

(1)

23

Note: Volume in billions. Assets in millions.

(1)

Definitions for all our operating metrics are available on page 24.

(2)

Reflects 1 month of OEC data.

3 Months Ended,

30-Mar-11

30-Jun-11

30-Sep-11

31-Dec-11

31-Mar-12

30-Jun-12

30-Sep-12

31-Dec-12

Retail

OTC Trading Volume

$402.5

$357.2

$447.9

$366.4

$385.1

$340.8

$278.7

$298.8

Average Daily Volume

$6.3

$5.4

$6.9

$5.6

$5.9

$5.2

$4.2

$4.7

Active OTC Accounts

66,106

65,455

65,397

63,435

62,723

61,746

59,166

60,219

Futures DARTs

-

-

-

-

-

-

15,270

(2)

13,000

Funded Accounts

85,698

78,379

77,013

76,485

73,483

74,620

82,394

85,099

Customer Assets

$283.0

$293.1

$286.4

$310.4

$325.9

$320.2

$426.6

$446.3

Institutional

Trading Volume

$110.1

$97.4

$260.0

$386.4

$468.0

$442.5

$503.7

$538.4

Average Daily Volume

$1.7

$1.5

$4.0

$5.9

$7.2

$6.8

$7.6

$8.4 |

Definition of Metrics

•

Funded Accounts

–

Retail accounts who maintain a cash balance

•

Active OTC Accounts

–

Retail accounts who executed a transaction during a given period

•

Trading Volume

–

Represents the U.S. dollar equivalent of notional amounts traded

•

Futures DARTs

–

Represents the average daily trades transacted by OEC customers

•

Customer Assets

–

Represents amounts due to clients, including customer deposits and

unrealized gains or losses arising from open positions

24 |

4

Quarter

&

Full

Year

2012

Financial and Operating Results

March 12, 2013

th |