Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - WESTWOOD HOLDINGS GROUP INC | d499846d8k.htm |

Westwood

Holdings Group, Inc. March 2013 Investor Presentation

Brian O. Casey

President & Chief Executive Officer

Mark A.

Wallace

Chief Financial Officer

Bill

Hardcastle

Vice President

Exhibit 99.1 |

Forward

– Looking Statements

Statements

in

this

presentation

that

are

not

purely

historical

facts,

including

statements

about

our

expected

future

financial

position,

preliminary

estimates,

results

of

operations

or

cash

flows,

as

well

as

other

statements

including

words

such

as

“anticipate,”

“believe,”

“plan,”

“estimate,”

“expect,”

“intend,”

“should,”

“could,”

“goal,”

“target,”

“designed,”

“on

track,”

“comfortable

with,”

“optimistic”

and

other

similar

expressions,

constitute

forward-

looking

statements

within

the

meaning

of

Section

27A

of

the

Securities

Act

of

1933,

as

amended,

and

Section

21E

of

the

Securities

Exchange

Act

of

1934,

as

amended.

Actual

results

and

the

timing

of

some

events

could

differ

materially

from

those

projected

in

or

contemplated

by

the

forward-

looking

statements

due

to

a

number

of

factors,

including,

without

limitation,

those

set

forth

below:

•

our ability to identify and successfully market services that appeal to our customers;

•

the significant concentration of our revenues in four of our customers;

•

our relationships with investment consulting firms;

•

our relationships with current and potential customers;

•

our ability to retain qualified personnel;

•

our ability to successfully develop and market new asset classes;

•

our ability to maintain our fee structure in light of competitive fee pressures;

•

competition in the marketplace;

•

downturn in the financial markets;

•

the passage of legislation adversely affecting the financial services industries;

•

interest rates;

•

changes in our effective tax rate;

•

our ability to maintain an effective system of internal controls; and

•

the other risks detailed from time to time in our SEC reports.

Additional

factors

that

could

cause

our

actual

results

to

differ

materially

from

our

expectations

are

discussed

under

the

section

entitled

“Risk

Factors”

in

our

Form

10-K

for

the

year

ended

December

31,

2012,

which

together

with

our

other

filings

can

be

viewed

at

www.sec.gov.

You

should

not

unduly

rely

on

these

forward-looking

statements.

Except

as

required

by

law,

we

are

not

obligated

to

publicly

release

any

revisions

to

these

forward-looking

statements. |

Agenda

I.

Firm Overview

II.

Growth Opportunities

III.

Financial Highlights

IV.

Equity Based Compensation

V.

Summary |

Firm

Overview |

Westwood at a

Glance •

Asset management firm focused on Value & Income, Global & Emerging Markets

strategies •

Serving institutional, private client and mutual fund investors since 1983

•

Publicly traded since 2002 (NYSE : WHG)

1

as of February 28, 2013

1

Firm Overview

Financial Profile

•

2012 Revenue: $77 million

•

Assets Under Management: $14.2 billion

•

Dividend yield @ $1.60 annual rate: 3.9%¹

•

Equity market cap: $336 million¹

•

Liquid balance sheet: $63.7 million of cash

and investments at year-end

•

No debt

•

Equity ownership

-

Employees & Directors: 30%

-

Institutional holdings: 59% |

Organization

& Product Distribution •

Targeted consultant relationships

•

Subadvisory partners

•

Plan sponsor direct marketing

Institutional

Mutual Funds

Westwood Management

Westwood Holdings Group, Inc.

Private Wealth

Westwood International

Westwood Trust

Westwood Funds

•

Client referrals

•

Third party referral sources

•

Local community involvement

•

DC consultants

•

Private Wealth Advisors

•

Media

•

Separately managed

portfolios

•

Subadvisory

•

UCITS

•

Canadian pooled fund

•

Separately managed

portfolios

•

Subadvisory

•

Collective funds

•

Enhanced Balanced

TM

asset allocation model

•

Commingled funds

•

Separately managed

portfolios

•

Tax-managed accounts

•

Capped expense ratios

•

Institutional share class

-

Defined

contribution plans

-

Other institutions

•

A share class

-

Mutual fund

supermarkets

2

D i s t r I b u t I o n

C h a n n e l s |

*The

institutional

track

record

started

January

1,

2002.

In

2001,

Westwood

transitioned

a

midcap

core

equity

strategy

to

the

institutional

SMidCap

strategy.

The

midcap

core

portfolio

was

exclusively

offered

to

private

clients

of

Westwood's

Trust

Company.

This

change

occurred

as

a

result

of

the

increased

demand

we

observed

by

institutional

investors.

January

1,

2002

reflects

the

inception

of

the

institutional

SMidCap

Equity

strategy.

The

true

inception

date

of

the

composite

is

7/1/97.

This

strategy

has

consistently

adhered

to

Westwood's

investment

process

and

philosophy.

Please

see

appendix

for

full

performance

disclosures.

The

disclosures

provided

are

considered

an

integral

part

of

this

presentation.

Domestic Equity Strategies

SmallCap

Value

1/1/04

SMidCap

Value *

1/1/02

(closed)

SMidCap Value

Plus+

7/1/10

LargeCap

Value

1/1/87

AllCap

Value

7/1/02

Dividend

Growth

11/1/93

Total Firm Assets Under Management as of 12/31/12: $14.2B

Specialized Strategies

Income Opportunity

1/1/03

LargeCap Value –

Socially

Responsible Investing

1/1/98

Master Limited Partnership

Infrastructure Renewal

1/1/03

Westwood Offerings

Product Mix Expanding with Non-U.S. & Specialized Offerings

Global/Emerging Markets Strategies

Global Equity

7/1/12

Global Dividend

7/1/12

Emerging Markets

7/1/12

Emerging Markets Plus

7/1/12

3 |

*Due

to

capacity

constraints,

this

product

closed

to

new

investors

effective

October

1,

2009.

Performance

provided

reflects

the

institutional

track

record

which

started

January

1,

2002.

In

2001,

Westwood

transitioned

a

midcap

core

equity

strategy

to

the

institutional

SMidCap

strategy.

The

midcap

core

portfolio

was

exclusively

offered

to

private

clients

of

Westwood's

Trust

Company.

This

change

occurred

as

a

result

of

the

increased

demand

we

observed

by

institutional

investors.

January

1,

2002

reflects

the

inception

of

the

institutional

SMidCap

Equity

strategy.

The

true

inception

date

of

the

composite

is

7/1/97.

This

strategy

has

consistently

adhered

to

Westwood's

investment

process

and

philosophy.

Past

performance

is

not

a

guarantee

of

future

returns.

Please

see

appendix

for

full

performance

disclosures

(http://westwoodgroup.com/disclaimers.pdf).

The

disclosures

provided

are

considered

an

integral

part

of

this

presentation.

Benchmark

Data

Source:

©

2012

FactSet

Research

Systems,

Inc.

All

Rights

Reserved.

Investment Product Performance

Delivered Excess Returns with Lower than Benchmark Risk

Net of Fees

10.8%

12.8%

17.1%

8.9%

7.5%

9.2%

9.1%

4 |

Portfolio

Attributes Westwood International’s AUM Surpassed $1B

Emerging

Markets

Emerging

Markets Plus

Global

Dividend

Global

Equity

Target number of holdings

70-90

50-70

65-90

65-85

Positions at initiation

1.2 -

1.5%

1.6 -

1.8%

1.0 -

1.2%

1.2 -

1.5%

Initial universe

27 countries

5,000+ securities

27 countries

5,000+ securities

45 countries

10,000+ securities

45 countries

10,000+ securities

Minimum Market capitalization (USD)

$500 million

$1.5 billion

$500 million

$1 billion

Liquidity (most recent 100 days -

USD)

$3.5 million daily

trading average

$7 million daily trading

average

$3.5 million daily

trading average

$7.5 million daily

trading average

Capacity (USD)

$4 billion

$4 billion

$7 billion

$10 billion

Prospective Client Reserved Capacity

$2.3 billion

$0.5 billion

$1 billion

$1 billion

Remaining Capacity

$1.2 billion

$3.4 billion

$5.9 billion

$8.8 billion

5 |

Growth

Opportunities |

Growth

Opportunities •

Significant capacity remains in seasoned products

-

Opportunity for substantial operating leverage

•

Subadvisory mandates

-

Access to broad distribution infrastructure &

global markets

-

Support partner distribution network vs. building

proprietary distribution network

•

Westwood Funds

-

Family of 10 mutual funds

-

Assets under management currently exceed

$1.8 billion

-

Launched Emerging Markets, Global Equity, and

Global Dividend in 4Q12

-

Strong organic growth

-

Asset acquisition opportunities

6

•

Private Wealth

•

Westwood International

-

Cultivate new products

-

Expand private wealth

platform

in new markets

-

Acquisition opportunities

in strategic markets

-

International Distribution

-

New Product Opportunities

-

Specialized Country Fund Structures |

Growth

Opportunities Significant Product Capacity For Future Growth

Seasoned Products

(>3 year track record & >$100 Million in assets)

Assets Under

Management

As of 12/31/12

Estimated

Maximum

Capacity AUM

Asset Growth

Potential

Product

Inception

LargeCap Value

$5.2 billion

$25 billion

$19.8 billion

1987

SMidCap Plus+

$492 million

$8 billion

$7.5 billion

2010

SMidCap Value

$2.8 billion

$3 billion

Closed

1997

SmallCap Value

$217 million

$1.5 billion

$1.3 billion

2004

AllCap Value

$402 million

$10 billion

$9.6 billion

2002

Dividend Growth

$182 million

$20 billion

$19.8 billion

2001

Income Opportunity

$1.7 billion

$5 billion

$3.3 billion

2003

MLP

$236 million

$1.5 billion

$1.3 billion

2003

Total Seasoned

$11.2 billion

$74 billion

$62.6 billion

New & Unseasoned (R&D) & Legacy Products

Emerging Markets

$538 million

$4 billion

$3.5 billion

2012

Emerging Markets Plus

$104 million

$4 billion

$3.9 billion

2012

Global Equity

$226 million

$10 billion

$9.8 billion

2012

Global Dividend

$20 million

$7 billion

$6.9 billion

2012

Short Duration High Yield

$54 million

N/A

N/A

2011

Balanced / Fixed Income / REIT / Global Strategic Diversification

$614 million

N/A

N/A

Various

Note:

Table

reflects

Westwood

Management

AUM

as

of

12/31/12

(including

Westwood

Trust

commingled

funds);

excludes

approximately

$912

million

in

Westwood

Trust

separately

managed accounts,

agency

assets and

subadvised

commingled

funds and

$581

million

of

additional

assets

managed

by

Omaha

office

7 |

Growth

Opportunities Sub-Advisory Brands

8

•

Access to established distribution channels

•

Generally lower average fee, but high profitability due to low incremental costs

|

Growth

Opportunities – Westwood Funds

Mutual Funds Now Represent 12% of AUM

•

Mutual Fund Assets have grown to

$1.8 billion from initial two fund launch

in December 2005

•

Six funds added last two years:

-

2011: Dividend Growth, SMidCap

Plus+, Short Duration High Yield

-

2012: Emerging Markets, Global

Equity, and Global Dividend

•

Targeted to institutional, defined

contribution and RIA markets

Growth in Westwood Funds Assets

1

Domestic Value & Income Strategies

LargeCap

Value

WHGLX

SMidCap

WHGMX

SMidCap

Plus+

WHGPX

SmallCap

Value

WHGSX

Dividend Growth

WHGDX

Income

Opportunity

WHGIX

Short Duration

High Yield

WHGHX

International Strategies

Emerging Markets

WWEMX

Global Dividend

WWGDX

Global Equity

WWGEX

Note: Short Duration High Yield is subadvised by SKY Harbor Capital Management,

LLC 9

1

thru February 28, 2013 |

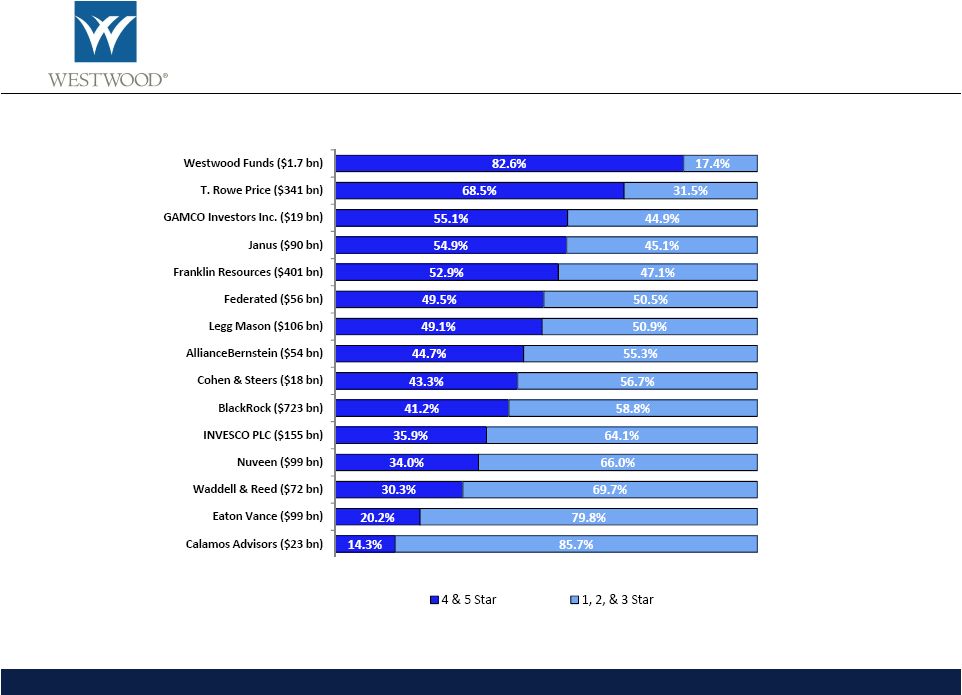

Growth

Opportunities – Westwood Funds

Substantial Proportion of 4 & 5 Star Rated Funds

Proportion of Assets Rated Four or Five Star by Morningstar (Asset Weighted)

Source:

JPMorgan

U.S.

Asset

Managers

–

North

America

Equity

Research

dated

February14

,2013;

Strategic

Insight.

Westwood Funds AUM as of 1/31/13

10 |

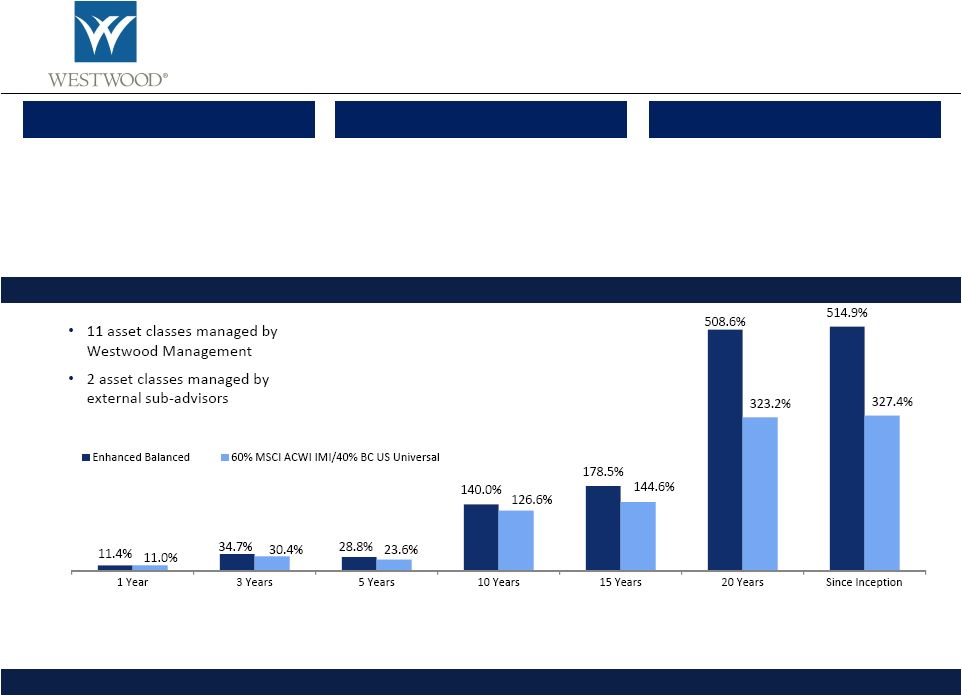

Westwood

Trust – Private Wealth

Focused on Organic Growth and Selective Acquisitions

•

Low cost, efficient solution

•

Asset gathering platform

•

“Best Ideas”

•

Consultative approach

1

For

the

period

from

1/1/93

to

12/31/12,

the

Enhanced

Balanced

performance

shown

is

that

of

a

representative

client

who

has

been

diversified

among

the

available

Westwood

commingled

funds

throughout

their

term

with

Westwood.

Since

12/31/12,

the

Enhanced

Balanced

performance

shown

is

a

composite

of

several

clients

who

have

been

diversified

among

the

available

Westwood

commingled

funds

throughout

their

term

with

Westwood..

2

The

Enhanced

Balanced

strategy

is

benchmarked

60%

against

the

MSCI

ACWI

IMI

Index

and

40%

against

the

Barclays

US

Universal

Index.

The

MSCI

ACWI

IMI

Index

is

an

unmanaged

market

index

consisting

of

Large,

Mid

and

Small

Cap

equities

in

24

Developed

Markets

and

21

Emerging

Markets

Countries.

The

Barclays

US

Universal

Index

is

an

unmanaged

market

index

consisting

of

US

Dollar

denominated

taxable

bonds

that

are

rated

either

investment

grade

or

highyield.

Since

the

inception

of

the

MSCI

ACWI

IMI

index

is

June

1,

1994,the

MSCI

ACWI

index

was

used

from

January

1,

1993

–

May

31,

1994.

Westwood

discontinued

the

use

of

the

60%

S&P

500

and

40%

Barclays

Government

Credit

benchmark

on

7/31/12

and

the

change

was

made

retroactively.

The

new

benchmark

is

more

representative

of

the

characteristics

of

the

strategy

because

it

represents

both

a

global

equity

focus

and

a

US

investment

grade

and

US

high

yield

bond

allocation.

The

60%

S&P

500

and

40%

Barclays

Government

Credit

benchmark

does

not

accurately

represents

the

characteristics

of

the

strategy.

Past

performance

is

not

indicative

of

future

results.

Stock

market

conditions

vary

from

year

toyear

and

can

result

in

a

decline

in

market

value.

This

information

is

provided

for

clients

and

prospective

clients

of

Westwood

Management

Corp.

and

Westwood

Trust

only.

This

is

not

an

offer

or

recommendation

to

buy

or

sell

a

security

or

an

economic

sector.

11

•

Establishes long-term trust relationship

•

Capable of serving multiple generations

Enhanced Balanced

Trust Services

Continuity of Leadership

Comprehensive Allocation Strategy

•

Randy Root, President Westwood Trust

Dallas (20 yrs)

•

Art Burtscher, President Westwood

Trust Western Region (13 yrs)

•

Kallie Myers, Board Certified Attorney |

1

Team members are listed from left to right as shown in picture above.

Westwood International Advisors Investment Team

Global Team with Impressive Track Record

Team Members¹

Sector Coverage

Industry Experience

Patricia Perez-Coutts, CFA –

Senior Vice President, Portfolio Manager

Lead Portfolio Manager

27 Years

Thomas Pinto Basto, CFA –

Vice President, Portfolio Manager

Technology,

Telecommunications

19 Years

Alice Popescu, CFA, CMT, DMS –

Associate Portfolio Manager

Consumer Discretionary, Energy

10 Years

Richard Dolhun, MBA –

Global Equity Analyst

Consumer Staples, Health Care

17 Years

Martin Pradier, CFA –

Global Equity Analyst

Materials, Industrials

23 Years

Max El-Sokkary, CFA –

Global Equity Analyst

Financials

18 Years

Gerald Loo, CIM –

Vice President

Portfolio Specialist

15 Years

12 |

Growth

Opportunities Westwood International Advisors

13

•

Internationally diverse team –

10 languages spoken fluently

•

Collectively lived or worked in 10 countries

•

Global research coverage of all GICS sectors –

developed and emerging

economies

•

Average 18 years of industry experience

•

Focus on Economic Value Added (EVA)

•

Risk management incorporated at every step of the process

•

Long-term focus with very low turnover (< 20% annualized on average)

Diversity

Experience

Investment Approach |

Financial

Highlights |

Total Return

Since 2002 WHG Spin-off Data as of 12/31/12

Track Record of Shareholder Value Creation

14 |

2012

Highlights •

AUM increased 8% to $14.2 billion

•

Average asset based fee increased from 53 bps to 55 bps

•

Income Opportunity strategy, with its focus on current income and lower volatility,

experienced high demand, nearly doubling its assets to over $1.7 billion

•

SmallCap and MLP products experiencing high levels of interest

•

Global and Emerging Market Strategies surpassed $1B AUM

•

Record 2012 revenue of $77.5 million, a 12.5% increase over the prior year

•

Net income decreased to $12.1 million, reflecting WIA start-up costs

•

Economic earnings increased 15% to $29.2 million¹

•

Increased quarterly dividend to $0.40 per share; dividend yield of 3.9% at February 28,

2013 •

Repurchased $3.8 million (97,724 shares) of our common stock

•

Liquid cash and investments of $63.7 million at December 31, 2012 vs. $57 million in

2011 Assets Under

Management

Investment Strategies

Operating Results

Capital Management

15

1

Excludes $5.9 million of Westwood International Advisors related

losses |

16

Growth in Assets Under Management |

Average

Asset-Based Fees 17

Note:

excludes impact of performance-based fees

Westwood Average Asset-Based Fee |

Quarterly

Revenue Growth – Trailing Five Years

1

Excluding performance-based fees

18 |

Attractive

Dividend Returns $91 Million of Dividends Declared Since Becoming Public

*Data as of 12/31/12, excludes special dividends

19 |

Shareholder

Value Creation WHG vs. S&P 500 Market Capitalization

20

WHG Market Capitalization |

Equity Based

Compensation |

21

Equity Based Compensation |

•

Annual Cash Performance Awards funded into an Employee Benefit Trust

•

RBC as Trustee invests funds in WHG common stock

•

WHG common stock acquired in open market transactions by the Trust

•

Stock held in trust until employee vests in the Award

•

Awards cliff vest 3 years after performance period

•

2013 Cash Awards approximate $880,000 –

all of which will be used to purchase WHG stock

•

Share Award Plan is Anti-Dilutive

Canadian Share Award Plan

Share Award Plan

22 |

•

Granted 188,124 restricted shares in February 2013

•

291,079 shares currently available for future grants

•

Proposal to increase shares available for future grants by 500,000

•

Total represents 4 years based on 2013 grant levels

Equity Based Compensation

23 |

Summary

|

Strategic

Priorities 24

•

Focus on Improving

LargeCap

and SMidCap performance

•

Broaden Institutional Sales

•

Fill remaining capacity of existing products

•

Cultivate new relationships

with

strong global partners

•

Hired first mutual fund and managed account

sales professional

•

Continue to expand sales

and

marketing platforms

•

Create commingled and UCITS

Funds

for global prospects

•

Add Sales and Relationship Managers

•

Corporate Development Opportunities

•

Focus on Performance

•

Capitalize on existing pipelines

•

Leverage National Bank of Canada relationship

Improve Performance & Fill Capacity

Sub-Advisory Mandates

Westwood Funds

Expand Private Wealth Platforms

Westwood International Advisors |

www.westwoodgroup.com

200 Crescent Court

Suite 1200

Dallas, Texas

75201

T. 214.756.6900

*

*

* * * * * * * * * * * * * * * |

Disclosures |

Economic

Earnings Reconciliation Economic Earnings Reconciliation

($ thousands)

2007

2008

2009

2010

2011

2012

GAAP net income

$ 7,944

$ 10,543

$ 7,895

$ 11,280

$ 14,686

$ 12,090

Add: Restricted stock expense

5,316

6,735

7,666

9,269

9,969

10,515

Add: Intangible amortization

-

-

13

155

498

472

Add: Tax benefit from goodwill amortization

-

-

5

59

189

154

Economic Earnings

$ 13,260

$ 17,278 $ 15,579

$ 20,763

$ 25,342

$ 23,231 |

|

|

|

|

|

|

|

|

|

|

|

|

IMPORTANT

INFORMATION ABOUT YOUR PRIVACY

BECAUSE YOUR TRUST IS SO IMPORTANT

Your trust is the cornerstone of our relationship. That is why we work so diligently to

safeguard your privacy. The information that you provide us is kept in the

strictest of confidence. We have no intentions of selling personal information

about our clients to third-party businesses. We are proud to make that

commitment to you, because your trust is the foundation of our business. The following

privacy policy explains how we use and protect the information about our clients.

We ask that you read it carefully.

A nonaffiliated third party is a person we do not employ or a company that is not an

affiliate of ours. This is also known as nonaffiliated third party, or simply,

an “other party.” THE INFORMATION WE COLLECT

We collect information about you from the following sources:

•

Information you give us on applications or other forms

•

Information about your transactions with us

•

Information about your transactions with our affiliates

INFORMATION WE DISCLOSE ABOUT YOU

We do NOT disclose any information about you to anyone, except as permitted by

law. This might include disclosures necessary to service your account, perform

joint marketing or prevent unauthorized transactions.

Destruction of Sensitive Data. All records and data are properly shredded prior to

disposal. Destruction of documents is handled by authorized employees and/or

bonded companies when the shredding of large quantities of documents is required.

THE CONFIDENTIALITY, SECURITY, AND INTEGRITY OF YOUR INFORMATION

We restrict access to information about you to those employees who need to know that

information to provide products or services to you. We maintain

physical, electronic, and

procedural safeguards to protect this information.

INFORMATION ABOUT FORMER CLIENTS

We have the same policy about disclosing information about former clients as we do about

current clients. We do not retrieve account or personal information from

visitors who browse the public areas of our website. Westwoodgroup.com does use

“HTTP cookies” –

tiny pieces of information

that we ask your browser to store. However, we make very limited use of these cookies

for website statistical information only. We do NOT use them to learn your

e-mail address, or to view data in cookies created by other websites. We

will not share the information in our cookies or give others access to it.

WESTWOOD TRUST DEPARTMENT OF BANKING DISCLAIMER

Westwood Trust is chartered under the laws of the State of Texas

and by state law is subject to

regulatory oversight by the Texas Department of Banking. Any consumer wishing to file a

complaint against Westwood Trust should contact the Texas Department of Banking

through one of the means indicated below:

In Person or U.S. Mail: 2601 North Lamar Boulevard, Suite 300, Austin, Texas

78705-4294 Fax No.: (512) 475-1313

E-mail: consumer.complaints@banking.state.tx.us

Website: www.banking.state.tx.us

NOTICE OF YOUR FINANCIAL PRIVACY RIGHTS

We, our, and us, when used in this notice, mean Westwood Management Corp., Westwood Trust, and

Westwood Holdings Group, Inc.

This is our privacy notice for our clients. When we use the words “you”

and “your”

we mean the

following types of clients:

•Our consumer clients who have a continuing relationship by purchasing or holding

financial products or services such as a(n):

•Self-directed Individual Retirement Account

•Financial, investment, or economic advisory services

•Mutual fund shares

•All persons who use our trust department

•All IRA accounts for which we act as custodian

•Former clients

We

will

tell

you

the

sources

of

the

information

we

collect

about

you.

We

willtell

you

what measures

we take to secure that information. We first define some terms.

Nonpublic personal information means information about you that we collect in connection with

providing a financial product or service to you. To help the government fight the

funding of terrorism and money laundering activities, Federal law requires all

financial institutions to obtain, verify, and record information that identifies each

person who opens an account. Therefore, when you open an account, we will ask for your

name, address, date of birth, and other information that will allow us to identify you.

We may also ask to see your driver’s license or other identifying documents. Federal law

requires us to screen new clients through the Office of Foreign Assets Control “Specially

Designated National & Blocked Persons”

list and/or the Financial Crimes Enforcement Network (FinCEN).

Nonpublic personal information does not include information that

is available from public sources,

such as telephone directories or government records. Hereafter,

we will use the term “information”

to

mean nonpublic personal information as defined in this section.

An affiliate is a company we own or control, a company that owns

or controls us, or a company that is

owned or controlled by the same company that owns or controls us. Ownership does not

mean complete ownership, but means owning enough to have control.

|