Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Nationstar Mortgage Holdings Inc. | d498381d8k.htm |

| EX-99.1 - EX-99.1 - Nationstar Mortgage Holdings Inc. | d498381dex991.htm |

Q4 and

FY 2012 Earnings Presentation Three Months and Twelve Months Ended December 31,

2012 March 7, 2013

Exhibit 99.2 |

Forward

Looking Statements 1

Any statements in this presentation that are not historical or current facts are

forward-looking statements. Forward-looking statements include,

without limitation, statements concerning plans, objectives, goals, projections,

strategies, future events or performance, and underlying assumptions and other

statements, which are not statements of historical facts. Forward-looking statements convey Nationstar Mortgage

Holdings Inc.’s (“Nationstar”) current expectations or forecasts of

future events. When used in this presentation, the words “anticipate,”

“appears,” “believe,” “foresee,” “intend,”

“should,” “expect,” “estimate,” “target,” “project,” “plan,” “may,” “could,” “will,” “are likely” and similar

expressions are intended to identify forward-looking statements. These statements

involve predictions of our future financial condition, performance, plans and

strategies, and are thus dependent on a number of factors including, without limitation, assumptions and data that may

be imprecise or incorrect. Specific factors that may impact performance or other

predictions of future actions have, in many but not all cases, been identified

in connection with specific forward-looking statements. Forward-looking statements involve known and unknown risks,

uncertainties and other factors that may cause Nationstar’s actual results,

performance or achievements to be materially different from any future results,

performances or achievements expressed or implied by the forward-looking statements. Certain of these risks and uncertainties

are described in the “Risk Factors” section of Nationstar Mortgage LLC’s

Form 10-K for the year ended December 31, 2011, Nationstar Mortgage Holdings

Inc.’s Form 10-Q for the quarter ended September 30, 2012, and other reports filed with the SEC, which are available at

the SEC’s website at http://www.sec.gov. We caution you not to place undue

reliance on these forward-looking statements that speak only as of the date

they were made. Unless required by law, Nationstar undertakes no obligation to publicly update or revise any forward-looking

statements to reflect circumstances or events after the date of this presentation.

|

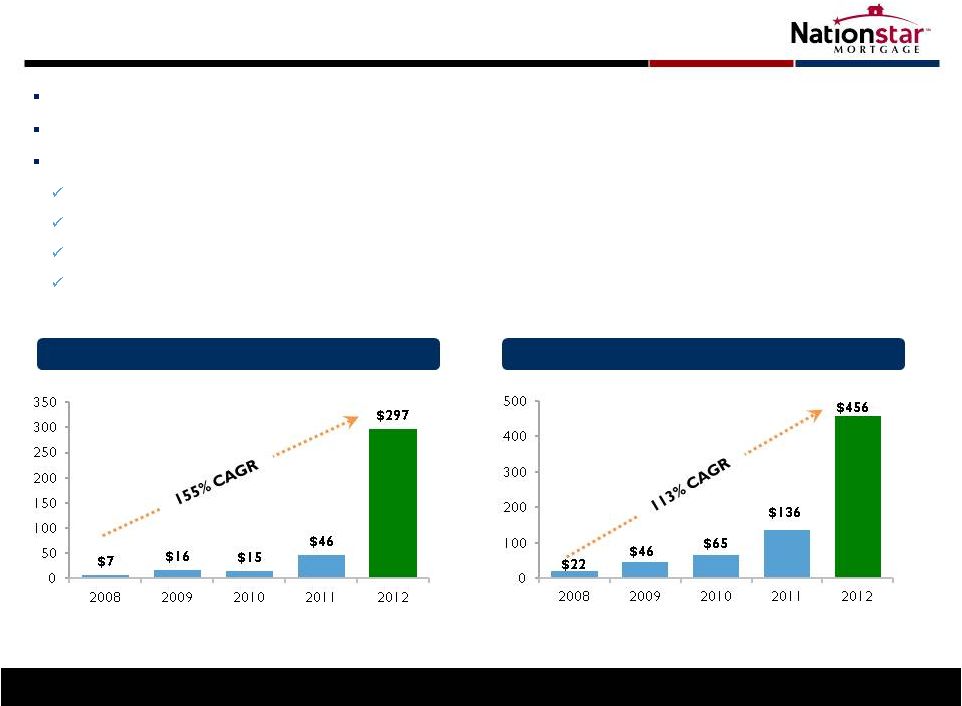

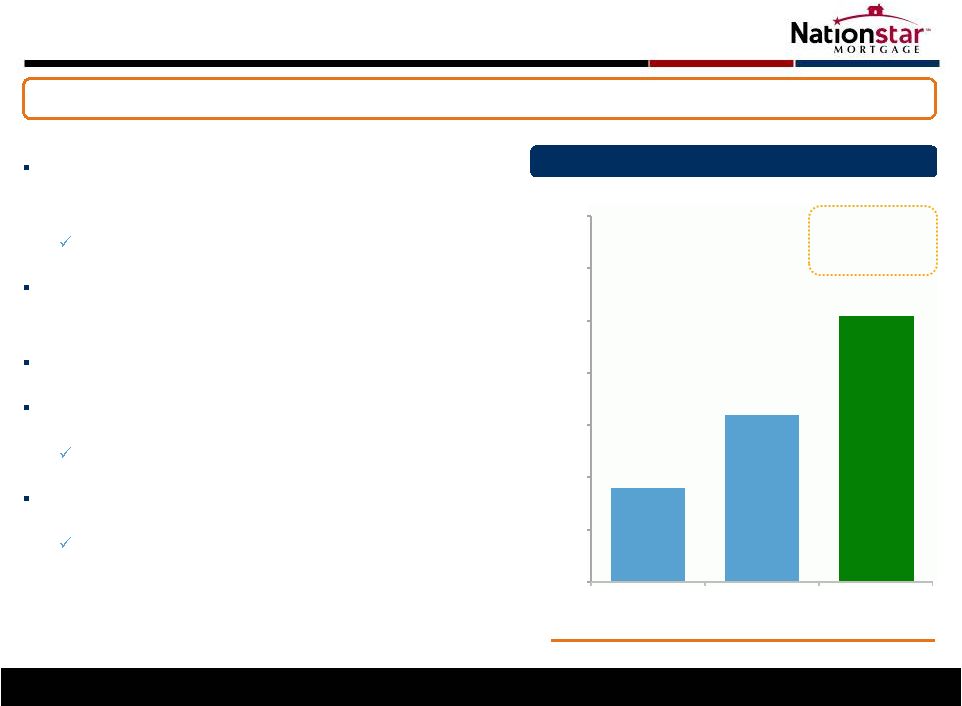

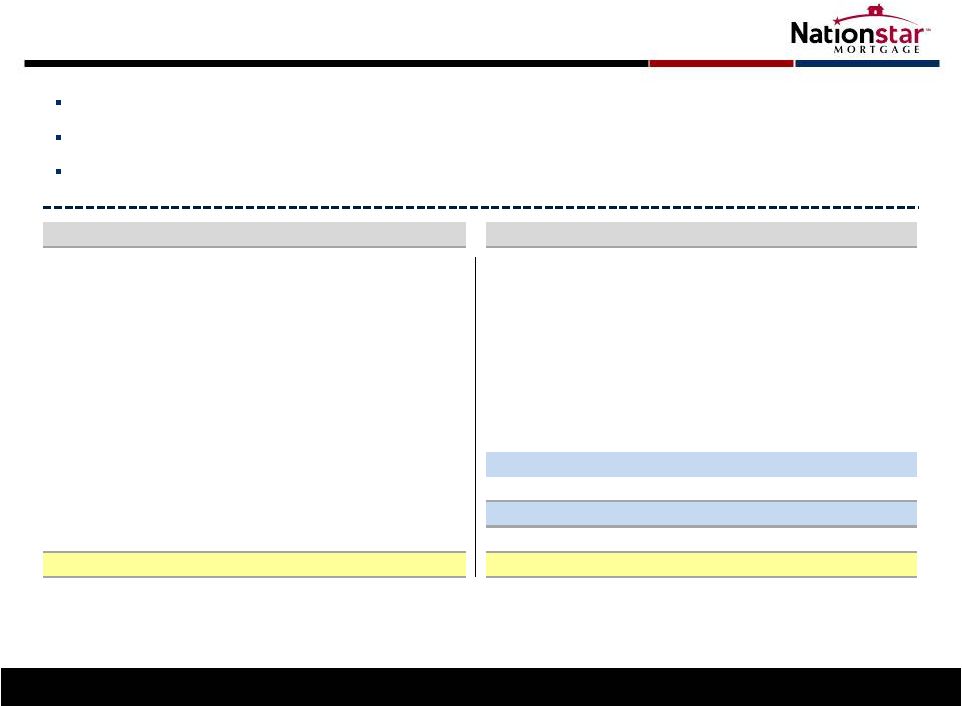

2012: Transformative Year for Nationstar

2

IPO on March 7, 2012; top 3 ranked IPO

(1)

Record EPS for Q4’12 and FY ’12 of $0.71 and $2.40, respectively

Significant YoY increases in key metrics

Revenue +161%

Net Income +882%

Servicing portfolio +94% to $208B

Record origination volume +132% to $7.9B

($mm)

Pre-Tax Income Growth

(2)

AEBITDA Growth

(2,3)

($mm)

By share price appreciation; Renaissance Capital - “Global IPO Market:

2012 Annual Review”; Global statistics include IPOs with a deal size of at least $100 million and exclude closed-end funds and SPACs; 203 deals total

For Operating segments; excludes Legacy segment

Please see Appendix for information on AEBITDA and reconciliations beginning on page 18

1)

2)

3) |

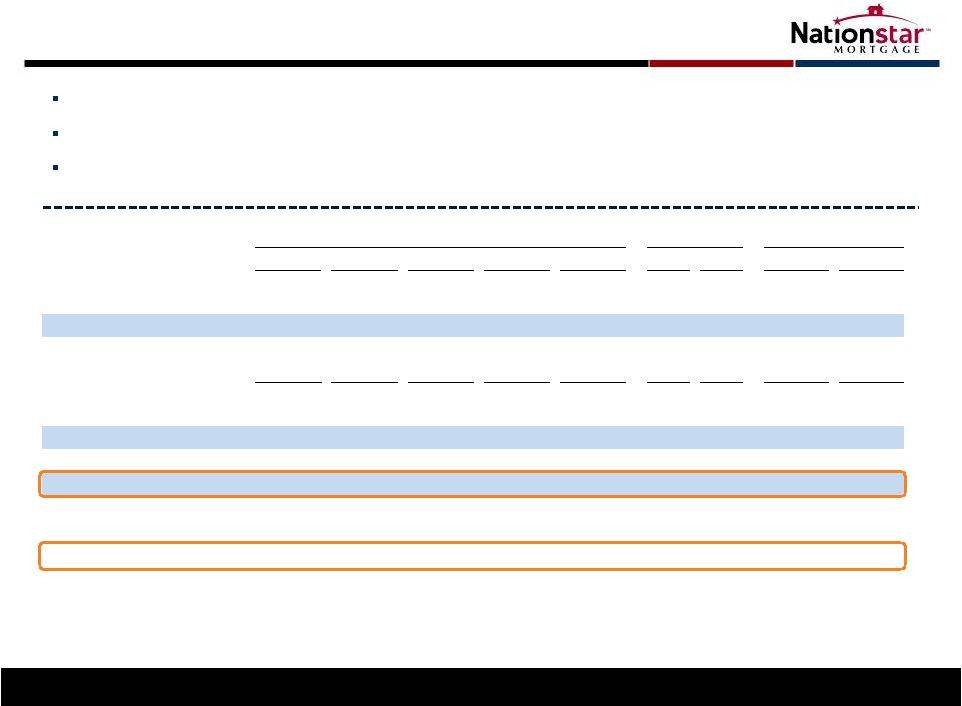

1 Year IPO

Anniversary: Significant Value Creation 3

Then (IPO)

Now

$1.3B

$3.7B

52%

80%

$14.00

$41.06

0.6M

1.6M

+185%

+54%

+193%

+167%

Increase

Substantial increase in key metrics

Share price value up more than 2.9x since IPO; significant value driven by

performance and expectations Diversified shareholder base and improved

liquidity Strong ROE

40%

Market capitalization

(1)

:

Institutional Ownership

(2)

:

Excludes Fortress

Share price

(1)

:

Average trading volume (Qtr)

:

Return on Equity (thru 12/31):

1)

As of March 6, 2013

2)

As of January 31, 2013 |

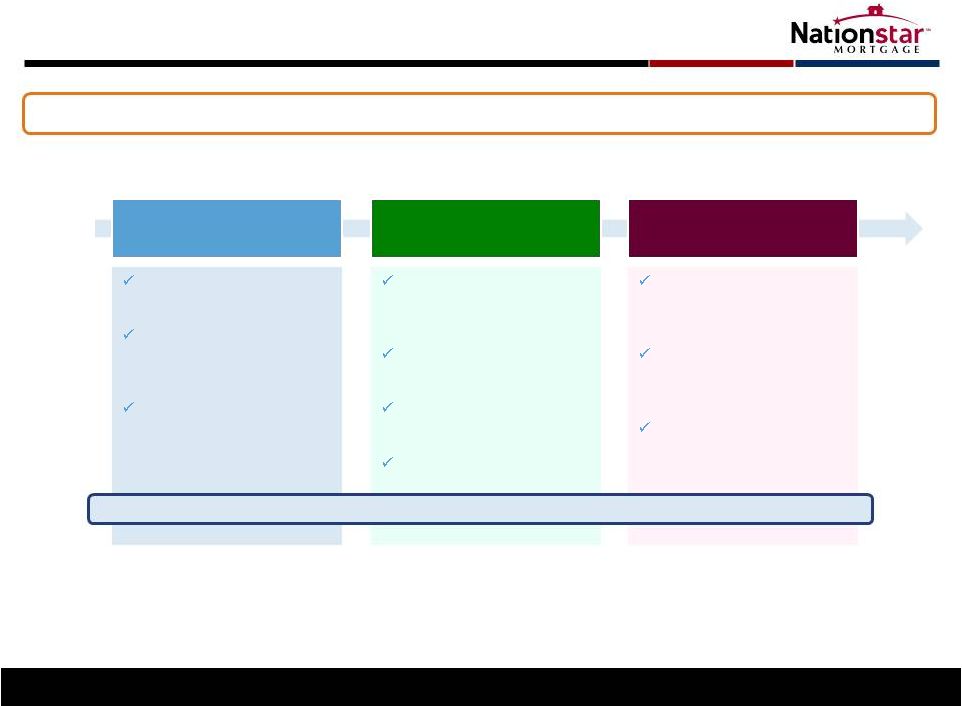

4

The Future of Our Business

Market dislocation as banks

focus on core customers

Bulk and flow servicing sales

Non-branch origination

opportunities

Non-core and default

servicing

Near term

Banks assess capital and

look for process partners

Mortgage services factory

with plug-in capability

Complete outsourcing

Origination/fulfillment

Continued servicing transfers

Intermediate term

Capital returns to the real

estate market

Investors require best-in-

class asset managers

Agency, non-agency, whole

loan, distressed assets

Credit risk management

essential

Longer term

Market

trends

Services

Well-positioned to capitalize on market trends

Solutionstar |

Customer-Centric Model

5

Preserve homeownership and increase mortgage affordability

Loan Modifications & HARP Originations

(units)

Cumulative Total

Performance-driven culture emphasizes customer service and

loan performance

Reduced over 60 days delinquency rate by 28% since ‘09

Single point of contact, a cornerstone of our success for 15

years

Completed 51,000 total workouts in ’12 (+25%)

~29,000 modifications in ‘12

100,000 modifications since ‘10

18,000+ HARP loans in ‘12 (+232%)

Servicing portfolio remains HARP rich

Customers

helped since

2010

45,000

127,000

0

25,000

50,000

75,000

100,000

125,000

150,000

175,000

2010

2011

2012

80,000 |

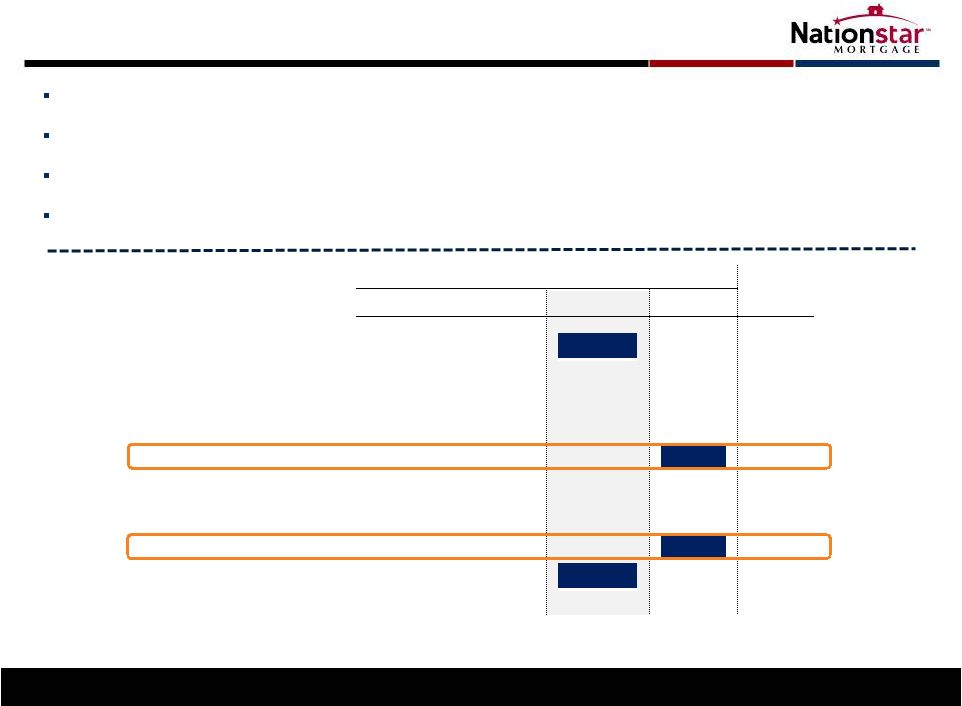

6

Focused on growth AND profitability

Landmark BofA

Transaction

Strong Pipeline

(1)

Cost Reduction

Initiatives

Jan/Feb:

Announced acquisition of BofA MSRs

Q1/Q2:

PLS third-party approvals & closing

Bulk pipeline:

$300B

Flow servicing target:

$25-50B annual

Flow agreements in place:

$15B annual

Total transfer potential:

Cost per loan:

Automation and strategic sourcing

Delinquencies:

Reduced Aurora 60+ DQ rate by 250 bps

Advances:

$300MM GSE advance securitization executed in Jan.

Non-agency securitization in Q2

Closed Fannie, Freddie, Ginnie portfolios

$2 trillion+

1)

The identified opportunities referenced above are not currently serviced by the Company

and there can be no assurance that these potential servicing transactions will ultimately be consummated, or will

remain the same size. Notwithstanding the above, it is possible that these potential

servicing transactions, if consummated, could result in a partial or total loss of any invested capital.

Servicing: Opportunities in ‘13 and Beyond |

Originations: Organic Growth for Servicing in ’13 and Beyond

7

Profitable: complements and enhances servicing segment

1)

KB Home FY 2012 10K; Nationstar Mortgage did not originate mortgages for 100% of KB

Home’s home sales in 2012 JV with KB Home

KB Home sold $1.5B of homes in

FY ’12

(1)

Improve capture rates; expense

sharing

Additional ventures with

homebuilders

Source of purchase money volume

Expand volume across channels to

organically grow servicing

Acquire servicing at attractive returns

Source of purchase money volume

Highest margin channel; integrated

with servicing platform

Helps borrowers with lower monthly

payments

Continued focus on HARP &

recapture opportunities to serve

customer

Recapture

Builder

Wholesale/Correspondent

’13/’14 Objectives: Increase Capacity, Productivity and Volume

|

Solutionstar: Meet Evolving Needs of Mortgage Industry

8

Broad array of services & technology offerings spanning entire mortgage

lifecycle Acquired Equifax Settlement Services on 2/7

Appraisal, title and closing

Large bank clients

Launch HomeSearch.com expected in Q1’13

Real estate marketplace

Accelerates sales and improves pricing

Evaluate strategic acquisitions

Key events in ‘13

Strategy

Support originators and servicers

Improve customer experience with seamless integration

Manage REO property sales

Completed 2,000 REO sales since Jan. 1

Future increase with BofA PLS portfolio

REO Sales

Brokerage

Valuation

Services

Title

Closing

Recovery Services

Bankruptcy Services

Foreclosure

Services

Claims Processing |

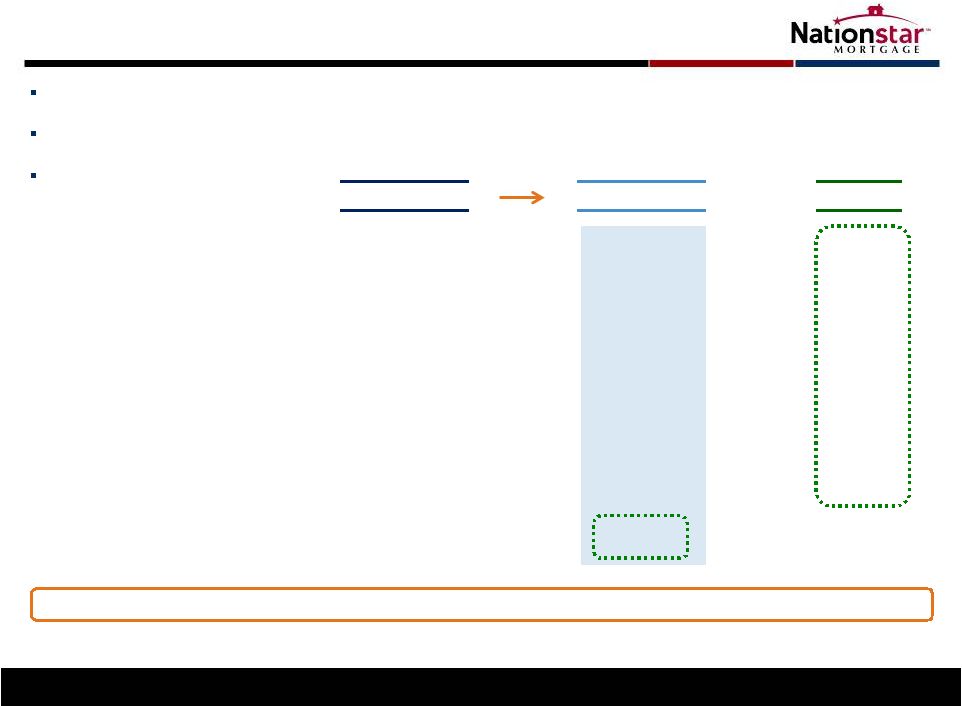

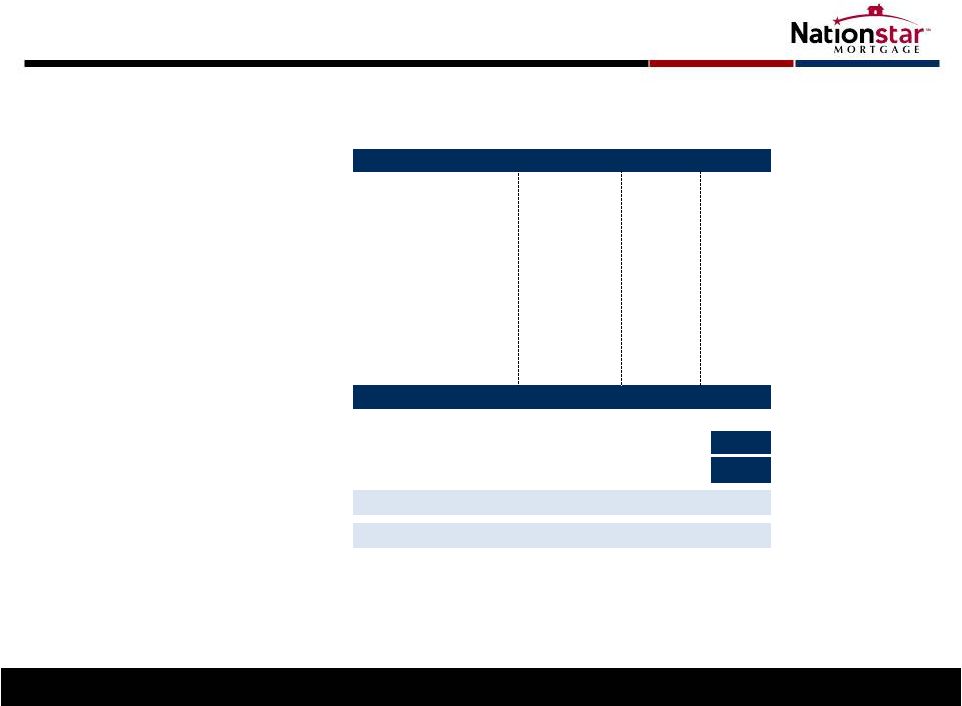

Doubled

size of servicing book Portfolio of $300B+ as of Feb ’13, including closing of BofA agency MSRs

Successful integration of Aurora portfolio

Segment pretax income increased 60% YoY to $35MM

Servicing

Results:

Substantial

Growth;

Building

to

Full

Scale

1)

Pro forma balance represents ending Q4’12 UPB balance plus $215B BofA servicing

portfolio announced on January 7, 2013. Balances may change prior to closing due to normal portfolio run-off

9

($bn of UPB)

Servicing Growth

(1)

As portfolio achieves critical mass, earnings potential realized

|

Originations Results: Robust Market Conditions

10

Record

pretax income for Q4’12 and FY’12

Record

Q4 volume of $3.1B; application pipeline growth to $6.6B

Gain on sale margin, ex-correspondent, modest decrease (682 bps in Q4 vs 744 bps in

Q3), remains elevated

Origination Volume

($bn of UPB)

Profitably creating servicing assets as we grow volume and channels

($mm)

Cash –

Points, Fees, Gain on Sale

$102

Pipeline Value

(1)

56

Subtotal Cash / Near Cash Revenue

$158

Servicing Asset

(Cash value realized over time)

21

Other

(6)

Total Originations Revenue

$173

Originations Volume

$3,081

Excluding Correspondent

$2,513

Locked Pipeline

$4,992

Application Pipeline

$6,643

Q4 ‘12 Economics

Cash / near

cash is 91% of

total revenue

1)

Includes mark-to-market on loans held for sale and derivative/hedges

2)

As of December 31, 2012

$1.5

$2.8

$3.4

$7.9

$16.0+

0

2

4

6

8

10

12

14

16

18

2009

2010

2011

2012

2013E

(2)

(2) |

Financial

Highlights: Q4 and FY ‘12 11

Annual Revenue and AEBITDA

(1,2)

Quarterly Revenue and AEBITDA

(1,2)

1)

2) Please see Appendix for information on AEBITDA and reconciliations beginning on page

18 Margin (%)

23%

29%

24%

36%

40%

47%

50%

47%

43%

46%

Q4’12

Increase (QoQ)

FY ’12

Increase (YoY)

$456MM

$155MM

$205MM

$2.40

$64MM

$0.71

26%

16%

16%

236%

882%

700%

AEBITDA

(1)

Net Income

EPS

AEBITDA

(1)

Net Income

EPS

($MM)

($MM)

$0

$50

$100

$150

$200

$250

$300

$350

Q4 '11

Q1 '12

Q2 '12

Q3 '12

Q4 '12

AEBITDA

Revenue

$0

$200

$400

$600

$800

$1,000

$1,200

2008

2009

2010

2011

2012

AEBITDA

Revenue

$22

$65

$136

$456

$97

$984

$378

$267

$46

$156

2) For Operating segments; excludes Legacy segment

$47

$77

$101

$123

$155

$119

$164

$203

$285

$333 |

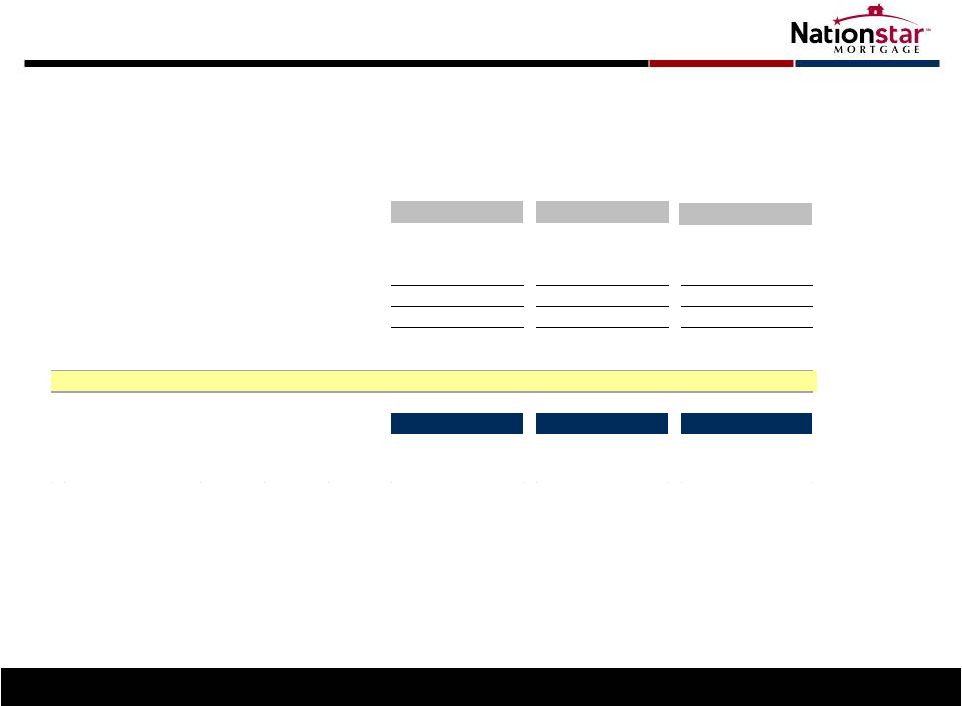

Q3'12

($ millions except where noted)

Servicing

Originations

Operating

Total

(2)

Total

AEBITDA

(1)

$66.9

$88.1

$155.0

$153.0

$121.7

margin%

42%

51%

47%

Pre-Tax Income

$14.9

$81.7

$96.6

$94.4

$79.8

Income Tax Expense

($30.7)

($24.7)

Net Income - GAAP

$63.8

$55.1

Per Share Data:

Pre-Tax Income

$1.08

$1.05

$0.89

Net Income - GAAP

$0.71

$0.61

AEBITDA

(1)

$0.74

$0.98

$1.72

$1.70

$1.36

Average shares outstanding (mm)

89.9

89.9

89.9

89.9

89.8

Q4 '12

Consolidated Performance

1) Please see Appendix for information on AEBITDA and reconciliations beginning on page

18 2) Includes Legacy Segment

12

Strong sequential quarter for Company

Total GAAP Net Income of $64MM

GAAP EPS of $0.71

Operating Segment AEBITDA of $155MM

(1) |

Appendix

13 |

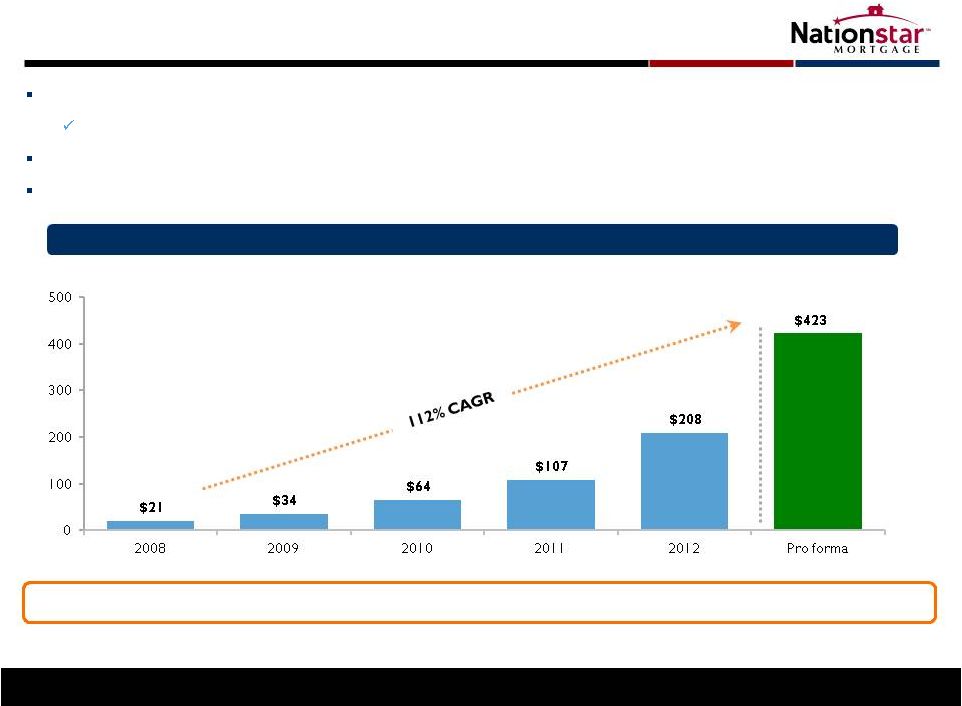

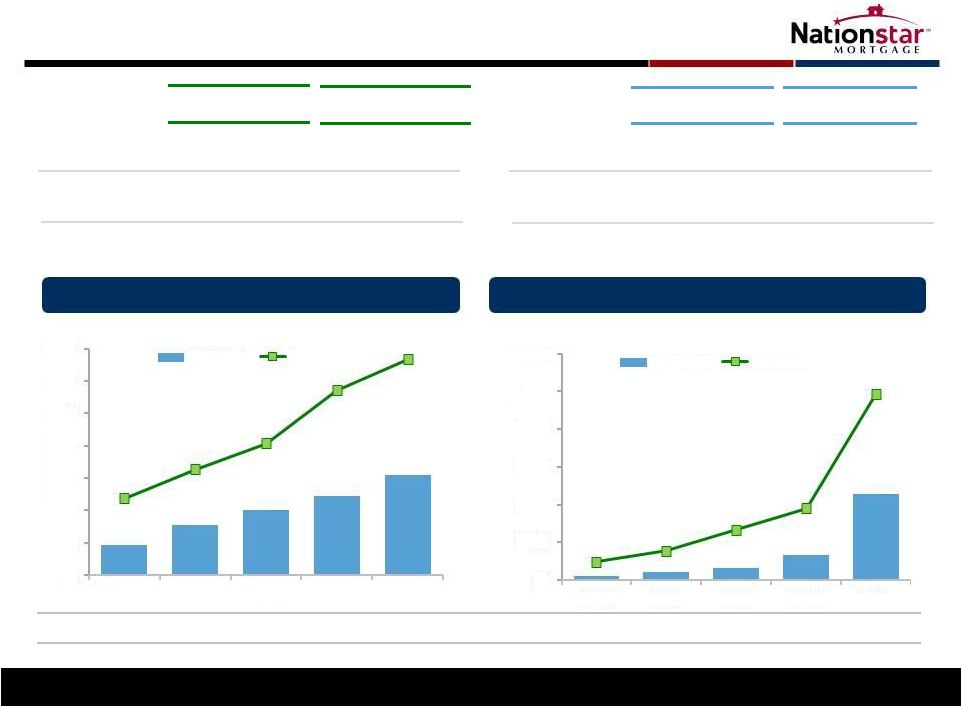

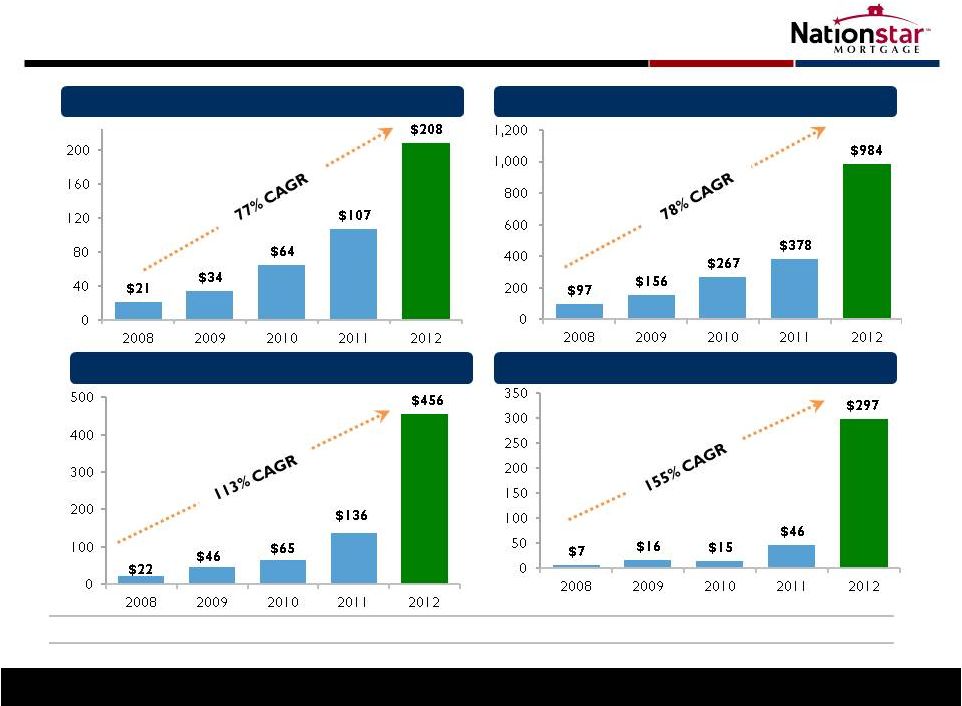

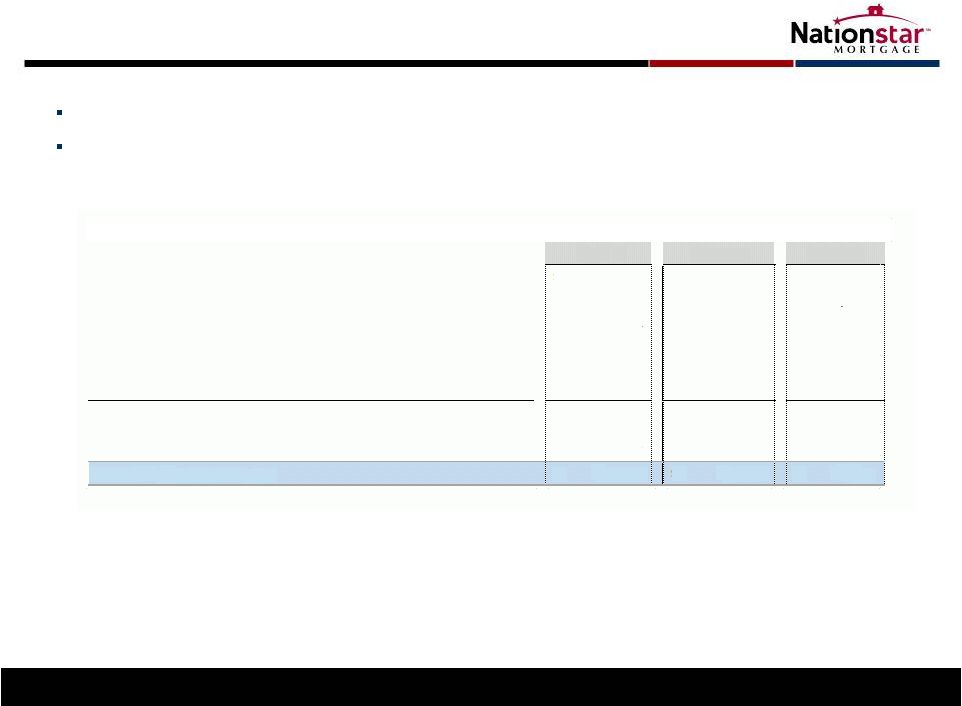

Focused

on Profitable Growth 1) Revenue, AEBITDA and

pre-tax income from operating segments 2) Please see

Appendix for information on AEBITDA and reconciliations beginning on page 18

14

Pre-Tax Income Growth ($mm)

(1)

UPB Growth ($bn)

Revenue Growth ($mm)

(1)

AEBITDA Growth ($mm)

(1)(2)

Margin (%)

23%

29%

24%

36%

7%

10%

6%

30%

12%

46% |

Balance

Sheet Low leverage with Corporate Debt to AEBITA of 1.7x

(1)

; net of cash, 1.5x

Significant capital levers in place for additional investment

Capacity remains for additional corporate debt

1)

Corporate Debt to Q4 run-rate AEBITDA

2)

Includes receivables from affiliates

3)

Includes servicing advance facilities and origination warehouse facilities

4)

Includes

derivative

financial

instruments

and

mortgage

servicing

liabilities

15

$ millions

Q4 '12

Q3 '12

$ millions

Q4 '12

Q3 '12

Assets:

Liabilities:

Cash and cash equivalents

$153

$431

Notes payable

(3)

$3,602

$2,532

Restricted cash

393

259

Senior unsecured notes

1,063

1,062

Accounts

receivable

(2)

3,056

2,866

Payables and accrued liabilities

628

762

Mortgage loans held for sale

1,481

703

Nonrecourse

debt

-

Legacy

assets

101

102

Mortgage

loans

held

for

investment

-

Legacy

239

238

Excess spread financing at fair value

288

255

Mortgage

servicing

rights

-

fair

value

636

593

Participating interest financing

581

415

Participating interest in reverse mortgages

750

453

Other liabilities

(4)

103

120

Mortgage

servicing

rights

-

amortized

cost

11

8

Total Liabilities

$6,365

$5,250

Property and equipment, net

75

49

Other assets

329

341

Shareholders Equity

$758

$691

Total Assets

$7,123

$5,941

Total Liabilities and Shareholders Equity

$7,123

$5,941 |

($ in

millions) For the three month period ending

Variance

Last twelve months

Q4'12

Q3'12

Q2'12

Q1'12

Q4'11

QoQ

YoY

Q4'12

Q3'12

Fee income

$158

$146

$100

$94

$83

8%

126%

$497

$411

Gain on sale

175

139

102

71

36

26%

363%

487

348

Total revenue

$333

$285

$202

$165

$119

17%

204%

$984

$759

Expenses and impairments

(200)

(155)

(130)

(97)

(86)

29%

87%

(582)

(468)

Other income (expense)

(38)

(50)

(23)

(15)

(18)

105%

291%

(126)

(94)

Pre-tax income

95

80

49

53

15

18%

NM

277

197

Income taxes

(31)

(25)

(13)

(3)

-

(71)

(41)

Net income

$64

$55

$36

$50

$15

53%

NM

$205

156

Adjusted AEBITDA

(1)

$155

$123

$101

$77

$47

26%

284%

$456

$348

EPS

(2)

$0.71

$0.61

$0.41

$0.67

$0.21

17%

NM

$2.40

$1.90

Pro forma EPS

(2,3)

$0.71

$0.64

$0.44

$0.44

$0.21

11%

NM

$2.23

$1.73

AEBITDA per share

(2)

$1.72

$1.37

$1.18

$1.04

$0.67

26%

157%

$5.31

$4.27

Five-Quarter Income Statement Summary

Successfully, consistently scaled the business

Increasing profitability with growth

Sequential improvement in pro forma EPS and AEBITDA per share

1)

Please see page 18 for AEBITDA reconciliations; excludes Legacy segment

2)

Calculated using a fully-diluted average share count for Q4’12 Q3

’12, Q2 ’12 and Q1’12 of 89.9, 89.8, 89.5 and 89.2 million shares, respectively, and 70.0 million shares for 2011 periods

3)

Please see Appendix for information on pro forma net income and EPS reconciliation

16 |

Servicing

Fee Detail (1)

17

Fee income before fair value adjustment increased by 9% to $175 million

MSR fair value adjustments include portfolio run-off and mark-to-market

adjustments 1)

Servicing segment only

($ in thousands)

Q4 '12

Q3 '12

Q4 '11

Total servicing fee income before MSR fair value adjustments

174,645

$

159,941

$

80,707

$

Fair value adjustments on excess spread financing

(5,633)

2,213

(3,060)

Reverse mortgage servicing liability amortization/accretion

1,844

2,652

-

MSR changes in fair value:

Due to changes in valuation inputs or assumptions

(1,169)

8,355

1,304

Other changes in fair value (portfolio run-off)

(24,263)

(30,785)

(9,547)

Servicing fee income

145,424

142,376

69,404

Other fee income

14,078

7,190

9,967

Total servicing fee income

159,502

$

149,566

$

79,371

$ |

AEBITDA

Reconciliation 18

1)

Calculated using a fully-diluted average share count of 89.9 million shares

For Quarter Ended December 31, 2012

($ in millions)

Servicing

Originations

Operating

Legacy

Total

Adjusted EBITDA

$66.9

$88.1

$155.0

($1.9)

$153.0

Interest expense on corporate notes

(20.0)

(4.2)

(24.2)

-

(24.2)

MSR valuation adjustment

(25.4)

-

(25.4)

-

(25.4)

Excess spread adjustment

(5.6)

-

(5.6)

-

(5.6)

Amortization of mort. serv. obligations

1.8

-

1.8

-

1.8

Depreciation & amortization

(2.0)

(1.1)

(3.1)

(0.2)

(3.3)

Stock-based compensation

(1.6)

(1.1)

(2.7)

(0.0)

(2.7)

Fair value adjustment for derivatives

0.8

-

0.8

(0.1)

0.7

Pre-Tax Income

$14.9

$81.7

$96.6

($2.2)

$94.4

Income Tax

(30.7)

Net Income

$63.8

Earnings per share

(1)

$0.71

AEBITDA per share

(1)

$0.74

$0.98

$1.72

($0.02)

$1.70

Pre-Tax Income per share

(1)

$0.17

$0.91

$1.07

($0.02)

$1.05

Average shares outstanding

89.9

89.9

89.9

89.9

89.9

|

AEBITDA

Reconciliation 19

1)

Calculated using a fully-diluted average share count of 89.8 million shares

For Quarter Ended September 30, 2012

($ in millions)

Servicing

Originations

Operating

Legacy

Total

Adjusted EBITDA

$42.1

$80.9

$123.0

($1.3)

$121.7

Interest expense on corporate notes

(15.7)

(1.9)

(17.7)

-

(17.7)

MSR valuation adjustment

(22.4)

-

(22.4)

-

(22.4)

Excess spread adjustment

2.2

-

2.2

-

2.2

Amortization of mort. serv. obligations

2.7

-

2.7

-

2.7

Depreciation & amortization

(2.0)

(0.8)

(2.8)

(0.2)

(3.0)

Stock-based compensation

(1.6)

(1.1)

(2.6)

0.0

(2.6)

Fair value adjustment for derivatives

0.2

-

0.2

(1.3)

(1.1)

Pre-Tax Income

$5.5

$77.1

$82.7

($2.9)

$79.8

Income Tax

(24.7)

Net Income

$55.1

Earnings per share

(1)

$0.61

AEBITDA per share

(1)

$0.47

$0.90

$1.37

($0.02)

$1.36

Pre-Tax Income per share

(1)

$0.06

$0.86

$0.92

($0.03)

$0.89

(continued) |

AEBITDA

Reconciliation (continued)

20

1)

Calculated using a fully-diluted average share count of 70.0 million shares

For Quarter Ended December 31, 2011

($ in millions)

Servicing

Originations

Operating

Legacy

Total

Adjusted EBITDA

$35.6

$11.7

$47.3

($7.6)

$39.7

Interest expense on corporate notes

(7.8)

-

(7.8)

-

(7.8)

MSR valuation adjustment

(8.2)

-

(8.2)

-

(8.2)

Excess spread adjustment

(3.1)

-

(3.1)

-

(3.1)

Amortization of mort. serv. obligations

-

(1.8)

(1.8)

-

(1.8)

Depreciation & amortization

(0.8)

(0.4)

(1.2)

(0.3)

(1.5)

Stock-based compensation

(2.4)

(0.3)

(2.6)

-

(2.6)

Fair value adjustment for derivatives

0.3

-

0.3

-

0.3

Pre-Tax Income

$13.6

$9.2

$22.8

($7.9)

$14.9

Income Tax

-

Net Income

$14.9

Earnings per share

(1)

$0.21

AEBITDA per share

(1)

$0.51

$0.17

$0.68

($0.11)

$0.57

Pre-Tax Income per share

(1)

$0.19

$0.13

$0.33

($0.11)

$0.21 |

AEBITDA

Reconciliations 21

($ in thousands)

Net Income (loss)

$ (157,610)

$ (80,877)

$ (9,914)

$ 20,887

$ 63,759

$ 205,287

Adjust for:

Net loss from Legacy Portfolio and Other

164,738

97,263

24,806

24,892

2,189

20,483

Interest expense from unsecured senior notes

-

-

24,628

30,464

24,165

63,879

Depreciation and amortization

1,172

1,542

1,873

3,395

3,107

8,880

Change in fair value of MSRs

11,701

27,915

6,043

39,000

25,432

68,242

Amortization of mortgage servicing obligations

-

-

-

-

(1,844)

(5,120)

Fair value changes on excess spread financing

-

-

-

3,060

5,633

10,684

Share-based compensation

1,633

579

8,999

14,764

2,675

14,045

Exit costs

-

-

-

1,836

-

-

Fair value changes on interest rate swaps

-

-

9,801

(298)

(813)

(1,237)

Ineffective portion of cash flow hedge

-

-

(930)

(2,032)

-

-

Income tax expense

-

-

-

-

30,657

71,296

Adjusted EBITDA

(1)

$ 21,634

$ 46,422

$ 65,306

$ 135,968

$ 154,960

$ 456,439

For Operating Segments; calculated using a fully-diluted average share count of

70.0 million shares for FY 2008 – 2011, 74.6 million shares in Q1 ‘12, 89.5 million shares in Q2 ’12, 89.8 million shares in Q3 ’12, 89.9

million shares in Q4’12

1)

FY 2008

FY 2009

FY 2010

FY 2011

Q4 ’12

FY 2012 |

Pro Forma

Per Share Reconciliations 22

For Quarters Ending September 30, June 30 and March 31, 2012

($ in millions)

Q3 '12

Q2 '12

Net Income

$55.1

$36.3

$50.2

Income Tax

24.7

12.8

3.1

Pre-Tax Income

79.8

49.1

53.3

ResCap and transaction-related expenses

3.9

4.1

-

Pro-forma Pre-Tax Income

$83.7

$53.2

$53.3

Income Tax -

Q3 & Q2 '12 Rate

(25.9)

(13.9)

(13.9)

Pro-Forma Income

$57.8

$39.3

$39.4

Pro-forma Per Share:

$0.64

$0.44

$0.44

Average shares outstanding

89.8

89.5

89.5

Q1 '12 |

Endnotes

Pro-forma

Earnings

Per

Share

(“Pro-forma

EPS”)

This

disclaimer

applies

to

every

usage

of

pro-forma

EPS

in

this

presentation.

Pro-forma

EPS

is

a

metric

that

is

used

by

management to exclude certain non-recurring items in an attempt to provide a better

earnings per share comparison to prior periods. Pro-forma Q3 ‘12 EPS excludes certain expenses

related

to

ResCap

and

other

transactions.

These

expenses

include

the

advance

hiring

of

servicing

staff,

recruiting

expenses

and

travel

and

licensing

expenses.

Pro-forma

Q2

‘12

EPS

excluded certain expenses incurred in advance of the closing of the Aurora transaction.

Pro-forma

AEBITDA

Per

Share

This

disclaimer

applies

to

every

usage

of

pro-forma

AEBITDA

per

share

in

this

presentation. Pro-forma

AEBITDA

per

share

is

a

metric

that

is

used

by management to exclude certain non-recurring items in an attempt to provide a

better earnings per share comparison to prior periods. Pro-forma Q3 ‘12 AEBITDA per share

excludes certain expenses related to ResCap and other transactions. These

expenses include the advance hiring of servicing staff, recruiting expenses and travel and licensing expenses.

Pro-forma Q2 ‘12 AEBITDA per share excluded certain expenses incurred in

advance of the closing of the Aurora transaction. Adjusted

EBITDA

(“AEBITDA”)

This

disclaimer

applies

to

every

usage

of

“Adjusted

EBITDA”

or

“AEBITDA”

in

this

presentation.

Adjusted

EBITDA

is

a

key

performance

metric

used

by management in evaluating the performance of our segments. Adjusted EBITDA

represents our Operating Segments' income (loss), and excludes income and expenses that relate to

the financing of our senior notes, depreciable (or amortizable) asset base of the

business, income taxes (if any), exit costs from our restructuring and certain non-cash items. Adjusted

EBITDA

also

excludes

results

from

our

legacy

asset

portfolio

and

certain

securitization

trusts

that

were

consolidated

upon

adoption

of

the

accounting

guidance

eliminating

the

concept

of a qualifying special purpose entity ("QSPE“).

23 |