Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - E TRADE FINANCIAL CORP | d495587d8k.htm |

E*TRADE

Financial Corporation Raymond

James

34

Annual

Institutional

Investors

Conference

Matthew Audette, Chief Financial Officer

March 5, 2013

©

2013 E*TRADE Financial Corporation all rights

reserved. Exhibit 99.1

th |

©

2013 E*TRADE Financial Corporation all rights reserved

2

Safe Harbor Statement

This presentation contains certain forward-looking statements regarding our business

strategy and the related impact, our strategic and capital plans, certain deleveraging

and cost-savings initiatives, the continuation of current trends,

future

events

and

the

future

performance

of

the

Company.

E*TRADE

claims

the

protection

of

the

safe

harbor

for forward-looking statements contained in the Private Securities Litigation Reform Act

of 1995 for all forward- looking statements. Various factors, including risks

and uncertainties referred to in the 10-K, 10-Q and other reports the Company

periodically files with the SEC, could cause our actual results to differ materially from those indicated by

our projections or other forward-looking statements.

Non-GAAP Financial Measures

In addition to financial results prepared in accordance with Generally Accepted Accounting

Principles, or GAAP, this presentation will also contain certain non-GAAP financial

measures. Management uses these non-GAAP measures to evaluate our performance

and in planning for future periods. Management believes that adjusting GAAP measures by

excluding

or

including

certain

items

is

helpful

to

investors

and

analysts

who

may

wish

to

use

some

or

all

of

this

information to analyze our current performance, prospects and valuation. It is important to

note these non-GAAP measures

involve

judgment

by

management

and

should

be

considered

in

addition

to,

not

as

a

substitute

for,

the

most directly comparable measures calculated and prepared in accordance with GAAP. Investors

and potential investors are encouraged to review the reconciliation of non-GAAP

financial measures with their most direct comparable GAAP financial measures included

as an appendix to this presentation. This presentation presents data as of December 31,

2012, unless otherwise indicated. Notice to investors |

©

2013 E*TRADE Financial Corporation all rights reserved

3

Business strategy

Improve market position in retail brokerage

•

Accelerate growth of the customer franchise

•

Continue to enhance the customer experience, improve satisfaction and retention

Capitalize on value of complementary brokerage businesses

•

Corporate Services Group

•

Market making operations

Enhance position in retirement & investing

•

Expand brand position for awareness and preference

•

Grow customer share of wallet

Continue to manage and de-risk the Bank

•

Mitigate

credit

losses

on

legacy

loan

portfolio

and

enhance

risk

profile

•

Build out enterprise risk management capabilities

Strengthen overall financial and franchise position

•

Improve capital ratios through de-risking and de-leveraging

•

Focus on ultimately deploying excess Bank capital to parent to pay off corporate debt

•

Increase focus on cost reductions and efficiencies: Targeting $110M in run-rate

reductions |

©

2013 E*TRADE Financial Corporation all rights reserved

4

($ M)

2012

Driver

Long-term impact

of current strategy

Revenue

$1,899

$2,161

Provision

($354)

$0

Servicing

($60)

$0

FDIC expenses

($117)

($59)

Other operating expenses

($985)

($985)

Expenses, total

($1,162)

($1,044)

Operating income

$383

$1,117

Corporate interest expense

($180)

$0

Other

($77)

$(77)

Pre-tax income

$126

$1,040

Should reduce to $0 as excess Bank capital is

deployed to parent to pay off corporate debt

Net interest spread should improve to 300bps

with normalized rate environment

Should reduce to $0 as legacy portfolio runs off

Should reduce to $0 as legacy portfolio runs off

Should reduce by half as risk profile improves

Strengthen overall financial and franchise position

Long-term impact of current strategy to improve earnings

(1) |

©

2013 E*TRADE Financial Corporation all rights reserved

5

Strengthen overall financial and franchise position

Focused on deleveraging to improve most constraining ratio: Tier

1 leverage

Capital ratios as of

12/31/12

Bank

Parent

Well-

capitalized

threshold

Total capital to

risk-weighted assets

(3)

20.6%

13.7%

10.0%

Tier 1 capital to

risk-weighted assets

(3)

19.3%

12.5%

6.0%

Tier 1 common

(4)

19.3%

10.3%

7.0%

Tier 1 leverage

(3)

8.7%

5.5%

5.0%

Reducing balance sheet size / improving leverage ratio is integral to the successful execution

of the Capital Plan Strategic and Capital Plan submitted to Fed and OCC

•

Outlines

assumptions

for

capital

levels

and

distributions

under

various

operating

conditions

over

the

next

5

years

•

Includes

assumption

that

Bank

begins

distributing

capital

to

Parent

by

the

end

of

2013

•

Plan

assumes

Bank

will

dividend

capital

to

Parent

above

Tier

1

leverage

ratio

of

9.5%

•

9.5%

target

decreases

by

50

bps

each

year

beginning

in

2014,

ultimately

settling

at

8.0%

Bank excess capital / Corporate debt

(5)

(6) |

©

2013 E*TRADE Financial Corporation all rights reserved

6

Drivers of change in balance sheet size

Focused on deleveraging to improve most constraining ratio: Tier

1 leverage

Strengthen overall financial and franchise position

Identified or Completed Deleveraging

Actions

2012

Q1 2013

Q2 2013

TOTAL

Transfer sweep deposits off balance sheet

$1,700

$2,300

$500

$4,500

Direct new customer cash to money funds

$800

$400

$1,200

Reduce wholesale borrowings

$1,500

$1,500

Convert customer payables to money funds

$900

$100

$1,000

Total

$4,900

$2,800

$500

$8,200

Tier 1 Leverage ratio: Bank | Parent

8.7% | 5.5% |

©

2013 E*TRADE Financial Corporation all rights reserved

7

Strengthen overall financial and franchise position

Debt refinancing to significantly improve cash flow and reduce interest burden

•

Lowest Senior Note coupons in the Company’s history

•

Improves annual earnings by approximately $60M or

$0.21 per share

(7)

•

Improves debt service coverage ratio for parent cash to

3.7X from 2.5X

•

Lengthens maturity profile, eliminating nearest maturity

and extending weighted average maturity by +1 year

•

Call features allow prepayment flexibility

Transaction benefits

Transaction overview

•

Launched transaction to refinance debt on 11/5

•

Successfully raised $1.3B in Senior Notes –

closed on

11/14

•

Issued call notice for $930M of Springing Lien Notes due

2017 and $243M of 7.875% Senior Notes due 2015

•

Called notes were extinguished on 12/1/2012 |

©

2013 E*TRADE Financial Corporation all rights reserved

8

Consolidated DTA of $1.4B

($0.4B at parent; $1.0B at Bank)

Ability to include more in regulatory capital with ongoing

profitability

Source of corporate cash as subsidiaries reimburse the

parent for use of its DTA

Approximately 15 years to use; expect to utilize the full

amount

Strengthen overall financial and franchise position

Deferred tax asset: Embedded value realized with ongoing profitability

|

©

2013 E*TRADE Financial Corporation all rights reserved

9

Committed to grow as a recognized leader with iconic brand and advertizing

Improve market position in retail brokerage |

©

2013 E*TRADE Financial Corporation all rights reserved

10

Improve market position in retail brokerage

Lower

attrition

Increase

net new assets /

share of wallet

Grow

high quality

account base

Increase asset-based

and commission-

based revenue

Key initiatives to drive success

•

Create leading online broker

experience:

•

E*TRADE.com

•

E*TRADE 360

•

E*TRADE Mobile

•

Education & research

•

E*TRADE Community

•

Focus on customer dissatisfiers

•

Continuous process improvements

•

Expand brand as a trusted

retirement and investing

provider

•

Deliver retirement advice &

planning:

•

Financial Consultants

•

Online planning tools

•

Managed Products

•

Increase awareness of needs-

based investing solutions:

•

Mutual funds

•

Fixed income

•

ETFs

•

Deepen relationships with

high-potential customers

Improve

Improve

customer experience

customer experience

Grow retirement

Grow retirement

& investing

& investing

Enhance retail

Enhance retail

trading offering

trading offering

•

Deliver best-in-class trading

experience:

•

E*TRADE.com

•

E*TRADE Pro

•

E*TRADE Mobile

•

Expand product engagement

through:

•

Platform enhancements

•

Idea generating tools

•

Education for all traders on

products, platforms, strategies and

risk management |

©

2013 E*TRADE Financial Corporation all rights reserved

11

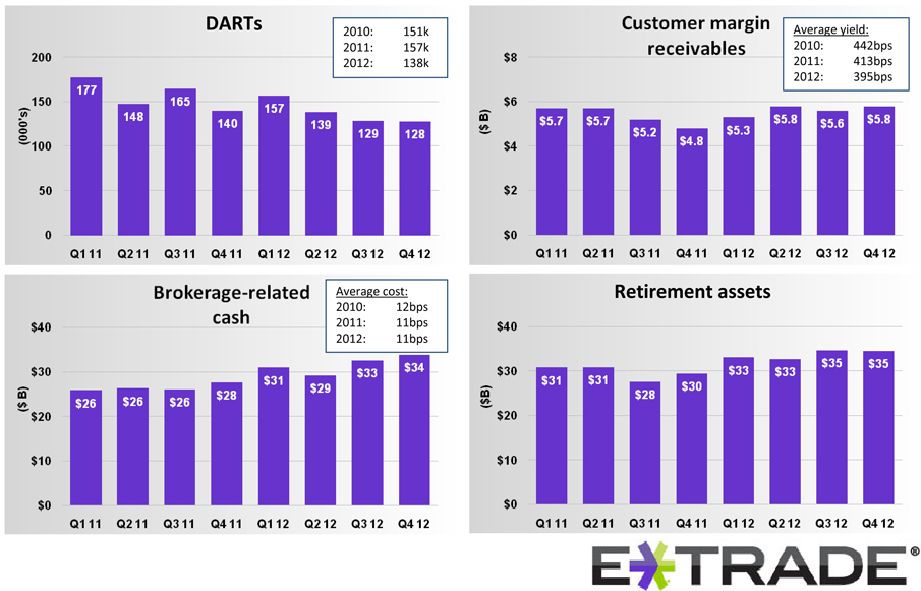

Improve market position in retail brokerage

Accelerate growth of the customer franchise |

©

2013 E*TRADE Financial Corporation all rights reserved

12

Improve market position in retail brokerage

Accelerate growth of the customer franchise |

©

2013 E*TRADE Financial Corporation all rights reserved

13

Financial Consultant network highlights

Increased Financial Consultant headcount by 40%

since year-end 2010

Estimated 12% share of our customers’

investible

assets (36% for active traders; 10% for investors)

(15)

Identified segments best served by proactive

engagement with Financial Consultants

—

1-year post assignment seeing significant

improvement in engagement and retention

Accounts &

assets

$34.6 billion in

retirement assets

20% of $173 billion of

brokerage-related assets

799k retirement

accounts

28% of brokerage accounts

$1.3 billion in managed

accounts

(3 years post inception)

8,100+ mutual funds

—

4,600 no-load

—

6,900 NTF

80+ Comm. Free

50,000+ bonds

Managed Accounts

(MIP & UMA)

Chartered Retirement

Planning

Counselors

#1 ranking in Kiplinger’s

2012 Best Online Brokers -

five stars in Investment

Choices and Customer

Service

Retirement education

Integrated into

advertising

Headcount of 270

Increased asset

penetration 1 year post

assignment

Complementary

retirement & portfolio

consultations

Products

†

Services

Financial

Consultants

Enhance position in retirement & investing

†

Unified Managed Accounts and Managed Investment Portfolios are offered by E*TRADE Capital

Management SM

Every

ETF

sold |

©

2013 E*TRADE Financial Corporation all rights reserved

14

Corporate Services Group

Build on market leadership with 1,000+ corporate stock plan clients

Award-winning

platform

–

Equity

Edge

Online

–

rated

#1

in

Overall Satisfaction and Loyalty in the 2012 Group Five Stock

Plan

Administration

Study

Industry

Report

Strategically important channel for new brokerage accounts,

accounting for 25-30% of gross new accounts

1.1 million accounts; $22B in vested and $47B in unvested

options

Proceeds retention of 35%+ 3 months post exercise,

and 15%+ 12 months post exercise

Market making business

Leading market share in ADRs; growing market share in

National Market Securities

Growing base of external customers, comprising 45+ external

clients

(30% y/y growth), and accounting for approximately

half of market making revenue

Capitalize on value of complementary brokerage businesses

TM

(16) |

©

2013 E*TRADE Financial Corporation all rights reserved

15

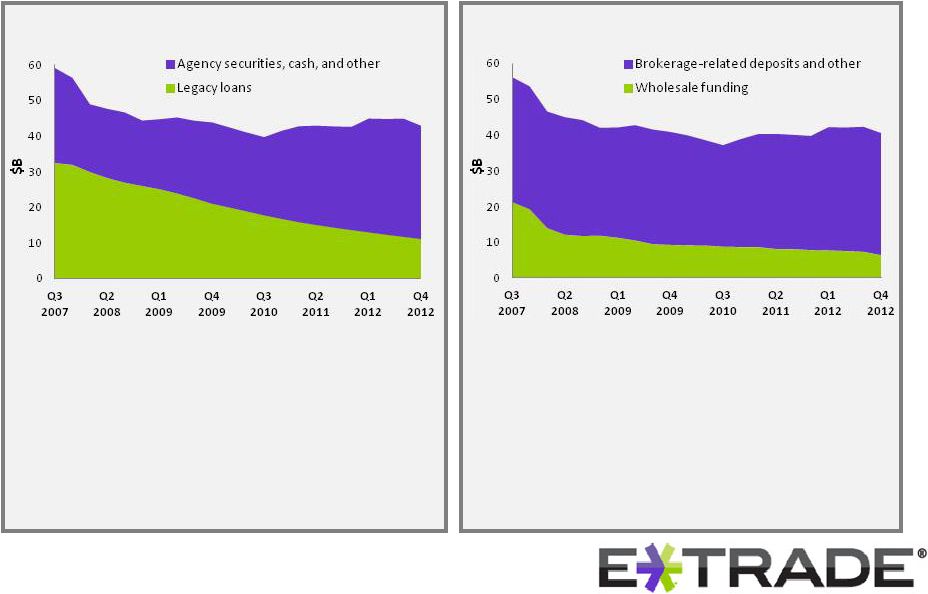

Improvement in asset composition…

…Funding mix also continues to improve

•

Legacy loan portfolio now accounts for less than 30% of

average interest-earning assets, down from 55% in Q3 2007

•

Average loan portfolio balances are down 66% from peak in

Q3 2007

•

Bank risk weighted assets are down 44% from peak in Q3

2007, while average total assets are down 27%

•

More expensive wholesale funding channel now accounts

for only 16% of average interest-bearing liabilities, down

from 38% at its peak in Q3 2007

•

Average wholesale funding is down 70% from its peak in Q3

2007

•

Balance sheet strategy going forward is liability-driven, by

brokerage cash

Favorable mix shift in assets (lower risk) and liabilities (lower-cost)

Continue to manage and de-risk the Bank |

©

2013 E*TRADE Financial Corporation all rights reserved

16

($ B)

Loan balance

9/30/07

(17)

Paydowns

(18)

Charge-offs

Loan balance

12/31/12

(17)

Average age

1-4 Family loans

$17

($10)

($1)

$6

6.7 yrs

Home equity

$12

($5)

($3)

$4

6.9 yrs

Consumer

$3

($2)

($0)

$1

9.0 yrs

TOTAL

$32

($17)

($4)

$11

Continue to manage and de-risk the Bank

Mitigate credit losses on legacy loan portfolio |

©

2013 E*TRADE Financial Corporation all rights reserved

17

Coverage of non-modified loans

Coverage of modified loans

Components of allowance for loan losses

Specific

Valuation

Allowance

Continue to manage and de-risk the Bank

Mitigate credit losses on legacy loan portfolio

0.0

0.5

1.0

1.5

2.0

Q1

2010

Q2

2010

Q3

2010

Q4

2010

Q1

2011

Q2

2011

Q3

2011

Q4

2011

Q1

2012

Q2

2012

Q3

2012

Q4

2012

90+ days past due non-modified loans

General

reserve

as

a

%

of

90+

days

past

due

non-modified

(20)

0.0

0.5

1.0

1.5

2.0

Q1

2010

Q2

2010

Q3

2010

Q4

2010

Q1

2011

Q2

2011

Q3

2011

Q4

2011

Q1

2012

Q2

2012

Q3

2012

Q4

2012

Total

expected

losses

on

modified

loans

Modified loans

General reserve

Prior charge-offs

Qualitative reserve

= Accounts for factors not directly considered in our quantitative model = Expected

losses over remaining life of modified loans

= Expected losses over next 12 months for non-modified loans 0%

20%

40%

60%

80%

0%

20%

40%

60%

80%

loans |

©

2013 E*TRADE Financial Corporation all rights reserved

18

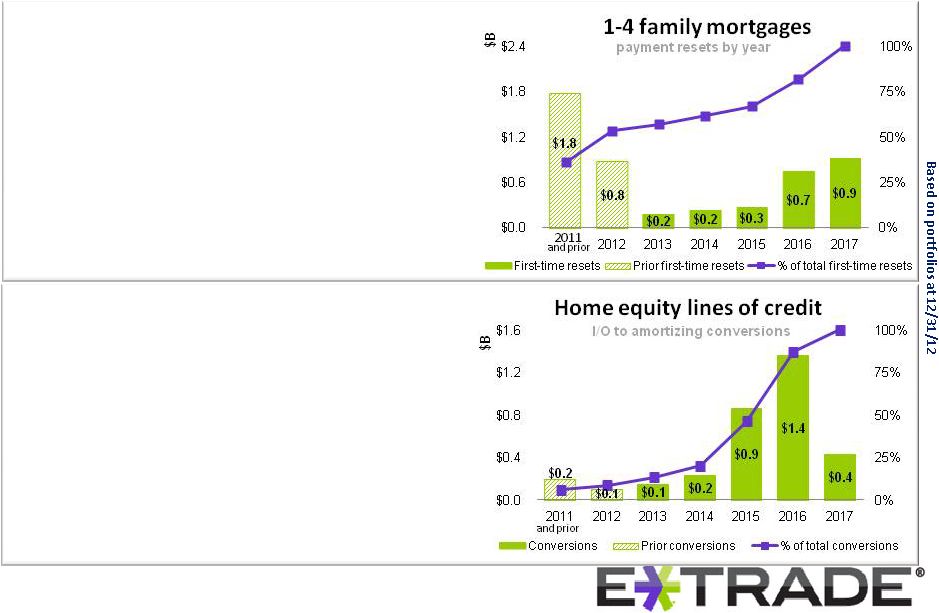

Continue to manage and de-risk the Bank

Visibility into future drivers of credit costs

•

Less than 1% of all 1-4 family loans resetting in 2013 are expected

to experience a payment increase of more than 10%

•

Nearly 83% of 1-4 family loans resetting in 2013 are expected to

reset to a lower payment

•

Average loan size: $458k

•

85% of non-TDR portfolio is adjustable for rate or amortization

•

Approximately $2.6B, or 53% of the portfolio, has previously reset

for the first time

•

Approximately 80% of home equity loans are lines of credit, the

majority of which do not begin to amortize until 2015 or later, and

balances continue to decline

•

Lines of credit are generally structured as 5-10 year draw period,

followed by 10-20 year amortization period

•

Average loan size: $75k

(21)

•

Approximately 40% of HELOC borrowers in their draw period

made meaningful voluntary principal reductions in 2012

of at least $500

•

Approximately half of those borrowers (20%) reduced their

principal balance by at least $2,500 during 2012 |

©

2013 E*TRADE Financial Corporation all rights reserved

19

Continue to manage and de-risk the Bank

•

Deleveraging actions and resulting smaller

balance sheet

•

Proactive and scheduled reduction of

wholesale borrowings

•

Runoff of higher yielding legacy loan

portfolio

•

Declining marginal reinvestment rate

on agency securities

Current drivers of net interest spread |

©

2013 E*TRADE Financial Corporation all rights reserved

20

•

Prolonged low interest rate environment

•

Home prices

•

Weak consumer / investor confidence

•

Heightened regulatory sensitivity

Environmental

Challenges

•

Mitigate credit losses on legacy loan portfolio

•

Execute on all aspects of the Strategic Plan

•

Obtain regulatory approval to distribute capital from

Bank to Parent

•

Build out enterprise risk management capabilities

E*TRADE

Challenges

•

Accelerate growth of customer franchise

•

Expand brand as a trusted retirement and investing

provider

•

Cost reduction / efficiency gains

E*TRADE

Opportunities

Challenges and opportunities |

|

©

2013 E*TRADE Financial Corporation all rights reserved

22

Appendix |

©

2013 E*TRADE Financial Corporation all rights reserved

23

Appendix |

©

2013 E*TRADE Financial Corporation all rights reserved

24

Appendix |