Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Chaparral Energy, Inc. | d492825d8k.htm |

| EX-99.1 - EX-99.1 - Chaparral Energy, Inc. | d492825dex991.htm |

Chaparral Energy

J.P. Morgan High Yield & Leveraged

Finance Conference

February, 2013

Chaparral Energy

J.P. Morgan High Yield & Leveraged

Finance Conference

February, 2013

Exhibit 99.2 |

2

This presentation contains "forward-looking statements" within the meaning of

Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities

Exchange Act of 1934, as amended. These forward-looking statements are subject

to certain risks, trends and uncertainties that could cause actual results to differ materially from

those projected. Among those risks, trends and uncertainties are our ability to find oil

and natural gas reserves that are economically recoverable, the volatility of oil and

natural gas prices and significantly depressed natural gas prices since the middle of

2008, the uncertain economic conditions in the United States and globally, the decline in the values of our

properties that have resulted in and may in the future result in additional ceiling test

write-downs, our ability to replace reserves and sustain production, our estimate of

the sufficiency of our existing capital sources, our ability to raise additional capital

to fund cash requirements for future operations, the uncertainties involved in prospect development

and property acquisitions or dispositions and in projecting future rates of production or future

reserves, the timing of development expenditures and drilling of wells, hurricanes and

other natural disasters, including the impact of the oil spill in the Gulf of Mexico on

our present and future operations, the impact of government regulation, and the operating

hazards attendant to the oil and natural gas business. In particular, careful consideration should be given to

cautionary statements made in the various reports we have filed with the Securities and

Exchange Commission. We undertake no duty to update or revise these forward-looking

statements. |

3

3

Company Representative

Company Representative

3

Joe Evans

Chief Financial Officer

& Executive Vice President

Mark Fischer

Chief Executive Officer

& President

Patrick Graham

Manager of Corporate Planning

& Investor Relations

Earl Reynolds

Chief Operating Officer

& Executive Vice President |

Founded in 1988, Based in

Oklahoma City Core

areas

—

Mid-Continent

(Oklahoma)

and

Permian

Basin

(W.

Texas)

Stable

1P

base

with

large

potential

upside

–

771

MMBoe,

R/P

16

years

Oil focused:

Third largest “oil”

producer in Oklahoma

(71%

oil;

29%

gas)

–

2012

Preliminary

SEC

Reserves

(64%

oil;

36%

gas)

–

2013

Production

Estimate

Growth drivers:

Near-term

growth

potential

through

drilling

~

500,000

acres

Long-term

growth

through

CO

2

EOR

–

74

fields

¹Based on 12/31/2011 and 12/31/2012 SEC methodology

2

Preliminary Results

Company Statistics

2011

2012

2

Annual Production (Boe/d)

~23,700

~24,910

Proved Reserves (MMBoe)

1

156.3

146.1

Proved Reserves PV-10 ($ in mm)

1

$2,309

$2,068

TTM EBITDA ($ mm)

$313

$330-340

4

4

Chaparral Overview

Chaparral Overview |

Operating

Areas Operating Areas

As of December 31, 2012 (SEC)

Core Area

Growth Area

Acreage

Field Offices

Headquarters

Val Verde

Basin

5

Sabine

Uplift

Midland

Basin

Delaware

Basin

Ouachita

Uplift

Arkoma

Basin

Fort

Worth

Basin

Anadarko

Woodford

Basin

OKC

Company Total

December

2012

proved

reserves

–

146.1

MMBoe

2012

average

daily

production

–

24.9

MBoe/d

Acreage (gross / net): 1,238,747 / 628,564

North Texas

Reserves: 3.8 MMBoe, 3% of total

Production: 0.4 Mboe/d, 2% of total

Permian Basin

Reserves: 17.1 MMBoe, 12% of total

Production: 3.2 MBoe/d, 13% of total

Mid-Continent

(Anadarko Basin & Central Oklahoma)

Reserves: 117.8 MMBoe, 81% of total

Production: 19.3 MBoe/d, 78% of total

Ark-La-Tex

Reserves: 5.4 MMBoe, 4% of total

Production: 1.2 MBoe/d, 5% of total

Gulf Coast

Reserves: 2.0 MMBoe, 1% of total

Production: 0.8 MBoe/d, 3% of total |

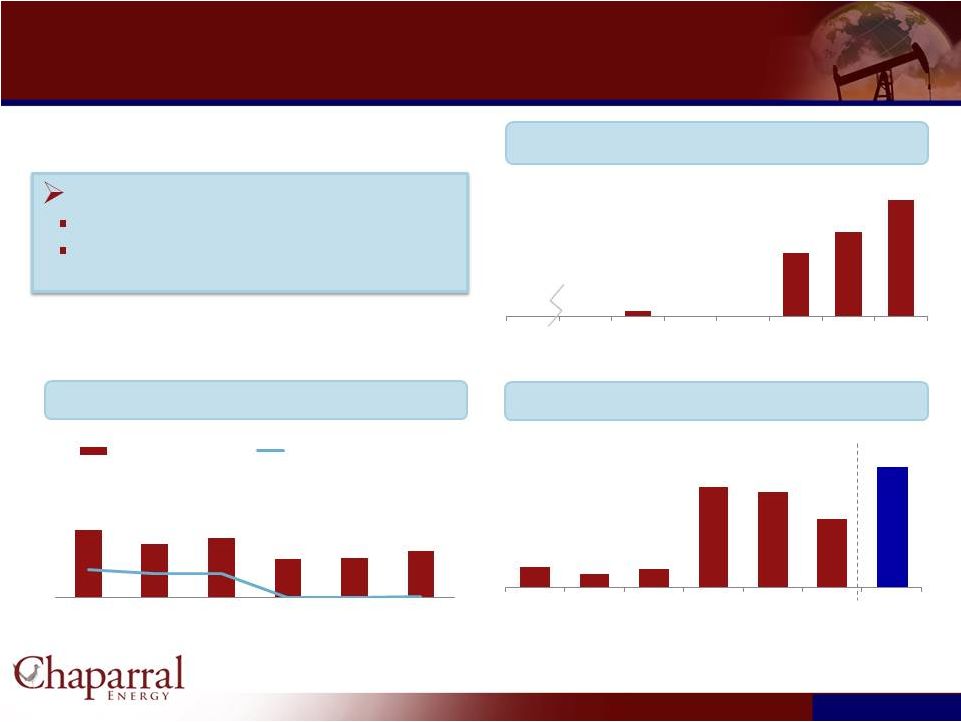

Strong

Record of Reserve and Production Growth Strong Record of Reserve and Production

Growth Year-End SEC Reserves (MMBoe)

(1)

2003 –

2012 CAGR = 12%

Annual Production (MMBoe)

2003 –

2012 CAGR = 15%

Chaparral’s reserve replacement ratio averaged 383%

per year since 2003

6

6

Year

Oil

Gas

2007

$96.01

$6.80

2008

$44.60

$5.62

2009

$61.18

$3.87

2010

$79.43

$4.38

2011

$96.19

$4.11

2012

$94.71

$2.76

1)

Reserves

as

of

December

31

for each year calculated

using flat SEC

pricing per the following:

6

6

*2013B illustrated at midpoint of guidance |

2011 to

2012 SEC Reserves Reconciliation 2011 to 2012 SEC Reserves Reconciliation

7

7

7

Product Pricing - SEC

12/31/2011

Price

12/31/2012

Price

Difference

Difference

(%)

Oil ($/bbl)

$ 96.19

$ 94.71

$ (1.48)

-1.5%

Gas ($/MMBtu)

$ 4.12

$ 2.76

$ (1.36)

-33.0%

Total YTD Proved Volume

Reconciliation

Volumes in

MMBOE

Beginning Balance (12/31/2011)

156.3

2012 Production

-9.1

Extensions & Discoveries

13.3

Improved Recoveries (EOR)

0.8

Divestitures

-3.8

Pricing Revisions

-12.0

Other Revisions

0.5

Ending Balance (12/31/2012)

146.1

Negative price revisions due to low

natural gas pricing and divestitures

reduced year end reserves by ~15.8

mmboe or 11%

Proved liquids reserves increased by

~3% compared to 2011 while total

reserves decreased by ~6.5% |

Current

Production - 2012

Current Production -

2012

2012 Production by Quarter

8

8

8

Production in the 4

quarter increased 4.3% over the previous quarter

and

increased

15.1%

when

compared

to

the

4

Quarter

2011

From 2011 to 2012, estimated liquids production

increased by over 15% and gas production declined by

approximately 8%

th

th |

9

9

Net Debt / EBITDA

Liquidity ($mm)

Financial Position to Execute Strategy

Financial Position to Execute Strategy

$325

$300

$400

* Pro-Forma for $150mm Senior Notes Add-On and Increased Borrowing Base;

subject to 4.5x Debt / EBITDA Borrowing Base covenant

* Pro-Forma for $150mm Senior Notes Add-On

Strong Financial Position

No senior note maturities before 2020

Hedge positions in place to secure

cash flow in near term

$25

$300

$400

$550

2012

2016

2017

2018

2019

2020

2021

2022

5.6x

4.4x

4.9x

3.2x

3.3x

3.8x

2.3x

2.0x

2.0x

0.0x

0.0x

0.1x

2007

2008

2009

2010

2011

Q3, 2012

Total net debt to EBITDA

Net secured debt to

EBITDA $88

$55

$77

$429

$407

$290

$514

2007

2008

2009

2010

2011

Q3, 2012

2012

Pro Forma*

Current Maturity Profile ($mm)

* |

Capital

Budget

($mm)

Capital

Budget

($mm)

Component

2010

2011

2012P

2013B

2013%

Drilling

$196

$172

$239

$206

50%

EOR

36

86

187

$130

32%

Enhancements

39

32

20

$20

5%

Acquisitions

41

17

48

$25

6%

Other (P&E, Capitalized

G&A, etc)

32

28

37

$30

7%

Total

$344

$336

$531

$411

100%

Key Drilling Areas

Capital

Wells

Northern OK Mississippi

Horizontal

$107

38

Marmaton

40

11

Anadarko

Cleveland

Sand

20

7

Anadarko Granite Wash

7

3

Other

32

*

Total

$206

59

10

EOR Field

Capital

N. Burbank

$84

Panhandle Area

42

Other

4

Total

$130

99% of 2013 Capital Program is Oil Focused

*Includes both Operated and Non-Operated Wells |

11

Drilling Resource Potential

Drilling Resource Potential |

Substantial Resource Potential for Near-Term Growth

Substantial Resource Potential for Near-Term Growth

12

12

Near-Term

2,640 Unrisked (1,406 Risked) Net Undrilled Wells

146

MMBoe

Proved

Reserves

Plus

625

MMBoe

Unproved

Resource

Potential

Conventional

Drilling

(ROR

50%

-

75%)

Anadarko Granite Wash

Anadarko Cleveland Sand

Unconventional

Resource

Play

Drilling

(ROR

35%

-

75%)

Northern Oklahoma Mississippi Play (NOMP)

~ 280,000 acres

Panhandle Marmaton

~ 50,000

acres

Anadarko Woodford Shale

~ 22,000 acres

Bone Spring/Avalon Shale

~ 18,000 acres

12 |

Northern

Oklahoma Mississippi Play The Northern Oklahoma Mississippi Play

(“NOMP”) is a key near–term focus area for Chaparral

Chaparral acreage over 280,000 net acres in the NOMP

Over 151 MMBoe of potential

1,740 unrisked drilling well inventory

Chaparral Acreage

13

KS

OK

Emerging

Core

IP Rates:

300 –

600 Boe/d

EUR:

300 –

400 MBoe

Well Cost:

$3.0 –

$4.0 million

% Oil

40% –

50%

IRR:

25% –

60%

IP Rates:

70 –

300 Boe/d

EUR:

50 –

150 Mboe

Well Cost:

$1.8 –

$2.3 million

% Oil

100%

IRR:

25% –

40%

NOMP Emerging Well Economics

NOMP Core Well Economics

Overview

NOMP Asset Map |

Marmaton Shelf Play

Marmaton Shelf Play

Johnston 1H-24

IP +300 Boepd

Lamaster 1H-23

IP +600 Boepd

Marmaton Vertical Production

Chaparral Acreage

Net Acreage: 50,000

14

IP Rates:

150 –

600 Boe/d

EUR:

150 –

200 Mboe

Well Cost:

$3.5 –

$4.0 million

% Oil

80%

IRR:

30% –

50%

Jay 1H-1098

IP +150 Boepd

Marmaton

Well

Economics |

15

Chaparral:

Chaparral:

A Growing Mid-Continent

CO

2

EOR Company

A Growing Mid-Continent

CO

2

EOR Company |

# of

Active Producer

CO2-EOR Projects

31

22

8

7

7

7

6

5

4

4

4

Total

105

Source: April 2012 Oil & Gas Journal

Note: Chaparral projects include the North Burbank Unit

16

Chaparral is a Leader in the CO2-EOR Industry

Chaparral is the third most active CO2-EOR producer in the U.S.

|

17

Long Life EOR Assets in Four Key Growth Areas

Long Life EOR Assets in Four Key Growth Areas

Panhandle

Area

Permian

Basin

Central

Oklahoma

Area

Burbank

Area

74 Fields

200+ MMBoe Potential Reserves

Low Geologic Risk

Attractive Economics

ROR –

25% to 40%

ROI –

2.5:1 to 3.5:1

Capital Requirements -

$75-$150 mm/yr

Long-term growth potential -

30-40% CAGR expected through 2020

405 miles of CO

2

Pipelines (net 245)

CO

2

Supply –

95 MMcfd

Current: 50 MMcfd

Coffeyville Contract: 45 MMcfd |

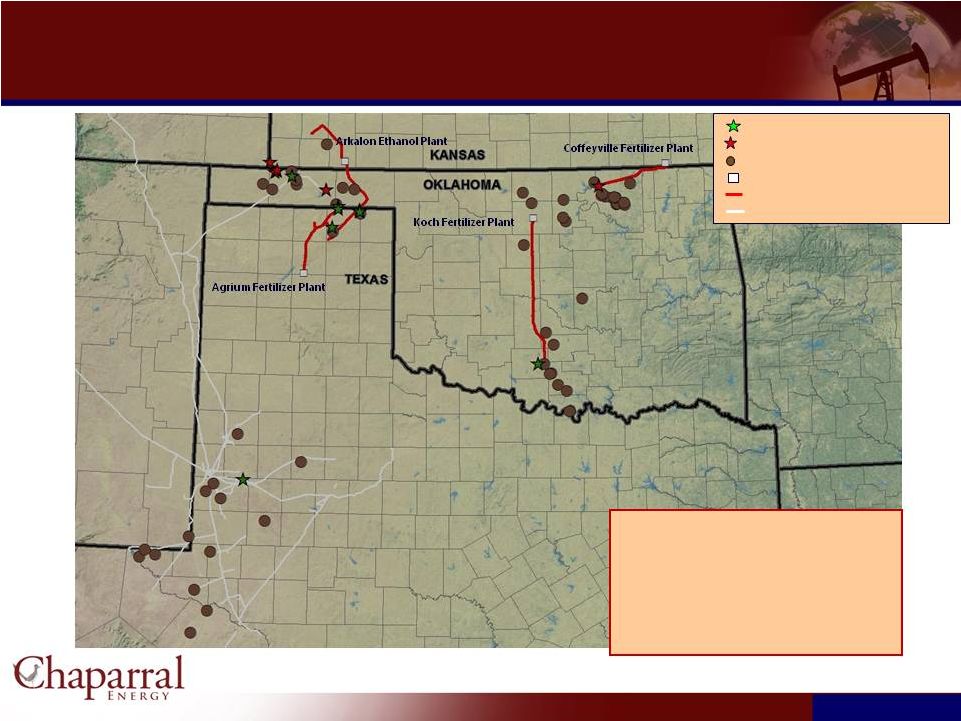

18

18

Current CO

2

Infrastructure/Future EOR Potential

Current CO

2

Infrastructure/Future EOR Potential

Total OOIP

3,735 MMBo

Primary Production 628 MMBo

Secondary Recovery

597 MMBo

Tertiary Potential

410 MMBo

Net Tertiary Potential

197 MMBo

Active CO2

fields

CO2

fields in 5 year plan

Chaparral

Owned

Potential

CO2

fields

CO2

Source

Locations

Chaparral

CO2

Pipelines

Third

Party

CO2

Pipelines |

EOR 2013

Capital Budget (1)

EOR 2013 Capital Budget

(1)

19

Budget by Category ($mm)

2012P

2013B

Infrastructure / Pipelines

105

62

Drilling

20

16

Enhancements / CO

2

Purchases

62

52

Total

$187

$130

Panhandle

Area

Permian

Basin

Central

Oklahoma

Area

Burbank

Area

(1)

Does not include Capitalized G&A |

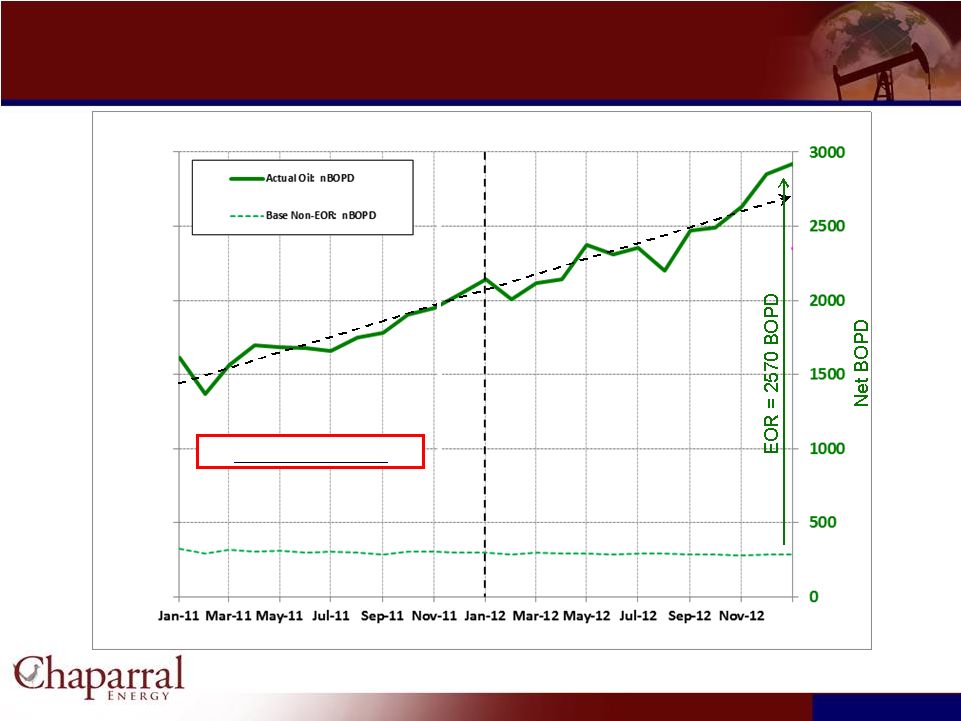

Monthly

Incremental EOR from Active CO 2

Projects

20

Avg. +41% CAGR |

Chaparral –

Potential EOR Production Growth

Chaparral –

Potential EOR Production Growth

21

Business Plan

Add C02

Others |

22

North Burbank CO

2

Development

North Burbank CO

2

Development |

Burbank

Area Potential CO 2

Projects

Burbank Area Potential CO

2

Projects

23

Total OOIP

1,163 MMBbls

Primary Production

239 MMBbls

Secondary Recovery

211 MMBbls

Tertiary Potential

119 MMBbls

Net Tertiary Potential

100 MMBbls

Burbank Area:

Net Potential: 100 MMBoe, 51% of total

|

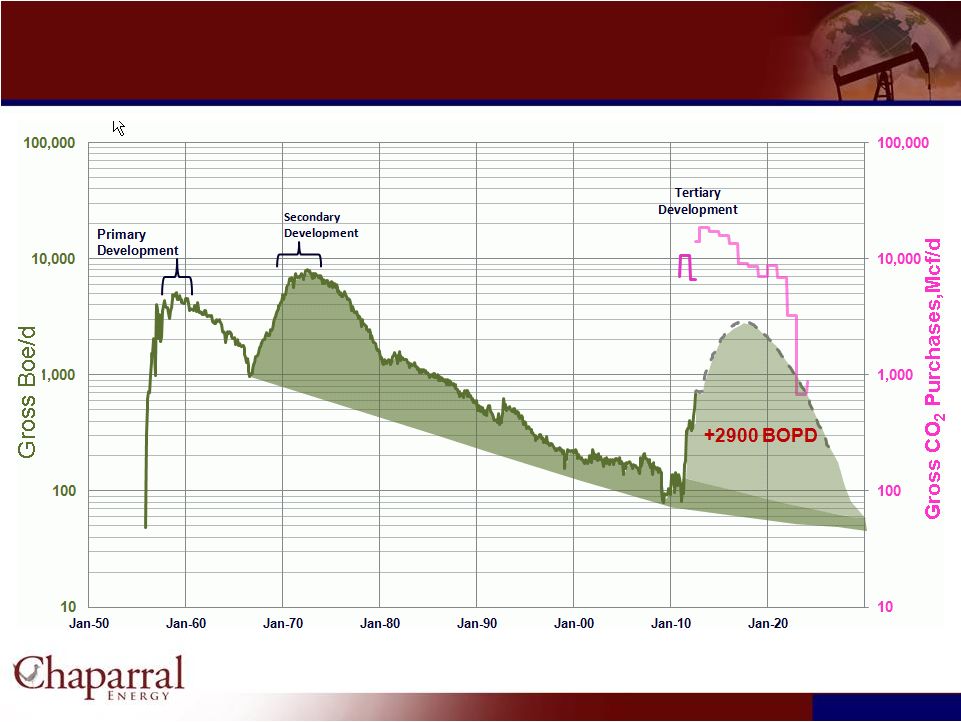

Burbank

in Perspective Burbank in Perspective

24

Secondary

Development

Primary

Development

Tertiary

Development

110 Years

“Waterflood”

+8000 BOPD |

25

Ph-I Vicinity

North Burbank Unit –

Miscibility Pressure Build

Dec 2012

Average pressure

1650 psia |

Coffeyville CO

2

System

Coffeyville CO

2

System

26

The Coffeyville CO

2

System

$110 million of total capital expenditures

23,500 HP compression facility

68.3-mile 8-inch pipeline with potential

capacity of approximately 60 MMcf/d.

CO

2

is sourced from the CVR Partners

fertilizer plant in Coffeyville, KS.

Online and operational in March 2013

Coffeyville CO2 System

Asset Map |

27

COFFEYVILLE

CO

2

PLANT

COFFEYVILLE

CO

2

PLANT |

28

COFFEYVILLE

CO

2

PLANT

COFFEYVILLE

CO

2

PLANT |

29

COFFEYVILLE

CO

2

PLANT

COFFEYVILLE

CO

2

PLANT |

30

COFFEYVILLE

CO

2

PLANT

COFFEYVILLE

CO

2

PLANT |

31

COFFEYVILLE

CO

2

PLANT

COFFEYVILLE

CO

2

PLANT |

32

COFFEYVILLE

CO

2

PIPELINE:

TRENCHING

RIGHT

OF WAY

COFFEYVILLE

CO

2

PIPELINE:

TRENCHING

RIGHT

OF WAY

Digging the trench in preparation for laying the pipeline

~68 miles; Coffeyville, KS to Shidler, OK |

33

COFFEYVILLE

CO

2

PIPELINE:

CLEARING

RIGHT-OF-WAY

COFFEYVILLE

CO

2

PIPELINE:

CLEARING

RIGHT-OF-WAY

Final Efforts:

•

Borings (Pic)

•

Hydro-test |

34

Other CO

2

Injection Projects

Other CO

2

Injection Projects |

Camrick

CO 2

–EOR Flood

Camrick CO

2

–EOR Flood

35 |

36

North Perryton CO

2

–EOR Flood

North Perryton CO

2

–EOR Flood |

37

Booker Area CO

2

–EOR Flood

Booker Area CO

2

–EOR Flood |

38

Farnsworth Area CO

2

–EOR Flood (West Side Only)

Farnsworth Area CO

2

–EOR Flood (West Side Only) |

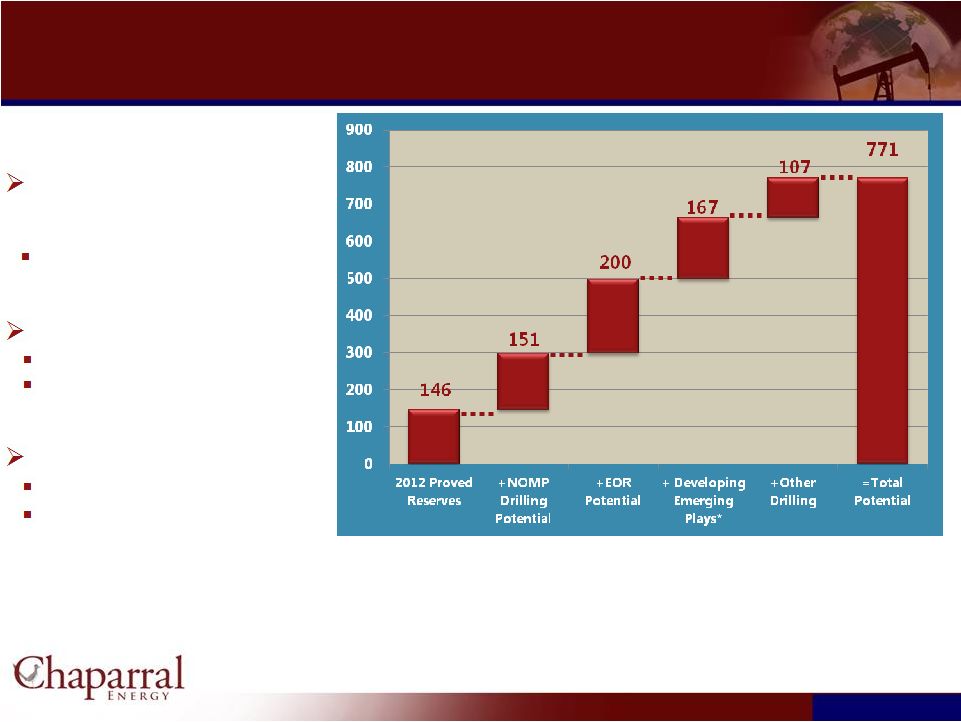

39

Potential in Excess of 771 MMBoe

Potential in Excess of 771 MMBoe

* Woodford, Bone Spring, Avalon, Cleveland Sand, Granite

Wash, and Marmaton

(1)

Near-term + Long-term

strategy yields significant

value increase

~ 70% Oil

Near-term focus on NOMP

De-risk play, unlock value

Production growth

Long-term focus on EOR

Low-risk production upside

Long-life, stable production |

40

Financial Overview

Financial Overview |

41

Financial Summary

Financial Summary |

Financial Metrics per Boe

Financial Metrics per Boe

42 |

Operating Statistics

2012

Guidance

2013

Guidance

Capital Expenditures

$460 million

$410 -

$420 million

Production

8.8 -9.0 MMBoe

9.6 -

9.8 MMBoe

General and Administrative

$5.75 –

$6.25/Boe

$5.50 -

$6.00/Boe

Lease Operating Expense

$14.25 -

$14.75/Boe

$14.25 -

$14.75/Boe

2012 and 2013 Guidance

2012 and 2013 Guidance

43 |

44

% of Total Proved Reserves Hedged (as of February 20, 2013)

Hedge Portfolio

Note:

Dollars

represent

average

strike

price

of

hedges

(includes

all

derivative

instruments)

Gas Basis Hedges

YR

Price

% TP

’13

$

0.20

82%

’14

$

0.23

69% |

Question & Answer

Question & Answer

45 |