Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Noranda Aluminum Holding CORP | q42012earnings8-k.htm |

| EX-99.3 - EXHIBIT 99.3 DIVIDEND RELEASE - Noranda Aluminum Holding CORP | a2012q4exhibit993.htm |

| EX-99.1 - EXHIBIT 99.1 FOURTH QUARTER EARNINGS RELEASE - Noranda Aluminum Holding CORP | a2012q4earningsreleaseexhi.htm |

TM 4th Quarter 2012 Earnings Conference Call Noranda Aluminum Holding Corp February 20, 2013 10:00 AM Eastern / 9:00 AM Central

The presentation and comments made by Noranda’s management on the quarterly conference call contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward- looking statements are statements about future, not past, events and involve certain important risks and uncertainties, any of which could cause the Company’s actual results to differ materially from those expressed in forward-looking statements, including, without limitation: the cyclical nature of the aluminum industry and fluctuating commodity prices, which cause variability in earnings and cash flows; a downturn in general economic conditions, including changes in interest rates, as well as a downturn in the end-use markets for certain of the Company’s products; fluctuations in the relative cost of certain raw materials and energy compared to the price of primary aluminum and aluminum rolled products; the effects of competition in Noranda’s business lines; Noranda’s ability to retain customers, a substantial number of which do not have long-term contractual arrangements with the Company; the ability to fulfill the business’s substantial capital investment needs; labor relations (i.e. disruptions, strikes or work stoppages) and labor costs; unexpected issues arising in connection with Noranda’s operations outside of the United States; the ability to retain key management personnel; and Noranda’s expectations with respect to its acquisition activity, or difficulties encountered in connection with acquisitions, dispositions or similar transactions. Forward-looking statements contain words such as “believes,” “expects,” “may,” “should,” “seeks,” “approximately,” “intends,” “plans,” “estimates,” or “anticipates” or similar expressions that relate to Noranda’s strategy, plans or intentions. All statements Noranda makes relating to its estimated and projected earnings, margins, costs, expenditures, cash flows, growth rates and financial results or to the Company’s expectations regarding future industry trends are forward-looking statements. Noranda undertakes no obligation to publicly update or revise any forward-looking statement as a result of new information, future events or otherwise, except as otherwise required by law. Readers are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date on which they are made and which reflect management's current estimates, projections, expectations or beliefs. For a discussion of additional risks and uncertainties that may affect the future results of Noranda, please see the Company’s filings with the Securities and Exchange Commission, including its Annual Report on Form 10-K and Quarterly Reports on From 10-Q. Forward Looking Statements 2

Over vi ew Results Overview • We accomplished key fourth quarter achievements that we believe position us well as we transition from 2012 to 2013. • Our CORE program continues to contribute not only to our efforts to manage our cost profile, but improve the reliability and effectiveness of our operations. • Our 2013 expectations reflect modest volume improvement supported by stable customer demand and our productivity and reliability programs. • We are moving forward with prudent capital investments that drive both growth and productivity. • Our financial structure provides us with flexibility through the cycle. Financial Highlights • Reported EPS—$0.06 • EPS excluding special items—$(0.12) • Total segment profit—$30.9 million • Cash from operating activities—$33.4 million • Cash and available ABL facility— $154.7 million 4th Quarter 2012 Financial Highlights 3

Primary Aluminum Shipments Bauxite Shipments 4 Quarterly Shipment Information Flat-Rolled Product Shipments 148 146 142 147 139 145 0 50 100 150 200 Q3-11 Q4-11 Q1-12 Q2-12 Q3-12 Q4-12 Po un ds in m illi on s Value-Added External sow Intercompany Alumina Shipments 1,369 1,271 1,145 1,162 1,267 1,185 0 300 600 900 1,200 1,500 Q3-11 Q4-11 Q1-12 Q2-12 Q3-12 Q4-12 km ts Internal External 284 260 288 289 271 261 0 50 100 150 20 250 300 350 Q3-11 Q4-11 1-12 Q2-12 Q3-12 Q4-12 Km ts CGA External SGA External SGA Intercompany 95 76 9 102 98 87 0 20 4 60 80 100 120 140 Q3-11 4-11 1-12 2-12 Q3-12 Q4-12 Po un ds in m illi on s Deman d

Productivity Complements Growth in Creating Value P rod u ctiv it y 5 EBITDA Capex Working Capital • Cost Out – Impact materials prices through procurement practices – Reduce costs through improved yields – Avoid unproductive spending by rationalizing investments • Reliability and Effectiveness – Grow capacity through improved utilization and de-bottlenecking – Improve operational predictability – Eliminate unplanned losses Flat-Rolled Products $15 Primary Aluminum $14 Alumina $15 Bauxite $9 Corporate $1 $ in millions EBITDA $30 Capex $5 Working Capital $19 $ in millions 2012 CORE Savings by Segment 2012 CORE Savings by Type $54 million in CORE savings during 2012

Demand Factors • Projected consumption CAGR through 2017(1) – Global—5.9% with China; 3.9% outside China – United States—3.0% • Global, emerging market drivers(1) – Infrastructure – Emerging middle class – Sophisticated equipment • US demand drivers(1) – Demographics – Improving economy – Substitution trends Supply Factor and Macroeconomic Factors • Supply Factors – World production/consumption balance(1) • 0.4 million MT surplus for 2012 • 0.2 million MT surplus for 2013 – Curtailments and disruptions since 3Q-11(1) • 1.6 million MT curtailed; 1.8 million MT disrupted – LME warehouse inventories—5.2 million MT(2) • Macroeconomic Factors(1) – Sovereign debt issues and high unemployment in Europe – Growth rate for China’s economy – “Debt Ceiling” and Consumer Confidence in U.S. Quarterly Average LME(2) $1.33 $0.62 $0.82 $0.92 $0.50 $0.60 $0.70 $0.80 $0.90 $1.00 $1.10 $1.20 $1.30 $1.40 Q1 -20 0 7 Q2 -20 0 7 Q3 -20 0 7 Q4 -20 0 7 Q1 -20 0 8 Q2 -20 0 8 Q3 -20 0 8 Q4 -20 0 8 Q1 -20 0 9 Q2 -20 0 9 Q3 -20 0 9 Q4 -20 0 9 Q1 -20 1 0 Q2 -20 1 0 Q3 -20 1 0 Q4 -20 1 0 Q1 -20 1 1 Q2 -20 1 1 Q3 -20 1 1 Q4 -20 1 1 Q1 -20 1 2 Q2 -20 1 2 Q3 -20 1 2 Q4 -20 1 2 LME Levels Rose Slightly, Still Below Equilibrium Levels Sn ap shot of Alum in u m Fu n dame n tal s 6 Sources: (1) CRU (2) LME

R esu lts O ve rv ie w TTM MWTP $1.17 $1.02 $1.01 $0.80 $0.90 $1.00 $1.10 $1.20 $1.30 Q4-11 Q3-12 Q4-12 $ p er po un d TTM Revenue TTM Net Cash Cost $262 $135 $135 $0 $50 $100 $ 50 $200 $250 $300 Q4-11 Q3-12 Q4-12 $ i n m illi on s Key Performance Indicators – Trailing Twelve Months (“TTM”) 7 $0.75 $0.82 $0.81 $0.20 $0.3 $0.40 $0.50 $0.60 $0.70 $0.80 $0.90 Q4-11 Q3-12 Q4-12 $ p er po un d TTM Segment Profit $1,560 $1,401 $1,395 $900 $1,000 $1,100 $1,200 $1,300 $1,400 $1,500 ,6 0 $1,700 Q4-11 3 2 Q4-12 $ i n m illi on s

Se gm ent Re sult s 8 Segment Profit Summary Q4 2011 Q3 2012 Q4 2012 Integrated upstream segment profit $30.7 $5.4 $27.8 Flat-Rolled Products segment profit 6.5 12.0 10.3 Corporate costs (6.1) (7.3) (7.2) Total segment profit $31.1 $10.1 $30.9

9 Upstream Segment Profit Q4 2011 Q3 2012 Q4 2012 Average realized Midwest transaction price $ 1.04 $ 0.96 $ 1.01 Net Cash Cost 0.83 0.92 0.82 Integrated upstream margin per pound $ 0.21 $ 0.04 $ 0.19 Total Primary Aluminum segment shipments 145.8 138.8 145.1 Integrated upstream segment profit $ 30.7 $ 5.4 $ 27.8 Se gm en t R esu lt s

Integrated Net Cash Cos t 10 Segment Profit and Net Cash Cost Bridge $0.82 $0.02 $0.10 $0.02 $0.92 $0.50 $0.55 $0.60 $0.65 $0.70 $0.75 $0.80 $0.85 $0.90 $0.95 $1.00 Q3 2012 Net Cash Cost Bauxite/Alumina Selling Price, other Peak Power Surcharge Bauxite cost Q4-12 Cash Cost $ p er p o u n d $30.9 $2.3 $8.4 $13.8 $0.9 $10.1 $- $10 $20 $30 $40 Q3 2012 LME / MWP Price Impact Seasonal Peak Power Excess Costs in Bauxite Segment Eliminations & Other Q4 2012 $ in m ill io n s

Net In com e (Loss), E xcludin g Sp ecia l Ite m s 11 Bridge of Segment Profit to Net Income, Excluding Special Items Q4 2011 Q3 2012 Q4 2012 Segment profit $ 31.1 $ 10.1 $ 30.9 LIFO/LCM 4.7 10.0 (4.6) Other recurring non-cash items (5.2) (3.8) (4.1) EBITDA, excluding special items 30.6 16.3 22.2 Depreciation and amortization (24.6) (23.6) (25.0) Interest expense, net (5.1) (8.9) (8.9) Pre-tax income (loss), excluding special items 0.9 (16.2) (11.7) Income tax (expense) benefit (0.3) 5.4 3.9 Net income (loss), excluding special items $ 0.6 $ (10.8) $ (7.8)

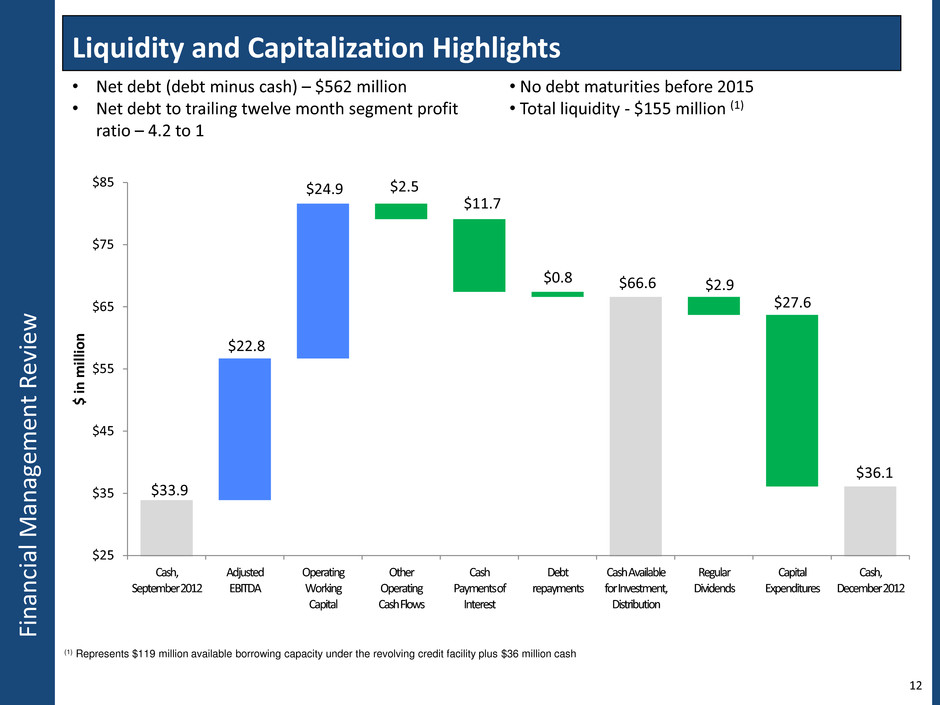

Fina n cial Mana ge m ent Rev ie w 12 Liquidity and Capitalization Highlights $2.5 $11.7 $0.8 $2.9 $27.6 $22.8 $24.9 $33.9 $66.6 $36.1 $25 $35 $45 $55 $65 $75 $85 Cash, September 2012 Adjusted EBITDA Operating Working Capital Other Operating Cash Flows Cash Payments of Interest Debt repayments Cash Available for Investment, Distribution Regular Dividends Capital Expenditures Cash, December 2012 $ in m ill io n (1) Represents $119 million available borrowing capacity under the revolving credit facility plus $36 million cash • Net debt (debt minus cash) – $562 million • Net debt to trailing twelve month segment profit ratio – 4.2 to 1 • No debt maturities before 2015 • Total liquidity - $155 million (1)

2 0 1 2 O utlo o k Key 2013 Expectations 13 Driver Annual Outlook Comments Primary Aluminum • Shipments • 579 to 582 million pounds • Quarterly expectations vs. ratable: Q1 ~-6%; Q3 ~+2%, Q4 ~+4% Integrated Cash Cost(1) • $0.79 to $0.83 per pound • Quarterly expectations vs. midpoint: Q1 ~+4%; Q2 ~-3%; Q3 ~+5% • Additional LME sensitivity: $0.03 decrease for each $0.10 cent increase in LME Flat-Rolled Products • Shipments • Margin • 383 to 386 million pounds • $0.12 to $0.15 per pound • Comparable seasonality to 2012 • In line with shipment seasonality Corporate • $32 to $33 million • Ratable across quarters Other recurring non-cash P&L • $33 to $35 million Non-LIFO • $4 to $6 million LIFO(1) • Total $37 to $41 million • Non-LIFO generally ratable • LIFO sensitive to changes in inventory levels, LME, input costs Capex • $70 to $75 million sustaining • $30 to $40 million incremental growth/productivity spending See slide 2 for important information about forward looking statements (1) Based on LME forward curve as of December 31, 2012

We accomplished key fourth quarter achievements that we believe position us well as we transition from 2012 to 2013 – Customer demand improved in 4Q-12 compared to 4Q-11, particularly in Flat Rolled Products – Reached five-year agreement with key bauxite customer to extend long-term supply agreement with improved pricing structure – Ameren rate case decided by PSC in December, with 6.6% base rate increase effective January 2013 – Returned New Madrid aluminum reduction cells to full operation by end of December Our CORE program generated $54 million of cost savings in 2012; program also drove reliability and effectiveness projects in 2012, and that focus will increase in 2013 Our expectations for key 2013 performance metrics reflect modest volume improvement supported by stable customer demand and our productivity and reliability programs. They further reflect stable prices for key input costs, except natural gas We are moving forward with prudent capital investments that drive both growth and productivity. – Increase capacity and improve productivity of our bauxite operation through up to $20 million investment in port expansion and railing infrastructure – Invest $10 million to start construction of state-of-the-art rod mill – Invest $8 million to improve New Madrid reliability and efficiency through rectifier upgrades Our financial structure provides us with flexibility through the cycle – ~ $155 million of total liquidity; FRN maturities in 2015; no maintenance covenants other than minimum availability requirement – Legacy natural gas hedges have expired, eliminating a $35 million use of 2012 cash – Legacy strategic hedge deferred tax liabilities funded, eliminating another $30 million use of 2012 cash Key Takeaways 14 1 2 Su m m ar y 3 4 5

Non-GAAP Measure: Disclaimer N o n -GAAP Measu re : Disclaim e r This presentation contains non-GAAP financial measures as defined by SEC rules. We believe these measures are helpful to investors in measuring our financial performance and comparing our performance to our peers. However, our non-GAAP financial measures may not be comparable to similarly titled non-GAAP financial measures used by other companies. These non-GAAP financial measures have limitations as an analytical tool and should not be considered in isolation or as a substitute for U.S. GAAP financial measures. To the extent we disclose any non-GAAP financial measures, a reconciliation of each measure to the most directly comparable U.S. GAAP measure is available in the Press Release included as an exhibit to the Current Report on Form 8-K to which this presentation is also an exhibit. As such, this presentation should be read in conjunction with our Press Release.

TM