Attached files

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

| x | Annual Report pursuant to section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the fiscal year ended December 31, 2010

or

| ¨ | Transition report pursuant to section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the transition period from to .

Commission file number: 001-34741

NORANDA ALUMINUM HOLDING

CORPORATION

(Exact name of registrant as specified in its charter)

| Delaware | 20-8908550 | |

| (State or other jurisdiction of incorporation) |

(I.R.S. Employer Identification No.) | |

| 801 Crescent Centre Drive, Suite 600 Franklin, TN 37067 |

37067 | |

| (Address of principal executive offices) | (Zip Code) | |

Registrant’s telephone number, including area code: (615) 771-5700

Securities registered pursuant to Section 12(g) of the Act: None

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Name of each exchange on which registered | |

| Common Stock, $0.01 par value | New York Stock Exchange |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months. Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | (Do not check if a smaller reporting company) x | Smaller reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

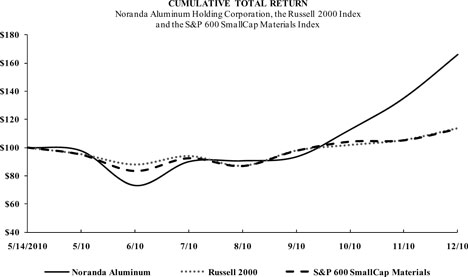

The aggregate market value of the Common Stock held by non-affiliates of the registrant, based on the closing of the Common Stock on the NYSE on June 30, 2010 the last business day of the registrant’s most recently completed second fiscal quarter, was $73,945,000. For purposes of this response, the registrant has assumed that its directors, executive officers and beneficial owners of 5% or more of its Common Stock are the affiliates of the registrant. Indicate the number of shares outstanding of cash of the registrant’s classes of common stock as of the latest practicable date.

| Class |

Outstanding at February 28, 2011 | |

| Common Stock, $0.01 par value | 66,826,561 |

Documents Incorporated by Reference: None

Table of Contents

NORANDA ALUMINUM HOLDING CORPORATION

2

Table of Contents

GLOSSARY OF SELECTED TERMS

“Noranda,” the “Company,” “we,” “our,” and “us” means collectively (1) Noranda Aluminum, Inc. and its subsidiaries on a consolidated basis prior to the consummation of the Apollo Acquisition and (2) Noranda HoldCo and its subsidiaries on a consolidated basis (including Noranda Aluminum, Inc.) after the completion of the Apollo Acquisition.

“AcquisitionCo Notes” means our senior floating rate notes due 2015 issued by Noranda AcquisitionCo.

“Apollo” means investment funds affiliated with, or co-investment vehicles managed indirectly by, Apollo Management L.P., including Apollo Investment Fund VI, L.P., along with its parallel investment funds.

“Apollo Acquisition” means the May 18, 2007 acquisition by Apollo of the Noranda aluminum business of Xstrata.

“Apollo Transactions” means collectively the Apollo Acquisition and related financings.

“Century” means Century Aluminum Company together with its subsidiaries.

“CORE” means Cost-Out Reliability and Effectiveness, the Company’s productivity program.

“CRU” means CRU International Limited, an independent consulting group focused in part on the mining and metal sectors.

“DMT” means dry metric tonnes.

“Downstream Business” means our flat rolled products reportable segment consisting of four rolling mill facilities.

“Exchange Act” means the Securities Exchange Act of 1934, as amended.

“FIFO” means the first-in, first-out method of valuing inventory.

“GOJ” means the Government of Jamaica.

“Gramercy” means our wholly owned alumina refinery in Gramercy, Louisiana.

“HoldCo Notes” means our senior floating rate notes due 2014 issued by Noranda HoldCo.

“Joint Venture Transaction” means the transaction, consummated on August 31, 2009, whereby Noranda became sole owner of Gramercy and St. Ann.

“KMts” means kilometric tonnes.

“LIFO” means the last-in, first-out method of valuing inventory.

“LME” means the London Metals Exchange.

“Midwest Transaction Price” or “MWTP” is equal to the LME price of primary aluminum plus a Midwest premium.

“NBL” means Noranda Bauxite Limited, a Jamaican private limited company and wholly owned subsidiary of Noranda HoldCo.

“New Madrid” means our aluminum smelter near New Madrid, Missouri.

“NJBP” means Noranda Jamaica Bauxite Partnership, a Jamaican partnership owned 51% by the GOJ and 49% by NBL.

“Noranda 2007 Long-Term Incentive Plan” means the Amended and Restated Noranda Aluminum Holding Corporation 2007 Long-Term Incentive Plan.

“Noranda 2010 Incentive Award Plan” means the Noranda Aluminum Holding Corporation 2010 Incentive Award Plan.

“Noranda AcquisitionCo” means Noranda Aluminum Acquisition Corporation, a Delaware corporation and wholly owned subsidiary of Noranda HoldCo, excluding its subsidiaries.

“Noranda HoldCo” means Noranda Aluminum Holding Corporation, a Delaware corporation, excluding its subsidiaries.

“Notes” means, collectively, the AcquisitionCo Notes and the HoldCo Notes.

“Pre-predecessor” means financial information (including results of operations, cash flows and financial information) as of and for the period from January 1, 2006 to August 15, 2006 for Noranda Aluminum Inc. on a basis reflecting the historical carrying values of Noranda Aluminum, Inc. prior to the Xstrata Acquisition.

“Predecessor” means financial information (including results of operations, cash flows and financial information) for the periods from August 16, 2006 to December 31, 2006 and from January 1, 2007 to May 17, 2007, and as of December 31, 2006 for Noranda Aluminum, Inc. on a basis reflecting the stepped-up values of Noranda Aluminum, Inc. prior to the Apollo Acquisition, but subsequent to the Xstrata Acquisition.

“Securities Act” means the Securities Act of 1933, as amended.

3

Table of Contents

“Special Dividend” means the June 2007 dividend of $216.1 million paid to Noranda stockholders, along with the related financing.

“St. Ann” means our bauxite mining operation in Jamaica.

“Successor” means financial information (including results of operations, cash flows and financial information) for the period from May 18, 2007 to December 31, 2007, as of December 31, 2007, and as of and for the years ended December 31, 2008, 2009 and 2010 for Noranda on a basis reflecting the impact of the purchase allocation of the Apollo Acquisition.

“Term B loan” means that certain term B loan maturing in 2014 with an original principal amount of $500.0 million pursuant to the secured credit facilities Noranda AquisitionCo entered into on May 18, 2007.

“Upstream Business” means, collectively, our three reportable segments: primary aluminum products, alumina refining and bauxite. These segments consist of the New Madrid, Missouri aluminum smelter, the Gramercy, Louisiana alumina refinery and the St. Ann, Jamaica bauxite mine.

“U.S. GAAP” means generally accepted accounting principles in the United States.

“Xstrata” means Xstrata (Schweiz) AG.

“Xstrata Acquisition” means the August 15, 2006 acquisition by which Noranda Aluminum, Inc. became Xstrata’s wholly owned subsidiary.

4

Table of Contents

CAUTIONARY STATEMENT CONCERNING FORWARD-LOOKING STATEMENTS

This report contains “forward-looking statements.” You can identify forward-looking statements because they contain words such as “believes,” “expects,” “may,” “should,” “seeks,” “approximately,” “intends,” “plans,” “estimates,” or “anticipates” or similar expressions that relate to our strategy, plans or intentions. All statements we make relating to our estimated and projected earnings, margins, costs, expenditures, cash flows, growth rates and financial results or to our expectations regarding future industry trends are forward-looking statements. These forward-looking statements are subject to known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. We derive many of our forward-looking statements from our operating budgets and forecasts, which are based upon many detailed assumptions. While we believe that our assumptions are reasonable, we caution that it is very difficult to predict the impact of known factors, and it is impossible for us to anticipate all factors that could affect our actual results. All forward-looking statements are based upon information available to us on the date of this report.

Important factors that could cause actual results to differ materially from our expectations, which we refer to as cautionary statements, are disclosed under “Risk Factors” and elsewhere in this report, including, without limitation, in conjunction with the forward-looking statements included in this report. All forward-looking information in this report and subsequent written and oral forward-looking statements attributable to us, or to persons acting on our behalf, are expressly qualified in their entirety by the cautionary statements. Some of the factors that we believe could affect our results include:

| • | our indebtedness, and the possibility that we may incur more indebtedness; |

| • | the cyclical nature of the aluminum industry and fluctuating commodity prices, which cause variability in our earnings and cash flows; |

| • | a downturn in general economic conditions, including changes in interest rates, as well as a downturn in the end-use markets for certain of our products; |

| • | losses caused by disruptions in the supply of electrical power; |

| • | fluctuations in the relative cost of certain raw materials and energy compared to the price of primary aluminum and aluminum rolled products; |

| • | the effects of competition in our business lines; |

| • | the relative appeal of aluminum compared with alternative materials; |

| • | our ability to retain customers, a substantial number of which do not have long-term contractual arrangements with us; |

| • | our ability to fulfill our business’s substantial capital investment needs; |

| • | the cost of compliance with and liabilities under environmental, safety, production and product regulations; |

| • | weather, including natural disasters and other unplanned business interruptions; |

| • | labor relations (i.e., disruptions, strikes or work stoppages) and labor costs; |

| • | unexpected issues arising in connection with our operations outside of the United States; |

| • | our ability to retain key management personnel; |

| • | our expectations with respect to our acquisition activity, or difficulties encountered in connection with acquisitions, dispositions or similar transactions; |

| • | the ability of our insurance to cover fully our potential exposures; |

| • | the cost of compliance with future changes to healthcare legislation; and |

| • | the concentration of ownership held by our equity sponsor. |

We caution you that the foregoing list of important factors may not contain all of the material factors that are important to you. In addition, in light of these risks and uncertainties, the matters referred to in the forward-looking statements contained in this report may not in fact occur. Accordingly, investors should not place undue reliance on those statements. We undertake no obligation to publicly update or revise any forward-looking statement as a result of new information, future events or otherwise, except as otherwise required by law.

5

Table of Contents

| ITEM 1. | BUSINESS |

Except as otherwise indicated herein or as the context otherwise requires, references in this report to (a) “Noranda HoldCo” refer only to Noranda Aluminum Holding Corporation, a Delaware corporation, excluding its subsidiaries, (b) “Noranda AcquisitionCo” refer only to Noranda Aluminum Acquisition Corporation, a Delaware corporation and wholly owned subsidiary of Noranda HoldCo, excluding its subsidiaries, and (c) “Noranda,” the “Company,” “we,” “our,” and “us” refer collectively to (1) Noranda Aluminum, Inc. and its subsidiaries on a consolidated basis prior to the Apollo Acquisition, and (2) Noranda HoldCo and its subsidiaries on a consolidated basis after the completion of the Apollo Acquisition, (d) “HoldCo Notes” refer to our senior floating rate notes due 2014 issued by Noranda HoldCo, and (e) “AcquisitionCo Notes” refer to senior floating rate notes due 2015 issued by Noranda AcquisitionCo.

Overview

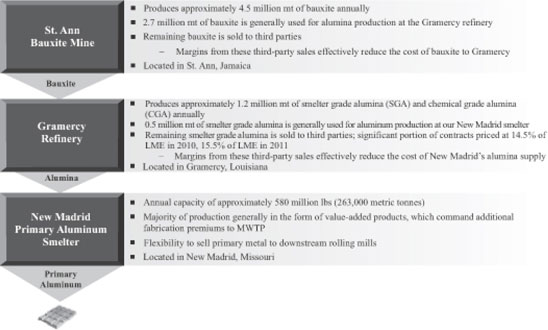

We are a leading North American integrated producer of value-added primary aluminum products and high quality rolled aluminum coils. We have two businesses: our upstream business and downstream business. Our upstream business consists of three reportable segments: primary aluminum products, alumina refining, and bauxite. These three segments are closely integrated and consist of a smelter near New Madrid, Missouri, which we refer to as “New Madrid,” and our bauxite mining operation and alumina refinery, both of which have sufficient capacity to support New Madrid and supply third party customers. New Madrid has annual production capacity of approximately 580 million pounds (263,000 metric tonnes). Operated at capacity, this represents more than 15% of total 2010 U.S. primary aluminum production, based on statistics from CRU. Our downstream business comprises our flat rolled products segment, which is one of the largest aluminum foil producers in North America and consists of four rolling mill facilities with a combined maximum annual production capacity of 410 to 495 million pounds, depending on production mix.

Our upstream business is one of the largest U.S. producers of primary aluminum products. We believe our combination of captive alumina and bauxite, a secure electric power contract and strategically located assets give us meaningful operational flexibility. Our bauxite mining operation in St. Ann, Jamaica provides a secure source of bauxite to our wholly owned alumina refinery in Gramercy, Louisiana. Gramercy provides a strategic supply of alumina to our New Madrid smelter at costs below recent spot market prices for alumina. Because our captive alumina and bauxite production capacity exceeds our internal requirements, we also sell these raw materials to third parties. The margin from these sales effectively lowers the cost of our alumina supply and therefore lowers our integrated aluminum cash cost. In addition, we have a long-term, secure power contract at New Madrid that extends through 2020. We believe this contract gives Noranda an advantage over aluminum smelters facing frequent power shortages or disruptions. In addition, our power costs are not linked to London Metals Exchange (or “LME prices”) aluminum prices, unlike the power costs of some of our competitors, particularly in North America.

In addition to providing security of supply, we believe our fully integrated upstream cost structure benefits us in an environment of rising aluminum prices. The cost of our supply of alumina, which we own, is positively affected by a rising LME price due to our realization of higher margins on third-party sales of alumina and bauxite.

Primary aluminum is a global commodity and its price is set on the LME. Due to a long-term domestic supply deficit in the U.S. and transportation costs, our primary aluminum products typically earn a Midwest premium on top of the LME price, the sum of which is known as the Midwest Transaction Price, or the “MWTP.” In addition, we typically sell a majority of our primary aluminum shipments in the form of value-added products, such as billet, rod and foundry, which include a fabrication premium over the MWTP. We also have the flexibility to direct primary aluminum volumes to our downstream rolling mills, on an arms-length basis, when demand is weak for our value-added end-products. This helps to ensure a standby demand for our upstream production.

Our downstream business is a low-cost domestic producer of aluminum rolled products. We own and operate four rolling mills, including the West plant in Huntingdon, Tennessee, which is recognized as one of the most advanced rolled aluminum production facilities in North America. Versatile manufacturing capabilities and advantageous geographic locations provide our rolling mills with the flexibility to serve a diverse range of end-users. We believe that this flexibility, when combined with our strong customer service capabilities, product quality and strategic sales support, has allowed our downstream business to gain share of demand in 2009 during a period of weakness in end-market demand and retain demand share in 2010. The downstream business prices its products at the MWTP plus a fabrication premium. Therefore, notwithstanding periodic metal margin gains or losses during times of volatility in aluminum prices, our downstream earnings are substantially insulated from fluctuations in primary aluminum prices. As a result, the downstream business’s performance is predominantly driven by fluctuations in volumes and the fabrication premiums we are able to achieve. During periods of difficult market conditions in our downstream business, we have the ability to scale back meaningfully on capital expenditures, such as in 2009, when we reduced our capital expenditures by 58% versus 2008. We believe that the nominal maintenance capital requirements combined with operating performance that is substantially insulated from aluminum price fluctuations make the downstream business a relatively effective vehicle for free cash flow generation. The geographic proximity of the facilities in our upstream and downstream businesses creates a further degree of vertical integration, providing for additional operational flexibility.

6

Table of Contents

Company History

The Apollo Acquisition. Noranda HoldCo and Noranda AcquisitionCo were formed on March 27, 2007 by investment funds affiliated with, or co-investment vehicles managed indirectly by, Apollo Management, L.P., including Apollo Investment Fund VI, L.P. (collectively “Apollo”), along with its parallel investment funds, to acquire a portion of the aluminum business of Xstrata (Schweiz) AG (“Xstrata”). The Apollo Acquisition was completed on May 18, 2007, when Noranda AcquisitionCo acquired the stock of a subsidiary of Xstrata that held the Noranda aluminum business. As used in this report, the term “Apollo Transactions” means, collectively, the May 18, 2007 acquisition by Apollo of the Noranda aluminum business.

Upon completion of the Apollo Acquisition, Apollo and certain members of management became the owners of all of the outstanding equity interests of Noranda HoldCo. Noranda AcquisitionCo is a wholly owned subsidiary of Noranda HoldCo.

The Joint Venture Transaction. On August 31, 2009, we completed a transaction, which we refer to as the “Joint Venture Transaction,” whereby we became the sole owner of the alumina and bauxite production joint ventures, Gramercy and St. Ann, respectively, that we had operated since 2004 with Century Aluminum Company (together with its subsidiaries, “Century”). In consideration for its ownership share, Century was forgiven certain liabilities to the alumina joint venture and was released from all agreements and obligations of the joint ventures. In addition, as part of the Joint Venture Transaction, we agreed to sell to Century approximately 190,500 metric tonnes of alumina through 2010, with the first 125,000 metric tonnes sold at a fixed price and the reminder sold at prices indexed to the LME price.

Primary Metal — Upstream Business

Business Overview. The upstream business is vertically integrated with operations in bauxite mining, alumina refining and aluminum smelting. The process of making aluminum is power intensive and requires a large amount of alumina (aluminum oxide), which is derived from the raw material bauxite. Approximately four pounds of bauxite are required to produce approximately two pounds of alumina, and two pounds of alumina will produce approximately one pound of aluminum.

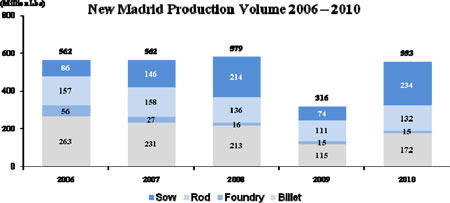

New Madrid Primary Aluminum Smelter. All of our primary aluminum production occurs at New Madrid, which produces approximately 580 million pounds (263,000 metric tonnes) of primary aluminum annually at full capacity, accounting for approximately 15% of total United States primary aluminum production for 2010 according to CRU. New Madrid is strategically located as the closest Midwest facility to a supply of alumina. It is also located in an area with abundant sources of electrical power. See “Raw Materials and Supply” below. The smelter was built in 1971 and underwent significant capacity expansions in 1976, 1983 and 2001. On August 4, 2010, the New Madrid smelter received a Prevention of Significant Deterioration (PSD) Permit from the Missouri Department of Natural Resources which allows the facility to increase production capacity to 650 million pounds per year. During the third quarter of 2010, we announced that we had initiated steps to complete a $38 million capital project at New Madrid, which we expect to increase annual metal production by approximately 35 million pounds during 2013. During the fourth quarter 2010, we invested approximately $1.1 million toward the smelter expansion project, which remains on schedule for completion during 2013.

7

Table of Contents

The smelter is located aside the Mississippi River near New Madrid, Missouri. It occupies 250 acres, including 44 acres under roof, of the 4,200 acre St. Jude Industrial Park, the largest industrial park in the State of Missouri. Noranda owns and manages approximately 2,600 acres of the St. Jude Industrial Park, providing us land for either expansion or sale to prospective tenants.

The smelter is fully integrated with its own raw material unloading facility, environmental control systems and aluminum reduction plant, including carbon anode fabrication. New Madrid has three production lines. This diversity of lines facilitates the maintenance of steady production levels near full capacity and, in rare instances of severe production threats; helps insulate us from complete plant shutdowns.

The plant site also includes a fabrication facility for the production of continuous cast rod, extrusion billet and foundry ingot. This business converts molten aluminum into value-added products. The fabrication facility has the capacity to produce annually approximately 160 million pounds of rod, used mainly for electrical applications and steel de-oxidation; 286 million pounds of extrusion billet, used mainly for building construction and architectural and transportation applications; and 75 million pounds of foundry ingot, used mainly for transportation. During 2010, based on CRU data, New Madrid produced approximately 28% of the rod manufactured in North America and supplied approximately 9% of North American primary extrusion billet. Molten aluminum that is not used in these product lines is produced as primary ingots for transfer to our downstream business or sale to other aluminum fabricators.

Source: Company data for the year ended December 31, 2010

During 2010, approximately 62% of our value-added products were sold at the prior month’s MWTP plus a fabrication premium. Our major target customers in the primary aluminum products segment are located in the Midwestern United States and Mexico, with 79% of loads delivered to these customers within a one-day truck delivery distance.

Raw Materials and Supply. Energy and alumina are the main cost components for primary aluminum production.

Raw Materials

Our upstream business is fully integrated from bauxite to alumina to primary aluminum metal, ensuring security of raw material supply at long-term competitive costs. Our aluminum smelter in New Madrid, Missouri receives substantially all of its alumina requirements from Gramercy. We believe New Madrid has a freight cost advantage relative to other smelters because of the proximity of Gramercy to St. Ann and New Madrid to Gramercy. We believe our strategic location allows New Madrid to source its alumina from Gramercy at a lower freight cost than other U.S. based smelters.

Gramercy Alumina Refinery. At the Gramercy refinery, bauxite is chemically refined and converted into alumina, the principal raw material used in the production of primary aluminum. Extensive portions of the Gramercy refinery were rebuilt from 2000 through 2002. Gramercy has an annual production capacity of 1.2 million metric tonnes of alumina, approximately 40% of which is supplied to our New Madrid facility. The Gramercy refinery is the source for the vast majority of New Madrid’s alumina requirements. New Madrid purchases alumina from time to time from third parties, but the quantities are minimal. The remaining alumina production at the Gramercy refinery that is not taken by New Madrid is sold in the form of smelter grade alumina and alumina hydrate, or chemical grade alumina, margins on which effectively reduce the cost of New Madrid’s alumina supply.

St. Ann Bauxite Mine. Bauxite is the principal raw material used in the production of alumina and all of the bauxite used at our Gramercy refinery is purchased from St. Ann. We transport bauxite from St. Ann to Gramercy by oceangoing vessels, which are the only available means of transportation. We recently signed a new contract which extends through December 2015 with a third party for bauxite ocean vessel freight.

We operate the St. Ann bauxite mine through Noranda Bauxite Limited, which we refer to as “NBL,” a Jamaican limited liability company formerly known as St. Ann Bauxite Limited. NBL’s bauxite mining assets consist of: (1) a concession from the Government of Jamaica, or “GOJ,” to mine bauxite in Jamaica through 2030 and (2) a 49% interest in Noranda Jamaica Bauxite Partnership, or “NJBP,” which holds the physical mining assets and conducts the mining and related operations pursuant to the concession. The GOJ owns the remaining 51% of NJBP. The physical mining assets consist primarily of rail facilities, other mobile equipment, dryers and loading and dock facilities. The age and remaining lives of the mining assets vary and they may be repaired or replaced from time to time as part of NJBP’s ordinary capital expenditure plan. Under the terms of the GOJ concession, NJBP mines

8

Table of Contents

the land covered by the concession and the GOJ retains surface rights and ownership of the land. The GOJ granted the concession and entered into other agreements with NBL for the purpose of ensuring that we have sufficient reserves to meet our annual alumina requirements. The concession ensures access to sufficient reserves to allow NBL to ship 4.5 million dry metric tonnes (“DMT”) of bauxite annually from mining operations in the specified concession area through September 30, 2030. We have reached agreement with the GOJ to mine 5.4 million DMT during each of the years 2011 and 2012.

The GOJ is required to provide additional concessions if the specified concession does not contain sufficient quantities of commercially exploitable bauxite. NBL is responsible for reclamation of the land that it mines. The outstanding reclamation liability at December 31, 2010 was $9.4 million.

Pursuant to an establishment agreement that governs the relationship between NBL and the GOJ, NBL manages the operations of the partnership (NJBP), pays operating costs and is entitled to all of its bauxite production. NBL pays the GOJ according to a negotiated fiscal structure, which consists of the following elements: (i) a royalty based on the amount of bauxite mined, (ii) an annual “asset usage fee” for the use of the GOJ’s 51% interest in the mining assets, (iii) customary income and other taxes and fees, (iv) a production levy, which was waived for certain historical periods, but which is applicable in 2009 and future periods, and (v) certain fees for lands owned by the GOJ that are covered by the concession. In calculating income tax on revenues related to sales to our Gramercy refinery, NBL uses a set market price, which is negotiated periodically between NBL and the GOJ. At the end of 2009, we and the GOJ reached an agreement setting the fiscal regime structure for NBL’s bauxite mining operations through December 31, 2014. The agreement covers the fiscal regime, as well as NBL’s commitment for certain expenditures for haulroad development, maintenance, dredging, land purchases, contract mining, training and other general capital expenditures from 2009 through 2014. If we do not meet our commitment to the GOJ regarding these expenditures, we would owe to the GOJ a penalty that could be material to our financial statements. We believe there is a remote possibility that we will not meet the commitment. We signed the formal amendment with the GOJ on the fiscal structure in June 2010, which did not change the cost structure from the agreement reached in 2009. The terms of the agreement required us to make a $14.0 million prepayment of Jamaican income taxes for fiscal years 2011 through 2014, of which $10.0 million was paid in June 2010 and the remainder will be paid in April 2011.

During 2010, approximately 60% of the bauxite from St. Ann is refined into alumina at our Gramercy refinery, and the remainder is sold to Sherwin Alumina Company pursuant to a contract through 2012. Beginning in 2011, pricing of the Sherwin contract is based on a percentage of LME, limited by certain ceilings and floors. The margins from these third-party sales effectively reduce the net cost of bauxite transferred to Gramercy. During the years ended December 31, 2008, 2009 and 2010, St. Ann mined 4.5 million, 3.2 million and 4.6 million DMTs of bauxite, respectively.

Energy

Electrical Power. The smelter is located in an area with abundant sources of electrical power. New Madrid has a power purchase agreement with Ameren Missouri, Missouri’s largest electric utility (“Ameren”), pursuant to which New Madrid has agreed to purchase substantially all of its electricity from Ameren through May 2020. This contract is for regulated power and cannot be altered without the approval of the Missouri Public Service Commission (“MoPSC”). On September 3, 2010, Ameren filed a rate case with the MoPSC seeking an 11% base rate increase. We expect a ruling on this request by July 29, 2011. The pricing structure of our power contract includes two components: a base rate and a fuel adjustment clause.

We are currently appealing several rate-related issues, including the previous two rate rulings and the amount of cost increases related to fuel adjustment charges. As of December 31, 2010, we have $9.8 million held in escrow by the Missouri Circuit Court for disputed amounts related to these appeals.

Natural Gas. Our Gramercy refinery has contractual arrangements with two local suppliers of natural gas, Shell Energy North America, L.P. (“Shell”) and Atmos Energy Marketing, LLC (“Atmos”). Shell supplies the majority of Gramercy’s natural gas needs on a month-to-month basis, following the expiration of our annual contract in April 2010. Atmos supplies the remaining natural gas under an annual contract that expires on April 30, 2011. We believe in the event Shell was unable or unwilling to continue to supply Gramercy with natural gas, there are sufficient alternatives, including Atmos, to meet our needs. These contracts guarantee a secure supply of natural gas at a price based on the Henry Hub Index plus transportation and pipeline costs. In addition, our contract with Atmos provides security in case of a short-term supply emergency (such as a hurricane or other force majeure situation), by granting Gramercy the option, at an established premium, to obligate Atmos to utilize its storage assets to supply Gramercy’s full natural gas supply requirements.

Fuel. Fuel is a substantial component of the cost structure at our St. Ann bauxite mine and is generally linked to the price of oil. The Pricing Index is based on the Platts Oilgram Price Reports, plus an adder for transportation and handling. The facility uses two types of oils. Bunker C or heavy fuel oil is supplied by Clark Oil Trading Company and diesel fuel is supplied by Petrojam, the local refinery. The contract with Petrojam expired December 31, 2010 and a new contract is currently being negotiated. The contract with Clark Oil expires on September 30, 2011.

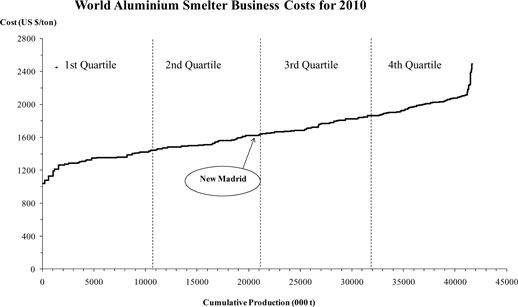

Competition. The market for primary aluminum is diverse and highly competitive. We believe that we compete on the basis of price, quality, timeliness of delivery and customer service, with our focus on the latter three areas. We also compete on a global basis with other producers and other materials on the basis of production cost. The marginal cost of these producers, who are in the highest

9

Table of Contents

cost quartile, is one factor in determining the market price for aluminum. Aluminum also competes with other materials such as steel, plastic, copper, titanium and glass, based upon functionality and relative pricing.

Sales and Marketing: Customers. We employ a sales force consisting of inside and outside salespeople. Inside salespeople are responsible for maintaining customer relationships, receiving and soliciting individual orders and responding to service and other inquiries by customers. Our outside sales force is responsible for identifying potential customers and calling them to explain our services, as well as maintaining and expanding our relationships with our current customers. The sales force is trained and knowledgeable about the characteristics and applications of various metals, as well as the manufacturing methods employed by our customers.

Our sales and marketing focus is on the identification of original equipment manufacturers, or “OEMs,” and other metals end-users that could achieve significant cost savings through the use of our inventory management, value-added processing, just-in-time delivery and other services. We use a variety of methods to identify potential customers, including the use of databases, direct mail and participation in manufacturers’ trade shows. Customer referrals and the knowledge of our sales force about regional end-users also result in the identification of potential customers. Once a potential customer is identified, our outside salespeople assume responsibility for visiting the appropriate customer contact, typically the vice-president of purchasing or operations and business owners.

All of our value-added (billet, foundry, rod) sales are on a negotiated price basis. In some cases, sales are the result of a competitive bid process where a customer provides a list of products, along with requirements, to us and several competitors and we submit a bid on each product. We have a diverse customer base in our upstream business, with no single customer accounting for more than 6% of our net sales in each of the last three full fiscal years. In 2010, our ten largest customers represented 42% of our net primary aluminum products sales.

Rolling Mills — Downstream Business

Business Overview. Our downstream business is an integrated manufacturer of aluminum foil and light sheet. Our rolling mills are located in the southeastern United States, in Huntingdon, Tennessee, Salisbury, North Carolina and Newport, Arkansas, with a combined maximum annual production capacity of 410 to 495 million pounds, depending on our production mix. Our products include heavy gauge foil products such as finstock and semi-rigid container stock, light gauge converter foils used for packaging applications, consumer foils and light gauge sheet products such as transformer windings and building products. We primarily sell our products to OEMs of air conditioners, transformers, semi-rigid containers and foil packaging, most of whom are located in the eastern and central part of the United States. Our plants are well situated to serve these customers and approximately 61% of deliveries are within a one-day truck delivery distance, resulting in freight savings and customer service benefits. Versatile manufacturing capabilities and advantageous geographic locations provide our rolling mills the flexibility to serve a diverse range of end uses while maintaining a low cost base. The Huntingdon site has ISO 9001-2000 certification from the International Organization for Standardization with regards to its quality management system. A description of the products produced at our four rolling mill facilities follows:

| Plant |

Location |

Maximum capacity | Products | |||

| (in millions of pounds) | ||||||

| Huntingdon – West | Huntingdon, TN | 235 | Finstock, container stock, intercompany reroll and miscellaneous heavy gauge products | |||

| Huntingdon – East | Huntingdon, TN | 130 | Finstock, transformer windings, household foil, and miscellaneous heavy gauge products | |||

| Salisbury | Salisbury, NC | 95 | Light gauge products including flexible packaging, finstock, lithographic sheet, intracompany reroll and miscellaneous leveled products | |||

| Newport | Newport, AR | 35 | Light gauge products including flexible packaging | |||

| Total |

495(1) | |||||

| (1) | Capacity includes intra-company reroll. Based on production mix at December 31, 2010, effective annual capacity of our rolling mills is 410 million pounds. |

Products. Aluminum foil has several outstanding characteristics that account for a wide range of commercial applications:

| • | long life—the aluminum surface has a natural hard, transparent layer of oxide which substantially precludes further oxidation; |

| • | high electrical and thermal conductivity; |

| • | nontoxic and nonabsorbent; |

| • | excellent moisture barrier even at thicknesses less than the diameter of a human hair; |

10

Table of Contents

| • | light weight; |

| • | highly reflective and attractive in appearance; |

| • | “dead fold” for packaging applications; |

| • | the most plentiful metal in the earth’s crust; |

| • | the most recycled packaging material in the world; and |

| • | attractive cost-to-weight ratio compared to other metals such as copper and tin. |

We have a variety of distinctive product and service capabilities, providing us with a strong competitive position. Our main product lines are the following:

Finstock: Bare or coated aluminum foil and sheet ranging in gauge from 0.002 inches to 0.007 inches is widely used as a heat exchanger in air conditioners because it provides more heat transfer area per unit of cost than any other material. Aluminum sheet and foil finstock are used in commercial, residential and automotive applications.

Semi-Rigid Containers: These products are typically made with harder alloys than finstock, although the range of gauges is similar, encompassing both foil and light sheet. Formed, disposable aluminum containers are among the most versatile of all packages and are widely used for pre-packaged foods, easily withstanding all normal extremes of heating and freezing.

Flexible Packaging: Aluminum foil is laminated to papers, paperboards and plastic films to make flexible and semi-rigid pouches and cartons for a wide range of food, drink, agricultural and industrial products. The laminating process is known as “converting,” hence the term “converter foil” for rolled aluminum products used in this application.

Transformer Windings: Aluminum sheet cut into strips and insulated is widely used as the conducting medium that forms the windings of electrical transformers widely used on power grids. Aluminum’s relatively low cost is key to this application.

We price our products at the MWTP plus a negotiated fabrication premium. The cost of primary metal is passed through to customers; therefore, our profitability is largely insulated from movement in aluminum prices except in periods of rapid change, which could create significant differences between the cost of metal purchased and the price of metal sold to customers. We use both primary aluminum, which is sourced from various smelters, and discounted metal units, which usually take the form of scrap or recycled scrap ingot. We seek to maximize profitability by optimizing both the mix of rolled products produced and the prime-to-scrap ratio in our metal feed. Historically, approximately 20% of our primary aluminum production is shipped to our rolling mills, providing security of supply, and allowing us to take advantage of short-term surges in demand.

Raw Materials and Supply. The principal raw materials that we use in rolled products manufacturing include primary aluminum, recycled aluminum and alloying elements. Total metal units purchased in 2010 were approximately 366 million pounds. These raw materials are generally available from several sources and are not subject to supply constraints under normal market conditions. We also consume considerable amounts of energy in the operation of our facilities, which is a significant component of our non-metal conversion costs.

In the downstream business, natural gas and electricity represent the substantial majority of our energy consumption. We purchase our natural gas on the open market with short to medium term supply contracts and agreements for key transportation requirements. See Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations - Quantitative and Qualitative Disclosures about Market Risk” for a summary of the price and quantity of natural gas hedging contracts.

Electricity is purchased through medium-term contracts at industrial rates from regional utilities supplied through local distributors. Supply has been reliable at all plants.

Competition. The aluminum rolled products market is highly competitive. We face domestic competition from a number of companies in the markets in which we operate. Our primary competitors are J.W. Aluminum Company, Aleris International Inc. and Novelis North America. Some of our competitors are substantially larger, have more diversified operations, and compete in product lines in which we do not operate. We also face competition from imports, mainly from Asia. The factors influencing competition vary by region and end-use, but we generally compete on the basis of price, product quality, the ability to meet customers’ specifications, range of products offered, lead times, technical support and customer service.

In addition to competition from within the aluminum rolled products industry, the industry faces competition from non-aluminum materials. In the packaging market, aluminum rolled products’ primary competitors are plastics and cardboard. However, for our most important heat exchanger customers, usage of aluminum finstock is well entrenched because we believe no other material offers more favorable economics. Factors affecting competition with substitute materials include technological innovation, relative prices, ease of manufacture, consumer preference and performance characteristics.

Sales and Marketing: Customers. Our sales force consists of inside and outside salespeople. Our outside sales force is primarily responsible for identifying potential customers and calling on them to negotiate profitable business and handling any subsequent issues that may arise. Inside salespeople are primarily responsible for maintaining customer relationships, receiving and

11

Table of Contents

soliciting individual orders and responding to service and other inquiries by customers. The sales force is trained and knowledgeable about the characteristics and applications of our various products, as well as our manufacturing methods and the end-use markets in which our customers are involved.

Our sales and marketing focus is on servicing OEMs who are major participants in the markets where our products are used as inputs. However, our staff participates in industry groups and attends trade shows in order to keep abreast of market developments and to identify potential new accounts. Once a potential new customer is identified, our outside salespeople assume responsibility for visiting the appropriate customer contact, typically the purchasing manager or manager of operations, to explore and develop business opportunities.

Nearly all business is conducted on a negotiated price basis, with a few sales made at list prices, typically to smaller accounts.

Our downstream business has a diverse customer base. Prior to 2009, no single customer accounted for more than 10% of our net sales in each of the last three years; however, in 2010, one customer represented 15% of net sales. In 2010, our ten largest flat rolled products customers represented 51% of flat rolled products net sales. Of our ten largest customers, we have done business with eight for ten years or more, and with six for 20 years or more.

Facilities. We operate four plants at three locations in the southeastern United States and our divisional offices, which consist of leased office space aggregating to approximately 30,000 square feet, are located at our corporate headquarters in Franklin, Tennessee.

Huntingdon. Our largest production site is in Huntingdon, Tennessee, with a maximum annual capacity of up to 365 million pounds, depending on production mix. The Huntingdon site is subject to a long-term lease arrangement with the Industrial Development Board of the Town of Huntingdon, pursuant to which we functionally own the facility and can acquire legal title for the nominal sum of $100. The site includes a long established casting and rolling facility which was built in 1967 and acquired from Archer Aluminum by Noranda in 1979, which we refer to as the East plant. Construction began on a second plant in 1998 and production started in 2000 at a capital cost of $238 million, which we refer to as the West plant. The two plants are physically separate, but are operated with shared administration and maintenance personnel, and with some sharing of production capabilities. According to CRU, the Huntingdon - West facility is one of the most advanced rolled aluminum production facilities in North America, and has the lowest conversion cost (excluding metal) for foil stock production in North and South America.

Salisbury. This plant was originally constructed in 1965 and has a maximum annual capacity of up to 95 million pounds, depending on production mix. The Salisbury plant is one of the largest U.S. producers of intermediate width light gauge product (less than 0.001 inches thickness), typically sold to customers who laminate the foil with paper, plastic or cardboard used in flexible packaging applications such as juice boxes. The facility also has a “tension leveling” line which enables production of lithographic sheet, a higher margin item used in the printing industry.

Newport. The Newport plant is a rolling and finishing operation only and relies on intermediate gauge “reroll” supplied by Salisbury or Huntingdon. The Newport plant has a maximum annual capacity of up to 35 million pounds, depending on production mix.

Employees

As of December 31, 2010, we employed approximately 2,400 persons.

We are a party to six collective bargaining agreements that expire at various times within the next five years. As of December 31, 2010, approximately 1,600 of our employees (or 69%) were members of the following unions: the United Steelworkers of America (“USWA”); the International Association of Machinists and Aerospace Workers (“IAMAW”); the University and Allied Workers Union (“UAWU”); and the Union of Technical, Administrative and Supervisory Personnel (“UTASP”). We have completed the process of formalizing recognition of a third union at St. Ann with the Bustamante Industrial Trade Union (“BITU”). We are currently in negotiations to finalize terms of a three year agreement with the BITU.

| • | The agreement with the USWA at our Gramercy refinery expired in September 2010, and on October 1, 2010 a new five year labor agreement with the USWA was ratified by the refinery’s union members. |

| • | The agreement at St. Ann with the UAWU expired on April 30, 2010. We are currently in negotiation to finalize the terms of a three year agreement with the UAWU. |

| • | The agreement at St. Ann with the UTASP expired in December 2010. As of December 31, 2010, we have not received a new claim and have not begun negotiations with the UTASP. (As customary in Jamaican labor practices, unions generally submit claims subsequent to the expiration of the collective bargaining agreements. Until a new agreement is ratified, we continue to operate under the terms of the expired agreement, and, once signed, the new agreement is retroactive to the previous expiration date.) |

| • | The agreement at our Newport rolling mill with the IAMAW expires in May 2011. |

| • | All other collective bargaining agreements expire within the next five years. |

12

Table of Contents

From time to time, there are shortages of qualified operators of metals processing equipment. In addition, during periods of low unemployment, turnover among less-skilled workers can be relatively high. We believe that our relations with our employees are satisfactory.

Safety

Our goal is to provide an accident-free workplace. We are committed to continuing and improving upon each facility’s focus on safety in the workplace. We have a number of safety programs in place, which include regular bi-weekly safety meetings and training sessions to teach proper safe work procedures.

Our executive management, along with site managers and union leadership, are actively involved in supporting and promoting the ongoing emphasis on workplace safety. Improvement in safety performance is a key metric used in determining annual incentive awards for our U.S. employees.

Research and Development

We do not incur material expenses in research and development activities but from time to time participate in various research and development programs. We address research and development requirements and product enhancement by maintaining a staff of technical support, quality assurance and engineering personnel.

Additional Information

Noranda Aluminum Holding Corporation was incorporated in Delaware on March 27, 2007. We file annual, quarterly and current reports and other information with the Securities and Exchange Commission (the “SEC”). You may read and copy any document we file with the SEC at the SEC’s public reference room at 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information on the public reference room. Our SEC filings are also available to the public at the SEC’s website at http://www.sec.gov.

You may obtain copies of the information and documents incorporated by reference in this report at no charge by writing or telephoning us at the following address or telephone number:

Noranda Aluminum Holding Corporation

801 Crescent Centre Drive, Suite 600

Franklin, TN 37067

Attention: Robert Mahoney

Chief Financial Officer

(615) 771-5700

We also maintain an internet site at http://www.norandaaluminum.com. We will, as soon as reasonably practicable after the electronic filing of our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports if applicable, make available such reports free of charge on our website. Our website and the information contained therein or connected thereto is not incorporated into this annual report.

13

Table of Contents

| ITEM 1A. | RISK FACTORS |

| You should carefully consider the risk factors set forth below as well as the other information contained in this Annual Report on |

Cyclical fluctuations in the primary aluminum industry cause variability in our earnings and cash flows.

Our operating results depend on the market for primary aluminum, a cyclical commodity with prices subject to global market forces of supply and demand and other related factors. Such factors include speculative activities by market participants, production activities by competitors, political and economic conditions, and production costs in major production regions. A substantial increase in primary aluminum production capacity could further affect prices. Prices have been historically volatile. Over the past ten years, the average daily LME settlement price has ranged from a low of $0.56 per pound in November 2001 to a high of $1.49 per pound in July 2008.

Beginning in the second half of 2008, global economic contraction severely impacted the aluminum industry. Driven by significant weakness in end-use markets such as housing and transportation, aluminum prices experienced a profound decline. During that contraction, the monthly average LME price dropped from a peak of $1.49 in July 2008, to a low of $0.57 in February 2009. The decline in LME price to levels at which our production cash costs were higher than our primary metal selling prices had a significant negative impact on our operating results. Though LME prices have risen to $1.12 as of December 31, 2010, our business, financial condition, results of operations and cash flows could be materially and adversely affected by significant declines in LME prices in the future.

Although we have at times hedged our exposure to the volatility of LME prices since the Apollo Acquisition, we currently have no such hedges in place. If we do not undertake further hedging activities, we will continue to have price risk with respect to the unhedged portion of our primary aluminum shipments. A prolonged downturn in prices for primary aluminum could significantly reduce the amount of cash available to us to meet our current obligations and fund our long-term business strategies. In addition, we may enter into new hedging arrangements in the future, which may not be beneficial, depending on subsequent LME price changes, and could materially and adversely affect our business, financial condition, results of operations and cash flows.

We are under no obligation under our senior secured credit facilities, our AcquisitionCo Notes or otherwise to enter into further hedging arrangements. Future market prices for aluminum could decline materially, reducing our revenues and cash flows. For additional information regarding our hedging activities, see Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and Item 7A, “Quantitative and Qualitative Disclosures about Market Risk.”

Our significant cost components, specifically our supply of alumina, which we own, and our New Madrid power contract are not tied to the LME price of aluminum. As a result, as the LME price decreases, we are at a competitive disadvantage to non-integrated primary aluminum producers and our profit margins are reduced which could materially and adversely affect our business, financial condition, results of operations and cash flows.

A continued or renewed downturn in general economic conditions, as well as a downturn in the end-use markets for certain of our products, could materially and adversely affect our business, financial condition, results of operations and cash flows.

A global recession and credit crisis began in late 2007 and continued through much of 2009. This crisis substantially impacted our upstream and downstream businesses. While the global market for our primary aluminum products has meaningfully recovered from its trough in early 2009 and the markets for our downstream products stabilized in the second half of 2009, a renewed decline in either the global primary aluminum market or the North American rolled products markets would have a negative impact on our business, financial condition, results of operations and cash flows. Historically, global supply and demand for primary aluminum have fluctuated in part due to general economic and market conditions in the United States and other major global economies, including China. In addition, certain end-use markets for our rolled products, such as the housing, construction and transportation industries, experience demand cycles that are correlated to the general economic environment. Economic downturns in regional and global economies or a decrease in manufacturing activity in industries such as construction, packaging and consumer goods, all of which are sensitive to a number of factors outside our control, could materially and adversely affect our business, financial condition, results of operations and cash flows.

Losses caused by disruptions in the supply of electrical power could materially and adversely affect our business, financial condition, results of operations and cash flows.

We are subject to losses associated with equipment shutdowns, which may be caused by the loss or interruption of electrical power to our facilities due to unusually high demand, blackouts, equipment failure, natural disasters or other catastrophic events. We use large amounts of electricity to produce primary aluminum, and any loss of power that causes an equipment shutdown can result in the hardening or “freezing” of molten aluminum in the pots where it is produced. If this occurs, we may experience significant losses

14

Table of Contents

if the pots are damaged and require repair or replacement, a process that could limit or shut down our production operations for a prolonged period of time.

During the week of January 26, 2009, power supply to our New Madrid smelter was interrupted numerous times because of a severe ice storm in Southeastern Missouri, causing a loss of approximately 75% of the smelter capacity. Although the smelter returned to full operations by March 31, 2010, there can be no assurance that we will not ultimately experience shorter pot lives or higher failure rates as a result of damage from the equipment shutdown.

Although we maintain property and business interruption insurance to mitigate losses resulting from catastrophic events, we may be required to pay significant amounts under the deductible provisions of those insurance policies. In addition, our coverage may not be sufficient to cover all losses, or may not address all causes of loss or cover certain events. Certain of our insurance policies do not cover any losses we may incur if our suppliers are unable to provide us with power during periods of unusually high demand.

Our operations consume substantial amounts of energy and our profitability may decline if energy costs rise.

Electricity and natural gas are essential to our businesses, which are energy intensive. The costs of these resources can vary widely and unpredictably. The factors that affect our energy costs tend to be specific to each of our facilities. Electricity is the largest cost component at our New Madrid smelter and is a key factor to our long-term competitive position in the primary aluminum business. We have a power purchase agreement with Ameren Missouri, Missouri’s largest electric utility (“Ameren”), pursuant to which we have agreed to purchase substantially all of New Madrid’s electricity through May 2020. Ameren may increase the rates it charges its customers, including Noranda, with the approval of the Missouri Public Service Commission (“MoPSC”).

On June 21, 2010, the MoPSC ruled on the power rate case filed by Ameren on July 24, 2009. The MoPSC’s ruling resulted in no significant change to the base electricity rate for the New Madrid smelter. The fuel adjustment clause resulted in additional fuel charges of $5.4 million recorded in cost of goods sold during the year ended December 31, 2010. Though we are not able to predict future fuel adjustment charges, as they are dependent on Ameren’s fuel costs and off system sales volume and prices, we expect the impact of fuel adjustment charges in 2011 to increase our integrated primary aluminum cash cost by 2 to 3 cents per pound for 2011. On September 3, 2010, Ameren filed a new rate case with the MoPSC seeking an 11% base rate increase. We expect a ruling on this request by July 29, 2011. The outcome of the rate case or any future rate cases Ameren may initiate could materially and adversely affect the competitiveness and long-term viability of our smelter as well as our business, financial condition, results of operations and cash flows.

Electricity is also a key cost component at our rolling mill facilities. Electricity is purchased through medium-term contracts at industrial rates from regional utilities supplied through local distributors. If we are unable to obtain power at affordable rates upon expiration of these contracts, we may be forced to curtail or idle a portion of our production capacity, which could materially and adversely affect our business, financial condition, results of operations and cash flows.

Natural gas is the largest cost component at our Gramercy refinery and a key cost component at our rolling mill facilities. Our Gramercy refinery has contracts to guarantee secure supply from two suppliers at an index-based price. Our downstream business purchases natural gas on the open market. The price of natural gas can be particularly volatile. As a result, our natural gas costs may fluctuate dramatically, and we may not be able to mitigate the effect of higher natural gas costs on our cost of sales. Any substantial increases in energy costs could cause our operating costs to increase and could materially and adversely affect our business, financial condition, results of operations and cash flows. At December 31, 2010, we are a party to forward swaps for natural gas, effectively fixing our cost for approximately 45% of our natural gas exposure through 2012. We will continue to have price risk with respect to the unhedged portion of our natural gas purchases. In addition, our actual future usage may be higher or lower than we estimated. As a result of these factors, our hedging activities may be less effective than expected in reducing the economic variability of our future costs.

Fuel is a substantial component of the cost structure at our St. Ann bauxite mining operation. Our fuel is provided under an indexed-based contract linked to the price of oil. Our fuel costs at St. Ann may fluctuate, and we may not be able to mitigate the effect of higher fuel costs. Changes in the index will have an impact on our cost structure. Any increases in fuel costs could cause our operating costs to increase and could materially and adversely affect our business, financial condition, results of operations and cash flows.

We may encounter increases in the cost of raw materials, which could cause our cost of goods sold to increase, thereby materially and adversely affecting our business, financial condition, results of operations or cash flows and limiting our operating flexibility.

We require substantial amounts of raw materials in our business. These raw materials consist principally of bauxite, alumina, primary aluminum, recycled aluminum and aluminum scrap; however, pricing volatility of other raw materials, including carbon products and caustic soda, may have a significant impact on our costs. If raw material prices increase we may not be able to pass on the entire cost of the increases to our customers or offset fully the effects of high raw materials costs through productivity improvements, which could materially and adversely affect our business, financial condition, results of operations or cash flows.

Beginning in fourth quarter 2008 and continuing through second quarter 2009, the cost of alumina purchased from the Gramercy refinery exceeded the spot prices of alumina available from other sources. If such situations arise in the future, we may not

15

Table of Contents

be able to decrease Gramercy’s production in response to changes in market forces and any such decreases will increase our unit costs and limit our ability to fully recover fixed costs. We may be forced to sell excess alumina at market prices that could be substantially lower than our cash cost of production, which could materially and adversely affect our business, financial condition, results of operations and cash flows.

During 2010, we sold approximately 40% of St. Ann’s bauxite production to Sherwin Alumina Company pursuant to a contract that extends through 2012. Margins from these sales effectively reduce the net cost of bauxite to Gramercy. In the event Sherwin Alumina Company is unable to honor that contract, or chooses not to extend the contract upon expiration, the net cost of our bauxite could increase, which could materially and adversely affect our business, financial condition, results of operations and cash flows.

Prices for the raw materials used by our downstream business, including primary aluminum, recycled aluminum and alloying elements, are subject to continuous volatility and may increase from time to time. Our sales are generally made on the basis of a “margin over metal price,” but if raw material costs other than metal increase we may not be able to pass on the entire cost of the increases to our customers or offset fully the effects of high raw materials costs through productivity improvements, which could materially and adversely affect our business, financial condition, results of operations and cash flows. In addition, a sustained material increase in raw materials prices may cause some of our customers to substitute other materials for our products.

We may be unable to continue to compete successfully in the highly competitive markets in which we operate.

We are engaged in a highly competitive industry. We compete with a number of large, well-established companies in each of the markets in which we operate. Our primary aluminum products segment competes with a large number of other value-added metals producers on an international, national, regional and local basis. We also compete, to a much lesser extent, with primary metals producers, who typically sell to very large customers requiring regular shipments of large volumes of metals. Our flat rolled products segment competes in the production and sale of rolled aluminum products with a number of other aluminum rolling mills, including large, single-purpose sheet mills, continuous casters and other multi-purpose mills. Aluminum also competes with other materials, such as steel, copper, plastics, composite materials and glass, among others, for various applications. In the past, for certain applications customers have demonstrated a willingness to substitute other materials for aluminum. In both businesses, some of our competitors are larger than us and have greater financial and technical resources than we do. These larger competitors may be better able to withstand reductions in price or other adverse industry or economic conditions.

Similarly, competitors with superior cost positions to ours, particularly those competitors that operate smelters with access to relatively lower cost production inputs, may be better able to withstand reductions in price or other adverse industry or economic conditions. In the event that the current competitive smelter cost landscape changes such that other smelters see stability or reductions in their major input costs and/or we see increases in ours, the long-term viability of our smelter could be compromised. A current or new competitor may also add or build new capacity, which could diminish our profitability by decreasing the equilibrium prices in our markets. New competitors could emerge from within North America or globally, including in China and the Middle East. If we do not compete successfully, our business, financial condition, results of operations and cash flows could be materially and adversely affected.

In addition, our flat rolled products segment competes with other rolled products suppliers, principally multi-purpose mills, on the basis of quality, price, and timeliness of delivery, technological innovation and customer service. One primary competitive factor, particularly in the flat rolled business, is price. We may be required in the future to reduce fabrication prices or shift our production to products that generally yield lower fabrication prices in order to remain at full capacity, which could impact our level of profitability. In addition, technological innovation is important to our customers and if we are unable to lead or effectively meet new innovations to meet our customers’ needs, such as down-gauging, our financial performance could be materially and adversely impacted. Increased competition in any of our businesses could have a material and adverse effect on our business, financial condition, results of operations and cash flows.

Aluminum may become less competitive with alternative materials, which could reduce our share of industry sales, lower our selling prices and reduce our sales volumes.

Aluminum competes with other materials such as steel, copper, plastics, composite materials and glass for various applications. Higher aluminum prices relative to substitute materials tend to make aluminum products less competitive with these alternative materials. Environmental or other regulations may increase our costs and be passed on to our customers, making our products less competitive. The willingness of customers to accept aluminum substitutes, or the ability of large customers to exert leverage in the marketplace to affect pricing for fabricated aluminum products, could result in a reduced share of industry sales or reduced prices for our products and services, which could decrease revenues or reduce volumes, either of which could materially and adversely affect our business, financial condition, results of operations and cash flows.

If we were to lose order volumes from any of our largest customers, our revenues and cash flows could be materially reduced.

Our business is exposed to risks related to customer concentration. In 2010, our ten largest customers were responsible for 36% of our consolidated revenues. In 2010, no one customer accounted for more than 8% of our consolidated revenues. A loss of order volumes from or a loss of industry share by, any major customer could materially and adversely affect our financial condition and results of operations by lowering sales volumes, increasing costs and lowering profitability. In addition, our customers may become

16

Table of Contents

involved in bankruptcy or insolvency proceedings or default on their obligations to us. Our balance sheet reflected an allowance for doubtful accounts totaling $0.2 million at December 31, 2009 and 2010.

We do not have long-term contractual arrangements with a significant majority of our customers, and our revenues and cash flows could be reduced if our customers switch their suppliers.

A significant majority of our customer contracts have a term of one year or less, although we have long-term relationships with many of our customers. Many of our customers purchase products and services from us on a purchase order basis and may choose not to continue to purchase our products and services. The loss of these customers or a significant reduction in their purchase orders could have a material and adverse impact on our sales volume and business, or cause us to reduce our prices, which could have a material and adverse effect on our business, financial condition, results of operations and cash flows.

Our business requires substantial capital investments that we may be unable to fulfill.

Our operations are capital intensive. Our capital expenditures were $51.6 million, $46.7 million and $61.3 million for 2008, 2009, and 2010 respectively. On a pro forma basis assuming 100% ownership for Gramercy and St. Ann, capital expenditures would have been $82.2 million and $52.3 million for 2008 and 2009, respectively.

We may not generate sufficient operating cash flows and our external financing sources may not be available in an amount sufficient to enable us to make required capital expenditures, service or refinance our indebtedness or fund other liquidity needs. If we are unable to make upgrades or purchase new plant and equipment, our business, financial condition, results of operations and cash flows could be materially and adversely affected by higher maintenance costs, lower sales volumes due to the impact of reduced product quality and other competitive influences.

We may be materially and adversely affected by environmental, safety, production and product regulations or concerns.

Our operations are subject to a wide variety of U.S. federal, state, local and non-U.S. environmental laws and regulations, including those governing emissions to air, discharges to waters, the generation, use, storage, transportation, treatment and disposal of hazardous materials and wastes, land reclamation and employee health and safety matters. Compliance with environmental laws and regulations can be costly, and we have incurred and will continue to incur costs, including capital expenditures, to comply with these requirements. Additionally, certain of our raw material suppliers may be subject to significant compliance costs, which may be passed through to us. As these direct or indirect regulatory costs increase and are passed through to our customers, our products may become less competitive than other materials, which could reduce our sales. If we are unable to comply with environmental laws and regulations, we could incur substantial costs, including fines and civil or criminal sanctions, or costs associated with upgrades to our facilities or changes in our manufacturing processes in order to achieve and maintain compliance. In addition, environmental requirements change frequently and have tended to become more stringent over time. We cannot predict what environmental laws or regulations will be enacted or amended in the future, how existing or future laws or regulations will be interpreted or enforced, or the amount of future expenditures that may be required to comply with such laws or regulations. Our costs of compliance with current and future environmental requirements could materially and adversely affect our business, financial condition, results of operations and cash flows.

In addition, as an owner and operator of real property and a generator of hazardous waste, we may be subject to environmental cleanup liability, regardless of fault, pursuant to Superfund or analogous state or non-U.S. laws. Thus, we could incur substantial costs, including cleanup costs and costs arising from third-party property damage or personal injury claims, relating to environmental contamination at properties currently or formerly operated by us or at third-party sites at which wastes from our operations have been disposed. Contaminants have been discovered in the soil and/or groundwater at some of our facilities. The discovery of additional contaminants or the imposition of additional cleanup obligations at these or other sites could result in significant liability. In addition, because we use or process hazardous substances in our operations, we may be liable for personal injury claims or workers’ compensation claims relating to exposure to hazardous substances.

We have identified certain environmental matters at both Gramercy and St. Ann, which are disclosed in our consolidated financial statements to the extent they represent liabilities as defined by U.S. GAAP. There could be other significant environmental issues of which we are not aware. The occurrence of new environmental issues could materially and adversely affect our business, financial condition, results of operations and cash flows.

Some of our facilities are located in areas that have been subject to natural disasters. Future natural disasters in these areas could damage our facilities and disrupt our operations.

Our aluminum smelter is located in New Madrid, Missouri on the banks of the Mississippi River and near the New Madrid fault line, in an area that may be subject to natural disasters such as floods, tornados, ice storms and earthquakes. As experienced during the January 2009 ice storm and subsequent power outages at our New Madrid facility, when such a disaster occurs, it can damage the facility in question and disrupt our production of aluminum. Our bauxite mine is located in St. Ann, Jamaica and our refinery is located in Gramercy, Louisiana, areas that may be exposed to hurricanes. In addition, our other facilities may be subject to natural disasters. We maintain insurance to protect us from events that may be caused by floods, earthquakes, tornados and hurricanes in amounts that we believe are commercially reasonable. There can be no assurance, however, that such insurance would be available on

17

Table of Contents