Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - TELLURIAN INC. /DE/ | a2013-02ipaaogis.htm |

NASDAQ: MPET February 2013 Delivering Shareholder Value Exhibit 99.1

1 Forward Looking Statements Statements in this presentation which are not historical in nature are intended to be, and are hereby identified as, forward-looking statements for purposes of the Private Securities Litigation Reform Act of 1995. These statements about Magellan and Magellan Petroleum Australia Limited (“MPAL”) may relate to their businesses and prospects, revenues, expenses, operating cash flows, and other matters that involve a number of uncertainties that may cause actual results to differ materially from expectations. Among these risks and uncertainties are the following: the future outcome of the negotiations by Santos with its customers for gas sales contracts for the remaining uncontracted reserves in the Amadeus Basin; the production volume at Mereenie and whether it will be sufficient to trigger the bonus amounts provided for in the Santos asset swap/sales agreement; the ability of the Company to successfully develop its existing assets; the ability of the Company to secure gas sales contracts for the uncontracted reserves at Dingo; the ability of the Company to implement a successful exploration program; pricing and production levels from the properties in which Magellan and MPAL have interests; the extent of the recoverable reserves at those properties; the profitable integration of acquired businesses, including Nautilus Poplar LLC; the likelihood of success of the drilling program at the Poplar Fields by the Company’s new farm-in partner, VAALCO Energy; and the results of the ongoing production well tests in the U.K. In addition, MPAL has a large number of exploration permits and faces the risk that any wells drilled may fail to encounter hydrocarbons in commercially recoverable quantities. Any forward-looking information provided in this report should be considered with these factors in mind. Magellan assumes no obligation to update any forward-looking statements contained in this report, whether as a result of new information, future events, or otherwise. Oil and gas issuers are required to include disclosures regarding proved oil and gas reserves in certain filings made with the U.S. Securities and Exchange Commission (“SEC”). Proved reserves are the estimated quantities of crude oil, natural gas, and natural gas liquids which geological and engineering data demonstrate with reasonable certainty to be recoverable in future years from known reservoirs under existing economic and operating conditions, i.e., prices and costs as of the date the estimate is made. The SEC also permits the disclosure of probable and possible reserves which are additional reserves that are less certain to be recovered. Investors are urged to consider closely the disclosures in Magellan’s periodic filings with the SEC available from us at the Company’s website, www.magellanpetroleum.com.

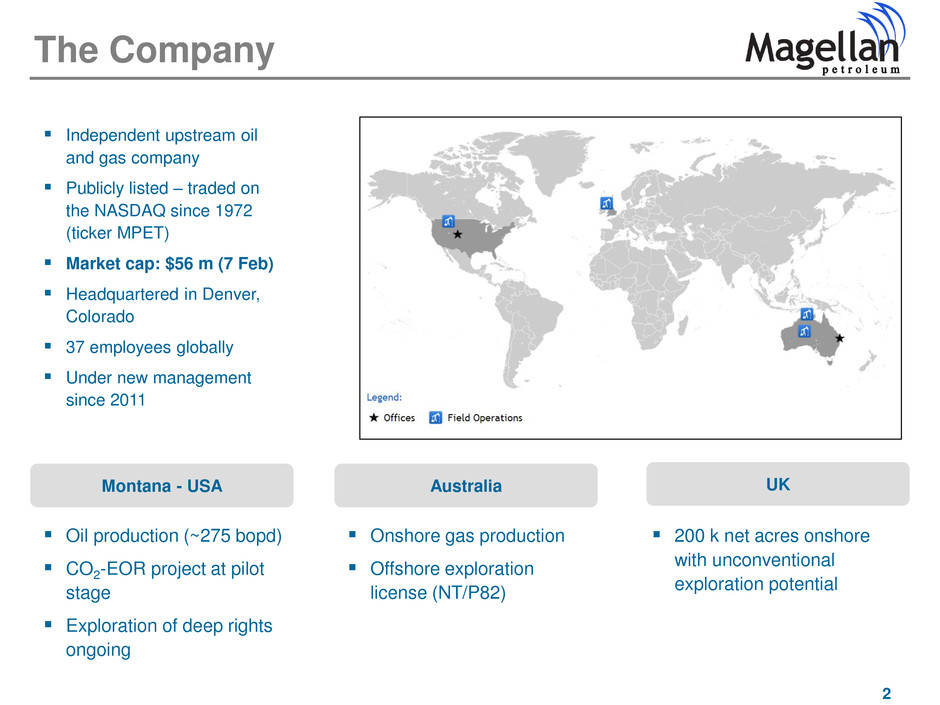

2 The Company Independent upstream oil and gas company Publicly listed – traded on the NASDAQ since 1972 (ticker MPET) Market cap: $56 m (7 Feb) Headquartered in Denver, Colorado 37 employees globally Under new management since 2011 Oil production (~275 bopd) CO2-EOR project at pilot stage Exploration of deep rights ongoing Onshore gas production Offshore exploration license (NT/P82) 200 k net acres onshore with unconventional exploration potential Montana - USA Australia UK

3 Exploration and development company with existing production and three high- growth assets Favorable market dynamics – Strong oil pricing in the US – Australian gas market – robust pricing – OECD countries only Attractive Company economics – Stable base level of production and reserves in US and Australia – Significant valuation upside from development of assets – Long-term contracts in Australia Control of core assets – 100% ownership Poplar CO2-EOR – 100% ownership of Australian assets Focused organization under new management – Emerging from an 18-month turnaround – Streamlined portfolio of projects poised for growth – Newly hired staff in US with decades of O&G experience Investment Considerations

4 27.3 15.6 87.2 PDP PDNP PUD 130.1 m 82% 18% US Australia 10.8 MMboe 82% 18% Oil Gas 10.8 MMboe 21% 12% 67% PDP PDNP PUD 10.8 MMboe PV-10 ($ m) Oil / Gas Proved Reserves Ratio Proved Reserves by Geography Proved Reserves Reserves Overview1 1. As of June 30, 2012.

5 Antoine Lafargue (38) – CFO Former CFO of Falcon Gas Storage based in Houston, TX Previously, a principal with Arcapita, a private equity fund focused on the energy and infrastructure sectors Previously held investment banking positions with DLJ/Credit Suisse and Bank of America Mark Brannum (46) – General Counsel & Secretary Former Deputy General Counsel of SM Energy Company Previously, a shareholder with Winstead P.C., a large business law firm based in Dallas, TX Over 17 years of in-house and outside counsel legal experience Tom Wilson (60) – CEO Former President of KMOC and Anderman International Former First Vice President and director of Young Energy Prize Previously, led new international strategy for Apache and served as a Project Manager for Shell Oil Robin West (66) – Chairman Founder, CEO of PFC Energy Former Reagan Administration Assistant Secretary of the Interior (1981-83), responsible for U.S. offshore oil policy Member of National Petroleum Council and Council on Foreign Relations Director of Key Energy Services and formerly of Cheniere Energy Experienced Leadership

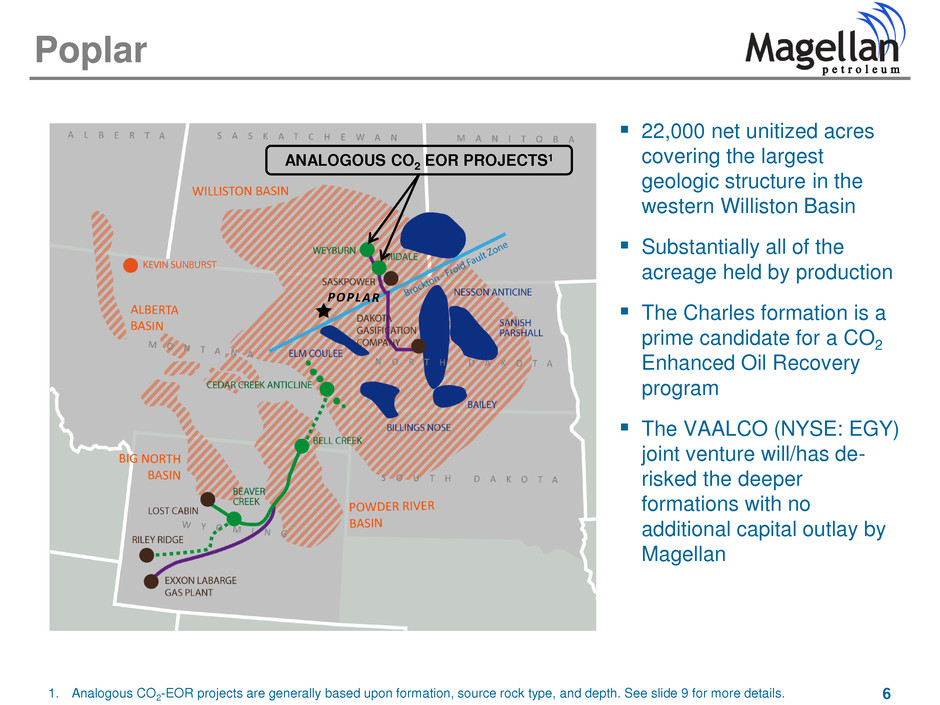

6 22,000 net unitized acres covering the largest geologic structure in the western Williston Basin Substantially all of the acreage held by production The Charles formation is a prime candidate for a CO2 Enhanced Oil Recovery program The VAALCO (NYSE: EGY) joint venture will/has de- risked the deeper formations with no additional capital outlay by Magellan Poplar ANALOGOUS CO2 EOR PROJECTS 1 1. Analogous CO2-EOR projects are generally based upon formation, source rock type, and depth. See slide 9 for more details.

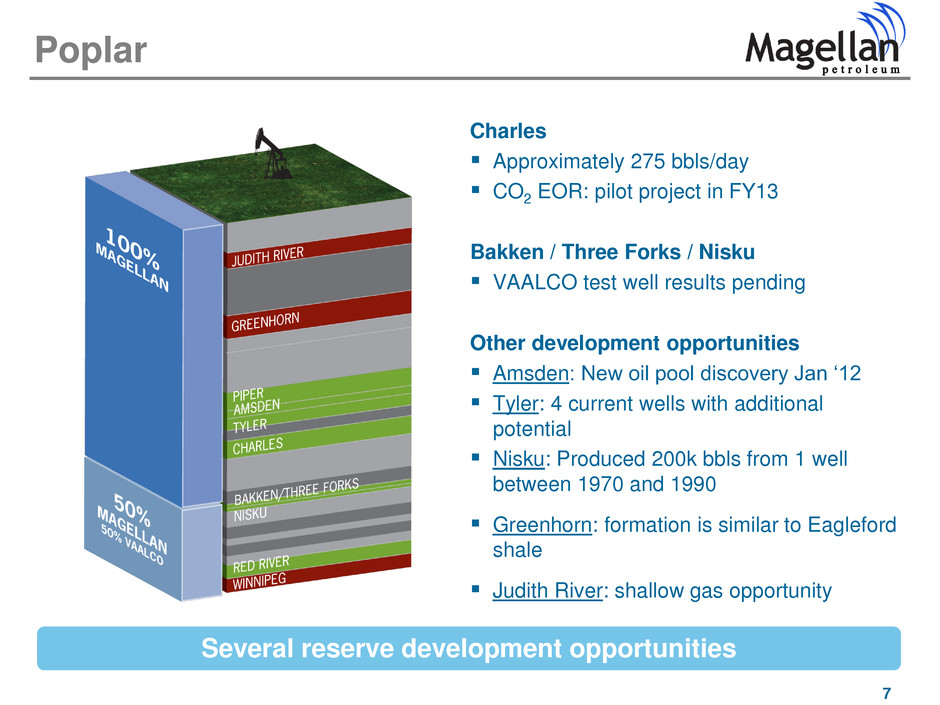

7 Charles Approximately 275 bbls/day CO2 EOR: pilot project in FY13 Bakken / Three Forks / Nisku VAALCO test well results pending Other development opportunities Amsden: New oil pool discovery Jan ‘12 Tyler: 4 current wells with additional potential Nisku: Produced 200k bbls from 1 well between 1970 and 1990 Greenhorn: formation is similar to Eagleford shale Judith River: shallow gas opportunity Poplar Several reserve development opportunities

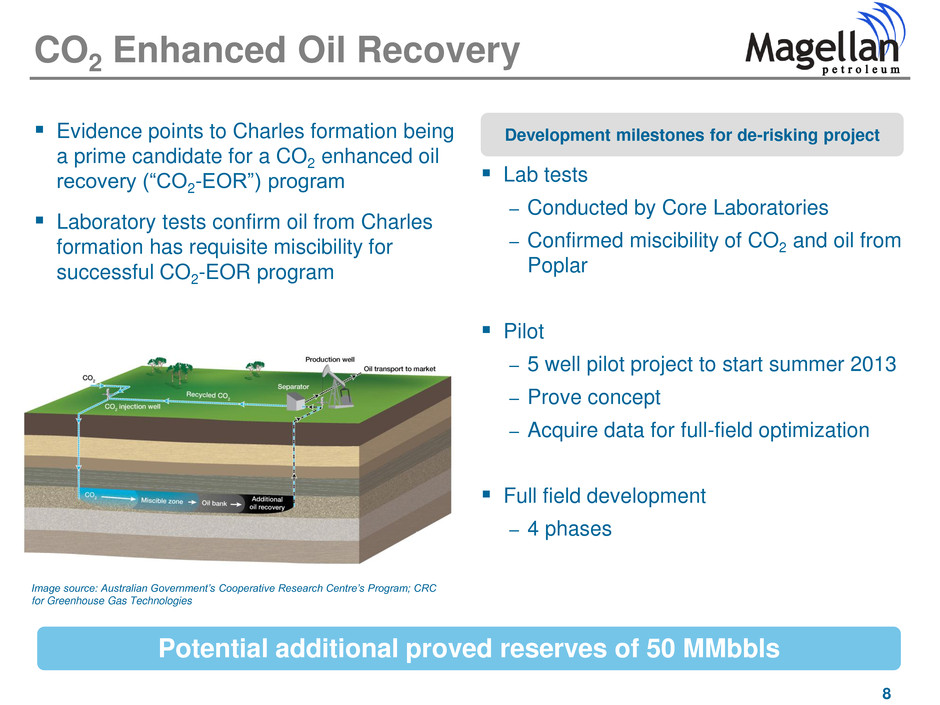

8 Development milestones for de-risking project Evidence points to Charles formation being a prime candidate for a CO2 enhanced oil recovery (“CO2-EOR”) program Laboratory tests confirm oil from Charles formation has requisite miscibility for successful CO2-EOR program Lab tests – Conducted by Core Laboratories – Confirmed miscibility of CO2 and oil from Poplar Pilot – 5 well pilot project to start summer 2013 – Prove concept – Acquire data for full-field optimization Full field development – 4 phases CO2 Enhanced Oil Recovery Potential additional proved reserves of 50 MMbbls Image source: Australian Government’s Cooperative Research Centre’s Program; CRC for Greenhouse Gas Technologies

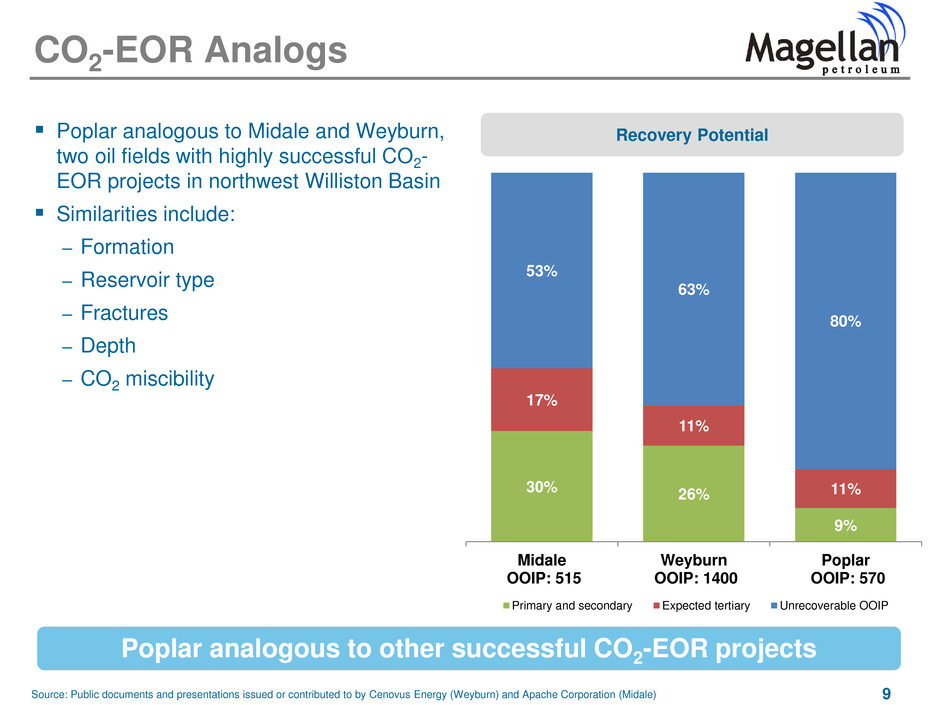

9 Recovery Potential Poplar analogous to Midale and Weyburn, two oil fields with highly successful CO2- EOR projects in northwest Williston Basin Similarities include: – Formation – Reservoir type – Fractures – Depth – CO2 miscibility CO2-EOR Analogs Poplar analogous to other successful CO2-EOR projects Source: Public documents and presentations issued or contributed to by Cenovus Energy (Weyburn) and Apache Corporation (Midale) 30% 26% 9% 17% 11% 11% 53% 63% 80% Midale OOIP: 515 Weyburn OOIP: 1400 Poplar OOIP: 570 Primary and secondary Expected tertiary Unrecoverable OOIP

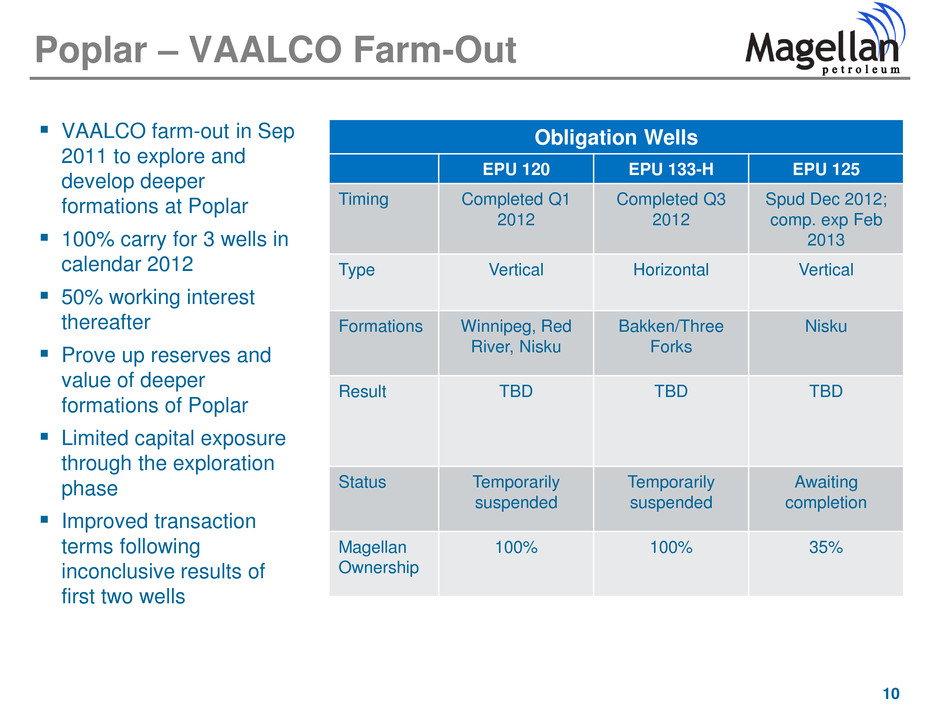

10 VAALCO farm-out in Sep 2011 to explore and develop deeper formations at Poplar 100% carry for 3 wells in calendar 2012 50% working interest thereafter Prove up reserves and value of deeper formations of Poplar Limited capital exposure through the exploration phase Improved transaction terms following inconclusive results of first two wells Poplar – VAALCO Farm-Out Obligation Wells EPU 120 EPU 133-H EPU 125 Timing Completed Q1 2012 Completed Q3 2012 Spud Dec 2012; comp. exp Feb 2013 Type Vertical Horizontal Vertical Formations Winnipeg, Red River, Nisku Bakken/Three Forks Nisku Result TBD TBD TBD Status Temporarily suspended Temporarily suspended Awaiting completion Magellan Ownership 100% 100% 35%

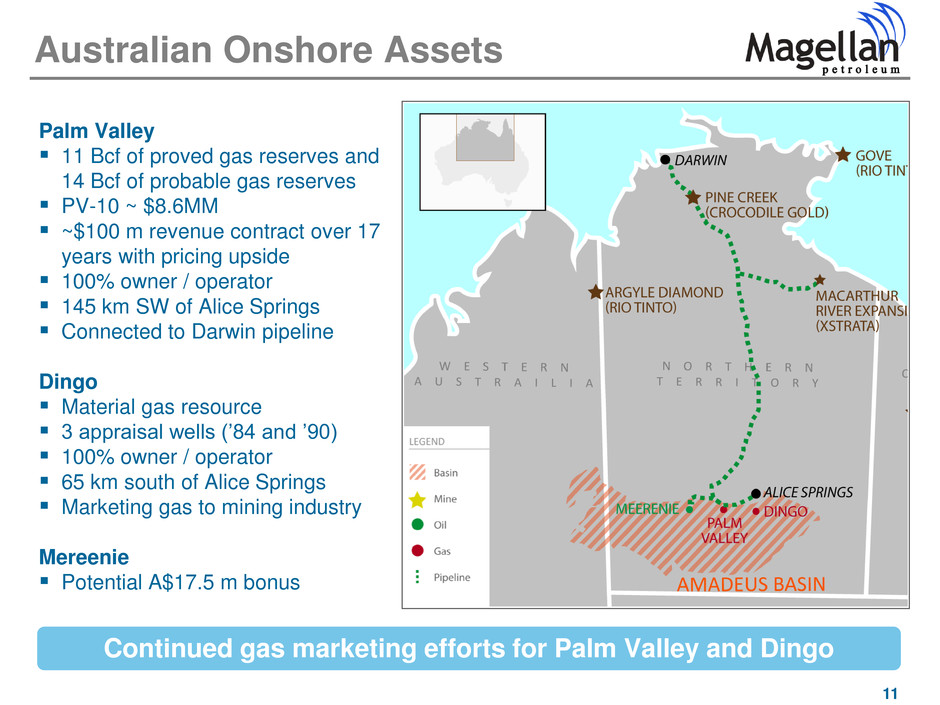

11 Palm Valley 11 Bcf of proved gas reserves and 14 Bcf of probable gas reserves PV-10 ~ $8.6MM ~$100 m revenue contract over 17 years with pricing upside 100% owner / operator 145 km SW of Alice Springs Connected to Darwin pipeline Dingo Material gas resource 3 appraisal wells (’84 and ’90) 100% owner / operator 65 km south of Alice Springs Marketing gas to mining industry Mereenie Potential A$17.5 m bonus Australian Onshore Assets Continued gas marketing efforts for Palm Valley and Dingo

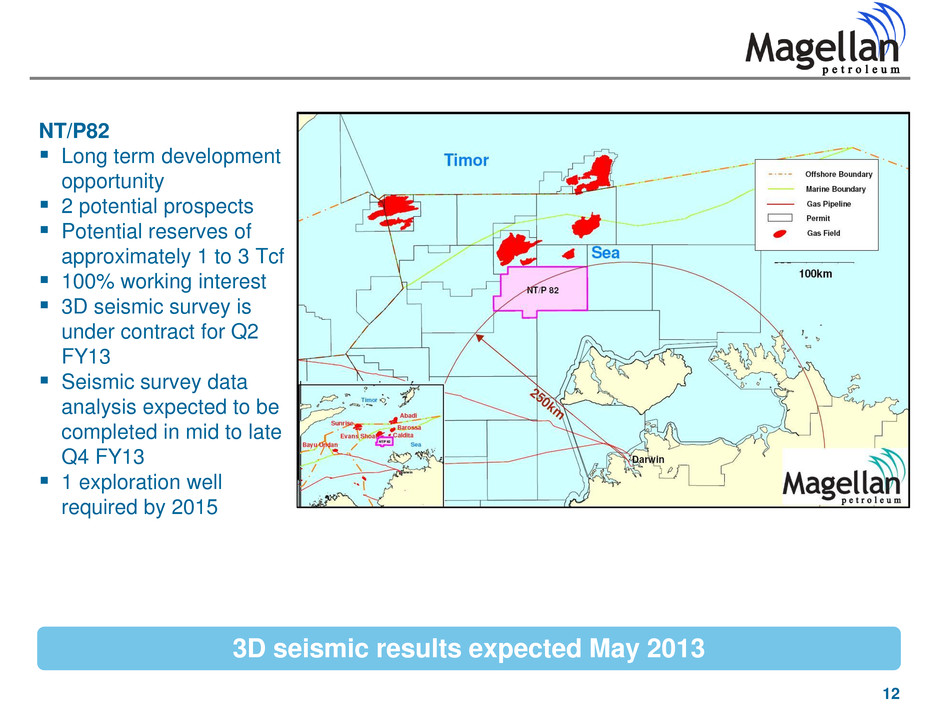

12 NT/P82 Long term development opportunity 2 potential prospects Potential reserves of approximately 1 to 3 Tcf 100% working interest 3D seismic survey is under contract for Q2 FY13 Seismic survey data analysis expected to be completed in mid to late Q4 FY13 1 exploration well required by 2015 3D seismic results expected May 2013

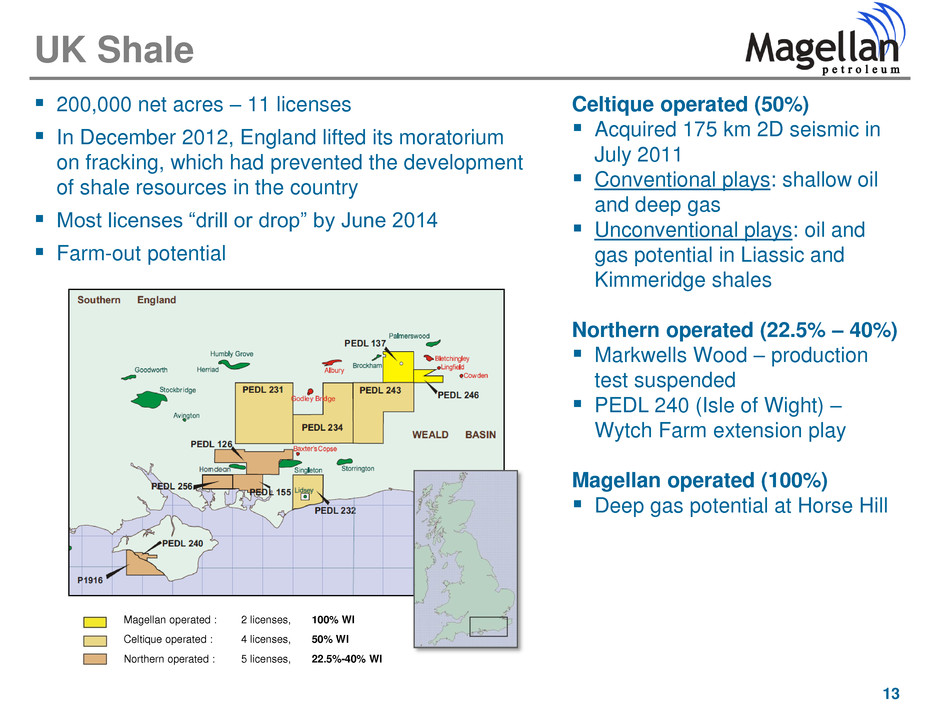

13 200,000 net acres – 11 licenses In December 2012, England lifted its moratorium on fracking, which had prevented the development of shale resources in the country Most licenses “drill or drop” by June 2014 Farm-out potential Celtique operated (50%) Acquired 175 km 2D seismic in July 2011 Conventional plays: shallow oil and deep gas Unconventional plays: oil and gas potential in Liassic and Kimmeridge shales Northern operated (22.5% – 40%) Markwells Wood – production test suspended PEDL 240 (Isle of Wight) – Wytch Farm extension play Magellan operated (100%) Deep gas potential at Horse Hill UK Shale Magellan operated : 2 licenses, 100% WI Celtique operated : 4 licenses, 50% WI Northern operated : 5 licenses, 22.5%-40% WI

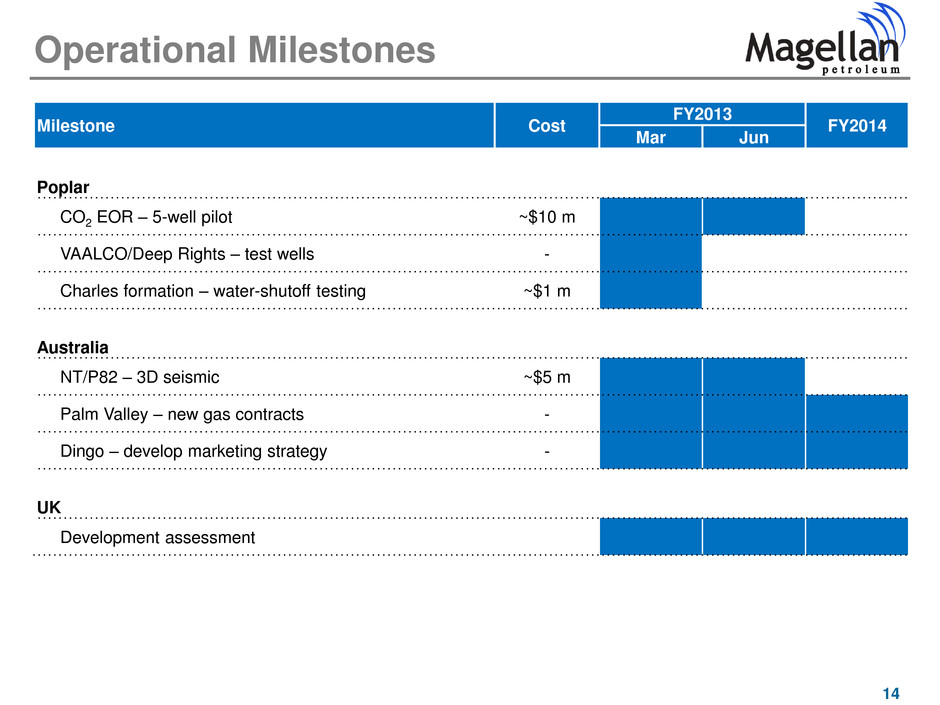

14 Operational Milestones Milestone Cost FY2013 FY2014 Mar Jun Poplar CO2 EOR – 5-well pilot ~$10 m VAALCO/Deep Rights – test wells - Charles formation – water-shutoff testing ~$1 m Australia NT/P82 – 3D seismic ~$5 m Palm Valley – new gas contracts - Dingo – develop marketing strategy - UK Development assessment

Questions?