Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CNO Financial Group, Inc. | form8-k022013creditsuisse.htm |

| EX-99.1 - EXHIBIT 99.1 - CNO Financial Group, Inc. | exhibit991022013creditsuis.htm |

2013 Credit Suisse Financial Services Forum February 14, 2013 Exhibit 99.2

CNO Financial Group | Credit Suisse 2013 Financial Services Forum | February 14, 2013 2

CNO Financial Group | Credit Suisse 2013 Financial Services Forum | February 14, 2013 3 Forward-Looking Statements Certain statements made in this presentation should be considered forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995. These include statements about future results of operations and capital plans. We caution investors that these forward- looking statements are not guarantees of future performance, and actual results may differ materially. Investors should consider the important risks and uncertainties that may cause actual results to differ, including those included in our Quarterly Reports on Form 10-Q, our Annual Report on Form 10-K and other filings we make with the Securities and Exchange Commission. We assume no obligation to update this presentation, which speaks as of today’s date.

CNO Financial Group | Credit Suisse 2013 Financial Services Forum | February 14, 2013 4 Non-GAAP Measures This presentation contains financial measures that differ from the comparable measures under Generally Accepted Accounting Principles (GAAP). Reconciliations between those non-GAAP measures and the comparable GAAP measures are included in the Appendix. While management believes these measures are useful to enhance understanding and comparability of our financial results, these non-GAAP measures should not be considered substitutes for the most directly comparable GAAP measures. Additional information concerning non-GAAP measures is included in our periodic filings with the Securities and Exchange Commission that are available in the “Investors – SEC Filings” section of CNO’s website, www.CNOinc.com.

CNO Financial Group | Credit Suisse 2013 Financial Services Forum | February 14, 2013 5 Well positioned in the growing and underserved senior and middle income market Track record of strong execution Building core value drivers Strong risk management Well capitalized and generating significant excess capital CNO Fundamentals

CNO Financial Group | Credit Suisse 2013 Financial Services Forum | February 14, 2013 6 What Differentiates CNO? Focus on serving the needs of our middle-income target market, a market that is fast growing and underserved Exclusive distribution ‒ Consistent with market focus ‒ We have “pricing” influence ‒ Track record of stable customer base Alignment Distribution Products Culture Service

CNO Financial Group | Credit Suisse 2013 Financial Services Forum | February 14, 2013 7 88% 16% 26% CNO Peer Group S&P Insurance Track Record of Execution Total Return Since YE2009* *As of market close on 12/31/12 Reset Business Mix Financial Foundation Return Value To Shareholders Invest in Growth Peers - AFL, AIZ, AMP, GNW, HIG, LNC, MET, PFG, PL, PNX, PRI, PRU, SFG, SYA, TMK, UNM

CNO Financial Group | Credit Suisse 2013 Financial Services Forum | February 14, 2013 8 Investment in the Business CNO Investing in productivity and growth of the agent force Expanding presence by adding new locations and geographies Developing and launching new products to meet the needs of our target market Increasing direct advertising Sales excluding Bankers Life annuities up 12% for the year * Core sales exclude Washington National’s Medicare supplement and annuities. Sales summarized above also exclude Bankers’ annuity sales. ($ millions) Core Sales Excluding Bankers Annuities* - 8% Consolidated CAGR Since 2010 $301.5 $313.5 $350.0 2010 2011 2012

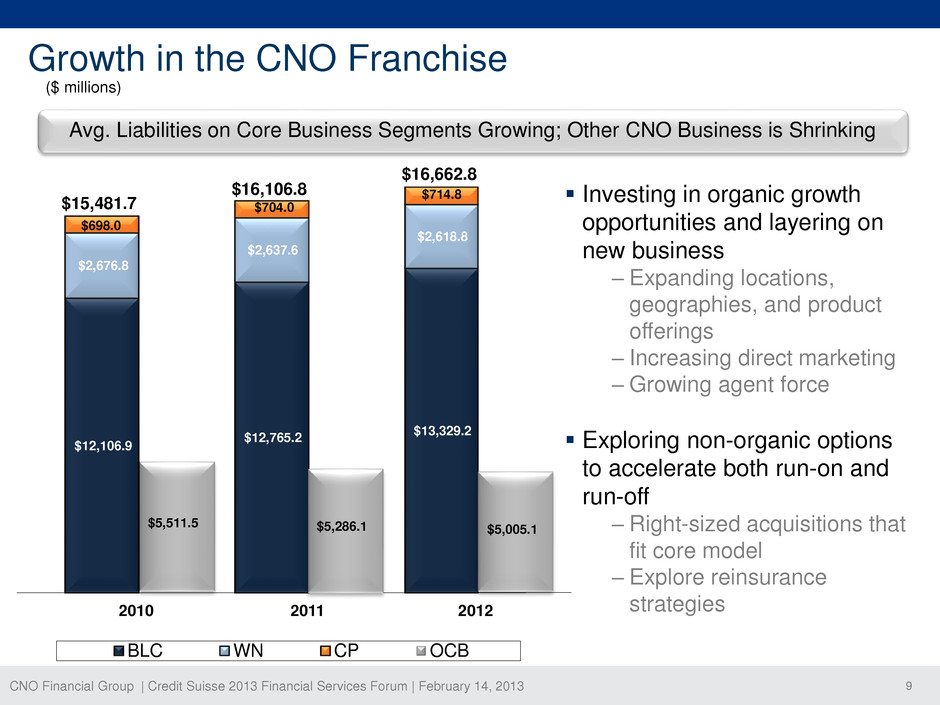

CNO Financial Group | Credit Suisse 2013 Financial Services Forum | February 14, 2013 9 $12,106.9 $12,765.2 $13,329.2 $2,676.8 $2,637.6 $2,618.8 $698.0 $704.0 $714.8 BLC WN CP OCB ($ millions) $16,662.8 $15,481.7 $16,106.8 2010 2011 2012 $5,511.5 Growth in the CNO Franchise $5,286.1 $5,005.1 Investing in organic growth opportunities and layering on new business ‒ Expanding locations, geographies, and product offerings ‒ Increasing direct marketing ‒Growing agent force Exploring non-organic options to accelerate both run-on and run-off ‒ Right-sized acquisitions that fit core model ‒ Explore reinsurance strategies Avg. Liabilities on Core Business Segments Growing; Other CNO Business is Shrinking

CNO Financial Group | Credit Suisse 2013 Financial Services Forum | February 14, 2013 10 ($ millions) * A non-GAAP measure. See the Appendix for a reconciliation to the corresponding GAAP measure. Segment Earnings Trend - Stable & Growing Headwinds Segment EBIT Excluding Significant Items* Favorable health benefit ratios Annuity persistency & spreads Corporate investment results Free cash flow and capital deployment $4.2 $(4.7) $(8.6) $17.8 $28.3 $46.5 $221.0 $250.2 $290.3 $100.4 $106.6 $127.1 $(34.0) $(36.1) $(3.3) 2010 2011 2012 CP OCB BLC WN Corporate $309.4 $344.3 $452.0 Tailwinds Low new money investment rates Natural run-off blocks of business Normalizing LTC benefit ratios Investment in business model driving growth and efficiencies

CNO Financial Group | Credit Suisse 2013 Financial Services Forum | February 14, 2013 11 Retirement Security Medicare Annuities Supplemental Health Long-Term Care Life Insurance Basic products that fit with exclusive distribution and meet the basic insurance needs of the middle market Attractive and more predictable return characteristics - price to unleveraged IRR target of 12% after–tax Product mix balances interest rate risk with shorter duration pure mortality and morbidity insurance Unique Long Term Care proposition produces a balanced risk profile Value of New Business (VNB) measures used to govern risk/return dynamics Diversified product mix focused on protection needs Product Level Risk Management

CNO Financial Group | Credit Suisse 2013 Financial Services Forum | February 14, 2013 12 Loss Recognition & Cash Flow Testing 2012 Statutory Cash Flow Testing 2012 GAAP Loss Recognition Testing Aggregate testing margins remain strong Testing margin Increased in 2012 ↑ - ASU 2010-26 ↑ - Net Growth from New Business (+6%) ↓ - Lower interest rates projected (-8%) ↓ - Legal Settlements (-2%) All intangibles are recoverable Insurance Company margins consistent with prior years All insurance entities pass Asset Adequacy / Cash Flow Testing under all standard scenarios Interest rate scenarios re-affirm strong asset liability management Year-end testing resulted in less than $5 million of additional asset adequacy reserves Line of Business Aggregate Margin Principal Risks to Margin Traditional life and Universal life (Bankers) +++ Unusually high mortality Medicare supplement and supplemental health +++ Unusually high morbidity Long term care Positive but vulnerable Low interest rates; High morbidity; Low policy termination Interest sensitive life (OCB) Positive but vulnerable Low interest rates; Litigation Interest sensitive annuities ++ Decrease in spread; Investment volatility Annuities in payout + Low mortality; Low interest rates CNO

CNO Financial Group | Credit Suisse 2013 Financial Services Forum | February 14, 2013 13 $175 $294 $347 $423 $146 $161 $203 $294 309% 332% 358% 367% 2009 2010 2011 2012 Capital to Holding Company from Insurance Subs Holding Company Liquidity RBC Debt to Cap xAOCI* 23.8% 21.9% 18.3% 20.7% ($ millions) Capital Strategy Forward Capital Plan Maintain capital cushion to absorb stress-test conditions ‒ Leverage of 20% ‒ Risk-based capital ratio of 350% ‒ Holdco liquidity & investments of $150mm Maintain positive ratings profile with goal of achieving investment grade ‒ Received 3 ratings upgrades in 2012 Balanced use of free cash flow Key Capital & Liquidity Metrics YE2012 deployable capital of ~$150mm * A non-GAAP measure. See the Appendix for a reconciliation to the corresponding GAAP measure

CNO Financial Group | Credit Suisse 2013 Financial Services Forum | February 14, 2013 14 2012 Capital Generation – Free Cash Flow Building ($ millions) 2013 Guidance: • $50-$75mm of capital retained to support growth • Statutory dividend range $250-$300mm • Securities* repurchase of $250-$300mm *Common stock and common stock equivalents Free Cash Flow 2012 2012 Full Year Uses Debt Payments $111.8 Stock Buybacks $180.2 Financing Costs $23.1 Common Stock Dividends $13.9

CNO Financial Group | Credit Suisse 2013 Financial Services Forum | February 14, 2013 15 Grow sales, distribution and product portfolio Increase operational effectiveness Build economic value by growing EPS and ROE Achieve BB/BB debt rating Continue balanced approach to capital deployment Invest $80-$85mm in strategic business initiatives Accelerate run-on and run-off Enhance customer experience and operational efficiency ROE run-rate of 9% Drive to investment grade Target dividend payout ratio of 20% CNO: Near Term Goals Lead to Long Term Value 2015 Milestones Near Term Objectives

CNO Financial Group | Credit Suisse 2013 Financial Services Forum | February 14, 2013 16 Q&A

CNO Financial Group | Credit Suisse 2013 Financial Services Forum | February 14, 2013 17 Appendix

CNO Financial Group | Credit Suisse 2013 Financial Services Forum | February 14, 2013 18 • Fixed and Fixed-Index Life and Annuity Products • Long-Term Care • Medicare Supplement • Whole and Universal life products • Final expense • Supplemental Health CNO can access consumers across multiple channels • With an Agent (Retail) • Bankers Career Force • Washington National • PMA (CNO-owned) • Independents • Without an Agent (Direct) • Colonial Penn • At Work (Worksite Marketing) • PMA Worksite Division • Washington National - Independents • Rising medical costs • Decline of societal safety nets (government and employer) • Increased longevity • Greater awareness of need for retirement planning CNO has expertise across important middle-market products Strong trends are driving middle-market consumers CNO: The right products and the right channels for today’s middle-market consumer

CNO Financial Group | Credit Suisse 2013 Financial Services Forum | February 14, 2013 19 • Moderate Stress: 4.75% NMR held flat for 5 years then recovering • Severe Stress: 50 basis point drop in NMR to 4.25% held flat indefinitely • 3Q assumption change: OCB interest sensitive life reserve charge - $28mm (after-tax) • Stress tests impact OCB interest-sensitive life and Bankers LTC reserves • Severe stress - manageable impact to GAAP leverage and 15 to 20 points of RBC impact Severe Stress Test (After- Tax) GAAP $100 - $125 million Statutory $75 - $100 million “Low-For-Long” Rates – Reserve Sensitivity Expanded New Money Rate (NMR) Stress Test Moderate Stress Test (After- Tax) GAAP $20 - $50 million Statutory $20 - $50 million 3.00% 3.50% 4.00% 4.50% 5.00% 5.50% 6.00% 6.50% 7.00% 7.50% 2012 2103 2014 2015 2016 2017 2018 2019 2020 2021 2022 New Money Rate Assumptions 2nd Quarter 2012 Current Moderate Stress Severe Stress

CNO Financial Group | Credit Suisse 2013 Financial Services Forum | February 14, 2013 20 The following provides additional information regarding certain non-GAAP measures used in this presentation. A non-GAAP measure is a numerical measure of a company’s performance, financial position, or cash flows that excludes or includes amounts that are normally excluded or included in the most directly comparable measure calculated and presented in accordance with GAAP. While management believes these measures are useful to enhance understanding and comparability of our financial results, these non-GAAP measures should not be considered as substitutes for the most directly comparable GAAP measures. Additional information concerning non-GAAP measures is included in our periodic filings with the Securities and Exchange Commission that are available in the “Investor – SEC Filings” section of our website, www.CNOinc.com. Information Related to Certain Non-GAAP Financial Measures

CNO Financial Group | Credit Suisse 2013 Financial Services Forum | February 14, 2013 21 Information Related to Certain Non-GAAP Financial Measures The table below summarizes the financial impact of significant items on our 2010 net operating income. Management believes that identifying the impact of these items enhances the understanding of our operating results during 2010 (dollars in millions). Net Operating Income: Bankers Life $ 237.5 $ (16.5) (1) $ 221.0 Washington National Colonial Penn Other CNO Business (2) EBIT from business segments Corporate Operations, excluding corporate interest expense (3) EBIT Corporate interest expense Operating earnings before tax Tax expense on operating income Net operating income * $ 136.4 $ 12.4 $ 148.8 (1) Pre-tax earnings in the Bankers Life segment included earnings of $10.0 million from favorable reserve developments in the Medicare supplement and long-term care blocks; and earnings of $6.5 million from the Prescription Drug Plan ("PDP") business assumed from Coventry due to premium adjustments. (2) Pre-tax earnings in the Other CNO Business segment included charges of $8.0 million from changes in assumptions for the implementation of certain non-guaranteed elements; $13.0 million reflecting the impact of decreased projected future investment yield assumptions related to interest-sensitive insurance products; and $6.0 million for the write-off of the present value of future profits related to the long-term care block. (3) Pre-tax earnings in the Corporate segment included charges of $4.5 million from a legal settlement and $4.3 million related to the impact of lower interest rates on the values of liabilities for agent deferred compensation and former executive retirement annuities. Year ended December 31, 2010 Actual results Significant items Excluding significant items 100.4 - 100.4 4.2 - 4.2 (9.2) 27.0 17.8 332.9 10.5 343.4 (34.0) 290.1 19.3 309.4 (79.3) - (79.3) (42.8) 8.8 210.8 19.3 230.1 74.4 6.9 81.3 * A non-GAAP measure. See page 24 for a reconciliation to the corresponding GAAP measure.

CNO Financial Group | Credit Suisse 2013 Financial Services Forum | February 14, 2013 22 Information Related to Certain Non-GAAP Financial Measures The table below summarizes the financial impact of significant items on our 2011 net operating income. Management believes that identifying the impact of these items enhances the understanding of our operating results during 2011 (dollars in millions). Net Operating Income: Bankers Life $ 290.9 $ (40.7) (1) $ 250.2 Washington National (2) Colonial Penn Other CNO Business (3) EBIT from business segments Corporate Operations, excluding corporate interest expense (4) EBIT Corporate interest expense Operating earnings before tax Tax expense on operating income Net operating income * $ 171.5 $ (0.7) $ 170.8 Year ended December 31, 2011 Actual results Significant items Excluding significant items 96.1 10.5 106.6 (4.7) - (4.7) 15.3 13.0 28.3 397.6 (17.2) 380.4 (47.7) 11.6 (36.1) 349.9 (5.6) 344.3 (76.3) - (76.3) 273.6 (5.6) 268.0 102.1 (4.9) 97.2 (1) Pre-tax earnings in the Bankers Life segment included earnings of $43.0 million from favorable reserve developments in the Medicare supplement and long-term care blocks; earnings of $3.7 million from the PDP business assumed from Coventry due to premium adjustments; and a $6.0 million charge due to additional Medicare supplement amortization related to higher lapsation. (2) Pre-tax earnings in the Washington National segment included charges of $10.5 million from out-of-period adjustments. (4) Pre-tax earnings in the Corporate segment included charges of $19.0 million related to the impact of lower interest rates on the values of liabilities for agent deferred compensation and former executive retirement annuities; and earnings of $7.4 million resulting from a trueup of stock- based compensation assumptions. (3) Pre-tax earnings in the Other CNO Business segment included a charge of $13.0 million reflecting the impact of decreased projected future investment yield assumptions related to interest-sensitive insurance products. * A non-GAAP measure. See page 24 for a reconciliation to the corresponding GAAP measure.

CNO Financial Group | Credit Suisse 2013 Financial Services Forum | February 14, 2013 23 Information Related to Certain Non-GAAP Financial Measures The table below summarizes the financial impact of significant items on our 2012 net operating income. Management believes that identifying the impact of these items enhances the understanding of our 2012 operating results (dollars in millions). Net Operating Income: Bankers Life $ 300.9 $ (10.6) (1) $ 290.3 Washington National Colonial Penn Other CNO Business (2) EBIT from business segments Corporate Operations, excluding corporate interest expense (3) EBIT Corporate interest expense Operating earnings before tax Tax expense on operating income Net operating income * $ 180.4 $ 65.0 $ 245.4 Year ended December 31, 2012 Actual results Significant items Excluding significant items 127.1 - 127.1 (8.6) - (8.6) (48.8) 95.3 46.5 370.6 84.7 455.3 (20.3) 17.0 (3.3) 350.3 101.7 452.0 (66.2) - (66.2) 284.1 101.7 385.8 103.7 36.7 140.4 (1) Pre-tax earnings in the Bankers Life segment included earnings of $25.0 million from favorable reserve developments in the Medicare supplement and long-term care blocks; earnings of $3.6 million from the PDP business assumed from Coventry due to premium adjustments; and $18.0 million of charges due to legal and regulatory expenses. (2) Pre-tax earnings in the Other CNO Business segment included charges of $43.0 million reflecting the imapct of decreased projected future investment yield assumptions related to interest-sensitive insurance products; $46.3 million related to tentative litigation settlements; and a charge of $6.0 million from out-of -period adjustments. (3) Pre-tax earnings in the Corporate segment included charges of $10.0 million related to the impact of lower interest rates on the values of liabilities for agent deferred compensation and former executive retirement annuities and $7.0 million related to the relocation of Bankers Life's primary office. * A non-GAAP measure. See page 24 for a reconciliation to the corresponding GAAP measure.

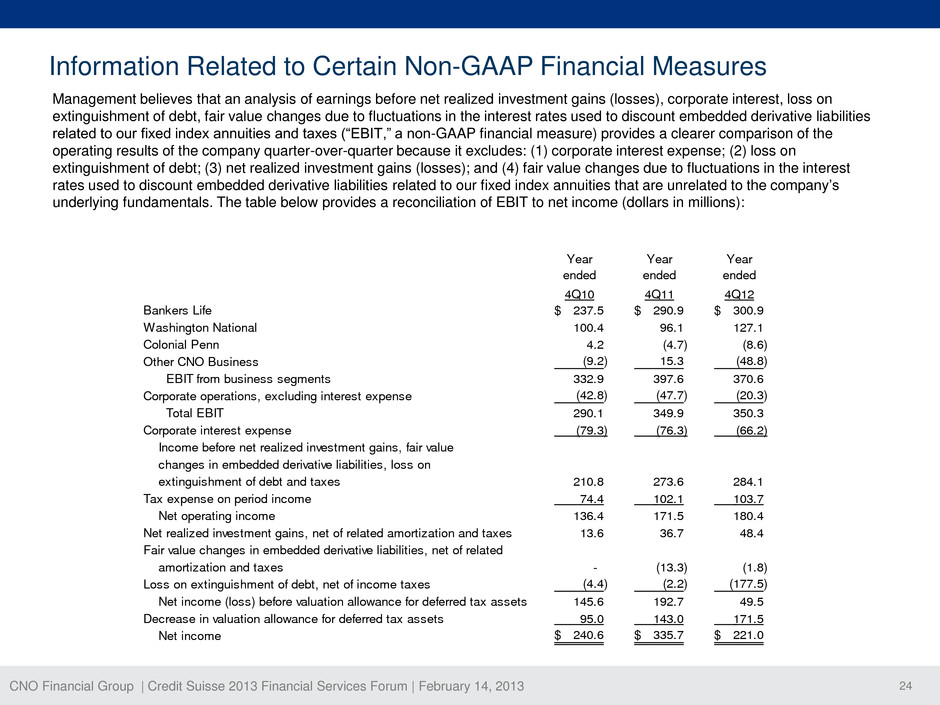

CNO Financial Group | Credit Suisse 2013 Financial Services Forum | February 14, 2013 24 Information Related to Certain Non-GAAP Financial Measures Management believes that an analysis of earnings before net realized investment gains (losses), corporate interest, loss on extinguishment of debt, fair value changes due to fluctuations in the interest rates used to discount embedded derivative liabilities related to our fixed index annuities and taxes (“EBIT,” a non-GAAP financial measure) provides a clearer comparison of the operating results of the company quarter-over-quarter because it excludes: (1) corporate interest expense; (2) loss on extinguishment of debt; (3) net realized investment gains (losses); and (4) fair value changes due to fluctuations in the interest rates used to discount embedded derivative liabilities related to our fixed index annuities that are unrelated to the company’s underlying fundamentals. The table below provides a reconciliation of EBIT to net income (dollars in millions): Year Year Year ended ended ended 4Q10 4Q11 4Q12 Bankers Life 237.5$ 290.9$ 300.9$ Washington National 100.4 96.1 127.1 Colonial Penn 4.2 (4.7) (8.6) Other CNO Business (9.2) 15.3 (48.8) EBIT from business segments 332.9 397.6 370.6 Corporate operations, excluding interest expense (42.8) (47.7) (20.3) Total EBIT 290.1 349.9 350.3 Corporate interest expense (79.3) (76.3) (66.2) Income before net realized investment gains, fair value changes in embedded derivative liabilities, loss on extinguishment of debt and taxes 210.8 273.6 284.1 Tax expense on period income 74.4 102.1 103.7 Net operating income 136.4 171.5 180.4 Net r alized inv stment gains, net of related amortization and taxes 13.6 36.7 48.4 Fa r al ha ges in embedded derivative liabilities, net of related amortization and taxes - (13.3) (1.8) Loss on extinguishment of debt, net of income taxes (4.4) (2.2) (177.5) Net income (loss) before valuation allowance for deferred tax assets 145.6 192.7 49.5 Decrease in valuation allowance for deferred tax assets 95.0 143.0 171.5 Net income 240.6$ 335.7$ 221.0$

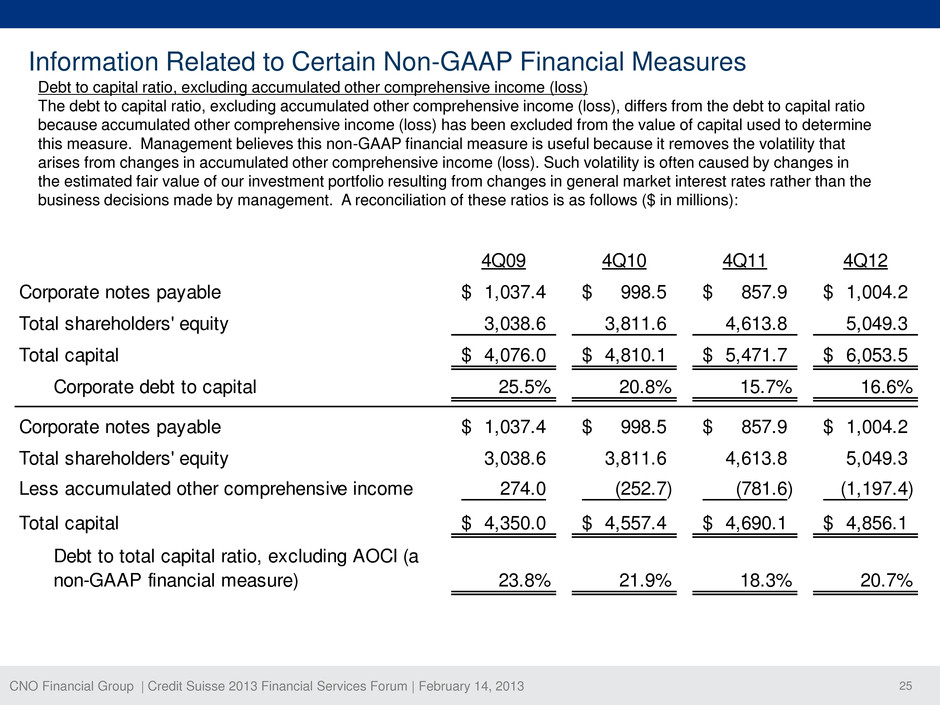

CNO Financial Group | Credit Suisse 2013 Financial Services Forum | February 14, 2013 25 Information Related to Certain Non-GAAP Financial Measures 4Q09 4Q10 4Q11 4Q12 Corporate notes payable 1,037.4$ 998.5$ 857.9$ 1,004.2$ Total shareholders' equity 3,038.6 3,811.6 4,613.8 5,049.3 Total capital 4,076.0$ 4,810.1$ 5,471.7$ 6,053.5$ Corporate debt to capital 25.5% 20.8% 15.7% 16.6% Corporate notes payable 1,037.4$ 998.5$ 857.9$ 1,004.2$ Total shareholders' equity 3,038.6 3,811.6 4,613.8 5,049.3 Less accumulated other comprehensive income 274.0 (252.7) (781.6) (1,197.4) Total capital 4,350.0$ 4,557.4$ 4,690.1$ 4,856.1$ Debt to total capital ratio, excluding AOCI (a non-GAAP financial measure) 23.8% 21.9% 18.3% 20.7% Debt to capital ratio, excluding accumulated other comprehensive income (loss) The debt to capital ratio, excluding accumulated other comprehensive income (loss), differs from the debt to capital ratio because accumulated other comprehensive income (loss) has been excluded from the value of capital used to determine this measure. Management believes this non-GAAP financial measure is useful because it removes the volatility that arises from changes in accumulated other comprehensive income (loss). Such volatility is often caused by changes in the estimated fair value of our investment portfolio resulting from changes in general market interest rates rather than the business decisions made by management. A reconciliation of these ratios is as follows ($ in millions):