Attached files

| file | filename |

|---|---|

| 8-K/A - FORM 8-K/A - Novus Robotics Inc. | nrbt_8ka.htm |

| EX-10.1 - SHARE EXCHANGE AGREEMENT - Novus Robotics Inc. | nrbt_ex101.htm |

| EX-10.4 - STOCK PURCHASE AGREEMENT - Novus Robotics Inc. | nrbt_ex104.htm |

| EX-10.25 - ASSIGNMENT AGREEMENT - Novus Robotics Inc. | nrbt_ex1025.htm |

| EX-99.3 - PRESS RELEASE - Novus Robotics Inc. | nrbt_ex993.htm |

| EX-10.26 - ASSIGNMENT AGREEMENT - Novus Robotics Inc. | nrbt_ex1026.htm |

| EX-10.28 - PURCHASE ORDER - Novus Robotics Inc. | nrbt_ex1028.htm |

| EX-10.27 - ASSIGNMENT AGREEMENT - Novus Robotics Inc. | nrbt_ex1027.htm |

EXHIBIT 10.5

RESCISSION AGREEMENT

THIS RESCISSION AGREEMENT is entered into as of this 27th day of January, 2012 by and among D&R Technology Inc., a private corporation organized under the laws of the Province of Ontario (“D&R”) and those certain sellers identified on Exhibit A attached hereto (the “Controlling Shareholders”).

RECITALS:

WHEREAS D&R and the Controlling Shareholders had entered into a stock purchase agreement dated November 7, 2011 (the “Stock Purchase Agreement”), pursuant to which D&R was to acquire an aggregate of 59,000,000 shares of common stock of Ecoland International Inc.., a corporation organized under the laws of the State of Nevada and a publicly traded corporation (“ECIT”);

WHEREAS D&R and the Controlling Shareholders entered into the Stock Purchase Agreement with the intent to effect a transaction in which D&R would become the wholly-owned subsidiary of ECIT;

WHEREAS upon advice of legal counsel and auditors: (i) D&R and the Controlling Shareholders desire to rescind the Stock Purchase Agreement (the “Rescission”); (ii) the Controlling Shareholders desire to return to ECIT their respective share certificates evidencing the aggregate 59,000,000 shares of common stock of ECIT for cancellation and return to treasury; (iii) the shareholders of D&R agree to pay $262,000.00 to the Controlling Shareholders proportionately as consideration for the rescission of the Stock Purchase Agreement and the cancellation of the share certificates; and (iv) the shareholders of D&R and ECIT shall enter into a share exchange agreement pursuant to which D&R shall become the wholly-owned subsidiary of ECIT;

WHEREAS, D&R and the Controlling Shareholders have settled their differences regarding the Rescission and D&R and the Controlling Shareholders agree that it is desirable to rescind and set aside the Stock Purchase Agreement, which includes the return by D&R to the Controlling Shareholders and the subsequent return by the Controlling Shareholders to ECT of the aggregate 59,000,000 shares of common stock and the resulting cancellation and return to treasury of the 59,000,000 shares of common stock;

WHEREAS D&R and the Controlling Shareholders wish to set forth their agreement relating to the Rescission and this Rescission Agreement;

WHEREAS the Board of Directors of D&R have approved the execution of this Rescission Agreement;

1

NOW, THEREFORE, in consideration of the aforesaid recitals and mutual promises contained herein, the receipt and sufficiency of which is hereby acknowledged, the parties agree as follows:

AGREEMENT

1. D&R and the Controlling Shareholders agree to hereby rescind, cancel and set aside the Stock Purchase Agreement in exchange for the payment by D&R to the Controlling Shareholders of an aggregate $262,000.00.

2. The Controlling Shareholders shall return to ECIT the share certificates evidencing the aggregate 59,000,000 shares of restricted common stock of ECIT and such 59,000,000 shares shall be cancelled and returned to treasury.

3. D&R represents and acknowledges that the execution and delivery by D&R of this Rescission Agreement is within the power of D&R, has been duly authorized by all necessary corporate action on behalf of D&R and does not: (i) require the consent of any other person or party; (ii) contravene or conflict with any provision of applicable law or the certificate of incorporation or other corporate agreement of D&R; or (iii) contravene or conflict with or result in a default under any other instrument or contract to which D&R is a party.

4. The Controlling Shareholders represent and acknowledge that the execution and delivery by the Controlling Shareholders of this Rescission Agreement is within the power of the Controlling Shareholders and does not: (i) require the consent of any other person or party; (ii) contravene or conflict with any provision of applicable law; or (iii) contravene or conflict with or result in a default under any other instrument or contract to which any of the Controlling Shareholders is a party.

5. This Rescission Agreement shall be effective as of the date first above written and shall be binding upon and insure to the benefit of the parties hereto and their respective successors.

2

6. D&R and the Controlling Shareholders shall agree to release each other and forever discharge any and all claims, manner of actions, whether at law or in equity suits, judgments, debts, liens, liabilities, demands, damages, losses, sums of money, expenses or disputes, known or unknown, fixed or contingent, which it now has or may have hereafter, directly or indirectly, individually or in any capacity against each other, their successors and assigns, as well as its present or former owners, directors, officers, stockholders, employees, agents, heirs, by reason of any act, omission, matter, cause, or thing whatsoever, from the beginning of time to, and including the date of the execution of this Rescission Agreement, relating to the aforesaid Stock Purchase Agreement and Rescission.

|

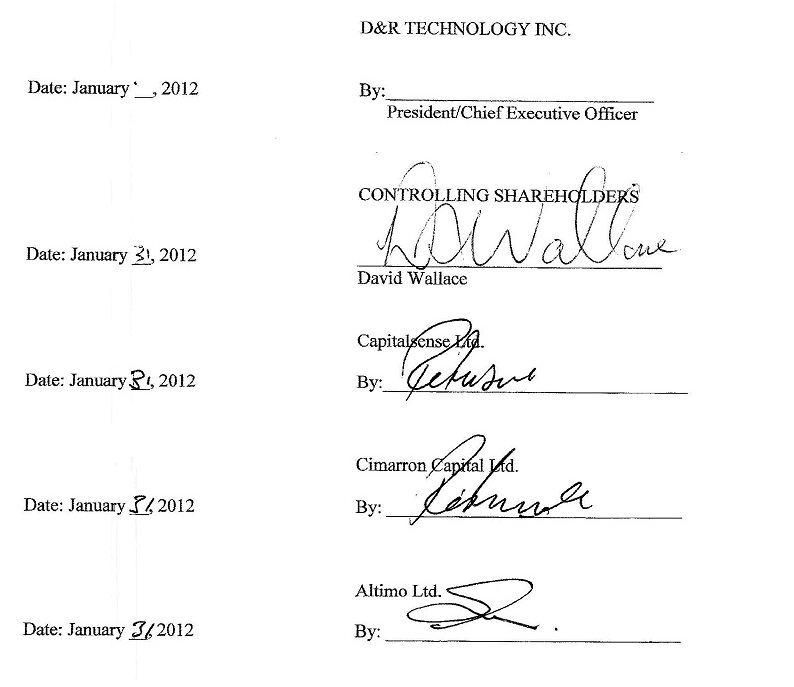

D&R TECHNOLOGY INC.

|

|||

|

Date: January 31, 2012

|

By:

|

||

| President/Chief Executive Officer | |||

|

CONTROLLING SHAREHOLDERS

|

|||

| Date: January 31, 2012 |

By:

|

||

|

David Wallace

|

|||

|

Capitalsense Ltd.

|

|||

|

Date: January 31, 2012

|

|||

|

By:

|

|||

| Cimarron Capital Ltd. | |||

| Date: January 31, 2012 | By: | ||

|

Altimo Ltd.

|

|||

| Date: January 31, 2012 | By: | ||

3

4