Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CVR Refining, LP | d480862d8k.htm |

Investor Presentation

February 6-7, 2013

Exhibit 99.1 |

Forward Looking Statements

1

The following presentation contains forward-looking statements based on management’s current

expectations and beliefs, as well as a number of assumptions concerning future events. The

assumptions and estimates underlying the financial information are inherently uncertain and,

although considered reasonable as of the date of preparation by the management team of our

general partner, all of whom are employed by CVR Energy, Inc., are subject to a wide variety of

significant business, economic, and competitive risks and uncertainties that could cause actual

results to differ materially from those contained in the prospective information. Accordingly, there

can be no assurance that the prospective results are indicative of our future performance or that

actual results will not differ materially from those presented in the prospective information.

You are cautioned not to put undue reliance on such forward-looking statements (including

forecasts and projections regarding our future performance) because actual results may vary

materially from those expressed or implied as a result of various factors, including, but not

limited to those set forth under “Risk Factors” in the Prospectus (File no.

333-184200), as amended, of CVR Refining, LP (the “Company”). CVR Energy,

Inc. and the Company assume no obligation to, and expressly disclaims any obligation to, update

or revise any forward-looking statements, whether as a result of new information, future

events or otherwise, except as required by law. |

Today’s presenters

2

Jack Lipinski

Chief Executive Officer & President

Susan Ball

Chief Financial Officer & Treasurer

Jay Finks

Director of Finance & Head of Investor Relations |

The

Offering 3

Issuer:

CVR Refining, LP (“CVR Refining,” “CVRR,” the “Company” or the

“Issuer”) NYSE Ticker:

CVRR

Security:

Common units representing limited partner interests

Common units offered:

24 million

Underwriters’ option to purchase additional units:

3.6 million common units (15%)

Units offered as a % of units outstanding after offering:

16.2% (18.7% including full exercise of the underwriters’ option to purchase additional units)

Offering Price:

$25 per common unit

MLP structure:

Variable distribution MLP; no distribution coverage, MQD or IDRs

Quarterly distribution policy:

An amount equal to 100% of available cash generated each quarter

Estimated Distribution for the 12 Months Ending

December 31, 2013:

$4.7215 per unit (to be prorated from the closing of the Offering)

Implied Yield at Offering Price:

18.89%

Joint Bookrunners:

Credit Suisse, Citi, Barclays, UBS, Jefferies

Co-Managers:

JP Morgan, Macquarie, Simmons and Company

Pricing Date/IPO Close Date:

January 16, 2013 / January 23, 2013

Intent to purchase:

Icahn Enterprises, LP (“IEP”) purchased $100 million of units in this offering

CEO Jack Lipinski purchased $5 million of units in this offering |

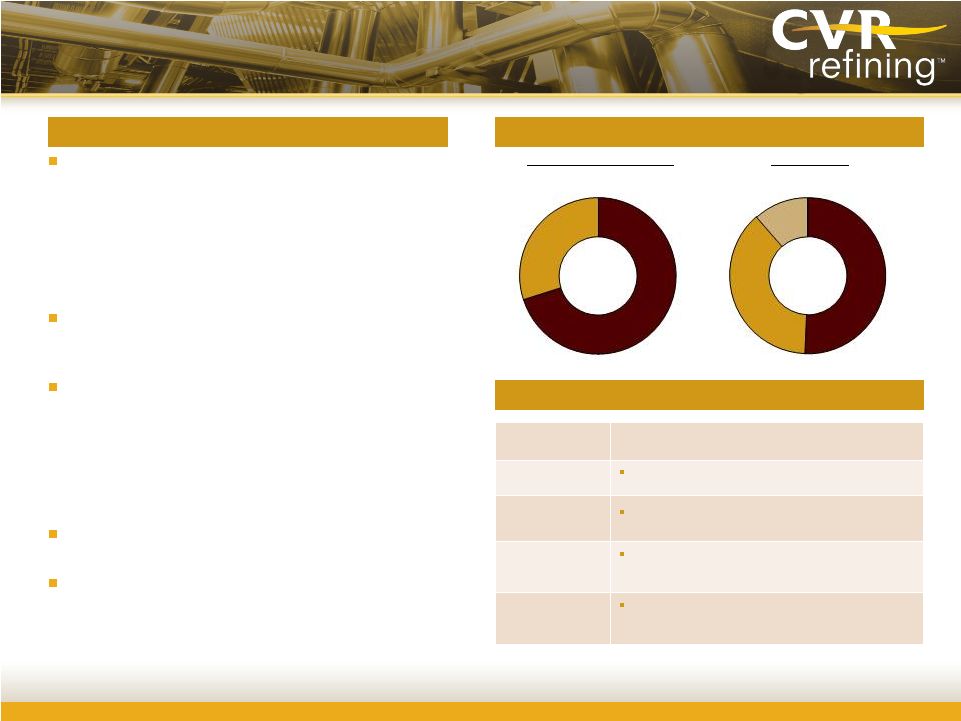

Gasoline

49.7%

Distillate

40.8%

Other

9.5%

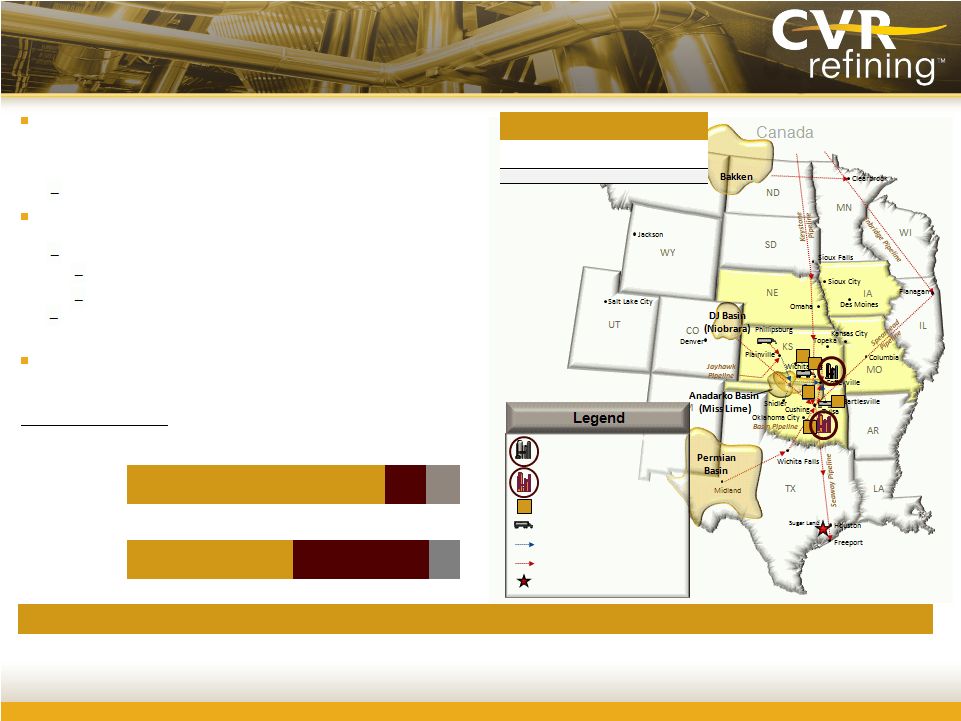

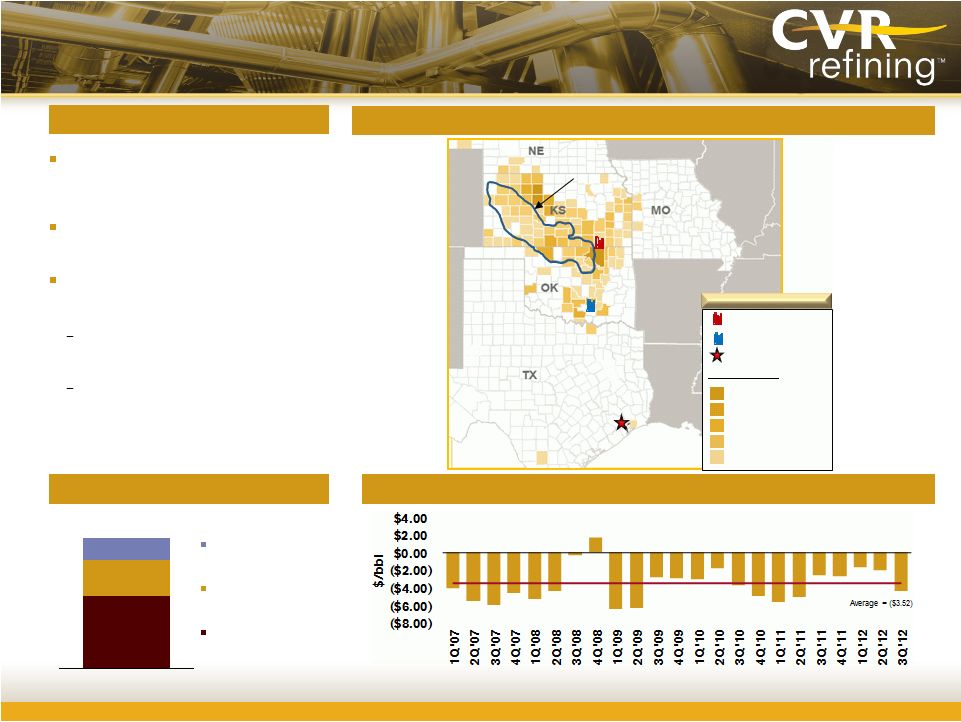

Owns two of only seven refineries in the underserved Group 3 of

the

PADD

II

region

–

refining

capacity

of

185

thousand

barrels per

day (“Mbpd”) and a weighted average complexity of 11.5 between

the two refineries

Represents ~22% of regional refining capacity

Strategic location and logistics assets provide access to price-

advantaged mid-continent, Bakken and Canadian crude oils

100% of processed crude is priced by reference to WTI

WTI

currently

(1)

trading

at

$19.93

discount

to

Brent

EIA

estimates

2013E

Brent-WTI

differential

of

$15.37

(2)

Average realized discount to WTI on purchased crudes of

$3.52/bbl

over

2007

–

Q3

2012

Favorable products demand / supply dynamics, with local demand

on average 16.9% higher than local fuel production over 2007-

2011

(3)

Company Overview

(1)

Bloomberg data as of 1/7/2013.

(2)

As per the EIA’s Short-term Energy Outlook dated December 11, 2012

(3)

Based on EIA data, including gasoline and ultra-low sulfur diesel (ULSD)

demand and production in the states of Kansas, Oklahoma, Missouri, Nebraska, and Iowa.

(4)

Data for nine months ended September 30, 2012.

(5)

Other includes pet coke, asphalt, natural gas liquids (“NGLs”), slurry,

sulfur, gas oil and specialty products such as propylene and solvents, excludes internally produced fuel.

Leading independent mid-con refiner with world class strategically located

refineries and supporting logistics assets 4

Wynnewood Refinery

CVR Refining Crude Transportation

CVR Refining Crude Oil Pipeline

Third-Party Crude Oil Pipeline

CVR Refining Headquarters

Other PADD II Group 3 refineries

Coffeyville Refinery

Key operational data

(4)

:

Sweet

77.3%

Medium

12.3%

Heavy sour

10.4%

Crude throughput

(176,589 bpd)

Production

(185,270 bpd)

(5)

Refinery

Capacity

Complexity

(Mbpd)

Coffeyville

115

12.9

Wynnewood

70

9.3

CVR Refining

185

11.5 |

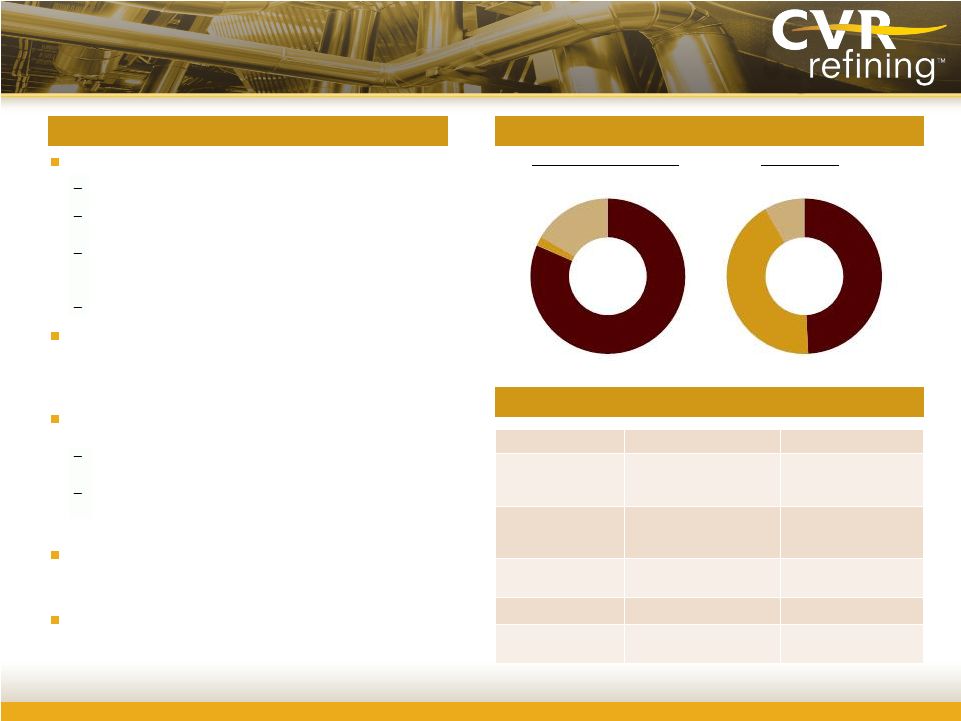

115,000 bpd of crude throughput capacity

12.9 complexity

Located in Kansas in Group 3 of the PADD II

region

Access to cost-advantaged, WTI price-linked

crude oils (100% of crude slate) –

local and

Canadian

~100 miles from Cushing, Oklahoma

High complexity refinery with last nine months ended

September 30, 2012 product yield including gasoline

(49.2%), distillate (42.4%), and pet coke and other

specialty products (8.4%)

Sales and distribution primarily to the central mid-

continent

~35% of FY 2011 products sold through the rack

system directly to retail and wholesale customers

~65% of remaining FY 2011 products sold

through pipelines (Magellan, Enterprise, and

NuStar) via bulk spot and term contracts

Over $700 million invested since 2005 to modernize

the refinery and meet more stringent environmental,

health, and safety requirements

Two-phase turnaround completed in early 2012 at a

total cost of ~$89 million

High Quality Refineries: Coffeyville

2005 (Acquisition year)

Current

Operational

Upgrades

Invested $700 million

since 2005

Now, one of the most

flexible Mid-Con

refineries

Crude

throughput

capacity (bpsd)

(4)

<90,000

~125,000

Feedstock

flexibility

No heavy sour

Up to 25,000 bpd

Complexity

10.3

12.9

Gathered Barrels

Capacity (bpd)

~7,000

~50,000

Summary

Crude oil & product mix

(1)

Management’s proven track record

(1)

For nine months ended September 30, 2012.

(2)

Other includes pet coke, asphalt, NGLs, slurry, sulfur, gas oil and specialty

products such as propylene and solvents, excludes internally produced fuel.

(3)

Includes 5.0% by volume used as blendstock.

(4)

Barrels per stream day (“bpsd”).

5

Crude oil throughput

Production

111,505

bpd

119,669

bpd

Heavy sour

16.5%

Light/medium

sour

2.0%

Sweet

81.5%

Other

(2)

8.4%

Distillate

42.4%

Gasoline

49.2%

(3) |

High

Quality Refineries: Wynnewood 70,000 bpd of crude throughput capacity

-

9.3 complexity

-

Located in Oklahoma in Group 3 of the PADD II

region

-

Access to local cost-advantaged, WTI price-

linked crude oils (100% of crude slate)

For the last nine months ended September 30, 2012

product yield includes gasoline (50.7%), distillate

(37.8%), asphalt and other products (11.5%)

Sales and distributions primarily to Oklahoma market

(~60%)

-

~12,000 bpd of gasoline and ULSD sold via the

truck rack located at the refinery

-

Non-Oklahoma gasoline and ULSD distributed in

the mid-con region via Magellan pipeline

Turnaround was completed in Q4 2012 for a total

expected cost of ~$105 million

Since acquisition in December 2011, utilization has

increased from ~88% to approximately ~93%

Project

Opportunity

Logistics

Opportunity to share feedstocks based on unit

economics

Crude slate

Optimize crudes to improve consumed crude

differentials and improve realized refining margin

Rail options

Wynnewood connected to a BNSF main line

–

Property can accommodate new track and

off-take infrastructure

Storage options

Currently 500,000 barrels of storage

–

Sufficient land for significant additional

storage / blending tanks

Summary

Asset improvement opportunities

6

Light/medium

sour

29.9%

Production

65,084

bpd

65,601

bpd

Crude oil throughput

Sweet

70.1%

(1)

For nine months ended September 30, 2012.

(2)

Other includes asphalt, NGL’s, slurry, sulfur, gas oil and specialty products

such as propylene and solvents, excludes internally produced fuel. (2)

Other

11.5%

Gasoline

50.7%

Distillate

37.8%

Crude oil & product mix

(1) |

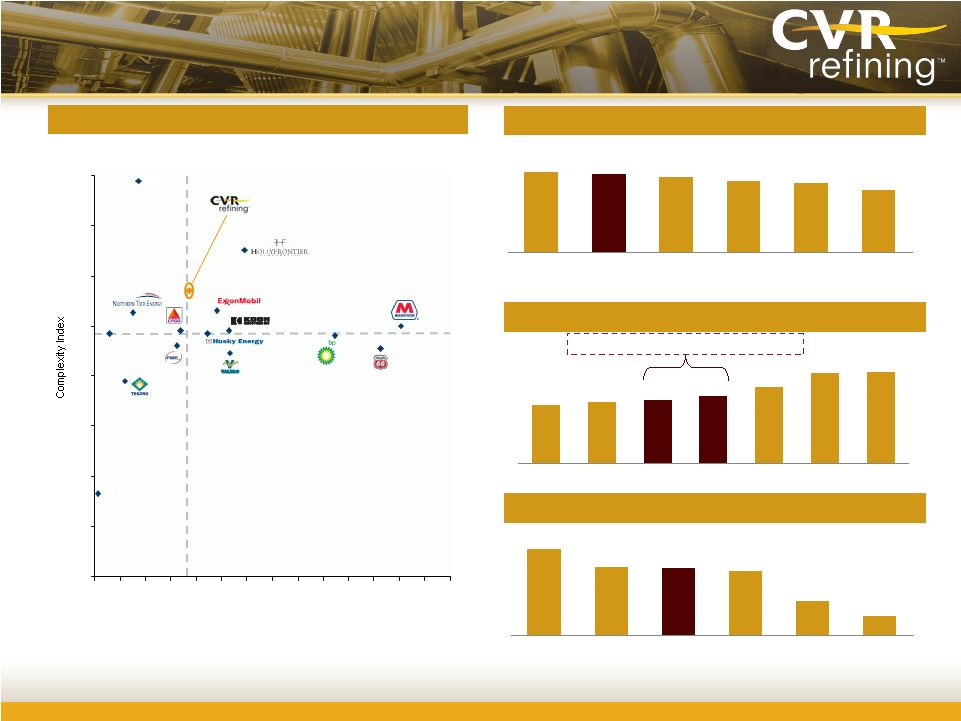

Source:EIA and Wall Street research.

(1)

PADD II consolidated refinery statistics.

(2)

For the nine months ended September 30, 2012.

(3)

Operating expenses calculated on a per barrel of crude throughput and excluding

SG&A and direct turnaround expenses. (4)

CVR Refining EBITDA margin calculated as Adjusted EBITDA of $988.9 million for nine

months ended September 30, 2012 divided by total crude throughput of 48.39 MMbbls

for nine months ended September 30, 2012.

High Quality Assets

Favorable high distillate yield

(2)

“Top quartile”

consolidated asset profile

(1)

Low cost operator (operating expenses in $/bbl)

(2) (3)

7

Median

Capacity:

185.0

Median

Complexity

9.7

CMC

SR

Capacity: 185 kbpd (Coffeyville & Wynnewood)

Complexity: 11.5 (blended average)

0.0

2.0

4.0

6.0

8.0

10.0

12.0

14.0

16.0

0

50

100

150

200

250

300

350

400

450

500

550

600

650

700

Crude Unit Processing Capacity (000's bpd)

Strong EBITDA margins ($/bbl)

(2)

Operating expenses for CVR Refining: $4.52/bbl

(4)

41.7%

40.8%

39.0%

36.8%

36.2%

32.1%

WNR

CVR

Refining

HFC

PBF

TSO

NTI

$4.08

$4.23

$4.41

$4.69

$5.32

$6.27

$6.33

NTI

PBF

Coffeyville

Refinery

Wynnewood

Refinery

HFC

WNR

TSO

$26.28

$20.74

$20.44

$19.47

$10.45

$5.76

NTI

WNR

CVR

Refining

HFC

TSO

PBF

NCRA |

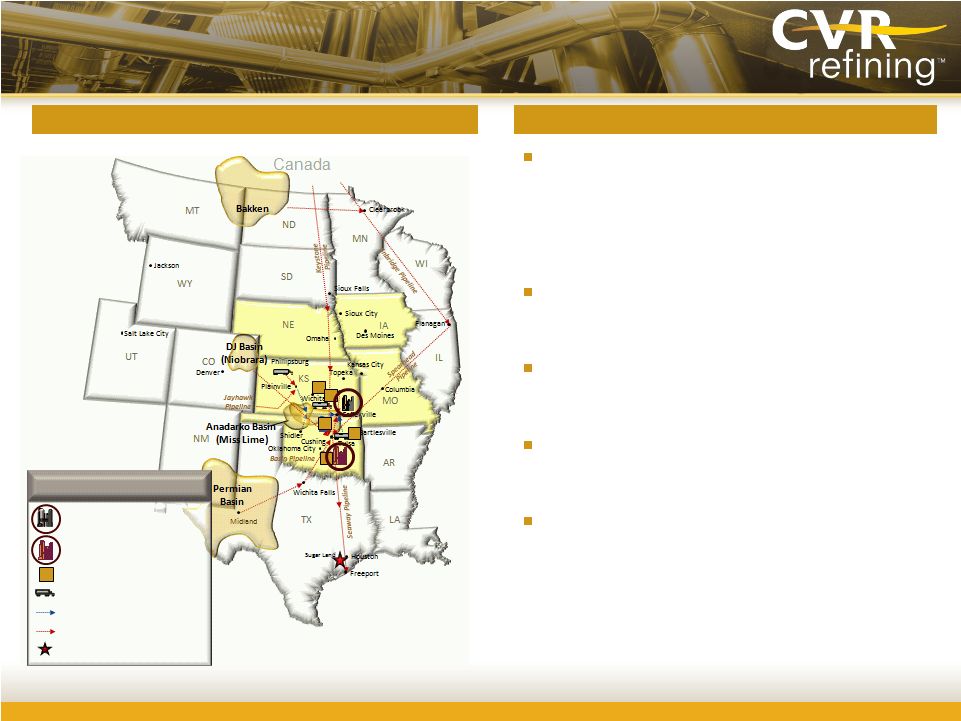

Strategically Located Mid-con Refineries

Source: EIA and Wall Street research.

Located in the Group 3 of the PADD II region which

currently has access to lower cost mid-continent

domestic sweet and sour crude oils

–

Located near the current crude export bottleneck at

Cushing

Near emerging mid-continent shale plays such as the

Niobrara in the DJ basin and the Mississippian Lime

in Northern Oklahoma and Southwestern Kansas

Near major pipelines (Keystone, Spearhead) with

access to various light and heavy grade Canadian

crude oils

Close proximity to, and substantial storage capacity

at, Cushing minimizes the likelihood of a supply

interruption

Supply-constrained products market with

transportation and crude cost advantage relative to

Gulf Coast refineries

8

CVR Refining asset locations

Strategically located refineries

Coffeyville Refinery

Wynnewood Refinery

Other PADD II Group 3 refineries

CVR Refining Crude Transportation

CVR Refining crude Oil Pipeline

Third-Party Crude Oil Pipeline

CVR Refining Headquarters

Legend |

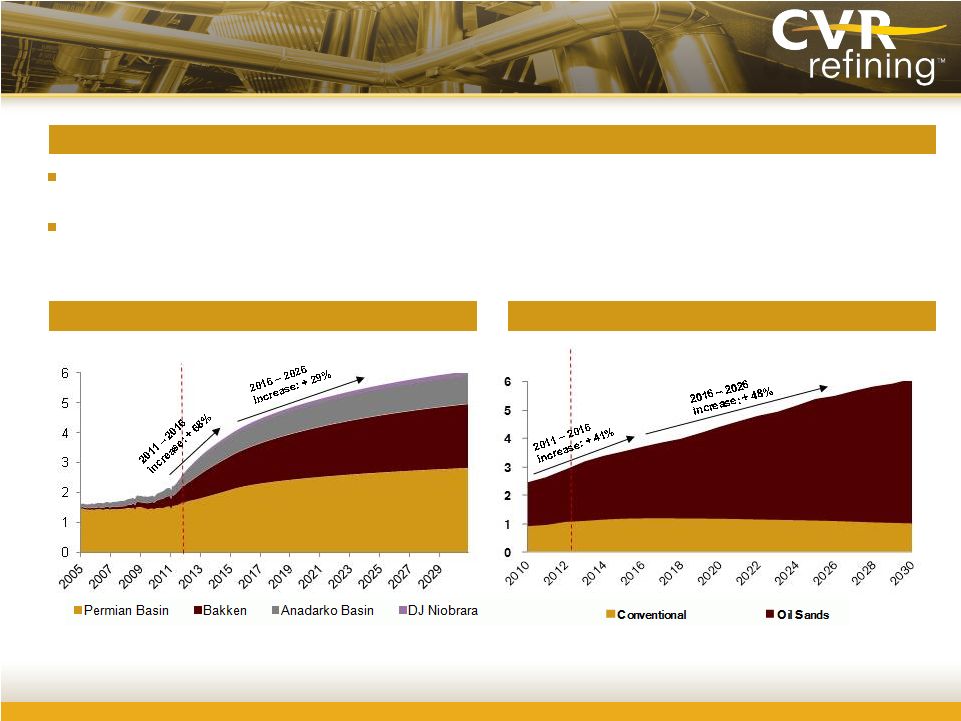

Historical Forecast

(MMbpd)

Crude Advantage Sustainable Long Term

We expect WTI to continue to trade at a discount to Brent over the long term, but

anticipate that this discount will vary over time

Canadian production exceeds existing transportation capacity south to the

U.S. Increasing domestic and Canadian crude oil production

Regional Play Oil and NGL Forecasts

Western Canada Crude Oil Forecasts

Source: Investment Technology Group.

Note:

Anadarko Basin includes Mississippian Lime, Granite Wash, Cleveland Tonkawa,

Marmaton; DJ Niobrara includes horizontal wells only.

Source:

Canadian Association of Petroleum Refiners, “Crude Oil Forecast, Markets

& Pipelines, June 2012.”

Note:

Oil sands includes upgraded conventional, imported condensate, manufactured

diluent from upgraders and upgraded heavy volumes coming from upgraders.

(MMbpd)

9

Historical Forecast |

Crude

Advantage Sustainable Long Term (cont’d)

Both

refineries

benefit

from

the

current

WTI-Brent

–

WTI price-linked crudes are currently trading at a historically wide discount

to waterborne foreign crudes, such as Brent

Ever-increasing

mid-continent

domestic

and

Canadian

crude

oil

production,

decreasing

North

Sea

production,

transportation infrastructure limitations and geopolitical factors are contributing

to maintain this differential Currently capable of gathering ~50,000 bpd of

crudes from our gathering area at a discount to WTI –

Volumes

are

expected

to

increase

further

with

the

growth

in

the

logistics

infrastructure

–

targeting

~10%

growth

per

annum

2013E Brent-WTI differential of $15.37, according to EIA’s Short-term

Energy Outlook dated December 11, 2012 Favorable crude differentials

Spot crude differentials

($/bbl)

10

Source: Bloomberg as of 2/4/2013.

$(70.00)

$(50.00)

$(30.00)

$(10.00)

$10.00

$30.00

Jan-05

Jan-06

Jan-07

Jan-08

Jan-09

Jan-10

Jan-11

Jan-12

Jan-13

Jan-14

Jan-15

Historical

Forward

Current

as of

2/4/13:

Average

(1/1/2005 –

2/4/2013):

($31.50)

($16.69)

WCS -

WTI

($20.56)

($4.31)

WTI -

Brent

NTM

average:

($14.32)

($27.72)

($52.06)

($24.49)

WCS -

Brent

($42.04)

($2.35)

($0.72)

WTI at Midland -

WTI

NA

differential – 100% of crude input priced with reference to WTI |

Complementary Logistics Assets

Logistics overview

~6.0MMbbls of total storage capacity,

including ~6% of total crude oil storage

capacity at Cushing

35,000 bpd of contracted capacity on the

Keystone and Spearhead pipelines

Currently gathering ~50,000 bpd of price-

advantaged crudes from Kansas, Nebraska,

Oklahoma, Missouri and Texas

CVR Refining gathering network

Crude storage owned / leased

Total purchased crude discount to WTI

1.7

3.3

1.0

Cushing owned

Wynnewood, Coffeyville,

and gathering system

Cushing leased

6.0

(MMbbls)

11

Greater than 3,000 bpd

1,000 to 3,000 bpd

500 to 999 bpd

100 to 499 bpd

0 to 99 bpd

Coffeyville Refinery

Wynnewood Refinery

CVR Refining Headquarters

Volumes gathered:

Mississippian Lime

350 miles of owned pipelines and over 125

crude oil transports and associated storage

facilities

Grown from ~7,000 bpd in 2005 to

~50,000 bpd currently and

targeting growth of ~10% per year

Legend |

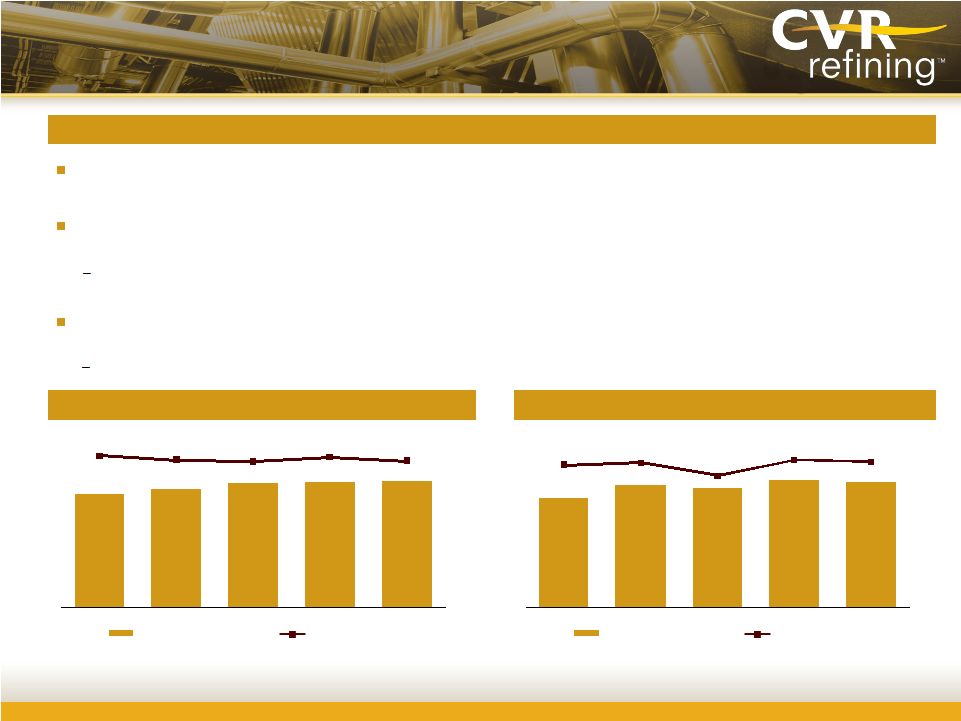

Since the mid-1990s, demand for gasoline and distillates in our key supply area

has exceeded production, resulting in a need for imports from other regions,

specifically from the U.S. Gulf Coast Group 3 market prices typically include

a premium equivalent to the logistics cost for U.S. Gulf Coast suppliers to ship

products into the region but this may vary

Favorable Local End Product Supply-Demand

12

Regional supply and demand for distillates

(1)

(Mbpd)

Regional supply and demand for gasoline

(1)

(Mbpd)

Source: EIA; Distillates include jet fuel, kerosene and distillate fuel

oil. (1) Based on data

for the following states: Kansas, Oklahoma, Missouri, Nebraska and Iowa. PADD

II Group 3 product pricing advantage CVR

Refining

benefits

from

the

favorable

supply

–

demand

dynamics

for

gasoline

and

distillates

in

its

key

supply

area

(Kansas, Oklahoma, Missouri, Nebraska, and Iowa)

PADD

II

Group

3

2-1-1

benchmark

was

on

average

$1.54/bbl

above

NYMEX

2-1-1

over

2007

–

2011

421

440

461

465

472

565

549

543

559

545

2007

2008

2009

2010

2011

Gasoline production

Total gasoline sales

274

306

297

318

311

354

360

328

367

362

2007

2008

2009

2010

2011

Distillate production

Total distillate sales

Over the five-year period ended December 31 2011, local gasoline and

distillate demand exceeded production by an average of 16.9%

|

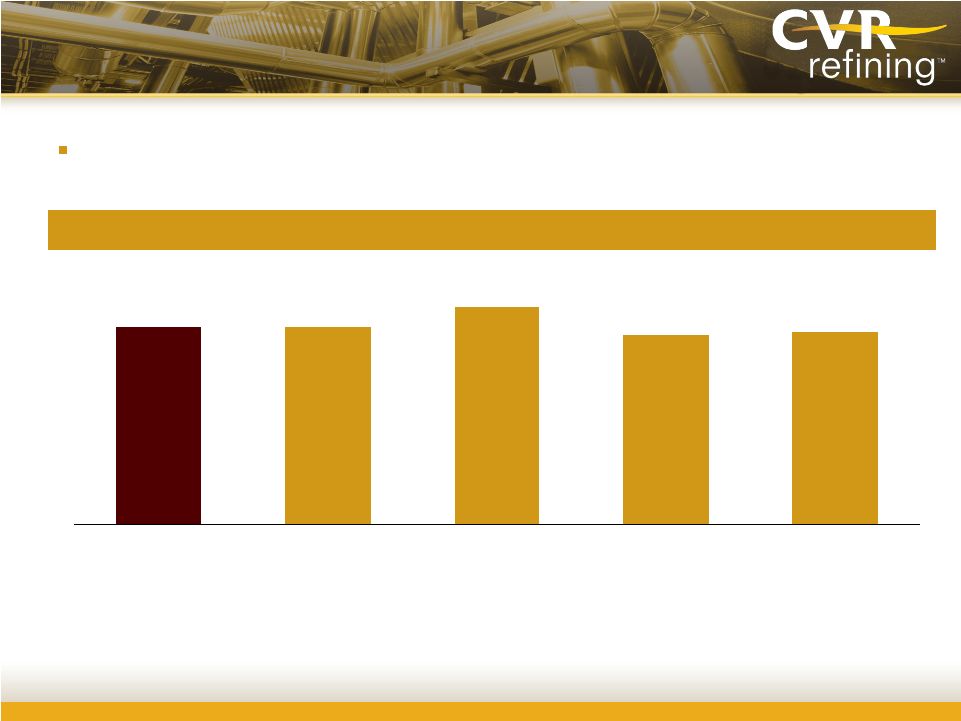

Strong Operating Track Record

Utilization rate

(1)

High

average

annual

refining

utilization

rate

of

94.3%

over

2009

–

2011

Source:

Company data and peer group filings.

(1)

Refinery

utilization

defined

as

crude

throughput

divided

by

the

capacity

of

the

refinery.

(2)

2009 and 2010 utilization rate is not pro forma for the Wynnewood

acquisition. (3)

2011 utilization rate is pro forma for Wynnewood acquisition.

94.3%

94.1%

98.6%

92.4%

93.1%

2009 - 2011 average

2009

2010

2011

Nine months ended

Sept 30, 2012

13

(2)

(2)

(3) |

How

CVR Refining Makes Money CVRR historical crack spread

(1)

14

CVR

Refining

makes

money

by

buying

crude

oil

and

selling

refined

products

(primarily

gasoline

and

diesel)

The crack spread for mid-continent suppliers includes the Brent-WTI

differential The Company enjoys some advantages that enhance this

spread Has access to and can process price-advantaged mid-continent

local and Canadian crude oils Markets its products in a

supply-constrained products market with transportation and crude cost advantage

Costs include

Direct and variable operating costs

Volumetric loss

Product mix variance

Long-term PADD II Group 3

2-1-1 crack premium versus

NYMEX:

(2)

•

$1.54 per barrel

CVRR long-term average crude cost

discount

versus

NYMEX

WTI:

(4)

•

$3.52 per barrel of crude

Average NYMEX 2-1-1 crack

spread,

2009

-

2011

(3)

:

$14.97/bbl

•

Crack spread for nine months

ended 9/30/2012 : $29.87/bbl

Implied CVRR 2-1-1 crack spread

$62

$80

$95

$96

$13

$13

$31

$30

$75

$93

$126

$126

2009

2010

2011

Nine months

ended

Sept 30, 2012

WTI

CVRR realized crack spread

Product prices

Note:

2009, 2010 and 2011 data includes Coffeyville refinery only.

(1)

CVRR 2-1-1 crack spread. The 2-1-1 crack spread is not a full representation of the

realized refining gross margin as it does not include asphalt and other lower margin products.

(2)

Based on historical five year period ended December 31, 2011.

(3)

Based on historical annual data from 2009 to 2011.

(4)

Based on historical Company data from 1Q 2007 to 3Q 2012.

NYMEX

2-1-1

crack

spread

Group 3 product premium

CVRR crude discount |

Financial Overview |

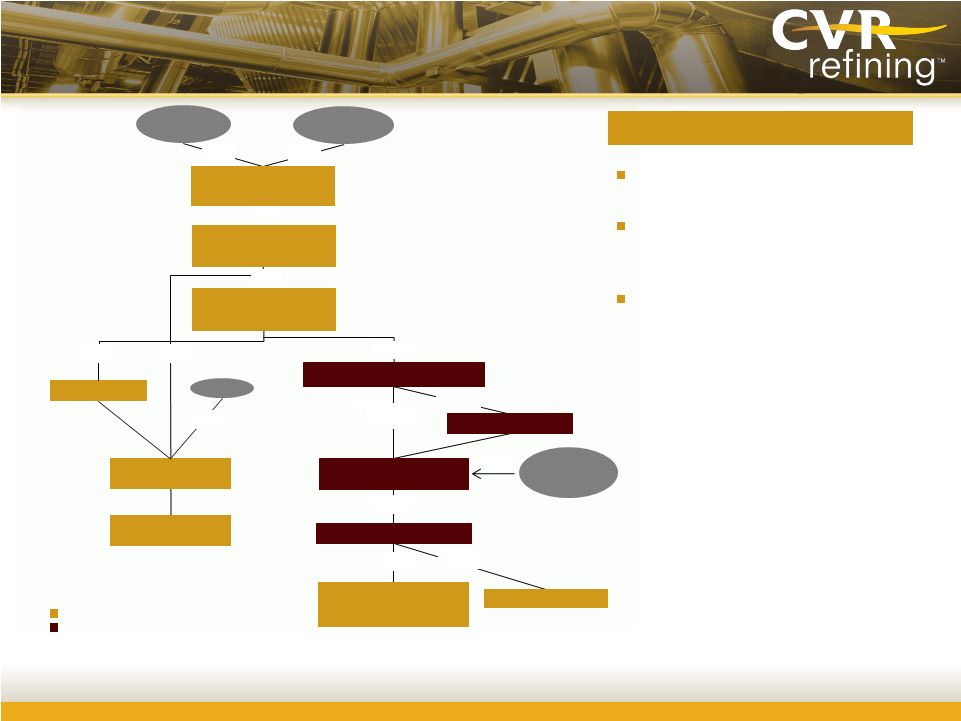

CVRR unit holders own units of CVR

Refining, LP

Liquidity supported by $400 million ABL

and $150 million inter-company credit

facility

Second Lien Notes due 2022 became

unsecured Notes upon IPO

Organizational Structure

16

Petroleum Refining and

Logistics Operating

Subsidiaries

(4)

CVR Refining, LLC

CVR Refining, LP (MLP)

(CVRR)

Coffeyville Finance Inc.

CVR Refining Holdings, LLC

100%

100%

100%

CVR Partners, LP

100%

Public

Public

30.3%

100%

Common

Units

Public

Offering

CVR GP, LLC

100%

CVR Energy, Inc. (CVI)

Coffeyville Resources, LLC

(CRLLC)

69.7%

IEP

82.0%

18.0%

100%

Existing entities

New entities created in conjunction with the MLP IPO

(1)

Includes Wynnewood Insurance Corporation, Coffeyville Nitrogen Fertilizers, Inc., CL

JV Holdings, LLC, Coffeyville Refining & Marketing Holdings, Inc., Coffeyville Refining & Marketing, Inc., Coffeyville

Terminal, Inc., Coffeyville Crude Transportation, Inc., and Coffeyville Pipeline,

Inc. (2)

Includes 12,000 common units issued to its wholly-owned subsidiary, CVR Refining

Holdings Sub, LLC. (3)

Includes Coffeyville Resources Nitrogen Fertilizers, LLC.

(4)

Includes Wynnewood Energy Company, LLC, Wynnewood Refining Company, LLC, Coffeyville

Resources Refining & Marketing, LLC, Coffeyville Resources Crude Transportation, LLC, Coffeyville

Resources Terminal, LLC, and Coffeyville Resources Pipeline, LLC.

Key structuring considerations

Fertilizer Operating

Subsidiaries

(3)

Holding Companies

(1)

100%

81.3%

Common

Units

18.7%

CVR Refining GP, LLC

(2) |

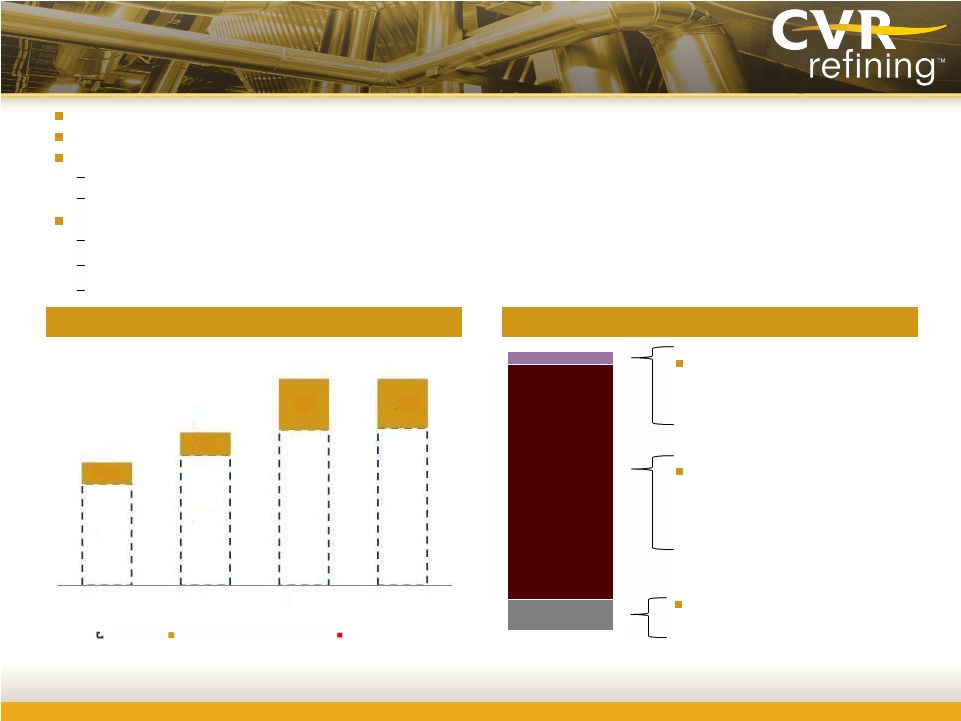

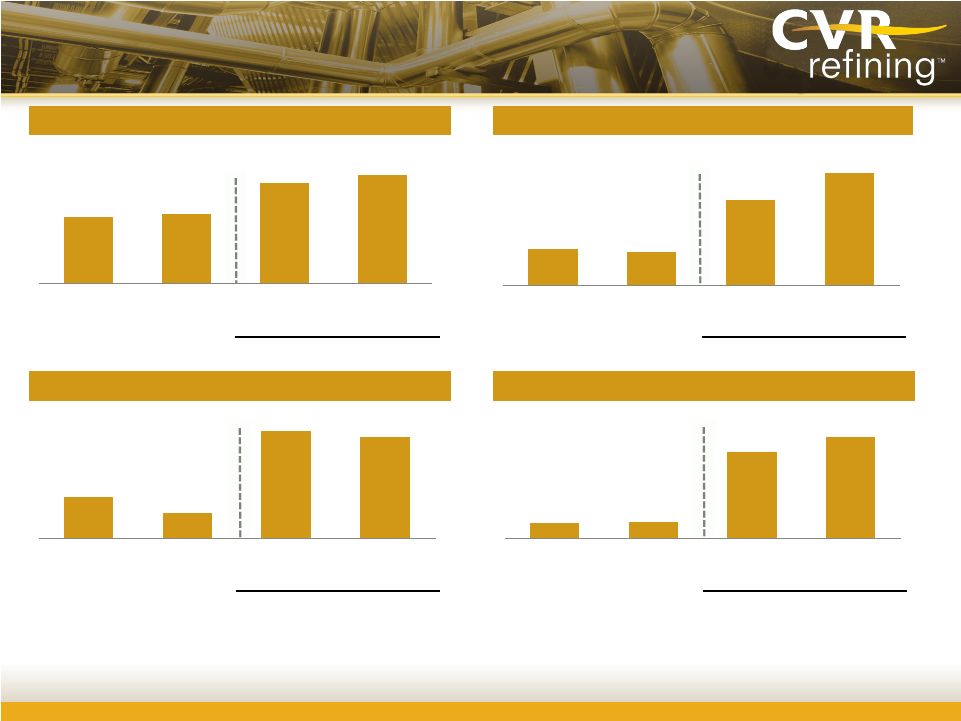

Historical Financial Summary

Refinery crude throughput

Refining gross margin

(1)

Capital expenditures

17

Adjusted EBITDA

(2)

(mbpd)

($ in millions)

($/bbl)

($ in millions)

Pro forma for Wynnewood acquisition

Pro forma for Wynnewood acquisition

Pro forma for Wynnewood acquisition

Pro forma for Wynnewood acquisition

$8.93

$8.07

$20.67

$27.46

2009

2010

2011

Nine months

ended

Sept 30, 2012

108.2

113.4

162.4

176.6

2009

2010

2011

Nine months

ended

Sept 30, 2012

$34.0

$21.2

$87.6

$82.8

2009

2010

2011

Nine months

ended

Sept 30, 2012

$147

$153

$843

$989

2009

2010

2011

Nine months

ended

Sept 30, 2012

Source:

Company filings.

Note:

2009 and 2010 numbers for Coffeyville only. 2011 carve-out values shown.

(1)

Refining margin per crude oil throughput barrel adjusted for FIFO impact. Calculated as the difference

between net sales and cost of product sold (exclusive of depreciation and amortization)

adjusted for FIFO impacts. (2)

Represents EBITDA adjusted for FIFO impacts, share-based compensation, loss on extinguishment of

debt, major scheduled turnaround expenses, Wynnewood acquisition transaction fees and

integration expenses, loss on disposition of assets and net unrealized gain (loss) on derivatives. |

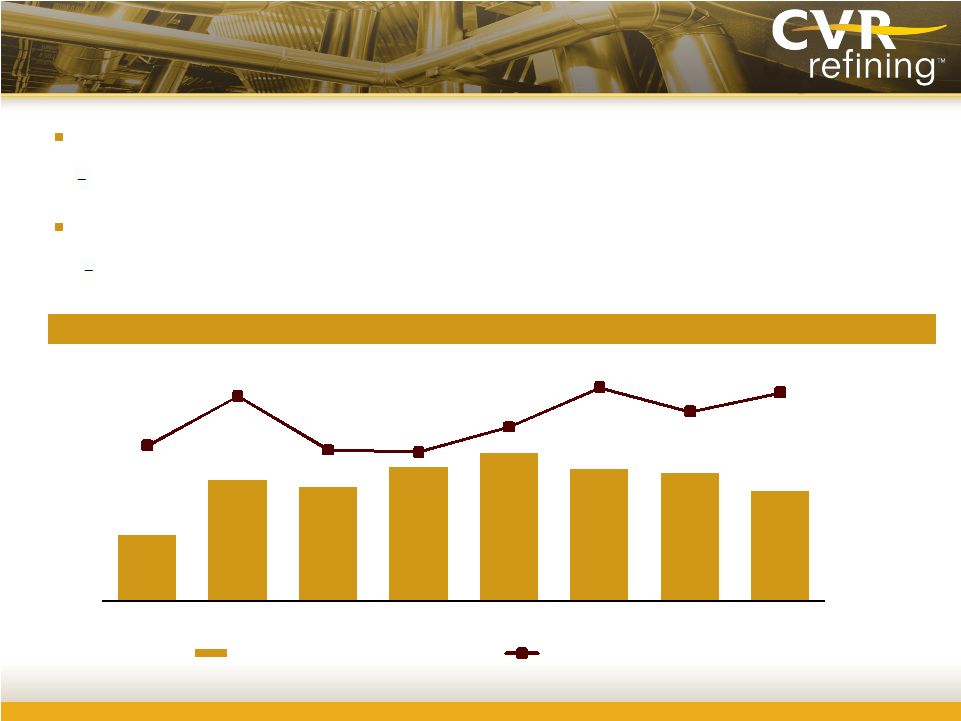

Hedging Policy Locks in Attractive Spreads

Hedged an average of ~52,000 bpd of production for 2012 and ~62,000 bpd in

2013 Crack spreads hedged at an average $24.47/bbl for 2012 and $26.13/bbl

for 2013 Hedging provides protection in a downside scenario

Ability to cover costs in a severe downside scenario

18

(1)

Hedged

crack

spreads

represent

weighted-average

price

of

all

positions

for

respective

quarters.

2.9

5.3

5.0

5.9

6.5

5.8

5.6

4.8

$23.87

$26.67

$23.62

$23.50

$24.94

$27.18

$25.80

$26.88

$15.00

$17.00

$19.00

$21.00

$23.00

$25.00

$27.00

0.0

1.0

2.0

3.0

4.0

5.0

6.0

7.0

8.0

9.0

10.0

Q1 '12

Q2 '12

Q3 '12

Q4 '12

Q1 '13

Q2 '13

Q3 '13

Q4 '13

Hedged bbls (millions)

Hedged crack spread ($/bbl)

Historical

refining

margin

(1) |

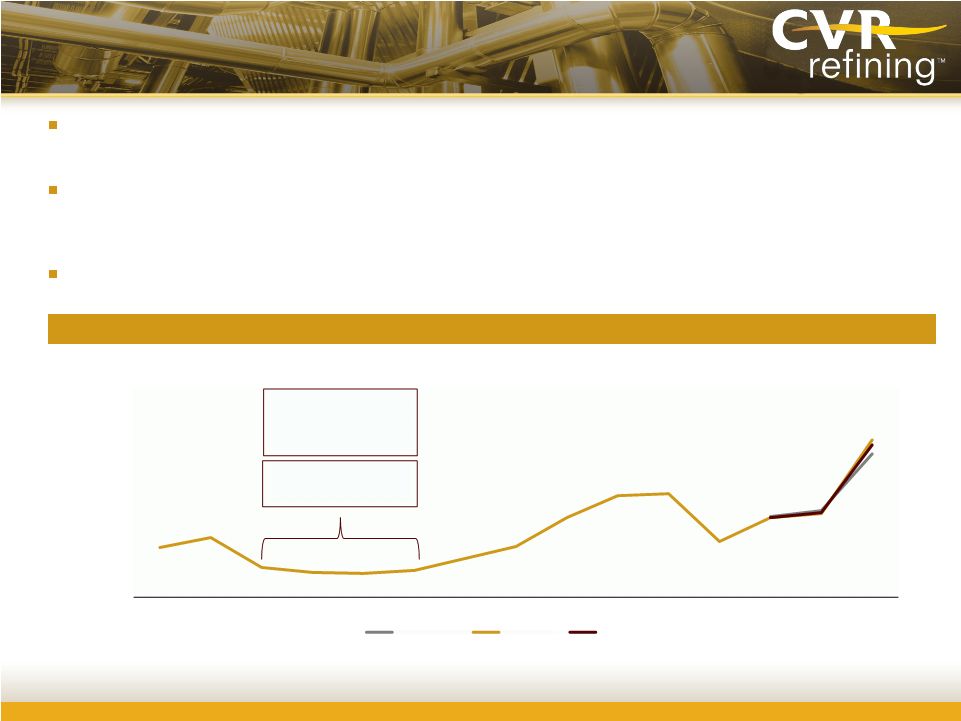

Ample

Liquidity, Sufficient to Sustain a

2009-style Downturn

Current local crude supply demand dynamics expected to be sustainable over longer

term and should support Brent – WTI differential

Average

refining

margin

over

Q3

2009

to

Q2

2010

(lowest

four

quarters

over

2009

–

Q3

2012)

of

$6.20/bbl

for

Coffeyville

refinery

versus

operating

expenses

(excl.

turnaround

expenses)

of

$4.52/bbl

over

nine

months

ended

September 30, 2012

Total liquidity of ~$863 million post-IPO; total debt of ~$553 million

post-IPO ($/bbl)

Historical refining margin

Source:

Company data.

19

$0.00

$5.00

$10.00

$15.00

$20.00

$25.00

$30.00

$35.00

$40.00

1Q '09

2Q '09

3Q '09

4Q '09

1Q '10

2Q '10

3Q '10

4Q '10

1Q '11

2Q '11

3Q '11

4Q '11

1Q '12

2Q '12

3Q '12

Wynnewood

Coffeyville

Combined

Lowest four quarters

over

Q3 '09 -

Q2 '10

Avg. refining margin:

$6.20/bbl |

Financial Strategy

On the closing of the MLP IPO, the cash balance at CVRR was ~$340 million, which

includes amounts for unpaid Wynnewood turnaround expenses incurred in Q4

2012 Strong liquidity through committed credit facilities ($400 million

ABL) $150 million senior unsecured credit facility to fund future capex

program Intermediation arrangement with Vitol reduces working capital

requirements The New Notes are unsecured

Debt covenants allow for distributions when fixed charge coverage ratio is 2.5x or

higher (2013E forecast is 23.1x)

Variable

distribution

with

no

MQD

and

no

IDRs

–

100%

of

available

cash

to

be

distributed

Wynnewood turnaround expense in Q4 2012 to be paid and near term

environmental capex to be prefunded with IPO proceeds

Going forward, cash to be reserved for turnaround costs associated with both

refineries 20

Distributions

Capital structure

Liquidity

management |

Appendix |

Partnership Distribution Policy

22

CVR Refining intends to make distributions within 60 days after the end of each

quarter, beginning with the quarter ending March 31, 2013

Distributions

for

each

quarter

will

be

in

an

amount

equal

to

the

available

cash

generated

in

such

quarter

Available cash for each quarter will generally equal Adjusted EBITDA, less:

–

Maintenance and environmental capex reserves

–

Reserves for turnaround and related expenses

–

Debt service and other contractual obligations

Distributions per unit declared using available cash for each quarter divided by

total common units outstanding

CVRR does not intend to maintain excess distribution coverage for the purpose of

maintaining stability or growth in its quarterly distributions nor does it

intend to incur debt to pay quarterly distributions |

Adjustments to reconcile Adjusted EBITDA to

estimated cash available for distribution

23

($ in millions)

2013E

Adjusted EBITDA

$900.8

Less:

Incremental general and administrative expenses

$5.0

Cash interest expense (net)

38.9

Maintenance capital expenditures

89.5

Environmental capital expenditures

94.7

Growth capital expenditures

47.5

Increase in reserves for environmental

and maintenance capital expenditures

125.0

Increase in reserves for future turnarounds

35.0

Plus:

Use of cash on hand to fund environmental

and maintenance capital expenditures

$184.2

Draw on $150mm senior unsecured credit facility

to fund growth capital expenditures

47.5

Total adjustments

$696.9 |

24

Non-GAAP Financial Measures (cont’d)

EBITDA.

EBITDA

is

defined

as

net

income

before

income

tax

expense,

net

interest

(income)

expense

and

depreciation and amortization expense. EBITDA is not a recognized term under GAAP

and should not be substituted for net income as a measure of performance but

should be utilized as a supplemental measure of performance in evaluating

our business. Management believes that EBITDA provides relevant and useful

information that enables external users of our financial statements, such as industry analysts,

investors, lenders and rating agencies to better understand and evaluate our

ongoing operating results and

allows

for

greater

transparency

in

the

review

of

our

overall

financial,

operational

and

economic

performance. |

25

Non-GAAP Financial Measures (cont’d)

Adjusted EBITDA.

Adjusted EBITDA represents EBITDA adjusted for FIFO impacts (favorable) unfavorable (as described below), share-based

compensation, and where applicable, loss on extinguishment of debt, major scheduled turnaround

expenses, Wynnewood acquisition transaction fees and integration expense, loss on disposition

of assets and unrealized gain (loss) on derivatives, net. Adjusted EBITDA is a supplemental

measure of our performance that is not required by, nor presented in accordance with,

GAAP. Management believes that Adjusted EBITDA provides relevant and useful information that

enables investors to better understand and evaluate our ongoing operating results and allows

for greater transparency in the reviewing of our overall financial, operational and economic

performance. |

Direct Operating Expenses (Excluding Major Scheduled Turnaround Expenses) Per Crude

Oil Throughput

Barrel.

Direct

operating

expenses

excluding

major

scheduled

turnaround

expenses

per

crude oil throughput barrel is a measurement calculated by excluding major

scheduled turnaround expenses from direct operating expenses (exclusive of

depreciation and amortization) divided by our refineries’

crude oil throughput volumes for the respective periods presented. Direct

operating expenses excluding major scheduled turnaround expenses per crude

oil throughput barrel is a supplemental measure of our performance that is

not required by, nor presented in accordance with, GAAP. Management believes

direct operating expenses excluding major scheduled turnaround expenses per

crude oil throughput most directly represents ongoing direct operating expenses at

our refineries. 26

Non-GAAP Financial Measures (cont’d) |

Gross Profit (Excluding Major Scheduled Turnaround Expenses and Adjusted for FIFO

Impacts) Per

Crude

Oil

Throughput

Barrel.

Gross

profit

excluding

major

scheduled

turnaround

expenses

and

adjusted for FIFO impacts per crude oil throughput barrel is calculated as the

difference between net sales, cost of product sold (exclusive of

depreciation and amortization) adjusted for FIFO impacts, direct operating

expenses (exclusive of depreciation and amortization) excluding scheduled turnaround

expenses

divided

by

our

refineries’

crude

oil

throughput

volumes

for

the

respective

periods

presented.

Gross profit excluding major scheduled turnaround expenses and adjusted for FIFO

impacts is a non- GAAP measure that should not be substituted for gross

profit or operating income. Management believes it is

important

to

investors

in

evaluating

our

refineries’

performance

and

our

ongoing

operating

results.

Our

calculation

of

gross

profit

excluding

major

scheduled

turnaround

expenses

and

adjusted

for

FIFO

impacts

per

crude

oil

throughput

may

differ

from

similar

calculations

of

other

companies

in

our

industry,

thereby

limiting its usefulness as a comparative measure.

27

Non-GAAP Financial Measures (cont’d) |

28

Non-GAAP Financial Measures

Refining margin per crude oil throughput barrel is a

measurement calculated as the difference between net sales and cost of product sold (exclusive of

depreciation and amortization) divided by our refineries’ crude oil throughput volumes for

the respective periods presented. Refining margin per crude oil throughput barrel is a

non-GAAP measure that should not be substituted for gross profit or operating income.

Management believes this measure is important to investors in evaluating our refineries’

performance as a general indication of the amount above our cost of product sold that we are

able to sell refined products. Our calculation of refining margin per crude oil throughput

barrel may differ from similar calculations of other companies in our industry, thereby

limiting its usefulness as a comparative measure. We use refining margin per crude oil throughput

barrel as the most direct and comparable metric to a crack spread which is an observable market

indication of industry profitability.

Refining Margin Per Crude Oil Throughput Barrel.

|

Refining

Margin

Per

Crude

Oil

Throughput

Barrel

Adjusted

for

FIFO

Impact.

Refining

margin

per

crude oil throughput barrel adjusted for FIFO impact is a measurement calculated as

the difference between net sales and cost of product sold (exclusive of

depreciation and amortization) adjusted for FIFO impacts

divided

by

our

refineries’

crude

oil

throughput

volumes

for

the

respective

periods

presented.

Refining margin adjusted for FIFO impact is a non-GAAP measure that we believe

is important to investors in evaluating our refineries’

performance as a general indication of the amount above our cost of product

sold

(taking

into

account

the

impact

of

our

utilization

of

FIFO)

that

we

are

able

to

sell

refined

products.

Our

calculation of refining margin adjusted for FIFO impact may differ from

calculations of other companies in our industry, thereby limiting its

usefulness as a comparative measure. Under our FIFO accounting method,

changes in crude oil prices can cause fluctuations in the inventory valuation of our crude oil, work

in process and finished goods, thereby resulting in favorable FIFO impacts when

crude oil prices increase and unfavorable FIFO impacts when crude oil prices

decrease. 29

Non-GAAP Financial Measures (cont’d) |

($ in millions)

CVR Refining, LP Historical Combined

CVR Refining LP

Combined Pro Forma

Year Ended

December 31,

Nine Months Ended

September 30,

Year Ended

December 31,

Nine Months Ended

September 30,

2009

2010

2011

2011

2012

2011

2012

(unaudited)

(unaudited)

Net

income

$64.6

$38.2

$480.3

$402.8

$540.7

$749.0

$565.1

Add:

Interest expense and other financing costs

43.8

49.7

53.0

39.2

56.0

41.7

31.6

Depreciation and amortization

64.4

66.4

69.8

50.9

80.4

98.9

80.4

EBITDA

$172.8

$154.3

$603.1

$492.9

$677.1

$889.6

$677.1

Add:

FIFO impacts (favorable),

unfavorable

(a)

(67.9)

(31.7)

(25.6)

1.5

54.3

(46.6)

54.3

Share-based compensation

2.5

11.5

8.9

8.0

15.6

8.9

15.6

Loss on disposition of assets

–

1.3

2.5

1.5

–

2.5

–

Loss on extinguishment of debt

2.1

16.6

2.1

2.1

–

2.1

–

Wynnewood acquisition transaction fees and integration expense

–

–

5.2

–

10.3

5.2

10.3

Major scheduled turnaround expenses

–

1.2

66.4

12.2

34.6

66.4

34.6

Unrealized (gain) loss on derivatives, net

37.8

(0.6)

(85.3)

6.8

197.0

(85.4)

197.0

Adjusted EBITDA

$147.3

$152.6

$577.3

$525.0

$988.9

$842.7

$988.9

Non-GAAP Financial Measures (cont’d)

30

(a)

FIFO is our basis for determining inventory value on a GAAP basis. Changes in crude oil prices can

cause fluctuations in the inventory valuation of our crude oil, work in process and finished goods

thereby resulting in favorable FIFO impacts when crude oil prices increase and unfavorable FIFO impacts

when crude oil prices decrease. The FIFO impact is calculated based upon inventory values at the

beginning of the accounting period and at the end of the accounting period. |

($ in millions, except

per barrel data) CVR Refining, LP Historical Combined

CVR Refining LP

Combined Pro Forma

Year Ended

December 31,

Nine Months Ended

September 30,

Year Ended

December 31,

Nine Months Ended

September 30,

2009

2010

2011

2011

2012

2011

2012

(unaudited)

(unaudited)

Direct operating expenses

$142.2

$153.1

$247.7

$144.0

$253.1

$345.0

$253.1

Less: Major scheduled turnaround expense

–

(1.2)

(66.4)

(12.2)

(34.6)

(66.4)

(34.6)

Direct operating expenses excluding

major scheduled turnaround expenses

142.2

151.9

181.3

131.8

218.5

278.6

218.5

Crude oil throughput(bpd)

108,226

113,365

103,702

107,070

176,589

162,437

176,589

Direct operating expenses excluding major

scheduled turnaround expenses per crude oil throughput barrel

$3.60

$3.67

$4.79

$4.51

$4.52

$4.70

$4.52

Non-GAAP Financial Measures (cont’d)

31 |

($ in millions, except

per barrel data) CVR Refining, LP Historical Combined

CVR Refining LP

Combined Pro Forma

Year Ended

December 31,

Nine Months Ended

September 30,

Year Ended

December 31,

Nine Months Ended

September 30,

2009

2010

2011

2011

2012

2011

2012

(unaudited)

(unaudited)

Net sales

$2,936.5

$3,905.6

$4,752.8

$3,773.3

$6,465.5

$7,398.3

$6,465.5

Cost of product sold

2,515.9

3,539.8

3,927.6

3,078.5

5,191.0

6,126.0

5,191.0

Direct operating expenses

142.2

153.1

247.7

144.0

253.1

345.0

253.1

Depreciation and amortization

64.4

66.4

69.8

50.9

80.4

98.9

80.4

Gross profit

214.0

146.3

507.7

499.9

941.0

828.4

941.0

Add:

Major scheduled turnaround expense

–

1.2

66.4

12.2

34.6

66.4

34.6

FIFO impacts (favorable)/unfavorable

(67.9)

(31.7)

(25.6)

1.5

54.3

(46.6)

54.3

Gross profit excluding major scheduled turnaround expenses

and adjusted for FIFO impacts

146.1

115.8

548.5

513.6

1,029.9

848.2

1,029.9

Crude oil throughput(bpd)

108,226

113,365

103,702

107,070

176,589

162,437

176,589

Gross profit excluding major scheduled turnaround expenses

and adjusted for FIFO impact per crude oil throughput barrel

$3.70

$2.80

$14.49

$17.57

$21.29

$14.31

$21.29

Non-GAAP Financial Measures (cont’d)

32 |

($ in millions, except

per barrel data) CVR Refining, LP Historical Combined

CVR Refining LP

Combined Pro Forma

Year Ended

December 31,

Nine Months Ended

September 30,

Year Ended

December 31,

Nine Months Ended

September 30,

2009

2010

2011

2011

2012

2011

2012

(unaudited)

(unaudited)

Net sales

$2,936.5

$3,905.6

$4,752.8

$3,773.3

$6,465.5

$7,398.3

$6,465.5

Less: cost of product sold (exclusive of depreciation and amortization)

2,515.9

3,539.8

3,927.6

3,078.5

5,191.0

6,126.0

5,191.0

Refining margin

420.6

365.8

825.2

694.8

1,274.5

1,272.3

1,274.5

FIFO impacts (favorable), unfavorable

(67.9)

(31.7)

(25.6)

1.5

54.3

(46.6)

54.3

Refining margin adjusted for FIFO impact

352.7

334.1

799.6

696.3

1,328.8

1,225.7

1,328.8

Crude oil throughput(bpd)

108,226

113,365

103,702

107,070

176,589

162,437

176,589

Refining margin per crude oil throughput barrel

$10.65

$8.84

$21.80

$23.77

$26.34

$21.46

$26.34

Refining margin per crude oil throughput barrel adjusted for FIFO impact

$8.93

$8.07

$21.12

$23.82

$27.46

$20.67

$27.46

Non-GAAP Financial Measures (cont’d)

33 |