Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ASSEMBLY BIOSCIENCES, INC. | v332604_8k.htm |

Forward Looking Statements This material contains estimates and forward - looking statements. The words “believe,” “may,” “might,” “will,” “aim,” “estimate,” “continue,” “would,” “anticipate, ”“intend,” “expect,” “plan” and similar words are intended to identify estimates and forward - looking statements. Our estimates and forward - looking statements are mainly based on our current expectations and estimates of future events and trends, which affect or might affect our businesses and operations. Although we believe that these estimates and forward - looking statements are based upon reasonable assumptions, they are subject to many risks and uncertainties and are made in light of information currently available to us. Our estimates and forward - looking statements may be influenced by the following factors, among others : risks related to the costs, timing, regulatory review and results of our studies and clinical trials; our ability to obtain FDA approval of our product candidates; differences between historical studies on which we have based our planned clinical trials and actual results from our trials; our anticipated capital expenditures, our estimates regarding our capital requirements, and our need for future capital; our liquidity and working capital requirements; our expectations regarding our revenues, expenses and other results of operations; the unpredictability of the size of the markets for, and market acceptance of, any of our products; our ability to sell any approved products and the price we are able to realize; our need to obtain additional funding to develop our products, and our ability to obtain future funding on acceptable terms; our ability to retain and hire necessary employees and to staff our operations appropriately; our ability to compete in our industry and innovation by our competitors; our ability to stay abreast of and comply with new or modified laws and regulations that currently apply or become applicable to our business; estimates and estimate methodologies used in preparing our financial statements; the future trading prices of our common stock and the impact of securities analysts’ reports on these prices; and the risks set out in our filings with the SEC, including our Annual Report on Form 10 - K. Estimates and forward - looking statements involve risks and uncertainties and are not guarantees of future performance. As a result of known and unknown risks and uncertainties, including those described above, the estimates and forward - looking statements discussed in this material might not occur and our future results and our performance might differ materially from those expressed in these forward - looking statements due to, including, but not limited to, the factors mentioned above. Estimates and forward - looking statements speak only as of the date they were made, and, except to the extent required by law, we undertake no obligation to update or to review any estimate and/or forward - looking statement because of new information, future events or other factors. 1

» A phase 3 specialty pharmaceutical company focused on neglected areas of drug development: Initial focus is anal disorders » Current portfolio VEN 307: Diltiazem cream for anal fissures – 505(b)(2) NDA filing Q4 2013 Phase III data from first pivotal trial showed good tolerability, significant improvement in efficacy outcomes for anal fissures Critical mass market focused in gastroenterologist and colorectal surgeons Significant lifecycle opportunities VEN 308: Topical phenylephrine for fecal incontinence – 505(b)(2) NDA filing 2015 P ublished proof of concept trials in fecal incontinence associated with Ileal Pouch Anal Anastomosis (IPAA) Orphan disorder treated in ~40 colorectal surgery centers nationwide Significant expansion opportunity » Funded through key milestones Sufficient cash for the completion of the VEN 307 development program Company Overview 2

VEN 307: Diltiazem Cream Novel Treatment for Anal Fissures

Anal Fissures: Cause and Management Increased sphincter tone Local ischemia Tear (fissure) in anal canal Cause Severe pain on defecation Treatment Options Control constipation, topical steroids Reduce sphincter tone Compounded t opical drugs: • GTN* • D iltiazem Botox Surgery Sphincters (muscles) Anal fistula Anal Fissure 1.1 million office visits/year † * Rectiv (topical GTN) recently approved by FDA; launched 3/2012 by Aptalis . † Physician Drug & Diagnosis Audit (PDDA), 2010. 4

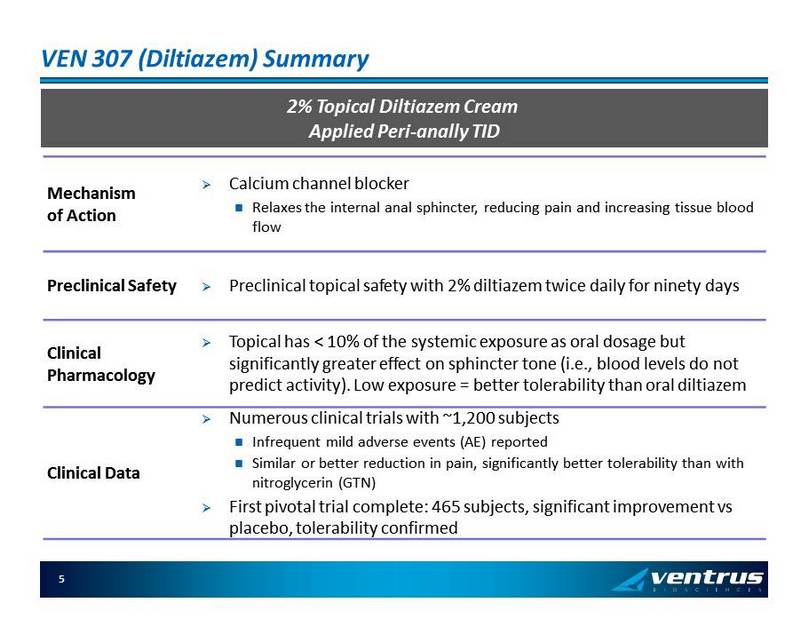

VEN 307 ( Diltiazem ) Summary 2% Topical Diltiazem Cream Applied Peri - anally TID Mechanism of Action » Calcium channel blocker Relaxes the internal anal sphincter, reducing pain and increasing tissue blood flow Preclinical Safety » Preclinical topical safety with 2% diltiazem twice daily for ninety days Clinical Pharmacology » Topical has < 10% of the systemic exposure as oral dosage but significantly greater effect on sphincter tone (i.e ., blood levels do not predict activity). Low exposure = better tolerability than oral diltiazem Clinical Data » Numerous clinical trials with ~1,200 subjects Infrequent mild adverse events (AE) reported Similar or better reduction in pain, significantly better tolerability than with nitroglycerin (GTN) » First pivotal trial complete: 465 subjects, significant improvement vs placebo, tolerability confirmed 5

FDA Written Feedback from Pre - NDA Meeting August 30, 2012 » Planned NDA submission following completion of second Phase 3 study (expected Q4 2013) » Second Phase 3 study design accepted Randomized, double - blind, placebo - controlled, parallel - treatment group efficacy and safety study of topical diltiazem hydrochloride 2% cream in subjects with anal fissures 400 subjects at approximately 120 clinical sites in the U.S., Canada and Israel Primary endpoint is reduction of worst anal fissure - related pain associated with or following defecation when administered three times a day for 28 days Secondary endpoints are reduction of (i) overall daily anal fissure - related pain and (ii) patient global impression of improvement (PGI - I) at day 29 in subjects with anal fissure - related pain » NDA to include clinical cutaneous sensitization and irritation studies and PK study » Confirmed with the FDA that there is no need for chronic studies 6

First Pivotal Phase III Trial » FDA (Analgesia Division) pre - IND meeting conducted in August 2007 Achieved clarity on primary endpoint: Reduction in pain Confirmed safety database and toxicology requirement » Phase III trial conducted by SLA Pharma (Ex - North America licensor) 3 arms with 155 patients per arm in 31 sites in Europe 2% and 4% diltiazem three times a day (TID) and placebo in 31 sites across Europe Romania (11 centers, 66%), Bulgaria, Spain, UK, Germany and Lithuania 94.6% of subjects completed the 12 - week study Primary outcome: Change from baseline in average of worst anal pain associated with or following defecation at Week 4 on an 11 - point numerical rating scale ( Likert - like scale) Selected secondary outcomes: Change from baseline in average of daily overall anal fissure - related pain at Week 4 Proportion of subjects who have complete healing of anal fissure at Week 8 Change in the Patient’s Global Impression of Improvement (PGI - I) at Week 4 Study Hit Anal Fissure “Trifecta” Outcome never before achieved in a single trial of a topical drug 7

Primary Endpoint: Average Score of Worst Anal Pain Associated with or Following Defecation at Week 4 2.5 3.0 3.5 4.0 4.5 5.0 5.5 6.0 6.5 7.0 Baseline 1 2 3 4 5 6 7 8 4% diltiazem 2% diltiazem Placebo ▲ ▲ ▲ ▲ Compared with placebo, significant reductions with diltiazem from Week 3 For 4% diltiazem, p = 0.011 vs placebo For 2% diltiazem, p = 0.012 vs placebo ź = p < 0.025 for 2% diltiazem only Ÿ = p < 0.025 for both diltiazem treatments ▼ ▼ Pain Rating 8

Secondary Endpoint: Average Score of Daily AF Pain at Week 4 2.0 2.5 3.0 3.5 4.0 4.5 5.0 5.5 6.0 6.5 Baseline 1 2 3 4 5 6 7 8 4% diltiazem 2% diltiazem Placebo ▼ ź = p < 0.025 for 2% diltiazem only Ÿ = p < 0.025 for both diltiazem treatments ▼ ▲ ▲ For 4% diltiazem, p = 0.029 vs placebo For 2% diltiazem, p = 0.014 vs placebo ▼ ▼ Pain Rating Compared with placebo, significant reductions with diltiazem from Week 3 9

Secondary Endpoint: Healing of Anal Fissure at Week 8 32.70% 31.20% 23.90% 20% 25% 30% 35% 4% diltiazem 2% diltiazem Placebo p = 0.018 vs placebo p = 0.043 vs placebo Percentage of Anal Fissure Healing Compared with placebo, significantly greater healing with diltiazem 4% at Week 8 10

Adverse Events: Incidence of Headache Incidence of Headache (%) 14.70% 12.30% 14.20% 0% 2% 4% 6% 8% 10% 12% 14% 16% 4% diltiazem 2% diltiazem Placebo No significant differences between diltiazem and placebo 11

Summary of First Phase III Results (May 14, 2012) » Double - blind, placebo - controlled clinical trial randomized 465 subjects to diltiazem hydrochloride 4% or 2% by weight (w/w) cream, or placebo, applied topically three times daily (TID) for 8 weeks, followed by a 4 week blinded observation period » At 4 weeks, the 2% diltiazem treatment arm demonstrated improvements compared to placebo: Primary endpoint of average of worst anal pain associated with or following defecation: Pain score improvement of 0.43 for 2% diltiazem (p=0.0122) Secondary endpoint of overall anal - fissure - related pain: Pain score improvement of 0.42 for 2% diltiazem (p=0.0143) » Compared with placebo, 2% diltiazem significantly improved the Patient’s Global Impression of Improvement measure at Week 4 (p = 0.0084) » At Week 8, healing was improved for the 2% diltiazem arm (31.2% healing; p=0.0426) compared to placebo (23.9%) » Adverse events (i.e., incidence of headaches) were similar across all 3 treatment arms (4%, 2%, placebo) 12

VEN 307 Life Cycle Management: BID Formulation » Licensed from SLA P harma for U.S. and Canada in return for single digit royalties and approval milestones » U.S. patent protects IP through February 2018 and with HW extension to August 2019. Possible pediatric extension to Q2 2020. After expiration, the Company expects generic approval to be difficult due to topical dosage, trade secret protection, re - formulation obstacles and the need for clinical study and comparative PK data in AF patients » Have completed technical development of 4 extended release formulations All patentable with expected protection through 2033 All B.I.D. or O.D. Conduct one U.S. Phase 3 trial with one extended release formulation in 2015 (if one is acceptable). File NDA in 2016 or 2017 13

Multiple Major Milestones Expected Over Next 12 Months Second Pivotal Phase 3 Trial Q3 - 12 Q4 - 12 Q1 - 13 Q2 - 13 Q3 - 13 Q4 - 13 FDA Meeting NDA Filing Cutaneous Safety Studies Expected 71 - Day Letter: Q1 2014 Expected PDUFA Date: November/December 2014 PK Studies 14

Commercialization VEN 307

VEN 307 Go To Market Plan Executive Summary » Launch VEN 307 in January 2015 to specialty physicians (colorectal surgeons and gastroenterologists) with a contract sales force of 2 0 sales representatives » Minimize financial risk by aligning the majority of commercial expenses with FDA filing and approval 16

VEN 307 Go To Market Plan Preliminary Positioning For your patients with anal fissures, VEN 307 is the first and only FDA - approved GMP prescription product proven to decrease the pain of anal fissures with minimal adverse events » Note : The positioning and messaging for VEN 307 will be finalized following the submission of the NDA 17

Market Forecast Key Model Variables » Population driven Captures natural growth of anal fissures (AF) patient population » Uses audited third party patient data (Physician Drug & Diagnosis Audit, PDDA) as surrogate for incidence of anal fissures » Assesses the market that is driven by colorectal surgeons (CRS) » Leverages market research (Princeton Brand Econometrics, PBE) about prescribing behavior of CRS with AF patients 18

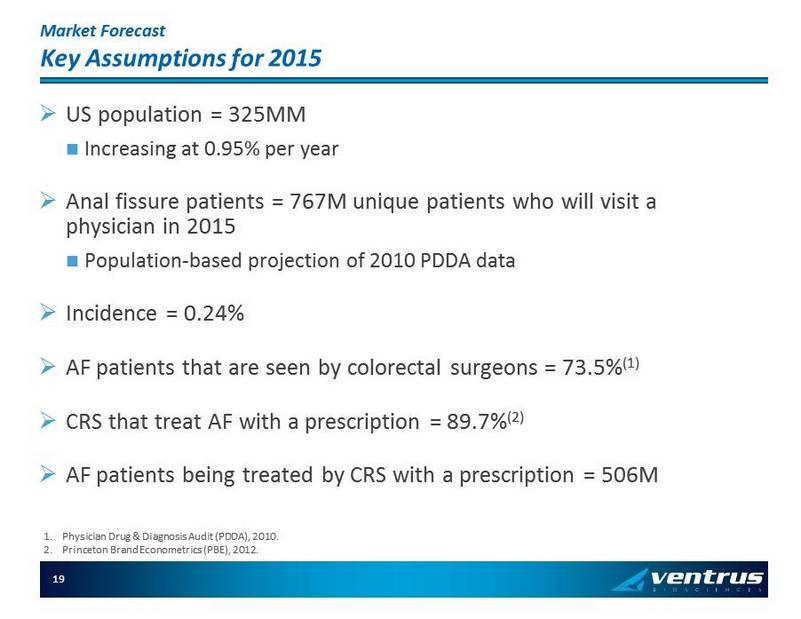

Market Forecast Key Assumptions for 2015 » US population = 325MM Increas ing at 0.95% per year » Anal fissure patients = 767M unique patients who will visit a physician in 2015 P opulation - based projection of 2010 PDDA data » Incidence = 0.24% » AF patients that are seen by colorectal surgeons = 73.5% (1) » CRS that treat AF with a prescription = 89.7% (2) » AF patients being treated by CRS with a prescription = 506M 1. Physician Drug & Diagnosis Audit (PDDA), 2010 . 2. Princeton Brand Econometrics (PBE), 2012. 19

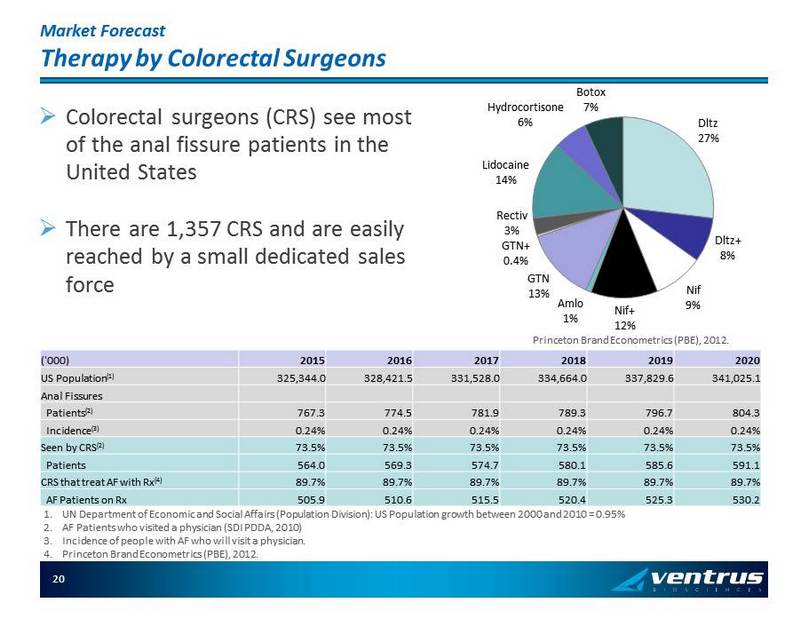

Market Forecast Therapy by Colorectal Surgeons ('000) 2015 2016 2017 2018 2019 2020 US Population (1 ) 325,344.0 328,421.5 331,528.0 334,664.0 337,829.6 341,025.1 Anal Fissures Patients (2 ) 767.3 774.5 781.9 789.3 796.7 804.3 Incidence (3 ) 0.24% 0.24% 0.24% 0.24% 0.24% 0.24% Seen by CRS (2 ) 73.5% 73.5% 73.5% 73.5% 73.5% 73.5% Patients 564.0 569.3 574.7 580.1 585.6 591.1 CRS that treat AF with Rx (4 ) 89.7% 89.7% 89.7% 89.7% 89.7% 89.7% AF Patients on Rx 505.9 510.6 515.5 520.4 525.3 530.2 » Colorectal surgeons (CRS) see most of the anal fissure patients in the United States » There are 1,357 CRS and are easily reached by a small dedicated sales force Dltz 27% Dltz+ 8% Nif 9% Nif+ 12% Amlo 1% GTN 13% GTN+ 0.4% Rectiv 3% Lidocaine 14% Hydrocortisone 6% Botox 7% Princeton Brand Econometrics (PBE), 2012. 1. UN Department of Economic and Social Affairs (Population Division): US Population growth between 2000 and 2010 = 0.95% 2. AF Patients who visited a physician (SDI PDDA, 2010) 3. Incidence of people with AF who will visit a physician. 4. Princeton Brand Econometrics (PBE), 2012. 20

Market Forecast Therapy by Gastroenterologists » Before Rectiv , 55% of patients were prescribed compounded GTN by Gastroenterologists 1 » More recent market research demonstrates that physicians will switch from compounded to GMP treatment options 1. Ventrus clinical trial site survey, 2012. Dltz 4% Dltz+ 2% Nif 3% Nif+ 3% Amlo 0.3% Amlo+ 0.3% GTN 17% GTN+ 6% Rectiv 21% Lidocaine 17% Hydrocortisone 25% Botox 2% Princeton Brand Econometrics (PBE), 2012. 21

Market Forecast Upsides » Issue : Using patient visits of 732M in 2010 as the incidence of AF (0.24%) assumes that all AF patients are visiting a physician Opportunity : Determine if the true incidence of AF is higher and if there are promotional tactics that could increase the number of patient visits » Issue : Forecast only considers those AF patients seen by colorectal surgeons Opportunity : Calling on first decile of gastroenterologists represents (1) an un - forecasted upside and (2) a market expansion assessment » Issue : Forecast assumes only one month of VEN 307 per patient Opportunity : Given a better adverse events profile (vs. GTN) and possibly lower cost to patients (vs. compounded), HCPs may write more than one month per patient 22

Market Forecast Messaging Opportunities » Quality of GMP formulations versus those of compounded agents C urrent compounding controversy Compounded diltiazem quality study 1 Compounded diltiazem is often difficult to get and will become harder as regional compounders only manufacture to an individual script and stop shipping across state lines » The Ventrus Copay Program will ensure that a patient’s out of pocket costs for VEN 307 are comparable to the expenses of a Tier 1 benefit » Highlighting the cost of surgery to drive use of medicine before surgical interventions » The AE profile of VEN 307 is expected to be considerably superior to that of Rectiv Topical diltiazem already has considerable thought leader support and is recommended as first line therapy in CRS practice guidelines 1. APhA , Mar 2013. 23

VEN 308: Topical Phenylephrine Novel Treatment for Fecal Incontinence

Fecal Incontinence Summary Symptoms: IPAA – Frequent soiling and seepage General – Mild soiling to severe urge incontinence Causes: IPAA – Loss of muscle tone and sensation, liquid stool General – Multiple etiologies, including child birth, many GI disorders and other complications Current Treatments: OTC – Bulking fiber, Imodium and pads Rx – No agents available Invasive – Dermal filler ( Solesta ®) and surgery to repair sphincter damage Most Common Pouch Procedures 25

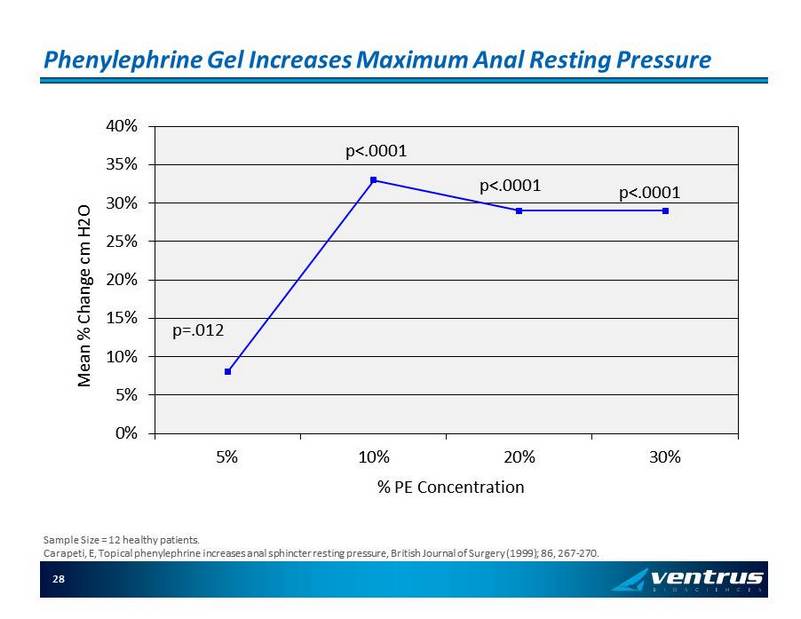

VEN 308 (Phenylephrine) Summary T opical Phenylephrine Applied Peri - anally Mechanism of Action » A selective alpha - 1 agonist that causes internal sphincter contraction and elevates maximum resting anal sphincter pressure Preclinical Safety » Oral: 2 year carcinogenicity; 12 week toxicology » Dermal sensitization and irritation in experimental formulation Clinical Data » Pharmacodynamic increase in maximum resting anal pressure » Proof of concept in 12 IPAA patients over 28 day period » >100 patients in multiple studies of passive FI with mixed results 26

VEN 308 Status » Constricts smooth muscle: I ntroduced into U.S. market as a nasal decongestant (5 - 15 mg, QID, oral ) In 2006, there were 17 million TRx /year written in the United States » 2000: Two clinical studies published Carapeti 1 – IPAA FI PE vs. PBO PE improved 28 day FI scores ( p=0.001) PE improved patient subjective measure (p=0.04 ) No reported side effects. Carapeti 2 – General FI PE vs. PBO No significant differences in FI scores 6 PE and 2 Plc patient had > 75% subjective improvement 3 patients had mild local dermatitis » Pre - IND meeting June 21 st , 2007 Confirmed Orphan development plan Confirmed objectives of dose range study » CMC – Final formulation in development 1. Carapeti E, et al, Randomized controlled crossover trial of topical phenylephrine for fecal incontinence in IPAA, Dis Colon Rectum (20 00 ); 43(8), 1059 - 1063. 2. Carapeti E, et al, Randomized controlled crossover trial of topical phenylephrine for general fecal incontinence, BJS (2000); 87, 38 - 42. 27

Phenylephrine Gel Increases Maximum Anal Resting Pressure 0% 5% 10% 15% 20% 25% 30% 35% 40% 5% 10% 20% 30% Mean % Change cm H2O % PE Concentration p=.012 p<.0001 p<.0001 p<.0001 Sample Size = 12 healthy patients. Carapeti , E, Topical phenylephrine increases anal sphincter resting pressure, British Journal of Surgery (1999); 86, 267 - 270. 28

Phenylephrine Gel Improves 28 Day Symptom Scores in IPAA Patients 0 50 100 150 200 250 Placebo Phenylephrine 10% 4 Wk FI Score 28 Day Symptom Score P=.001 Sample size = 12 IPAA FI patients. Carapeti E, et al, Randomized controlled crossover trial of topical phenylephrine for fecal incontinence in IPAA , Dis Colon Rectum (2000); 43(8), 1059 - 1063. 29

Fecal Incontinence Market Summary » Patient Population Orphan: 50,000 – 100,000 25% of Ulcerative Colitis patients undergo surgical resection procedures such as IPAA General Population: 9 million 63% female » Competitive Landscape Bulking fiber and pads are the current standard of care No approved products in the U.S./E.U. Solesta ® dermal filler: No data regarding applicability in this population IPAA population focused in gastroenterologists and colorectal surgeons 30

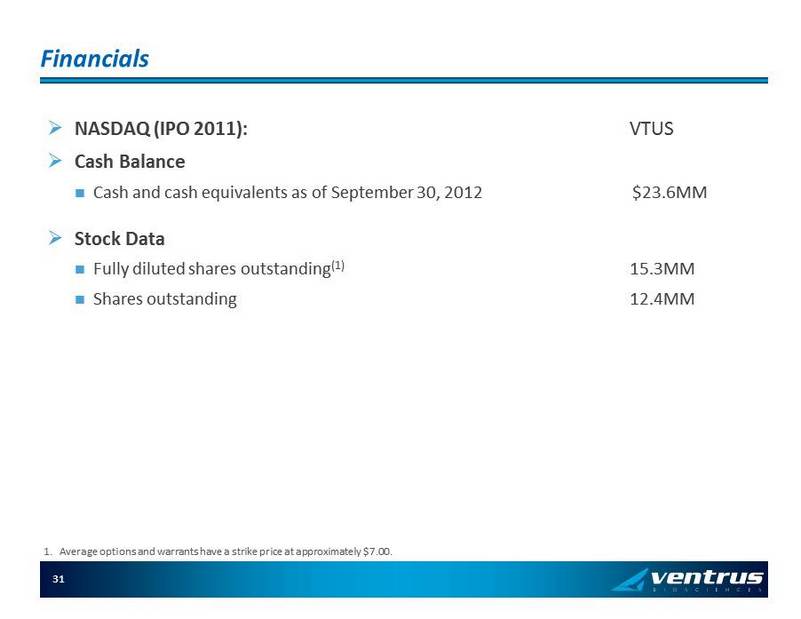

Financials » NASDAQ (IPO 2011): VTUS » Cash Balance Cash and cash equivalents as of September 30, 2012 $23.6MM » Stock Data Fully diluted shares outstanding (1) 15.3MM Shares outstanding 12.4MM 1. Average options and warrants have a strike price at approximately $ 7.00. 31

» A phase 3 specialty pharmaceutical company focused on neglected areas of drug development: Initial focus is anal disorders » Current portfolio VEN 307: Diltiazem cream for anal fissures - 505(b)(2) NDA filing Q4 2013 Phase III data from first pivotal trial showed good tolerability, significant improvement in efficacy outcomes for anal fissures Critical mass market focused in gastroenterologist and colorectal surgeons Significant lifecycle opportunities VEN 308: Topical phenylephrine for fecal incontinence – 505(b)(2) NDA filing 2015 P ublished proof of concept trials in fecal incontinence associated with Ileal Pouch Anal Anastomosis (IPAA) Orphan disorder treated in ~40 colorectal surgery centers nationwide Significant expansion opportunity » Funded through key milestones Sufficient cash for the completion of the VEN 307 development program Company Overview 32

Backup Slides VEN 307

First Phase 3 Trial: Enrollment Criteria » Inclusion Criteria Written informed consent An average of ≥4 on the 11 - point NRS during the screening phase for worst anal pain associated with, or following, defecation for the most recent 3 days of the 7 - day screening period in which the subject has defecated Evidence of anal fissure Willingness to stop all concomitant topical preparations Ability to use Interactive Voice Recognition System (IVRS) diary » Exclusion Criteria Use of opioids and other analgesics (except acetaminophen up to 4 g per day and ibuprofen up to 1.8 g per day) Prior lateral sphincterotomy or other previous surgery AF associated with other conditions Cardiovascular disease Pregnancy, lactation 35

Study Design 36

Baseline Demographics Variable 4% diltiazem 2% diltiazem Placebo Age (years) 42.3 ± 13.6 44.2 ± 14.2 43.2 ± 12.5 Male 38.5% 48.1% 43.9% Female 61.5% 51.9% 56.1% Caucasian 100.0% 100.0% 99.4% Height (cm) 169.3 ± 7.8 170.8 ± 9.1 168.9 ± 13.6 Weight (kg) 73.9 ± 16.6 77.5 ± 17.7 76.0 ± 18.1 Geographic distribution of all 465 enrolled subjects 66.5% 18.5% 6.5% 3.7% 3.0% 1.9% Romania Bulgaria Germany Lithuania United Kindom Spain 37

Patient Disposition 38

Secondary Endpoint: PGI - I at Week 4 Patient’s Global Impression of Improvement (PGI - I) 0.60% 7.10% 87.20% 0.00% 3.20% 93.60% 1.90% 8.40% 85.20% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% Worse No change Improved 4% diltiazem 2% diltiazem Placebo At Week 4 for 2% diltiazem, p = 0.008 vs placebo 39

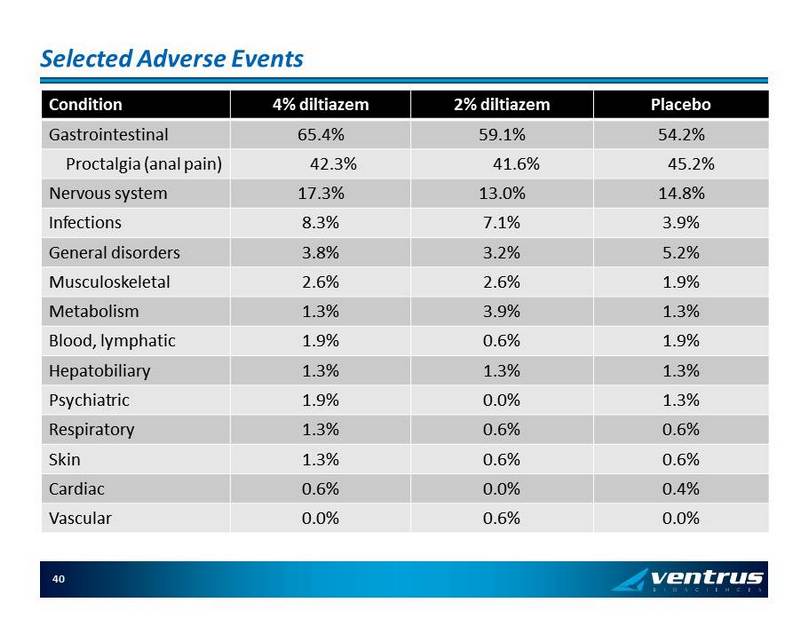

Selected Adverse Events Condition 4% diltiazem 2% diltiazem Placebo Gastrointestinal 65.4% 59.1% 54.2% Proctalgia (anal pain) 42.3% 41.6% 45.2% Nervous system 17.3% 13.0% 14.8% Infections 8.3% 7.1% 3.9% General disorders 3.8% 3.2% 5.2% Musculoskeletal 2.6% 2.6% 1.9% Metabolism 1.3% 3.9% 1.3% Blood, lymphatic 1.9% 0.6% 1.9% Hepatobiliary 1.3% 1.3% 1.3% Psychiatric 1.9% 0.0% 1.3% Respiratory 1.3% 0.6% 0.6% Skin 1.3% 0.6% 0.6% Cardiac 0.6% 0.0% 0.4% Vascular 0.0% 0.6% 0.0% 40

Gastrointestinal Adverse Events Condition 4% diltiazem 2% diltiazem Placebo Gastrointestinal 65.4% 59.1% 54.2% Proctalgia (anal pain) 42.3% 41.6% 45.2% Anal pruritus 14.7% 14.9% 7.7% Anorectal discomfort 15.4% 13.6% 5.8% Abdominal pain 3.2% 2.6% 5.2% Anal haemorrhage 2.6% 3.2% 5.2% Constipation 3.2% 0.6% 3.2% Abdominal pain upper 2.6% 1.9% 1.3% Diarrhoea 2.6% 0.6% 0.6% Faeces hard 1.9% 0.6% 0.6% Toothache 1.3% 1.3% 0.6% Haemorrhoids 1.9% 0.6% 0.6% Anal inflammation 1.3% 1.3% 0.0% Rectal haemorrhage 0.6% 0.6% 1.3% 41

Gastrointestinal Adverse Events (Cont.) Condition 4% diltiazem 2% diltiazem Placebo Gastrointestinal 65.4% 59.1% 54.2% Nausea 0.6% 0.0% 1.9% Anal fissure 0.6% 0.6% 0.6% Dyspepsia 1.9% 0.0% 0.0% Anal fistula 0.6% 0.0% 0.6% Anal spasm 0.0% 1.3% 0.0% Periproctitis 0.6% 0.0% 0.6% Abdominal pain lower 0.6% 0.0% 0.0% Haematochezia 0.0% 0.6% 0.0% Abdominal distension 0.6% 0.0% 0.0% Anal polyp 0.6% 0.0% 0.0% Anal prolapse 0.6% 0.0% 0.0% Anal ulcer 0.6% 0.0% 0.0% Faecal incontinence 0.0% 0.6% 0.0% Flatulence 0.6% 0.0% 0.0% Gingival bleeding 0.6% 0.0% 0.0% Irritable bowel syndrome 0.6% 0.0% 0.0% Painful defaecation 0.0% 0.6% 0.0% Pancreatitis 0.0% 0.0% 0.6% Perianal erythema 0.6% 0.0% 0.0% 42

Infections Adverse Events Condition 4% diltiazem 2% diltiazem Placebo Infections 8.3% 7.1% 3.9% Nasopharyngitis 2.6% 3.2% 1.9% Influenza 2.6% 0.6% 1.9% Sinusitis 0.6% 0.6% 0.0% Cystitis 0.6% 0.0% 0.0% Acute tonsillitis 0.0% 0.6% 0.0% Gastroenteritis 0.0% 0.6% 0.0% Pneumonia 0.0% 0.6% 0.0% Respiratory tract infection 0.6% 0.0% 0.0% Tonsillitis 0.6% 0.0% 0.0% Tooth abscess 0.0% 0.6% 0.0% Vulvovaginal candidiasis 0.6% 0.0% 0.0% Vulvovaginal mycotic infection 0.0% 0.6% 0.0% 43

Metabolic and Nutritional Adverse Events Condition 4% diltiazem 2% diltiazem Placebo Metabolism and Nutrition Disorders 1.3% 3.9% 1.3% Dyslipidaemia 0.6% 1.3% 0.6% Hypertriglyceridaemia 0.0% 1.9% 0.6% Hypercholesterolaemia 0.0% 0.6% 0.0% Hyperglycaemia 0.6% 0.0% 0.0% 44

Appendix Commercialization Slides

Market Forecast PBE Market Research » Market research conducted by Princeton Brand Econometrics to better understand the drivers needed to size the current prescription market for anal fissures » Conducted Q4 2012 via the internet 7.2% of all CRS Physicians responding to the primary research » 731 invites were sent to CRS to secure the 98 respondents » 5,857 invites were sent to GI to secure the 500 respondents 46

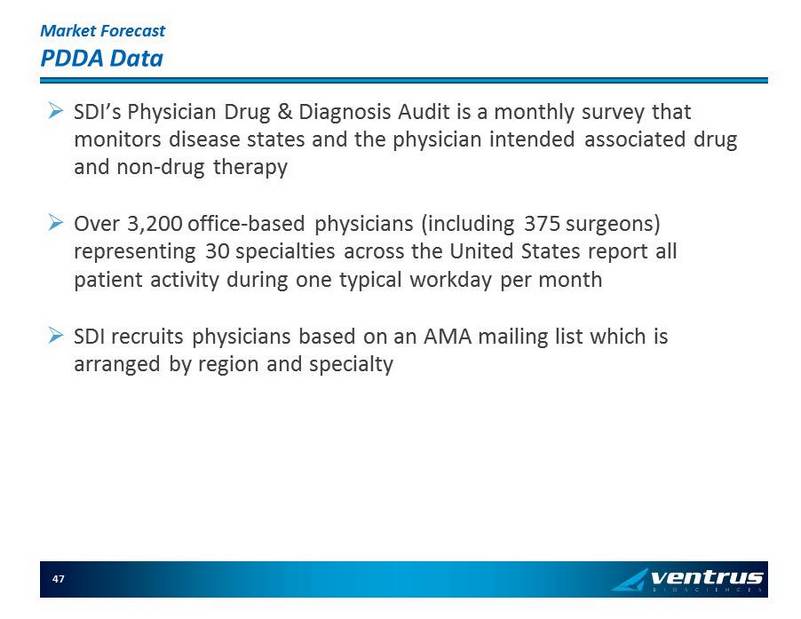

Market Forecast PDDA Data » SDI’s Physician Drug & Diagnosis Audit is a monthly survey that monitors disease states and the physician intended associated drug and non - drug therapy » Over 3,200 office - based physicians (including 375 surgeons) representing 30 specialties across the United States report all patient activity during one typical workday per month » SDI recruits physicians based on an AMA mailing list which is arranged by region and specialty 47

Market Forecast Forecast Model (‘000) 2015 2016 2017 2018 2019 2020 U.S. Population (1) 325,344.0 328,421.5 331,528.0 334,664.0 337,829.6 341,025.1 Anal Fissures Patients (2) 767.3 774.5 781.9 789.3 796.7 804.3 Incidence (3) 0.24% 0.24% 0.24% 0.24% 0.24% 0.24% Seen by CRS (2) 73.5% 73.5% 73.5% 73.5% 73.5% 73.5% Patients 564.0 569.3 574.7 580.1 585.6 591.1 CRS That Treat AF with Rx (4) 89.7% 89.7% 89.7% 89.7% 89.7% 89.7% AF Patients on Rx 505.9 510.6 515.5 520.4 525.3 530.2 Surgical Intervention (4) 33.7% 33.7% 33.7% 33.7% 33.7% 33.7% AF Surgeries 190.1 191.8 193.7 195.5 197.3 199.2 Rx Before Surgery (4) 85.9% 85.9% 85.9% 85.9% 85.9% 85.9% Patients Rx Before Surgery 163.3 164.8 166.4 167.9 169.5 171.1 1. UN Department of Economic and Social Affairs (Population Division): US Population growth between 2000 and 2010 = 0.95% 2. AF Patients who visited a physician (SDI PDDA, 2010) 3. Incidence of people with AF who will visit a physician. 4. Princeton Brand Econometrics (PBE), 2012. 48

VEN 307 Go To Market Plan Launch Objectives 1. Raise the awareness of the “branded, FDA - approved, GMP topical diltiazem” Develop core group of 10 - 15 CRS and GI KOLs 12 months prior to launch Increase the awareness by 100% of all CRSs from the pre - launch (baseline) ATU to the first post - launch ATU Convert 50% of all CRSs prescribing compounded diltiazem for their AF patients to VEN 307 by end of Year 1 Convert 75% of all HCPs prescribing Rectiv to VEN 307 by end of Year 1 2. Ensure early MHC reimbursement Ensure that VEN 307 is Tier 2 for 10% and Tier 3 for 90% of covered lives in managed healthcare plans by Year 1 Ensure that VEN 307 is Tier 2 for 25% and Tier 3 for 75% of covered lives in managed healthcare plans by Year 2 3. Implement LCM plan Qualify two suppliers Develop a meter dose pump for launch 4Q’15/1Q’16 Ensure a BID formulation is ready for phase 3 trials by the end of 2015 49

VEN 307 Go To Market Plan Sequence of Objectives » Q1 2015 : convert compounded diltiazem and Rectiv Rx to VEN 307 Cost effective targeting via a specialty sales force Employ sales force - directed activities (e.g. s amples, etc.) and n on - personal promotion (e.g., internet, journal ads, etc.) » Q1 2016 : expand the market Implement “remind and maintain” with prescribers of VEN 307 Expand Rx volume via lower decile GIs 50

VEN 307 Go To Market Plan Segmentation & Targeting » Healthcare providers All colorectal surgeons First decile GIs who manage and/or refer AF patients » Patients Existing and newly presenting AF patients To ensure the initial HCP experience with VEN 307 is positive, the appropriate patient type per the PI should be targeted » Payors Pharmacy Directors: drive early coverage of VEN 307 Medical Directors: drive awareness of viable non - surgical option 51

VEN 307 Go To Market Plan Managed Healthcare Coverage Objectives (% of patients) 2015 2016 2017 2018 2019+ Copay Tier 1 ($20) 0% 0% 0% 0% 0% Tier 2 ($50) 10% 25% 40% 55% 60% Tier 3 ($75) 90% 75% 60% 45% 40% Restrictions No restrictions 80% 90% 100% 100% 100% Step edit 0% 0% 0% 0% 0% Prior authorization 20% 10% 0% 0% 0% Step + PA 0% 0% 0% 0% 0% » Assumes VEN 307 ultimately ends up as branded preferred (Tier 2) in the majority of plans » It is assumed that MHC plans will not step patients through compounded options, given the relatively small total cost burden; medical loss ratio targets @ 80%, and evolving compounding concerns » While off - label use isn’t expected with VEN 307, a few prior authorizations are nevertheless expected at launch 52

VEN 307 Go To Market Plan Physician Calls by Decile Call Capacity (y early) Days/year 365 Weekend days 104 Holidays and vacations 20 Working days/rep 241 Calls/day 8 Call capacity/rep 1,928 Call capacity, Ventrus/CSO 38,560 Decile Colorectal Surgeons 1 Gastroenterologists 2 Total Calls/ Decile HCPs / Decile Cumulative HCPs Calls/HCP (yearly) Calls/ Decile HCPs / Decile Cumulative HCPs Calls/HCP (yearly) Calls/ Decile 1 136 136 18 2,443 1,236 1,236 12 14,836 17,278 2 136 271 18 2,443 1,236 2,473 - - 2,443 3 136 407 18 2,443 1,236 3,709 - - 2,443 4 136 543 18 2,443 1,236 4,945 - - 2,443 5 136 679 18 2,443 1,236 6,182 - - 2,443 6 136 814 18 2,443 1,236 7,418 - - 2,443 7 136 950 18 2,443 1,236 8,654 - - 2,443 8 136 1,086 18 2,443 1,236 9,890 - - 2,443 9 136 1,221 12 1,628 1,236 11,127 - - 1,628 10 136 1,357 12 1,628 1,236 12,363 - - 1,628 Total 1,357 N/A N/A 20,355 12,363 N/A N/A 14,836 37,633 » Decile options: Rectiv Rx, surrogate markers (e.g., lidocaine ), self - reported AF patient population or compounding activity » Call activity: 2,593 HCPs 100% of CRS every 3 to 4 weeks 10% of GIs every 4 weeks 1. American College of Surgeons Health Policy Research Institute, Jan 2009. 2. American Board of Internal Medicine, Feb 2011. 53

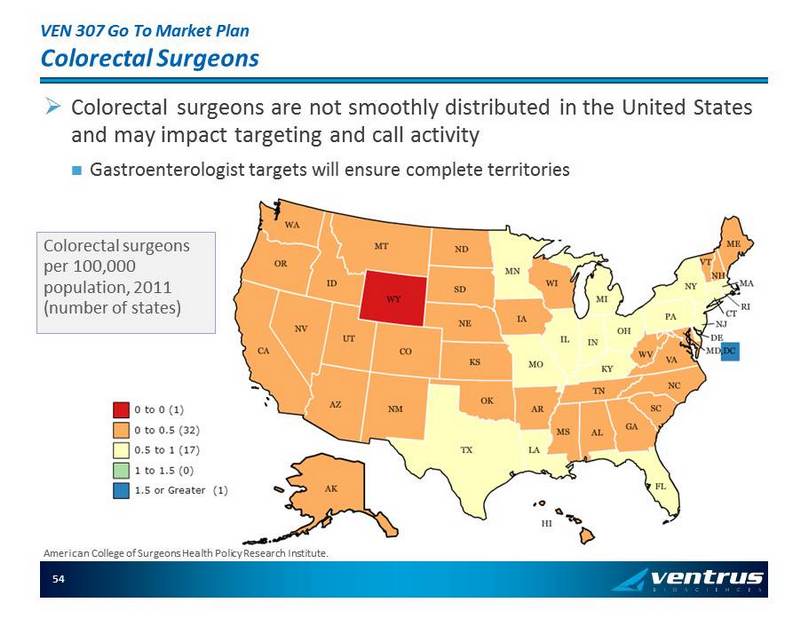

VEN 307 Go To Market Plan Colorectal Surgeons » Colorectal surgeons are not smoothly distributed in the United States and may impact targeting and call activity Gastroenterologist targets will ensure complete territories Colorectal surgeons per 100,000 population, 2011 (number of states) American College of Surgeons Health Policy Research Institute. 54