Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - STREAMLINE HEALTH SOLUTIONS INC. | d455231d8k.htm |

Exhibit 99.1

| Investor Presentation December 2012 NASDAQ: STRM |

| Disclosure Statements TRADEMARKS Product or company names referenced herein may be trademarks or registered trademarks of their respective owners. |

| Proprietary SaaS-based solutions that: capture and convert unstructured data into EMR accessible information; accelerate coding; shorten billing cycles; and deliver robust analytics to improve efficiencies across the healthcare enterprise Suite of solutions improve financial performance Company Highlights Integrates with leading EMR, financial and clinical systems 95% client retention due to subject matter expertise, deep and broad solutions that seamlessly integrated into provider business processes High client retention with deeply embedded solutions Installed base of top tier clients presents sizable opportunity SaaS model enhances recurring revenue profile - Q3 2012 recurring revenue grew 60.9% over Q3 2011; YOY recurring revenue grew 41.2% Highly scalable SaaS model Management team with extensive HCIT experience repositioned Company for growth and profitability as evidenced by double digit growth YTD Proven management team and successful turn- around Computer Assisted Coding (CAC) solution positions the Company at the forefront of the ICD-10 transition scheduled for 2014. The acquisition increases the Company's relevance in the HIM space. Meta acquisition opens new doors for Coding and CDI opportunities |

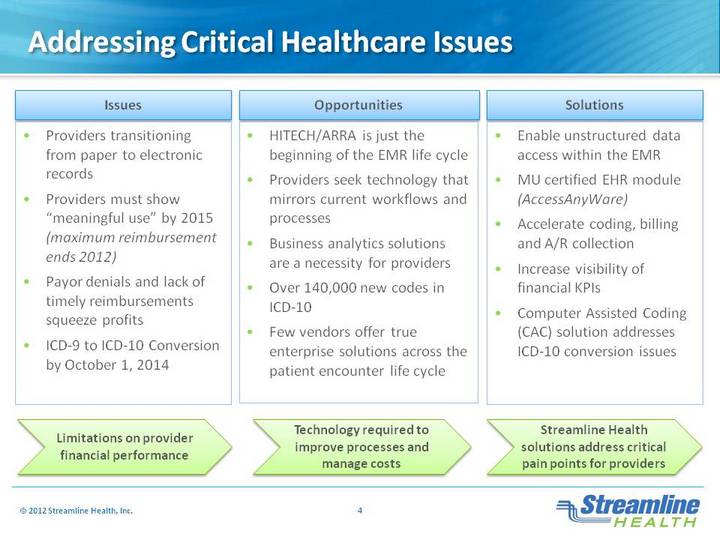

| Issues Solutions Addressing Critical Healthcare Issues Opportunities Limitations on provider financial performance Technology required to improve processes and manage costs Streamline Health solutions address critical pain points for providers |

| Enterprise Applications Patient Encounter Life Cycle Solutions Across the Enterprise AccessAnyWare Content Management Collabra Coding and CDI OpportunityAnyWare Business Analytics CharityWare ReferWare PreOpWare CompletionWar e ReleaseWare FolderView eCAC eCDI ePhysician Query eAbstract 835DenialWare AuditWare ARWare Patient Access | Clinicians | HIM | Coding | CDI | PFS | Revenue Cycle Referral Registration Admission Discharge Coding Billing & Collections CDI Reconciliation Audit HIM Business Analytics |

| TTM Oct 2012 TTM Oct 2011 78.4% Recurring revenue % total 70.3% 37.0% Recurring revenue growth 9.7% 53.5% Gross margin 42% 17.8% EBITDA margin 16.1% $48.7 Backlog ($ millions) $16.8 Performance Momentum and Demonstrated Results Strong Revenue Backlog Increasing Recurring Revenue Key Strategic Goals and Accomplishments YTD FY 2012 Key Financial Improvements Achieved |

| YTD Comparison Highlights Successful Execution 51.2% Growth 48.7% Growth Revenue ($ in millions) Adj. EBITDA ($ in millions) |

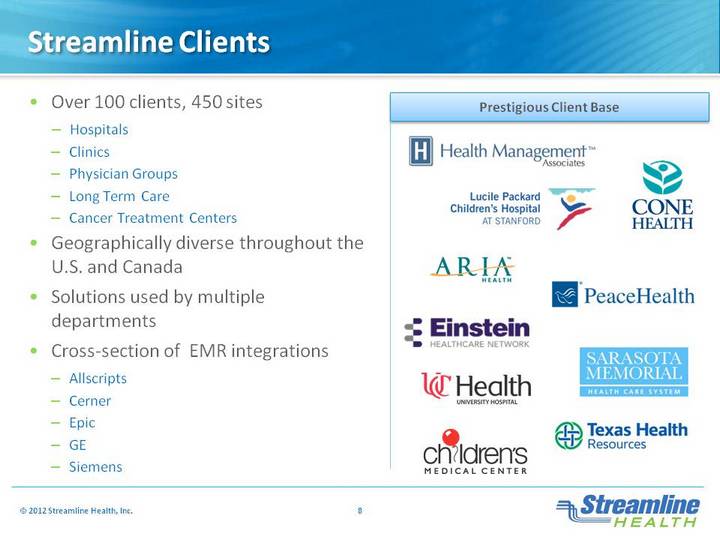

| Streamline Clients Prestigious Client Base |

| Growing Addressable Market Current Market Focus Potential New Markets Compelling Market Fundamentals Gartner and Cerner estimates |

| Company Summary NASDAQ: STRM Exchange/Ticker December 14, 2012: $5.22 (52 Week High - $6.60, Low - $1.35) Share Price (52 Week Range) 12.5 million Common Shares Outstanding December 14, 2012: $65.4 million Market Cap $10.5 million (October 31, 2012) Cash $14.0 million (October 31, 2012) Debt $21.5 million (October 31, 2012) TTM Revenue $5.6 million (October 31, 2012) TTM Adj. EBITDA 119 Number of Associates |