Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Manitex International, Inc. | d456332d8k.htm |

Exhibit 99.1

Manitex International, Inc.

Corporate Presentation

(NASDAQ: MNTX)

December 2012

“Focused manufacturer

of engineered lifting

equipment” |

“Focused manufacturer

of engineered lifting

equipment”

2

Safe Harbor Statement under the U.S. Private Securities Litigation Reform Act of

1995: This presentation contains statements that are forward-looking

in nature which express the beliefs and expectations of management

including statements regarding the Company’s expected results of operations

or liquidity; statements concerning projections, predictions,

expectations, estimates or forecasts as to our business, financial and operational results

and future economic performance; and statements of managemet’s goals and

objectives and other similar expressions concerning matters that are not

historical facts. In some cases, you can identify forward-looking

statements by terminology such as “anticipate,” “estimate,”

“plan,” “project,” “continuing,” “ongoing,” “expect,”

“we believe,” “we intend,” “may,”

“will,” “should,” “could,” and similar expressions. Such statements are based

on current plans, estimates and expectations and involve a number of known and

unknown risks, uncertainties and other factors that could cause the

Company's future results, performance or achievements to differ

significantly from the results, performance or achievements expressed or implied

by such forward-looking statements. These factors and additional

information are discussed in the Company's filings with the Securities

and Exchange Commission and statements in this presentation should be evaluated

in light of these important factors. Although we believe that these

statements are based upon reasonable assumptions, we cannot guarantee

future results. Forward-looking statements speak only as of the date on

which they are made, and the Company undertakes no obligation to update

publicly or revise any forward-looking statement, whether as a result of new

information, future developments or otherwise.

Non-GAAP

Measures:

Manitex

International

from

time

to

time

refers

to

various

non-GAAP

(generally

accepted

accounting

principles)

financial

measures

in

this

presentation.

Manitex

believes

that

this

information

is

useful

to

understanding its operating results without the impact of special items. See

Manitex’s Third Quarter 2012 earnings release

on

the

Investor

Relations

section

of

our

website

www.manitexinternational.com

for

a

description

and/or

reconciliation of these measures.

Forward Looking Statements

& Non-GAAP Measures

|

Company Snapshot

“Focused manufacturer

of engineered lifting

equipment”

Manitex

International,

Inc.

Niches

Served

Company

Origin

3

Global provider of highly specialized and custom

configured cranes, materials and container handling

equipment sold through dealerships Energy exploration and field development (including

Canadian oil sands and recent oil and natural gas

development initiatives throughout U.S.), power line

construction, military, railroads, port, government/agency Launched as a private company in 2003, Manitex

International is publicly traded as NASDAQ:MNTX and has

steadily grown organically and as a consolidator in its

industry, acquiring seven branded product lines since

going public in 2006 |

“Focused manufacturer

of engineered lifting

equipment”

4

According to Forbes, this list compiles "an annual ranking of America's Best

Small Companies that have experienced strong growth over the past five

years. The 2012 list highlights public companies with sales under $1

billion, which are ranked based on return on equity, sales growth and

earnings growth over the past year and the past five years." Forbes

methodology factored in stock performance versus each company's peer

group during the last 12 months.

Companies 2012

#44 on Forbes Best Small |

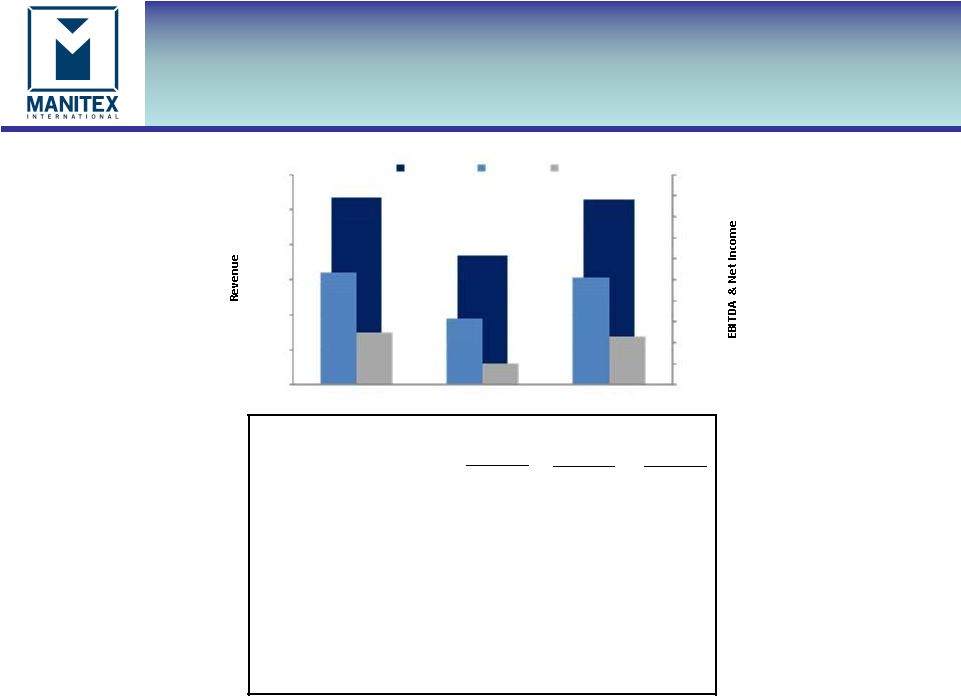

Summary Financials

“Focused manufacturer

of engineered lifting

equipment”

Financial Summary

Total Enterprise Val.

(11/29/2012):

$135.9 million

Market Cap (11/29/2012):

$92.9 million

2011 Revenue:

$142.3 million

2011 Net Income:

$2.8 million

2011 EBITDA:

$11.1 million

Stock Price (11/29/2012):

$7.60

Capitalization

Diluted shares outstanding (9/30/2012):

12.2 million

Total Debt (9/30/2012):

$46.3 million

Shares outstanding (11/9/2012)

12.2 million

(1) 2009 GAAP Net Income includes gain on bargain purchase of $3,815

(2) 2012 figures are per company estimates

Recent Announcements

11/16/12 -

Named to Forbes Magazine “Best 100 US Small Companies List”

11/8/12 -

Announced Record Quarterly Results for Q3 2012

10/15/12 -

Announced Launch of New CD4415 Rough Terrain Crane

5

Revenues

Gross Margin (%)

EBITDA

EBITDA Margin (%)

Net income

Backlog

$000, except percentages

2008

2009

2010

2011

2012 (2)

$106,341

$55,887

$95,875

$142,291

$200,000

16.4%

20.0%

24.3%

20.6%

20.0%

$5,416

$1,982

$8,676

$11,120

$18,300

5.1%

3.5%

9.0%

7.8%

9.0%

$1,799

$3,639

(1)

$2,109

$2,780

$8,000

$15,703

$22,122

$39,905

$83,700

$126,000 |

“Focused manufacturer

of engineered lifting

equipment”

•

•

•

•

Sign

cranes

•

RT forklifts

•

Special mission-oriented

vehicles

•

Carriers

•

Heavy material handling

•

Transporters & steel mill

equipment

•

Specialized earthmoving,

railroad and material

handling equipment since

1945

•

Has built ~ 10,000 units

since 1945

•

Manufacturer of container

handling equipment for the

global port and inter-modal

sectors.

•

Products: reach stackers,

laden and unladen container

forklifts & straddle carriers

Product Overview

6

Engineered lifting

equipment Manitex boom trucks SkyCrane aerial platforms |

“Focused manufacturer

of engineered lifting

equipment”

Strong brand history

Acknowledged product development record

International dealers enable us to follow demand

Focused on specialized equipment and niche end-

markets

Core competencies

Products

Superior ROI

Niche Markets

Broad end-user base

Highly customized/specialized; will configure-to-

order

Parts and service an important part of business

model

Lower capital commitment for a boom truck vs.

competitors’

custom cranes of similar lifting

capacity

Usually less or no special permitting vs.

competitors’

custom cranes of similar lifting

capacity

7

Competitive Positioning |

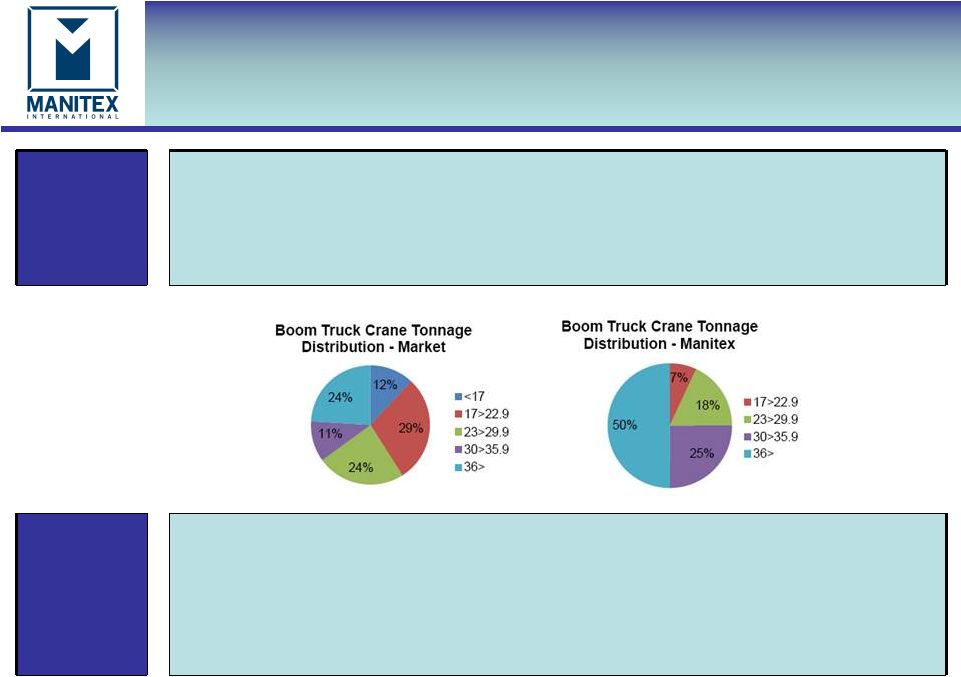

“Focused manufacturer

of engineered lifting

equipment”

Lifting Equipment

Market Overview

Market

Overview

•

Principal

products

are

boom

truck

cranes

that

vary

in

height

and

tonnage

capacity

•

Smaller tonnage cranes (<30 tons) are more focused on general construction

markets while larger cranes (30+ tons) focus on power line construction

and energy •

Larger tonnage cranes have had higher demand since economic downturn

•

Boom truck cranes are typically less expensive than rough terrain and all

terrain cranes Manitex’s

Market

Position

•

Broader market has seen ~65% of cranes shipped in the smaller tonnage range,

while ~75% of Manitex shipments have been in the larger tonnage

•

Focus

on

being

a

niche

player

allows

specialization

tailored

towards

customers’

needs

•

Production distribution skewed toward larger tonnage machines

•

First to launch 50-ton crane (May 2007)

•

Have

developed

a

series

of

products

around

the

demand

for

larger

tonnage

cranes

Source: Manitex International and MOTACC

8 |

9

“Focused manufacturer

of engineered lifting

equipment”

Replacement Parts & Service

Consistent Recurring Revenue

•

Recurring revenue of approximately 20% of total sales

•

Spares relate to swing drives, rotating components, and booms among others, many

of which are proprietary

–

Serve additional brands

–

Service team for crane equipment

–

Automated proprietary system implemented in principal operations

|

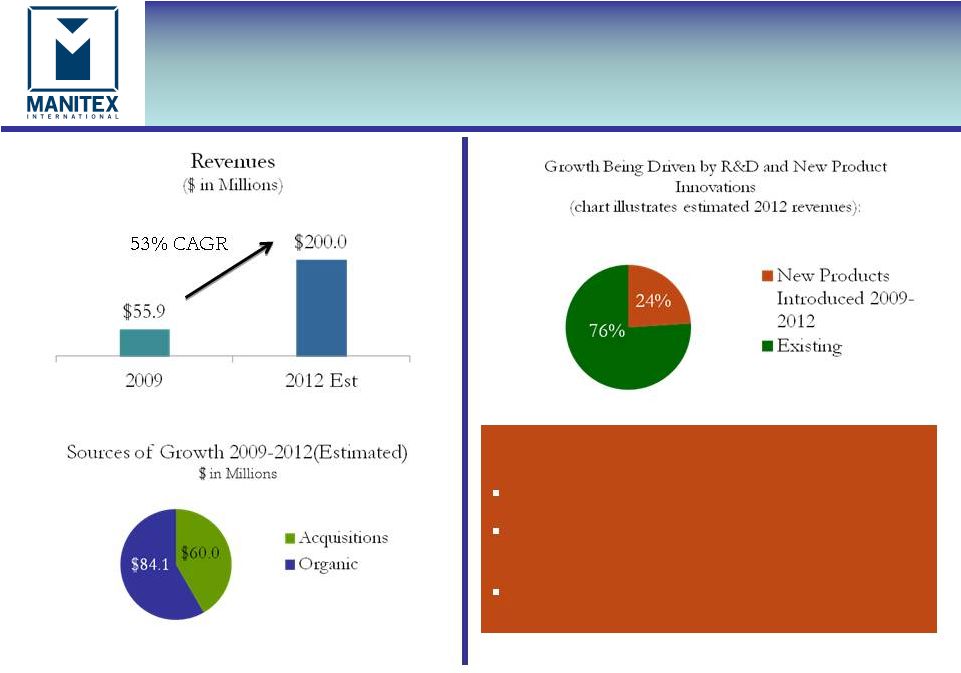

Revenue Growth Drivers

“Focused manufacturer

of engineered lifting

equipment”

10

Pie chart represents the difference/reconciliation between

$55.9M & $200M

R&D budget: up from ~ $1M to ~ $2.5M/year

Energy business was less than 10% in 2009,

R&D commitment

Of 2012 Revenues, approximately $48M due to

estimated ~ 50% in 2012

2009 – 2012 |

11

Investment Highlights

“Focused manufacturer

of engineered lifting

equipment”

Growth in End

Markets

Flexible

Operating

Model

Growth in

Backlog,

Revenues,

Earnings &

Cash Flow

Broad Industry

& Geographic

Distribution

Experienced

Management

•

Niche markets with solid demand drivers for products

•

Increased penetration in oil and gas, power grid and rail industries

•

Demand

in

end

markets

–

energy,

railroad,

and

utilities

–

is

expected

to

be

consistently

strong

•

Customer focused design strategy

•

Diversified product offering

•

Quickly adaptable to changes in demand

•

Commitment to innovation, research, & product development

•

Expected impact from new product launches in 2013

•

Eight

of

nine

consecutive

quarters

of

backlog

growth;

6/30/12

backlog

peak

of

$150M;

9/30/12

-

$125M

•

Full year 2011 sales up 48% to $142M; record EBITDA of $11.1M & adjusted

EPS of $0.31 •

9-month YTD 2012 revenues, EBITDA, and EPS exceeds full year 2011

•

3Q

2012

EBITDA

of

$5.3M

(10.0%

of

sales)

represents

a

70%

Y-o-Y

increase

&

a

quarterly

record

for

MNTX

•

Focus

on

growing

bottom

line

faster

than

top

line;

output

increases

expected

2012-2013

in

North

America

•

End market diversity offers a cushion due to weak demand in segments

•

North America currently represents ~75% of revenue, mitigating concerns of

European economic climate •

Existing global presence (~20K units worldwide)

•

International dealer network provides footprint for on-going international

growth •

Seasoned

senior

management:

over

70

years

of

collective

industry

experience

•

Successfully integrated multiple acquisitions

•

Significant management ownership |

Financial Overview

“Focused manufacturer

of engineered lifting

equipment”

Manitex International, Inc.

December 2012 |

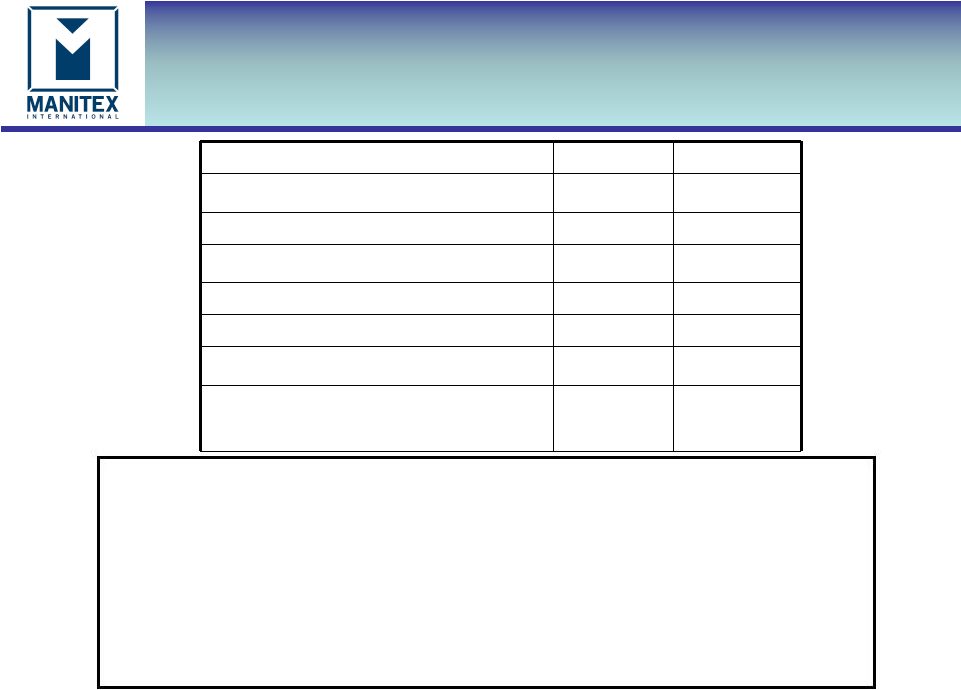

Key

Figures

-

Quarterly

“Focused manufacturer

of engineered lifting

equipment”

13

$53,380

$36,942

$52,946

$5,349

$3,147

$5,116

$2,504

$1,020

$2,308

$0

$1,000

$2,000

$3,000

$4,000

$5,000

$6,000

$7,000

$8,000

$9,000

$10,000

$0

$10,000

$20,000

$30,000

$40,000

$50,000

$60,000

Q3-2012

Q3-2011

Q2-2012

Revenue

EBITDA

Net Income

USD thousands except as noted

Net sales

$53,380

$36,942

$52,496

Gross profit

10,810

7,824

10,756

Gross margin %

20.3%

21.2%

20.5%

Operating expenses

6,343

5,591

6,560

Net Income

2,504

1,020

2,308

EBITDA

5,349

3,147

5116

EBITDA % of Sales

10.0%

8.5%

9.7%

Backlog ($ million)

$125.7

$63.7

$149.6

Q3-2012

Q3-2011

Q2-2012 |

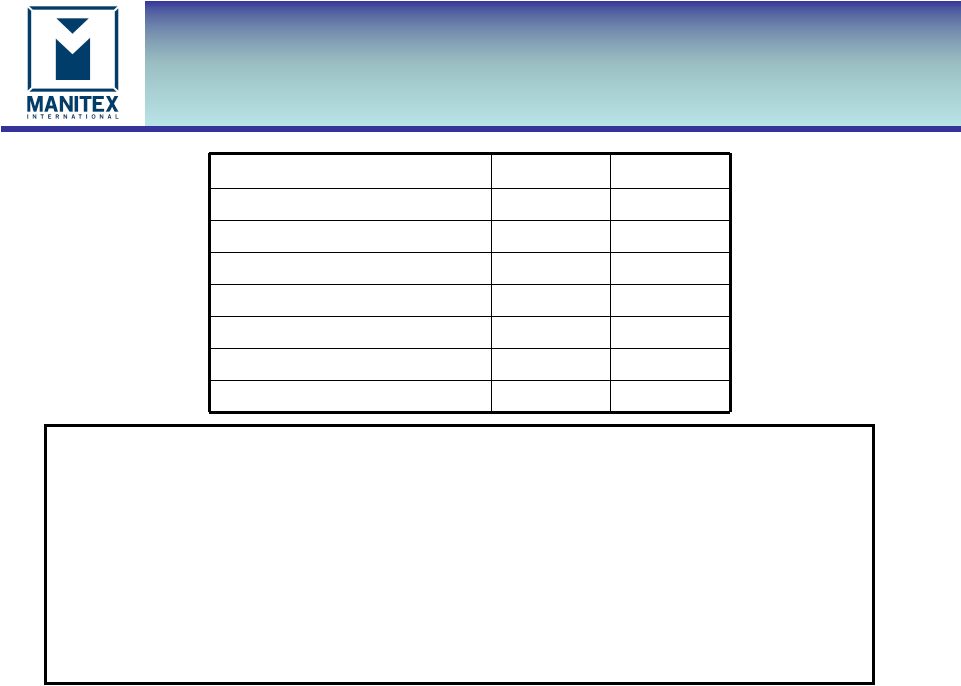

Summary Balance Sheet

“Focused manufacturer

of engineered lifting

equipment”

14

$000s

30-Sep-12

30-Jun-12

31-Dec-11

31-Dec-10

31-Dec-09

Current assets

$103,450

$96,496

$71,209

$54,703

$40,147

Fixed assets

10,273

10,358

11,017

10,659

11,804

Other long-term assets

35,714

36,192

39,365

40,155

42,734

Total Assets

$149,437

$143,046

$121,591

$105,517

$94,685

Current liabilities

$44,655

$44,193

$30,177

$23,011

$14,569

Long-term liabilities

47,574

48,398

44,620

39,232

39,688

Total Liabilities

92,229

92,591

74,797

62,243

54,257

Shareholders equity

57,208

50,455

46,794

43,274

40,428

Total liabilities & Shareholders equity

$149,437

$143,046

$121,591

$105,517

$94,685 |

15

Working Capital

“Focused manufacturer

of engineered lifting

equipment”

$000

Q3-2012

Q4-2011

Working Capital

$58,795

$41,032

Days sales outstanding (DSO)

57

60

Days payable outstanding (DPO)

65

59

Inventory turns

2.8

2.7

Current ratio

2.3

2.4

Operating working capital

66,556

50,007

Operating working capital % of annualized

LQS

31.2%

34.2%

•Major movements in working capital increase Q3-2012 v Q4 2011 of

$17.8m •Cash ($3.2m), Receivables ($9.2m), inventory ($18.2m) 7

Prepaid ($1.2m), offset by increased accounts payable ($11.3m), and

accrued expenses & other current liabilities ($2.4m)

•Inventory: increases in raw materials ($15.4m) and WIP ($1.5m) to

support growth •Operating working capital % decreased compared to

Q4-2011, as revenue growth was achieved in the quarter as

planned |

16

“Focused manufacturer

of engineered lifting

equipment”

$000

Q3-2012

Q4-2011

Total Cash

3,305

71

Total Debt

46,304

42,227

Total Equity

57,208

46,794

Net capitalization

100,207

88,950

Net debt / capitalization

42.9%

47.4%

Quarterly EBITDA

5,349

2,876

Quarterly EBITDA % of sales

10.0%

7.9%

•Increase in cash $3.2m

•Increase in debt at 9/30/2012 from 12/31/2011 of $4.1m, ($0.8m net of

cash) •

Increase in lines of credit, equipment finance and Italian working capital finance

$10.3m •

Repayments of $6.4 m on long term debt, including $3.8m paid early during Q2

& Q3- 2012

•N. American revolver facilities, based on available collateral at 9/30/12 was

$38.5m. •N. American revolver availability at 9/30/12 of $6.0m

•July 2012 raised $4.1m (gross) from equity to repay long term debt in

Q3-2012 Debt & Liquidity

•

Net capitalization is the sum of debt plus equity minus cash

•

Net debt is total debt less cash |

Experienced Management

Team

“Focused manufacturer

of engineered lifting

equipment”

Name & Title

Experience

David Langevin

Chairman & CEO

20+ years principally with Terex

Andrew Rooke

President & COO

20+ years principally with Rolls Royce, GKN Sinter Metals,

Off-Highway & Auto Divisions

David Gransee

CFO & Treasurer

Formerly with Arthur Andersen, 15+ years with Eon Labs

(formerly listed)

Robert Litchev

President –

Manufacturing Operations

10+ years principally with Terex

Scott Rolston

SVP Strategic Planning

13+ years principally with Manitowoc

17 |

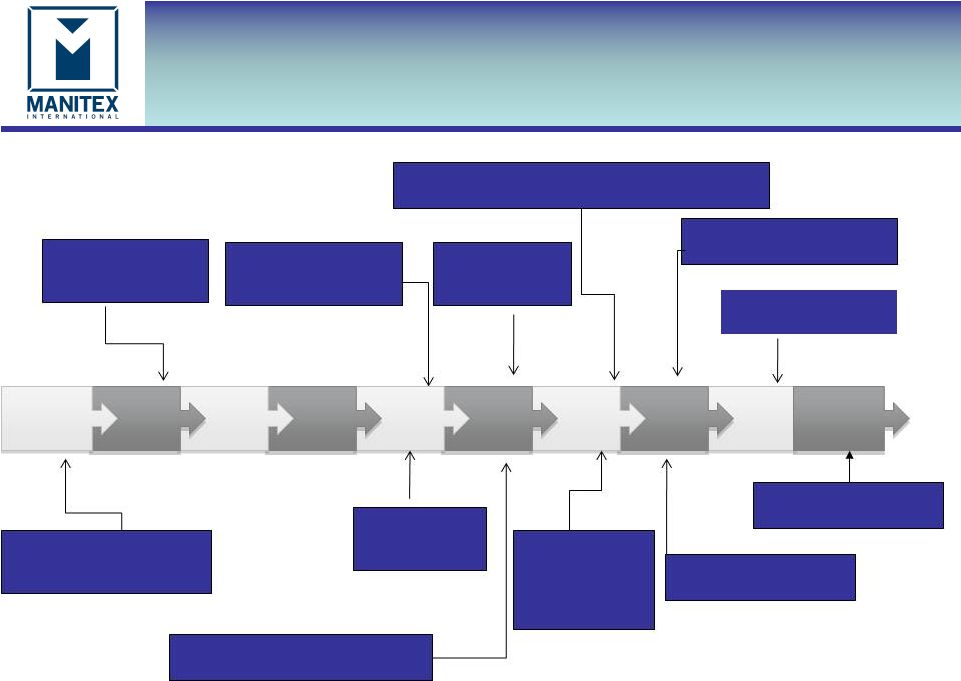

2010

2008

2009

2007

Company Timeline

“Focused manufacturer

of engineered lifting

equipment”

2006

2004

2002

2005

2003

2011

18

January 2003:

Manitowoc divests

Manitex

July 2007: VCC

acquires Noble

forklift

December 2009: Acquire Load

King Trailers

August 2007: Sale of assets and

closure of legacy VCC business

November 2006:

Veri-Tek Acquires

LiftKing

July 2006: Manitex merges

into Veri-Tek, Intl. (VCC)

July 2010 : CVS Operating

Agreement

October 2008:

Crane & Machinery

and Schaeff Forklift

acquired

July 2009: Acquire Badger

Equipment Co.

July 2011: Closes

Acquisition of CVS

March 2002:

Manitowoc (NYSE:MTW)

acquires Grove

May 2008: Name changed to Manitex International

and listed on Nasdaq (MNTX) |

Brand

Products

End Markets

Drivers

•

Boom trucks and cranes

•

Sign cranes

•

Parts

•

Energy exploration

•

Power transmission

•

Industrial projects

•

Infrastructure development

•

Strong end market demand for specialized, competitively

differentiated products for oil, gas, and energy sectors

•

Product development

•

Rough terrain cranes

•

Specialized construction

equipment

•

Parts

•

Railroad

•

Construction

•

Refineries

•

Municipality

•

Equipment replacement cycle in small tonnage flexible cranes for

refinery market

•

More efficient product offering across end markets

•

Rough terrain forklifts

•

Special mission-oriented

vehicles

•

Custom specialized carriers

•

Parts

•

Military

•

Utility

•

Ship building

•

Commercial

•

Steady, profitable growth from both commercial and military

application of products

•

Custom trailers

•

Hauling systems for heavy

equipment transport

•

Parts

•

Energy

•

Mining

•

Railroad

•

Commercial construction

•

U.S. energy exploration build-out

•

Oil and gas exploration

•

General infrastructure construction

•

Reach stackers

•

Container handling forklifts

•

Parts

•

Global container market

•

International container market and global trade

•

Re-establishing customer relationships and select product categories

•

Repair parts

•

Crane dealership

•

North American Equipment

Exchange

•

Distributor of Terex

products

•

Replacement parts

•

Used equipment

•

General construction environment

19

“Focused manufacturer

of engineered lifting

equipment”

Operating Companies |