Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - S&T BANCORP INC | d449725d8k.htm |

| EX-99.2 - INVESTOR PRESENTATION - S&T BANCORP INC | d449725dex992.htm |

Exhibit 99.1 |

Todd

Brice President and

Chief Executive Officer |

Forward Looking Statement

and Risk Factor

•

This presentation contains certain forward-looking statements within the

meaning of Section 27A of the Securities Act of 1933 and Section 21E of the

Securities Exchange Act of 1934. Forward- looking statements

include, among others, statements regarding trends, strategies, plans, beliefs,

intentions, expectations, goals and opportunities. Forward looking

statements are typically identified by words or phrases such as believe,

expect, anticipate, intend, estimate, assume, strategy, plan, outlook,

outcome, continue, remain, trend and variations of such words and similar

expressions,

or

future

or

conditional

verbs

such

as

will,

would,

should,

could,

may

or

similar

expressions. Actual results and performance could differ materially from

those anticipated by these forward-looking statements. Factors

that could cause such a difference include, but are not limited to, general

economic conditions, changes in interest rates, deposit flows, loan demand,

asset quality, including real estate and other collateral values, and

competition. •

S&T cautions that these forward-looking statements are subject to numerous

assumptions, risks and uncertainties, which change over time. These

forward-looking statements speak only as of the date hereof, and

S&T assumes no duty to update forward-looking statements. Subsequent

written

or

oral

statements

attributable

to

S&T

or

persons

acting

on

its

behalf

are

expressly

qualified in their entirety by the cautionary statements contained herein and

those in S&T’s reports previously and subsequently filed with the

Securities and Exchange Commission. 3 |

4

Non-GAAP Financial Measures

•

In

addition

to

the

results

of

operations

presented

in

accordance

with

Generally

Accepted

Accounting Principles (GAAP), S&T management uses and this presentation

contains or references, certain non-GAAP financial measures, such as

net interest income on a fully taxable equivalent basis, that S&T

believes provide information useful to investors in understanding our

underlying operational performance and our business and performance trends as they

facilitate comparisons with the performance of others in the financial

services industry. Although S&T believes

that

these

non-GAAP

financial

measures

enhance

investors’

understanding

of

S&T’s

business and performance, these non-GAAP financial measures should not be

considered an alternative to GAAP. The non-GAAP financial

measures contained therein should be read in conjunction with the audited

financial statements and analysis as presented in the Annual Report on Form

10-K as well as the unaudited financial statements and analyses as presented in the

respective Quarterly Reports on Forms 10-Q for S&T Bancorp, Inc. and

subsidiaries. |

5

Corporate Profile |

6

Assets

ROA

ROE

FNB Corporation

$12.0

0.93%

7.93%

Northwest Bancshares

8.1

0.78

5.42

First Commonwealth Financial

6.0

0.75

5.75

S&T Bancorp

4.4

0.77

6.46

TriState Capital

2.0

0.61

5.86

Data source: Federal Reserve YTD as of 09.30.12

$ in billions

Western PA Bank Holding Companies |

7

*

2012 peer banks per 2012 proxy statement

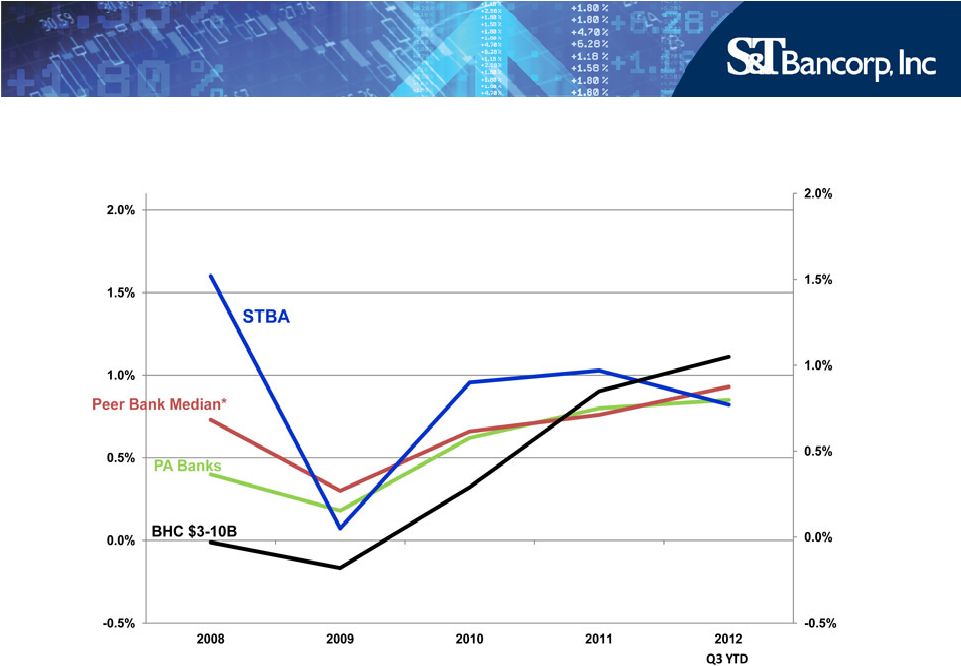

Common Return on Assets |

8

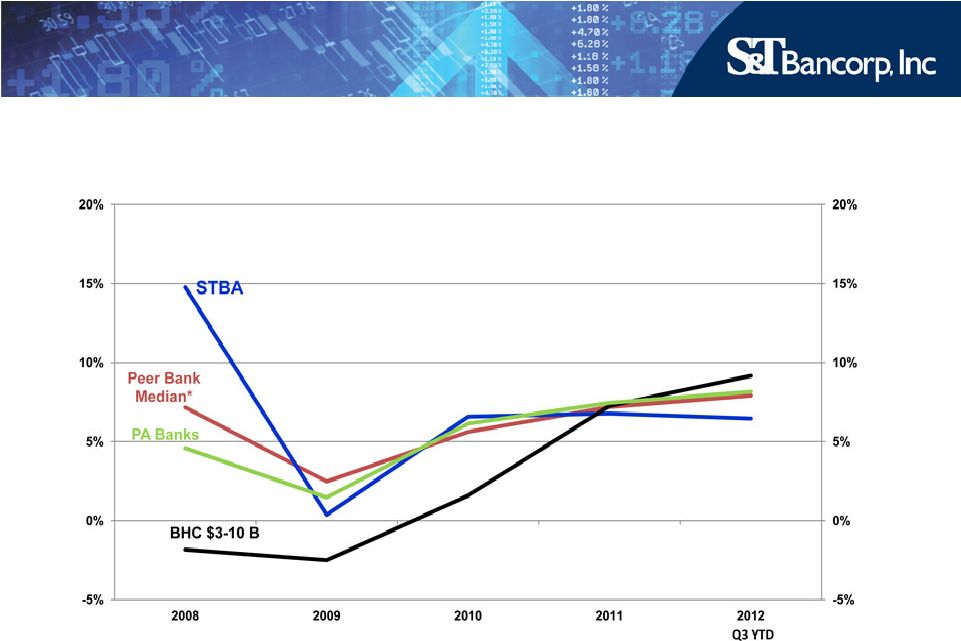

Common Return on Equity

*

2012 peer banks per 2012 proxy statement |

9

4 Lines of Business |

10

Commercial Banking |

11

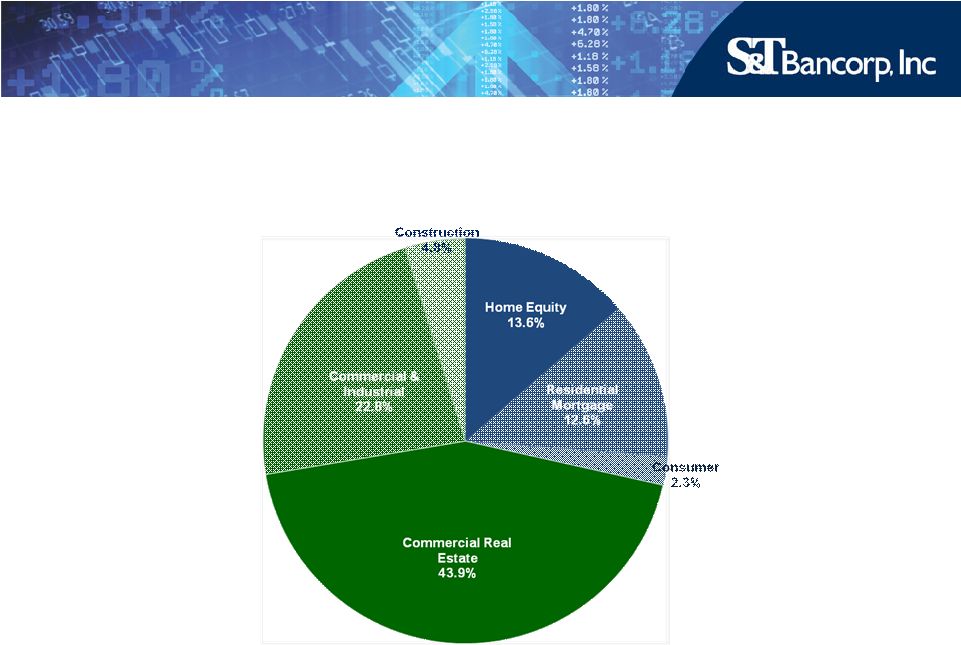

Loan Mix

Total Loans as of 09.30.12 = $3.3 Billion |

Commercial Banking

•

31 commercial lenders

•

12 community lenders

•

Privately held companies with sales up to

$150 million

•

$1-7 million preferred facility

•

Growing pipeline

•

Adding producers

12 |

13

Retail Banking |

Retail Banking

•

Over 100,000 Households

•

59 branches

•

Average branch size of $61.5 million

•

Home Center

•

92% of customers highly satisfied

•

Over 70,000 customers enrolled in online banking

•

Over 9,500 customers enrolled in Mobile Banking

14 |

15

Wealth Management |

Wealth Management

•

$1.7 billion AUM

•

3 Divisions

–

S&T Trust

–

S&T Financial Services

–

RIA/Stewart Capital

•

Estimated annual revenue in excess of $10 million

•

Adding producers

16 |

17

Insurance |

Insurance

•

Purchased Evergreen Insurance in 2002

•

Full service agency

–

Commercial P&C (65%)

–

Group Life and Health (20%)

–

Personal Lines (15%)

•

Estimated annual revenue in excess of $5 million

18 |

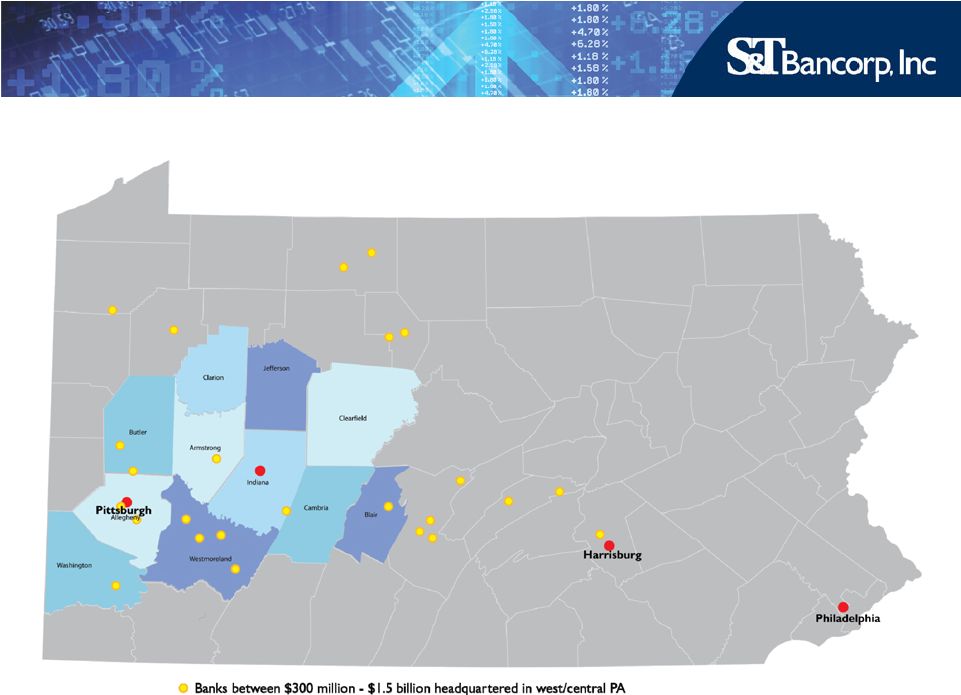

Growth –

Merger & Acquisition Activity

•

2012 -

Gateway Bank of Pennsylvania

•

2012 -

Mainline Bancorp

•

2008 –

IBT Bancorp

•

2002 -

Peoples Financial Corp

•

1997 -

Peoples Bank of Unity

•

1991 -

Atlantic Financial Savings Bank

•

1991 -

Vanguard Savings Bank

19 |

Growth –

Merger Opportunities

20 |

Growth -

Organic

County

Total Deposits*

S&T Deposits*

# Branches

Share

Rank

Allegheny

$76,568

$691

12

0.9%

10

Washington

4,525

89

1

2.0

10

Butler

3,458

34

2

1.0

15

Westmoreland

6,833

788

11

11.5

5

Cambria

2,776

179

7

6.4

5

Blair

2,182

52

3

2.4

9

Armstrong

1,114

82

2

7.4

4

Indiana

2,052

959

10

46.7

1

Clearfield

1,291

165

3

12.8

5

Jefferson

878

412

6

46.9

1

Clarion

800

180

2

22.5

1

Total

$102,477

$3,631

59

3.5%

21

* $ in millions

Source: Highline Financial as of 06.30.12 |

22

The Right Size

•

Big Enough to:

–

Provide full complement of products and services

–

Access technology

–

Access Capital Markets

–

Attract talent

–

Expand –

Mergers and Acquisitions/DeNovo

•

Small Enough to:

–

Stay close to our customers

–

Understand our markets

–

Be responsive |

|