Attached files

| file | filename |

|---|---|

| 8-K/A - FORM 8-K/A - China Network Media, Inc. | v329111_8ka.htm |

| EX-99.1 - EXHIBIT 99.1 - China Network Media, Inc. | v329111_ex99-1.htm |

| EX-10.6 - EXHIBIT 10.6 - China Network Media, Inc. | v329111_ex10-6.htm |

| EX-10.8 - EXHIBIT 10.8 - China Network Media, Inc. | v329111_ex10-8.htm |

| EX-10.9 - EXHIBIT 10.9 - China Network Media, Inc. | v329111_ex10-9.htm |

| EX-10.7 - EXHIBIT 10.7 - China Network Media, Inc. | v329111_ex10-7.htm |

| EX-10.10 - EXHIBIT 10.10 - China Network Media, Inc. | v329111_ex10-10.htm |

| EX-10.11 - EXHIBIT 10.11 - China Network Media, Inc. | v329111_ex10-11.htm |

INDEX TO FINANCIAL STATEMENTS

| PAGE | ||

| SCIENCE AND TECHNOLOGY WORLD WEBSITE MEDIA GROUP CO., LTD. INTERIM CONSOLIDATED FINANCIAL STATEMENTS | ||

| CONSOLIDATED BALANCE SHEET AT JUNE 30, 2012 (UNAUDITED) AND COMBINED BALANCE SHEET AT DECEMBER 31, 2011 | F-2 | |

| CONSOLIDATED STATEMENT OF OPERATIONS AND COMPREHENSIVE LOSS FOR THE SIX MONTHS ENDED JUNE 30, 2012 AND COMBINED STATEMENT OF OPERATIONS AND COMPREHENSIVE LOSS ENDED JUNE 30, 2011 (UNAUDITED) | F-3 | |

| CONSOLIDATED STATEMENTS OF CASH FLOWS FOR THE SIX MONTHS ENDED JUNE 30, 2012 AND COMBINED STATEMENTS OF CASH FLOWS FOR THE SIX MONTHS ENDED JUNE 30, 2011 (UNAUDITED) | F-4 | |

| NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED) | F-5 |

| F-1 |

Science & Technology World Website Media Group Co., Ltd

Consolidated Balance Sheet at June 30, 2012 and Combined Balance Sheet at December 31, 2011

(U.S. Dollars)

| June 30, | December 31, | |||||||

| 2012 | 2011 | |||||||

| (Unaudited) | ||||||||

| Assets | ||||||||

| Current assets | ||||||||

| Cash and cash equivalents | $ | 202,021 | $ | 250,107 | ||||

| Accounts receivable | 5,275 | 21,996 | ||||||

| Due from a related party | - | 31,164 | ||||||

| Taxes receivable | 85,279 | 29,431 | ||||||

| Deferred tax assets | 97,504 | 305 | ||||||

| Prepaid expenses and other current assets | 382,007 | 385,445 | ||||||

| Total current assets | 772,086 | 718,448 | ||||||

| Property and equipment, net | 71,230 | 67,477 | ||||||

| Total Assets | $ | 843,316 | $ | 785,925 | ||||

| Liabilities and Shareholders' Deficit | ||||||||

| Current liabilities | ||||||||

| Advanced from customers | $ | 458,882 | $ | 298,522 | ||||

| Deferred revenue | 266,752 | 244,094 | ||||||

| Due to related party | 1,203,199 | 1,147,557 | ||||||

| Accrued expenses and other current liabilities | 125,121 | 44,362 | ||||||

| Total Liabilities | 2,053,954 | 1,734,535 | ||||||

| Shareholders' Deficit | ||||||||

| Common stock ($1 par value, 50,000 shares authorized, issued and outstanding as of June 30, 2012 and December 31, 2011, respectively | 50,000 | 50,000 | ||||||

| Additional paid-in capital | 243,191 | 146,109 | ||||||

| Accumulated deficit | (1,470,376 | ) | (1,118,344 | ) | ||||

| Accumulated other comprehensive loss | (33,453 | ) | (26,375 | ) | ||||

| Total Shareholders' Deficit | (1,210,638 | ) | (948,610 | ) | ||||

| Total Liabilities and Shareholders' Deficit | $ | 843,316 | $ | 785,925 | ||||

See accompanying notes to the consolidated financial statements.

| F-2 |

Science & Technology World Website Media Group Co., Ltd.

Consolidated Statement of Operations and Comprehensive Loss

For the Six Months Ended June 30, 2012 and Combined Statement of Operations and Comparative Loss

For the Six Months Ended June 30, 2011

(Unaudited)

(U.S. Dollars)

| 2012 | 2011 | |||||||

| Revenues | ||||||||

| - Third parties | $ | 81,858 | $ | 43,456 | ||||

| - Related parties | 13,174 | - | ||||||

| Cost of revenue | ||||||||

| - Third parties | 108,372 | 154,798 | ||||||

| - Related parties | 17,441 | - | ||||||

| Gross loss | (30,781 | ) | (111,342 | ) | ||||

| Operating expenses: | ||||||||

| Research and development | 29,337 | 24,809 | ||||||

| Selling and marketing | 64,830 | 74,431 | ||||||

| General and administrative | 251,014 | 155,407 | ||||||

| Total operating expenses | 345,181 | 254,647 | ||||||

| Loss from Operations | (375,962 | ) | (365,989 | ) | ||||

| Other income (expense): | 23,930 | (488 | ) | |||||

| Loss from operations before income taxes | (352,032 | ) | (366,477 | ) | ||||

| Provision for income taxes | - | - | ||||||

| Net loss | (352,032 | ) | (366,477 | ) | ||||

| Other comprehensive loss: | ||||||||

| Foreign currency translation loss | $ | (7,078 | ) | $ | (7,963 | ) | ||

| Comprehensive loss | $ | (359,110 | ) | $ | (374,440 | ) | ||

| Loss per share | ||||||||

| Loss per common stock | ||||||||

| Basic and diluted | (7.18 | ) | - | |||||

| Weighted average number of common shares outstanding: | ||||||||

| Basic and diluted shares | 50,000 | - | ||||||

See accompanying notes to the consolidated financial statements.

| F-3 |

Science & Technology World Website Media Group Co., Ltd.

Consolidated Statements of Cash Flows

For the Six Months Ended June 30, 2012 and 2011

(Unaudited)

(U.S. Dollars)

| 2012 | 2011 | |||||||

| Cash Flows From Operating Activities | ||||||||

| Net loss | $ | (352,032 | ) | $ | (366,477 | ) | ||

| Adjustments to reconcile net loss to net cash used in operating activities: | ||||||||

| Depreciation expense | 15,398 | 12,772 | ||||||

| Deferred income taxes | (97,109 | ) | (219 | ) | ||||

| Changes in operating assets and liabilities: | ||||||||

| Accounts receivable | 16,863 | (7,636 | ) | |||||

| Prepaid expenses and other current assets | 6,176 | (403,440 | ) | |||||

| Advance from customers | 158,090 | (2,291 | ) | |||||

| Deferred revenue | 20,900 | 3,398 | ||||||

| Taxes receivable | (55,587 | ) | 170 | |||||

| Accounts payable and accrued expenses | 80,370 | 19,705 | ||||||

| Net cash (used in) operating activities | (206,931 | ) | (744,018 | ) | ||||

| Cash Flows From Investing Activities | ||||||||

| Cash paid to a related party | - | (9,163 | ) | |||||

| Cash received from repayment from a related party | 31,358 | - | ||||||

| Purchases of property and equipment | (18,668 | ) | (14,795 | ) | ||||

| Net cash provided by (used in) investing activities | 12,690 | (23,958 | ) | |||||

| Cash Flows From Financing Activities | ||||||||

| Cash received from related parties | 47,427 | 930,768 | ||||||

| Capital contributed by owners | 96,993 | - | ||||||

| Net cash provided by financing activities | 144,420 | 930,768 | ||||||

| Effect of exchange rate fluctuation on cash and cash equivalents | 1,735 | 2,273 | ||||||

| Net increase (decrease) in cash and cash equivalents | (48,086 | ) | 165,065 | |||||

| Cash and cash equivalents, beginning of period | 250,107 | 6,727 | ||||||

| Cash and cash equivalents, end of period | $ | 202,021 | $ | 171,792 | ||||

| Supplemental disclosure information: | ||||||||

| Income taxes paid | $ | 97,109 | $ | 219 | ||||

| Interest paid | $ | - | $ | - | ||||

See accompanying notes to the consolidated financial statements.

| F-4 |

Science & Technology World Website Media Group Co., Ltd.

Notes to Consolidated Financial Statements

(U.S Dollars unless otherwise noted)

| NOTE 1. | DESCRIPTION OF BUSINESS AND ORGANIZATION |

Science & Technology World Website Media Group Co., Ltd. (“Science & Technology Media”, ‘we’, “us”, “our” or “the Company”) is an emerging Chinese online media, search, gaming, community and mobile service group. We operate a multi-languages portal website that serves to the technology industry and provide advertising opportunities to the companies through our diverse business network in China. The Company currently operates its website through different versions in China.

As our main target, we provide online platform to business entrepreneurs and corporations with a B2B marketplace that can help our customers:

| · | Set their brand image through online magazine, online corporate multimedia advertisement, Executives interviews, institutional alliances and flexible membership package that tailor made based on what our customers need; |

| · | Set up customer’s online exhibition to introduce their products to the public, where they have our tailor-made corporate introduction with 3D product description and factory facilities online show room ; |

| · | B2B product purchase platform for companies and end-users; |

| · | Online job opportunity section for corporate clients; and |

| — | Corporate blogs; |

We currently derive a substantial portion of our revenues from online advertising membership services. Our advertising membership solutions present corporate users with attractive opportunities to combine the visual impact and engagement of traditional television-like multimedia advertisements and online magazines with the interactivity and precise targeting capabilities of the Internet. We strive to promote a novel and unique advertising environment on our website to attract technology enterprises.

We were organized under the laws of the British Island on February 15, 2011 to serve as a holding company for our PRC operations. On September 16, 2011, we established Science & Technology World Website Hong Kong Media Holding Co., Ltd. (“HK Science & Technology”) in Hong Kong to serve as an intermediate holding company.

On January 20, 2012, HK Science and Technology established Science& Technology World Website Trade (Dalian) Co., Ltd (the “WFOE” or “Science & Technology Trading”) in the PRC. Its purposes are, among others, a platform for online B2B service.

Science & Technology Media and the WFOE are considered foreign investor and foreign invested enterprise respectively under PRC law. As a result, Science & Technology Media and the WFOE are subject to limitations under PRC law on foreign ownership of Chinese companies. According to the Catalogue of Industries for Guiding Foreign Investment (2011 Revision) (the “Catalogue”), there are four kinds of industries which are encouraged, permitted, restricted and prohibited for foreign investment. The primary business of Dalian Tianyi Culture Development Co., Ltd (“Dalian Tianyi”) and Science & Technology World Network (Dalian) Co., Ltd (“Science & Technology (Dalian)”) are within the category in which foreign investment is currently restricted.

On January 21, 2012, the WFOE respectively entered into a series of agreements with Dalian Tianyi, Science & Technology (Dalian) and their respective shareholders (“Contractual Arrangements”). The relationship with Dalian Tianyi, Science & Technology (Dalian) and their respective shareholders are governed by the Contractual Arrangements. The Contractual Arrangements is comprised of a series of agreements, including Exclusive Technical Consulting Service Agreements and Operating Agreements, through which WFOE has the right to advise, consult, manage and operate Dalian Tianyi and Science & Technology (Dalian), and collect 85% of their respective net profits. In order to further reinforce the WFOE’s rights to control and operate Dalian Tianyi and Science & Technology (Dalian), the shareholders of Dalian Tianyi and Science & Technology (Dalian) have granted WFOE, under the Exclusive Equity Interest Purchase Agreement, the exclusive right and option to acquire all of their equity interests respectively in Dalian Tianyi and Science & Technology (Dalian). Furthermore, the shareholders of Dalian Tianyi and Science & Technology (Dalian) is under the procedure of pledging all of their equity interests respectively in Dalian Tianyi and Science & Technology (Dalian) to WFOE under the Exclusive Equity Interest Pledge Agreement, and through the Exclusive Equity Interest Pledge Agreement, WFOE can collect the remaining 15% of Dalian Tianyi and Science & Technology (Dalian)’s respective net profits.

According to the Power of Attorney executed by the shareholders of Dalian Tianyi and Science & Technology (Dalian), they exclusively authorized WFOE to perform and exercise any and all of the shareholder’s rights in Dalian Tianyi and Science & Technology (Dalian).

| F-5 |

As a result of the Contractual Arrangements, under generally accepted accounting principles in the United States, or U.S. GAAP, the Company is considered the primary beneficiary of Dalian Tianyi and Science & Technology (Dalian) (“VIEs”) and thus consolidates their results in its consolidated financial statements from January 1, 2012 to June 30, 2012 due to the fact that the activities between January 1 and January 21, 2012 were insignificant. Before and after the Contractual Agreements were executed on January 21, 2012, the Company, its subsidiaries and VIEs were under the controls of the same group of shareholders. The Company thus combined the financial positions of Science & Technology Media, HK Science & Technology, Science & Technology (Dalian) and Dalian Tianyi into the combined balance sheet for the year ended December 31, 2011. The Company also combined the results of operation for Science & Technology Media, Science & Technology (Dalian) and Dalian Tianyi into our combined statement of operations for the six months ended June 30, 2011.

| NOTE 2. | SUMMARIES OF SIGNIFICANT ACCOUNTING POLICIES |

| a. | Basis of preparation |

These consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America (U.S. GAAP). The consolidated financial statements include the Company’s accounts and those of its wholly-owned subsidiaries and VIEs. Upon consolidation, all significant intercompany accounts and transactions are eliminated.

| b. | Principles of consolidation |

The consolidated financial statements include the financial statements of the Company and its wholly-owned subsidiaries and VIEs. Upon consolidation, all balances and transactions between the Company and its subsidiaries and VIEs have been eliminated upon consolidation. We have entered into contractual arrangements with our VIEs and their shareholders, Mr. Jiang Wei, Mr. Peng Huian, Mrs. Wang Lijuan, Mr. He Zhongmin, Mrs. Gao Guifen, Mr. He Dan, He Yang, Mrs. An Huilian and Mrs. Wang Ying. PRC regulations require any foreign entities that invest in the advertising services industry to have at least two years of direct operations in the advertising industry outside of China. Since December 10, 2005, foreign investors have been allowed to own directly 100% of PRC companies operating an advertising business if the foreign entity has at least three years of direct operations in the advertising business outside of China or less than 100% if the foreign investor has at least two years of direct operations in the advertising industry outside of China. We do not currently directly operate an advertising business outside of China and cannot qualify under PRC regulations any earlier than two or three years after we commence any such operations outside of China or until we acquire a company that has directly operated an advertising business outside of China for the required period of time. Substantially all of our advertising business is currently provided through our contractual agreements with our PRC VIEs in China. Our PRC VIEs hold the requisite licenses to provide advertising services in China. Our PRC VIEs directly operate our advertising network. We have been and are expected to continue to be dependent on these PRC VIEs to operate our advertising business for the foreseeable future. We have entered into contractual agreements with the PRC VIEs, pursuant to which we, through the WFOE, provide technical support and consulting services to the PRC VIEs. In addition, we have entered into agreements with our PRC VIEs and each of their shareholders which provide us with the substantial ability to control these affiliates. Through these arrangements, we exercise effective control over the operations of these entities and receive the economic benefits of these entities. As a result of these contractual arrangements, under generally accepted accounting principles in the United States, or U.S. GAAP, we are considered the primary beneficiary of Tianyi and Science & Technology (Dalian) and thus consolidate their results in our consolidated financial statements.

| b. | Use of estimates |

The preparation of consolidated financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of revenues and expenses during the reporting period. Management makes these estimates using the best information available at the time the estimates are made; however actual results could differ from those estimates. Significant items subject to such estimates and assumptions include valuation allowances for receivables and recoverability of carrying amount and the estimated useful lives of long-lived assets.

| d. | Cash and cash equivalents |

Cash and cash equivalents include cash on hand, cash on deposit with various financial institutions in the People’s Republic of China (“PRC”) and all highly-liquid investments with original maturities of three months or less at the time of purchase. Cash accounts are not insured or otherwise protected. Should any bank or trust company holding cash deposits become insolvent, or if the Company is otherwise unable to withdraw funds, the Company would lose the cash on deposits with that particular bank or other financial institutions.

| F-6 |

| e. | Accounts Receivable |

Accounts receivable are recorded at net realizable value consisting of the carrying amount less an allowance for uncollectible accounts as needed. The allowance for doubtful accounts is the Company’s best estimate of the amount of probable credit losses in the Company’s existing accounts receivable. The Company determines the allowance based on aging data, historical collection experience, customer specific facts and economic conditions. Account balances are charged off against the allowance after all means of collection have been exhausted and the potential for recovery is considered remote. The Company did not have any off-balance-sheet credit exposure relating to its customers, suppliers or others. As of June 30, 2012 and December 31, 2011, management has determined that no allowance for doubtful accounts is required.

| f. | Property and equipment |

Property and equipment mainly comprise computer equipment, hardware and office furniture. Property and equipment are recorded at cost less accumulated depreciation with no residual value. Depreciation is computed using the straight-line method over the estimated useful lives of the assets.

Depreciation for financial reporting purposes is provided using the straight-line method over the estimated useful lives of the assets:

| Office and other equipment | 5 years | |

| Computers | 3 years |

Depreciation expense is included in Selling and marketing expenses and general and administrative expenses.

When office equipment and electronic devices are retired or otherwise disposed of, resulting gain or loss is included in net income or loss in the year of disposition for the difference between the net book value and proceeds received thereon. Maintenance and repairs which do not improve or extend the expected useful lives of the assets are charged to expenses as incurred.

| g. | Impairment of long-lived assets |

Long-lived assets are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. Recoverability of long-lived assets to be held and used is measured by a comparison of the carrying amount of the asset to the estimated undiscounted future cash flows expected to be generated by the asset. If the carrying amount of an asset exceeds its estimated future undiscounted cash flows, an impairment loss is recognized for the difference between the carrying amount of the asset and its fair value. There were no impairment losses in the periods ended June 30, 2012 and 2011, respectively.

| h. | Revenue recognition |

The Company recognizes revenue in accordance with ASC 605, Revenue Recognition. Revenues are recognized when the four of the following criteria are met: (i) persuasive evidence of an arrangement exists, (ii) the service has been rendered, (iii) the fees are fixed or determinable, and (iv)collectability is reasonably assured. The recognition of revenue involves certain management judgments. The amount and timing of our revenues could be materially different for any period if management made different judgments or utilized different estimates.

Online Membership Revenue

Online membership revenue includes revenue from members for brand advertising services as well as others services.

The Company has the Arrangements with nonrefundable up-front fees model (“the Model”) to recognize revenue for the online membership business. We apply the Model, where a contract is signed to establish a fixed price for our services to be provided for a period of time as a membership enrollment, for a majority of our online membership revenue. Revenue is recognized ratably over the membership periods on a straight line basis, unless evidence suggests that the revenue is earned or obligations are fulfilled in a different pattern, over the contractual term of the arrangement or the expected period during which those specified services will be performed, whichever is longer. We provide advertisement placements to our advertising customers on our different Website channels and in different formats, which can include, among other things, banners, links, logos, buttons, rich media, pre-roll and post-roll video screens, pause video screens and content integration, as specified in the contracts with the members. The members can choose various on line services from the membership contracts based on their yearly membership.

For online membership revenue recognition, prior to entering into contracts, we make a credit assessment of the customer to assess the collectability of the contract. For those contracts for which the collectability is determined to be reasonably assured, we recognize revenue when all revenue recognition criteria are met. For those contracts for which the collectability is determined not to be reasonably assured, we recognize revenue only when the cash was received and all other revenue recognition criteria are met. For those contracts for which the collectability is determined not to be reasonably assured, we recognize revenue only when the cash was received and all other revenue recognition criteria are met.

| F-7 |

Others Revenues

Other revenues are primarily generated from online advertisement planning services which introduce our customer’s profile, product, and awareness promotion for their executive officers to build a better brand name for non-member companies. We follows the guidance of the Securities and Exchange Commission’s FASB Accounting Standards Codification No. 605 for revenue recognition for others revenues. The Company recognize others revenue when they are realized or realizable and earned. The Company considers revenue realized or realizable and earned when it has persuasive evidence of an arrangement that the services have been rendered to the customer, the sales price is fixed or determinable, the services are rendered and collectability is reasonably assured.

| i. | Income taxes |

The Company follows ASC 740, Income Taxes, which requires the recognition of deferred tax assets and liabilities for the expected future tax consequences of events that have been included in the financial statements or tax returns. Under this method, deferred income taxes are recognized for the tax consequences in future years of differences between the tax bases of assets and liabilities and their financial reporting amounts at each period end based on enacted tax laws and statutory tax rates, applicable to the periods in which the differences are expected to affect taxable income. Valuation allowances are established, when necessary, to reduce deferred tax assets to the amount expected to be realized.

The Company adopted ASC 740-10-25, which provides criteria for the recognition, measurement, presentation and disclosure of uncertain tax position. The Company must recognize the tax benefit from an uncertain tax position only if it is more likely than not that the tax position will be sustained on examination by the taxing authorities, based on the technical merits of the position. The tax benefits recognized in the financial statements from such a position are measured based on the largest benefit that has a greater than 50% likelihood of being realized upon ultimate resolution. Our estimated liability for unrecognized tax benefits, may be affected by changing interpretations of laws, rulings by tax authorities, changes and/or developments with respect to tax audits, and expiration of the statute of limitations. The outcome for a particular audit cannot be determined with certainty prior to the conclusion of the audit and, in some cases, appeal or litigation process. The actual benefits ultimately realized may differ from our estimates. As each audit is concluded, adjustments, if any, are recorded in our financial statements. Additionally, in future periods, changes in facts, circumstances, and new information may require us to adjust the recognition and measurement estimates with regard to individual tax positions. Changes in recognition and measurement estimates are recognized in the period in which the changes occur. The Company has elected to classify interest and penalties related to an uncertain tax position, if and when required, as part of income tax expense in the combined statements of operations. The Company did not recognize any additional liabilities for uncertain tax positions as a result of the implementation of ASC 740-10-25.

| j. | Related parties |

A party is considered to be related to the Company if the party directly or indirectly or through one or more intermediaries, controls, is controlled by, or is under common control with the Company. Related parties also include principal owners of the Company, its management, members of the immediate families of principal owners of the Company and its management and other parties with which the Company may deal if one party controls or can significantly influence the management or operating policies of the other to an extent that one of the transacting parties might be prevented from fully pursuing its own separate interests. A party which can significantly influence the management or operating policies of the transacting parties or if it has an ownership interest in one of the transacting parties and can significantly influence the other to an extent that one or more of the transacting parties might be prevented from fully pursuing its own separate interests is also a related party.

| k. | Earnings (loss) per common share |

Basic earnings (loss) per share is computed by dividing net income (loss) attributable to common shareholders by the weighted average number of common shares outstanding for all periods. Diluted earnings per share is computed by dividing net income (loss) attributable to common shareholders by the weighted average number of shares outstanding, increased by common stock equivalents. Common stock equivalents represent incremental shares issuable upon exercise of outstanding warrants. However, potential common shares are not included in the denominator of the diluted earnings (loss) per share calculation when inclusion of such shares would be anti-dilutive, such as in a period in which a net loss is recorded. For the six months ended June 30, 2012 and 2011, there were no treasury stock purchases or common stock equivalents outstanding.

| F-8 |

| l. | Foreign currency transactions and translations |

An entity’s functional currency is the currency of the primary economic environment in which it operates, normally that is the currency of the environment in which the entity primarily generates and expends cash. Management’s judgment is essential to determine the functional currency by assessing various indicators, such as cash flows, sales price and market, expenses, financing and inter-company transactions and arrangements. The reporting currency of the Company is United States dollars (“US Dollars” or “$”), and the functional currency of HK Science & Technology is Hong Kong dollars (“HK Dollar”). The functional currency of the Company’s PRC subsidiary and VIEs is the Renminbi (“RMB’), and PRC is the primary economic environment in which the Company operates. The reporting currency of these consolidated financial statements is the United States dollar (“US Dollars” or “$”).

For financial reporting purposes, the financial statements of the Company’s PRC subsidiary and VIEs, which are prepared using the RMB, are translated into the Company’s reporting currency, the United States Dollar. Assets and liabilities are translated using the exchange rate at each balance sheet date. Revenue and expenses are translated using average rates prevailing during each reporting period, and shareholders' equity is translated at historical exchange rates. Adjustments resulting from the translation are recorded as a separate component of accumulated other comprehensive income in owners’ equity.

Transactions denominated in currencies other than the functional currency are translated into the functional currency at the exchange rates prevailing at the dates of the transactions. The resulting exchange differences are included in the determination of net loss of the consolidated financial statements for the respective periods.

The exchange rates used for foreign currency translation were as follows (US$1 = RMB):

| Period End | Average | |||||||

| 06/30/2012 | 6.3197 | 6.3255 | ||||||

| 12/31/2011 | 6.3647 | 6.4735 | ||||||

| 06/30/2011 | 6.4640 | 6.5482 | ||||||

| 12/31/2010 | 6.6118 | 6.7788 | ||||||

| 12/31/2009 | 6.8372 | 6.8212 | ||||||

No representation is made that the RMB amounts could have been, or could be, converted into U.S. dollars at the rates used in translation.

Translations adjustments resulting from this process are included in accumulated other comprehensive loss in the shareholder’s equity were $7,078 and $7,963 as of June 30, 2012 and 2011, respectively.

| m. | Fair Value Measurements |

The Company applies the provisions of ASC Subtopic 820-10, Fair Value Measurements, for fair value measurements of financial assets and financial liabilities and for fair value measurements of nonfinancial items that are recognized or disclosed at fair value in the financial statements. ASC 820 also establishes a framework for measuring fair value and expands disclosures about fair value measurements.

Fair value is defined as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. When determining the fair value measurements for assets and liabilities required or permitted to be recorded at fair value, the Company considers the principal or most advantageous market in which it would transact and it considers assumptions that market participants would use when pricing the asset or liability.

ASC 820 establishes a fair value hierarchy that requires an entity to maximize the use of observable inputs and minimize the use of unobservable inputs when measuring fair value. ASC 820 establishes three levels of inputs that may be used to measure fair value. The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to measurements involving significant unobservable inputs (Level 3 measurements). The three levels of the fair value hierarchy are as follows:

| · | Level 1 inputs to the valuation methodology are quoted prices (unadjusted) for identical assets or liabilities in active markets. |

| · | Level 2 inputs to the valuation methodology include quoted prices for similar assets and liabilities in active markets, and inputs that are observable for the assets or liability, either directly or indirectly, for substantially the full term of the financial instruments. |

| · | Level 3 inputs to the valuation methodology are unobservable and significant to the fair value. |

There were not transfers between level 1, level 2 or level 3 measurements for the six month period ended June 30, 2012.

As of June 30, 2012, none of the Company’s nonfinancial assets or liabilities was measured at fair value on a nonrecurring basis.

| F-9 |

The carrying values of the Company’s financial assets and liabilities, including accounts receivables, other current assets, and accrued expenses and other current liabilities, are a reasonable estimate of fair value because of the short period of time between the origination of such instruments and their expected realization and if applicable, their stated interest rate approximates current rates available.

| n. | Recently adopted accounting pronouncements |

In June 2011, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (ASU) No. 2011-05, Comprehensive Income (Topic 220): Presentation of Comprehensive Income. This guidance improves the comparability, consistency and transparency of financial reporting and increases the prominence of items reported in other comprehensive income. The guidance provided by this update becomes effective for annual periods beginning on or after December 15, 2011. For nonpublic entities, the ASU is effective for fiscal years ending after December 15, 2012, and interim and annual periods thereafter. The adoption of this standard is not expected to have a material impact on the Company’s financial position and results of operations.

No other recently issued accounting standards are expected to have a material effect on the financial position, results of operations or cash flows of the Company.

NOTE 3.GOING CONCERN AND LIQUIDITY

The accompanying consolidated financial statements have been prepared assuming that the Company will continue as a going concern. The Company currently has limited revenue and has cumulative net losses of $1,470,376 during the period from December 26, 2007 (inception of Dalian Tianyi) through June 30, 2012. These conditions raise substantial doubt about the Company’s ability to continue as a going concern. As of June 30, 2012, Mr. Jiang Wei, the shareholder of the Company loaned an aggregated amount of $1,067,742 to the Company for its operation. There can be no assurance that the Company will be able to obtain additional debt or equity financing on terms acceptable to it, or if at all. Management plans to fund continuing operations through new financing from related parties and equity financing arrangements. The Company’s continuation as a going concern is dependent on its ability to meet its obligations, to obtain additional financing as may be required until 2013 when it can generate sources of recurring revenues and to ultimately attain profitability. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

NOTE 4. SIGNIFICANT RISKS

Policy risk

Internet Industry

Internet content providers (ICP) are under strict supervision, and are not opened up to foreign merchants temporarily. According to the Catalogue of Industries for Guiding Foreign Investment (2011 Revision) (the “Catalogue”), there are four kinds of industries which are encouraged, permitted, restricted and prohibited for foreign investment. The primary business of Dalian Tianyi and Science & Technology World Network (Dalian) are within the category in which foreign investment is currently restricted.

Revenue risk

According to the Company’s understanding of the internet industry, there is periodicity in this industry, especially periodicity for development of the internet. As we can see from with emergence and application of new technology, existing technology and mode may change.

In accordance to the related Advertisement Law of PRC, the Company, as a publisher of advertisement has the obligation to check relevant documents and verify the content of the advertisement. However, even the Company checked all required documents according to the law and made judgments based on its best knowledge, the Company is still not able to fully detect the facts when its customers made dishonest statements about the contents of the advertisement published or going to be published by the Company and there is no mandatory requirement that the Company shall be responsible for the customer’s business activities. Under this circumstance, although the Company has fully fulfilled the obligations required by the law, the Company may still be censured by the public who do not have the full knowledge of the situation for involving in “falsely advertising to deceive or mislead consumers”. This will cause a negative impact on the Company’s reputation and may lead negative impact on the Company’s performance.

| F-10 |

Technical and Safety risk

Prevention of stealing for core technology: The Company applied for protection of property rights to protect its technology to the extent possible.

Safety of the internet: The internet is always attacked by hackers. The Company takes many measures to prevent its internet system from being intruded.

Besides prevention in technology, investment in equipment is also necessary. A perfect safety system and backup system can prevent safety risk in operation. Of course the possibility of invasion of virus always exists. The Company pays great attention to prevent it.

Internet electronic business system: self-help terminal for internet business operation is convenient for customers. At the same time, lawbreakers may intrude into bank business systems or steal customer information. The Company takes measures to avoid technical leaks, so to promote safe operation of the system.

Credit risk

Financial instruments that potentially expose the Company to concentrations of credit risk consist primarily of cash, cash equivalents, and accounts receivables The Company places its cash and cash equivalents with financial institutions, which management believes are of high-credit ratings and quality.

The Company conducts credit evaluations of customers and generally does not require collateral or other security from its customers. The Company establishes an allowance for doubtful accounts primarily based upon the age of the receivables and factors surrounding the credit risk of specific customers.

Foreign currency risk

A majority of the Group’s sales and expenses transactions and a significant portion of the Company’s assets and liabilities are denominated in Renminbi (“RMB”). RMB is not freely convertible into foreign currencies. In the PRC, certain foreign exchange transactions are required by law to be transacted only by authorized financial institutions at exchange rates set by a third party company at http://www.oanda.com/.Remittances in currencies other than RMB by the Company in China must be processed through the PBOC or other China foreign exchange regulatory bodies which require certain supporting documentation in order to affect the remittance.

| NOTE 5. | PREPAID EXPENSESAND OTHER CURRENT ASSETS |

At June 30, 2012 and December 31, 2011, prepayment and other current assets consist of:

| June 30, | December 31, | |||||||

| 2012 | 2011 | |||||||

| Prepaid rental, phone and to other vendors | $ | 11,009 | $ | 12,536 | ||||

| Prepayment to advertisement and internet resources providers | 313,102 | 330,730 | ||||||

| Other current assets | 57,895 | 42,179 | ||||||

| $ | 382,006 | $ | 385,445 | |||||

Prepayment to advertisement and internet resources providers consists of the deposits required by and made to the telecommunication platform operators for using their network services.

NOTE 6.PROPERTY AND EQUIPMENT

Property and equipment consists of network equipment and servers used for hosting Company’s website and furniture, equipment and computers used in the office.

Property and equipment consists of the following:

| June 30, | December 31, | |||||||

| 2012 | 2011 | |||||||

| Office and other equipment | $ | 30,789 | $ | 25,873 | ||||

| Computers | 40,441 | 41,604 | ||||||

| Total | $ | 71,230 | $ | 67,477 | ||||

| F-11 |

Depreciation expense for the period ended June 30, 2012 and year end December 31, 2011 was $15,398 and $27,528 for both periods.

| NOTE 7. | RELATED PARTY TRANSACTIONS |

At June 30, 2012 and December 31, 2011, the Company had a balance due to Mr. Jiang Wei, the majority shareholder and Chairman, of $1,059,521 and $1,067,742, respectively, for advances made to fund operations. This payable is due on demand, is non-interest bearing and has no maturity date.

At June 30, 2012 and December 31, 2011, the Company had a balance due to Xie He Si Decoration Co., Ltd, a related company owned by Chairman, of $80,384 and $79,815, respectively, for advances made to fund operations. This payable is due on demand, is non-interest bearing and has no maturity date.

At June 30, 2012, the Company had a balance due to Mr. Peng Huian, the CEO, of $63,294 for advances made to fund operations. This payable is due on demand, is non-interest bearing and has no maturity date.

At December31, 2011, the Company had a balance due from Mr. Peng Huian, the CEO, of $31,164 for Mr. Peng Huian to purchase materials and tools on behalf of Science & Technology World Website Media Group. The balance was cleared as of June 30, 2012.

| NOTE 8. | ADVANCED FROM CUSTOMER AND DEFERRED REVENUE |

Advanced from customers were the pre-payments received from customers but the services have yet provided. Deferred revenue was the portion of contractual amount not being recognized as revenue for our membership services which revenue is ratably recognized over the membership period.

| NOTE 9. | ACCRUED EXPENSES AND OTHER CURRENT LIABILITIES |

Accrued expenses and other current liabilities consist of the following:

| June 30, | December 31, | |||||||

| 2012 | 2011 | |||||||

| Payroll Payable | $ | 27,195 | $ | 21,186 | ||||

| Other payable | 97,926 | 23,176 | ||||||

| Total | $ | 125,121 | $ | 44,362 | ||||

| NOTE 10. | TAXATION |

| A) | Income Tax |

Science & Technology Trading and our combined VIEs are established in Dalian, Province, PRC, and governed by the Income Tax Law of the PRC concerning privately-held enterprises, which are generally subject to tax at a statutory rate of 25% on income reported in the statutory financial statements after appropriate tax adjustments in 2012 and 2011.

The Company has deferred taxes as the Company has prepaid enterprise income tax caused by the timing difference between accounting basis and tax basis and the Company has tax losses in both six months ended June 30, 2012 and 2011.

The effective tax rate for the Company for the period ended June 30, 2012 and 2011 was 25% for all periods.

A reconciliation between the income tax computed at the U.S. statutory rate and the Company’s provision for income tax is as follows:

| June 30, | December 31, | |||||||

| 2012 | 2011 | |||||||

| PRC statutory tax rate | 25 | % | 25 | % | ||||

| Taxable losses | 352,032 | 790,233 | ||||||

| Computed expected income tax benefit | 88,008 | 197,558 | ||||||

| Reconciliation items: | ||||||||

| Non-deductible expenses/(non-taxable income) | (5,982 | ) | 65 | |||||

| Temporary difference on revenue recognition | 97,504 | 305 | ||||||

| Changes in valuation allowance | (82,026 | ) | (197,623 | ) | ||||

| Net deferred tax assets | $ | 97,504 | $ | 305 | ||||

| F-12 |

Realization of the net deferred tax assets is dependent on factors including future reversals of existing taxable temporary differences and adequate future taxable income, exclusive of reversing deductible temporary differences and tax loss or credit carry forwards. The Company evaluates the potential realization of deferred tax assets on an entity-by-entity basis. As of June 30, 2012, valuation allowances were provided against deferred tax assets in entities where it was determined it was more likely than not that the benefits of the deferred tax assets will not be realized. The Company had deferred tax assets of approximately $82,026 and $197,623 as of June 30, 2012 and December 31, 2011 which consisted of tax loss carry-forwards of $328,104 and $790,491, respectively as of June 30, 2012 and December 31, 2011, which can be carried forward to offset future taxable income. The management determines it is more likely than not that these deferred tax assets could not be recognized, so full allowances were provided as of June 30, 2012 and December 31, 2011. The deferred tax assets arising from net operating losses will expire from 2013 if not utilized.

| B) | Business Tax and relevant surcharge |

Revenue of our membership and advertising planning services are subject to 5.5% business tax and 0.6% total surcharge of the gross service income. Business tax charged was included in cost of sales.

At June 30, 2012 and December 31, 2011 taxes receivable consists of:

| June 30, | December 31, | |||||||

| 2012 | 2011 | |||||||

| Business tax receivable | $ | 86,316 | $ | 30,564 | ||||

| Other surcharge payable | (1,037 | ) | (1,133 | ) | ||||

| Tax Receivable | $ | 85,279 | $ | 29,431 | ||||

| NOTE 11. | SHAREHOLDERS’ EQUITY AND STATUTORY RESERVES |

The Company registered 50,000 shares with a par value of $1 per common share. During year 2011, 50,000 shares of common stocks were issued and additional capital of $181,494 was invested to fulfill statutory investment requirements of $196,109.

As stipulated by the laws and regulations for enterprises operating in PRC, the subsidiaries of the Company are required to make annual appropriations to a statutory surplus reserve fund. Specifically, the subsidiaries of the Company are required to allocate 10% of their profits after taxes, as determined in accordance with the PRC accounting standards applicable to the subsidiaries of the Company, to a statutory surplus reserve until such reserve reaches 50% of the registered capital of the subsidiaries of the Company. The Company can use the statutory surplus reserve to offset deficits, expand its plant or increase capital when and only when the reserve balance exceeds 50% of the registered capital, and the amount capitalized should be limited to 50% of the statutory surplus reserve. The Company is not yet subject to the requirement to appropriate statutory reserves as they have not produced a profit to date.

NOTE 12. SUBSEQUENT EVENTS

Merger with Metha Energy Solutions,Inc.

Science & Technology World Website Media Holding Co., Ltd (“Science & Technology Holding”) is a corporation organized under the laws of British Virgin Islands on February 15, 2011. It was the sole shareholder of Science & Technology Media.

On October 29, 2012, Science & Technology Media entered into a Share Exchange Agreement by and among (i) Science & Technology Holding, (ii) the principal shareholders of Metha Energy Solutions, Inc (“Metha Energy Solutions”) (iii) Metha Energy Solutions, Inc and (iv) the shareholders of Science &Technology Holding.

| F-13 |

The acquisition is being accounted for as a “reverse merger,” and Science & Technology Media is deemed to be the accounting acquirer in the reverse merger. Consequently, the assets and liabilities and the historical operations that will be reflected in the financial statements prior to the acquisition will be those of Science &Technology Media and its wholly owned subsidiaries and VIEs, and will be recorded at the historical cost, and the consolidated financial statements after completion of the acquisition will include the assets, liabilities and operation of Metha Energy Solutions, Science & Technology Media and its wholly owned subsidiaries and VIEs from the closing date of the acquisition. As a result of the issuance of the shares of common stock pursuant to the Exchange Agreement, a change in control of occurred as a result of the acquisition.

In connection with the closing of the Exchange Agreement, Toft ApS, Metha Energy Solutions’ principal shareholder, agreed to cancel its 10,000,000 shares of the common stock that it owned in Metha Energy Solutions and to issue 50,000,000 shares to shareholders of Science & Technology Holding, who acquired a majority interest in Metha Energy Solutions in October 2012 for the purpose of the reverse acquisition of Science & Technology Media. Additionally, the existing officers and directors from Metha Energy Solutions resigned from its board of directors and all officer positions effective immediately after the closing of the reverse merger. Accordingly, Metha Energy Solutions appointed Mr. Jiang Wei, the former major shareholder of Science & Technology Holding as the Chairman of the Board and Chief Executive Officer.

Metha Energy Solutions’ directors approved the Exchange Agreement and the transactions contemplated thereby. Simultaneously, the directors of Science & Technology Media also approved the Exchange Agreement and the transactions contemplated thereby.

Metha Energy Solutions was formed as a corporation pursuant to the laws of the State of Delaware on April 18, 2008.

As a result of the Exchange Agreement, Metha Energy Solutions acquired 100% of the processing and production operations of Science & Technology Media and its subsidiaries, the business and operations of which now constitutes its primary business and operations. Specifically, as a result of the Exchange Agreement on October 29, 2012:

| £ |

Metha Energy Solutions acquired and now owns 100% of the issued and outstanding shares of capital stock of Science &Technology Media, a British Virgin Islands holding company which controls Dalian Tianyi, Science &Technology (Dalian) and their telecommunications business; | |

| £ |

Metha Energy Solutions issued 50,000,000 shares of common stock to the shareholders of Science & Technology Media shareholders; and | |

| £ | Science & Technology Media were issued common stock of Metha Energy Solutions constituting approximately 95.02% of the fully diluted outstanding shares. |

As a result of Metha Energy Solutions’ reverse acquisition of Science & Technology Media, Metha Energy Solutions has assumed the business and operations of Science & Technology Media with its principal activities engaged in the internet service business in the city of Dalian, Province of the People’s Republic of China.

| F-14 |

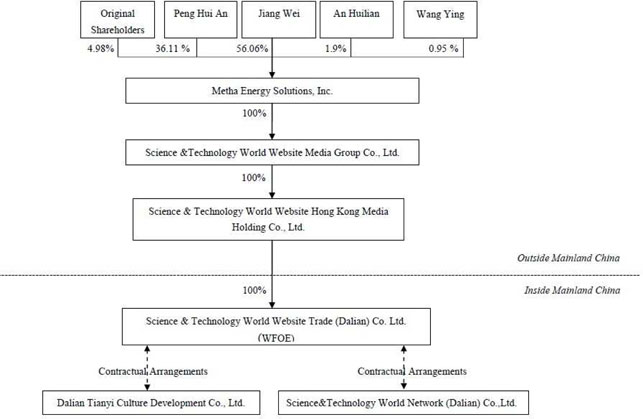

Metha Energy Solutions’ corporate structure after the reorganization is set forth below:

NOTE 13. PROFORMA COMBINED FINANCIAL STATEMENTS

The unaudited pro forma combined balance sheet as of June 30, 2012 and statements of operations for the six months ended June 30, 2012, and for the twelve months ended December 31, 2011are presented below as if the reverse merger had taken place on June 30, 2012. Metha Energy Solutions, Inc.’s fiscal year end is December 31. Science & Technology World Website Media Group Co., Ltd.’s fiscal year end is December 31. The statements of operations for Metha Energy Solutions, Inc. are presented for the six months ended June 30, 2012, and for the year ended December 31, 2011 to conform to Science & Technology World Website Media Group’s fiscal year end of December 31. The pro forma combined balance sheet and statement of operations are presented for informational purposes only and are not necessarily indicative of the results of operations that actually would have been achieved had the sale been consummated as of that time, nor is it intended to be a projection of future results. The unaudited pro forma results are as follows:

| F-15 |

Metha Energy Solutions, Inc.

Pro Forma Combined Balance Sheet

(Unaudited)

(U.S. Dollars)

| Science & Technology World Website Media Group, Co. Ltd | Metha Energy Solutions | Pro Forma | Pro Forma Combined | |||||||||||||

| June 30, 2012 | June 30, 2012 | Adjustments | June 30, 2012 | |||||||||||||

| Assets | ||||||||||||||||

| Current Assets | ||||||||||||||||

| Cash and cash equivalents | $ | 202,021 | $ | 526 | $ | (526 | )(A) | $ | 202,021 | |||||||

| Accounts receivable | 5,275 | - | 5,275 | |||||||||||||

| Taxes receivable | 85,279 | - | 85,279 | |||||||||||||

| Deferred tax assets | 97,504 | - | 97,504 | |||||||||||||

| Prepaid expenses and other current assets | 382,007 | - | 382,007 | |||||||||||||

| Total current assets | 772,086 | 526 | (526 | ) | 772,086 | |||||||||||

| Property and equipment, net | 71,230 | 535 | (535 | )(A) | 71,230 | |||||||||||

| Other Assets | - | 465 | (465 | ) | - | |||||||||||

| Total Assets | $ | 843,316 | $ | 1,526 | $ | (1,526 | ) | $ | 843,316 | |||||||

| Liabilities and Shareholders' Equity | ||||||||||||||||

| Current Liabilities | ||||||||||||||||

| Accounts payable | $ | $ | 21,206 | $ | (21,206 | )(A) | $ | - | ||||||||

| Accounts payable - related parties | 1,203,199 | - | 1,203,199 | |||||||||||||

| Advanced from customers | 458,882 | - | - | 458,882 | ||||||||||||

| Deferred Revenue | 266,752 | - | - | 266,752 | ||||||||||||

| Accrued expenses | 125,121 | - | - | 125,121 | ||||||||||||

| Total current liabilities | 2,053,954 | 21,206 | (21,206 | ) | 2,053,954 | |||||||||||

| Total Liabilities | 2,053,954 | 21,206 | (21,206 | ) | 2,053,954 | |||||||||||

| Shareholders' Equity | ||||||||||||||||

| 50,000 | (D) | |||||||||||||||

| (20,100 | )(C) | |||||||||||||||

| Common Stock | 50,000 | 22,371 | (50,000 | )(B) | 52,271 | |||||||||||

| (181,708 | )(E) | |||||||||||||||

| 19,680 | (A) | |||||||||||||||

| (50,000 | )(D) | |||||||||||||||

| 20,100 | (C) | |||||||||||||||

| Additional paid-in capital | 243,191 | 139,657 | 50,000 | (B) | 240,920 | |||||||||||

| Accumulated loss | (1,470,376 | ) | (181,708 | ) | 181,708 | (E) | (1,470,376 | ) | ||||||||

| Accumulated other comprehensive loss | (33,453 | ) | - | (33,453 | ) | |||||||||||

| Total shareholders' equity | (1,210,638 | ) | (19,680 | ) | 19,680 | (1,210,638 | ) | |||||||||

| Total Liabilities and Shareholders' Equity | $ | 843,316 | $ | 1,526 | $ | (1,526 | ) | $ | 843,316 | |||||||

| A. | To eliminate assets and liabilities retained by predecessor owner of Metha Energy Solutions Inc. | |

| B. | To eliminate common stock of Science & Technology World Website Media Group Co., Ltd. | |

| C. | .To record cancellation of 100,000 shares of preferred stock and 20,000,000 common shares for Metha Energy Solutions | |

| D. | To issue 50,000,000 shares of common stocks per Share Exchange Agreement | |

| E. | To eliminate Metha’s accumulated deficit. |

| F-16 |

Metha Energy Solutions, Inc.

Pro Forma Combined Income Statement

For six months ended June 30, 2012

(Unaudited)

(U.S. Dollars)

| Science & Technology World Website Media Group, Co. Ltd | Metha Energy Solutions Inc. | Pro Forma Adjustments | Pro Forma Combined | |||||||||||||

| Revenue: | - | |||||||||||||||

| Third parties | $ | 81,858 | $ | - | $ | - | $ | 81,858 | ||||||||

| Related parties | 13,174 | - | - | 13,174 | ||||||||||||

| Total Revenue | 95,032 | - | - | 95,032 | ||||||||||||

| Cost of revenue: | ||||||||||||||||

| Third parties | 108,372 | - | - | 108,372 | ||||||||||||

| Related parties | 17,441 | - | - | 17,441 | ||||||||||||

| Total cost of sales | 125,813 | - | - | 125,813 | ||||||||||||

| Gross loss | (30,781 | ) | - | - | (30,781 | ) | ||||||||||

| Operating expenses: | ||||||||||||||||

| Research & Development | 29,337 | - | - | 29,337 | ||||||||||||

| Selling and marketing | 64,830 | - | - | 64,830 | ||||||||||||

| General and administrative | 251,014 | 30,837 | (30,837 | ) | 251,014 | |||||||||||

| Total operating expenses | 345,181 | 30,837 | (30,837 | ) | 345,181 | |||||||||||

| Loss from operations | (375,962 | ) | (30,837 | ) | 30,837 | (375,962 | ) | |||||||||

| Total other income | 23,930 | 1,772 | (1,772 | ) | 23,930 | |||||||||||

| Net loss | $ | (352,032 | ) | $ | (29,065 | ) | $ | 29,065 | $ | (352,032 | ) | |||||

| Currency translation gain | (7,078 | ) | - | - | (7,078 | ) | ||||||||||

| Comprehensive loss | $ | (359,110 | ) | $ | (29,605 | ) | $ | 29,605 | $ | (359,110 | ) | |||||

| Net loss per share | (7.18 | ) | 0.00 | 0.00 | (0.01 | ) | ||||||||||

| Weight Average Outstanding | 50,000 | 22,620,030 | 30,000,000 | 52,620,030 | ||||||||||||

| F-17 |

Metha Energy Solutions, Inc.

Pro Forma Combined Income Statement

For twelve months ended December 31, 2011

(Unaudited)

(U.S. Dollars)

| Science & Technology World Website Media Group, Co. Ltd | Metha Energy Solutions Inc. | Pro Forma Adjustments | Pro Forma Combined | |||||||||||||

| Revenue: | - | |||||||||||||||

| Third parties | $ | 123,336 | $ | - | $ | - | $ | 123,336 | ||||||||

| Related parties | 6,363 | - | - | 6,363 | ||||||||||||

| Total Revenue | 129,699 | - | - | 129,699 | ||||||||||||

| Cost of revenue: | ||||||||||||||||

| Third parties | 308,145 | - | - | 308,145 | ||||||||||||

| Related parties | 15,898 | - | - | 15,898 | ||||||||||||

| Total cost of sales | 324,043 | - | - | 324,043 | ||||||||||||

| Gross loss | (194,344 | ) | - | - | (194,344 | ) | ||||||||||

| Operating expenses: | ||||||||||||||||

| Research & Development | 56,807 | - | - | 56,807 | ||||||||||||

| Selling and marketing | 159,750 | - | - | 159,750 | ||||||||||||

| General and administrative | 379,590 | 769,577 | 769,577 | 379,590 | ||||||||||||

| Total operating expenses | 596,147 | 769,577 | 769,577 | 596,147 | ||||||||||||

| Loss from operations | (790,491 | ) | (769,577 | ) | 769,577 | (790,491 | ) | |||||||||

| Total other income | 258 | 1,531,580 | (1,531,580 | ) | 258 | |||||||||||

| Net gain (loss) | $ | (790,233 | ) | $ | 762,003 | $ | (762,003 | ) | $ | (790,233 | ) | |||||

| Currency translation loss | (18,924 | ) | - | - | (18,924 | ) | ||||||||||

| Comprehensive loss | $ | (809,157 | ) | $ | 762,003 | $ | (762,003 | ) | $ | (809,157 | ) | |||||

| Net loss per share | (46.15 | ) | 0.03 | - | (0.02 | ) | ||||||||||

| Weight Average Outstanding | 17,534 | 22,620,030 | 30,000,000 | 52,620,030 | ||||||||||||

| F-18 |