Attached files

| file | filename |

|---|---|

| EX-32.1 - EXHIBIT 32.1 - China Network Media, Inc. | v405645_ex32-1.htm |

| EX-31.1 - EXHIBIT 31.1 - China Network Media, Inc. | v405645_ex31-1.htm |

| EXCEL - IDEA: XBRL DOCUMENT - China Network Media, Inc. | Financial_Report.xls |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2014

OR

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ____________ to ____________

Commission file number: 333-152539

CHINA NETWORK MEDIA, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 32-0251358 | |

| (State or other jurisdiction of | (I.R.S Employer Identification No.) | |

| incorporation or organization) | ||

Room 205, Building A No. 1 Torch Road, High-Tech Zone Dalian, China |

116023 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: +86 (411) 3973-1515

| Securities registered under Section 12(b) of the Act: |

| Title of each class: | Name of each exchange on which registered: | |

| None | None |

| Securities registered under Section 12(g) of the Act: |

| None |

| (Title of class) |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes x No ¨

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ¨ No x

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company.

| Large accelerated filer | ¨ | Accelerated filer | ¨ |

| Non-accelerated filer | ¨ | Smaller reporting company | x |

| (Do not check if a smaller reporting company) |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

Aggregate market value of the voting and non-voting common equity held by non-affiliates as of June 30, 2014: none.

As of March 31, 2015, there were 65,604,533 shares of the registrant’s common stock outstanding.

TABLE OF CONTENTS

| 2 |

SPECIAL NOTE REGARDING VOLUNTARY FILER STATUS

The Company is a “voluntary filer” with the U.S. Securities and Exchange Commission. This means that the Company is not required to file Current and Periodic Reports with the U.S. Securities and Exchange Commission. The Company is not a fully reporting company that is subject to review under Section 408 of the Sarbanes-Oxley Act of 2002. Furthermore, the Company is not subject to the going private rules and certain tender offer regulations, and the beneficial holders of the Company’s securities do not need to report on acquisitions or depositions of the Company’s securities or their plans regarding their influence and control over the Company. Therefore the Company’s status a voluntary filer reduces investors’ rights to access significant information regarding the Company and its controlling shareholders.

The Company’s voluntary filer status may lead to its removal from the Over-the-Counter Bulletin Board (“OTCBB”), as Rule 6530 of the Financial Industry Regulatory Authority provides that issuers must be required to file reports pursuant to Section 13 or 15(d) of the Securities and Exchange Act of 1934 in order to remain listed.

CAUTIONARY STATEMENT ON FORWARD-LOOKING INFORMATION

This Annual Report on Form 10-K (this “Report”) contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Forward-looking statements discuss matters that are not historical facts. Because they discuss future events or conditions, forward-looking statements may include words such as “anticipate,” “believe,” “estimate,” “intend,” “could,” “should,” “would,” “may,” “seek,” “plan,” “might,” “will,” “expect,” “predict,” “project,” “forecast,” “potential,” “continue” negatives thereof or similar expressions. Forward-looking statements speak only as of the date they are made, are based on various underlying assumptions and current expectations about the future and are not guarantees. Such statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, level of activity, performance or achievement to be materially different from the results of operations or plans expressed or implied by such forward-looking statements.

We cannot predict all of the risks and uncertainties. Accordingly, such information should not be regarded as representations that the results or conditions described in such statements or that our objectives and plans will be achieved and we do not assume any responsibility for the accuracy or completeness of any of these forward-looking statements. These forward-looking statements are found at various places throughout this Report and include information concerning possible or assumed future results of our operations, including statements about potential acquisition or merger targets; business strategies; future cash flows; financing plans; plans and objectives of management, any other statements regarding future acquisitions, future cash needs, future operations, business plans and future financial results, and any other statements that are not historical facts.

| 3 |

These forward-looking statements represent our intentions, plans, expectations, assumptions and beliefs about future events and are subject to risks, uncertainties and other factors. Many of those factors are outside of our control and could cause actual results to differ materially from the results expressed or implied by those forward-looking statements. In light of these risks, uncertainties and assumptions, the events described in the forward-looking statements might not occur or might occur to a different extent or at a different time than we have described. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this Report. All subsequent written and oral forward-looking statements concerning other matters addressed in this Report and attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this Report.

Except to the extent required by law, we undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events, a change in events, conditions, circumstances or assumptions underlying such statements, or otherwise.

CERTAIN TERMS USED IN THIS REPORT

When this report uses the words “we,” “us,” “our,” and the “Company,” they refer to the combined business of China Network Media Inc. and its consolidated subsidiaries and variable interest entities.

In addition, unless the context otherwise requires and for the purposes of this Report only:

| ● | “MGYS” refers to Metha Energy Solutions Inc., a Delaware corporation; |

| ● | “PRC” and “China” refers to the People’s Republic of China, excluding, for the purpose of this prospectus, Taiwan and the special administrative regions of Hong Kong and Macau; |

| ● | “PRC Operating Subsidiaries” and “PRC Operating Entities” refers to “Science & Technology (Dalian)” and “Dalian Tianyi”; |

| ● | “Renminbi” and “RMB” refers to the legal currency of China; |

| ● | “Science & Technology Trading” or “WFOE” refers to our indirect subsidiary of Science & Technology World Website Trade (Dalian) Co., Ltd., a PRC limited company; |

| ● | “Science & Technology (Dalian)” refers to our variable interest entity Science & Technology World Network (Dalian) Co., Ltd., a PRC limited company; |

| ● | “Dalian Tianyi” refers to our variable interest entity Dalian Tianyi Culture Development Co., Ltd., a PRC limited company; |

Overview

We operate a multi-lingual portal website that offers advertising opportunities, technical support, and industrial information and community functions to science and technology companies and entrepreneurs in China. We conduct our business through our variable interest entities Dalian Tianyi Culture Development Co., Ltd., a PRC limited company (“Dalian Tianyi”) and Science & Technology World Network (Dalian) Co., Ltd., a PRC limited company (“Science & Technology (Dalian)”) in China, which we control through a series of contractual arrangements.

Our website has 28 domestic channels featuring different regions in greater China area and two user interactive and information sharing platforms bulletin board system (BBS) and Blog and, is available in three languages Chinese, English and Japanese.

Our vision is to develop a worldwide online platform for science and technology companies and entrepreneurs to:

| 4 |

| · | Build brand image through a package of online magazine and multimedia advertisement, executive interview display, and online institutional alliances; |

| · | Showcase products through our customer-made corporate and factory facilities online show room; |

| · | Host product purchase for businesses and end-users; |

| · | Publish job openings and seek talents for corporate clients; and |

| · | Post corporate blogs; |

Advertisement

We currently derive a substantial portion of our revenues from online advertising services. Our advertising solutions present corporate users with attractive opportunities to combine the visual impact of traditional television-like multimedia advertisements and online magazines with the interactivity and precise targeting capabilities of the internet. We strive to promote a novel and unique advertising environment on our website to attract technology enterprises.

Technical Support

We offer a range of business management software, internet infrastructure services and export-related services, and provide educational services to incubate enterprise management and e-commerce professionals.

Industrial Information and Online Community

We provide “home-oriented” online experience to our technicians, science and technology professionals, where they can easily find industrial information, job openings, and social opportunities to meet friends and professionals through our website. In addition, through our BBS, users can upload and download software and data, read news and bulletins, and exchange messages with other users either through emails or on public message board.

We mainly focused on the technology development, and clients marketing in 2013 and 2012. This effort brought us an increase in online members to 41 with average annual contract price of $41,220 from 30 with average annual contract price of $51,344.

Despite said above, we also allay with traditional media channels, such as magazine, TV channels, by mutual referrals of clients in need of advertisement or publicity So far, we have built a steady relationship with four major Chinese magazines: 315online, China Brand, China High-Tech zone and Dalian Machinery.

Moreover, we also work closely with WO 3G mobile TV, which is a new media channel through mobile that developed by Liaoning broadcast TV and China Unicom, which is the second largest mobile phone operator in China. With the new strategic cooperation with 3G, we are building a new mobile platform for entrepreneurs, local government or any entities that have the needs to advertise their business and corporate cultures through a new channel.

During the past two years, we have attracted clients from different industries: governments, academic institutions, OEM, Environmental technology firms, and other high-tech companies.

In 2015, we plan to continue to focus on marketing our online advertisement service to build sustainable income steam.

In addition to the business described above, the Company intends to explore business opportunities in retirement home industry in Dalian, China.

| 5 |

Our Corporate History

We were founded on April 18, 2008 as Instructor, Inc., a development stage company, under the laws of the State of Delaware. On October 12, 2009, we changed our name to Metha Energy Solutions Inc. We entered into our current line of business on October 29, 2012 by acquiring Science& Technology World Website Media Group Co., Ltd., a British Virgin Islands company (“Science & Technology BVI”).

On October 12, 2009, we entered into a Share Exchange Agreement (the “Exchange Agreement”) with (i) Science & Technology BVI, (ii) the sole shareholder of Science & Technology BVI, Science & Technology World Website Media Holding Co., Ltd., a corporation organized under the laws of British Virgin Islands (“Science & Technology Media”) and the shareholders of Science & Technology Media (together with Science & Technology Media, as the “Science & Technology BVI Shareholders”) and (iv) our former principal shareholder pursuant to which we acquired all of the outstanding capital stock of Science & Technology BVI in exchange for the issuance of 50,000,000 shares of our common stock to the Science& Technology Shareholders (the “Share Exchange”). The shares issued to the Science & Technology Shareholders in the Share Exchange constituted approximately 95% of our issued and outstanding shares of common stock as of and immediately after the consummation of the Share Exchange. In connection with the closing, 10,000,000 shares of our common stock held by our former principal shareholder have been cancelled. As a result of the Share Exchange, Science & Technology BVI became our wholly owned subsidiary and, Wei Jiang and HuiAn Peng became our principal beneficial shareholders.

The transaction was regarded as a reverse merger whereby Science & Technology Media was considered to be the accounting acquirer as it retained control of the Company after the Share Exchange.

Science & Technology World was organized under the laws of the British Virgin Islands on February 15, 2011 as a holding company of our PRC operations. On September 16, 2011, Science & Technology BVI established Science & Technology World Website Hong Kong Media Holding Co., Ltd., a Hong Kong company (“Science & Technology HK”), as an intermediate holding company.

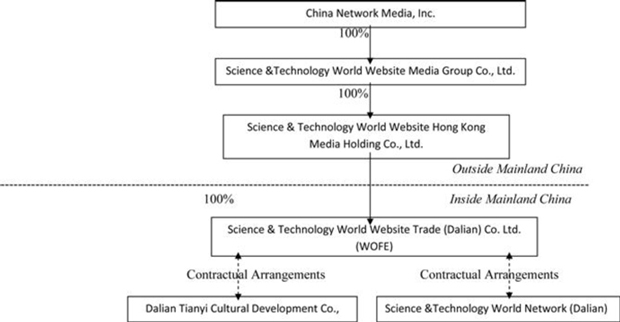

On January 20, 2012, Science & Technology HK established Science & Technology World Website Trade (Dalian) Co., Ltd., a PRC limited company (“WOFE”). On January 21, 2012, WOFE respectively entered into a series of agreements with Dalian Tianyi, Science & Technology World Network (Dalian) Co., Ltd., a PRC limited company (“Science & Technology Dalian”) and their respective shareholders (the “Contractual Arrangements”). The Contractual Arrangements is comprised of a series of agreements, including Exclusive Technical Consulting Service Agreements and Operating Agreements, through which WFOE has the right to advise, consult, manage and operate Dalian Tianyi and Science & Technology Dalian, and collect 85% of their respective net profits. The shareholders of Dalian Tianyi and Science & Technology Dalian have granted WFOE, under the Exclusive Equity Interest Purchase Agreement, the exclusive right and option to acquire all of their equity interests respectively in Dalian Tianyi and Science & Technology Dalian. Furthermore, the shareholders of Dalian Tianyi and Science & Technology Dalian is under the procedure of pledging all of their equity interests respectively in Dalian Tianyi and Science & Technology Dalian to WFOE under the Exclusive Equity Interest Pledge Agreement, and through the Exclusive Equity Interest Pledge Agreement, WFOE can collect the remaining 15% of Dalian Tianyi and Science & Technology Dalian’s respective net profits. According to the Power of Attorney executed by the shareholders of Dalian Tianyi and Science & Technology Dalian, they exclusively authorized WFOE to perform and exercise any and all of the shareholder’s rights in Dalian Tianyi and Science & Technology Dalian.

HK Science and Technology and WFOE are considered foreign investor and foreign invested enterprise respectively under PRC law. As a result, HK Science and Technology and WFOE are subject to limitations under PRC law on foreign ownership of Chinese companies. According to the Catalogue of Industries for Guiding Foreign Investment (2011 Revision) (the “Catalogue”), there are four kinds of industries which are encouraged, permitted, restricted and prohibited for foreign investment. The primary business of Dalian Tianyi and Science & Technology Dalian are within the category in which foreign investment is currently restricted. The Contractual Arrangements with Dalian Tianyi and Science & Technology Dalian allow the Company to substantially control Dalian Tianyi and Science & Technology Dalian through WFOE without any equity relationship.

According to the Power of Attorney executed by the shareholders of Dalian Tianyi and Science & Technology Dalian, they exclusively authorized WFOE to perform and exercise any and all of the shareholder’s rights in Dalian Tianyi and Science & Technology Dalian.

| 6 |

As a result of the Contractual Arrangements, under generally accepted accounting principles in the United States, or U.S. GAAP, Science & Technology BIV is considered the primary beneficiary of Dalian Tianyi and Science & Technology Dalian and thus consolidates their results in its consolidated financial statements.

Our corporate structure is set forth below:

Corporate Information

Our principal executive offices are located at Room 205, Building A, No. 1, Torch Road, Hi-tech Zone, Dalian, China, 116023, the People’s Republic of China. Our telephone number at this address is +86 (411) 39731515.

Our Competitive Strengths

We believe that the following strengths contribute to our success and differentiate us from our competitors:

We are well positioned in a highly fragmented and competitive market. Our China-based website for technology allows us to utilize cost-competitive domestic labor and resources to manage costs, provides a close proximity to our customers to better understand and service their needs and allows us to have real time updates on prevailing market conditions in China.

We run our business with an attractive and diverse business models. We provide a broad range of services to entrepreneurs and corporations that include online exhibition, online magazine, online corporate multimedia advertisement, executive interviews, institutional alliances and flexible membership package that is tailor made based on what our customers need.

| 7 |

We have development strong business relationship with enterprises throughout China, and business professionals; we also work closely with main media press. We work closely with major scientifically magazines, local governments, major media channels, and high-tech enterprises throughout China from different industry. So far, we have built a steady relationship with four major Chinese magazines: 315online, China Brand, China High-Tech Zone and Dalian Machinery. We also work closely with WO (UMTS/3G network service brand by China Unicom) 3G mobile TV, which is a new mobile media that developed by Liaoning broadcast TV and China Unicom (China Unicom is the second largest mobile phone operator in the country).

We also undertake big events to spread out our brand name, and therefore, earn the opportunities with other major media companies and enterprises. For example, from June to November in year of 2012, we have organized on the events called “China Brand image spokesman competition” During the 21st century, Chinese brands are poised to step into a new age. To set up a well-known brand, a company would need a high quality image spokesman to represent its product besides the high quality of its product. The aim of this contest is to select high quality image spokesman for emerging national brand, the advisory institutions for this contest include General Administration of Quality Supervision, Inspection and Quarantine of PRC, China Enterprise Confederation, China Enterprise Directors Association, China Radio and Television Association and China Council for the Promotion of Famous Brand Strategy. After local selection and final contest, a hundred brand image spokesmen will be chosen as winners of this contest. We have set up a team to deal with the work of contest design, operation, promotion and sponsorship. Local contest will be held by different local enterprises who have related qualifications and our authorization. The income of this event is mainly from the sponsorship of the final contest, endowment of co-organizers, sponsor from exclusive product enterprise, and 500,000 RMB from each enterprise who undertake the local contest.

We have an experienced management and operational teams with extensive market knowledge. Our management team and key operations and technical personnel have extensive management skills, relevant operational experience and industry knowledge. We have created and maintained a stable management team and have been able to retain our core management and key technical personnel since our inception. We believe that our management team’s experience, longstanding customer relationships and in depth knowledge of the Chinese market will enable us to continue our successful execution of expansion strategies and take advantage of market opportunities that may arise.

Multi-language website provides potential opportunities to attract clients from all over the world. We currently operate our website through three (3) languages: Chinese, English and Japanese. We believe with our multi-language portal website, more audience from the world will be able to learn, to communicate, and share information through our website.

Our Growth Strategy

Our vision is to become the primary source of technology information, knowledge, products platform for companies and entrepreneurs in China and, in the future, we hope to attract international technology professionals and enterprises through our multi-languages website. We intend to achieve our vision by expanding our content library and user base, enhancing our brand and improving our business model. More specifically, we plan to implement the following strategies:

| · | Increase the breadth and depth of our online technology content library. We currently have more than 34 in-house editors to collect and translate the most updated news through the world. We believe that the long-term strategy of having a global growth is to improve the strength and capability to collect prompt information in time, and therefore, turning ourselves into one of the Chinese top online news channel. |

| · | Further enhance our brand recognition. We have a limited operating history that has yet to build adequate exposure in our business. We plan to dedicate more effort on company brand management through a cost effective way, such as promoting our brand through our strategic cooperation partners, high-technology product representative agent, carrying out important social events with famous media channels and brands. |

| · | Expand our revenue sources. Our current revenue is mainly generated from online advertising for our customers through membership sales model. After the 2008 Olympic competition was rebroadcasted on mobile TV for the first time, the new media such as mobile TV created a new space for advertising business, which provide possibilities for us to expand our advertising business into new media. The 12th Five-Year Plan issued by China’s Ministry of Industry and Information Technology (MIIT) established aggressive development targets for the China telecommunications industry from 2011 to 2015. During this time, China’s mobile communications user base will reach more than 1.1 billion with total Internet users climbing to 600 million, representing a 40% penetration rate (www.iresearchchina.com). We regard the development of a base of smart phone users a key to grasp the opportunity in new media advertising business. We have engaged WO 3G mobile TV, which is a new mobile media that developed by Liaoning broadcast TV and China Unicom, the second largest mobile phone operator in the country, to build a mobile platform for advertisement and publicity demands. As of this Report, we are uncertain when the mobile platform will be completed. |

| 8 |

| · | Diversify our revenue sources. With the increase of our market share, brand recognition, and technology development, we expect to be able to work with most high-tech companies to develop a stable and active online trading platform, and by then, we anticipate that we will derive a new revenue stream from the trading platform. See “our business and service” section for more information. |

| · | Expand our online network infrastructure and optimize our services. In order to increase website hits, we modify our website from time to time to provide the most user-oriented set up. |

| · | Recruit additional qualified employees and enhance our research and development capabilities. In connection with the expansion of our business, we plan to continue recruiting more highly qualified individuals to conduct our operations of our website while maintaining the consistency and quality of the services that we deliver. We also plan to recruit more high profile personnel in our research and development department and invest in enhancing our research and development capabilities to be more competitive. |

Our Services

We currently generate revenues through our diverse advertisement package to our business clients. We generally target the companies with the following three distinct criteria to o be our customers:

| • | Companies that have its own innovative technology and project or have had significant success in the technology industry; |

| • | Companies that are reputable and have great influence in their respective industry; and |

| • | Companies that have fine product quality and recognized brand in the industry. |

We have classified our service package as follow (Service fee in RMB):

| Platinum Package | Gold Package | Silver Package | Bronze Package | |||||

| Fee/ year | 500,000 | 300,000 | 200,000 | 100,000 | ||||

| Service Item | ||||||||

| Front page ad | 1 years, 20MM* 50MM | 1 years, 20MM* 50MM | 1 years, 20MM* 50MM | No | ||||

| Online exhibition display | 1years | 1 years | 1 years | No | ||||

| Multi-lingual online profile | 1 years | 1 years | 1 years | 1 year | ||||

| Trading platform setup | 1 years | 1 years | 1 years | No | ||||

| Job recruitment | 1 years | 1 years | 1 years | 1 year | ||||

| Online magazine advertisement | 1 years | 1 years | 1 year | 1 year | ||||

| Annual conference or summit | at least once a year | at least once a year | at least once a year | once a year | ||||

| Public relations | Yes | Yes | Yes | Yes | ||||

| Keyword for searching engine | 1 year | 1 year | No | No | ||||

| Website design | Yes | No | No | No | ||||

| Business Referrals | 1 year | 1 year | 1 year | 1 year | ||||

| Discount for partnership members with S&T | Yes | Yes | No | No |

| 9 |

Details of Service Offered in Package

Front page ad: front page advertisement for our member companies on our website;

Online exhibition display: display our member companies’ products and corporate profile on our website;

Multilingual online profile: develop the member company’s corporate profile with more than one language. They can choose to develop their corporate profile in English, Japanese or other languages;

Setup trading platform: help our member company setup an online trading section on our website under the online trading section;

Job recruitment: setup a corporate recruiting section on our website for our member companies, to help them recruit new employees from our website resources;

Online magazine advertisement: we help our member companies design and display their own corporate magazine on our website;

Annual conference/summit: we organize conferences for more than one time in a year; the topic for each conference can vary. The membership companies will be invited to join the conference we organize;

Public Relations: we provide public relation services by running articles based on a specific topic for our member company’s core business and/or background of the executive officers.

Keyword for searching engine: we can set the name of our member company’s firm as the keyword in our search engine, so when any individual or corporate wants to search any information on our website, the keyword will show up immediately;

Website design: we provide website design service to our member company;

Business Referrals: we introduce business relations for our member company within our website;

Discount for partnership members with S&T: we offer exclusive discounts to our member company who wants to enter into partnership relationship with Science and Technology (Dalian). This innovative business model differentiates us from other advertising companies:

Online Exhibition

The “Online-Expo” of the Company is a brand-new model of product exhibition. We put our members product information on the internet through this window based on actual exhibition locations; it is a percept complement to the “International High-tech product exhibition of Dalian”. Each exhibiter has its own web page, and all information about the exhibiter and its products are available to internet users on the page. According to actual exhibition, we divide the “Internet Expo” into 14 sections, including software, electronics, internet, cartoon, manufacture, biology, medicine, communications, automobile, energy, environmental protection, aerospace, new material and agriculture.

We have set up an integral database for every single exhibiter on the “Internet Expo,” all the data such as exhibition information; daily turnover and the attention rate of the product are available on their respective web page.

Business Mode of Software and Information Service

The Company has established a research and development team to handle our website’s daily technique upgrade and support related research and development efforts. Meanwhile, we make available to our clients software outsource services, such as building corporate websites or office management systems.

| 10 |

Online Trading Platform

We plan to derive revenue from providing marketplace to market and distribute technology products. The Company has a self-contained online trading platform for technology products, which caters for the needs of most of the internet users who are likely to make technology product deals on the internet. For the new products that cannot be shown on the internet due to its own technical characteristics, we also have an offline team to promote and distribute these products.

Our Company has strict product selecting procedures. Before we introduce a product to customers, we verify the qualification of the manufacturing enterprise and conduct a series of test of the products’ function and performance. Furthermore, we work directly with enterprises, enhancing the price advantage of these products.

We have two strategies to offer online trading platform services: exclusive distribution of technology product and equity participation program. The first strategy requires us to buy out all the distribution right of a product in a specific area from a company; on top of that we will put this product on our promotion network. Our revenue comes from the price difference of the product. With the second strategy, we will select a product which is likely to have a vigorous momentum in the future. We cooperate with the manufacturing enterprise through cash investment, technology investment or other cooperative mode. Investing in these businesses and being part of the operations of these companies, we are able to generate revenues from the profit distribution of the enterprise.

Our Customers

We seek to target science and technology companies and entrepreneurs that:

| · | need to have its own technology created and have innovative project or have had significant success in the technology industry; |

| · | are reputable in their industry, and can influence the whole industry with their reputation; |

| · | offer quality product and are well recognized in the industry. |

We have various customers that come from different industries, such as: logistics, energy, social society, healthcare, construction, machinery, clothing, food and retailing and so forth.

Sales and Marketing

Sales to customers in China account for all of our revenue. We target our sales efforts primarily in major leading companies in China; however, we tend to focus on the local companies in Dalian and Northeast China for the beginning of our business, and then expand to companies throughout all China. We have developed and strive to maintain a diversified sales network that allows us to effectively market products and services to our customers. Our sales and marketing team currently consists of ten (10) full time employees and some part-time workers. Our executive management team is also actively involved in business development and in managing our key client relationships.

Research and Development

The nature of our business requires us to update our technology frequently in order to compete with other business competitors in the business.

Since the beginning of our operation in 2010, we have striven to work on our website by increasing the input of our database, developing new channels and functions on our website, creating new platform for job recruitment, trading through different industries, and designing, editing, and publishing online journals and carrying out other activities to dramatically enlarge our service capability.

During 2014, the development and continuing upgrade of our website for Science & Technology website was the cornerstone of our services, as our current website offers more features to the users. First, we added several distinctive columns into our columns list in Chinese, English and Japanese version, including Gallery Week, Sci-tech Translate, Web Map, Sci-tech Search and Today in History, as we spent great efforts to advertise them deeply in our website. Second, we allocated more resources on the development of nation channels, as we used six months to launch four new national channels consecutively, which are Sci-tech Russia, Sci-tech UK, Sci-tech Germany and Sci-tech South-Africa. We expect the launch of the four channels to help us attract more new users from these four countries to visit our website and expand our business opportunities.

| 11 |

Competition

Our business model is to provide our business to business, or “B2B” platform to technology enterprises, and our revenue is generated from advertisement business through our membership payment model. We believe that our major competitors are companies that provide the same advertising portal website to B2B customers and also the portal website that provide services to individuals, the large internet companies such as, Sohu.com, Sina.com, Baidu.com and others. We also face competition from large online video advertisers such as Youku.com, Tudou.com and 56.com and others.

Traditional media channel (magazine, newspapers, and radio), telecommunications, street showcase, billboard, frame and public transport advertising companies are also our competitors.

Our advantage is that we provide a multi-lingual platform focus on a specific area, scientific and technology industry, to our customers. We can also provide more tailor-made services to different demand stratification customers with lower price. We also provide a platform for our members to have the opportunities to communicate with each other.

Our disadvantage is our less famous brand in the industry which will require us to put more efforts and fund to exploit sales channels and market shares.

Factors and Trends Affecting our Business

The internet and internet-related markets in China continued to evolve rapidly during 2014. According to an annual report issued by the China Internet Network Information Center (“CNNIC”), the total number of internet users in China had reached 649 million by the end of December 2014, with an increase of 31.17 million from the end of 2013. The number of mobile internet users in China had reached 557 million by the end of December 2014, with an increase of 56.72 million compared with the last year. Mobile internet is becoming the top channel for Internet users to access websites in China. Meanwhile, the rising of the Blog and E-commerce platform in China contributed to attracting an increasing number of internet users. We believe that this large and expanding user base will continue to provide significant opportunities for our company to expand our product offerings and to explore new revenue streams.

However, China’s economy has been experiencing slower growth recently, with the result that many large advertisers were cautious regarding their spending on advertising in light of this economic uncertainty. At the same time, we have been facing fierce competition arising from existing and new internet companies, which have been seizing advertising market share. We have noted that this macro-economic environment and increased competition has had some impact on our brand advertising business.

Due to above various factors, however, it is difficult for us at this point to predict growth trends for our brand advertising business through the end of 2014.

We continue to be pleased with, and optimistic regarding, its growth and potential profitable opportunity. Our performance in the first half reflects the resilience of the online media industry in China despite the weakening global macroeconomic environment and economic slowdown in China. It also reflects the ongoing strength of our online content and the successful expansion into other fast-growing segments of the industry.

We believe, as discussed above, that there are significant opportunities to explore new revenue streams related to the online internet advertising market, in that regard, we will need to catch up with our peer competitors with respect to penetration of new online functions and features.

| 12 |

Intellectual Property

To establish and protect our proprietary rights, we rely on a combination of trademarks, copyrights, trade secrets, license agreements, patent applications, confidentiality agreements and other contractual rights.

Trademarks

Registered trademarks in the PRC are protected by the Trademark Law of the PRC which came into effect in 1982 and was revised in 1993 and 2001 and the Regulations for the Implementation of Trademark Law of PRC which came into effect in 2002. A trademark can be registered in the PRC with the Trademark Office under the State Administration for Industry and Commerce, or the SAIC. The protection period for a registered trademark in the PRC is ten years starting from the date of registration and may be renewed if an application for renewal is filed within six months prior to expiration.

We have received the approval on the following trademark with the Trademark Office, State Administration for Industry and Commerce in the PRC:

| No. | Registration No. | Trademark | Applicant | Item Category | Trademark Validity | |||||||||

| 1 | 10494489 |  |

Science & Technology (Dalian) | 42 | * | April 7,2013—April 6,2023 | ||||||||

| 2 | 10494453 and 10494499 | TWWTN | Science &Technology (Dalian) | 35 42 |

* * |

April 7, 2013—April 6, 2023 | ||||||||

| 3 | 10494470 |  |

Science &Technology (Dalian) | 35 | * | August 28, 2013—August 27, 2023 | ||||||||

*35: Product/service category: 1. Advertising; 2 advertising agency; 3 Advertising space for rent;4 Online advertising on the data communication network; 5 advertising planning; 6 advertising design; 7 advertising publication; 8 Rental for advertising time on communication media; 9 direct email advertising;10 provide models for advertising or promotion purpose

*42: Product/service category: 1. Computer software design; 2 transfer data and document into electronic media;3 help the others to create or maintain website; 4 packaging design; 5 Exterior design for industrial product;6 Fashion design; 7 artwork appraisal; 8.Written graphic arts design; 9 Computer programming; 10 Managing computer stations.

Domain Names

Dalian Tianyi owns five domain names, including www.twwtn.com, www.twwtn.cn, www.twwtn.net, www.twwtn.com.cn and www.twwtn.org.

Governmental Approvals and Regulations

Patent

In accordance with the PRC Patent Law, the State Intellectual Property Office is responsible for administering patents in the PRC. The patent administration departments of provincial, autonomous region or municipal governments are responsible for administering patents within their respective jurisdictions.

The Chinese patent system adopts a “first to file” principle, which means that, where more than one person files a patent application for the same invention, a patent will be granted to the person who filed the application first. To be patentable, invention or utility models must meet three conditions: novelty, inventiveness and practical applicability. A patent is valid for twenty (20) years in the case of an invention and ten (10) years in the case of utility models and designs. A third-party user must obtain consent or a proper license from the patent owner to use the patent. Otherwise, the use constitutes an infringement upon patent rights.

| 13 |

Copyright

Copyright in the PRC is protected by the Copyright Law of the PRC which was promulgated in 1990 and revised in 2001 and February 2010 and the Regulation for the Implementation of the Copyright Law of the PRC which came into effect in September 2002. Under the revised Copyright Law, copyright protections have been extended to information network and products transmitted on information network. Copyrights are reserved by the author, unless specified otherwise by the laws. According to Article 16 of the Copyright Law, if a work constitutes “work for hire”, the employer, instead of the employee, is considered the legal author of the work and will enjoy the copyrights of such “work for hire” other than rights of authorship. “Works for hire” include, (1) drawings of engineering designs and product designs, maps, computer software and other works for hire, which are created mainly with the materials and technical resources of the legal entity or organization with responsibilities being assumed by such legal entity or organization; (2) those works the copyrights of which are, in accordance with the laws or administrative regulations or under contractual arrangements, enjoyed by a legal entity or organization. The actual creator may enjoy the rights of authorship of such “work for hire.”

A copyright owner may transfer its copyrights to others or permit others to use its copyrighted works. Use of copyrighted works of others generally requires a licensing contract with the copyright owner. The protection period for copyrights in the PRC varies, with 50 years as the minimum. The protection period for a “work for hire” where a legal entity or organization owns the copyright (except for the right of authorship) is 50 years, expiring on December 31 of the fiftieth year after the first publication of such work.

Employees

As of the date of this Report, we had a total of 61 employees. We have paid the social insurance coverage for our full time employees for certain pension benefits, medical care, unemployment insurance, employee housing fund and other welfare benefits are provided to employees, which are in compliance with PRC law. The following table shows the number of our employees by function.

| Function | Number Of Employees |

|||

| Management | 6 | |||

| Technicians and Engineers | 9 | |||

| Editorials | 26 | |||

| Sales and Marketing | 10 | |||

| Accounting | 3 | |||

| Administration | 7 | |||

| Total | 61 | |||

We believe that we maintain a satisfactory working relationship with our employees, and we have not experienced any significant labor disputes or any difficulty in recruiting staff for our operations. None of our employees is represented by a labor union.

Our employees in China participate in a state pension plan organized by Chinese municipal and provincial governments. We are required to make monthly contributions to the plan for each employee at the rate of 20% of his or her average assessable salary. In addition, we are required by Chinese law to cover employees in China with various types of social insurance. We believe that we are in material compliance with the relevant PRC laws.

Smaller reporting companies are not required to provide information required under this item.

Item 1B. Unresolved Staff Comments.

Smaller reporting companies are not required to provide information required under this item.

| 14 |

We currently operate in the following facility under a lease agreement. The aggregate monthly payment under these leases is RMB 43,828 (approximately $6,929), as set forth on the table below:

| Facility | Address | Lessor | Space (Square Meters) |

Monthly Rent |

Lease Period | |||||||||

| Dalian (headquarters) | Room 205, Building A, No. 1, Torch Road, Hi-tech Zone, Dalian, China | Dalian Hi-Tech Enterprises Service Center | 1,440.92 | $ | 6,929 | May 1, 2014

to April 30, 2015 | ||||||||

We are currently not involved in any litigation that we believe could have a material adverse effect on our financial condition or results of operations. There is no action, suit, proceeding, inquiry or investigation before or by any court, public board, government agency, self-regulatory organization or body pending or, to the knowledge of the executive officers of our company or any of our subsidiaries, threatened against or affecting our company, our common stock, any of our subsidiaries or of our companies or our subsidiaries’ officers or directors in their capacities as such, in which an adverse decision could have a material adverse effect.

Item 4. Mine Safety Disclosures.

Not applicable.

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

Market Information

Our common stock is quoted on the OTC Markets, or OTC, under the symbol “CNNM”. As of March 31, 2015, the closing price for our common stock was $1.5 per share. The bid prices set forth below reflect inter-dealer quotations, do not include retail markups, markdowns or commissions and do not necessarily reflect actual transactions.

The following table sets forth, for the periods indicated, the high and low bid prices of our common stock.

Our common stock is currently quoted on OTC Markets under the symbol “CNNM.”

| High | Low | |||||||

| Fiscal Year Ended December 31, 2015 | ||||||||

| First Quarter | $ | 1.5 | $ | 0.1 | ||||

| Fiscal Year Ended December 31, 2014 | ||||||||

| First Quarter | $ | N/A | $ | N/A | ||||

| Second Quarter | $ | N/A | $ | N/A | ||||

| Third Quarter | $ | N/A | $ | N/A | ||||

| Fourth Quarter | $ | N/A | $ | N/A | ||||

| Fiscal Year Ended December 31, 2013 | ||||||||

| First Quarter | $ | N/A | $ | N/A | ||||

| Second Quarter | $ | N/A | $ | N/A | ||||

| Third Quarter | $ | N/A | $ | N/A | ||||

| Fourth Quarter | $ | N/A | $ | N/A | ||||

| 15 |

Holders

As of March 31, 2015, there were 250 stockholders of record of common stock. This does not reflect the number of persons or entities who held stock in nominee or street name through various brokerage firms.

Dividends

To date, we have not declared or paid any dividends on our common stock. We currently do not anticipate paying any cash dividends in the foreseeable future on our common stock, when issued pursuant to this offering. Although we intend to retain our earnings, if any, to finance the exploration and growth of our business, our Board of Directors will have the discretion to declare and pay dividends in the future.

Payment of dividends in the future will depend upon our earnings, capital requirements, and other factors, which our Board of Directors may deem relevant.

Recent Sales of Unregistered Securities

On April 8, 2014 the Company granted equity awards of 2,377,950 and 820,354 shares to 10 part-time consultants and 53 employees respectively, for the services rendered.

On September 17, 2014 the Company granted equity awards of 373,200 shares to 13 part-time consultants for the services rendered.

On December 14, 2014 the Company granted equity awards of 1,218,000 shares to 9 part-time consultants for the services rendered.

The issuances of the aforementioned shares were exempt from the registration requirements of the Securities Act of 1933, as amended (the “Securities Act”), pursuant to Section 4(2) thereof as a transaction by an issuer not involving a public offering.

Item 6. Selected Financial Data.

Smaller reporting companies are not required to provide information required under this item.

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operation.

The following discussion provides information which management believes is relevant to an assessment and understanding of our results of operations and financial condition for the fiscal years ended December 31, 2014, and December 31, 2013. The discussion should be read along with our financial statements and notes thereto contained elsewhere in this Report. The following discussion and analysis contains forward-looking statements, which involve risks and uncertainties. Our actual results may differ significantly from the results, expectations and plans discussed in these forward-looking statements. See “Cautionary Statement On Forward-Looking Information.”

Overview

We operate a multi-lingual portal website that offers advertising opportunities, technical support, and industrial information and community functions to science and technology companies and entrepreneurs in China. We conduct our business through our variable interest entities Dalian Tianyi Culture Development Co., Ltd., a PRC limited company (“Dalian Tianyi”) and Science & Technology World Network (Dalian) Co., Ltd., a PRC limited company (“Science & Technology Network”) in China, which we control through a series of contractual arrangements.

| 16 |

Our website has twenty-eight (28) domestic channels featuring different regions in greater China area and two user interactive and information sharing platforms bulletin board system (BBS) and Blog and, is available in three languages Chinese, English and Japanese.

| · | Build brand image through multiple languages online magazines, online corporate multimedia advertisement, executives interviews, institutional alliances and flexible membership package that are tailored to each business’ needs. |

| · | Showcase products to the public, through our customer-made corporate and factory facilities online show room; |

| · | Develop intelligent leisure retirement industry through building a unique international intelligent technology health leisure endowment industrial district including residential area, holiday resort, spa area etc.; |

| · | Develop an e-commercial platform to combine the online sales business with above intelligent leisure district and all the branches over the world to provide elderly products and also exclusive products provided by our agents; |

| · | Host product purchase for businesses and end-users; |

| · | Publish job openings and seek talents for corporate clients; and |

| · | Post corporate blogs; |

We currently derive a substantial portion of our revenues from online advertising services. Our advertising solutions present corporate users with attractive opportunities to combine the visual impact of traditional television-like multimedia advertisements and online magazines with the interactivity and precise targeting capabilities of the Internet.

Critical Accounting Policies and Management Estimates

Our discussion and analysis of our financial condition and results of operations relates to our consolidated financial statements, which have been prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”). The preparation of these financial statements requires us to make estimates and judgments that affect the reported amounts of assets, liabilities, revenues and expenses, and related disclosure of contingent assets and liabilities. On an ongoing basis, we evaluate our estimates based on historical experience and on various other assumptions that are believed to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from other sources. Actual results may differ from these estimates under different assumptions or conditions. We believe the consolidation, revenue recognition, income taxes and uncertain tax positions, computation of net loss per share, determination of net accounts receivable, and determination of functional currencies represent critical accounting policies that reflect the more significant judgments and estimates used in the preparation of our consolidated financial statements.

Principles of consolidation

The consolidated financial statements include the financial statements of the Company and its wholly-owned subsidiaries and VIEs. Upon consolidation, all balances and transactions between the Company and its subsidiaries and VIEs have been eliminated.

| 17 |

Use of estimates

The preparation of consolidated financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of revenues and expenses during the reporting period. Management makes these estimates using the best information available at the time the estimates are made; however actual results could differ from those estimates. Significant items subject to such estimates and assumptions include valuation allowances for receivables and recoverability of carrying amount and the estimated useful lives of long-lived assets.

Revenue Recognition

The Company recognizes revenue in accordance with ASC 605, Revenue Recognition. Revenues are recognized when the four of the following criteria are met: (i) persuasive evidence of an arrangement exists, (ii) the service has been rendered, (iii) the fees are fixed or determinable, and (iv) collectability is reasonably assured. The recognition of revenue involves certain management judgments. The amount and timing of our revenues could be materially different for any period if management made different judgments or utilized different estimates.

Online Membership Revenue

Online membership revenue includes revenue from members for brand advertising services as well as others services such as planning and advertising revenue and information revenue.

The Company has the arrangements with nonrefundable up-front fees model (“the Model”) to recognize revenue for the online membership business. We apply the Model, where a contract is signed to establish a fixed price for our services to be provided for a period of time as a membership enrollment, for a majority of our online membership revenue. Revenue is recognized ratably over the membership periods on a straight line basis, unless evidence suggests that the revenue is earned or obligations are fulfilled in a different pattern, over the contractual term of the arrangement or the expected period during which those specified services will be performed, whichever is longer. We provide advertisement placements to our advertising customers on our different Website channels and in different formats, which can include, among other things, banners, links, logos, buttons, rich media, pre-roll and post-roll video screens, pause video screens and content integration, as specified in the contracts with the members. The members can choose various on line services from the membership contracts based on their yearly membership.

Others Revenues

Other revenues are primarily generated from online advertisement planning services which introduce our customer’s profile, product, and awareness promotion for their executive officers to build a better brand name for non-member companies. We follows the guidance of FASB Accounting Standards Codification No. 605 for revenue recognition for others revenues. The Company recognize others revenue when they are realized or realizable and earned. The Company considers revenue realized or realizable and earned when it has persuasive evidence of an arrangement that the services have been rendered to the customer, the sales price is fixed or determinable, the services are rendered and collectability is reasonably assured.

Income Taxes and Uncertain Tax Positions

Income Taxes

The Company follows ASC 740, Income Taxes, which requires the recognition of deferred tax assets and liabilities for the expected future tax consequences of events that have been included in the financial statements or tax returns. Under this method, deferred income taxes are recognized for the tax consequences in future years of differences between the tax bases of assets and liabilities and their financial reporting amounts at each period end based on enacted tax laws and statutory tax rates, applicable to the periods in which the differences are expected to affect taxable income. Valuation allowances are established, when necessary, to reduce deferred tax assets to the amount expected to be realized.

| 18 |

The Company adopted ASC 740-10-25, which provides criteria for the recognition, measurement, presentation and disclosure of uncertain tax position. The Company must recognize the tax benefit from an uncertain tax position only if it is more likely than not that the tax position will be sustained on examination by the taxing authorities, based on the technical merits of the position. The tax benefits recognized in the financial statements from such a position are measured based on the largest benefit that has a greater than 50% likelihood of being realized upon ultimate resolution. Our estimated liability for unrecognized tax benefits, may be affected by changing interpretations of laws, rulings by tax authorities, changes and/or developments with respect to tax audits, and expiration of the statute of limitations. The outcome for a particular audit cannot be determined with certainty prior to the conclusion of the audit and, in some cases, appeal or litigation process. The actual benefits ultimately realized may differ from our estimates. As each audit is concluded, adjustments, if any, are recorded in our financial statements. Additionally, in future periods, changes in facts, circumstances, and new information may require us to adjust the recognition and measurement estimates with regard to individual tax positions. Changes in recognition and measurement estimates are recognized in the period in which the changes occur. The Company has elected to classify interest and penalties related to an uncertain tax position, if and when required, as part of income tax expense in the combined statements of operations. The Company did not recognize any additional liabilities for uncertain tax positions as a result of the implementation of ASC 740-10-25.

Accounts Receivable

Accounts receivable are recorded at net realizable value consisting of the carrying amount less an allowance for uncollectible accounts as needed. The allowance for doubtful accounts is the Company’s best estimate of the amount of probable credit losses in the Company’s existing accounts receivable. The Company determines the allowance based on aging data, historical collection experience, customer specific facts and economic conditions. Account balances are charged off against the allowance after all means of collection have been exhausted and the potential for recovery is considered remote. The Company did not have any off-balance-sheet credit exposure relating to its customers, suppliers or others. As of December 31, 2014 and December 31, 2013, management has determined that no allowance for doubtful accounts is required.

Property and equipment

Property and equipment mainly comprise computer equipment, hardware and office furniture. Property and equipment are recorded at cost less accumulated depreciation with no residual value.

Depreciation for financial reporting purposes is provided using the straight-line method over the estimated useful lives of the assets:

| Office and other equipment | 5 years |

| Computers | 3 years |

Depreciation expense is allocated among research and development expenses, selling and marketing expenses and general and administrative expenses.

When office equipment and electronic devices are retired or otherwise disposed of, resulting gain or loss is included in net income or loss in the year of disposition for the difference between the net book value and proceeds received thereon. Maintenance and repairs which do not improve or extend the expected useful lives of the assets are charged to expenses as incurred.

Foreign currency transactions and translations

An entity’s functional currency is the currency of the primary economic environment in which it operates, normally that is the currency of the environment in which the entity primarily generates and expends cash. Management’s judgment is essential to determine the functional currency by assessing various indicators, such as cash flows, sales price and market, expenses, financing and inter-company transactions and arrangements. The reporting currency of the Company is United States dollars (“U.S. dollars” or “$”), and the functional currency of HK Science & Technology is Hong Kong dollars (“HK dollar”). The functional currency of the Company’s PRC subsidiary and VIEs is the Renminbi (“RMB’), and PRC is the primary economic environment in which the Company operates. The reporting currency of these consolidated financial statements is the United States dollar.

| 19 |

For financial reporting purposes, the financial statements of the Company’s PRC subsidiary and VIEs, which are prepared using the RMB, are translated into the Company’s reporting currency, the United States dollar. The financial statements of HK Science & Technology, which are prepared using the HK dollar, are translated into the Company’s reporting currency, the United States dollar. Assets and liabilities are translated using the exchange rate at each balance sheet date. Revenue and expenses are translated using average rates prevailing during each reporting period, and shareholders' equity is translated at historical exchange rates. Adjustments resulting from the translation are recorded as a separate component of accumulated other comprehensive income in owners’ equity.

Transactions denominated in currencies other than the functional currency are translated into the functional currency at the exchange rates prevailing at the dates of the transactions. The resulting exchange differences are included in the determination of net income (loss) of the consolidated financial statements for the respective periods.

The exchange rates used for foreign currency translation were as follows

(US$1 = RMB):

| Year End | Average | |||||||

| 12/31/2014 | 6.1535 | 6.1482 | ||||||

| 12/31/2013 | 6.1140 | 6.1982 | ||||||

| (US$1 = HKD) | ||||||||

| Year End | Average | |||||||

| 12/31/2014 | 7.7580 | 7.7549 | ||||||

| 12/31/2013 | 7.7638 | 7.7546 | ||||||

No representation is made that the RMB amounts and HKD amounts could have been, or could be, converted into U.S. dollars at the rates used in translation.

Translations adjustments resulting from this process are included in accumulated other comprehensive loss in the shareholder’s deficit were $56,845 at December 31, 2014 and $59,158 at December 31, 2013, respectively.

Results of Operations for Years Ended December 31, 2014 and 2013

The following table shows key components of the results of operations during the years ended December 31, 2014 and 2013 :

| 20 |

| For Years Ended December 31, | Change of Amount | Change of % | ||||||||||||||

| 2014 | 2013 | |||||||||||||||

| Revenue | ||||||||||||||||

| - Third parties | $ | 1,256,987 | 850,034 | $ | 406,953 | 48 | % | |||||||||

| - Related parties | 27,108 | 26,890 | 218 | 1 | % | |||||||||||

| 1,284,095 | 876,924 | 407,171 | 46 | % | ||||||||||||

| Cost of revenue | ||||||||||||||||

| - Third parties | 443,685 | 496,291 | (52,606 | ) | (11 | )% | ||||||||||

| - Related parties | 9,568 | 15,700 | (6,132 | ) | (39 | )% | ||||||||||

| 453,253 | 511,991 | (58,738 | ) | (11 | )% | |||||||||||

| Gross profit | 830,842 | 364,933 | 465,909 | 128 | % | |||||||||||

| Operating expenses: | ||||||||||||||||

| Research and development expenses | 120,013 | 114,243 | 5,770 | 5 | % | |||||||||||

| Selling and marketing expenses | 29,620 | 56,243 | (26,623 | ) | (47 | )% | ||||||||||

| General and administrative expenses | 644,998 | 552,512 | 92,482 | 17 | % | |||||||||||

| Total operating expenses | 794,631 | 722,998 | 71,633 | 10 | % | |||||||||||

| Income (Loss) from Operations | 36,221 | (358,065 | ) | 394,276 | (110 | )% | ||||||||||

| Other income | 155,473 | 1,282,492 | (1,127,019 | ) | (88 | )% | ||||||||||

| Income from operations before income taxes | 191,684 | 924,427 | (732,743 | ) | (79 | )% | ||||||||||

| Provision for income taxes | 150,829 | 306,945 | (156,116 | ) | (51 | )% | ||||||||||

| Net income | 40,855 | 617,482 | (576,627 | ) | (93 | )% | ||||||||||

| Other comprehensive loss | ||||||||||||||||

| Foreign currency translation adjustment | 2,313 | (24,446 | ) | 26,759 | (109 | )% | ||||||||||

| Comprehensive income | $ | 43,168 | 593,036 | $ | (549,868 | ) | (93 | )% | ||||||||

Revenue

Total revenues were $1,284,095 for the year ended December 31, 2014, compared to $876,924 for the corresponding period in 2013. The increase in total revenues from the year ended December 31, 2013 to the year ended December 31, 2014 was $407,171, or 46%. The increase was mainly attributable to increases in online members to 54 with average annual contract price of $66,284 from 40 with average annual contract price of $41,220, driven by the business development activities since the second half of year 2012.

| 21 |

Costs and Expenses

Cost of revenue

Total cost of revenues was $453,253 for the year ended December 31, 2014, compared to $511,991 for the corresponding period in 2013. The decrease in cost of revenues from the year ended December 31, 2013 to the year ended December 31, 2014 was $58,738, or 11%. The main decrease in cost of revenues was mainly a result of decrease in the fees paid to WO 3G mobile TV for mobile platform construction of $101,656 due to the termination of collaboration in fiscal year 2014, decrease in information cost of $9,429, and other expenses of $2,020, offset by increase in labor related cost of $54,366.

Operating Expenses

Total operating expenses were $794,631 for the year ended December 31, 2014, compared to $722,998 for the corresponding period in 2013. The increase in operating expenses from the year ended December 31, 2013 to the year ended December 31, 2014 was $71,633, or approximately 9.91%. The increase was mainly attributed to the increase of research and development expenses of $5,770 and general and administrative expenses of $92,486, which are mainly due to the issuance of share based payment and offset by decrease of selling expenses of $26,623.

Research and Development Expenses

Research and development expenses mainly consist of personnel-related expenses incurred for costs associated with research in new products and services, development and enhancement of existing products, services, techniques, or processes. The research and development expenses of the Company mainly represented the labor-related cost of technical department, which engaged in developing and inputting new content into the Company’s website and improving existing services.

Research and development expenses were $120,013 for the year ended December 31, 2014, compared to $114,243 for the corresponding period in 2013. The increase in research and development expenses from the year ended December 31, 2013 to the year ended December 31, 2014 was $5,770, or 5%. The increase was mainly related to increase in salary and benefits expenses.

Selling and Marketing Expenses

Selling and marketing expenses mainly consist of advertising and promotional expenditures, salary and benefits expenses, sales commissions and travel expenses.

Selling and marketing expenses were $29,620 for the year ended December 31, 2014, compared to $56,243 for the corresponding period in 2013. The decrease in selling and marketing expenses from the year ended December 31, 2013 to the year ended December 31, 2014 was $26,623, or 47%. The decrease was mainly contributed by decrease in office expenses by $12,525, salary by $4,259 and miscellaneous expense by $9,839. The Company put more emphasis on exploring sizable customers and customers located in the northeast district of China, which led to a decrease in marketing expenses in 2014.

General and Administrative Expenses

General and administrative expenses mainly consist of salary and benefits expenses, professional service fees, and website hosting service fee, and office rental expenses.

General and administrative expenses were $644,998 for the year ended December 31, 2014, compared to $552,512 for the corresponding period in 2013. The increase in general and administrative expenses from the year ended December 31, 2013 to the year ended December 31, 2014 was $92,486, or approximately 16.74%. The increases were mainly due to a difference of an increase of $133,953 related to shares granted and issued to employees, and a $27,454 increase in professional fees and a $23,921 decrease in staff expenses, a $17,675 decrease in office expenses, a $11,095 decrease in transportation and $16,230 decrease in miscellaneous fee.

| 22 |

Income from Operations

As a result of the foregoing, our operating income was $36,211 for the year ended December 31, 2014, compared to loss of $358,065 for the year ended December 31, 2013.

Other Income

Other income was $155,473 for the year ended December 31, 2014, compared to other income of $1,282,492 for the corresponding period in 2013. There was no customer deposit recognized as other income in 2014. The other income in 2014 was mainly for the governmental subsidy.

Income Tax Expense

Income tax expense was $150,829 for the year ended December 31, 2014, compared to $306,945 for the year ended December 31, 2013. The decrease of income tax mainly due to less profit was driven from business operating.

Net Income

For the year ended December 31, 2014, we had net income of $40,855, compared to the net income of $617,482 for the year ended December 31, 2013.

Going Concern

The financial statements have been prepared assuming that the Company will continue as a going concern. The Company currently has limited revenue and has accumulated deficit of $1,514,655 and $1,555,510 as of December 31, 2014 and December 31, 2013 and net income of $40,855 and $617,482 for the year ended December 31, 2014 and 2013, respectively. Also, the Company’s current liability exceeds current assets. These conditions raise substantial doubt about the Company’s ability to continue as a going concern. As of December 31, 2014, the Company generated net income of $40,855 and generated more revenue to help achieve profitable operations. Management plans to fund continuing operations through new financing from related parties and equity financing arrangements. The Company’s continuation as a going concern is dependent on its ability to meet its obligations, to obtain additional financing as may be required until 2016 when it can generate sources of recurring revenues and to ultimately attain profitability. The financial statements do not include any adjustments that might result from the outcome of this uncertainty

Liquidity and Capital Resources

Our principal sources of liquidity are cash and cash equivalents, short-term investments, loans from shareholders, as well as the cash flows generated from our operations.

As of December 31, 2014, we had cash and cash equivalents of approximately $909,922. As of December 31, 2013, we had cash and cash equivalents of approximately $135,465. Cash equivalents primarily comprise petty cash and cash in the bank accounts.

We believe that the current cash and cash equivalents combined with proceeds that it expect to generate from operating activities are sufficient to meet anticipated working capital needs, commitments and capital expenditures over the next twelve months. It may, however, require additional cash resources due to changes in business conditions and other future developments, or changes in general economic conditions.

Cash Generating Ability

We believe that we will generate cash flow from our membership business and other business, which, along with our available cash, will provide sufficient liquidity and financial flexibility.

| 23 |

Our cash flows were summarized below:

| Year Ended December 31, | ||||||||

| 2014 | 2013 | |||||||

| Net cash provided by (used in) operating activities | $ | 776,162 | $ | (559,200 | ) | |||

| Net cash used in investing activities | (2,277 | ) | (5,683 | ) | ||||

| Net cash provided by financing activities | 2,109 | - | ||||||

| Effect of exchange rate change on cash and cash equivalents | (1,537 | ) | 14,881 | |||||

| Net increase (decrease) in cash and cash equivalents | 774,457 | (550,002 | ) | |||||

| Cash and cash equivalents at beginning of period | 135,465 | 685,476 | ||||||

| Cash and cash equivalents at end of period | $ | 909,922 | $ | 135,465 | ||||

Net Cash Used in Operating Activities

For the year ended December 31, 2014, $776,162 net cash provided by operating activities was primarily attributable to our net income of $40,885 adjusted by non-cash items of depreciation and amortization of $30,819 and issuance of stocks to employees of $161,133, prepaid expenses and other current assets decreased by $80,897 due to decreased advanced payment for advertising strategic cooperation fee, prepaid taxes decreased by $2,517, income tax payable increased by $116,125, accounts receivable decreased by $7,455 and deferred revenue increased by $414,373 and offset by advance from a customer decreased by $48,795 deferred revenue-noncurrent decreased by $11,295 and other current liabilities decreased by $12,888.

For the year ended December 31, 2013, $559,200 net cash used in operating activities was primarily attributable to our net income of $617,482 adjusted by non-cash items of depreciation and amortization of $37,423 and issuance of stocks to employees of $27,180, prepaid expenses and other current assets decreased by $171,383 due to decreased advanced payment for advertising strategic cooperation fee, prepaid taxes decreased by $14,375, income tax payable increased by $179,249 and advance from a customer increased by $80,669 and offset by accounts receivable increased by $7,395, deferred revenue decreased by $216,177, deferred revenue-noncurrent decreased by $265,311 and other current liabilities decreased by $1,198,078.

Net Cash Used in Investing Activities

For the year ended December 31, 2014, net cash used in investing activities of $2,277 was primarily the result of the purchase of office equipment.

For the year ended December 31, 2013, net cash used in investing activities of $5,683 was primarily the result of the purchase of office equipment.

Net Cash Provided by Financing Activities

For the year ended December 31, 2014, net cash provided by financing activities of $2,109 was primarily the result of the increase of due to a related party.

For the year ended December 31, 2013, there was no cash used in financing activities.

Off-Balance Sheet Commitments and Arrangements