Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Exelis Inc. | d445618d8k.htm |

Exelis

Inc. 2012 Credit Suisse Aerospace & Defense Investor Conference

David F. Melcher, Chief Executive Officer & President

Peter Milligan, Chief Financial Officer and Senior Vice President

November 28, 2012

Exhibit 99.1 |

SAFE

HARBOR

STATEMENT

Safe

Harbor

Statement

under

the

Private

Securities

Litigation

Reform

Act

of

1995

(the

“Act”):

Certain

material

presented

herein

includes

forward-looking

statements intended to qualify for the safe harbor from liability established by the Act. These

forward-looking statements include, but are not limited to, statements about the

separation of the Company from ITT Corporation, the terms and the effect of the separation, the nature and impact of such a separation,

capitalization of the Company, future strategic plans and other statements that describe the

Company’s business strategy, outlook, objectives, plans, intentions or

goals,

and

any

discussion

of

future

operating

or

financial

performance.

Whenever

used,

words

such

as

“anticipate,”

“estimate,”

“expect,”

“project,”

“intend,”

“plan,”

“believe,”

“target”

and other terms of similar meaning are intended to identify such forward-looking

statements. Forward-looking statements are uncertain and to some extent

unpredictable, and involve known and unknown risks, uncertainties and other important factors that could cause actual results to differ

materially from those expressed or implied in, or reasonably inferred from, such

forward-looking statements. Factors that could cause results to differ materially

from those anticipated include, but are not limited to:

In addition, there are risks and uncertainties relating to our separation from ITT Corporation

including whether those transactions will result in any tax liability, the operational

and financial profile of the Company or any of its businesses after giving effect to the separation, and the ability of the Company to operate as

an independent entity.

The Company undertakes no obligation to update any forward-looking statements, whether as

a result of new information, future events or otherwise, except as required by law. In

addition, forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from

the Company’s historical experience and our present expectations or projections. These

risks and uncertainties include, but are not limited to, those described in Exelis

Inc.’s Annual Report on Form 10-K for the fiscal year ended December 31, 2011 and those described from time to time in our future reports filed with

the Securities and Exchange Commission.

Our dependence on the defense industry and the business risks

peculiar to that industry, including changing priorities or reductions

in the U.S.

Government or international defense budgets;

Government regulations and compliance therewith, including

changes to the Department of Defense procurement process;

Our international operations, including sales to foreign customers;

Competition, industry capacity and production rates;

Misconduct of our employees, subcontractors, agents and business

partners;

The level of returns on postretirement benefit plan assets and

potential employee benefit plan contributions and other

employment and pension matters;

Changes

in

interest

rates

and

other

factors

that

affect

earnings

and

cash flows;

The mix of our contracts and programs, our performance, and our

ability to control costs;

Governmental investigations;

Our

level

of

indebtedness

and

our

ability

to

make

payments

on

or

service

our

indebtedness;

Subcontractor performance;

Economic and capital markets conditions;

The availability and pricing of raw materials and components;

Ability to retain and recruit qualified personnel;

Protection of intellectual property rights;

Changes in technology;

Contingencies related to actual or alleged environmental contamination,

claims and concerns;

Security breaches and other disruptions to our information technology and

operations; and

Unanticipated changes in our tax provisions or exposure to additional

income tax liabilities.

2 |

EXELIS – INVESTMENT

HIGHLIGHTS Diversified portfolio

with

attractive positions

in

enduring market segments

Mission-critical and affordable

ready-now solutions

Proven record of solid program

performance and operational

excellence

Large fielded base and platform-

agnostic solutions drive

sustainable revenue

3

(1)

See Appendix for non-GAAP reconciliations.

Diversified portfolio, strong cost controls,

Diversified portfolio, strong cost controls,

and solid FCF

and solid FCF

2012 Guidance

Revenue

$5.4B -

$5.5B

Adj. Operating Margin

(1)

10.6% -

10.8%

Adj. Earnings per Share

(1)

$1.80 -

$1.86 |

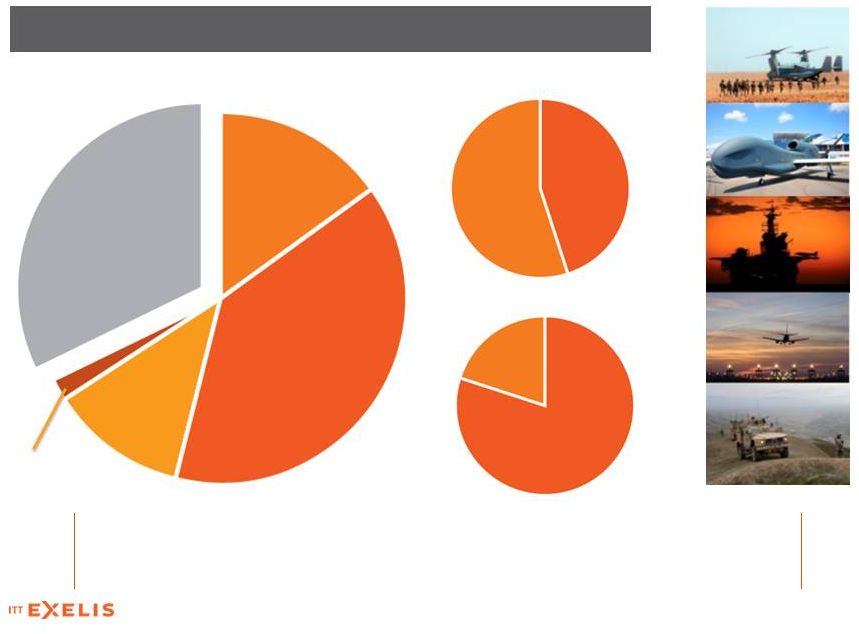

2011

REVENUE

BY

CUSTOMER

AND

CONTRACT

TYPE

4

Cost

Plus

55%

Fixed

Price

45%

Army

39%

Intel,

Special

Ops,

Other

DOD 2%

Navy

12%

Air Force

15%

International,

Other Non-DoD,

NASA,

Commercial, FAA

32%

CUSTOMERS

CONTRACT TYPE

CONTRACT POSITION

Customer and contract diversity provides

Customer and contract diversity provides

sustainability and mitigates against downside risk

sustainability and mitigates against downside risk

Sub

20%

Prime 80%

2011 Revenue $5.8B

2011 Revenue $5.8B |

5

We are among the most agile C4ISR, aerospace, and information & technical services provider

with deep customer knowledge and technology expertise to deliver affordable,

mission-critical products and services. Information & Technical Services

(I&TS) C4ISR

Electronics

& Systems

>

Electronic warfare

>

Unmanned ISR

>

Force protection

>

Networked

communications

>

Radar

>

Composite structures

>

Reconnaissance &

surveillance

>

Acoustic systems

Information Systems

Mission Systems

Geospatial

Systems

Electronic

Systems

>Airborne

situational awareness

>Information

exploitation

>Space

-based

satellite imaging

>Weather

& climate monitoring

>

GPS

>

Night vision

>

Power solutions

>Information

-enabled

mission solutions

>High

-end engineering

services

>Air traffic

management systems

>Commercial

aviation solutions

>

Satellite ground

systems

>

Spectrum management

>

Space, ground & range

operations, sustainment,

upgrade & modernization

AGILITY AND INGENUITY FOR THE

21

CENTURY

ST

>

Global-base

operations and

infrastructure

support

>Battlefield

network communications &

information support

>Worldwide

logistics & deployment

support

>

Ground vehicle &

equipment

maintenance |

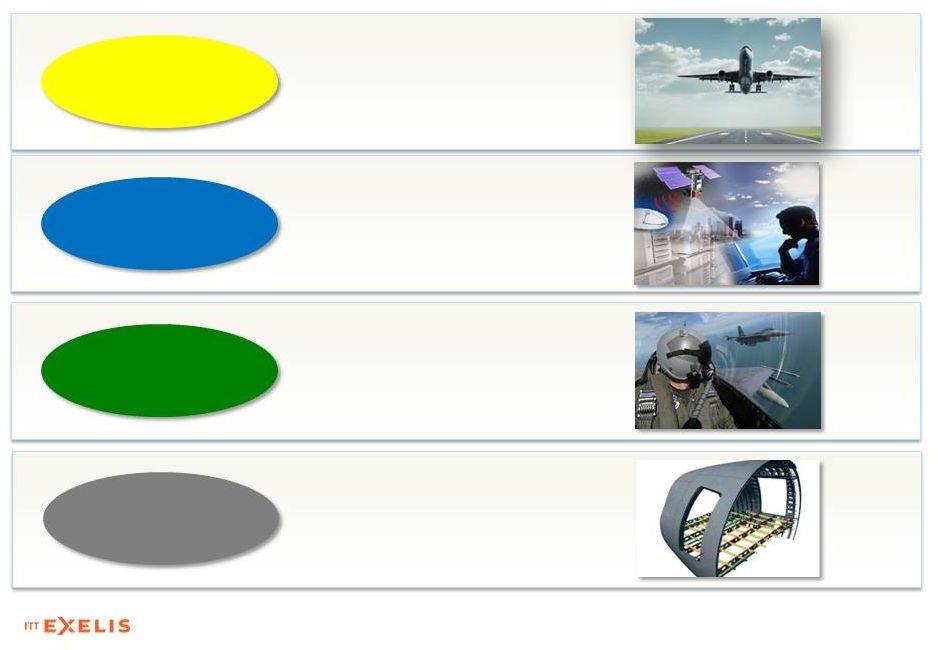

STRATEGIC

GROWTH

PLATFORMS

GUIDE

INVESTMENTS

6

Leverage deep technical expertise in

the electro-magnetic spectrum to

provide specialized systems and

components for critical missions

Provide key solutions in image

analysis, processing, exploitation

and dissemination

Design, build, operate and sustain

large, specialized and secure

communications networks for

customers for whom outages

are high-risk

Electronic

Warfare

Critical

Networks

Sensors to

Decisions

Invest and grow integrated

aerostructures assemblies

capabilities

Aerostructures |

2012 PERFORMANCE (1)

Free Cash Flow = Cash Flow from Operations less Capital Expenditures plus Separation Costs.

Does not include dividend payments. For Non-GAAP reconciliations, refer to appendix

and www.exelisinc.com/investors 7

Performance in line with expectations

Performance in line with expectations

On track to achieve 2012 guidance

On track to achieve 2012 guidance

Revenue trending to high end of guidance range

Generated $167 of Free Cash Flow

(1)

in Q3

Positioning to perform in tighter U.S. DoD budget outlook

Key contract vehicles in place

Global Tactical Advanced Communications Systems (GTAC)

Enhanced Army Global Logistics Enterprise (EAGLE) Program

Adaptive Persistent Awareness System (APAS) |

LOOKING AHEAD TO

2013

Positioning for greater flexibility in uncertain budget

environment

Anticipating pension headwind in 2013

Focused on cash generation -

managing cash obligations

8

Continue to deliver innovative, differentiated

Continue to deliver innovative, differentiated

and ready-now solutions

and ready-now solutions |

9

|

APPENDIX |

RECONCILIATION OF

NON-GAAP

MEASURES

Management reviews key performance indicators including revenue,

segment operating income and margins, orders growth, and

backlog, among other metrics on a regular basis. In addition, we

consider certain additional measures to be useful to management

and investors evaluating our operating performance for the periods presented, and provide a

tool for evaluating our ongoing operations, liquidity and management of assets. This

information can assist investors in assessing our financial performance and

measures our ability to generate capital for deployment among competing strategic alternatives

and initiatives, including, but not limited to, acquisitions, and debt repayment. These

metrics, however, are not measures of financial performance under accounting principles

generally accepted in the United States of America (GAAP) and should not be considered

a substitute for sales, operating income, income from continuing operations, or net

cash from continuing operations as determined in accordance with GAAP. We consider the

following non-GAAP measures, which may not be comparable to similarly titled measures reported by

other companies, to be key performance indicators:

“adjusted net income”

defined as net income, adjusted to exclude items that include, but are not limited to

significant charges or credits that impact current results, but are not related to our

ongoing operations, unusual and infrequent non-operating items and

non-operating tax settlements or adjustments. A reconciliation of adjusted net income is

provided below. 11

($ million, except per share)

Q3 2012

Q3 2011

YTD Q3 2012

YTD Q3 2011

Net Income

88

101

244

262

Separation Costs, net of tax

4

6

19

15

Reversal of Separation Related Tax Receivable Write-down

(4)

-

(4)

-

Separation Related Tax Items

(4)

-

-

-

Adjusted Net Income

84

107

259

277

Net Income per fully diluted share

$0.47

$0.54

$1.30

$1.40

Adjusted Net Income per fully diluted share

$0.45

$0.57

$1.38

$1.48

Weighted Average Shares Outstanding, Diluted

188.7

187.1

188.3

187.1 |

RECONCILIATION OF NON-GAAP

MEASURES “segment adjusted operating income”

defined as operating income of our two segments, adjusted to exclude items that

include, but are not limited to significant charges or credits that impact current results, but

are not related to our ongoing operations, unusual and infrequent non-operating

items and non-operating tax settlements or adjustments. A reconciliation of segment

operating income is provided below. “segment adjusted operating margin”

defined as segment adjusted operating income as defined above, divided by

revenue. A reconciliation of segment operating margin is provided below.

12

($ million)

Q3 2012

Q3 2011

YTD Q3 2012

YTD Q3 2011

Sales

1,361

1,529

4,161

4,359

C4ISR

611

746

1,884

2,114

I&TS

750

786

2,277

2,250

Eliminations

-

(3)

-

(5)

Segment Operating Income, As Reported

143

156

426

392

C4ISR

84

107

261

278

I&TS

59

49

165

114

Separation Costs

6

9

22

23

C4ISR

3

6

13

15

I&TS

3

3

9

8

Segment Operating Income, Adjusted

149

165

448

415

C4ISR

87

113

274

293

I&TS

62

52

174

122

Segment Operating Margin, As Reported

C4ISR

13.7%

14.3%

13.9%

13.2%

I&TS

7.9%

6.2%

7.2%

5.1%

Segment Operating Margin, Adjusted

C4ISR

14.2%

15.1%

14.5%

13.9%

I&TS

8.3%

6.6%

7.6%

5.4%

Operating Margin, As Reported

10.5%

10.2%

10.2%

9.0%

Operating Margin, Adjusted

10.9%

10.8%

10.8%

9.5% |

“Free

cash flow” defined as GAAP cash flow from operating activities, less capital

expenditures plus separation costs. This metric does not include dividend

payments. 13

Free Cash Flow -

Quarterly

Q3 QTD 2012

Q3 YTD 2012

Q2 YTD 2012

($ million)

Cash Flow From Operating Activities

207

97

(110)

Subtract

Capital Expenditures

(36)

(86)

(50)

Free Cash Flow

171

11

(160)

Add:

Separation Costs, net of tax

4

19

15

Reversal of Separation Related Tax Receivable

(4)

(4)

-

Reversal of Separation Related Tax Items

(4)

-

4

Free Cash Flow, as Adjusted

167

26

(141)

RECONCILIATION OF

NON-GAAP MEASURES

|

RECONCILIATION

OF

NON-GAAP

MEASURES

“Free cash flow”

defined as GAAP cash flow from operating activities, less capital expenditures plus separation

costs. This metric does not include dividend payments.

14

Free Cash Flow Year-to-Date

Q3 YTD 2012

Q3 YTD2011

($ million)

Cash Flow From Operating Activities

97

343

Subtract

Capital Expenditures

(86)

(55)

Free Cash Flow

11

288

Add:

Separation Costs, net of tax

19

15

Reversal Separation Tax Receivable

(4)

-

Separation Related Tax Items

-

-

Free Cash Flow, as Adjusted

26

303 |

15

RECONCILIATION

OF

NON-GAAP

MEASURES

Operating Income, Operating Margin, & EPS Guidance Mid Point

($ million, except per share)

FY 2012

Sales, Guidance Mid Point Estimate

5,450

Operating Income, Guidance Mid Point Estimate

567

Separation Costs

27

Adjusted Operating Income, Guidance Mid Point Estimate

594

Operating Margin, Guidance Mid Point Estimate

10.4%

Adjusted Operating Margin, Guidance Mid Point Estimate

10.9%

Net Income, Guidance Mid Point Estimate

327

Separation Costs, net of tax

17

Adjusted Net Income, Guidance Mid Point Estimate

344

Net Income per fully diluted share, Guidance Mid Point Estimate

$1.74

Adjusted Net Income per fully diluted share, Guidance Mid Point Estimate

$1.83

Weighted Average number shares outstanding diluted

188.5 |