Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT OF MATERIAL EVENTS OR CORPORATE CHANGES - Lightstone Value Plus REIT V, Inc. | a12-28164_18k.htm |

Exhibit 99.1

|

|

Behringer Harvard Opportunity REIT II, Inc. 2012 Third Quarter Update Arbors Harbor Town, Memphis, TN |

|

|

To Listen to Today’s Call To listen to today’s call: Dial: 877-312-3928 Conference ID: 26455243 (Only the slide presentation is available online during the call) |

|

|

Forward-Looking Statements This presentation contains forward-looking statements, including discussion and analysis of the financial condition of us and our subsidiaries and other matters. These forward-looking statements are not historical facts but are the intent, belief or current expectations of our management based on their knowledge and understanding of our business and industry. Words such as “may,” “anticipates,” “expects,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “would,” “could,” “should” and variations of these words and similar expressions are intended to identify forward-looking statements. We intend that such forward-looking statements be subject to the safe harbor provisions created by Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These statements are not guarantees of future performance and are subject to risks, uncertainties and other factors, some of which are beyond our control, are difficult to predict and could cause actual results to differ materially from those expressed or forecasted in the forward-looking statements. Forward-looking statements that were true at the time made may ultimately prove to be incorrect or false. We caution you not to place undue reliance on forward-looking statements, which reflect our management's view only as of the date of this presentation. We undertake no obligation to update or revise forward-looking statements to reflect changed assumptions the occurrence of unanticipated events or changes to future operating results. |

|

|

Forward-Looking Statements Factors that could cause actual results to differ materially from any forward-looking statements made in the presentation include but are not limited to: no trading market for the Shares exists and the Company can provide no assurance that one will ever develop; possible delays in locating suitable investments; the Company’s potential inability to invest in a diverse portfolio; investments in foreign properties are susceptible to currency exchange rate fluctuations, adverse political developments, and changes in foreign laws; adverse market and economic challenges experienced by the U.S. and global economies or real estate industry as a whole and the local economic conditions in the markets in which the Company’s properties are located; the availability of credit generally, and any failure to refinance or extend the Company’s debt as it comes due or a failure to satisfy the conditions and requirements of that debt; future increases in interest rates; the Company’s ability to raise capital in the future by issuing additional equity or debt securities, selling its assets or otherwise; payment of distributions from sources other than cash flows from operating activities; the Company’s obligation to pay substantial fees to the advisor and its affiliates; the Company’s ability to retain its executive officers and other key personnel of the advisor, its property manager and their affiliates; conflicts of interest arising out of the Company’s relationships with the advisor and its affiliates; unfavorable changes in laws or regulations impacting the Company’s business or our assets; and factors that could affect the Company’s ability to qualify as a real estate investment trust. The forward-looking statements should be read in light of these and other risk factors identified in the “Risk Factors” section of our Annual Report on Form 10-K for the year ended December 31, 2011, as filed with the Securities and Exchange Commission. |

|

|

Questions? During the call, please e-mail questions to: bhreit@behringerharvard.com |

|

|

Agenda Economic Overview Noteworthy Events Financial Review Portfolio Updates Questions Regency Center in Houston, TX Becket House, London, UK Property Name River Club and Townhomes at River Club, Athens, GA 1875 Lawrence, Denver, CO |

|

|

Economy remains a “mixed bag” U.S. Q3 GDP increased 2.0% (advance estimate) compared with 1.3% increase in Q2 U.S. employment picture continues to be weak October unemployment rate ticked up to 7.9%, from 7.8% in prior month U6 unemployment rate remains high at 14.6%, compared with 14.7% in previous two months U.S. exports declined in Q2 and Q3 October durable goods orders unchanged On the other hand, retail sales have been trending higher Major areas of concern: U.S. fiscal cliff European debt crisis Economic slowdown in China Continuing unrest in Middle East Economic Overview Medical Office Building Portfolio, South FL |

|

|

Noteworthy Items Sold Parrot’s Landing in October 2012 for contract sales price of $56.3 million Acquired in September 2010 for contract purchase price of $42 million Acquired for $75,000/unit Invested $750/unit in renovations and upgrades Sold for $101,000/unit Portion of sales proceeds used to pay off the $28.6 million of debt on the property Net proceeds to the REIT of $19.2 million will be used to make additional investments Cash gain of $4.7 million Annual average return of 13% Holstenplatz, Hamburg, Ger. Parrot’s Landing, North Lauderdale, FL |

|

|

Noteworthy Items (cont.) Sold 1 of the 4 buildings at Interchange Business Center in October 2012 for contract price of $7.5 million Acquired property in November 2010 Acquired for $37/s.f. Sold for $56/s.f. Sales proceeds used to pay down debt on the entire property by $7 million Outstanding debt on property is now $9.9 million Letter of intent from potential lessee for 354,000 s.f. building Plan to sell remaining 3 buildings in 2013 Parrot’s Landing, North Lauderdale, FL Interchange Business Center, San Bernardino, CA |

|

|

Recap of Recent Acquisitions Parrot’s Landing, North Lauderdale, FL Lakes of Margate Margate, Florida Multifamily Acquired October 2011 Contract price $24.4 million Arbors Harbor Town Memphis, Tennessee Multifamily Acquired December 2011 Contract price $31.5 million Alte Jakobstrasse (AJS) Berlin, Germany Commercial office Acquired April 5, 2012 Contract price $11.1 million |

|

|

Significant Full-Cycled Investments Fully Loaded Annual Average Return Gain (Cash) Inland Empire Distribution Center 28% $2.4 Million Archibald Business Center 18% $1.5 Million Palms of Monterrey 28% $6.5 Million Parrot’s Landing 13% $4.7 Million Asset Sales Borrower prepaid the $25 million principal balance, $4 million of accrued and unpaid interest and a $1 million prepayment penalty. Privatization of Army Lodging (PAL) Mezzanine Loan Prepayment Special Distribution 50 cents per share paid in May 2012. |

|

|

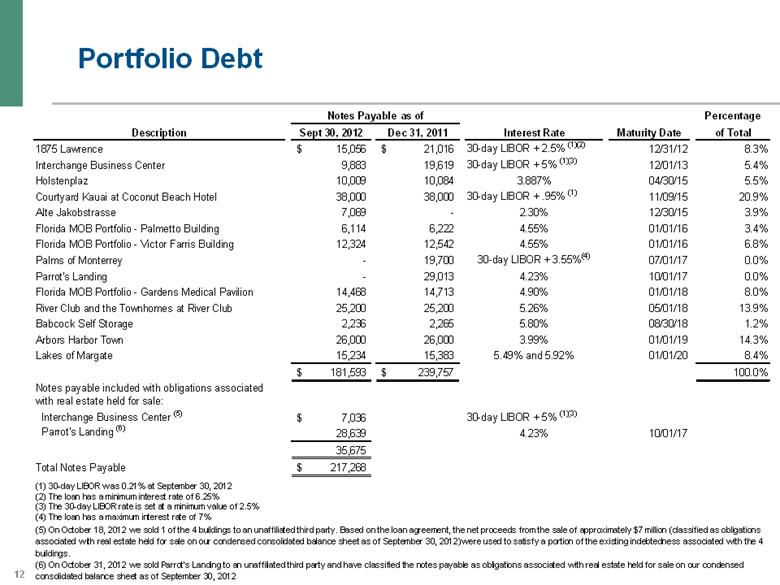

Portfolio Debt Percentage Description Sept 30, 2012 Dec 31, 2011 Interest Rate Maturity Date of Total 1875 Lawrence 15,056 $ 21,016 $ 30-day LIBOR + 2.5% (1)(2) 12/31/12 8.3% Interchange Business Center 9,883 19,619 30-day LIBOR + 5% (1)(3) 12/01/13 5.4% Holstenplaz 10,009 10,084 3.887% 04/30/15 5.5% Courtyard Kauai at Coconut Beach Hotel 38,000 38,000 30-day LIBOR + .95% (1) 11/09/15 20.9% Alte Jakobstrasse 7,069 - 2.30% 12/30/15 3.9% Florida MOB Portfolio - Palmetto Building 6,114 6,222 4.55% 01/01/16 3.4% Florida MOB Portfolio - Victor Farris Building 12,324 12,542 4.55% 01/01/16 6.8% Palms of Monterrey - 19,700 30-day LIBOR + 3.55% (4) 07/01/17 0.0% Parrot's Landing - 29,013 4.23% 10/01/17 0.0% Florida MOB Portfolio - Gardens Medical Pavilion 14,468 14,713 4.90% 01/01/18 8.0% River Club and the Townhomes at River Club 25,200 25,200 5.26% 05/01/18 13.9% Babcock Self Storage 2,236 2,265 5.80% 08/30/18 1.2% Arbors Harbor Town 26,000 26,000 3.99% 01/01/19 14.3% Lakes of Margate 15,234 15,383 5.49% and 5.92% 01/01/20 8.4% 181,593 $ 239,757 $ 100.0% Notes payable included with obligations associated with real estate held for sale: Interchange Business Center (5) 7,036 $ 30-day LIBOR + 5% (1)(3) Parrot's Landing (6) 28,639 4.23% 10/01/17 35,675 Total Notes Payable 217,268 $ (6) On October 31, 2012 we sold Parrot's Landing to an unaffiliated third party and have classified the notes payable as obligations associated with real estate held for sale on our condensed consolidated balance sheet as of September 30, 2012 Notes Payable as of (2) The loan has a minimum interest rate of 6.25% (1) 30-day LIBOR was 0.21% at September 30, 2012 (3) The 30-day LIBOR rate is set at a minimum value of 2.5% (5) On October 18, 2012 we sold 1 of the 4 buildings to an unaffiliated third party. Based on the loan agreement, the net proceeds from the sale of approximately $7 million (classified as obligations associated with real estate held for sale on our condensed consolidated balance sheet as of September 30, 2012)were used to satisfy a portion of the existing indebtedness associated with the 4 buildings. (4) The loan has a maximum interest rate of 7% |

|

|

Financial Review Selected balance sheet items (Sept. 30, 2012) Cash and equivalents: $60.9 million Total assets: $408.2 million Total liabilities: $229.9 million Total notes payable: $217.3 million Recent debt repayments Interchange: $7.0 million in Q4 1875 Lawrence: $5.9 million in Q3 Parrot’s Landing: $28.6 million in Q4 Improved funds from operations (FFO) Q3 2012: $0.01 per share Q2 2012: $(0.03) per share Capital investment $11.7 million during the first nine months of 2012 Courtyard by Marriott at Coconut Beach, Kauai, HI Note: For a reconciliation of net income to FFO, please refer to the REIT’s Current Report on Form 8-K filed on November 28, 2012 with the SEC. |

|

|

Portfolio Updates Courtyard by Marriott at Coconut Beach – Kauai, Hawaii Taking actions to improve operations Moving in right direction Compared with same time last year: Revenues +64% NOI +$1.3 million (into positive territory, from negative territory) Occupancy +51% ADR +6% RevPAR +61% Courtyard by Marriott at Coconut Beach, Kauai, HI |

|

|

Portfolio Updates 1875 Lawrence – Denver, Colorado In early stages of lobby renovation and repositioning of property within its market Converting to triple-net leases Evaluating feasibility of creating leasable retail space Negotiating refinancing of $15 million loan due in December 2012 Plan to remarket in late-2013 1875 Lawrence, Denver, CO |

|

|

Portfolio Updates River Club and Townhomes at River Club – University of Georgia Acquired in April 2011 Cost: $29,000/bed Renovations to date: $1,900/bed Increased rents approximately 5% $396/bed vs. $375/bed Apartments 80% leased Townhomes 64% leased Local market 89% leased Pushing property management company to improve performance Early leasing program for 2013/14 school year is proving successful Already have 63 contracts River Club and Townhomes at River Club, Athens, GA |

|

|

Portfolio Updates Lakes of Margate – Margate, Florida Renovation project now projected to be approximately $3.9 million We are assuming oversight of project; will accelerate the pace Leasing has slowed during renovation Acquired in October 2011 Cost: $87,000/unit Planned renovations: $14,000/unit Increased rents approximately 12% $1.28/s.f. vs. $1.14/s.f. Increased occupancy: 90% vs. 88% Expect to stabilize in 92-94% range after rehab project Lakes of Margate, Margate, FL |

|

|

Portfolio Updates Arbors Harbor Town – Memphis, Tennessee $2.8 million renovation project nearly complete and under budget Acquired in December 2011 Cost: $91,000/unit Planned renovations: $8,000/unit Increased rents approximately 3% $1.07/s.f. vs. $1.04/s.f. Occupancy remains strong at 95% Arbors Harbor Town, Memphis, TN |

|

|

Value Creation Strategy 1875 Lawrence, Denver, CO New income producing acquisitions using cash and proceeds from asset sales Multifamily opportunities in Texas and states with strong economies Student housing opportunities at large universities within 1 to 1½ miles of campus Other value-add real estate investments that have in-place cash flow Selected mezzanine loans that balance attractive returns with acceptable risk Stabilize existing portfolio of assets |

|

|

Questions? Please e-mail questions to: bhreit@behringerharvard.com |

|

|

Playback Information Representatives may log on to the password protected portion of the Behringer Harvard website (www.behringerharvard.com) for a playback of today’s call Investors may dial toll free (855) 859-2056 and use conference ID 26455243 to access a playback of today’s call Replays will be available until December 28 |