Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CommunityOne Bancorp | d442064d8k.htm |

FNB

United Corp. Third Quarter 2012

November 19, 2012

Exhibit 99.1 |

2

Presenters

Brian Simpson

Chief Executive Officer

David Nielsen

Chief Financial Officer

David Lavoie

Chief Risk Officer |

3

Forward Looking Statements & Other Information

Forward Looking Statements

This

presentation

contains

certain

forward-looking

statements

within

the

safe

harbor

rules

of

the

federal

securities

laws.

These

statements

generally

relate

to

FNB’s

financial

condition,

results

of

operations,

plans,

objectives,

future

performance

or

business.

They

usually

can

be

identified

by

the

use

of

forward-looking

terminology,

such

as

“believes,”

“expects,”

or

“are

expected to,”

“plans,”

“projects,”

“goals,”

“estimates,”

“may,”

“should,”

“could,”

“would,”

“intends to,”

“outlook”

or “anticipates,”

or variations of these and similar words, or by discussions of strategies that

involve risks and uncertainties. Forward looking statements

are

subject

to

risks

and

uncertainties,

including

but

not

limited

to,

those

risks

described

in

FNB’s

Annual

Report

on

Form

10-K

for

the

year

ended

December

31,

2011

under

the

section

entitled

“Item

1A,

Risk

Factors,”

and

in

other

reports

that have been filed by FNB with the Securities and Exchange Commission. You are

cautioned not to place undue reliance on these forward-looking

statements, which are subject to numerous assumptions, risks and uncertainties, and which change

over time. These forward-looking statements speak only as of the date of this

presentation. Actual results may differ materially from those

expressed in or implied by any forward looking statements contained in this presentation. We assume

no duty to revise or update any forward-looking statements, except as required

by applicable law. Non-GAAP Financial Measures

In

addition

to

the

results

of

operations

presented

in

accordance

with

Generally

Accepted

Accounting

Principles

(GAAP),

FNB

management uses and this presentation contains or references, certain non-GAAP

financial measures, such as pre-tax, pre- credit &

non-recurring net income (PPNR), recurring non-credit, non-interest expense, recurring noninterest income, net

interest income on a fully taxable equivalent basis, proforma total loans, proforma

total ALL and fair value marks, proforma nonperforming

assets

and

tangible

shareholders’

equity.

FNB

believes

these

non-GAAP

financial

measures

provide

information useful to investors in understanding our underlying operational

performance and our business and performance trends as they facilitate

comparisons with the performance of others in the financial services industry. Although FNB believes

that

these

non-GAAP

financial

measures

enhance

investors’

understanding

of

FNB’s

business

and

performance,

these

non-

GAAP financial measures should not be considered an alternative to GAAP. The

non-GAAP financial measures contained within this presentation should be

read in conjunction with the audited financial statements and analysis as presented in

FNB’s Annual Report on Form 10-K as well as the unaudited financial

statements and analyses as presented in FNB’s Quarterly Reports on

Forms 10-Q. A reconciliation of non-GAAP measures to the most directly comparable GAAP measure

is included as an appendix to this presentation.

|

4

Key Accomplishments

Execution of our key priorities

—

Reduced problem assets by $15 million or 9%, to $167 million

—

OREO reduced $6 million or 6%, to $81 million

—

$18 million of OREO was under contract at September 30,2012

—

Continued implementation of “Back to Business”

strategies:

—

Net loans and loans held for sale is up 2% in 2012 but fell by $36 million

or 3% in the 3rd quarter

—

Record quarter for originations and sales in our mortgage banking

business. Revenue increased 154% over 2Q 2012

—

Hired new bankers in key areas

—

Deposit mix continues to improve and cost decline, from 83 bps in 2Q to

76 bps in 3Q 2012. Since recap, deposit costs have declined by 54 bps as

a result of management strategies

—

Executing phased integration plan for the banks

—

Consolidated core data platform over Labor Day weekend

—

Conformed general ledgers in mid October

—

Heightened focus on reducing controllable expenses

—

Branch closures: 1 CommunityOne in July, 1 Granite in December

—

Cross-organization vendor expense review underway

—

PPNR of $937 thousand in 3Q 2012 vs. $911 thousand in 2Q 2012 and

$(5.6) million in 3Q 2011

—

NIM declined from 3.06% to 2.95% on Granite Purchased Loan runoff

—

Up 91 bps since recap as a result of investment of excess liquidity and

reductions in nonperforming loans

Positive PPNR in 3Q 2012 |

5

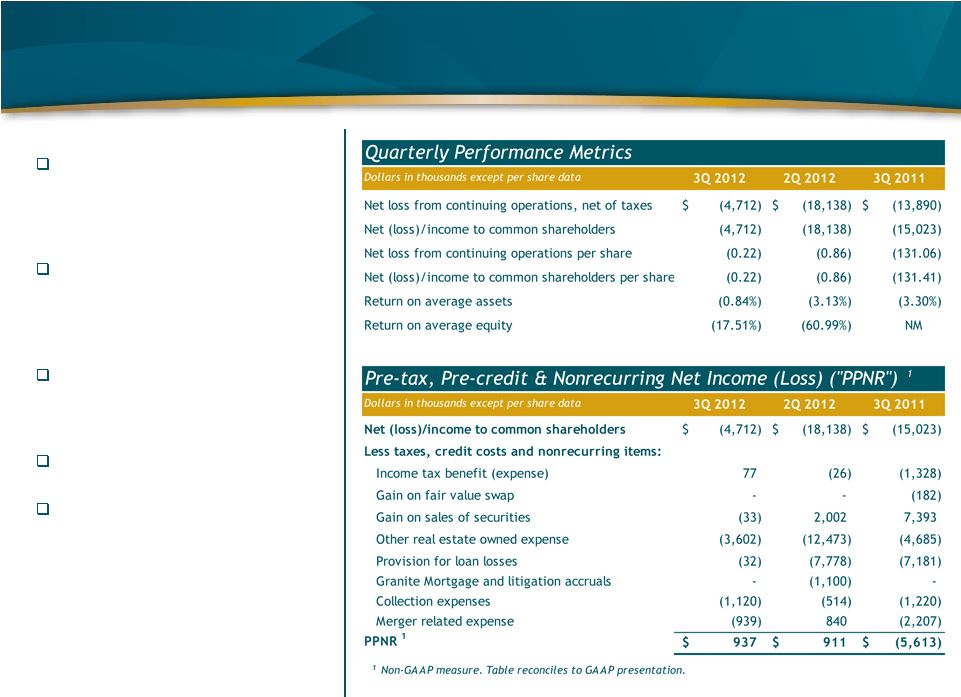

Quarterly Operating Highlights

3Q 2012 net loss from continuing

operations of $4.7 million, a $13.4

million decrease in net loss from 2Q

2012 and a $9.2 million improvement

in net loss from 3Q 2011

3Q 2012 net loss to common

shareholders of $4.7 million

compared to net losses to common

shareholders of $18.1 million in 2Q

2012 and $15.0 million in 3Q 2011

Net loss per common share of $0.22

per share compared to net losses of

$0.86 in 2Q 2012 and $131.41 in 3Q

2011

3Q 2011 does not reflect Granite

results

PPNR net income of $0.9 million in

3Q 2012 flat to the second quarter

and improved from a PPNR net loss

of $5.6 million in 3Q 2011 |

6

Quarterly Operating Results

Net interest income in 3Q 2012

decreased $0.8 million (5%) to $15.2

million compared to 2Q 2012

Provision expense fell $7.7 million to

$32 thousand in 3Q 2012

—

Improved loan portfolio mix and

continued declines in non-

performing assets

Noninterest income fell $1.9 million

on $2.0 million in securities gains in

2Q, seasonal declines in service

charge income, partially offset by

strong mortgage banking related

income

Noninterest expense decreased $8.3

million (25%) in 3Q 2012 on $8.9

million decrease in OREO expenses

from 2Q 2012

Quarterly Results

Results of Operations

Dollars in thousands, except per share data

3Q 2012

2Q 2012

3Q 2011

Net interest income

15,202

$

16,049

$

7,739

$

Provision expense

(32)

(7,778)

(7,181)

Noninterest income

4,643

6,532

10,080

Noninterest expense

(24,602)

(32,915)

(23,200)

Net loss from continuing operations, net of taxes

(4,712)

(18,138)

(13,890)

Net loss from discontinued operations, net of taxes

-

-

(40)

Preferred stock gain and dividends, net

-

-

(1,093)

Net loss to common shareholders

(4,712)

$

(18,138)

$

(15,023)

$

(0.22)

$

(0.86)

$

(131.06)

$

Net loss to common shareholders per share

(0.22)

$

(0.86)

$

(131.41)

$

Weighted average basic and diluted shares outstanding

21,588,027

21,190,848

114,320

Net loss to common shareholders from

continuing operations per share |

7

Net Interest Margin

Net interest margin declined 11 bps

to 2.95% from 3.06% in 2Q 2012

Average earning assets, net of low

yielding bank balances that declined

$52 million in the second quarter,

fell by $8 million in the quarter as a

result of loan runoff net of securities

portfolio growth

Average loan yield fell to 5.14% as a

result of the purchase of $36 million

of mortgage loan pools during the

third quarter of 2012, and the runoff

of higher yielding loans at Granite

Average loans fell $24.8 million (2%)

during 2Q 2012 on runoff of

purchases residential loan pools and

continued asset resolution

Improved deposit mix resulted in 7

bp decline in cost of deposits to 76

bps, down from 130 bps in 3Q 2011

NIM and Cost of Deposits

Loan and Securities Yields

Quarterly Results

Average Balances, Yields and Net Interest Margin

Dollars in thousands

3Q 2012

2Q 2012

3Q 2011

Average loans (includes loans held for sale)

1,262,229

$

1,287,022

$

992,096

$

Average yield

5.14%

5.40%

4.41%

Average earning assets

2,055,193

2,115,029

1,521,652

Average yield

3.73%

3.89%

3.50%

Average interest bearing liabilities

1,858,339

1,926,658

1,627,217

Average rate

0.86%

0.91%

1.37%

Average cost of deposits

0.76%

0.83%

1.30%

Net interest margin

2.95%

3.06%

2.04%

Net interest rate spread

2.87%

2.98%

2.13% |

8

Noninterest Income

Recurring noninterest income

increased $146 thousand (3%) to $4.7

million from 2Q 2012

—

Nonrecurring securities gains of

$2.0 million during the second

quarter of 2012

Mortgage loan income increased

$441 thousand during the quarter

—

Sold $34 million of loans during

the quarter

Service charges on deposits declined

4% on seasonal declines

Quarterly Results

Noninterest Income

Dollars in thousands

3Q 2012

2Q 2012

3Q 2011

Service charges on deposit accounts

1,883

$

1,960

$

1,377

$

Mortgage loan income/(loss)

728

287

(116)

Cardholder and merchant services income

1,014

1,046

808

Trust and investment services

234

256

221

Bank-owned life insurance

290

314

262

Other service charges, commissions and fees

252

271

198

Securities (losses)/gains, net

(33)

2,002

7,393

Gain on fair value swap

-

-

(182)

Other income

275

396

119

Total noninterest income

4,643

$

6,532

$

10,080

$

Less:

Securities (losses)/gains, net

(33)

2,002

7,393

Gain on fair value swap

-

-

(182)

Recurring noninterest income

1

4,676

$

4,530

$

2,869

$

1

Non-GAAP measure. Reconciliation included in this table.

|

9

Noninterest Expense

Noninterest expense fell $8.3 million

(25%) from 2Q 2012

—

OREO expense declined $8.9

million (71%) on reduced OREO

balances and stabilizing real

estate values

—

FDIC expense declined $0.2

million (14%)

—

Personnel expense declined $0.8

million (8%) during 3Q, primarily

on reduced benefits costs and

compensation accruals

—

Merger-related expenses

increased $1.8 million on merger

expense accrual reversals in the

second quarter of 2012

—

Other expenses declined $1.2

million on the accrual of $1.1

million of expense related to

Granite Mortgage and litigation

accruals in the second quarter

Excluding OREO, collection, non-

recurring merger, Granite Mortgage

and litigation accruals, and MSR

impairment, noninterest expense

declined by $726 thousand (4%)

Quarterly Results

Noninterest Expense

Dollars in thousands

3Q 2012

2Q 2012

3Q 2011

Personnel expense

9,717

$

10,541

$

6,453

$

Net occupancy expense

1,710

1,603

1,180

Furniture, equipment and data processing expense

2,012

2,020

1,561

Professional fees

1,336

1,109

1,339

Stationery, printing and supplies

152

153

100

Advertising and marketing

166

125

170

Other real estate owned expense

3,602

12,473

4,685

Credit/debit card expense

432

437

434

FDIC insurance

1,056

1,225

1,461

Loan collection expense

1,119

514

1,220

Merger-related expense

939

(840)

2,207

Loss on sale of loans held for sale

-

30

-

Core deposit intangible amortization

352

352

199

Other expense

2,009

3,173

2,191

Total noninterest expense

24,602

$

32,915

$

23,200

$

Other information:

Other real estate owned expense

3,602

$

12,473

$

4,685

$

Merger-related expense

939

(840)

2,207

Loan collection expense

1,119

514

1,220

Granite Mortgage and litigation accruals

-

1,100

-

Recurring non-credit noninterest expense

1

18,942

$

19,668

$

15,088

$

FTE Employees

637

635

462

1

Non-GAAP measure. Reconciliation included in this table.

|

10

Balance Sheet

Total assets decreased $63.7 million

(3%)

—

Cash and interest bearing bank

balances decreased $36.0 million

(10%) on securities and loan

purchases and deposit actions

—

Investment securities increased

$15.3 million

—

Net loans decreased $35.5 million

(3%) on residential mortgage pool

runoff, problem asset resolution,

ALL charge offs, net of the

purchase of $36 million residential

mortgage portfolio during 3Q 2012

—

OREO decreased $5.4 million (6%)

on continued resolution and write

down activity

Deposits declined $59.5 million (3%)

—

Improved mix change from time

deposits to lower rate deposit

products

Balance sheet excludes reserved

deferred tax assets of $179 million,

including $34 million relating to the

Bank of Granite

Balance Sheet

Dollars in thousands

3Q 2012

2Q 2012

3Q 2011

Cash and interest bearing bank balances

327,870

$

363,879

$

364,011

$

Investment securities

492,386

477,136

199,271

Loans and loans held for sale, net

1,209,148

1,244,596

916,549

Other real estate owned

80,800

86,183

96,099

Intangible assets

11,574

11,678

3,577

Other assets

116,287

118,289

64,119

Assets from discontinued operations

-

-

268

Total assets

2,238,065

$

2,301,761

$

1,643,894

$

Deposits

1,982,253

$

2,041,770

$

1,565,636

$

Borrowings

124,474

126,507

184,957

24,465

25,482

22,141

-

-

1,092

Equity

106,873

108,002

(129,932)

Total liabilities and equity

2,238,065

$

2,301,761

$

1,643,894

$

Other liabilities

Liabilities from discontinued operations

Tangible Shareholders' Equity Rollforward

1

Dollars in thousands

Tangible shareholders' equity, December 31, 2011

116,933

$

Total comprehensive loss

(27,929)

Issuance of common stock, net of issuance costs

6,696

Expense related to 2011 issuance of common stock

(913)

Decrease/(increase) in intangible assets, net

508

Dividends, stock compensation expense and Series A preferred conversion, net

4

Tangible shareholders' equity, September 30, 2012

95,299

$

1

Non-GAAP measure. See Appendix for reconciliation to GAAP

presentation. |

11

13%

13%

10%

18%

17%

15%

4%

4%

3%

23%

22%

18%

23%

23%

24%

3%

5%

8%

16%

17%

22%

0%

20%

40%

60%

80%

100%

3Q 2012

2Q 2012

3Q 2011

Noninterest-bearing demand

Interest-bearing demand

Savings

Money market

Time deposits < $100,000

Brokered

Time deposits > $100,000

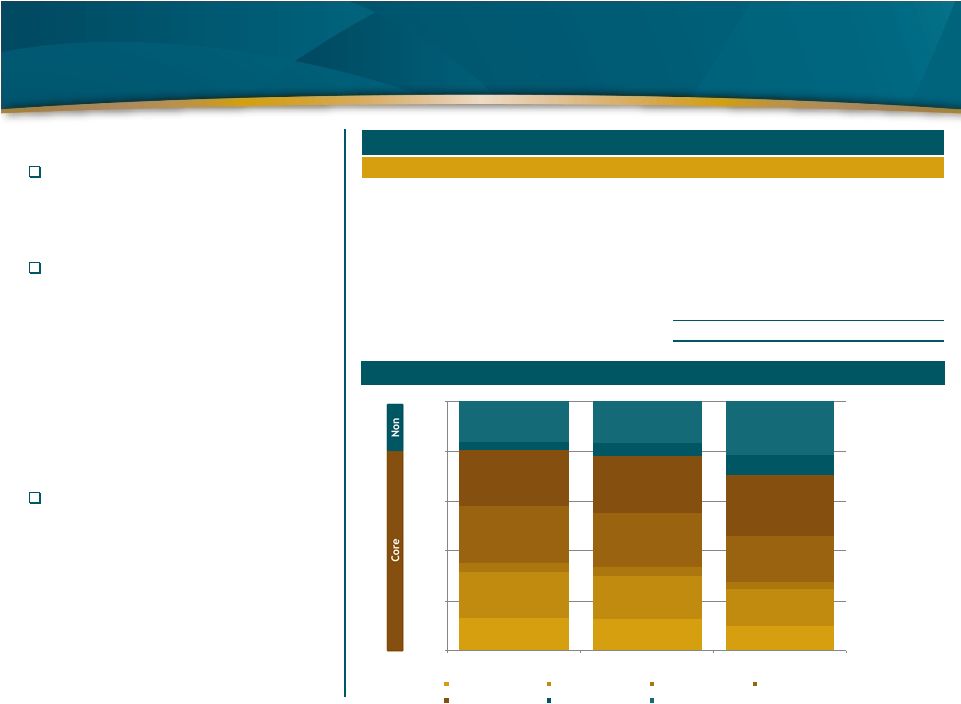

Deposits

Increased core deposits from 78% at

2Q 2012 to 81% of the total at 3Q

2012

Continued improved deposit mix

profile via management actions

—

Indeterminate term core now

represents 58% of deposits, up

from 55% in the prior quarter

—

Time deposits (including brokered

deposits) as a percentage of total

deposits declined from 45% at 2Q

2012 to 42% at 3Q 2012

Deposits declined by $59.5 million

(3%)

—

Brokered deposits fell by $33.3

million

Deposit Mix Composition

Deposits

Dollars in thousands

3Q 2012

2Q 2012

3Q 2011

Noninterest-bearing demand

264,370

$

262,087

$

157,207

$

Interest-bearing demand

358,376

353,586

231,467

Savings

73,382

72,925

46,168

Money market

450,164

441,824

288,345

Brokered

63,455

96,747

122,456

Time deposits < $100,000

449,542

471,366

383,259

Time deposits > $100,000

322,964

343,235

336,734

Total deposits

1,982,253

$

2,041,770

$

1,565,636

$ |

12

Capital and Liquidity

Capital ratios at both banks

remain above the level

defined as “well capitalized”

under applicable law

Both banks, however, are

designated as “adequately

capitalized”

by their

regulators because they

remain subject to regulatory

orders

—

CommunityOne Bank and

Bank of Granite leverage

ratios are currently below

the levels required in their

respective regulatory

orders

—

CommunityOne Bank’s

total risk based capital

ratio is also below that

required by its order

The loans to deposits ratio

was stable at 62% at

September 30, 2012, and

improved from 57% at

September 30, 2011

Capital and Liquidity Ratios

Well

Regulatory

3Q 2012

2Q 2012

3Q 2011

Capitalized

Orders

FNB United Corp

Leverage

5.68%

5.83%

(8.54%)

5.00%

N/A

Tier 1 risk based capital

9.60%

9.62%

(13.48%)

6.00%

N/A

Total risk based capital

12.47%

12.19%

(13.48%)

10.00%

N/A

Tangible common equity/tangible assets

4.28%

4.21%

(8.14%)

N/A

N/A

Loans/deposits

62%

63%

57%

N/A

N/A

Cash and investment securities/deposits

41%

41%

36%

N/A

N/A

CommunityOne Bank

Leverage

6.46%

6.47%

(5.09%)

5.00%

9.00%

Tier 1 risk based capital

10.52%

10.45%

(8.06%)

6.00%

N/A

Total risk based capital

11.79%

11.73%

(8.06%)

10.00%

12.00%

Bank of Granite

Leverage

7.88%

7.61%

N/A

1

5.00%

8.00%

Tier 1 risk based capital

14.54%

13.37%

N/A

1

6.00%

N/A

Total risk based capital

15.57%

13.53%

N/A

1

10.00%

12.00%

1

FNB United Corp purchased Bank of Granite Corp and its bank subsidiary Bank of Granite

on October 21, 2011 |

13

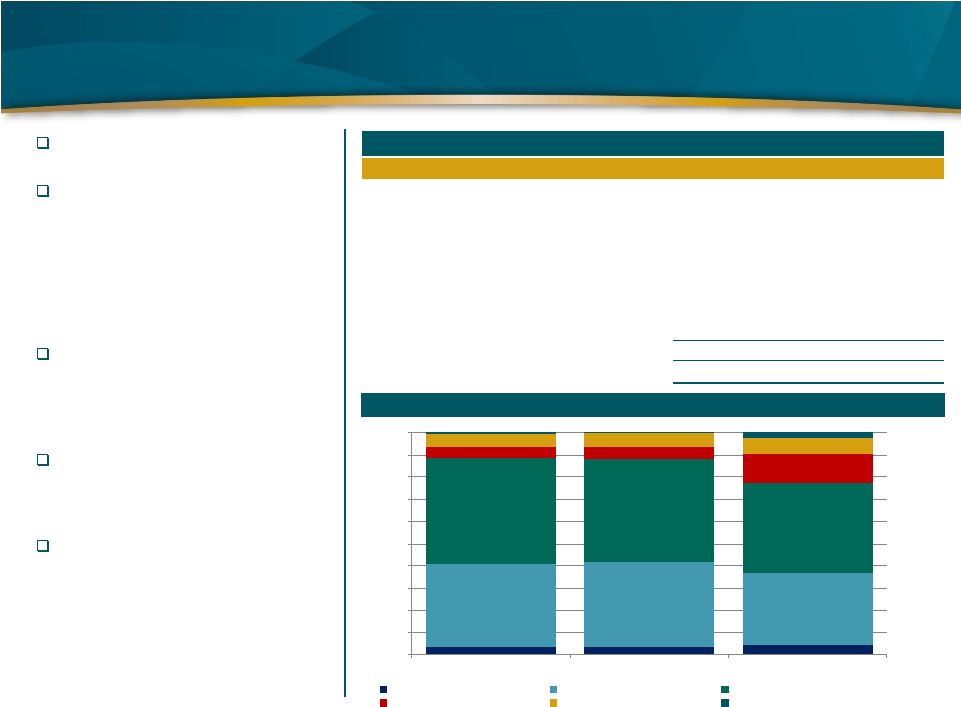

Loan Portfolio

Total loans, including loans held for

sale, decreased $43.1 million (3%)

1-4 family residential mortgage loans

portfolio were stable from 2Q 2012

—

Purchased a diversified pool of

loans totaling $36 million

—

Offset by prepayments and

amortization of previously

purchased pools

The Bank of Granite portfolio of

loans was added in the 4th quarter

of 2011 and was heavily weighted

toward commercial-purpose

mortgage loans

Real Estate Construction loans fell by

$14.3 million (19%) from 2Q 2012 to

5% of our total loans at 3Q 2012,

down from 13.7% a year ago

Credit costs for 3Q 2012 included net

charge-offs of $7.7 million and

write-downs and net loss on sale of

OREO of $1.6 million

Loan Portfolio Composition

4%

3%

5%

37%

38%

32%

48%

46%

40%

5%

6%

13%

6%

6%

7%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

3Q 2012

2Q 2012

3Q 2011

Consumer

CRE, OO and NOO

1-4 family residential

Real estate-construction

Commercial and agricultural

Loans held for sale

Loan Portfolio

Dollars in thousands

3Q 2012

2Q 2012

3Q 2011

Loans held for sale

8,212

$

1,324

$

25,661

$

Loans held for investment:

Commercial and agricultural

72,669

78,367

62,341

Real estate-construction

61,263

75,576

121,905

Real estate-mortgage:

1-4 family residential

590,251

589,972

369,093

Commercial

463,173

493,721

293,778

Consumer

44,439

44,187

43,771

Total Loans held for investment

1,231,795

1,281,823

890,888

Total loans

1,240,007

$

1,283,147

$

916,549

$ |

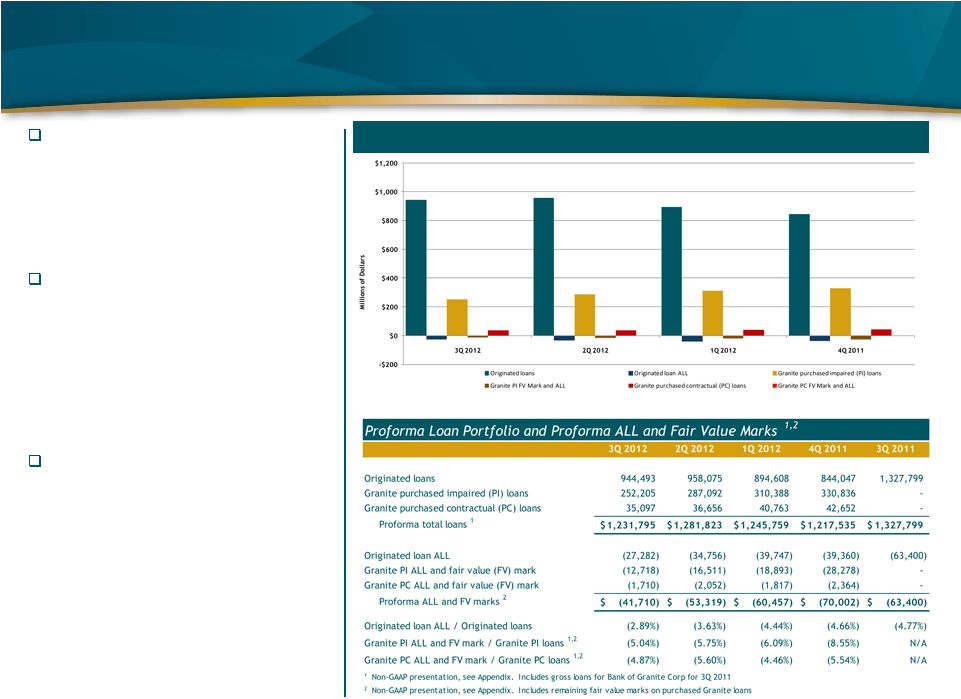

Portfolio

and Allowance For Loan Losses Originated loans (including purchased

mortgage pools) are accounted for

under ASC 310-20

—

ALL established via provision,

losses recognized via charge-offs

—

3Q 2012 ALL of $27.0 million

Granite purchased contractual (PC)

loans are accounted for under ASC

310-20

—

Subject to ALL as FV mark is

accreted

—

Total ALL and remaining

unaccreted FV mark of $1.7 million

at September 30, 2012

Granite purchased impaired (PI)

loans, are accounted for under ASC

310-30 (SOP-03-3)

—

ALL of $3.3 million established

during 2Q 2012 based on

reforecast of expected cash flows

—

Remaining FV mark of $9.4 million

at September30, 2012

—

Remaining projected accretion of

$36.6 million at the end of

September

Loan Portfolio and ALL By Origination Type

14 |

15

Asset Quality

The allowance has been reduced over

the last year, from $44 million to just

under $31 million, reflecting an

improvement in asset quality

The remaining fair value adjustment

on the acquired Granite portfolio fell

by $4 million as a result of accretion

and realization of expected loss

content

The Bank continues to be focused on

problem asset resolution, with a staff

of more than 20 in our Special Assets

Group.

—

$170 million of Classified loans and

$82 million of loans rated Special

Mention remain.

—

Reduction of problem loans will

continue to be one of our primary

objectives

Problem

Loan

and

Asset

Trends

¹

¹

Non-GAAP

presentation.

See

Appendix.

Charts

include

Bank

of

Granite

Corp

loans

and

OREO

in

3Q

2011

Asset

Quality

¹

Dollars in thousands

3Q 2012

2Q 2012

3Q 2011

Allowance for loan losses (ALL)

30,859

$

38,551

$

44,121

$

Remaining fair value (FV) mark on Granite portfolio

10,851

14,768

-

Nonperforming loans/Total loans

7.0%

7.5%

16.3%

Nonperforming assets/ Loans plus OREO

12.7%

13.3%

24.5%

Annualized net charge-offs/Average loans

2.46%

2.83%

9.07%

Allowance for loan loss/Total loans

2.51%

3.01%

4.95%

ALL

and

FV

mark/Total

loans

¹

3.39%

4.16%

4.95%

¹

Non-GAAP

presentation,

see

Appendix.

Includes

remaining

fair

value

marks

on

purchased

Granite

loans |

16

Non-Performing Assets

Nonperforming loans fell by $9 million

(11%) from 2Q 2012

Real estate construction loans remain

the most troubled category, but the

level of such loans has been reduced

68% since 3Q 2011

OREO dispositions have been

outpacing foreclosure additions.

OREO was reduced by $6 million (6%)

during the third quarter

OREO assets are carried at appraised

value less selling costs, and

sometimes adjusted further by

management due to age or other

market criteria

As of September 30, 2012, $18.2

million of OREO was under contract

for sale and carried at the net sales

price

Nonperforming Loans and OREO

Dollars in thousands

3Q 2012

2Q 2012

3Q 2011

Commercial and agricultural

3,147

$

2,934

$

4,126

$

Real estate - construction

18,506

24,853

62,203

Real estate - mortgage:

1-4 family residential

22,131

22,300

26,350

Commercial

42,133

44,817

52,361

Consumer

226

633

304

Total nonperforming loans

86,143

95,537

145,344

OREO, other foreclosed assets and disc ops assets

80,800

86,400

96,275

Total nonperforming assets

166,943

$

181,937

$

241,619

$

0%

20%

40%

60%

80%

100%

3Q 2012

2Q 2012

3Q 2011

RE -

1-4 Family

RE -

Commercial

Commercial and agricultural

Real estate -construction

Consumer

Nonperforming Loan Composition |

Appendix |

18

Non-GAAP Measures

Reconciles non-GAAP

measures to the most

directly comparable

GAAP measure

Reconciliation of Non-GAAP Measures

Dollars in thousands

3Q 2012

2Q 2012

3Q 2011

Total shareholders' equity

106,873

$

108,002

$

(129,932)

$

Less:

Goodwill

(4,205)

(4,205)

-

Core deposit and other intangibles

(7,369)

(7,473)

(3,577)

Tangible shareholders' equity

95,299

$

96,324

$

(133,509)

$

3Q 2012

2Q 2012

1Q 2012

4Q 2011

3Q 2011

Originated loan ALL

(27,282)

$

(34,756)

$

(39,747)

$

(39,360)

$

(44,121)

$

Purchased contractual (PC) loan ALL

(281)

(459)

(48)

-

-

Purchased impaired (PI) loan ALL

(3,296)

(3,336)

-

-

-

Total allowance for loan losses

(30,859)

(38,551)

(39,795)

(39,360)

(44,121)

Plus:

Pre purchase Bank of Granite Corp ALL

-

-

-

-

(19,279)

Fair value (FV) mark on PC loans

(1,429)

(1,593)

(1,769)

(2,364)

-

Fair value (FV) mark on PI loans

(9,422)

(13,175)

(18,893)

(28,278)

-

Proforma total ALL and FV mark

(41,710)

$

(53,319)

$

(60,457)

$

(70,002)

$

(63,400)

$

3Q 2012

2Q 2012

1Q 2012

4Q 2011

3Q 2011

Pass rated loans

979,993

$

998,025

$

931,211

$

910,650

$

952,668

$

Special mention rated loans

81,616

91,655

106,687

130,677

165,554

Classified loans

170,186

192,143

207,861

176,208

209,577

Total loans

1,231,795

1,281,823

1,245,759

1,217,535

890,888

Plus:

Pre purchase BOG Corp pass rated loans

-

-

-

-

274,465

Pre purchase BOG Corp special mention loans

-

-

-

-

79,961

Pre purchase BOG Corp classified loans

-

-

-

-

82,485

Proforma total loans

1,231,795

$

1,281,823

$

1,245,759

$

1,217,535

$

1,327,799

$

3Q 2012

2Q 2012

1Q 2012

4Q 2011

3Q 2011

Nonperforming Loans

86,143

$

95,537

$

105,341

$

105,973

$

145,344

$

OREO and Foreclosed Assets

80,800

86,400

104,379

110,386

96,275

Total nonperforming assets

166,943

181,937

209,720

216,359

241,619

Plus:

Pre purchase BOG Corp Nonperforming Loans

-

-

-

-

32,224

Pre purchase BOG Corp OREO

-

-

-

-

23,836

Proforma nonperforming assets

166,943

$

181,937

$

209,720

$

216,359

$

297,679

$ |