Attached files

| file | filename |

|---|---|

| 8-K - ARAMARK CORP--FORM 8-K - ARAMARK CORP | form8-kebittargets.htm |

| EX-10.4 - THIRD AMENDMENT DATED NOVEMBER 14, 2012 TO THE EMPLOYMENT AGREEMENT, DATED AS OF NOVEMBER 2, 2004, AS AMENDED FROM TIME TO TIME, BETWEEN ARAMARK CORPORATION AND JOSEPH NEUBAUER - ARAMARK CORP | legal-386361xv2xthird_amen.htm |

| EX-10.2 - REVISED SCHEDULE 1S TO OUTSTANDING NON QUALIFIED STOCK OPTION AGREEMENTS - ARAMARK CORP | legal-384963xv2xschedule_1.htm |

| EX-10.3 - FORM OF INSTALLMENT STOCK PURCHASE OPPORTUNITY AGREEMENT - ARAMARK CORP | legal-384565xv1xform_ofxis.htm |

| EX-10.1 - NEW SCHEDULE 1 TO FORM OF NON QUALIFED STOCK OPTION AGREEMENT - ARAMARK CORP | legal-384962xv1xschedule_1.htm |

Exhibit 10.5

AMENDED AND RESTATED

EXECUTIVE LEADERSHIP COUNCIL

MANAGEMENT INCENTIVE BONUS PLAN

General

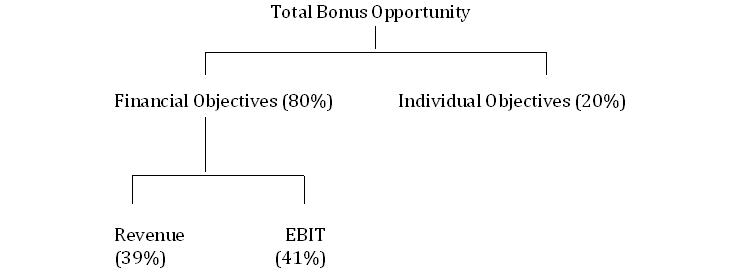

Management Incentive Bonus (MIB) Plan provides annual cash bonuses to eligible executives for the achievement of explicit performance objectives established prior to each fiscal year. The ELC MIB is in two parts: a financial portion representing 80% of the overall MIB, and individual objectives representing the remaining 20%.

Eligibility

All executives in career bands 2 and 3 are eligible to participate in the ELC MIB Plan. Generally an individual is eligible for a potential award under the ELC MIB Plan if they were an executive for six or more months during the fiscal year.

Overall Structure

MIB awards will be determined by performance during the fiscal year as measured by the following:

• | Financial Objectives |

• | Attainment of revenue targets by the business to which the participant is assigned. * |

• | Attainment of EBIT targets by the business to which the participant is assigned. * |

• | Individual Objectives |

• | Individual or team objectives the plan participant is expected to attain during the fiscal year. |

Bonus potential will be based upon the "guideline" or standard percent of salary set at the beginning of the fiscal year for an eligible executive. The apportionment of the bonus payoff elements is reflected in this diagram:

MANAGEMENT INCENTIVE BONUS - OVERALL STRUCTURE

To establish the performance expectations for the fiscal year, as close as possible to the start of each fiscal year, individuals are provided with an ELC MIB Plan that specifies: (1) the appropriate business Revenue & EBIT targets, and (2) an area to develop individual objectives.

Determination of Bonus Targets — Financial Portion

For purposes of determining bonus targets, Revenue & EBIT are defined as follows:

Revenue | -Sales as reported internally to Corporate Accounting and used for external financial reporting. |

EBIT | -Earnings before interest expense (income) and income tax expense (benefit) and inclusive of Corporate and other overhead allocations determined pursuant to the Corporation’s accounting policies and procedures. |

If these definitions differ from those included within the final year-end financial statements of the business, the definitions which were used in establishing the Revenue & EBIT targets will be attached to each performance plan.

In a limited number of cases and where business warrants, the financial targets and percentages may be other than those shown here. All such changes, however, must be approved by the Chief Executive Officer in advance.

Determination of Awards — Financial Portion

For all financial metrics, payouts under the financial portion of the MIB vary as financial targets are over or under achieved. The minimum bonus, equal to 25% of the guideline amount, is awarded provided a minimally acceptable "threshold" level of performance is achieved. (No bonus will be awarded for

3

performance below the threshold for that metric.) Bonuses increase to the guideline amount if targets are achieved fully and may increase up to a maximum ("ceiling") of 150% to 200% of the guideline amount if performance increasingly exceeds the target levels.

Bonus awards for performance between threshold and ceiling will be computed by interpolating between either: (1) the threshold and target awards, or (2) the target and ceiling awards, as appropriate.

The levels for threshold and maximum bonus payouts (referred to as the "leverage curve"), may vary among organizations, reflecting financial volatility resulting from the magnitude of the unit's business plan. For example, a lower volatility business may begin to pay out at 90% of target attainment, while a higher volatility business may begin to pay out at 85% of target attainment.

Determination of Individual Objectives and Awards

The remaining parts of the ELC MIB Plan provide for establishing the individual objectives upon which those portions of the bonus will be based.

Generally, objectives will be established for each participant at the start of the fiscal year. The individual objectives will not duplicate the measures of annual financial performance addressed under the financial portion of the MIB. Rather, they will address those concerns which most contribute to the business gaining a sustainable competitive advantage. Attainment of them is measured for and during the fiscal year for which they are set. Unplanned objectives that emerge during the fiscal year and which take priority over the planned objectives may be added (or substituted) as appropriate.

For each part, the guideline bonus amounts will be awarded if performance fully meets the target expectations defined in these objectives. If performance differs from expectations, the bonuses awarded will vary proportionally with performance, from 0 to 150% of the guideline amount.

Total MIB Award

The total MIB award will be the sum of the bonuses awarded for each of the performance measures: Revenue, EBIT and individual objectives.

Payment of Awards

1) | Earned awards are paid (minus appropriate tax withholdings) as soon as practicable after receipt of the audited year-end financial reports, but in no event more than 2.5 months after the end of the calendar year in which it was earned. Except in cases of voluntary or involuntary termination (discussed in 2 below), the following provisions apply: |

• | If the executive has worked at least 6 months, but less than 12 and is still employed at the end of the bonus (fiscal) year, the participant will receive a pro-rata share of the earned bonus award (e.g., if the executive has worked for 9 months, 75% of the calculated total bonus will be awarded). |

• | If the executive has served in two or more components or units covered by this plan, the earned award will be calculated on the portion of the year served in each component or unit. |

• | If the executive was promoted during the year and his guideline bonus amount changed, the earned award will be prorated. However, if the executive remains in the same position with essentially the same duties and responsibilities, and the participant's guideline amount changed during the fiscal year, the guideline amount at year end will be used in determining the award for the entire year. |

4

2) | No bonus award is payable to an executive whose employment terminates, voluntarily or involuntarily, prior to completion of the bonus (fiscal) year.* Exceptions in certain cases of involuntary termination may be granted with prior approval of the Chief Executive Officer of ARAMARK. |

An executive whose employment terminates after the close of the bonus year but before awards are paid will be eligible to receive any award attained under the payout formula of the financial portion of the Plan. Any bonus awards for individual achievement in the case of such terminations may be payable at the discretion of the Chief Executive Officer of ARAMARK.

In no case, however, will a bonus award be made to an individual whose employment is terminated at any time for “cause," as defined in the plan participant’s Agreement Relating to Employment and Post Employment Competition.

* A pro-rata bonus award is payable in the event the executive becomes permanently disabled, retires having reached the age of 65, or dies.

Deferral

Payment of all or part of the MIB award may be deferred in accordance with procedures established by ARAMARK and amended from time to time.

Administration

The Chief Executive Officer of ARAMARK is the sole interpreter and arbiter of the provisions of the ELC MIB Plan and has the right to amend, withdraw, or revoke them before the beginning of any fiscal year or to grant specific exceptions.

In administering the ELC MIB Plan, the Chief Executive Officer of ARAMARK has the final authority to adjust financial performance standards or actual results for unusual non-recurring income, expense or balance sheet items (e.g., non-operating gains/losses, acquisitions, divestitures) so that comparisons between actual and planned performance are consistent.

Objectives and formulas for all portions of the MIB must be approved by the Chief Executive Officer of ARAMARK. He also must approve any unplanned objectives added during the year.

Bonus awards are reviewed and approved by the Compensation and Human Resources Committee.

5