Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Carbonite Inc | d438984d8k.htm |

Tuesday, November 13, 2012

©

Carbonite, Inc | Company Confidential

Carbonite, Inc. (NASDAQ: CARB)

Investor Presentation

November 2012

1

Exhibit 99.1 |

2

©

Carbonite, Inc | Company Confidential

Safe Harbor Statement

Cautionary Language Concerning Forward-Looking Statements

These slides and the accompanying oral presentation contain

"forward-looking statements" within the meaning of the Securities Act of

1933, as amended, the Securities Exchange Act of 1934, as amended, and the Private

Securities Litigation Reform Act of 1995. These forward-looking

statements represent the Company’s views as of the date that they were first made based on the current intent,

belief or expectations, estimates, forecasts, assumptions and projections of the

Company and members of our management team. Words such as

“expect,” “anticipate,”

“should,”

“believe,”

“hope,”

“target,”

“project,”

“goals,”

“estimate,”

“potential,”

“predict,”

“may,”

“will,”

“might,”

“could,”

“intend,”

and any variations of these terms or the negative of these terms and similar

expressions are intended to identify these forward-looking statements.

Those statements include, but are not limited to, statements regarding guidance on our

future financial results and other projections or measures of future performance,

and our expectations concerning market opportunities and our ability to

capitalize on them. Forward-looking statements are subject to a number of risks and uncertainties, many of which

involve factors or circumstances that are beyond the Company’s control. The

Company’s actual results could differ materially from those stated or

implied in forward-looking statements due to a number of factors, including, but not limited to, the Company’s ability to

profitably attract new customers and retain existing customers, the Company’s

dependence on the market for online computer backup services, the

Company’s ability to manage growth, and changes in economic or regulatory conditions or other trends affecting the

Internet and the information technology industry. These and other important risk

factors are discussed or referenced in our Quarterly Report on Form 10-Q

for the fiscal quarter ended September 30, 2012, which is Factors”

and elsewhere, and any subsequent periodic or current reports filed by us with the

SEC. The Company anticipates that subsequent events and developments will

cause its views to change. Except as required by applicable law or regulation, the Company

does not undertake any obligation to update our forward-looking statements to

reflect future events or circumstances. available on

www.sec.gov, under the heading “Risk ` |

Wednesday, November 14, 2012

©

Carbonite, Inc | Company Confidential

BUSINESS OVERVIEW

3 |

4

©

Carbonite, Inc | Company Confidential

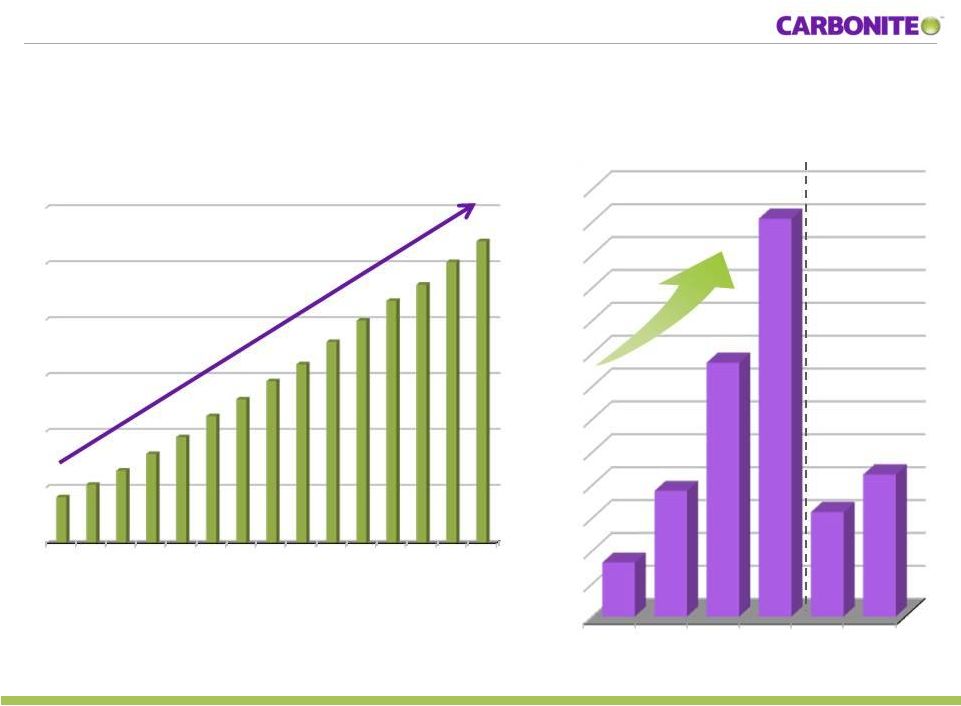

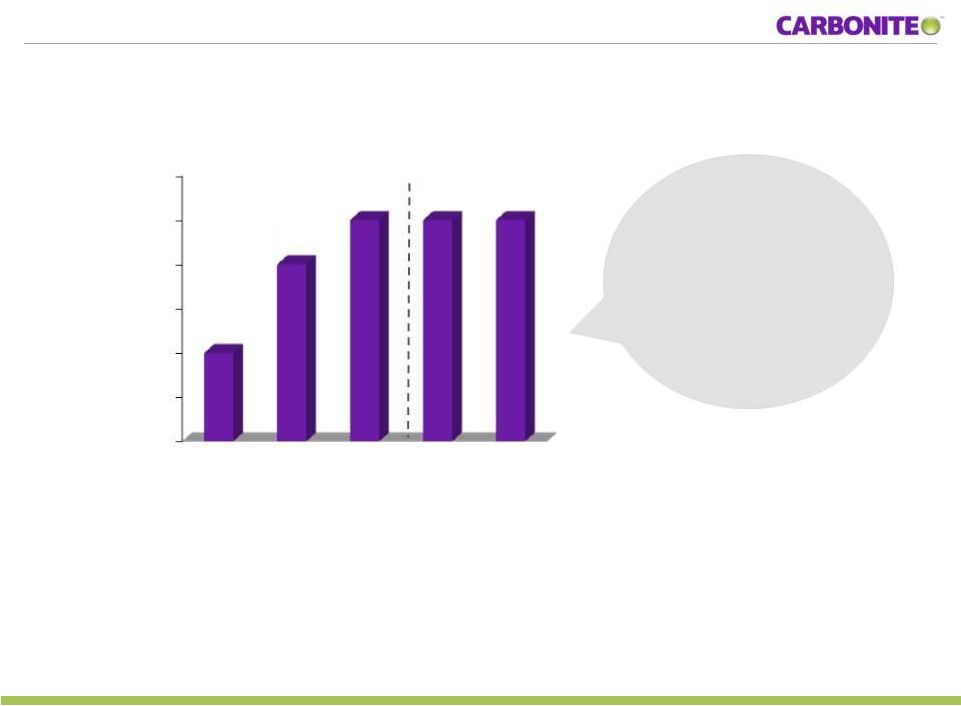

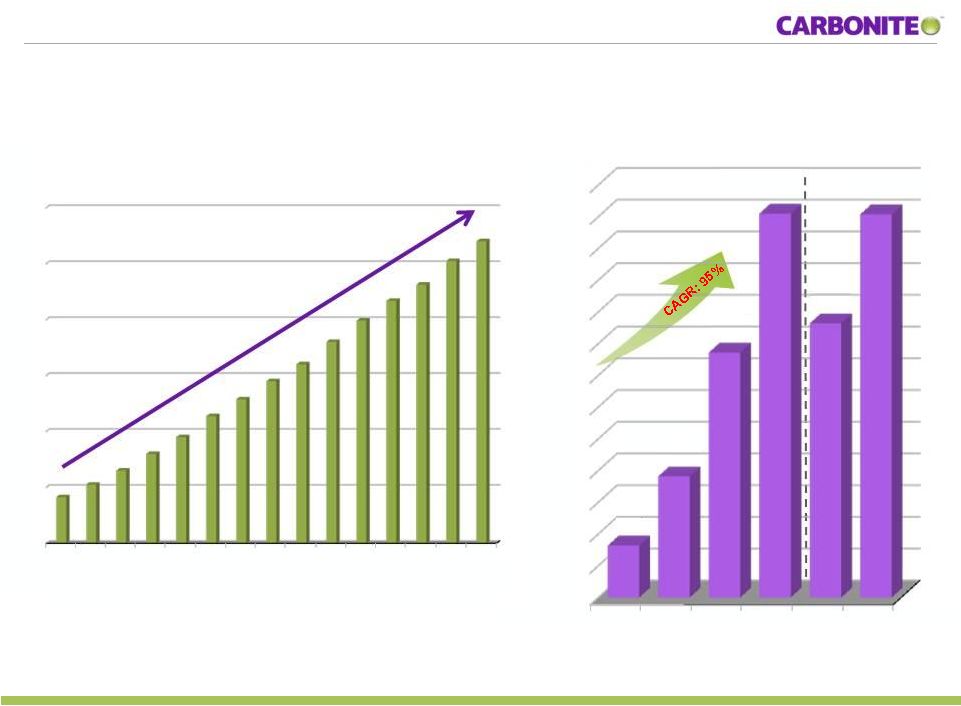

Rapid revenue growth

Predictable revenue growth: record revenue every quarter since launch

($mm)

($000’s)

Source: Carbonite SEC Filings

$0

$5

$10

$15

$20

$25

$30

$35

$40

$45

$50

$55

$60

$65

2008

2009

2010

2011

Q3 11

Q3 12

$8.2

$19.1

$38.6

$60.5

$15.9

$21.6

$0

$4

$8

$12

$16

$20

$24

Q1

'09

Q2

'09

Q3

'09

Q4

'09

Q1

'10

Q2

'10

Q3

'10

Q4

'10

Q1

'11

Q2

'11

Q3

'11

Q4

'11

Q1

'12

Q2'

12

Q3

'12 |

5

©

Carbonite, Inc | Company Confidential

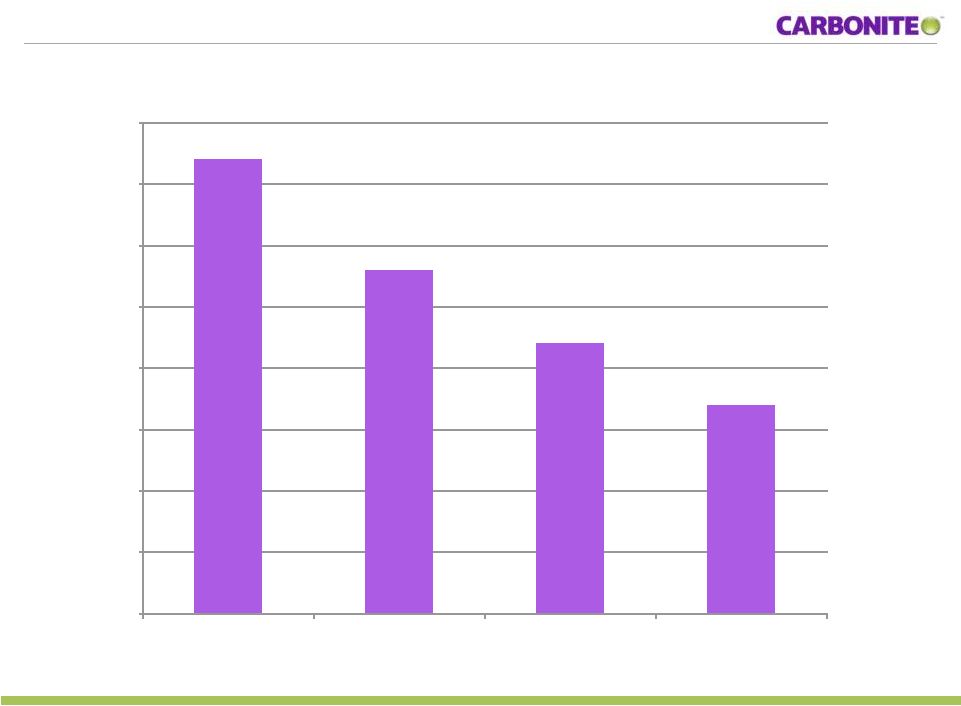

Storage costs keep dropping

37%

28%

22%

17%

0%

5%

10%

15%

20%

25%

30%

35%

40%

2009

2010

2011

9 mos 2012

Capex as a % of Revenue |

6

©

Carbonite, Inc | Company Confidential

Customer support costs keep dropping

*2011 Included transition of support from India to US

Source: Management estimates. Excludes stock based compensation expense

|

7

©

Carbonite, Inc | Company Confidential

Source: Carbonite SEC Filings

Adjusted for stock-based compensation expense and amortization of intangible

assets. Gross Margin Expansion

*2011 included costs of transition support to US

and duplicate datacenter cost

(DC relocation completed end of Q1 2012)

53%

58%

*62%

64%

66%

67%

40%

45%

50%

55%

60%

65%

70%

2009

2010

2011

Q1 12

Q2 12

Q3 12 |

8

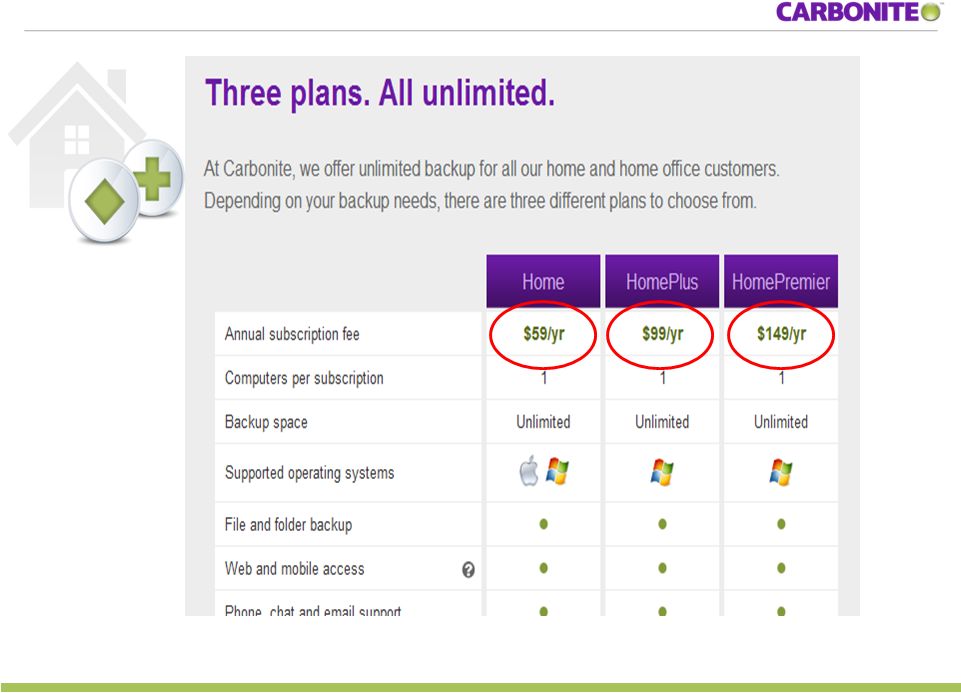

2 New Up-market Consumer Products

©

Carbonite, Inc | Company Confidential |

9

©

Carbonite, Inc | Company Confidential

Successful new SMB Product

$229/yr

Unlimited

PCs

250GBs |

©

Carbonite, Inc | Company Confidential

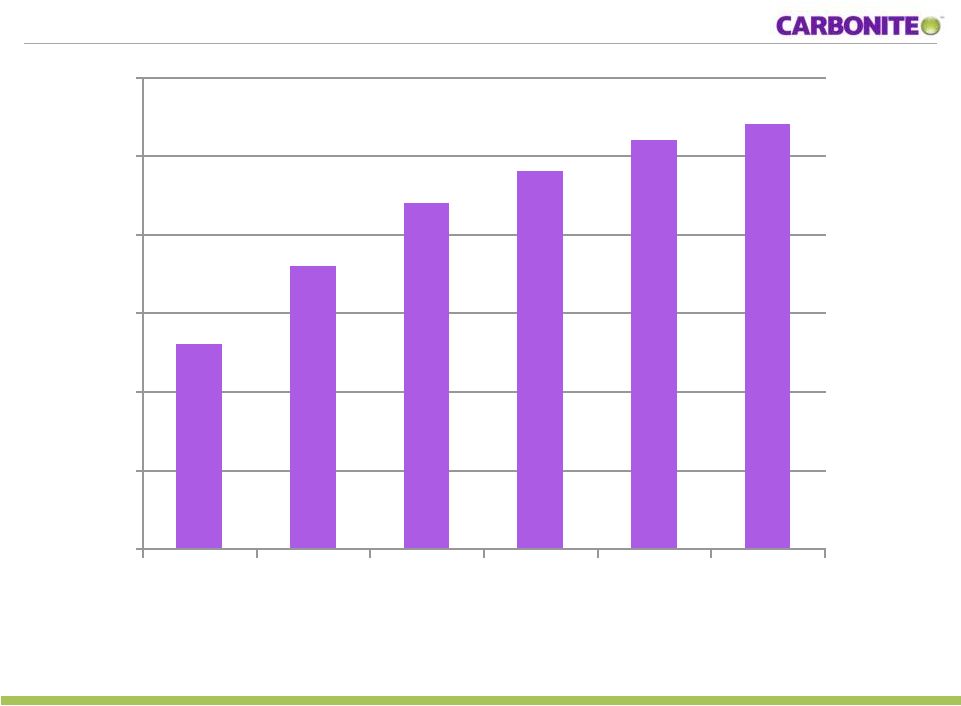

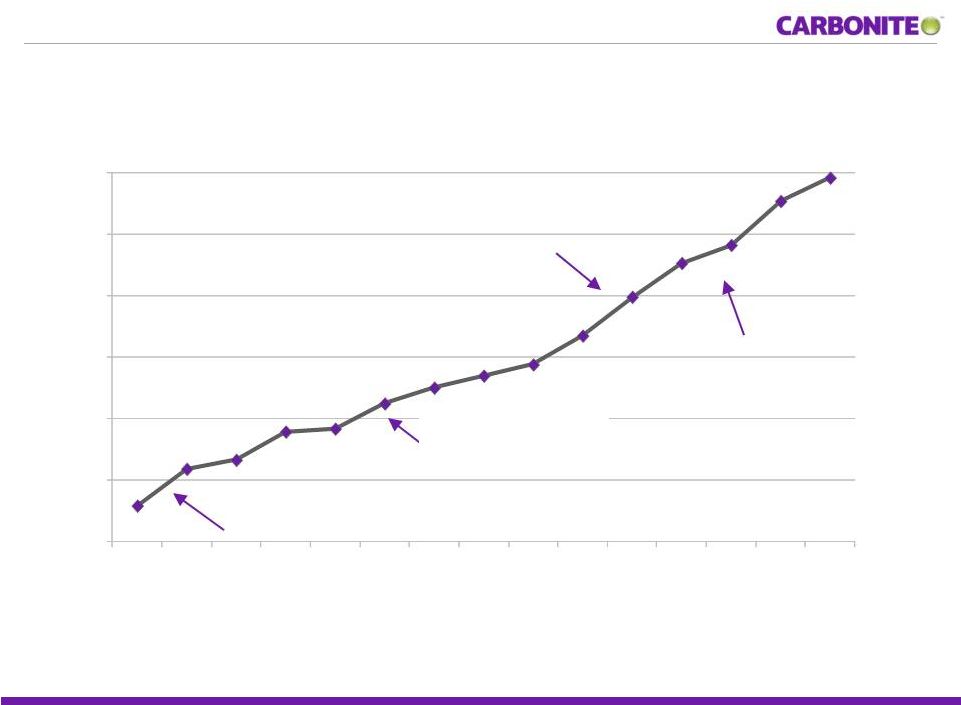

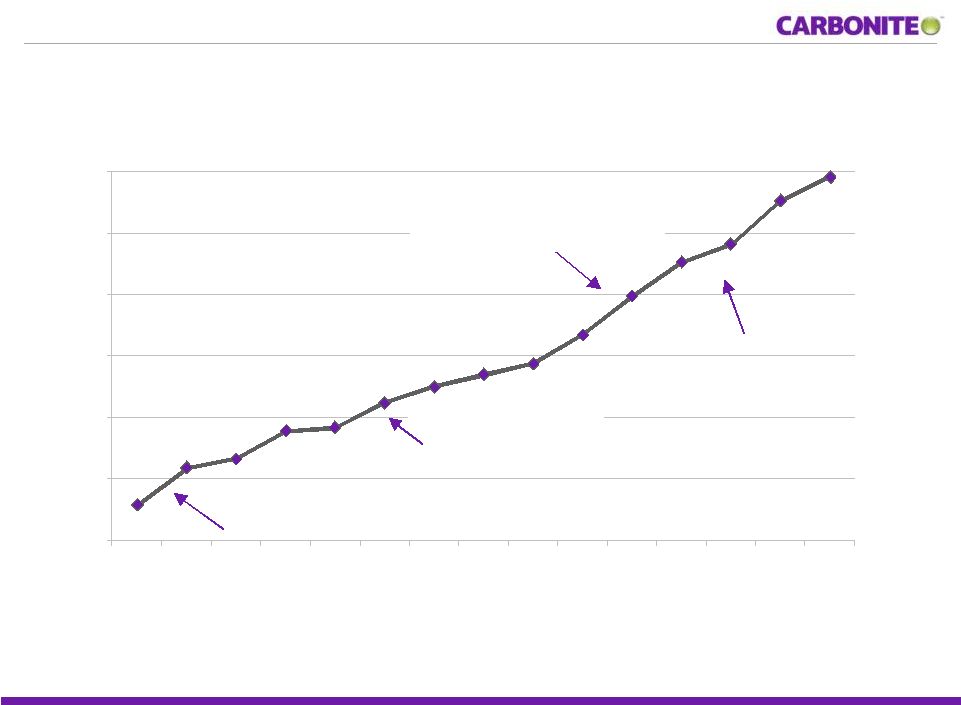

Increasing revenue per customer

Consistent growth in revenue per customer, with further upside

potential from the recently launched Consumer and SMB offerings

Price increase and release of second

generation business products

Release of first generation

business product

Price increase

Release of two new

consumer products

Source: Carbonite filings

Note:

Calculated

as

revenue

for

any

given

quarter

divided

by

the

average

number

of

subscribers

during

that

quarter.

Average

number

of

subscribers

is

the

sum

of

the

total

number

of

subscribers

at

the

end

of

a

quarter

plus

the

total

number

of

subscribers

at

the

end

of

the

prior

quarter,

divided

by

2.

10

$10.58

$11.18

$11.33

$11.79

$11.84

$12.25

$12.50

$12.70

$12.88

$13.35

$13.98

$14.53

$14.83

$15.54

$15.92

$10.00

$11.00

$12.00

$13.00

$14.00

$15.00

$16.00

Q1 '09

Q2 '09

Q3 '09

Q4 '09

Q1 '10

Q2 '10

Q3 '10

Q4 '10

Q1 '11

Q2 '11

Q3 '11

Q4 '11

Q1 '12

Q2 '12

Q3 '12 |

11

©

Carbonite, Inc | Company Confidential

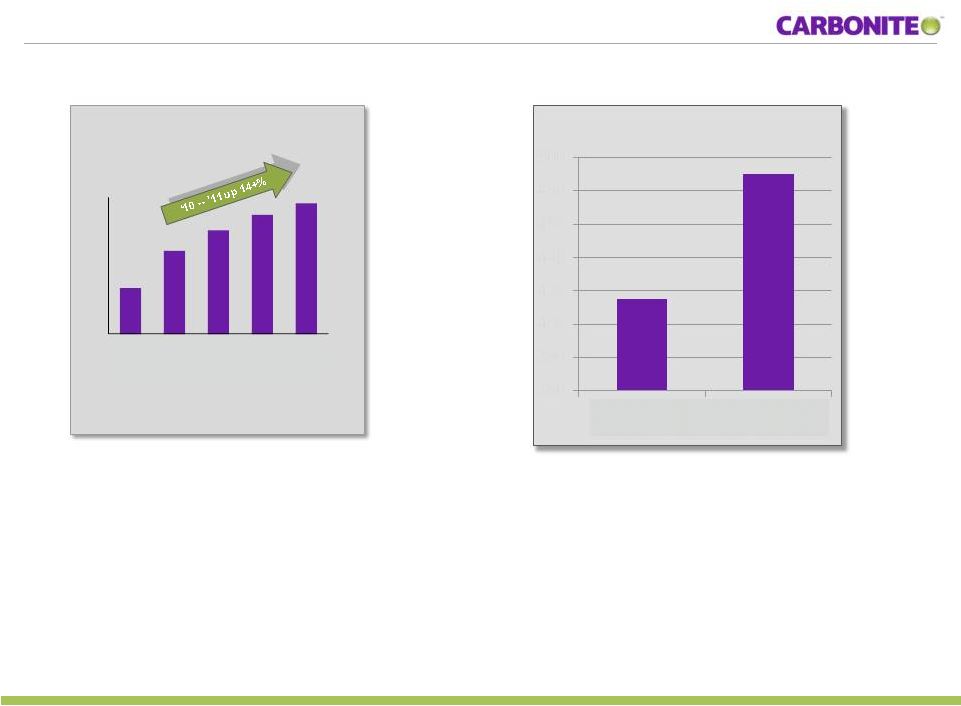

Huge addressable market

•

Mobile: 2011 first time Smart Phone > PC.

•

Up 62+% from 2010, about 487M units

* Canalys estimates ©

Canalys 2012

415M Computers in 2011*

(mm)

•

PCs: 415 million PCs shipped in 2011.

•

Up 14+% from 2010

2010

2014

360

380

400

420

440

460

480

500

Computers

Smart Phones

487M Smart Phones in 2011* |

12

©

Carbonite, Inc | Company Confidential

Highest retention rate in our history

85.5% retention

rate equates to

5.9 years average

customer life

Annual Retention Rate

81%

82%

83%

84%

85%

86%

87%

2009

2010

2011

9 mos

2011

9 mos

2012

83%

85%

86%

86%

86%

2

1

Source: Carbonite management

1 Represents annual retention rate excluding renewal activity related to

third-party distributor sales, which are being deliberately phased out. Represented 8% of

revenue in 2010. Annual retention rate is the percentage of customers on the last day of the prior

period who remain customers on the last day of the current period. Retention rates including

third-party distributor sales renewals were 79%, 83% and 82% respectively for 2009, 2010 and 2011; and 81% and 84%

respectively for the nine months ended September 30, 2011 and September 30, 2012.

2 Average customer life = 1/(1-r)-1 where r = retention rate

|

13

©

Carbonite, Inc | Company Confidential

Easy to get started…Easy to use

Nothing

to choose.

Never

run out of space.

No scheduling

it’s continuous.

Just works in the background.

Everything

in the cloud. |

14

©

Carbonite, Inc | Company Confidential

Affordable

Our disruptive idea:

Unlimited online backup space

for one flat price.

No worrying

about falling into another storage tier.

No calculating

monthly storage costs. |

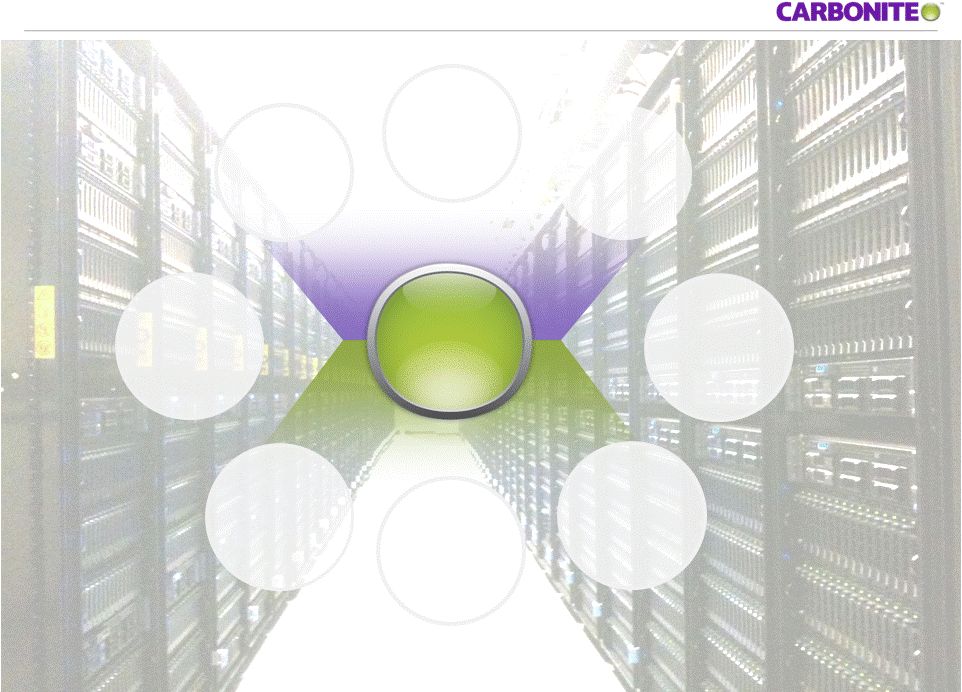

300+

million files backed

up per day

~1

petabyte

every

2 weeks

~70

petabytes

today

High

reliability

& density

Low

overhead

Proprietary

Carbonite

File System

94% disk

utilization

Highly

scalable

15

Low cost is key to market leadership |

16

©

Carbonite, Inc | Company Confidential

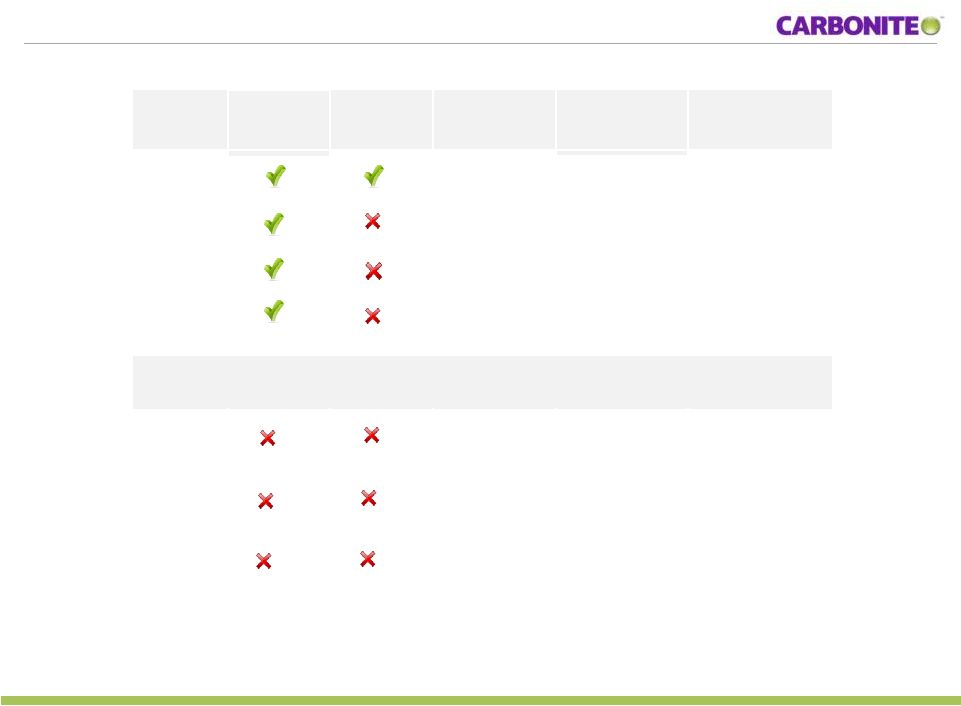

Competition

(annual

pricing)

Simple,

safe,

secure,

automatic

Unlimited

US Based

Phone

Support

Consumer

with 100 gig

of storage

SMB with 10

computers & 250

gig of storage

SMB with 15

computers &

500 gig of storage

Carbonite

$59

$229

$599

Mozy

$143

$1,044

$2,089

SOS

$99

$499

$849

Symantec

Not Available

$1,679

$3,085

INDIRECT COMPETITION

Dropbox

$99

$1,420

$2,045

iCloud

$200

Not Available

Not Available

Google

$59

Not Available

Not Available |

17

©

Carbonite, Inc | Company Confidential

Staying ahead of competition

Scale:

Takes years to design, test, and deploy large-scale backup-focused

infrastructure software and hardware.

Well positioned to continue to stay ahead of competition.

Technology:

Requires specialized technology. There are no off-the-shelf

solutions. Brand:

Building a trusted brand is essential and takes time and money.

Focus:

Protecting your data is all we do. |

18

©

Carbonite, Inc | Company Confidential

Keys to Carbonite’s success

Easy

Affordable Trusted

& Secure

“Trust Carbonite

with ALL your

private

information.” |

19

©

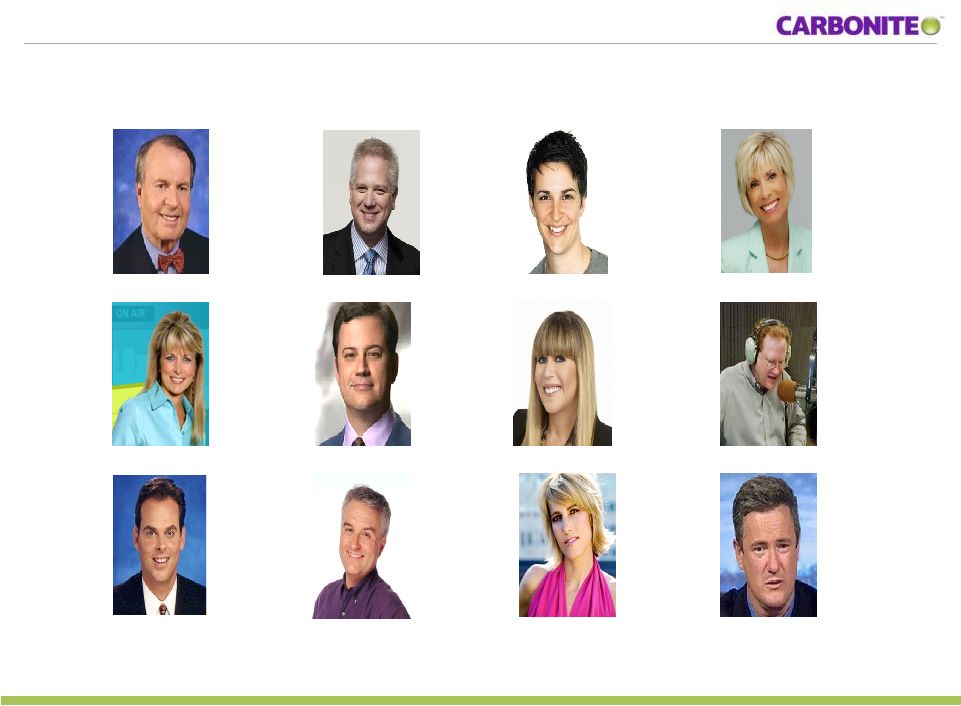

Carbonite, Inc | Company Confidential

Talk radio hosts were key to early trust-building

Glenn Beck

Rachel Maddow

Joe Scarborough

Charles Osgood

Jimmy Kimmel

Ed Shultz

Randi Rhodes

Kim Komando

Leo Laporte

Laura Ingraham

Colin Cowherd

Dr. Laura |

20

©

Carbonite, Inc | Company Confidential

We deploy a wide range of marketing programs to drive demand

Direct marketing expertise |

21

©

Carbonite, Inc | Company Confidential

Multiple avenues for future growth

Small business

Mobile and

Tablet apps

Additional

services

International

Consumer

Carbonite

Cloud |

Wednesday, November 14, 2012

©

Carbonite, Inc | Company Confidential

FINANCIAL OVERVIEW

22 |

©

Carbonite, Inc | Company Confidential

Rapid

growth

in

bookings,

customers

and

revenue

Highly

scalable

subscription-based

model

with

strong

visibility

New

products

driving

higher

ASP,

ARPU

and

margins

High

retention

rates

Approaching

free cash flow breakeven

Financial highlights

23 |

24

©

Carbonite, Inc | Company Confidential

Consistent bookings growth

Highly predictable subscription-based model with consistent bookings

growth ($mm)

Source: Carbonite SEC Filings

Note: Bookings during a period is defined as revenue recognized during the period

plus change in deferred revenue. See appendix for a reconciliation of

bookings to revenue for the periods presented. $0

$15

$30

$45

$60

$75

$90

2008

2009

2010

2011

9 mos 2011

9 mos 2012

$14.1

$32.9

$54.1

$80.9

$57.7

$71.0 |

25

©

Carbonite, Inc | Company Confidential

Rapid revenue growth

Predictable revenue growth: record revenue every quarter since launch

($mm)

($000’s)

Source: Carbonite SEC Filings

$0

$4

$8

$12

$16

$20

$24

Q1

'09

Q2

'09

Q3

'09

Q4

'09

Q1

'10

Q2

'10

Q3

'10

Q4

'10

Q1

'11

Q2

'11

Q3

'11

Q4

'11

Q1

'12

Q2

'12

Q3

'12

$0

$5

$10

$15

$20

$25

$30

$35

$40

$45

$50

$55

$60

$65

2008

2009

2010

2011

9 mos

11

9 mos

12

$8.2

$19.1

$38.6

$60.5

$43.2

$60.4 |

26

©

Carbonite, Inc | Company Confidential

Our highly scalable business model

High lifetime value

Highly scalable

Strong visibility

Significant operating leverage

Cumulative gross margin per customer

Source: Carbonite filings and management estimates

Based

on

1

year

Home

subscription,

5.90

year

customer

life

based

on

85.5%

annual

retention

rate

for

today’s

core

business

and

cost

structure.

Does

not

account

for

projected

future

decline

in storage, bandwidth costs or customer support. Excludes stock based compensation.

CAC represents $41.28 average customer acquisition costs based on YTD 2012 advertising expense/

new bookings during the same period times annualized ARPU from the current quarter

. Year 1

% rev

Lifetime

% rev

Revenue per customer

$64

100%

376

100%

Depreciation &

hosting

(14)

(22%)

(81)

(22%)

Customer support

(8)

(11%)

(35)

(9%)

Gross margin

$42

67%

$260

69%

Business model illustration

6.3x gross

margin return

on CAC

$0

$50

$100

$150

$200

$250

Year 1

Year 2

Year 3

Year 4

Year 5

Year 6

42

83

125

166

207

260 |

Wednesday, November 14, 2012

©

Carbonite, Inc | Company Confidential

Increasing revenue per customer

Consistent growth in revenue per customer, with further upside

potential from the recently launched Consumer and SMB offerings

$10.58

$11.18

$11.33

$11.79

$11.84

$12.25

$12.50

$12.70

$12.88

$13.35

$13.98

$14.53

$14.83

$15.54

$15.92

$10.00

$11.00

$12.00

$13.00

$14.00

$15.00

$16.00

Q1 '09

Q2 '09

Q3 '09

Q4 '09

Q1 '10

Q2 '10

Q3 '10

Q4 '10

Q1 '11

Q2 '11

Q3 '11

Q4 '11

Q1 '12

Q2 '12

Q3 '12

Price increase and release of second

generation business products

Release of first generation

business product

Price increase

Release of two new

consumer products

27

Source: Carbonite filings

Note: Calculated as revenue for any given quarter divided by the average number of subscribers during

that quarter. Average number of subscribers is the sum of the total number of subscribers at the

end of a quarter plus the total number of subscribers at the end of the prior quarter, divided by 2. |

Wednesday, November 14, 2012

©

Carbonite, Inc | Company Confidential

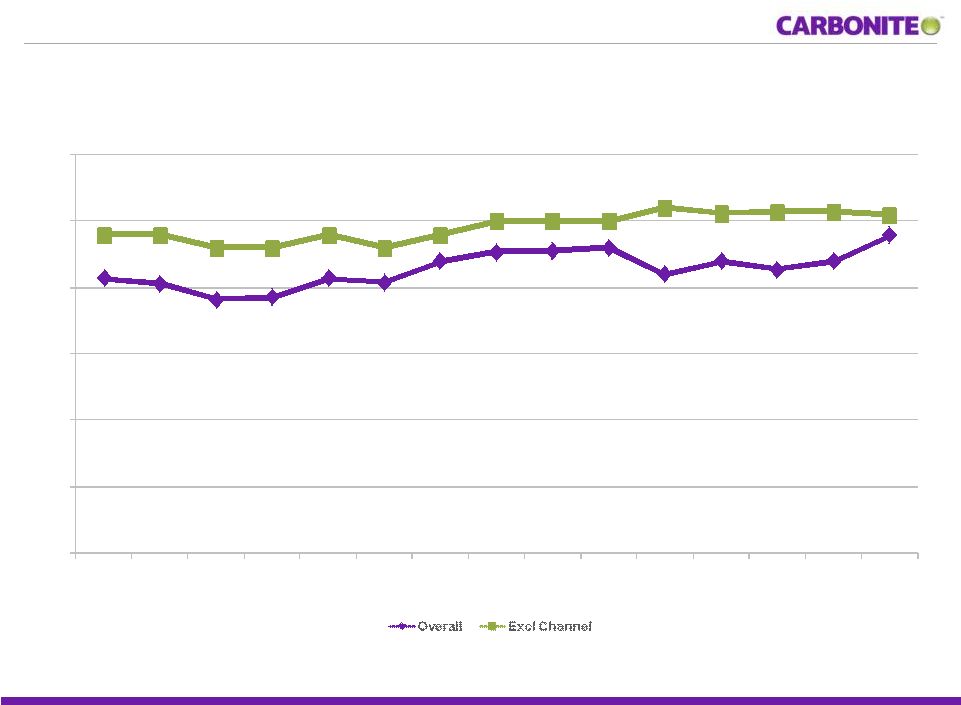

84%

84%

83%

83%

84%

83%

84%

85%

85%

85%

86%

86%

86%

86%

86%

81%

80%

79%

79%

81%

80%

82%

83%

83%

83%

81%

82%

81%

82%

84%

60%

65%

70%

75%

80%

85%

90%

Q1 '09

Q2 '09

Q3 '09

Q4 '09

Q1 '10

Q2 '10

Q3 '10

Q4 '10

Q1 '11

Q2 '11

Q3 '11

Q4 '11

Q1 '12

Q2 '12

Q3 '12

Strong customer retention

Consistently high customer retention rates, key to our model

Overall includes discontinued channel including force

churn customers (20K in Q3 2011 and 15K in Q1 12)

28

Source: Carbonite filings

Note: Annual retention rate is the percentage of customers on the last day of the prior period

who remain customers on the last day of the current period. Channel sales being

deliberately phased out. |

29

©

Carbonite, Inc | Company Confidential

Business model with declining costs per customer leading to

expanding margin profile:

Gross profit

per

average

customer¹

Source: Carbonite SEC Filings

1. Adjusted for stock-based compensation and amortization of intangibles.

Improving

margins

Gross

Margin¹

*2011 included costs of transition support to US

and duplicate datacenter cost

(DC relocation completed end of Q1 2012)

$0

$10

$20

$30

$40

2008

2009

2010

2011

9 mos 11

9 mos 12

$21.0

$23.4

$29.0

$34.6

$25.4

$30.6

67%

66%

64%

*62%

58%

53%

70%

65%

60%

55%

50%

45%

40%

2009

2010

2011

Q1 12

Q2 12

Q3 12 |

30

©

Carbonite, Inc | Company Confidential

Mix shift toward new products

Adoption and upsell upon renewal ramps over time

Higher ASP and higher gross margins

Rapid decline in storage costs at ~30-40% per year

4 year depreciable life, delayed impact to P&L

Temporary flattening in 2012 from Thailand flooding

Unlimited free support: major differentiator to our offerings

50% of lifetime support contacts during trial and year 1,

remainder over next ~5 years of a customer's life

Electricity and broadband: largest components of COS

after support and depreciation

Datacenter locations moving to lower cost electricity areas

Economies achieved by increasing equipment density

High BB consumption during initial upload

Purchasing power at scale

Source: Carbonite filings and management estimates. Support excludes stock based

compensation expense. Drivers of margin expansion

2012

Capex as a % of Revenue

37%

28%

22%

17%

0%

10%

20%

30%

40%

2009

2010

2011

9 mos

18%

**13

12%

0%

5%

10%

15%

20%

2010

2011

9 mos 2012

Support as a % of Revenue

*HD pricing temporarily impacted by Thailand floods

**2011 Included transition of support to US |

31

©

Carbonite, Inc | Company Confidential

Strong balance sheet

Cash and short-term investments

$66.3

Working capital (deficit)

$3.0

Total assets

$96.9

Deferred revenue, including current portion

$70.3

Total liabilities

$82.2

Total

stockholders’

equity

(deficit)

$14.7

Source: Carbonite SEC Filings

$ in millions

As of September 30, 2012

($mm) |

32

©

Carbonite, Inc | Company Confidential

Investment highlights

•

Enormous world-wide market opportunity

•

“Category killer”

with established brand leadership

•

Personal cloud important market opportunity

•

Proprietary technology & scale

•

Strong competitive advantages

•

Proven direct marketing expertise

•

Multiple avenues for sustained growth |

©

Carbonite, Inc | Company Confidential

Questions?

33 |

34

©

Carbonite, Inc | Company Confidential

Non-GAAP reconciliation

Source: Carbonite SEC Filings

1. Excludes $586k from acquisitions

$ in thousands

2008

2009

2010

2011

9 mo

2011

9 mo

2012

Revenue

$8,202

$19,114

$38,563

$60,512

$43,168

$60,367

Plus: Change in deferred revenue

5,867

13,743

15,578

20,388

(1)

14,546

(1)

10,587

Bookings

$14,069

$32,857

$54,141

$80,900

$57,714

$70,954

$ in thousands

2008

2009

2010

2011

9 mo

2011

9 mo

2012

GAAP Loss from Operations

$(17,852)

$(19,602)

$(25,896)

$(23,554)

$(17,453)

$(16,685)

Add: Stock-based Compensation

203

390

542

1,445

963

2,974

Add: Amortization of Intangibles

0

0

0

155

89

200

Add: Patent Litigation Expenses

0

0

39

966

664

948

Add: Lease exit charge

0

0

0

0

0

1,174

Non-GAAP Loss from Operations

$(17,649)

$(19,212)

$(25,315)

$(20,988)

$(15,737)

$(11,389)

Plus: D&A Less Amort. Of

Intangibles

1,481

2,977

5,060

7,715

5,562

7,677

Adjusted EBITDA

$(16,168)

$(16,235)

$(20,255)

$(13,273)

$(10,175)

$(3,712) |