Attached files

| file | filename |

|---|---|

| EX-99.1 - PRESS RELEASE - FIRST MARBLEHEAD CORP | exhibit991.htm |

| 8-K - FORM 8-K - FIRST MARBLEHEAD CORP | form8k.htm |

Sandler O’Neill + Partners 2012 East Coast Financial Services Conference November 15, 2012 NYSE: FMD

Exhibit 99.2

Sandler O’Neill + Partners

2012 East Coast Financial

Services Conference

November 15, 2012

NYSE: FMD

2

Forward-Looking Statements

Statements in this presentation regarding First Marblehead’s strategy, competitive position, the demand for private education loans, growth prospects, the characteristics, pricing or

performance of future Monogram-based private education loan portfolios and our expectations to future financial success, as well as any other statements that are not purely historical,

constitute forward-looking statements for purposes of the safe harbor provisions of The Private Securities Litigation Reform Act of 1995. These forward-looking statements are based

on our historical performance and on our plans, estimates and expectations as of November 15, 2012. The inclusion of this forward-looking information should not be regarded as a

representation by us or any other person that the future results, plans, estimates and expectations expressed or implied by us will be achieved. You are cautioned that matters subject

to forward-looking statements involve known and unknown risks and uncertainties, including economic, legislative, regulatory, competitive and other factors, which may cause our

actual financial or operating results, facilitated loan volumes and resulting cash flows or financing-related revenues, or the timing of events, to be materially different than those

expressed or implied by forward-looking statements. Important factors that could cause or contribute to such differences include: market acceptance of, and demand for, our

Monogram® platform and fee-based service offerings; the successful sales and marketing of Monogram-based loan offerings, including the volume of loan applications and the extent

to which loan applications ultimately result in booked loans; the volume, timing and performance of disbursed loans; the size and structure of any credit enhancement provided by us

in connection with our Monogram platform; our success in designing, implementing and commercializing private education loan programs through Union Federal Savings Bank,

including receipt of and compliance with regulatory approvals and conditions with respect to such programs; capital markets conditions and our ability to structure securitizations or

alternative financings; the size, structure and timing of any such securitizations or alternative financings; any investigation, audit, claim, regulatory action or suit relating to the

transfer of the trust certificate of NC Residuals Owners Trust or the asset services agreement between the purchaser and us, including any challenge to tax refunds previously received

as a result of the audit being conducted by the Internal Revenue Service; resolution of litigation and regulatory proceedings pertaining to our Massachusetts state income tax returns;

the estimates and assumptions we make in preparing our financial statements, including quantitative and qualitative factors used in determining the estimate of the fair value of our

service revenue receivables; our success in realizing the anticipated benefits of our acquisition of the operating assets of Cology, Inc. and certain of its affiliates; and the other factors

set forth under the caption “Part II- Item 1A. Risk Factors” in First Marblehead’s quarterly report on Form 10-Q filed with the Securities and Exchange Commission on November 8,

2012. Important factors that could cause or contribute to future adjustments to the estimates and assumptions we make in preparing our financial statements include: actual

transactions or market observations relating to asset-backed securities, loan portfolios or corporate debt securities; variance between our performance assumptions and the actual

performance of the loan portfolios held by the GATE Trusts, Union Federal Savings Bank or our clients (the “Portfolios”); economic, legislative, regulatory, competitive and other factors

affecting discount, default, recovery and prepayment rates on the Portfolios, including general economic conditions, the consumer credit environment and unemployment rates;

management’s determination of which qualitative and quantitative factors should be weighed in our estimates, and the weight to be given to such factors; capital markets receptivity

to securities backed by private education loans; and interest rate trends. We specifically disclaim any obligation to update any forward-looking statements as a result of developments

occurring after the date of this presentation, even if our estimates change, and you should not rely on those statements as representing our views as of any date subsequent to the

date of this presentation

performance of future Monogram-based private education loan portfolios and our expectations to future financial success, as well as any other statements that are not purely historical,

constitute forward-looking statements for purposes of the safe harbor provisions of The Private Securities Litigation Reform Act of 1995. These forward-looking statements are based

on our historical performance and on our plans, estimates and expectations as of November 15, 2012. The inclusion of this forward-looking information should not be regarded as a

representation by us or any other person that the future results, plans, estimates and expectations expressed or implied by us will be achieved. You are cautioned that matters subject

to forward-looking statements involve known and unknown risks and uncertainties, including economic, legislative, regulatory, competitive and other factors, which may cause our

actual financial or operating results, facilitated loan volumes and resulting cash flows or financing-related revenues, or the timing of events, to be materially different than those

expressed or implied by forward-looking statements. Important factors that could cause or contribute to such differences include: market acceptance of, and demand for, our

Monogram® platform and fee-based service offerings; the successful sales and marketing of Monogram-based loan offerings, including the volume of loan applications and the extent

to which loan applications ultimately result in booked loans; the volume, timing and performance of disbursed loans; the size and structure of any credit enhancement provided by us

in connection with our Monogram platform; our success in designing, implementing and commercializing private education loan programs through Union Federal Savings Bank,

including receipt of and compliance with regulatory approvals and conditions with respect to such programs; capital markets conditions and our ability to structure securitizations or

alternative financings; the size, structure and timing of any such securitizations or alternative financings; any investigation, audit, claim, regulatory action or suit relating to the

transfer of the trust certificate of NC Residuals Owners Trust or the asset services agreement between the purchaser and us, including any challenge to tax refunds previously received

as a result of the audit being conducted by the Internal Revenue Service; resolution of litigation and regulatory proceedings pertaining to our Massachusetts state income tax returns;

the estimates and assumptions we make in preparing our financial statements, including quantitative and qualitative factors used in determining the estimate of the fair value of our

service revenue receivables; our success in realizing the anticipated benefits of our acquisition of the operating assets of Cology, Inc. and certain of its affiliates; and the other factors

set forth under the caption “Part II- Item 1A. Risk Factors” in First Marblehead’s quarterly report on Form 10-Q filed with the Securities and Exchange Commission on November 8,

2012. Important factors that could cause or contribute to future adjustments to the estimates and assumptions we make in preparing our financial statements include: actual

transactions or market observations relating to asset-backed securities, loan portfolios or corporate debt securities; variance between our performance assumptions and the actual

performance of the loan portfolios held by the GATE Trusts, Union Federal Savings Bank or our clients (the “Portfolios”); economic, legislative, regulatory, competitive and other factors

affecting discount, default, recovery and prepayment rates on the Portfolios, including general economic conditions, the consumer credit environment and unemployment rates;

management’s determination of which qualitative and quantitative factors should be weighed in our estimates, and the weight to be given to such factors; capital markets receptivity

to securities backed by private education loans; and interest rate trends. We specifically disclaim any obligation to update any forward-looking statements as a result of developments

occurring after the date of this presentation, even if our estimates change, and you should not rely on those statements as representing our views as of any date subsequent to the

date of this presentation

Disclaimer

The information in this presentation is intended to provide a broad overview of a portfolio of private education loans previously facilitated by First Marblehead. Neither First Marblehead

nor any other party is offering any securities by making this presentation or soliciting any action based upon the information provided. Nothing in this presentation should be relied

upon as a representation by First Marblehead, or any other person, as to the future performance of any securities that may be issued in the future. The information contained herein is

intended to be illustrative only, and historical collateral pools may not be representative of any future collateral pool. Investing in our common stock involves a high degree of risk.

Prior to purchasing any shares, you should carefully consider the risks and uncertainties described in the reports we file from time to time with the Securities and Exchange

Commission.

nor any other party is offering any securities by making this presentation or soliciting any action based upon the information provided. Nothing in this presentation should be relied

upon as a representation by First Marblehead, or any other person, as to the future performance of any securities that may be issued in the future. The information contained herein is

intended to be illustrative only, and historical collateral pools may not be representative of any future collateral pool. Investing in our common stock involves a high degree of risk.

Prior to purchasing any shares, you should carefully consider the risks and uncertainties described in the reports we file from time to time with the Securities and Exchange

Commission.

3

FMD at a Glance

v Leading solutions provider offering a complete and integrated suite of outsourced

services focused on lifecycle of education financing needs

services focused on lifecycle of education financing needs

§ Industry expert with over 20 years’ experience in education financing

§ Data driven

§ Credit focused

v Established, scalable infrastructure

§ Complete suite of private label services

§ Online, easy to use interface

§ Robust, customizable platform scalable to over $10BN+ in annual originations

v Compelling industry dynamics

§ Private student lending market is poised for strong growth

§ Increasing cost of attendance at both public and private four-year institutions

§ Attractive ROE in Brand and Partnered Lending models

“The right loans for the right borrowers at the right schools for the right educations.”

4

Diversified Revenue Sources

v Private Student Loan Origination

• Union Federal offers traditional higher education and K-12 loan programs nationally; earns net

interest margin by holding loans to term

interest margin by holding loans to term

v Partnered Lending

• Provide customized loan programs to lender clients; earn up-front fees for loan origination

and marketing; can earn a share of ongoing borrower interest income in exchange for

providing credit enhancement and portfolio management

and marketing; can earn a share of ongoing borrower interest income in exchange for

providing credit enhancement and portfolio management

v Capital Markets

• Long-term financing solutions for FMD-facilitated loan programs; earn ongoing fees for

portfolio management; earn net interest margin by retaining residual interests

portfolio management; earn net interest margin by retaining residual interests

v Fee-For-Service

• Services provided in our Private Student Loan Origination, Partnered Lending, and Capital

Markets businesses available on an a la carte basis

Markets businesses available on an a la carte basis

v Tuition Payment Plans

• Offer schools a suite of outsourced billing, payment processing, refund management and

education payment counseling products and services from TMS

education payment counseling products and services from TMS

5

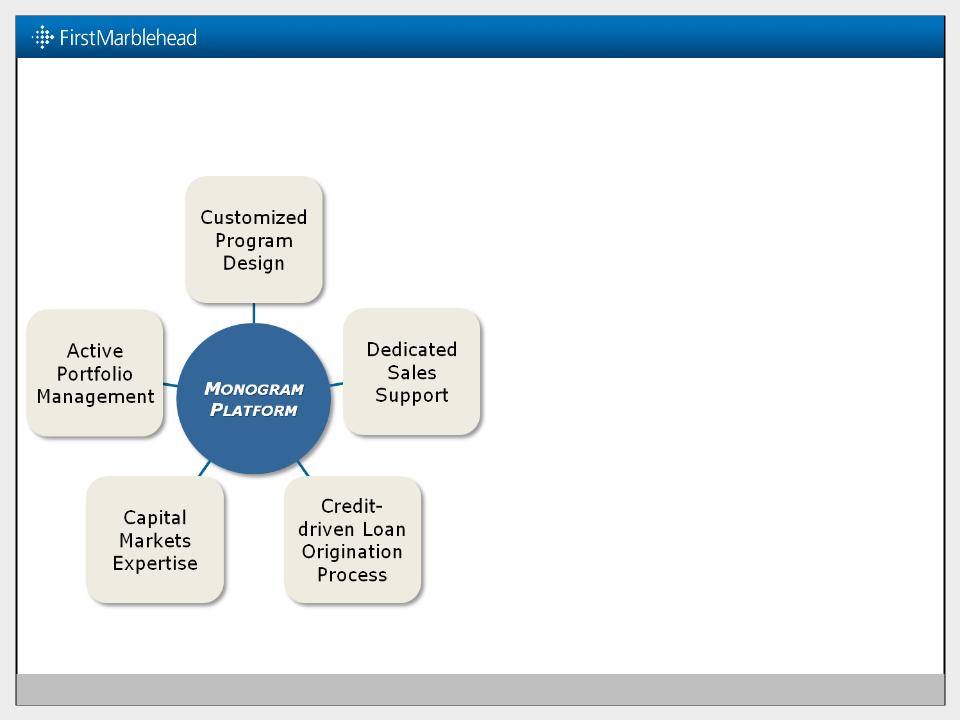

Monogram Platform Incorporates FMD’s Core Competencies to

Source the Best Credits

Source the Best Credits

v Targeting and approving only higher

credit quality applicants

credit quality applicants

• Our Monogram platform’s underwriting

characteristics are derived from extensive

private student loan performance database

characteristics are derived from extensive

private student loan performance database

v Granular risk segmentation allows for

better risk-based pricing

better risk-based pricing

• Depth of credit risk knowledge used to

optimize profitability and manage risk

optimize profitability and manage risk

v Schools involved in loan process

• Schools certify student enrollment and

loan amount and receive funds directly

loan amount and receive funds directly

v Monitor results

• Daily review of actual portfolio distribution

• Flexible program design allows FMD to

adapt student loan product to meet

market needs in a timely manner

adapt student loan product to meet

market needs in a timely manner

6

v Current principal balance: $42.0 million

v Current accrued interest balance: $1.0 million

v Weighted average interest rate: one month LIBOR + 5.95%

v Percent cosigned: 91%

v Percent cash-flowing: 58%

v Percent school certified: 100%; all loan proceeds disbursed directly to school

v Weighted average FICO score: 751

v Percent homeownership:1 79%

v Average age of oldest trade line:1 20 years

v Average number of satisfactory trade lines opened for > 6 months:1 11

v Projected cumulative default rate: 6.5%

v Projected portfolio weighted average life: 5.6 years

1”Percent homeownership”: represents percentage of loans where either the borrower or cosigner (if applicable) is a homeowner; “Average age of oldest trade line” and “Average

number of satisfactory trade lines opened for > 6 months” use the higher of borrower or cosigner (if applicable). Source: September 30, 2012 servicer and origination data

number of satisfactory trade lines opened for > 6 months” use the higher of borrower or cosigner (if applicable). Source: September 30, 2012 servicer and origination data

Monogram Platform Yielding High Quality Portfolios

Union Federal Booked Volume Characteristics through September 30 2012

7

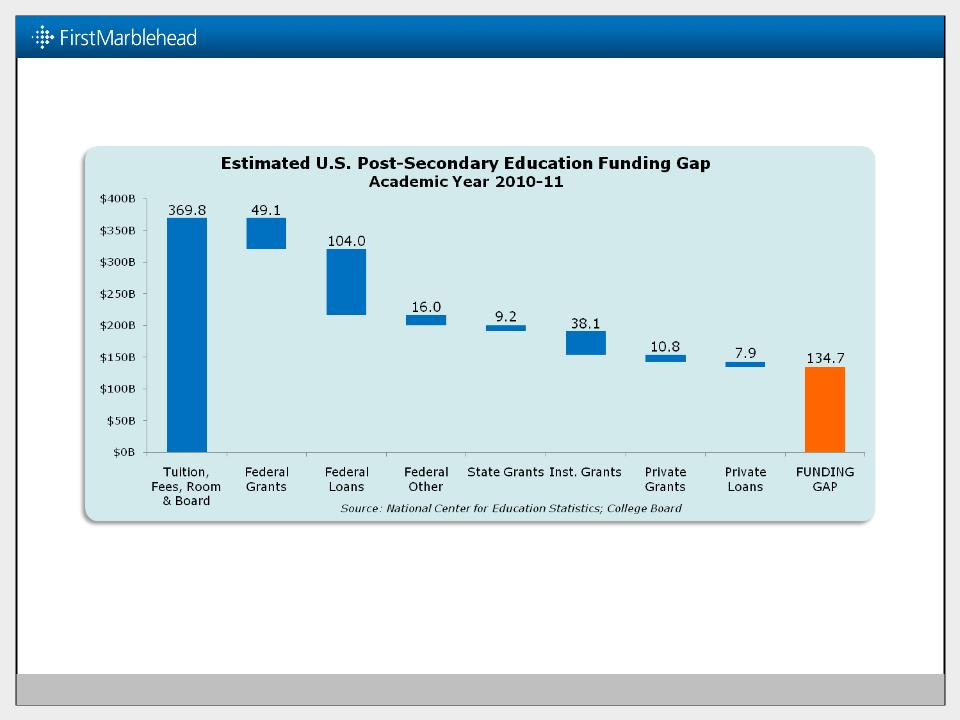

A significant funding gap still exists for students and families

• Currently, 21 million higher education students enrolled; 23 million expected in 2020 (Actual and

projected numbers for enrollment in all degree-granting institutions; National Center for Education Statistics, 2011)

projected numbers for enrollment in all degree-granting institutions; National Center for Education Statistics, 2011)

• Public four-year colleges have raised costs by 4% annually above inflation during past ten years

(Tuition and Fee and Room and Board Charges over Time; College Board, Trends in College Pricing 2011)

(Tuition and Fee and Room and Board Charges over Time; College Board, Trends in College Pricing 2011)

Sandler O’Neill + Partners

2012 East Coast Financial

Services Conference

November 15, 2012

NYSE: FMD