Attached files

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

| x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Quarterly Period Ended September 30, 2012

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 000-54489

Triton Pacific Investment Corporation, Inc.

(Exact name of registrant as specified in its charter)

| Maryland | 45-2460782 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

10877 Wilshire Blvd., 12th Floor

Los Angeles, CA 90024

(Address of principal executive offices)

(310) 943-4990

(Registrant’s telephone number, including area code)

(Former name, former address and former fiscal year, if changed since last report)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ¨ No x

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | x (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

As of September 30, 2012, the Registrant had 7,500 shares of common stock, $0.001 par value, outstanding.

Table of Contents

2

Table of Contents

TRITON PACIFIC INVESTMENT CORPORATION, INC.

CONDENSED STATEMENT OF FINANCIAL POSITION

(UNAUDITED)

SEPTEMBER 30, 2012

|

ASSETS |

| |||

|

CURRENT ASSETS |

||||

|

Cash |

$33,566 | |||

|

Prepaid Expenses |

1,715 | |||

|

Deferred offering costs |

461,932 | |||

|

|

|

|||

| 497,213 | ||||

|

|

|

|||

|

PROPERTY AND EQUIPMENT |

2,495 | |||

|

Less: Accumulated depreciation |

832 | |||

|

|

|

|||

| 1,663 | ||||

|

|

|

|||

| $498,876 | ||||

|

|

|

|||

| LIABILITIES AND STOCKHOLDERS’ EQUITY |

| |||

|

LIABILITIES |

||||

|

Accounts payable and accrued liabilities |

$261,441 | |||

|

Due to related parties |

172,410 | |||

|

|

|

|||

| 433,851 | ||||

|

|

|

|||

|

STOCKHOLDERS’ EQUITY |

||||

|

Common stock, $0.001 par value, |

||||

|

75,000,000 shares authorized, |

||||

|

7,500 shares issued and outstanding |

7 | |||

|

Additional paid-in capital |

101,243 | |||

|

Accumulated deficit during the development stage |

(36,225) | |||

|

|

|

|||

| 65,025 | ||||

|

|

|

|||

| $498,876 | ||||

|

|

|

|||

3

Table of Contents

TRITON PACIFIC INVESTMENT CORPORATION, INC.

CONDENSED STATEMENTS OF OPERATIONS

(UNAUDITED)

PERIODS ENDED SEPTEMBER 30, 2012

| Three Months Ended September 30, 2012 |

Nine Months Ended September 30, 2012 |

April 29, 2011 (Date of Inception) Through September 30, 2012 |

||||||||||

|

INVESTMENT INCOME |

$ | — | $ | — | $ | — | ||||||

|

|

|

|

|

|

|

|||||||

|

OPERATING EXPENSES |

||||||||||||

|

Board fees |

21,750 | 21,750 | 21,750 | |||||||||

|

Professional fees |

12,719 | 12,719 | 12,719 | |||||||||

|

Management fees |

714 | 714 | 714 | |||||||||

|

Other operating expenses |

701 | 1,756 | 1,756 | |||||||||

|

|

|

|

|

|

|

|||||||

|

Expenses before waiver of management fees |

35,884 | 36,939 | 36,939 | |||||||||

|

Waiver of management fees |

(714) | (714) | (714) | |||||||||

|

|

|

|

|

|

|

|||||||

|

|

35,170 |

|

36,225 | 36,225 | ||||||||

|

|

|

|

|

|

|

|||||||

| NET LOSS |

$ | (35,170) | $ | (36,225) | $ | (36,225) | ||||||

|

|

|

|

|

|

|

|||||||

|

PER SHARE INFORMATION - BASIC AND DILUTED |

||||||||||||

|

Net loss |

$ | (4.69) | $ | (8.79) | $ | (16.75) | ||||||

|

|

|

|

|

|

|

|||||||

|

Weighted average common shares outstanding |

7,500 | 4,121 | 2,163 | |||||||||

|

|

|

|

|

|

|

|||||||

4

Table of Contents

TRITON PACIFIC INVESTMENT CORPORATION, INC.

CONDENSED STATEMENTS OF CASH FLOWS

(UNAUDITED)

PERIODS ENDED SEPTEMBER 30, 2012

| Nine Months Ended September 30, 2012 |

April 29, 2011 (Date of Inception) Through September 30, 2012 |

|||||||

|

CASH FLOWS FROM FINANCING ACTIVITIES |

||||||||

|

Capital contribution |

$ | — | $ | 101,250 | ||||

|

Deferred offering costs |

(2,699) | (67,684) | ||||||

|

|

|

|

|

|||||

|

|

||||||||

|

NET CHANGE IN CASH |

(2,699) | 33,566 | ||||||

|

|

||||||||

|

CASH - BEGINNING OF PERIOD |

36,265 | — | ||||||

|

|

|

|

|

|||||

|

|

||||||||

|

CASH - END OF PERIOD |

$ | 33,566 | $ | 33,566 | ||||

|

|

|

|

|

|||||

5

Table of Contents

TRITON PACIFIC INVESTMENT CORPORATION, INC.

NOTES TO THE CONDENSED FINANCIAL STATEMENTS

(UNAUDITED)

NOTE 1 – DESCRIPTION OF BUSINESS AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Description of Business. Triton Pacific Investment Corporation, Inc. (the “Company”), incorporated in Maryland on April 29, 2011, is a newly organized specialty finance company. Pursuant to the Articles of Incorporation, the Company is authorized to issue 75,000,000 shares of common stock with a par value of $0.001 per share. Additionally, the Company is authorized to issue 25,000,000 shares of preferred stock with a par value of $0.001 per share. The Company intends to offer for sale a maximum of 20,000,000 shares of common stock at an initial price of $15 per share, on a “best efforts” basis pursuant to a registration statement on Form N-2 filed with the Securities and Exchange Commission under the Securities Act of 1940, as amended (the “Offering”). The Company has set a minimum offering requirement of $2,500,000 and will not sell any shares unless this minimum is satisfied from persons not affiliated with the Company.

The Company was formed to make debt and equity investments in small to mid-sized private U.S. companies either alone or together with other private equity sponsors. Upon commencement of this offering, the Company will be an externally managed, non-diversified closed-end investment company that has elected to be treated as a business development company, or BDC, under the Investment Company Act of 1940, or the 1940 Act. The Company will therefore be required to comply with certain regulatory requirements. The Company intends to elect to be treated for U.S. federal income tax purposes, and to qualify annually thereafter, as a regulated investment company, or RIC, under Subchapter M of the Internal Revenue code of 1986, as amended, or the Code.

Triton Pacific Adviser, LLC (the “Adviser”) will serve as the Investment Adviser and TFA Associates, LLC will serve as the Administrator. Each of these entities are affiliated with Triton Pacific Group, Inc., a private equity investment management firm, and its subsidiary Triton Pacific Capital Partners, LLC, a private equity investment fund management company, each focused on debt and equity investments for small to mid-sized private companies.

The Adviser was formed in Delaware as a private investment management firm and is registered as an investment adviser under the Investment Advisers Act of 1940, of the Advisers Act. The Adviser will oversee the management of its activities and will be responsible for making the investment decisions for the portfolio.

The Company sold 7,500 shares to the Adviser on May 3, 2012, at $13.50 per share, which represents the initial public offering price of $15.00 per share minus selling commissions and dealer manager fees aggregating $1.50.

Basis of Presentation. These financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”) for interim financial information and the rules and regulations of the Securities and Exchange Commission for interim financial statements. These financial statements reflect all adjustments and accruals of a normal recurring nature that, in the opinion of management, are necessary to make the financial statements not misleading. The results of the interim periods presented are not necessarily indicative of results expected for any future period. A balance sheet as of the end of the preceding year has not been provided as the Company did not begin operations until 2012.

Development Stage Company. The Company complies with the reporting requirements of development stage enterprises. The Company has incurred organizational, accounting and offering costs in connection with the Offering. The offering and other organization costs, which are primarily being advanced by the Adviser, are not expected to be paid before the commencement of the Offering and will be paid or reimbursed by the Company from proceeds of the Offering. It is the Company’s plan to complete the Offering; however, there can be no assurance that the Company’s plans to raise capital will be successful.

6

Table of Contents

TRITON PACIFIC INVESTMENT CORPORATION, INC.

NOTES TO THE CONDENSED FINANCIAL STATEMENTS

(UNAUDITED)

Management Estimates and Assumptions. The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the amounts reported in the financial statements and accompanying notes. Actual results could differ from those estimates.

Deferred Offering Costs. The Company has incurred certain expenses in connection with registering to sell shares of its common stock in connection with the Offering. These costs principally relate to professional and filing fees. Simultaneously with selling common shares, the deferred offering costs will be charged to stockholders’ equity upon commencement of the Offering or to expense if the Offering is not completed.

Depreciation. Property and equipment are recorded at cost. Depreciation is computed using the straight-line method based on the estimated useful lives of the related assets. Property and equipment are reviewed for impairment when events or changes in circumstances indicate that the carrying amount of the assets may not be recoverable. There were no impairment charges from inception through September 30, 2012.

Income Taxes. The Company intends to elect to be treated for federal income tax purposes, and intends to qualify thereafter, as a regulated investment company (“RIC”) under Subchapter M of the Code. Generally, a RIC is exempt from federal income taxes if it distributes at least 90% of “Investment Company Taxable Income,” as defined in the Code, each year. Dividends paid up to one year after the current tax year can be carried back to the prior tax year for determining the dividends paid in such tax year. The Company intends to distribute sufficient dividends to maintain its RIC status each year. The Company is also subject to nondeductible federal excise taxes if it does not distribute at least 98% of net ordinary income, 98.2% of realized net short-term capital gains in excess of realized net long-term capital losses, if any, and any recognized and undistributed income from prior years for which it paid no federal income taxes. The Company will generally endeavor each year to avoid any federal excise taxes.

GAAP requires management to evaluate tax positions taken by the Company and recognize a tax liability (or asset) if the Company has taken an uncertain position that more likely than not would not be sustained upon examination by the Internal Revenue Service or other tax authorities. Management has analyzed the tax positions taken by the Company, and has concluded that as of September 30, 2012, there are no uncertain positions taken or expected to be taken that would require recognition of a liability (or asset) or disclosure in the financial statements. The Company is subject to routine audits by the Internal Revenue Service or other tax authorities, generally for three years after the tax returns are filed; however, there are currently no audits for any tax periods in progress.

NOTE 2 – RELATED PARTY TRANSACTIONS AND ARRANGEMENTS

Triton Pacific Adviser, LLC and TFA Associates, LLC and their affiliates will receive compensation and reimbursement for services relating to this Offering and the investment and management of its assets. All of the Company’s outstanding common stock is owned by the Adviser as of September 30, 2012.

The Company will compensate the Adviser for investment services per an Investment Adviser Agreement (“Agreement”) calculated as the sum of (1) base management fee, calculated quarterly at 0.5% of the Company’s average gross assets payable quarterly in arrears, and (2) an incentive fee upon capital gains determined and payable in arrears as of the end of each quarter or upon liquidation of the Company or upon termination of Agreement at 20% of Company’s realized capital gains, as defined. The Agreement expires June 2013 and may continue automatically for successive annual periods, as approved by the Company. The Adviser has advanced the Company $34,830 for registration and organization expenditures as of September 30, 2012. This amount is expected to be repaid from the proceeds of the Offering.

The Company will compensate TFA Associates, LLC for administration services per an Administration Agreement for costs and expenses incurred with the administration and operation of the Company. Such agreement expires June 2013 and may continue automatically for successive annual periods, as approved by the Company.

Triton Pacific Capital Partners, LLC has advanced the Company $115,830 as of September 30, 2012 and for registration and organization expenditures. This amount is expected to be repaid from the proceeds of the Offering.

7

Table of Contents

TRITON PACIFIC INVESTMENT CORPORATION, INC.

NOTES TO THE CONDENSED FINANCIAL STATEMENTS

(UNAUDITED)

NOTE 3 – LIABILITIES

Liabilities are broken down as follows:

| September 30, 2012 |

||||

|

Accounts payable and accrued liabilities |

||||

| Legal |

$ | 253,441 | ||

| Professional |

8,000 | |||

|

|

|

|||

| 261,441 | ||||

|

|

|

|||

| Due to Affiliates |

||||

| Legal |

87,000 | |||

| Licenses, fees and registration expenses |

63,660 | |||

| Board fees |

21,750 | |||

|

|

|

|||

| 172,410 | ||||

|

|

|

|||

| $ | 433,851 | |||

|

|

|

|||

NOTE 4 – PER SHARE INFORMATION

Net loss per share is calculated by dividing net loss by the weighted average number of common shares outstanding during the period. The current Net Asset Value (NAV), or book value per share based on 7,500 shares outstanding is $8.67 per share as of September 30, 2012.

NOTE 5 – SUBSEQUENT EVENTS

Management has evaluated all known subsequent events from September 30, 2012 through November 12, 2012, the date the accompanying financial statements were available to be issued, and is not aware of any material subsequent events occurring during this period.

8

Table of Contents

Item 2: Management’s Discussion and Analysis of Financial Condition and Results of Operations.

The following discussion and analysis should be read in conjunction with our financial statements and related notes and other financial information appearing elsewhere in this quarterly report on Form 10-Q.

Except as otherwise specified, references to “we,” “us,” “our,” or the “Company,” refer to Triton Pacific Investment Corporation, Inc.

Forward-Looking Statements

Some of the statements in this quarterly report on Form 10-Q constitute forward-looking statements, which relate to future events or our performance or financial condition. The forward-looking statements contained in this quarterly report on Form 10-Q involve risks and uncertainties, including, but not limited to, statements as to:

| • | our future operating results; |

| • | our business prospects and the prospects of our portfolio companies; |

| • | changes in the economy; |

| • | risk associated with possible disruptions in our operations or the economy generally; |

| • | the effect of investments that we expect to make; |

| • | our contractual arrangements and relationships with third parties; |

| • | actual and potential conflicts of interest with Triton Pacific Adviser, LLC and its affiliates; |

| • | the dependence of our future success on the general economy and its effect on the industries in which we invest; |

| • | the ability of our portfolio companies to achieve their objectives; |

| • | the use of borrowed money to finance a portion of our investments; |

| • | the adequacy of our financing sources and working capital; |

| • | the timing of cash flows, if any, from the operations of our portfolio companies; |

| • | the ability of Triton Pacific Adviser, LLC to locate suitable investments for us and to monitor and administer our investments; |

| • | the ability of Triton Pacific Adviser, LLC and its affiliates to attract and retain highly talented professionals; |

| • | our ability to qualify and maintain our qualification as a RIC and as a BDC; and |

| • | the effect of changes in laws or regulations affecting our operations or to tax legislation and our tax position. |

9

Table of Contents

Such forward-looking statements may include statements preceded by, followed by or that otherwise include the words “trend,” “opportunity,” “pipeline,” “believe,” “comfortable,” “expect,” “anticipate,” “current,” “intention,” “estimate,” “position,” “assume,” “potential,” “outlook,” “continue,” “remain,” “maintain,” “sustain,” “seek,” “achieve,” and similar expressions, or future or conditional verbs such as “will,” “would,” “should,” “could,” “may,” or similar expressions. The forward looking statements contained in this quarterly report involve risks and uncertainties. Our actual results could differ materially from those implied or expressed in the forward-looking statements for any reason, including the factors set forth as “Risk Factors” in our final post-effective, amended registration statement filed on form N-2 dated October 26, 2012, filed with the Securities and Exchange Commission (the “SEC”) on October 31, 2012.

We have based the forward-looking statements included in this report on information available to us on the date of this report, and we assume no obligation to update any such forward-looking statements. Actual results could differ materially from those anticipated in our forward-looking statements, and future results could differ materially from historical performance. Although we undertake no obligation to revise or update any forward-looking statements, whether as a result of new information, future events or otherwise, you are advised to consult any additional disclosures that we may make directly to you or through reports that we have filed or in the future may file with the SEC, including quarterly reports on Form 10-Q, annual reports on Form 10-K, and current reports on Form 8-K.

Overview

We are a newly-formed specialty finance company operating as an externally managed, closed-end, non-diversified management investment company that has elected to be treated as a business development company under the Investment Company Act of 1940, as amended. Triton Pacific Adviser, LLC (“Triton Pacific Adviser”), which is a registered investment adviser under the Investment Advisers Act of 1940, as amended, (the “Advisers Act”) will serve as our investment adviser and TFA Associates, LLC will serve as our administrator. Each of these companies is affiliated with Triton Pacific Group, Inc., a private equity investment management firm, and its subsidiary, Triton Pacific Capital Partners, LLC, a private equity investment fund management company, each focused on debt and equity investments in small to mid-sized private companies.

We primarily make debt and equity investments in small to mid-sized private U.S. companies either alone or together with other private equity sponsors. Our investment objective is to generate current income and long term capital appreciation.

Triton Pacific Adviser is responsible for sourcing potential investments, conducting due diligence on prospective investments, analyzing investment opportunities, structuring investments and monitoring our portfolio on an ongoing basis. In addition, we intend to elect and qualify to be treated, for U.S. federal income tax purposes, as a regulated investment company (“RIC”), under subchapter M of the Internal Revenue Code of 1986, as amended (the “Code”).

On September 4, 2012 our prospectus was declared effective by the SEC. The Company issued 7,500 shares of its common stock to Triton Pacific Adviser in exchange for gross proceeds of $101,250.

Our investment objective is to maximize our portfolio’s total return by generating current income from our debt investments and long term capital appreciation from our equity investments. We will seek to meet our investment objectives by:

-Focusing primarily on debt and equity investments in small and mid-sized private U.S. companies, which we define as companies with annual revenue of from $10 million to $ 250 million at the time of investment;

-Leveraging the experience and expertise of our Adviser and its affiliates in sourcing, evaluating and structuring transactions;

-Employing disciplined underwriting policies and rigorous portfolio management;

10

Table of Contents

-Developing our equity portfolio through our Adviser’s Value Enhancement Program, more fully discussed below in “Investment Objectives and Policies – Investment Process”; and

-Maintaining a well balanced portfolio.

We intend to be active in both debt and equity investing. We will seek to provide current income to our investors through our debt investments while seeking to enhance our investors’ overall returns through long term capital appreciation of our equity investments. We will be opportunistic in our investment approach, allocating our investments between debt and equity, depending on:

-Investment opportunities

-Market conditions

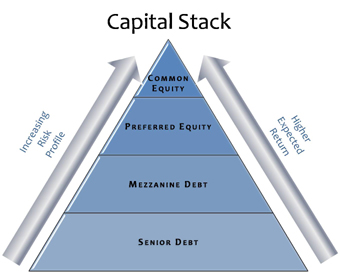

-The risk—reward profiles of the companies we evaluate and our Adviser’s determination as to the best possible investment in each company’s capital structure or “Capital Stack” as shown below:

Depending on the amount of capital we raise in this offering and subject to subsequent changes in our capital base, we expect that our investments will generally range between $1 million and $25 million per portfolio company, although this range may change in the discretion of our Adviser, subject to oversight by our board of directors. Prior to raising sufficient capital to finance investments in this range and as a strategy to manage excess cash, we may make smaller and differing types of investments in, for example, syndicated loan opportunities, high quality debt securities, and other public and private yield-oriented debt and equity securities, directly and through sub-advisers.

We will generally source our equity investments through third party intermediaries and our debt investments primarily through other private equity groups. We will invest only after we conduct a thorough evaluation of the risks and strategic opportunity of an investment and a price (or interest rate in the case of debt investments) has been established that reflects the intrinsic value of the opportunity. We will endeavor to identify the best exit strategy for each investment, including methodology (for example, a sale, company redemption or public offering) and an appropriate time horizon. We will then attempt to build each portfolio company accordingly to maximize our potential return on investment using such exit strategy or another strategy that may become preferable due to changing market conditions. We anticipate that the holding period for most of our equity investments will range from four to six years, but we will be flexible in order to take advantage of market opportunities or to wait out unfavorable market conditions.

11

Table of Contents

As a BDC, we will be subject to certain regulatory restrictions in making our investments. For example, we will not be permitted to co-invest in transactions originated by affiliates of our Adviser, including TPCP and certain of its affiliates, unless we obtain an exemptive order from the SEC. We are seeking exemptive orders for investments, though there is no assurance that such exemptions will be granted, and in either instance, conflicts of interests with affiliates of our Adviser might exist. Should such conflicts of interest arise, we and the Adviser have developed policies and procedures for dealing with such conflicts which require the Adviser to (i) execute such transactions for all of the participating investment accounts, including the Company’s, on a fair and equitable basis, taking into account such factors as the relative amounts of capital available for new investments and the investment programs and portfolio positions of the Company, the clients for which participation is appropriate and any other factors deemed appropriate and (ii) endeavor to obtain the advice of Adviser personnel not directly involved with the investment giving rise to the conflict as to such appropriateness and other factors as well as the fairness to all parties of the investment and its terms. We intend to make all of our investments in compliance with the Company Act and in a manner that will not jeopardize our status as a BDC or RIC.

As a BDC, we are permitted under the Company Act to borrow funds to finance portfolio investments. To enhance our opportunity for gain, we intend to employ leverage as market conditions permit, but, as required under the Company Act, in no event will our leverage exceed 50% of the value of our assets. While we have not yet determined the amount of leverage we will use, we do not currently anticipate that we would approach the 50% maximum level frequently or at all. The use of leverage, although it may increase returns, may also increase the risk of loss to our investors, particularly if the level of our leverage is high and the value of our investments declines.

Revenues

We plan to generate revenue in the form of dividends, interest and capital gains. In addition, we may generate revenue from our portfolio companies in the form of commitment, origination, structuring or diligence fees, monitoring fees, fees for providing managerial assistance and possibly consulting fees and performance-based fees. Any such fees will be recognized as earned.

Expenses

Our primary operating expenses will be the payment of advisory fees and other expenses under the proposed investment adviser agreement. The advisory fees will compensate our Adviser for its work in identifying, evaluating, negotiating, executing, monitoring and servicing our investments.

We will bear all other expenses of our operations and transactions, including (without limitation) fees and expenses relating to:

-corporate and organizational expenses relating to offerings of our common stock, subject to limitations included in the investment advisory and management services agreement;

-the cost of calculating our net asset value, including the cost of any third-party valuation services;

-the cost of effecting sales and repurchase of shares of our common stock and other securities;

-investment advisory fees;

-fees payable to third parties relating to, or associated with, making investments and valuing investments, including fees and expenses associated with performing due diligence reviews of prospective investments;

-transfer agent and custodial fees;

-fees and expenses associated with marketing efforts;

-federal and state registration fees;

-federal, state and local taxes;

-independent directors’ fees and expenses;

-costs of proxy statements, stockholders’ reports and notices;

-fidelity bond, directors and officers/errors and omissions liability insurance and other insurance premiums;

-direct costs such as printing, mailing, long distance telephone, and staff;

12

Table of Contents

-fees and expenses associated with independent audits and outside legal costs, including compliance with the Sarbanes-Oxley Act;

-costs associated with our reporting and compliance obligations under the Company Act and applicable federal and state securities laws;

-brokerage commissions for our investments;

-legal, accounting and other costs associated with structuring, negotiating, documenting and completing our investment transactions;

-all other expenses incurred by our Adviser, in performing its obligations, subject to the limitations included in the investment adviser agreement; and

-all other expenses incurred by either our Administrator or us in connection with administering our business, including payments to our Administrator under the administration agreement that will be based upon our allocable portion of its overhead and other expenses incurred in performing its obligations under the administration agreement, including rent and our allocable portion of the costs of compensation and related expenses of our chief executive officer, chief compliance officer and chief financial officer and their respective staffs.

Reimbursement of TFA Associates, LLC for Administrative Services

We will reimburse TFA Associates for the administrative expenses necessary for its performance of services to us. However, such reimbursement will be made at an amount equal to the lower of TFA Associates’ actual costs or the amount that we would be required to pay for comparable administrative services in the same geographic location. Also, such costs will be reasonably allocated to us on the basis of assets, revenues, time records or other reasonable methods. We will not reimburse TFA Associates for any services for which it receives a separate fee or for rent, depreciation, utilities, capital equipment or other administrative items allocated to a controlling person of TFA Associates.

Portfolio and Investment Activity

We commenced operations on September 4, 2012. As a newly-organized investment company, we have not yet made any portfolio investments.

The following table summarizes the amortized cost and the fair value of investments and cash and cash equivalents as of September 30, 2012:

| Amortized Cost |

Percentage of Total |

Fair Value | Percentage of Total |

|||||||||||||||||

| Cash and Cash Equivalents |

$ | 33,566 | 100.0 | % | $ | 33,566 | 100.0 | % | ||||||||||||

|

Total |

$ | 33,566 | 100.0 | % | $ | 33,566 | 100.0 | % | ||||||||||||

As of September 30, 2012, as no investments have been made, there is no data on portfolio weighted average yield or interest rates.

Triton Pacific Adviser plans to regularly assess the risk profile of each of our debt investments and rates each of them based on the following categories, which we refer to as Triton Pacific Adviser investment credit rating:

| Credit Rating |

Definition | |

| 1 |

Investments that are performing above expectations. | |

| 2 |

Investments that are performing within expectations, with risks that are neutral or favorable compared to risks at the time of origination. All new loans are rated ‘2’. | |

| 3 |

Investments that are performing below expectations and that require closer monitoring, but where no loss of interest, dividend or principal is expected. Companies rated ‘3’ may be out of compliance with financial covenants; however, loan payments are generally not past due. | |

13

Table of Contents

| 4 | Investments that are performing below expectations and for which risk has increased materially since origination. Some loss of interest or dividend is expected but no loss of principal. In addition to the borrower being generally out of compliance with debt covenants, loan payments may be past due (but generally not more than 180 days past due). | |

| 5 |

Investments that are performing substantially below expectations and whose risks have increased substantially since origination. Most or all of the debt covenants are out of compliance and payments are substantially delinquent. Some loss of principal is expected. | |

Results of Operations

We commenced principal operations on September 4, 2012, and therefore have no prior periods with which to compare our operating results.

Operating results for the three and nine months ended September 30, 2012 are as follows:

| For the three months ended September 30, 2012 |

For the nine months ended September 30, 2012 |

|||||||

| Total investment income (loss) |

$ | 0 | $ | 0 | ||||

|

Total expenses, net |

35,170 | 36,225 | ||||||

|

Net investment income (loss) |

(35,170 | ) | (36,225 | ) | ||||

|

Net realized gains (losses) |

0 | 0 | ||||||

|

Net unrealized gains (losses) |

0 | 0 | ||||||

|

Net decrease in net assets |

$ | (35,170 | ) | $ | (36,225 | ) | ||

Investment Income

For the three and nine months ended September 30, 2012, there was no investment income as no portfolio investments have been made.

Operating Expenses

Total operating expenses after taking into account expense support payments from Triton Pacific Adviser totaled $35,170 for the three months ended September 30, 2012, and consisted of base management fees, adviser and administrator reimbursements, professional fees, insurance expense, directors’ fees and other general and administrative fees. The base management fees for the quarter were $715 and no incentive fee was incurred for the quarter. Triton Pacific Adviser has waived its base management fee for the three months ended September 30, 2012, thus removing the expense for the base management fee.

Total operating expenses after taking into account expense support payments from Triton Pacific Adviser totaled $36,225 for the nine months ended September 30, 2012, and consisted of base management fees, administrator reimbursements, professional fees, insurance expenses, directors’ fees and other general and administrative fees. The base management fees for the period were $715 and no incentive fee was incurred for the quarter. Triton Pacific Adviser has waived its base management fee for the three months ended September 30, 2012, thus removing the expense for the base management fee.

Net Realized Gains/Losses from Investments

We measure realized gains or losses by the difference between the net proceeds from the disposition and the amortized cost basis of investment, without regard to unrealized gains or losses previously recognized.

During the three and nine months ended September 30, 2012, there were no realized gains or losses.

14

Table of Contents

Net Unrealized Appreciation/Depreciation on Investments

Net change in unrealized appreciation on investments reflects the net change in the fair value of our investment portfolio. For the three and nine months ended September 30, 2012, there were no unrealized gains or losses.

Changes in Net Assets

For the three months ended September 30, 2012, we recorded a net loss of $35,170 versus a net loss of $36,225 for the nine months ended September 30, 2012. Based on 7,500 and 7,500 weighted average common shares outstanding for the three and nine months ended September 30, 2012, respectively, our per share net decrease in net assets was $4.69 for the three months ended September 30, 2012 versus a per share net decrease in net assets of $4.83 for the nine months ended September 30, 2012.

Financial Condition, Liquidity and Capital Resources

We will generate cash primarily from the net proceeds of this offering, and from cash flows from fees (such as management fees), interest and dividends earned from our investments and principal repayments and proceeds from sales of our investments. Our primary use of funds will be investments in companies, and payments of our expenses and distributions to holders of our common stock.

This is a continuous offering of our shares. We will file post-effective amendments to the registration statement to allow us to continue this offering for at least two years. The Dealer Manager is not required to sell any specific number or dollar amount of shares but will use its best efforts to sell the shares offered. The minimum investment in shares of our common stock is $5,000. We will not sell any shares unless we raise gross offering proceeds of $2.5 million, all of which must be from persons who are not affiliated with us or Triton Pacific Adviser, which we refer to as the minimum offering requirement. Pending satisfaction of this condition, all subscription payments will be placed in an account held by the escrow agent, City National Bank, in trust for our subscribers’ benefit, pending release to us. If we do not satisfy the minimum offering during the time period of the continuous offering, we will promptly return all funds in the escrow account (including interest). We will not deduct any fees or expenses if we return funds from the escrow account. At such time as we have met our minimum offering requirement, subscription funds held by City National Bank will be released from escrow to us within approximately 30 days and investors with subscription funds held in the escrow will be admitted as stockholders as soon as practicable, but in no event later than 10 days after such release.

Subsequent to obtaining the minimum offering requirement, we will sell our shares on a continuous basis at a price of $15.00; however, if our net asset value per share increases above $15.00 per share by more than 10%, we will increase the offering price to a price which, after deduction of the sales load, it will be at least equal to our net asset value per share. In connection with each closing on the sale of shares of our common stock pursuant to this prospectus, our board of directors or a committee thereof is required to make the determination within 48 hours of the time that we price our shares for sale that we are not selling shares of our common stock at a price materially below our then current net asset value per share. Prior to each closing, to the extent we are required to do so under applicable disclosure obligations, we will provide updates, including with regard to any changes in the offering price per share, by filing a prospectus supplement with the SEC, and we will also post any updated information to our website.

We may borrow funds to make investments at any time, including before we have fully invested the proceeds of this offering, to the extent we determine that additional capital would allow us to take advantage of investment opportunities, or if our board of directors determines that leveraging our portfolio would be in our best interests and the best interests of our stockholders. We have not yet decided, however, whether, and to what extent, we will finance portfolio investments using debt. We do not currently anticipate issuing any preferred stock.

Contractual Obligations

We have entered into certain contracts under which we have material future commitments. On July 27, 2012, we entered into the investment advisory agreement with Triton Pacific Adviser, LLC in accordance with the 1940 Act. The investment advisory agreement is effective as of the date that we meet the minimum offering requirement. Triton Pacific Adviser will serve as our investment advisor in accordance with the terms of our investment advisory agreement. Payments under our investment advisory agreement in each reporting period will consist of (i) a management fee equal to a percentage of the value of our gross assets and (ii) a capital gains incentive fee based on our performance.

15

Table of Contents

On July 27, 2012, we entered into the administration agreement with TFA Associates, LLC pursuant to which TFA Associates furnishes us with administrative services necessary to conduct our day-to-day operations. TFA Associates is reimbursed for administrative expenses it incurs on our behalf in performing its obligations. Such costs are reasonably allocated to us on the basis of assets, revenues, time records or other reasonable methods. We do not reimburse TFA Associates for any services for which it receives a separate fee or for rent, depreciation, utilities, capital equipment or other administrative items allocated to a controlling person of TFA Associates. At the time of this offering, our Administrator has contracted with Bank of New York Mellon and affiliated entities to provide additional compliance and administrative services, while we have directly engaged Bank of New York Mellon and affiliated entities to act as our custodian.

If any of our contractual obligations discussed above are terminated, our costs may increase under any new agreements that we enter into as replacements. We would also likely incur expenses in locating alternative parties to provide the services we expect to receive under the investment advisory agreement and administration agreement. Any new investment advisory agreement would also be subject to approval by our stockholders.

Off-Balance Sheet Arrangements

Other than contractual commitments and other legal contingencies incurred in the normal course of our business, we do not have any off-balance sheet financings or liabilities.

Distributions

We intend to elect to be treated, beginning with our fiscal year ending December 31, 2012, and intend to qualify annually thereafter, as a RIC under the Code. To obtain and maintain RIC tax treatment, we must, among others things, distribute at least 90% of our net ordinary income and net short-term capital gains in excess of net long-term capital losses, if any, to our stockholders. In order to avoid certain excise taxes imposed on RICs, we must distribute during each calendar year an amount at least equal to the sum of: (i) 98% of our ordinary income for the calendar year, (ii) 98.2% of our capital gains in excess of capital losses for the one-year period generally ending on October 31 of the calendar year (unless an election is made by us to use our taxable year) and (iii) any ordinary income and net capital gains for preceding years that were not distributed during such years and on which we paid no federal income tax.

While we intend to distribute any income and capital gains in the manner necessary to minimize imposition of the 4% U.S. federal excise tax, sufficient amounts of our taxable income and capital gains may not be distributed to avoid entirely the imposition of the tax. In that event, we will be liable for the tax only on the amount by which we do not meet the foregoing distribution requirement.

We intend to authorize, declare and pay distributions quarterly as soon as practicable after we have obtained the minimum offering requirement. Subject to our board of directors’ discretion and applicable legal restrictions, our board of directors intends to authorize and declare a quarterly distribution amount per share of our common stock. We will then calculate each stockholder’s specific distribution amount for the quarter using record and declaration dates and the distributions will begin to accrue on the date we accept a subscription for shares of our common stock. From time to time, we may also pay interim distributions at the discretion of our board. Each year a statement on Internal Revenue Service Form 1099-DIV (or any successor form) identifying the source of the distribution (i.e., paid from ordinary income, paid from net capital gain on the sale of securities, and/or a return of paid-in capital surplus which is a nontaxable distribution) will be mailed to our stockholders. Our distributions may exceed our earnings, especially during the period before we have substantially invested the proceeds from this offering. As a result, a portion of the distributions we make may represent a return of capital for tax purposes.

We have adopted an “opt in” distribution reinvestment plan for our common stockholders. As a result, if we make a distribution, then stockholders will receive distributions in cash unless they specifically “opt in” to the distribution reinvestment plan so as to have their cash distributions reinvested in additional shares of our common stock. Any distributions reinvested under the plan will nevertheless remain taxable to U.S. stockholders.

16

Table of Contents

No distributions were declared for the three months ended September 30, 2012 or for the nine months ended September 30, 2012.

Related Party Transactions

We have entered into an investment and advisory agreement with Triton Pacific Adviser in which our senior management holds equity interest. Members of our senior management also serve as principals of other investment managers affiliated with Triton Pacific Adviser that do and may in the future manage investment funds, accounts or other investment vehicles with investment objectives similar to ours.

We have entered into an administration agreement with TFA Associates in which our senior management holds equity interest and act as principals.

We have entered into a dealer manager agreement with Triton Pacific Securities, LLC and will pay them a fee of up to 10% of gross proceeds raised in the offering, some of which will be re-allowed to other participating broker-dealers. Triton Pacific Securities, LLC is an affiliated entity of Triton Pacific Adviser.

We have entered into a license agreement with Triton Pacific Group, Inc. under which Triton Pacific Group, Inc. has agreed to grant us a non-exclusive, royalty-free license to use the name “Triton Pacific” for specified purposes in our business. Under this agreement, we will have a right to use the “Triton Pacific” name, subject to certain conditions, for so long as Triton Pacific Adviser or one of its affiliates remains our investment advisor. Other than with respect to this limited license, we will have no legal right to the “Triton Pacific” name.

Management Fee

Pursuant to the investment adviser agreement, we will pay our Adviser a fee for investment advisory and management services consisting of two components—a base management fee and an incentive fee.

The base management fee will be calculated at a quarterly rate of 0.5% of our average gross assets (including amounts borrowed for investment purposes) and payable quarterly in arrears. For the first quarter of our operations, the base management fee will be calculated based on the initial value of our gross assets. Subsequently, the base management fee for any calendar quarter will be calculated based on the average value of our gross assets at the end of that and the immediately preceding quarters, appropriately adjusted for any share issuances or repurchases during that quarter. The base management fee may or may not be taken in whole or in part at the discretion of our Adviser. All or any part of the base management fee not taken as to any quarter shall be accrued without interest and may be taken in such other quarter as our Adviser shall determine. The base management fee for any partial quarter will be appropriately pro-rated.

Though, in accordance with the Advisers Act, the Adviser is entitled to an incentive fee on both current income earned and income from capital gains, the Adviser has agreed to waive its right to any incentive fees from current income. As such, the Adviser will be paid an incentive fee only upon the realization of a capital gain from the sale of an investment. The incentive fee will be calculated and payable quarterly in arrears or as of the date of our liquidation or the termination of the investment adviser agreement, and will equal 20% of our realized capital gains on a cumulative basis from inception through the end of each quarter, computed net of all realized capital losses and unrealized capital depreciation on a cumulative basis, less the aggregate amount of any previously paid capital gain incentive fees.

For purposes of the foregoing: (1) the calculation of the incentive fee shall include any capital gains that result from cash distributions that are treated as a return of capital, (2) any such return of capital will be treated as a decrease in our cost basis for the relevant investment and (3) all fiscal year-end valuations will be determined by us in accordance with GAAP, applicable provisions of the Company Act and our pricing procedures. In determining the incentive fee payable to our Adviser, we will calculate the aggregate realized capital gains, aggregate realized capital losses and aggregate unrealized capital depreciation, as applicable, with respect to each of the investments in our portfolio. For this purpose, aggregate realized capital gains, if any, will equal the sum of the positive differences between the net sales prices of our investments, when sold, and the cost of such investments since inception. Aggregate realized capital losses will equal the sum of the amounts by which the net sales prices of our investments, when sold, is less than the original cost of such investments since inception. Aggregate unrealized capital

17

Table of Contents

depreciation will equal the sum of the difference, if negative, between the valuation of each investment as of the applicable date and the original cost of such investment. At the end of the applicable period, the amount of capital gains that serves as the basis for our calculation of the capital gains incentive fee will equal the aggregate realized capital gains less aggregate realized capital losses and less aggregate unrealized capital depreciation with respect to our portfolio investments. If this number is positive at the end of such period, then the incentive fee for such period will be equal to 20% of such amount, less the aggregate amount of any incentive fees paid in all prior periods.

The organizational and offering expense and other expense reimbursements may include a portion of costs incurred by our Adviser or its members or affiliates on our behalf for legal, accounting, printing and other offering expenses, including for marketing, salaries and direct expenses of its employees, employees of its affiliates and others while engaged in registering and marketing the shares of our common stock, which shall include development of marketing and marketing presentations and training and educational meetings and generally coordinating the marketing process for us and may also include amounts reimbursed by us to our Dealer Manager for actual bona fide due diligence expenses incurred by our Dealer Manager or participating broker-dealers in an aggregate amount that is reasonable in relation to the gross proceeds raised in this Offering and which are supported by detailed, itemized invoices. None of the reimbursements referred to above will exceed actual expenses incurred by our Adviser, its members or affiliates. Our Adviser will reimburse to us, without recourse or reimbursement by us, any organizational and offering expenses to the extent those expenses, when aggregated with sales load, exceed 15.0%.

Critical Accounting Policies

This discussion of our expected operating plans is based upon our expected financial statements, which will be prepared in accordance with accounting principles generally accepted in the United States, or GAAP. The preparation of these financial statements will require our management to make estimates and assumptions that affect the reported amounts of assets, liabilities, revenues and expenses. Changes in the economic environment, financial markets and any other parameters used in determining such estimates could cause actual results to differ. In addition to the discussion below, we will describe our critical accounting policies in the notes to our future financial statements.

Valuation of Investments

Our board of directors has established procedures for the valuation of our investment portfolio. These procedures are detailed below.

Investments for which market quotations are readily available will be valued at such market quotations. For most of our investments, market quotations will not be available. With respect to investments for which market quotations are not readily available or when such market quotations are deemed not to represent fair value, our board of directors has approved a multi-step valuation process each quarter, as described below:

| 1. | Each portfolio company or investment will be valued by our Adviser, potentially with assistance from one or more independent valuation firms engaged by our board of directors; |

| 2. | the independent valuation firm, if involved, will conduct independent appraisals and make an independent assessment of the value of each investment; |

| 3. | the audit committee of our board of directors will review and discusses the preliminary valuation prepared by our Adviser and that of the independent valuation firm, if any; and |

| 4. | the board of directors will discuss the valuations and determine the fair value of each investment in our portfolio in good faith based on the input of our Adviser, the independent valuation firm, if any, and the audit committee. |

Investments will be valued utilizing a cost approach, a market approach, an income approach, or a combination of approaches, as appropriate. The cost approach is most likely only to be used early in the life of an investment or if we determine that there has been no material change in the investment since purchase. The market

18

Table of Contents

approach uses prices and other relevant information generated by market transactions involving identical or comparable assets or liabilities (including a business). The income approach uses valuation techniques to convert future amounts (for example, cash flows or earnings) to a single present value amount, calculated using an appropriate discount rate. The measurement is based on the net present value indicated by current market expectations about those future amounts. In following these approaches, the types of factors that we may take into account in fair value pricing our investments include, as relevant: available current market data, including relevant and applicable market trading and transaction comparables, applicable market yields and multiples, security covenants, call protection provisions, information rights, the nature and realizable value of any collateral, the company’s ability to make payments, its earnings and discounted cash flows, the markets in which the company does business, comparisons of financial ratios of peer companies that are public, M&A comparables, the principal market and enterprise values, among other factors.

We have adopted Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 820, Fair Value Measurements and Disclosures (formerly Statement of Financial Accounting Standards No. 157, Fair Value Measurements), which defines fair value, establishes a framework for measuring fair value in accordance with generally accepted accounting principles and expands disclosures about fair value measurements.

ASC Topic 820 provides a consistent definition of fair value which focuses on exit price and prioritizes, within a measurement of fair value, the use of market-based inputs over entity-specific inputs. It defines fair value as the price an entity would receive when an asset is sold or when a liability is transferred in an orderly transaction between market participants at the measurement date. In addition, ASC Topic 820 provides a framework for measuring fair value and establishes a three-level hierarchy for fair value measurements based upon the transparency of inputs to the valuation of an asset or liability as of the measurement date. The three levels of valuation hierarchy established by ASC Topic 820 are defined as follows:

Level 1: Quoted prices in active markets for identical assets or liabilities, accessible by the company at the measurement date.

Level 2: Quoted prices for similar assets or liabilities in active markets, or quoted prices for identical or similar assets or liabilities in markets that are not active, or other observable inputs other than quoted prices.

Level 3: Unobservable inputs for the asset or liability.

In all cases, the level in the fair value hierarchy within which the fair value measurement in its entirety falls has been determined based on the lowest level of input that is significant to the fair value measurement. Our assessment of the significance of a particular input to the fair value measurement in its entirety requires judgment and considers factors specific to each investment.

In accordance with ASC Topic 820, the fair value of our investments is defined as the price that we would receive upon selling an investment in an orderly transaction to an independent buyer in the principal or most advantageous market in which that investment is transacted.

Revenue Recognition

We record interest income on an accrual basis to the extent that we expect to collect such amounts. For loans and debt securities with contractual PIK interest, which represents contractual interest accrued and added to the principal balance, we generally will not accrue PIK interest for accounting purposes if the portfolio company valuation indicates that such PIK interest is not collectible. We do not accrue as a receivable interest on loans and debt securities for accounting purposes if we have reason to doubt our ability to collect such interest. Original issue discounts, market discounts or premiums are accreted or amortized using the effective interest method as interest income. We record prepayment premiums on loans and debt securities as interest income. Dividend income, if any, is recognized on an accrual basis to the extent that we expect to collect such amount.

19

Table of Contents

Net Realized Gains or Losses and Net Change in Unrealized Appreciation or Depreciation

We will measure net realized gains or losses by the difference between the net proceeds from the repayment or sale and the amortized cost basis of the investment, without regard to unrealized appreciation or depreciation previously recognized, but considering unamortized upfront fees and prepayment penalties. Net change in unrealized appreciation or depreciation will reflect the change in portfolio investment values during the reporting period, including any reversal of previously recorded unrealized appreciation or depreciation, when gains or losses are realized.

Payment-in-Kind Interest

We may have investments in our portfolio that contain a PIK interest provision. Any PIK interest will be added to the principal balance of such investments and is recorded as income, if the portfolio company valuation indicates that such PIK interest is collectible. In order to maintain our status as a RIC, substantially all of this income must be paid out to stockholders in the form of dividends, even if we have not collected any cash.

Organization and Offering Expenses

The Company has incurred certain expenses in connection with the registration of shares of its common stock for sale as discussed in Note 1 – Description of Business and Summary of Significant Accounting Policies. These costs principally relate to professional fees, fees paid to the SEC and fees paid to the Financial Industry Regulatory Authority. These costs were included in deferred offering costs in the accompanying balance sheets. Simultaneous with the sale of common shares, the deferred offering costs will be reclassified to stockholders’ equity upon the issuance of shares.

Federal Income Taxes

We intend to elect to be treated for federal income tax purposes, and intend to qualify annually thereafter, as a RIC under Subchapter M of the Code. As a RIC, we generally will not have to pay corporate-level federal income taxes on any ordinary income or capital gains that we distribute to our stockholders from our tax earnings and profits. To obtain and maintain our RIC tax treatment, we must, among other things, meet specified source-of-income and asset diversification requirements and distribute annually at least 90% of our ordinary income and realized net short-term capital gains in excess of realized net long-term capital losses, if any.

Recent Developments

On July 21, 2010, the President signed into law the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”). The Dodd-Frank Act institutes a wide range of reforms that will have an impact on all financial institutions. Many of the requirements called for in the Dodd-Frank Act will be implemented over time, most of which will be subject to implementing regulations over the course of several years. Given the uncertainty associated with the manner in which the provisions of the Dodd-Frank Act will be implemented by the various regulatory agencies and through regulations, the full impact such requirements will have on our business, results of operations or financial condition is unclear.

The Jumpstart Our Business Startups Act (the “JOBS Act”) became law on April 5, 2012. The JOBS Act substantially reduces the regulatory burdens on “emerging growth companies” (companies with less than $1 billion in annual revenue) during and following an IPO, and also substantially relaxes restrictions on communications with potential investors in the context of both public and private offerings. Many provisions of the JOBS Act, including the new relaxed standards for emerging growth companies, were immediately effective and did not require further SEC rulemaking. Certain other provisions, including the elimination of restrictions on publicity in connection with certain private offerings, will not become effective until the SEC adopts implementing rules. We believe we will qualify as an “emerging growth company.”

Item 3: Quantitative and Qualitative Disclosures About Market Risk.

Our current primary market risk is the lack of liquidity in the marketplace which could prevent us from raising sufficient funds to adequately invest in a broad pool of assets. We are subject to other financial market risks, including changes in interest rates. However, at this time, with no portfolio investments, this risk is immaterial.

20

Table of Contents

Item 4: Controls and Procedures.

Disclosure Controls

In accordance with Rules 13a-15(b) and 15d-15(b) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), we, under the supervision and with the participation of our Chief Executive Officer and Chief Financial Officer, carried out an evaluation of the effectiveness of our disclosure controls and procedures (as defined in Rule 13a-15(e) and Rule 15d-15(e) of the Exchange Act) as of the end of the period covered by this Quarterly Report on Form 10-Q and determined that the disclosure controls and procedures are effective.

Change In Internal Control Over Financial Reporting

No change occurred in our internal control over financial reporting (as defined in Rule 13a-15(f) and 15d-15(f) of the Exchange Act) during the three months ended September 30, 2012 that has materially affected, or is reasonably likely to materially affect, our internal control over financial reporting.

The Company is not currently subject to any legal proceedings, nor, to our knowledge, are any legal proceedings threatened against us or our subsidiaries.

In addition to other information set forth in this report, you should carefully consider the “Risk Factors” discussed in our final post-effective, amended prospectus dated October 26, 2012, filed with the SEC on October 31, 2012, which could materially affect our business, financial condition and/or operating results. Additional risks or uncertainties not currently known to us or that we currently deem to be immaterial also may materially affect our business, financial condition and/or operating results.

Item 2: Unregistered Sales of Equity Securities and Use of Proceeds.

On May 3, 2012, we sold 7,500 shares of our common stock for aggregate gross proceeds of $101,243 to Triton Pacific Adviser. These shares were purchased at $13.50 per share, which represents the initial public offering price of $15.00 per share minus selling commissions of $1.05 per share and dealer manager fees of $0.45 per share. The shares were sold pursuant to the exemption from registration found in Section 4(2) of the Securities Act of 1933, as amended.

Item 3: Defaults Upon Senior Securities.

None.

Item 4: Mine Safety Disclosures.

None.

None.

21

Table of Contents

EXHIBIT INDEX

| Number |

Description | |

| 31.1 | Certification by Chief Executive Officer pursuant to Exchange Act Rule 13a-14(a), as adopted pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 | |

| 31.2 | Certification by Chief Financial Officer pursuant to Exchange Act Rule 13a-14(a), as adopted pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 | |

| 32.1 | Certification pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. |

22

Table of Contents

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| Dated: November 13, 2012 | Triton Pacific Investment Corporation, Inc. | |||||

| By | /s/ Craig J. Faggen | |||||

| Craig J. Faggen | ||||||

| Chief Executive Officer (Principal Executive Officer) | ||||||

| Dated: November 13, 2012 | By | /s/ Michael L. Carroll | ||||

| Michael L. Carroll | ||||||

| Chief Financial Officer (Principal Accounting and Financial Officer) | ||||||

23