Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - HD SUPPLY, INC. | d435641d8k.htm |

A

Portfolio of Best-in-Class A Portfolio of Best-in-Class

Industrial Distributors

Industrial Distributors

6

November,

2012

Exhibit 99.1

th |

2

Disclaimer

This presentation includes forward-looking information. Forward-looking

statements are subject to known and unknown risks and uncertainties, many of

which may be beyond our control. We caution you that the forward-looking information presented

in this presentation is not a guarantee of future performance and that our actual

results of operations, financial condition and liquidity, and the development

of the industries in which we operate may differ materially from those made in or suggested by

the forward-looking information contained in this presentation. A number

of important factors could cause actual results to

differ materially from those contained in or implied by the forward-looking

statements, including those factors discussed in our annual report on Form

10K filed March 23, 2012 and subsequent filings with the SEC. Any forward-looking information

presented herein is made only as of the date of this presentation, and we do not

undertake any obligation to update or revise any forward-looking

information to reflect changes in assumptions, the occurrence of unanticipated events, changes in future

operating results over time or otherwise. Comparisons of results

for current and any prior periods are not intended to express

any future trends or indications of future performance, unless expressed as such,

and should only be viewed as historical data.

In addition to disclosing financial results that are determined in accordance with

U.S. generally accepted accounting principles (“GAAP”), the Company

also disclosed in this presentation certain non-GAAP financial information including Adjusted

EBITDA. These financial measures are not recognized measures under GAAP, and

are not intended to be and should not be considered in isolation or as a

substitute for, or superior to, the financial information prepared and presented in accordance

with GAAP. |

3

Agenda

2.

Market Opportunity

3.

Differentiated Growth

4.

Financial Performance

5.

Key Messages

1.

1.

HD

HD

Supply

Supply

Overview

Overview |

4

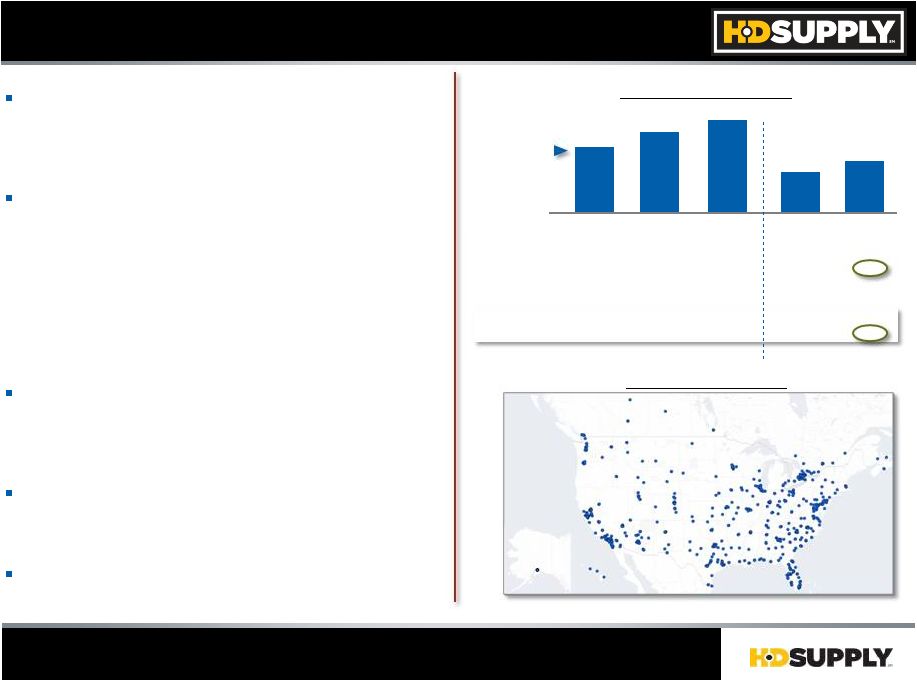

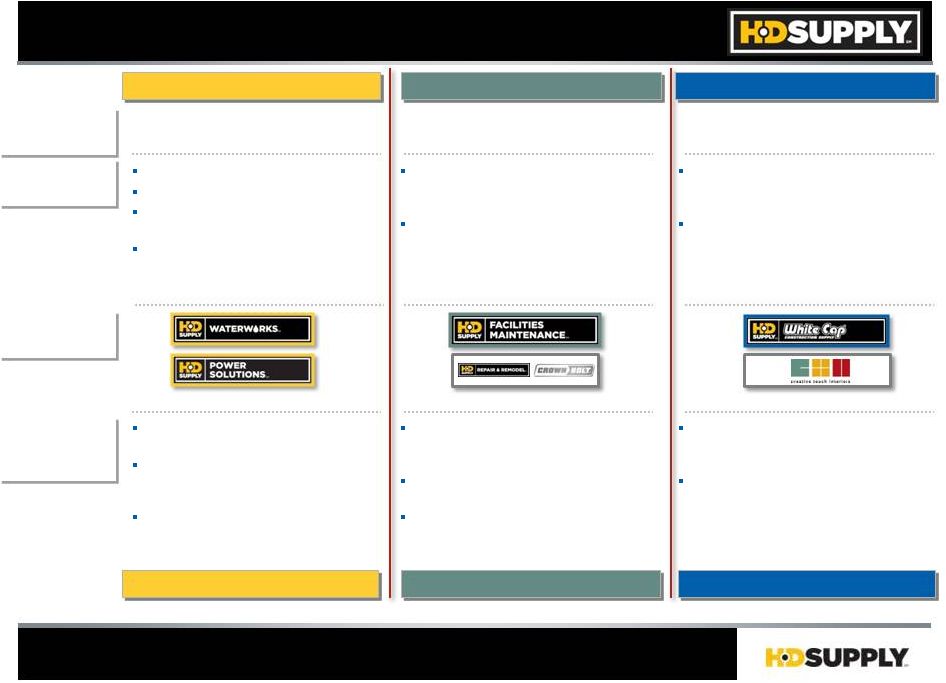

Portfolio of Best-in-Class Industrial Distributors

At a Glance

A Portfolio of Best-in-Class

Industrial Distributors

Serving the Large and Highly

Fragmented

U.S.

and

Canadian

Infrastructure,

MRO

and

Construction

Sectors

Diverse

Portfolio

of Distribution Businesses that

Provide

Approximately

1

Million

SKUs

to

440,000

Professional

Customers,

Including

Contractors,

Government Entities, Maintenance

Professionals,

Home

Builders

and

Industrial

Businesses

–

Operate Approximately 630 Locations Across 46 U.S.

States and 9 Canadian Provinces

Broad Diversity in Product Portfolio, Customer

Base and Vendor Relationships Reduces the

Company’s

Exposure

to

Any

Single

Segment,

Product or Customer

Size, Scale

and National Presence Drive

Competitive Advantage in Large, Fragmented

Markets

Talent with Deep, Relevant Experience;

Pervasive Training

Financial Summary

Financial Summary

Gross Profit

GM %

Adj. EBITDA %

Cash Flow

Sales % VPY

’10A

’11A

$411M

$508M

$1.8B

$2.0B

$0.7B

$0.1B

28.5%

28.7%

2%

9%

6.4%

7.2%

Adj. EBITDA

YTD

Q2’11

YTD

Q2’12

Q2’12

LTM

$582M

$2.1B

$0.2B

28.7%

12%

7.8%

$251M

$325M

$1.0B

($0.1B)

28.5%

7.2%

$1.1B

($0.0B)

28.7%

8.3%

6%

Adj. EBITDA Growth

20%

24%

27%

24%

Sales

$6.4B

$7.0B

$7.4B

$3.5B

$3.9B

National Footprint

National Footprint

Note: HD Supply Operates a Sourcing Office in China

1

See pg. 89 of 10-K Filed March 23, 2012 and pg. 21 of 10-Q Filed

September 4, 2012 for a Discussion of Adj. EBITDA and Reconciliation to Income (Loss) From Continuing Operations

29%

12%

1 |

5

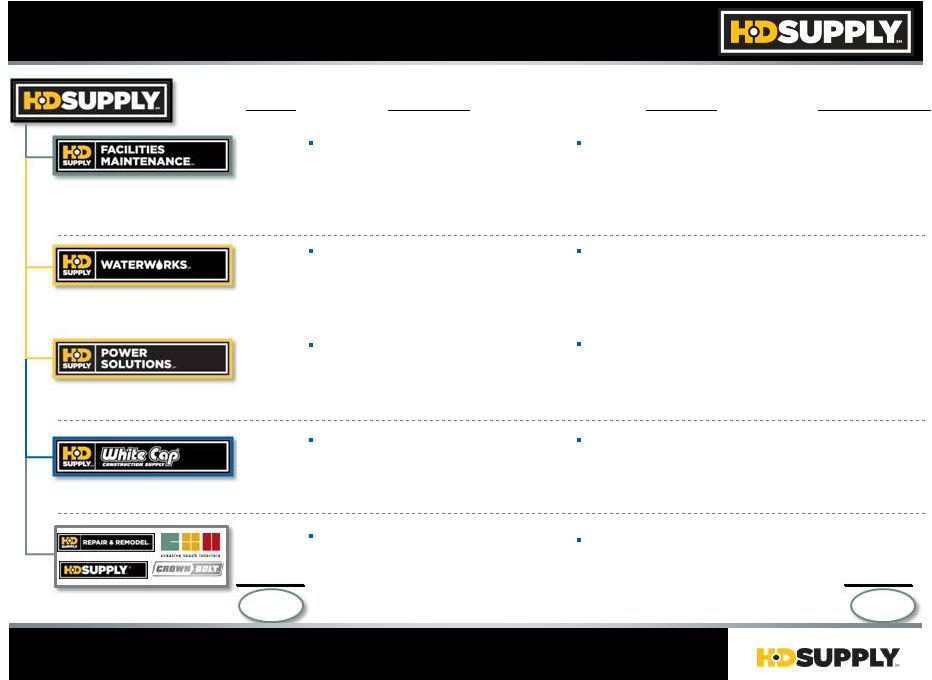

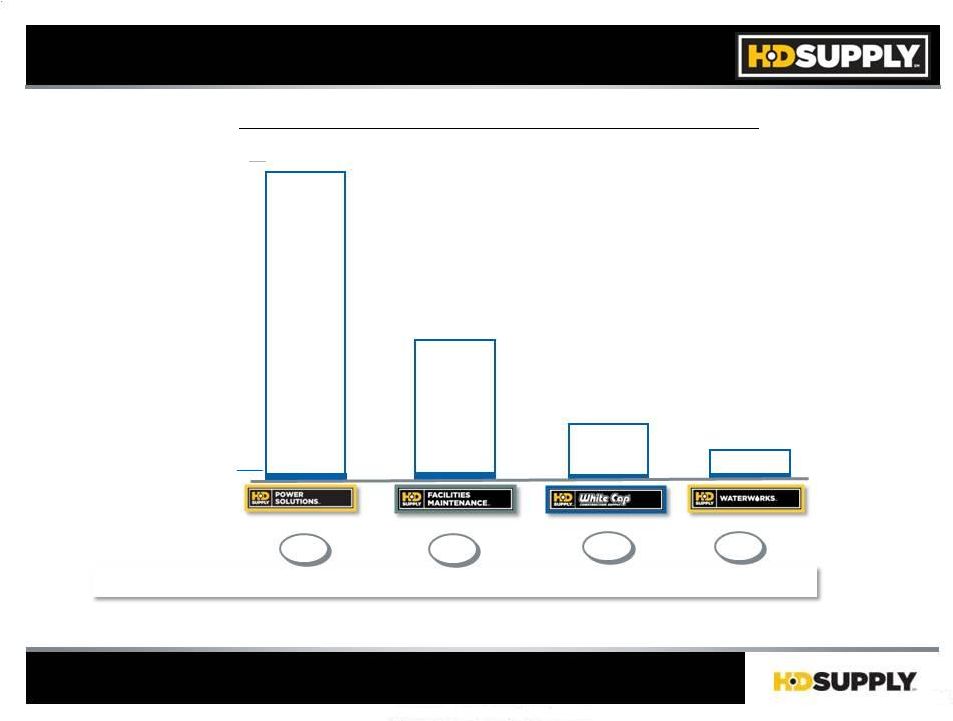

At a Glance

Sales

Products

(’11A)

$1.9B

$1.8B

$1.6B

$0.8B

$1.0B

Market Size

($ in Billions)

$48B

$10B

$110B

$19B

~$190B

Markets

Apartments, Hotels

and Motels,

Assisted

and Independent

Living,

Skilled

Nursing

Facilities,

Government

Housing and Education

Maintenance, Repair and

Improvement

Municipal, Residential, and Non-

Residential Construction

$5B+

Non-Residential Construction,

Electrical Consumption, and

Residential Construction

Non-Residential and Residential

Construction

Repair and Remodel, Residential

Construction, and Non-Residential

Construction

“Maintenance, Repair and

Improvement”

“Infrastructure”

“Specialty Construction”

1

Per Leading Global Consultant

2

Management Estimates

HVAC,

Appliances,

Janitorial

and

Cleaning

Supplies,

Faucets

and

Showerheads,

Kitchen

and

Bath,

Hardware,

Lamps

and

Ballasts,

Electrical, Lighting Fixtures,

Hospitality Supplies, Tools, Textiles,

Paint

and

Sundries

Pipe

(PVC,

Ductile

Iron,

HDPE);

Fittings,

Valves, Fire Protection, Metering

Systems, Storm Drain, Hydrants;

Fusion

Machine Rental, Valve Testing

and Repair

Concrete Related Products, Forming

and Shoring Braces, Chemicals, Power

Tools and Accessories, Wood

Connectors; Equipment Rental, Rebar

and Rebar Fabrication

Building Materials; Fasteners,

Flooring, Countertops, Cabinets

Wire, Hardware, Meters, Transformers,

Connectors, Tools, Protective

Equipment, Molded Rubber, Lighting,

Conduit; Smart Grid Solutions, Project

Services

1

$7.0B

2

Portfolio of Best-in-Class Industrial Distributors |

6

Facilities Maintenance…

At A Glance

#1 Distributor to Multi-Family Properties

Products and

Value-Added Services

Customers and

End Markets

“Go to Market”

Execution

Operating

Model

150,000+ SKUs

Proprietary

Brands

Fabrication

and

Installation

Services

Renovations

Project

Management

95%

of

U.S.

Served

With

Next-Day

Delivery

8 Call Centers

41

istribution

enters

600+

Dedicated

Delivery Trucks

950+ Sales Associates

With Average of

6

Years of Service

Industry Specific

Catalogs, Tabloids,

Product

Guides

and

e-Business Portal

–

HVAC

–

Appliances

–

Janitorial and Cleaning

Supplies

–

Faucets and

Showerheads

–

Kitchen and Bath

Hardware

–

Lamps and Ballasts

Electrical

–

Lighting Fixtures

–

Hospitality Supplies

–

Tools

–

Textiles

–

Paint and Sundries

244,000+ Property

Management

–

Multi-Family

–

Hospitality

–

Healthcare

–

Institutional

$48B Market Size

$1,994M

EBITDA (Adj.

)

VPY

17.3%

Revenue

Adj. EBITDA

Margin %

+13%

+25BPs

$345M

LTM Q2’12

+15%

1

Per Leading Global Consultant

2

See pg. 89 of 10-K Filed March 23, 2012 and pg. 21 of 10-Q Filed

September 4, 2012 for a Discussion of Adj. EBITDA and Reconciliation to Income (Loss) From Continuing Operations

36% of Sales

1

2

D

C |

7

Waterworks…

At A Glance

#1 National Industry Position

Products and

Value-Added Services

Customers and

Customers and

End Markets

End Markets

“Go to Market”

Execution

Operating

Operating

Model

Model

300,000+

SKUs

Nation’s Largest

Distributor of Water,

Sewer, Storm and Fire

Protection Products

96% Fill Rate

235 Locations

44 States

620+

Dedicated

Delivery Trucks

860+ Sales Associates;

With Average of

12

Years of Service

–

Pipe

PVC

Ductile Iron

HDPE

–

Fittings

–

Valves

–

Fire Protection

–

Metering Systems

–

Storm Drain

–

Hydrants

–

Fusion Machine Rental

–

Valve Testing and Repair

45,000 Professional

Contract Customers

–

Municipal

–

Residential

–

Non-Residential

$10B Market Size

Revenue

Adj. EBITDA

Margin %

$1,877M

6.7%

+11%

+78BPs

VPY

$125M

+26%

LTM Q2’12

EBITDA

(Adj.

)

1

Per Leading Global Consultant

2

See pg. 89 of 10-K Filed March 23, 2012 and pg. 21 of 10-Q Filed

September 4, 2012 for a Discussion of Adj. EBITDA and Reconciliation to Income (Loss) From Continuing Operations

Branch Based

Customer Advantage

Programs;

Powerscope…

Since

’93

2

1 |

8

Products and

Value-Added Services

Customers and

End Markets

“Go to Market”

Execution

Operating

Model

200,000+ SKUs

North America’s

Largest Utilities

Distributor

and

Full

Line Electrical

Distributor of

Construction,

Industrial

and

Communications

Products

101 Locations

25 States; 4 Canadian

Provinces

240 Dedicated Delivery

Trucks

550+ Sales Associates

With Average of

11

Years of Service

–

Wire

–

Hardware

–

Meters

–

Transformers

–

Connectors

–

Tools

–

Protective Equipment

–

Molded Rubber

–

Lighting

–

Conduit

–

Smart Grid Solutions

–

Project Services

8,500+ Professional

Contractor Customers

–

Non-Residential

–

Utilities

–

Residential

–

Industrial

$110B Market Size

EBITDA (Adj.

)

VPY

Revenue

Adj. EBITDA

Margin %

LTM Q2’12

1

Per Leading Global Consultant

2

See pg. 89 of 10-K Filed March 23, 2012 and pg. 21 of 10-Q Filed

September 4, 2012 for a Discussion of Adj. EBITDA and Reconciliation to Income (Loss) From Continuing Operations

Power Solutions…

At A Glance

$58M

+12%

$1,670M

3.5%

+7%

+14BPs

MRO

and Safety

Offering

Branch

Based

and

Customer Site

2

1

#1 Leadership Position in U.S. and Canada for Utilities |

9

#1 National Industry Position

Products and

Value-Added Services

Customers and

End Markets

“Go to Market”

Execution

Operating

Model

200,000+ SKUs

Nation’s Leading

Distributor of

Specialty Hardware,

Tools and Materials

134 Locations

31 States

620+ Dedicated

Delivery Trucks

920+ Sales Associates

With

Average

of

9

Years

of Service

53,000 Professional

Contractor Customers

–

Residential

–

Non-Residential

–

Industrial

$19B Market Size

EBITDA (Adj.

)

VPY

Revenue

Adj. EBITDA

Margin %

LTM Q2’12

1

Per Leading Global Consultant

2

See pg. 89 of 10-K Filed March 23, 2012 and pg. 21 of 10-Q Filed

September 4, 2012 for a Discussion of Adj. EBITDA and Reconciliation to Income (Loss) From Continuing Operations

Branch Based;

Open Warehouse

Format

White Cap…

At A Glance

+39x

$39M

$1,083M

3.6%

+22%

+349BPs

Catalog

and

Regional Traders

–

Concrete Related

Products

–

Forming and Shoring

Braces

–

Chemicals

–

Power Tools and

Accessories

–

Building Materials and

Fasteners

–

Erosion and

Waterproofing

–

Safety Products

–

Equipment Rental and

Tool Repair

–

Rebar Fabrication

1

2 |

10

Agenda

1.

HD Supply Overview

2.

2.

Market Opportunity

Market Opportunity

3.

Differentiated Growth

4.

Financial Performance

5.

Key Messages |

~$190B Market Opportunity, Solid Growth Drivers

1

Per Leading Global Consultant; Management Estimates

Infrastructure

Maintenance & Repair

Maintenance & Repair

Specialty Construction

“Endless, Critical Demand”

“Continual Demand”

“Continual Demand”

“Niche Expertise”

11

End Market Overview

1

Market

Opportunity

$120B

$120B

$48B+

$48B+

$19B+

$19B+

Demand

Drivers

Aging Overburdened

Infrastructure

Coverage for Population Growth

Cost-Effective and Efficient

Distribution of Water

and Electricity

Infrastructure Build Out for

Growing

Resource Base of Shale Gas

Maintenance

Required for Existing

Stock

of U.S. Multifamily, Hospitality,

Healthcare

and Institutional

Structures

Repair and Remodel

Construction

Single Family, Multifamily, Commercial,

Municipal and Repair and Remodel

Construction

Infrastructure Build Out for Growing

Resource Base of Shale Gas

HD Supply

Businesses

HD Supply

Competitive

Advantages

Scale, Information

Technology

and

Pricing

Rigor

Deep Customer and Vendor

Relationships with Solution Selling

Capabilities

Industry Leading Management Talent

and Experience

Comprehensive Product

Assortment,

Superior Availability

and Delivery

Time

Differentiation

Superior National

Distribution

Capabilities

Lean

Operating Cost

Structure

Leveraging ERP Technologies

Customer Service Differentiation

(i.e.,

Delivery Times, Sales Expertise, Value-

Added Product)

Product Assortment

and Knowledge |

12

Addressable Opportunities

1

Per Leading Global Consultants

2

Sales for the Year Ending January 29, 2012

3

.Power Solutions is the Largest Utilities Distributor; Facilities Maintenance is the

Largest Distributor to Multifamily Properties $48B

Est. Market Size

HD Supply Sales

2

Share

1

Rank

$1.8B

$10B

18%

#1

#1

~$190B Opportunity…

Leading Positions, Large Opportunities

$1.0B

$19B

5%

#1

#1

($ in billions)

$1.9B

4%

#1

#1

3

$110B

2%

#1

#1

3

$1.6B

Addressable Opportunity and HD Supply’s Position

1 |

13

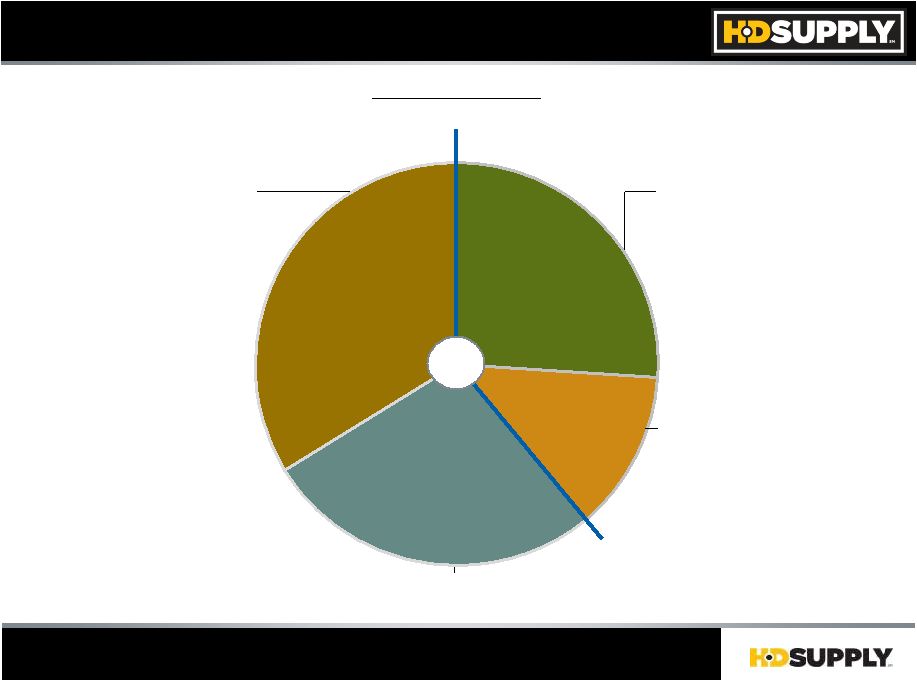

39% Construction, 27% MRO, 34% Infrastructure

End Market Diversity

HD Supply Sales

HD Supply Sales

Estimated % of FYE Jan. ’12 Sales

Construction, 39%

Infrastructure

and Other

34%

MRO

27%

Residential

13%

Non-Residential

26%

$7B |

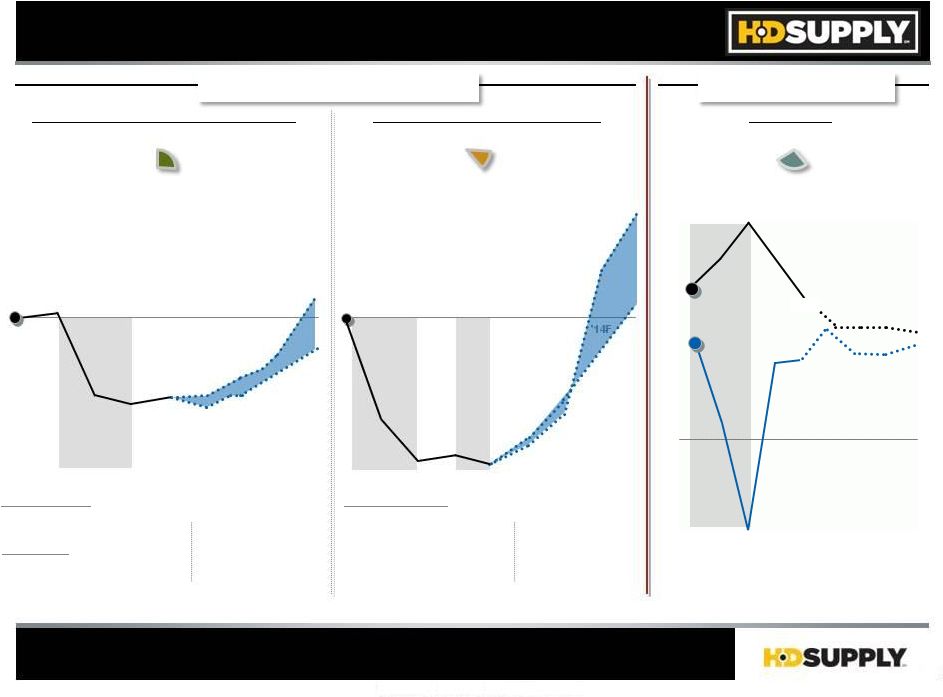

Non-Residential Construction

(26%)

(Construction Spend Change, Index = '07)

Residential Construction (13%)

(SF Housing Starts Change, Index = '07)

Multifamily

Multifamily

(U.S. Apartments

Vacancy Rate; Rev. Per Occupied Stock)

'07A

'08A

'09A

'10A

'11A

'12F

'13F

'14F

'15F

'08A

'09A

'10A

'11A

'13F

'14F

'12F

'15F

'07A

-60%

40%

20%

20%

40%

Spend ($ in billions)

High

$164

Low

$154

$165

$187

$163

$165

$243

$239

Actual

$183

$206

Forecast Range

$156

$209

$260

1,035

431

471

445

616

535

905

642

512

695

1,224

1,095

1,467

Annual SF Starts (000s)

Construction End Markets

Apartment Outlook

End Market Outlook

Growth Projected Going Forward

Sources: Management Estimates Based on Industry Data

Source: REIS (“United States Apartment 2Q 2012 MetroTrend Futures”)

14

5.7%

8.0%

4.1%

'07A

'13F

'12F

'11A

'10A

'09A

'08A

4.8%

(4.3%)

4.0%

'14F

'15F

4.9%

5.2%

Vacancy

Rate

Rev. /

Occupied

Stock |

Agenda

1.

HD Supply Overview

2.

Market Opportunity

3.

3.

Differentiated Growth

Differentiated Growth

4.

Financial Performance

5.

Key Messages

15 |

Increase Share

of Wallet

Sell

More

Products

to

New

Customers

New Product

and

Service

Introduction

Redesign

the

Business

System

by

Which

a

Product

or

Service

is

Delivered

Acquisitions

Enter New

Geographies

Enter

Entire

New

Business

Segment

Strategic Investments Through the Cycle

to Drive ROIC and Scale Differentiation

Differentiated Growth Investments

Sales Training

+10K SKUs Added

Storm Drainage

Fusion

Equipment

Rental

Acquired RAMSCO

to Enter NY State

12

Greenfields

1

Expansion

Oil & Gas

Sales Force

Effectiveness

+11K SKUs Added

e-Commerce

Acquired Peachtree

Business Products

3

Dist. Center

5

Expansions

MSA

Leadership

+3K SKUs Added

Catalog

Introduction

2

Greenfields

2

Expansions

Oil & Gas

Talent…

Product

Specialist

(HDPE) Leader

Talent…

Segment Leaders

Talent…

Executive

Leadership

(President),

Merchandising

Experts

Existing

Customers

New

Customers

New Products

and Services

New Value

Delivery

System

Improve

Industry

Structure

Geographic

Expansion

New

Competitive

Arenas

1

Includes SG&A, Capital and Net Working Capital

Project Services

Automation

Catalog

Introduction

5

Greenfields

1

Expansion

Industrial

Oil & Gas

Sales Force

Effectiveness

Talent…

MRO

Specialist

1

2

3

4

5

6

7

16

~$400M Strategic

Investment

1

Since ’10 |

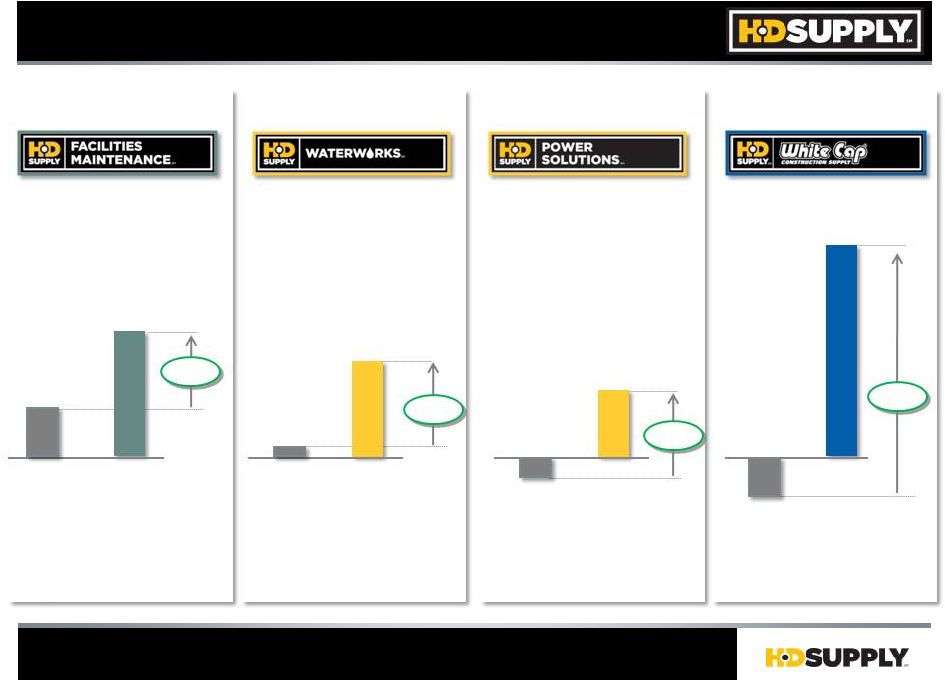

(Organic Sales Growth Versus Market)

Outpace Market Growth…

LTM Q2’12

+11%

+11%

Source: 3

Party Market Sources, Management Estimates

(4%)

(4%)

Market

+22%

+22%

FM

+13%

+13%

+5%

+5%

+8 Pts

+8 Pts

Market

+7%

+7%

(2%)

(2%)

Market

WW

+9 Pts

+9 Pts

+26 Pts

+26 Pts

WC

Market

+1%

+1%

PS

17

+10 Pts

+10 Pts

rd

Total HD Supply… +10 Pts V Estimated Market Growth |

Agenda

1.

HD Supply Overview

2.

Market Opportunity

3.

Differentiated Growth

4.

4.

Financial Performance

Financial Performance

5.

Key Messages

18 |

19

Financial Performance

Gross Profit

GM %

Adj. EBITDA %

Cash Flow

Net Debt

Sales Growth VPY

’10A

’11A

YTD

Q2 ’11

$1.8B

$2.0B

$1.1B

$0.7B

$0.1B

($0.0B)

$5.0B

$5.4B

$5.7B

28.5%

28.7%

28.7%

2%

9%

12%

6.4%

7.2%

8.3%

YTD

Q2 ’12

$1.0B

($0.1B)

$5.4B

28.5%

7.2%

($ in billions,

Except Adj. EBITDA)

6%

Adj. EBITDA

Nine Consecutive Quarters

of Year-Over-Year Sales Growth

LTM

Q2’12

$2.1B

$0.2B

$5.7B

28.7%

12%

7.8%

Adj. EBITDA Growth VPY

20%

24%

29%

24%

27%

$411M

$508M

$582M

$251M

$325M

Sales

$6.4B

$7.0B

$3.9B

$3.5B

$7.4B

1

See pg. 89 of 10-K Filed March 23, 2012 and pg. 21 of 10-Q Filed

September 4, 2012 for a Discussion of Adj. EBITDA and Reconciliation to Income (Loss) From Continuing Operations

1 |

Agenda

1.

HD Supply Overview

2.

Market Opportunity

3.

Differentiated Growth

4.

Financial Performance

5.

5.

Key Messages

Key Messages

20 |

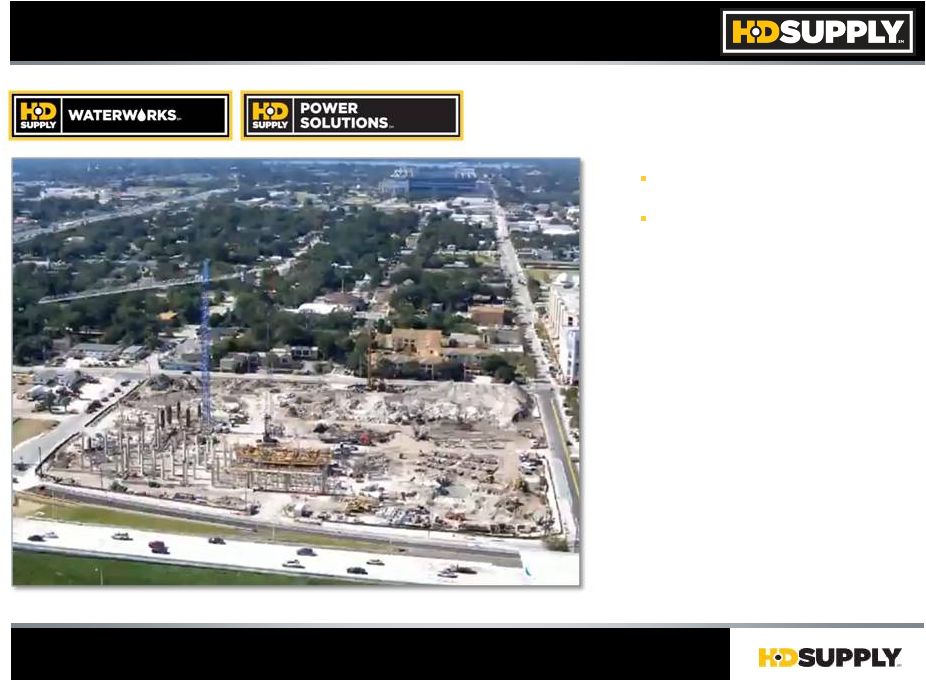

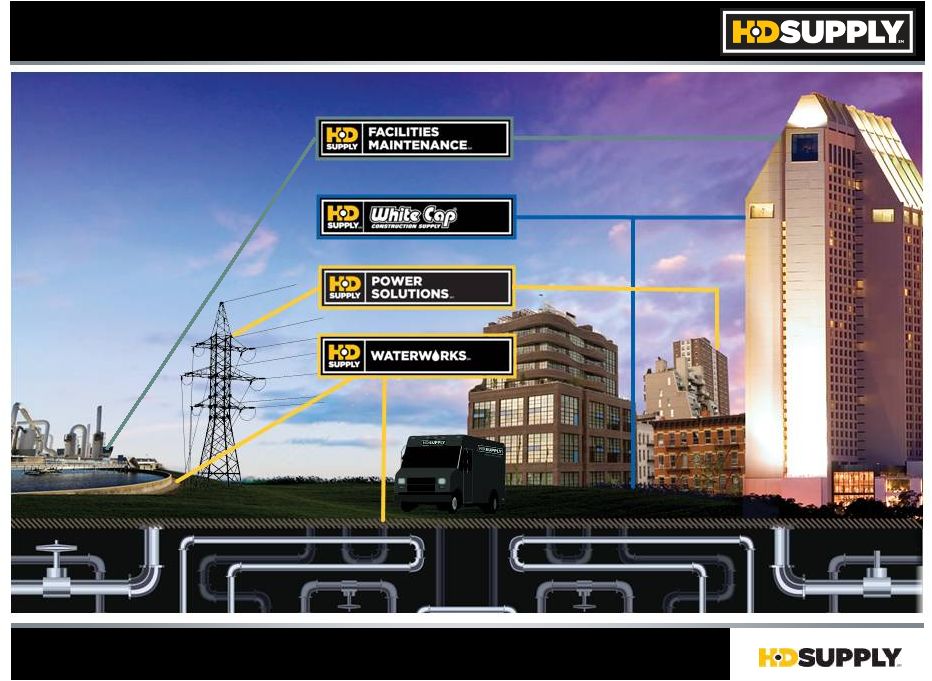

21

Pipe, Meters

and Fire

Hydrants

Utility Cable, Transformers

and Switches

Pipe, Meters

and Fire

Hydrants

Utility Cable, Transformers

and Switches

We Build Your City…

…

and Keep it Running |

22

Concrete, Masonry

Tools

and

Accessories

Specialty Power Tools

Specialty Hardware

and Tools

Safety

Doors, Windows, Building

Materials

Flooring

Concrete, Masonry

Tools

and

Accessories

Specialty Power

Tools

Specialty Hardware

and Tools

Safety

Doors, Windows, Building

Materials

Flooring

Pipe, Meters

and Fire

Hydrants

Utility Cable, Transformers

and Switches

We Build Your City…

…

and Keep it Running |

23

Concrete, Masonry

Tools

and

Accessories

Specialty Power Tools

Specialty Hardware

and Tools

Safety

Doors, Windows, Building

Materials

Flooring

Pipe, Meters

and Fire

Hydrants

Utility Cable, Transformers

and Switches

We Build Your City…

Cleaning

and Hospitality

Products

Upgrade

and Renovation

Services

…

and Keep it Running |

24

Key Messages

1.

We

Had

a

Very

Good

Company

in

’06

in

Strong

Markets…

Great

Company

in

’12,

Obsessed with Being the Best of the Best

2.

We are in the Early Innings of Our Amazing Full Potential

3.

4.

We

Invested Heavily Throughout the Downturn to Extend Our Advantage and Barriers to

Entry… Talent / Training, Technology Platforms, Processes, Products,

Supplier Alignments, Facilities, Geographies and Fleet

5.

Our

Initiative

“Stack”

Ensures

We

Always

Grow

Faster

than

Our

Markets

and

Save

as

We

Grow

6.

Costs

are

Down

and

Capabilities

are

Up...

Q2’12

LTM

Sales

+12%

with

EBITDA

+27%

7.

Distractions

are

Behind

Us

and

We

are

Advantaged

Together

Portfolio of Best-in-Class Industrial Distributors

Our Businesses are Market Leaders in Highly Fragmented

Markets with Large Profit Pools… We Have Unique Capabilities

to Consolidate Markets to Benefit Customers and Investors |

25

We Build Your City…

…

and Keep it Running |

Appendix

Appendix |

27

GAAP Reconciliation

Fiscal

Fiscal

LTM

YTD

YTD

2010

2011

Q2’12

Q2’11

Q2’12

Adjusted Cash Flow

$658

$94

$214

($140)

($20)

Reconciling Items:

Interest Paid

(363)

(356)

(530)

(177)

(351)

Taxes (Paid) Received

216

(5)

(2)

(5)

(2)

Capital Expenditures

49

115

132

35

52

Proceeds from Sale of PPE

(4)

(4)

(2)

(4)

(2)

Management Fees & Expenses

(5)

(5)

(5)

(2)

(2)

Other

(4)

(3)

1

GAAP Operating Cash Flows

$551

($165)

($193)

($296)

($324)

($ in millions)

-

- |

28

Adjusted EBITDA

$411

$508

$582

$251

$325

Reconciling Items:

Depreciation and Amortization

(343)

(329)

(331)

(165)

(167)

Goodwill impairment

Restructuring

(8)

Stock Compensation

(17)

(20)

(21)

(9)

(10)

Management Fee

(5)

(5)

(5)

(3)

(3)

Other

(1)

1

2

1

GAAP Operating Income (Loss)

37

155

227

74

146

Interest Expense, net

(623)

(639)

(646)

(317)

(324)

Gain (loss) on extinguishment of debt

(220)

(220)

Other Income (Expense)

1

(1)

1

GAAP Pre-Tax Income (Loss)

(585)

(484)

(640)

(242)

(398)

Tax Benefit (Expense)

(28)

(79)

(78)

(35)

(34)

GAAP Net Income (Loss) Cont Ops

($613)

($563)

($718)

($277)

($432)

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

Fiscal

Fiscal

LTM

YTD

YTD

2010

2011

Q2’12

Q2’11

Q2’12

($ in millions)

GAAP Reconciliation |

29

$1,500M

($315M)

Drawn

$971M

$1,273M

$675M

$1,000M

$728M

Capital Structure Summary

1

Maturity

Date

Secured Debt:

Funded Debt

4/12/2017

4/15/2019

4/15/2020

10/12/2020

9/1/2015

10/12/2017

S&P

Rating

BB-

B+

CCC+

CCC+

CCC+

B+

Net Debt

Senior Sub. Notes –

Public Owned

4

Senior ABL Facility

Senior

Term

Loan

Sr. Secured 2

Lien Notes

Sr.

Secured

1

Lien

Notes

PIK for min. 5½

years

$5.9B

$5.8B

$348M

$541M

Sr. Notes

7/15/2020

CCC+

–

Sponsor Owned

4

Unsecured Notes:

Senior Notes

–

Sponsor Owned

($ in millions,

other than Funded Debt and Net Debt)

Earliest Maturing Debt... September 2015

Notes

2

3

3

st

nd

3

st

1

As of 7/29/12; Pro Forma for Aug. $300M 1st Lien Add-on and Oct. $1B Senior Note

Offering 2

Drawn

ABL

as

at

7/29/2012

was

$632M.

$315M

reflects

the

use

of

Sr.

Sec.

1

Lien

Add-on

proceeds

to

pay

down

ABL

3

Including Applicable Premiums and Net of Applicable Discounts

4

Net

of

$1B

of

proceeds

from

issuance

of

Senior

Notes

less

initial

purchasers’

commissions

and

accrued

interest

and

redemption

premium

on

Senior

Sub.

Notes |