Attached files

| file | filename |

|---|---|

| EX-99.1 - EARNINGS RELEASE - Approach Resources Inc | d435945dex991.htm |

| 8-K - FORM 8-K - Approach Resources Inc | d435945d8k.htm |

INVESTOR

PRESENTATION

NOVEMBER 2012

Exhibit 99.2 |

Forward Looking-Statements

This

presentation

contains

forward-looking

statements

within

the

meaning

of

Section

27A

of

the

Securities

Act

of

1933

and

Section

21E

of

the

Securities

Exchange

Act

of

1934.

All

statements,

other

than

statements

of

historical

facts,

included

in

this

presentation

that

address

activities,

events

or

developments

that

the

Company

expects,

believes

or

anticipates

will

or

may

occur

in

the

future

are

forward-looking

statements.

Without

limiting

the

generality

of

the

foregoing,

forward-looking

statements

contained

in

this

presentation

specifically

include

the

expectations

of

management

regarding

plans,

strategies,

objectives,

anticipated

financial

and

operating

results

of

the

Company,

including

as

to

the

Company’s

Wolffork

shale

resource

play,

estimated

resource

potential

and

recoverability

of

the

oil

and

gas,

estimated

reserves

and

drilling

locations,

capital

expenditures,

typical

well

results,

and

well

profiles,

type

curve,

and

production

and

operating

expenses

guidance

included

in

the

presentation.

These

statements

are

based

on

certain

assumptions

made

by

the

Company

based

on

management's

experience

and

technical

analyses,

current

conditions,

anticipated

future

developments

and

other

factors

believed

to

be

appropriate

and

believed

to

be

reasonable

by

management.

When

used

in

this

presentation,

the

words

“will,”

“potential,”

“believe,”

“intend,”

“expect,”

“may,”

“should,”

“anticipate,”

“could,”

“estimate,”

“plan,”

“predict,”

“project,”

“target,”

“profile,”

“model”

or

their

negatives,

other

similar

expressions

or

the

statements

that

include

those

words,

are

intended

to

identify

forward-looking

statements,

although

not

all

forward-looking

statements

contain

such

identifying

words.

Such

statements

are

subject

to

a

number

of

assumptions,

risks

and

uncertainties,

many

of

which

are

beyond

the

control

of

the

Company,

which

may

cause

actual

results

to

differ

materially

from

those

implied

or

expressed

by

the

forward-looking

statements.

In

particular,

careful

consideration

should

be

given

to

the

cautionary

statements

and

risk

factors

described

in

the

Company's

most

recent

Annual

Report

on

Form

10-K

and

Quarterly

Reports

on

Form

10-Q.

Any

forward-looking

statement

speaks

only

as

of

the

date

on

which

such

statement

is

made

and

the

Company

undertakes

no

obligation

to

correct

or

update

any

forward-looking

statement,

whether

as

a

result

of

new

information,

future

events

or

otherwise,

except

as

required

by

applicable

law.

2

Cautionary Statements Regarding Oil & Gas Quantities

The

Securities

and

Exchange

Commission

(“SEC”)

permits

oil

and

gas

companies,

in

their

filings

with

the

SEC,

to

disclose

only

proved,

probable

and

possible

reserves

that

meet

the

SEC’s

definitions

for

such

terms,

and

price

and

cost

sensitivities

for

such

reserves,

and

prohibits

disclosure

of

resources

that

do

not

constitute

such

reserves.

The

Company

uses

the

terms

“estimated

ultimate

recovery”

or

“EUR,”

reserve

or

resource

“potential,”

and

other

descriptions

of

volumes

of

reserves

potentially

recoverable

through

additional

drilling

or

recovery

techniques

that

the

SEC’s

rules

may

prohibit

the

Company

from

including

in

filings

with

the

SEC.

These

estimates

are

by

their

nature

more

speculative

than

estimates

of

proved,

probable

and

possible

reserves

and

accordingly

are

subject

to

substantially

greater

risk

of

being

actually

realized

by

the

Company.

EUR

estimates,

potential

drilling

locations

and

resource

potential

estimates

have

not

been

risked

by

the

Company.

Actual

locations

drilled

and

quantities

that

may

be

ultimately

recovered

from

the

Company’s

interest

may

differ

substantially

from

the

Company’s

estimates.

There

is

no

commitment

by

the

Company

to

drill

all

of

the

drilling

locations

that

have

been

attributed

these

quantities.

Factors

affecting

ultimate

recovery

include

the

scope

of

the

Company’s

ongoing

drilling

program,

which

will

be

directly

affected

by

the

availability

of

capital,

drilling

and

production

costs,

availability

of

drilling

and

completion

services

and

equipment,

drilling

results,

lease

expirations,

regulatory

approval

and

actual

drilling

results,

as

well

as

geological

and

mechanical

factors

Estimates

of

unproved

reserves,

type/decline

curves,

per

well

EUR

and

resource

potential

may

change

significantly

as

development

of

the

Company’s

oil

and

gas

assets

provides

additional

data.

Type/decline

curves,

estimated

EURs,

resource

potential,

recovery

factors

and

well

costs

represent

Company

estimates

based

on

evaluation

of

petrophysical

analysis,

core

data

and

well

logs,

well

performance

from

limited

drilling

and

recompletion

results

and

seismic

data,

and

have

not

been

reviewed

by

independent

engineers.

These

are

presented

as

hypothetical

recoveries

if

assumptions

and

estimates

regarding

recoverable

hydrocarbons,

recovery

factors

and

costs

prove

correct.

The

Company

has

very

limited

production

experience

with

these

projects,

and

accordingly,

such

estimates

may

change

significantly

as

results

from

more

wells

are

evaluated.

Estimates

of

resource

potential

and

EURs

do

not

constitute

reserves,

but

constitute

estimates

of

contingent

resources

which

the

SEC

has

determined

are

too

speculative

to

include

in

SEC

filings.

Unless

otherwise

noted,

IRR

estimates

are

before

taxes

and

assume

NYMEX

forward-curve

oil

and

gas

pricing

and

Company-generated

EUR

and

decline

curve

estimates

based

on

Company

drilling

and

completion

cost

estimates

that

do

not

include

land,

seismic

or

G&A

costs. |

Notes: Proved reserves and acreage as of 6/30/2012 and 9/30/2012, respectively. All

Boe and Mcfe calculations are based on a 6 to 1 conversion ratio. Enterprise

value is equal to market capitalization using the closing share price of $25.83 per

share on 11/1/2012, plus net debt as of 9/30/2012. Company Overview

•

Enterprise value $1.2 BN

•

High quality reserve base

•

Permian core operating area

167,000 gross (148,000 net) acres

500+ MMBoe gross, unrisked resource

potential

2,900+ drilling and recompletion opportunities

•

Oil-driven growth in 3Q 2012

3Q’12 Production 8.1 MBoe/d, 65% oil & NGLs

3Q’12 Revenue mix 65% oil, 22% NGLs and

13% natural gas

3

AREX OVERVIEW

ASSET OVERVIEW

83.7 MMBoe proved reserves, 37% PD

99% Permian Basin |

Oil-Focused,

Pure-Play

•

Transitioning Wolfcamp B to development mode and preparing for full-scale

exploitation •

Pilot program evaluating additional Wolfcamp zones (A and C benches)

•

Adding 3

horizontal rig in January 2013

•

Concentrated geographic footprint in the southern Midland Basin

•

148,000 net, primarily contiguous acres, 100% operated

•

64% of proved reserves are oil and NGLs

Track Record of

Growth at Low

Costs

Accelerating

Horizontal

Wolfcamp

Development

•

Reserve and production CAGR since 2004 of 33% and 37%, respectively

•

Low-cost operator with best-in-class F&D and low lifting

costs •

$280 MM borrowing base

•

$222.9 MM liquidity at 9/30/12

Strong Balance

Sheet

Multi-Year

Drilling Inventory

and Significant

Resource

Potential

•

2,900+ identified drilling and recompletion locations

•

500+ MMBoe of gross, unrisked resource potential

•

Rigorous pilot program has de-risked ~100,000 gross acres

•

Additional upside potential from tighter well spacing and multi-zone

development Key Investor Highlights

4

STRENGTHS

HIGHLIGHTS

Note: See liquidity calculation in appendix.

rd |

Track

Record of Reserve and Production Growth •

MY’12 reserves up 25% YoY and 9% over YE’11

Oil reserves up 30% to 23.5 MMbbls

•

Wolfcamp Shale key contributor to reserve growth

500+ MMBoe gross, unrisked resource potential

5

RESERVE GROWTH

PRODUCTION GROWTH

•

2011 production increased 50% YoY

•

Targeting 20% to 24% production growth in 2012

•

Strong liquids production growth

2012E production 65% liquids |

Extensive Inventory of Future Drilling Locations

6

POTENTIAL DRILLING LOCATIONS

Gross Resource

Potential (MMBoe):

225

200+

17+

85

500+

500+ MMBoe Total Gross Resource Potential |

2012

& 2013 Capital Programs 7

•

Horizontal Wolfcamp

2 horizontal rigs

Beginning development program of B zone

Testing A & C zones

•

Vertical Clearfork & Wolfcamp

2012 PROGRAM OVERVIEW

2012 Capital Program $295 MM

•

Horizontal Wolfcamp

3 horizontal rigs to drill 35 to 40 wells

•

Vertical Clearfork & Wolfcamp

2013 PROGRAM OVERVIEW

2013 Capital Program $260 MM

1 vertical rig and recompletion program

1 vertical rig to drill 12 wells

Recompletion program |

Infrastructure & Equipment Projects

8

•

Safely and securely transport water across Project Pangea and Pangea West

•

Reduce time and money spent on water hauling and disposal and truck traffic

•

Expected savings from water transfer equipment ~$0.1 MM/HZ well

•

Expected savings from SWD system ~$0.45 MM/HZ well

•

Expected company-wide LOE savings ±$0.4 MM per month

•

Replace rental equipment and contractors with Company-owned and operated

equipment and personnel; reduce money spent on flowback operations

•

Expected savings from flowback equipment ~$0.1 MM/HZ well

•

Expected LOE savings from gas lift system $6,300/HZ per month

•

Facilitate large-scale field development

•

Reduce fresh water use and water costs

•

Expected savings from non-potable water source ~$0.45 MM/HZ well

•

Efficiently transport crude oil to market and reduce inventory

•

Reduce

oil

transportation

differential

to

an

estimated

$2.50/Bbl

–

$4.00/Bbl

Purchasing and installing water

transfer equipment

Drilling and/or converting SWD

wells

Purchasing and installing flowback

equipment

Securing water supply

Testing non-potable water and

recycling flowback water

Installing crude takeaway lines

Purchased oil hauling trucks

PROJECTS

BENEFITS

Infrastructure and equipment projects are key to large-scale field development

and to reducing D&C costs as well as LOE cost

|

Infrastructure Projects –

Gathering Lines & Facilities

9

Existing Line

New Line

•

Building new gathering lines

•

New lines to transport AREX gas to DCP Gas Line

•

Market gas/NGLs to DCP

•

Improved economics

•

Increased capacity |

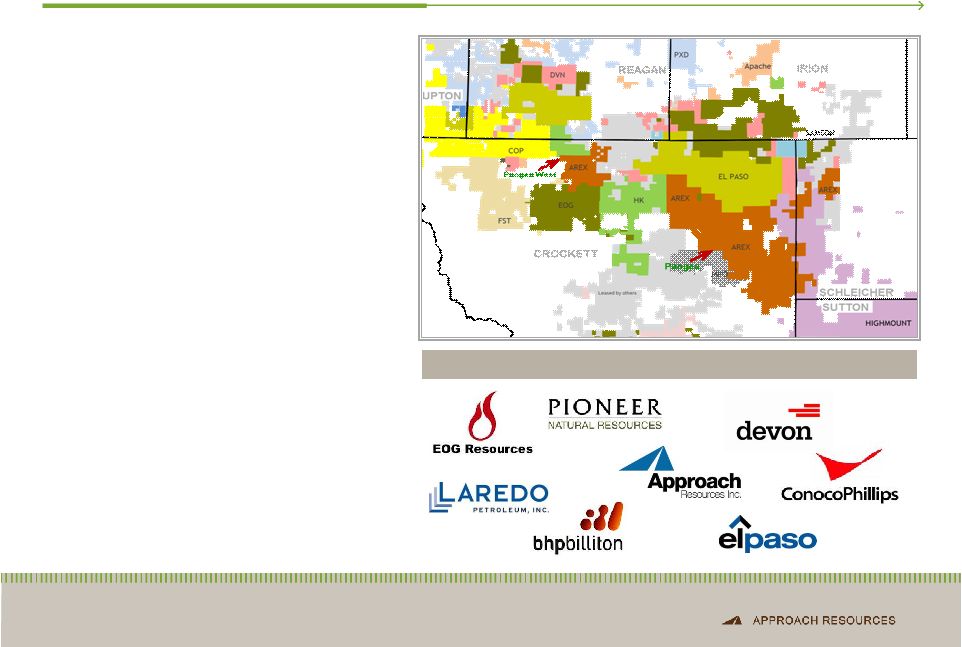

AREX

Wolfcamp Oil Shale Resource Play 10

Large, primarily contiguous acreage position

Liquids-rich, multiple pay zones

167,000 gross (148,000 net) acres

Low acreage cost ~$500 per acre

2,900+ drilling and recompletion opportunities

Transitioning Wolfcamp B to development

mode

Testing Wolfcamp A and C

Testing tighter well spacing

Preparing field for large-scale development

Broad industry participation de-risking play

ACTIVE PARTICIPANTS IN THE PLAY

500+ MMBoe gross, unrisked resource

potential

Early-stage play development |

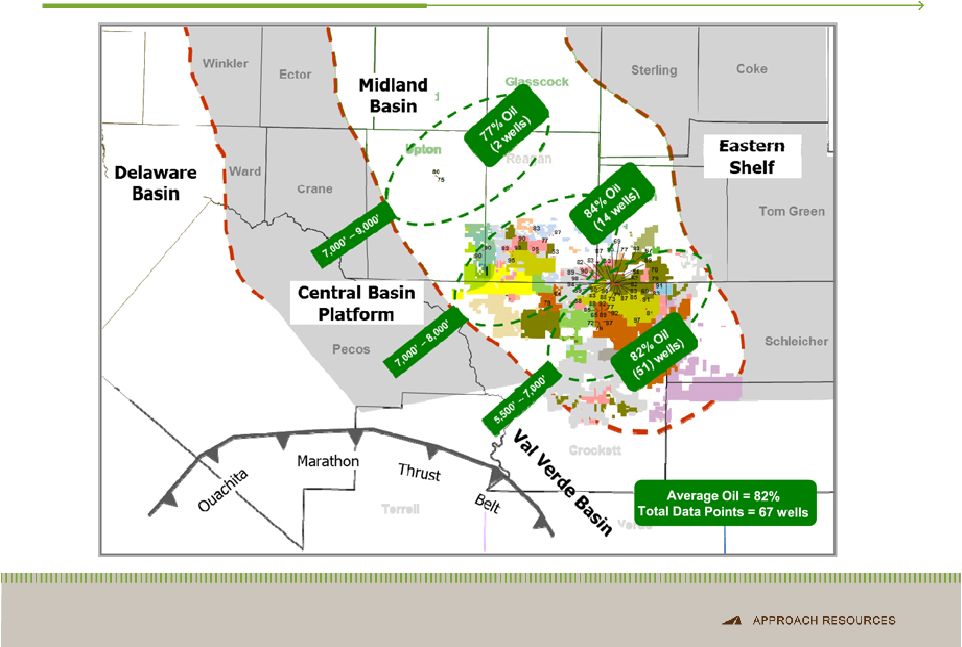

AREX

Wolfcamp Play Favorably Located in the S. Midland Basin 11

|

12

Wolfcamp Oil Shale Play –

Widespread, Thick, Consistent & Repeatable |

Horizontal Wolfcamp Targets

13

SYSTEM

STRATIGRAPHIC

UNIT

Permian

Clearfork/Spraberry

Dean

Wolfcamp

Pennsylvanian

Canyon

Strawn

Mississippian

Devonian

Silurian

Ordovician

Ellenburger

WOLFCAMP A

WOLFCAMP B

WOLFCAMP C

WOLFCAMP D

Pilot

Transitioning

to

Development

Pilot –

Recent

Results

Encouraging

Under

Evaluation

POTENTIAL HORIZONTAL

WOLFCAMP TARGETS |

14

Horizontal Wolfcamp Play -

82% of IP is Oil

Source: Publicly available regulatory filings, company presentations.

|

AREX

Wolfcamp Play – Activity Map

15

Note: Acreage as of 9/30/2012. |

Horizontal Wolfcamp Type Curve

16 |

Horizontal Wolfcamp Economics

17

Play Type

Horizontal

Wolfcamp

Avg. EUR

450 MBoe

Targeted Well Cost

$5.5 MM

Potential Locations

500

Gross Resource

Potential

225 MMBoe

BTAX IRR SENSITIVITIES

Notes: IP’s based on 24-hr. rates. Potential locations are based on

1,000-feet spacing between each horizontal well. Economics assume NYMEX gas strip and NGL

price based on 40% of WTI oil price.

•

Horizontal drilling improves recoveries and

returns

•

Multiple, stacked horizontal targets

•

7,000’+ lateral length

•

~80% of EUR made up of oil and NGLs

•

2 HZ rigs running in Project Pangea / Pangea

West

•

Adding 3

rd

HZ rig in January 2013

•

Recent Wolfcamp B

bench well results in

Project Pangea

•

922 BOEPD IP for U 45 C 806H (93% oil)

•

Recent Wolfcamp A

bench well result in

Project Pangea

•

689 BOEPD IP for U 45 D 905H (90% oil) |

Clearfork & Wolfcamp (“Wolffork”) Economics

18

Play Type

Vertical

Wolffork

Avg. EUR

110 MBoe

Targeted Well Cost

$1.2 MM

Potential Locations

1,825

Gross Resource

Potential

200+ MMBoe

BTAX IRR SENSITIVITIES

Notes: Vertical Wolffork potential locations based on 20-acre spacing.

Vertical Wolffork recompletion potential locations based on 20 to 40-acre spacing.

Economics assume NYMEX gas strip and NGL price based on 40% of WTI oil price.

Play Type

Vertical Wolffork

Recompletion

Avg. EUR

93 MBoe

Targeted Well Cost

$0.75 MM

Potential Locations

190

Gross Resource

Potential

17+ MMBoe

BTAX IRR SENSITIVITIES |

AREX

Drilling Targets & Resource Potential 19

PLAY TYPE

Horizontal

Wolfcamp

Vertical

Wolffork

Vertical Wolffork

Recompletion

Vertical Canyon

Wolffork

EUR (MBoe)

450

110

93

193

Targeted well cost ($MM)

$5.5

$1.2

$0.75

$1.5

Potential locations

500

1,825

190

440

GROSS RESOURCE

POTENTIAL (MMBoe)

225

200+

17+

85

Target

Wolfcamp

Clearfork,

Wolfcamp

Clearfork, Wolfcamp

Canyon, Clearfork,

Wolfcamp

Drilling depth (ft.)

7,000+ (lateral

length)

< 7,500

< 7,500

< 8,500

500+ MMBoe Total Gross Resource Potential

Notes: Potential locations based on 1,000-feet spacing between each horizontal

well for Horizontal Wolfcamp, 20-acre spacing for Vertical Wolffork, 20 to 40-

acre spacing for Vertical Wolffork Recompletion and 40-acre spacing for Vertical

Canyon Wolffork. |

Creating Value Through Growth

20

•

Concentrated geographic footprint in the southern Midland Basin

•

Strong growth track record at competitive costs

•

Detailed technical evaluation led to discovery of significant growth

potential in the Wolfcamp / Wolffork oil shale resource play

•

Rigorous pilot program de-risked ~100,000 gross acres

•

Capital discipline for Wolfcamp / Wolffork program acceleration

|

Financial

Framework

NON-GAAP RECONCILIATIONS |

2012

Operating and Financial Guidance 22

2012 GUIDANCE

2012 Guidance

Production

Total (MBoe)

2,800 -

3,000

Percent Oil & NGLs

65%

Operating costs and expenses ($/per Boe)

Lease operating

$

6.50 –

7.50

Severance and production taxes

$

2.50 –

4.00

Exploration

$

4.00 –

5.00

General and administrative

$

7.00 –

8.00

Depletion, depreciation and amortization

$

18.00 –

22.00

Capital expenditures ($MM)

Approximately $295 |

Hedge Position

23

CURRENT HEDGE POSITION

Commodity and Time Period

Type

Volume

Price

Crude Oil

2012

Collar

700 Bbls/d

$85.00/Bbl

-

$97.50/Bbl

2012

Collar

500 Bbls/d

$90.00/Bbl

-

$106.10/Bbl

September 2012 –

December 2012

Collar

350 Bbls/d

$90.00/Bbl

-

$102.30/Bbl

2013

Collar

650 Bbls/d

$90.00/Bbl

-

$105.80/Bbl

2013

Collar

450 Bbls/d

$90.00/Bbl

-

$101.45/Bbl

2014

Collar

550 Bbls/d

$90.00/Bbl

-

$105.50/Bbl

Natural Gas Liquids

Natural Gasoline –

February 2012 –

December 2012

Swap

225 Bbls/d

$95.55/Bbl

Normal Butane –

March 2012 –

December 2012

Swap

225 Bbls/d

$73.92/Bbl

Natural Gas

2012

Call

230,000 MMBtu/month

$6.00/MMBtu

July 2012 –

December 2012

Swap

360,000 MMBtu/month

$2.70/MMBtu

2013

Swap

200,000 MMBtu/month

$3.54/MMBtu

2013

Swap

190,000 MMBtu/month

$3.80/MMBtu |

Financial Strength

24

Liquidity

(unaudited)

is

calculated

by

adding

the

net

funds

available

under

our

revolving

credit

facility

and

cash

and

cash

equivalents.

We

use

liquidity

as

an

indicator

of

the

Company’s

ability

to

fund

development

and

exploration

activities.

Liquidity

has

limitations,

and

can

vary

from

year

to

year

for

the

Company

and

can

vary

among

companies

based

on

what

is

or

is

not

included

in

the

measurement

on

a

company’s

financial

statements.

Liquidity

is

provided

in

addition

to,

and

not

as

an

alternative

for,

and

should

be

read

in

conjunction

with,

the

information

contained

in

our

financial

statements

prepared

in

accordance

with

GAAP

(including

the

notes),

included

in

our

SEC

filings

and

posted

on

our

website.

The

table

below

summarizes

our

liquidity

at

September

30,

2012.

(in thousands)

Liquidity at

September 30, 2012

Borrowing base

$

270,000

Cash and cash equivalents

841

Long-term debt

(47,600)

Unused letters of credit

(350)

Liquidity

$

222,891

Long-term

debt-to-capital

ratio

(unaudited)

is

calculated

as

of

September

30,

2012,

and

by

dividing

long-term

debt

(GAAP)

by

the

sum

of

total

stockholders’

equity

(GAAP)

and

long-term

debt

(GAAP).

We

use

the

long-term

debt-to-capital

ratio

as

a

measurement

of

our

overall

financial

leverage.

However,

this

ratio

has

limitations.

This

ratio

can

vary

from

year-to-year

for

the

Company

and

can

vary

among

companies

based

on

what

is

or

is

not

included

in

the

ratio

on

a

company’s

financial

statements.

This

ratio

is

provided

in

addition

to,

and

not

as

an

alternative

for,

and

should

be

read

in

conjunction

with,

the

information

contained

in

our

financial

statements

prepared

in

accordance

with

GAAP

(including

the

notes),

included

in

our

SEC

filings

and

posted

on

our

website.

The

table

below

summarizes

our

long-term

debt-to-capital

ratio

at

September

30,

2012.

(in thousands)

September 30, 2012

Long-term debt

$

47,600

Total stockholders’

equity

624,341

671,941

Long-term debt-to-capital

7.1% |

Contact

Information

MEGAN P. HAYS

Manager, Investor Relations & Corporate Communications

817.989.9000 x 2108

mhays@approachresources.com

www.approachresources.com |