Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ASSEMBLY BIOSCIENCES, INC. | v327380_8k.htm |

| EX-99.1 - EXHIBIT 99.1 - ASSEMBLY BIOSCIENCES, INC. | v327380_ex99-1.htm |

Exhibit 99.2

1 This material contains estimates and forward - looking statements. The words “believe,” “may,” “might,” “will,” “aim,” “estimate,” “continue,” “would,” “anticipate, ”“intend,” “expect,” “plan” and similar words are intended to identify estimates and forward - looking statements. Our estimates and forward - looking statements are mainly based on our current expectations and estimates of future events and trends, which affect or might affect our businesses and operations. Although we believe that these estimates and forward - looking statements are based upon reasonable assumptions, they are subject to many risks and uncertainties and are made in light of information currently available to us. Our estimates and forward - looking statements may be influenced by the following factors, among others : risks related to the design, costs, timing, regulatory review and results of our studies and clinical trials; our ability to obtain FDA approval of our product candidates; differences between historical studies on which we have based our planned clinical trials and actual results from our trials; our anticipated capital expenditures, our estimates regarding our capital requirements, and our need for future capital; our liquidity and working capital requirements; our expectations regarding our revenues, expenses and other results of operations; the unpredictability of the size of the markets for, and market acceptance of, any of our products; our ability to sell any approved products and the price we are able realize; our need to obtain additional funding to develop our products, and our ability to obtain future funding on acceptable terms; our ability to retain and hire necessary employees and to staff our operations appropriately; our ability to compete in our industry and innovation by our competitors; our ability to stay abreast of and comply with new or modified laws and regulations that currently apply or become applicable to our business; estimates and estimate methodologies used in preparing our financial statements; the future trading prices of our common stock and the impact of securities analysts’ reports on these prices; and the risks set out in our filings with the SEC, including our Annual Report on Form 10 - K and our Form 10 - Q for the quarter ended June 30, 2012. Estimates and forward - looking statements involve risks and uncertainties and are not guarantees of future performance. As a result of known and unknown risks and uncertainties, including those described above, the estimates and forward - looking statements discussed in this material might not occur and our future results and our performance might differ materially from those expressed in these forward - looking statements due to, including, but not limited to, the factors mentioned above. Estimates and forward - looking statements speak only as of the date they were made, and, except to the extent required by law, we undertake no obligation to update or to review any estimate and/or forward - looking statement because of new information, future events or other factors. Forward Looking Statements

» A Gastroenterology Phase III biopharmaceutical company focused on bringing 505b2 products to market for unmet needs, especially in the area of anal disorders - a neglected area of drug development. » Current Portfolio VEN 307 – Phase III data for first pivotal program showed good tolerability, significant improvement in efficacy outcomes for anal fissures Critical mass market focused in gastroenterologist and colorectal surgeons Significant lifecycle opportunities VEN 308 – Proof of concept in fecal incontinence associated with Ilea Pouch Anal Anastomosis (IPAA) Orphan disorder treated in ~ 40 CRS centers nationwide Significant expansion opportunity » Funded through key milestones Sufficient cash and cash equivalents for approval of VEN 307 2 Company Overview

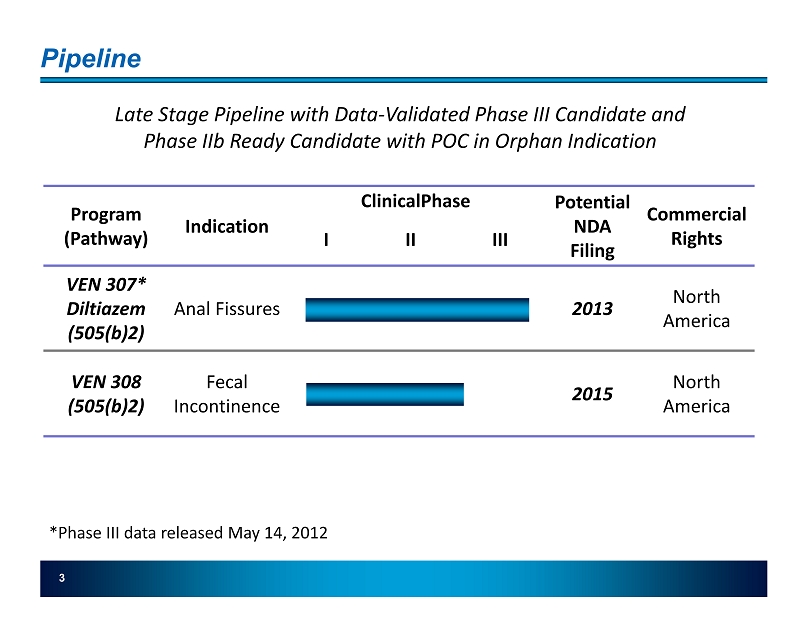

Pipeline 3 Program (Pathway) Indication ClinicalPhase Potential NDA Filing Commercial Rights I II III VEN 307* Diltiazem (505(b)2 ) Anal Fissures 2013 North America VEN 308 (505(b)2) Fecal Incontinence 2015 North America Late Stage Pipeline with Data - Validated Phase III Candidate and Phase IIb Ready Candidate with POC in Orphan Indication *Phase III data released May 14, 2012

VEN 307: Diltiazem Cream Novel Treatment for Anal Fissures

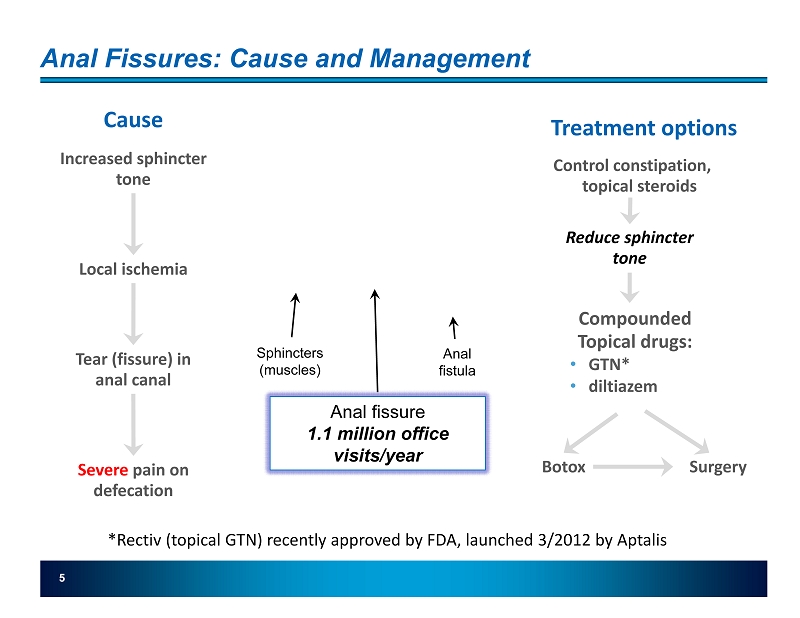

5 Anal Fissures: Cause and Management Increased sphincter tone Local ischemia Tear (fissure) in anal canal Cause Severe pain on defecation Treatment options Control constipation, topical steroids Reduce sphincter tone Compounded Topical drugs: • GTN* • diltiazem Botox Surgery Sphincters (muscles) Anal fistula *Rectiv (topical GTN) recently approved by FDA, launched 3/2012 by Aptalis Anal fissure 1.1 million office visits/year

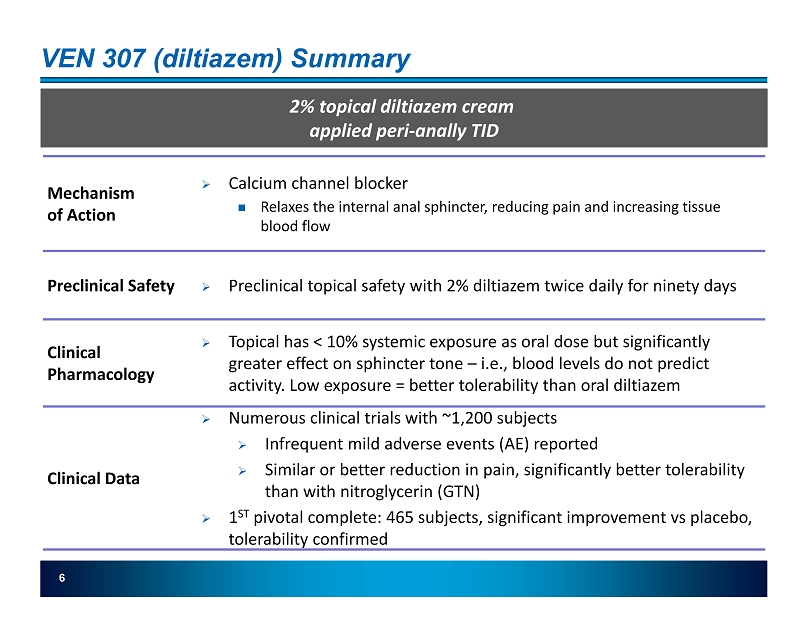

6 VEN 307 (diltiazem) Summary 2% topical diltiazem cream applied peri - anally TID Mechanism of Action » Calcium channel blocker Relaxes the internal anal sphincter, reducing pain and increasing tissue blood flow Preclinical Safety » Preclinical topical safety with 2% diltiazem twice daily for ninety days Clinical Pharmacology » Topical has < 10% systemic exposure as oral dose but significantly greater effect on sphincter tone – i.e., blood levels do not predict activity. Low exposure = better tolerability than oral diltiazem Clinical Data » Numerous clinical trials with ~1,200 subjects » Infrequent mild adverse events (AE) reported » Similar or better reduction in pain, significantly better tolerability than with nitroglycerin (GTN) » 1 ST pivotal complete: 465 subjects, significant improvement vs placebo, tolerability confirmed

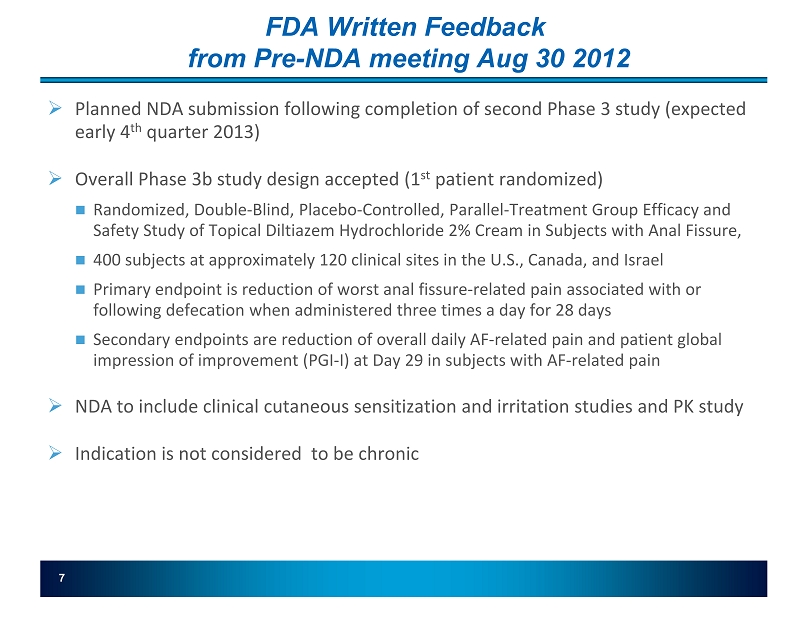

FDA Written Feedback from Pre - NDA meeting Aug 30 2012 » Planned NDA submission following completion of second Phase 3 study (expected early 4 th quarter 2013) » Overall Phase 3b study design accepted (1 st patient randomized) Randomized, Double - Blind, Placebo - Controlled, Parallel - Treatment Group Efficacy and Safety Study of Topical Diltiazem Hydrochloride 2% Cream in Subjects with Anal Fissure, 400 subjects at approximately 120 clinical sites in the U.S., Canada, and Israel Primary endpoint is reduction of worst anal fissure - related pain associated with or following defecation when administered three times a day for 28 days Secondary endpoints are reduction of overall daily AF - related pain and patient global impression of improvement (PGI - I) at Day 29 in subjects with AF - related pain » NDA to include clinical cutaneous sensitization and irritation studies and PK study » Indication is not considered to be chronic 7

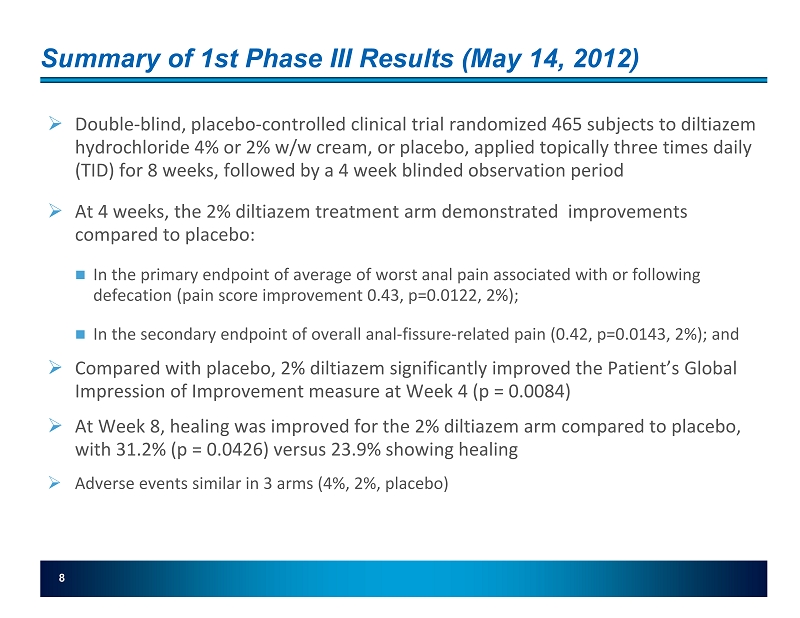

Summary of 1st Phase III Results (May 14, 2012) » Double - blind, placebo - controlled clinical trial randomized 465 subjects to diltiazem hydrochloride 4% or 2% w/w cream, or placebo, applied topically three times daily (TID) for 8 weeks, followed by a 4 week blinded observation period » At 4 weeks, the 2% diltiazem treatment arm demonstrated improvements compared to placebo: In the primary endpoint of average of worst anal pain associated with or following defecation (pain score improvement 0.43 , p=0.0122, 2 %); In the secondary endpoint of overall anal - fissure - related pain (0.42, p=0.0143, 2 %); and » Compared with placebo, 2% diltiazem significantly improved the Patient’s Global Impression of Improvement measure at Week 4 (p = 0.0084) » At Week 8, healing was improved for the 2% diltiazem arm compared to placebo, with 31.2% (p = 0.0426) versus 23.9% showing healing » Adverse events similar in 3 arms (4%, 2%, placebo) 8

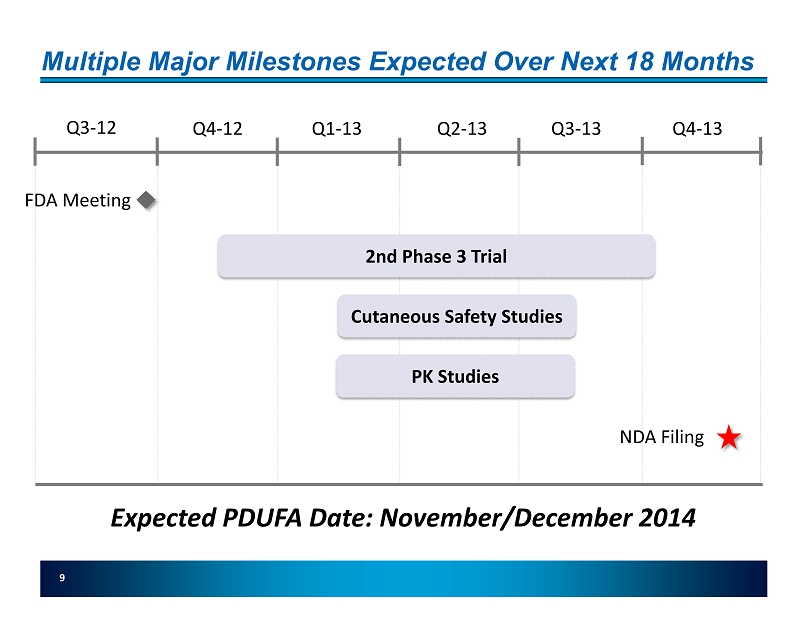

Multiple Major Milestones Expected Over Next 18 Months 9 2nd Phase 3 Trial Q3 - 12 Q4 - 12 Q1 - 13 Q2 - 13 Q3 - 13 Q4 - 13 FDA Meeting NDA Filing Cutaneous Safety Studies Expected PDUFA Date: November/December 2014 PK Studies

10 VEN 307 Life cycle management: BID Formulation » U.S. patent Feb 2018, HW extension to 8/2019; possible pediatric extension to Q2 2020. After this, we expect that generic approvals will be difficult (topical, trade secrets, re - formulation , will need clinical study and comparative PK in AF patients) » Have completed technical development of 4 extended release formulations: all patentable (exp. 2033), all B.I.D. or O.D. Conduct 1 US PH III trial with 1 extended release formulation, if one is acceptable, in 2015, file NDA 2016/2017

COMPETITIVE POSITIONING » vs COMPOUNDED CALCIUM CHANNEL BLOCKERS: main target Limited number of compounding pharmacies – VEN 307 widely available Dr has to write a “recipe” vs a simple scrip for VEN 307 Concentration of compounded CCB’s is highly variable between pharmacies, prescriptions and within each tube – VEN 307 made to FDA standards Patient has to pay (80$ - 200$/month) with no or very low assistance/reimbursement: Ventrus will provide copay coupons to get patient out - of - pocket costs to < 50$ » vs RECTIV or compounded nitroglycerin: second target Nitro and CCB’s believed to be equally effective (Cochrane review 2012 & association guidelines) Nitro has a very high rate of moderate to severe headaches: VEN 307 has no incremental side effects over placebo and is recommended as 1 st line by US surgery guidelines » vs Cortisone &/or Lidocaine: expansion opportunity No evidence of safety or efficacy, no reimbursement for these products 11

VEN 307 - Diltiazem Cream 12 Prototypical Spec. Pharma Product Ideal First Product for Small Biotech Company Competitive Profile Lifecycle Opportunities Easily Self - Commercialized • DTZ is already preferred treatment for AF • Extensive literature & KOL supporting 1 st line use • Only approved competitor has rate limiting SE profile • Majority of AF treated by ~1,500 specialists • Critical mass within target market of >500k patients • Market within targeted physicians of $200 - 300M • Reduced dosing frequency with potentially patentable delivery technology • Future launch of i mproved metered dose packaging • Topical product with limited systemic exposure Additional Upside: Improve differential diagnosis of anal rectal disorders 12

13 Financials » Nasdaq (IPO 2011): VTUS » Cash balance Cash and cash equivalents at June 30 th , 2012$ 29 Mil » Stock data Fully diluted shares outstanding 15.3 Mil Shares outstanding 12.4 Mil