Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Lumos Networks Corp. | d431651d8k.htm |

| EX-99.1 - EXHIBIT 99.1 - Lumos Networks Corp. | d431651dex991.htm |

Company Presentation

November 2012

Exhibit 99.2 |

1

Use of Non-GAAP Financial Measures

Special Note Regarding Forward-Looking Statements

Included in this presentation are certain non-GAAP financial measures that are not

determined in accordance with US generally accepted accounting principles. These

financial performance measures are not indicative of cash provided or used by operating activities and exclude the

effects of certain operating, capital and financing costs and may differ from comparable

information provided by other companies, and they should not be considered in

isolation, as an alternative to, or more meaningful than measures of financial performance determined in

accordance with US generally accepted accounting principles. These financial performance

measures are commonly used in the industry and are presented because Lumos Networks

Corp. believes they provide relevant and useful information to investors. The Company utilizes these

financial performance measures to assess its ability to meet future capital expenditure and

working capital requirements, to incur indebtedness if necessary, and to fund continued

growth. Lumos Networks Corp. uses these financial performance measures to evaluate the performance of

its business, for budget planning purposes and as factors in its employee compensation

programs. Any statements contained in this presentation that are not statements

of historical fact, including statements about our beliefs and expectations, are

forward-looking statements and should be evaluated as such. The words “anticipates,” “believes,” “expects,” “intends,” “plans,” “estimates,”

“targets,” “projects,” “should,” “may,”

“will” and similar words and expressions are intended to identify forward-looking statements. Such

forward-looking statements reflect, among other things, our current expectations, plans

and strategies, and anticipated financial results, all of which are subject to known

and unknown risks, uncertainties and factors that may cause our actual results to differ materially from those

expressed or implied by these forward-looking statements. Many of these risks are beyond

our ability to control or predict. Because of these risks, uncertainties and

assumptions, you should not place undue reliance on these forward-looking statements. Furthermore, forward-looking

statements speak only as of the date they are made. We do not undertake any obligation to

update or review any forward-looking information, whether as a result of new

information, future events or otherwise. Important factors with respect to any such forward-looking statements,

including certain risks and uncertainties that could cause actual results to differ from those

contained in the forward-looking statements, include, but are not limited to: rapid

development and intense competition in the telecommunications industry; our ability to achieve benefits from our

separation from NTELOS Holdings Corp; our ability to offset expected revenue declines in our

Competitive business from legacy voice products and in our RLEC business related to the

recent regulatory developments and carriers grooming their networks; adverse economic conditions; operating

and financial restrictions imposed by our senior credit facility; our cash and capital

requirements; declining prices for our services; the potential to experience a high

rate of customer turnover; federal and state regulatory fees, requirements and developments; our reliance on certain suppliers

and vendors; and other unforeseen difficulties that may occur. These risks and uncertainties

are not intended to represent a complete list of all risks and uncertainties inherent

in our business, and should be read in conjunction with the more detailed cautionary statements and risk factors

included in our SEC filings, including our Annual Reports filed on Forms 10-K. |

2

Value creation for our customers enhances value for

our shareholders.

Lumos Networks provides next-

generation communication solutions

and personalized service to customers

over an advanced fiber network. |

3

Diversified revenue stream served over a dense fiber network

3

Key Events

•

Oct.

31,

2011

–

Spin

from

NTELOS

•

2012 New leadership

•

Q3-12

•

Yr/Yr revenue growth

•

Strategic Data > 50% of revenue

•

Margin Expansion

Customers and Markets

•

21,000 business customers

•

Relationships with all major carriers

in the region

Products

•

Enterprise

Data

–

Metro

E,

Internet

•

Carrier Data -

up to 10Gig+

•

IP Services –

Fiber BXL, Video, VoIP

Network

•

5,800 long haul Fiber Network miles

•

~ 300 cell site fiber connections by

12/31/12

•

Interconnection to all major data

centers in region

People

•

Diversified and experienced

leadership team

•

400 sales and support personnel

deployed across the region

•

Deep technical expertise |

4

Highlights

Strong Management

Team

Experienced leadership team

Diverse operational background

Attractive Revenue

Growth Opportunity

Significant growth available in existing markets

Edge out potential with unique network footprint

Margin Expansion

Increasing mix of high margin Strategic Data products

Leverage existing infrastructure

Efficient Capital

Management

Investments focused on Strategic Data initiatives

Disciplined success based capital approach

Delight Customers

Top Tier SLA standards

In Market support teams |

5

Executive Management with Deep Industry Experience

Tim Biltz

Chief Executive Officer

Joined in April 2012

Over 20 years of operating experience as Chairman of iPCS, COO of

Spectrasite and EVP, COO of Vanguard Cellular Systems

Harold Covert

Chief Financial Officer

Joined in October 2011

Over

27

years

of

experience

with

technology

and

telecommunications

companies as CFO of six publicly traded companies

Joseph McCourt

Jr.

Chief Revenue Officer

Joined in May 2012

Over

25

years

of

experience

in

wholesale

and

enterprise

sales

in

Time

Warner Telecom, Level 3 Communications, Dukenet Communications,

Zayo Networks, and 1901 Group |

70% of

internet access will come from mobile devices

Increase in networked devices 2011-

2016

Enabling rapid growth in rich media

Access to cloud services

6

Exponential Growth in Data and Devices…

Applications and devices generating

constant streams of data

Enterprises capturing and processing

data :

Customers

Products

Transactions

Operations

Digitization of records

Increasing use of:

Cloud and data center storage

Back-up file protection and

security

Source: Cisco VNI June 2012

Big Data

Proliferation of Networked Devices

mm

“90% of the world’s data has been

created in the last 2 years”

Source: Mark Hurd, Oracle Open World 2012. |

7

…Driving Demand for Connectivity and Speed

Source: Cisco VNI June 2012

U.S. Business IP Traffic

More Cloud, More Mobility

Business IP traffic to grow 2.5-fold from

2011 to 2016 or CAGR of 20%

Mix of Business Data from mobile devices

increases from 4% to 19%

Enterprise Cloud Spending grows 12.5X from 2011

to 2016 with 35-45% telecom

Source:

Oppenheimer & Co Estimates

Source: Cisco VNI June 2012

20,000

15,000

10,000

5,000

0

2011

2012

2013

2014

2015

100%

80%

60%

40%

20%

0%

2011

2012

2013

2014

2015

2016

Business and IP Traffic

Mobile% Business Traffic |

8

Next-generation network solutions

Enterprise Data

•

Ethernet connectivity among multiple locations

•

Dedicated Internet connections

•

Speeds of 1.5M to 10 Gbps

IP Services

•

IP-enabled product offerings that combines voice and

data services

•

Enables advanced features and dynamic bandwidth

•

Broadband XL high speed Internet over fiber over for

100M+

Carrier Data

•

IP-based Ethernet transport

•

Fiber connectivity to cell sites to support 4G growth

•

High-bandwidth transport (OC-X and wavelengths) |

9

Enterprise Data enables networking and addresses

future growth needs

Attractive Available Markets

Current Share ~ 10%

Ethernet represents a disproportionate

share of the overall telecom growth with

overall growth 3-4% and TDM flat to

declining

Enterprise Data Demand growth 45%+

annually

Ethernet market has 50% at speeds of

100Mbps or below

Fastest growth segment of Ethernet is

100Mbps+

with

24%

looking

for

speeds

at

1Gig +

Source: Heavy Reading Study 2012, Oracle Openworld

2012

Future

Edge Out

Markets

Current

Markets |

10

Customer Demand Drives Growth

Education Customer

Started with several data

circuits

-

$11K

monthly

recurring charge (“MRC”)

Expanded into IP based

services

–

Bandwidth

to

data centers + IP voice

MRC now $29K for $100K

capital investment

Regional Healthcare

Provider

Several small locations

with leased voice access -

$2K MRC

Today 37 locations, most

are on-net

Buying voice and Metro E

MRC of $29K with a

$1.0M capital investment |

Transport

opportunity greatly enhanced with edge out opportunities like Atlanta

interconnection 11

Carrier Today

Provide transport across region

Responded to RFP for cell sites

across region

Sites coming on line now

New RFP for next wave of sites…..

1/3 as second tenant

New Opportunity with Atlanta

interconnection

Diversity to I-95 national carrier

routes

High speed connections –

10Gig +

Expands overall market for carriers

Attractive Available Markets

2012

Future

Edge Out

Opportunity

Current

Markets |

Fiber to the

cell site: End-to-End Transport opportunity Approximately 5,000 sites within 10

miles of existing network Goal to double sites annually with the expansion of 4G roll

out Long-term growth in bandwidth creates opportunity for significant

ROI Illustrative Wireless Cell Site Economics

Average

Capital

Investment

$75K-$100K

per site

Two Carrier Equivalent

Annual EBITDA:

$30K to $36K

Payback:

2 to 3 years

12

Three to Five

Carrier Equivalent

Annual EBITDA:

$45K to $90K

Payback:

1 to 2 years

Contracts of 5 to 10 years and multiple carriers per site drive

long-term profitable revenue streams |

Legacy TDM

Voice Revenue RLEC voice continuing moderate decline with strong cash generation

Legacy

Competitive

voice

focus

on

mix

shift

to

larger

and

higher

margin

customers, churn low margin base

13

($000)

($000) |

Access

Revenue RLEC access reform underway: Lower rates, long term transition

funding continues strong cash generation

Competitive Access: Continuing moderate declines with good cash

generation

14

($000)

($000)

0

500

1,000

1,500

2,000

2,500

3,000

3,500

Q3-11

Q4-11

Q1-12

Q2-12

Q3-12

Competitive Access

0

1,000

2,000

3,000

4,000

5,000

6,000

7,000

8,000

9,000

Q3-11

Q4-11

Q1-12

Q2-12

Q3-12

RLEC Access |

Well

positioned for the competitive environment 15

Network Capability

•

Dense fiber with available or expandable capacity

•

Most complete fiber network in our markets

•

High quality ring based network

Customer

Relationship

•

Strategic partnership

•

Care and sales support in region

•

Technical support expertise and responsiveness

Products

•

First to bring products to addressed markets

•

Top Tier SLAs

•

Competitive pricing |

16

Key Success Factors

Revenue

Growth

•

Strong portfolio of Strategic Data products

•

Significant opportunity to grow in current markets

•

Meaningful edge-out opportunities

Leverage

Infrastructure

Solid

Execution

•

Sales force expansion and productivity

•

Installation streamlining and productivity

•

Automated customer interfaces

Financial

Performance

•

High margin product mix

•

Capital expenditure efficiency

•

Cash flow from operations

•

Current return to shareholders

•

Maximizing network efficiency

•

On-net or near-net customers

•

Focused capital deployment |

17

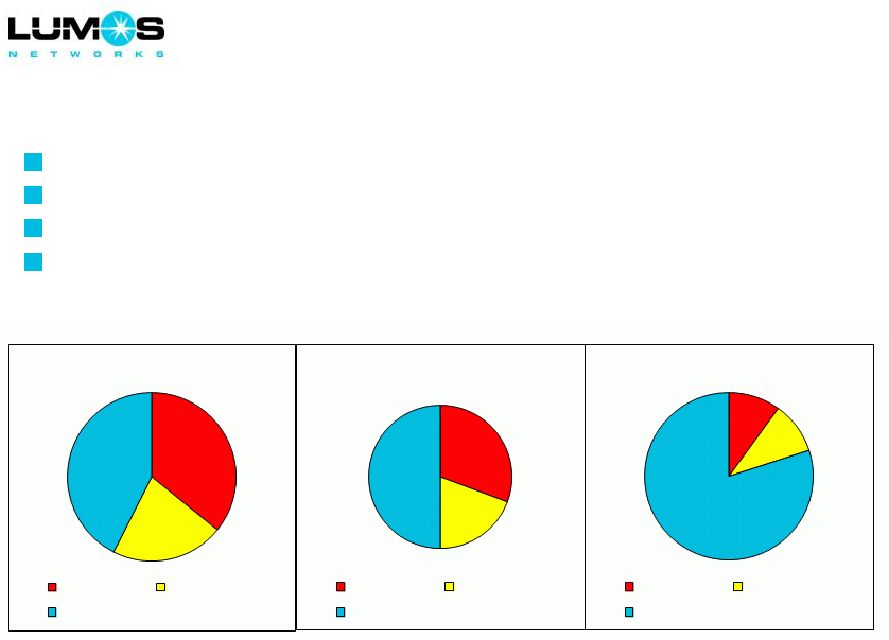

Business Transformation

Shift to Strategic Data products

Enhanced sales organization

Improve mix to more on-net or near-net customers

Effective expense management

> 75%

19%

31%

50%

22%

36%

42%

Legacy Voice

Access

Strategic Data

Legacy Voice

Access

Strategic Data

Legacy Voice

Access

Strategic Data

2011

2012

Long Term Target |

Income

Statement Overview 18

Quarterly Revenue

EBITDA

$M

Q3-12 results highlight the transformation

Strategic Data now > 50% of total revenue

% Margin

Data -

% Rev

$M

30%

35%

40%

45%

50%

55%

60%

0

5

10

15

20

25

30

35

Q3-11

Q4-11

Q1-12

Q2-12

Q3-12

Strategic Data

Legacy Voice and Access

% Data Revenue

48%

45%

43%

42%

43%

30%

35%

40%

45%

50%

15.0

17.0

19.0

21.0

23.0

25.0

27.0

29.0

Q3-11

Q4-11

Q1-12

Q2-12

Q3-12

EBITDA

% Margin |

19

Disciplined approach to capital investment

Guiding principles include:

Achievement of capital efficiency goals

Focus on success based projects

Compliance with liquidity goals

Maintain current shareholder dividend

Metric

Target

Near

–

Term

Revenue

Opportunity

Capital

~75%

Capex to Revenue Ratio

~2.0x -

3.0x

EBITDA Payback

~36 –

48 Months

Return on Investment (EBITDA After Tax)

~15% -

20%

Capex as a % of Revenue

~30-35% |

($mm)

Cash

-.0

$ -

Restricted cash

6.8

Total Assets

504.4

Revolver ($60M)

4.7

Long-term debt

314.4

Liquidity Overview

20

9/30/12 |

Cash Flow

Overview 21

FY 2012 Guidance

$M

88

55

Cash Resources

$143M

EBITDA

Line of Credit

12

16

Cash Uses

$88M

Capital Investment

Dividend

Interest, Debt Payment, Cash Tax

60 |

Financial

Model 22

% of revenue

% of revenue

% of revenue

2011

Q3-12

Q4-12

FY 2012

(Dollars in millions)

Actual

Actual

Guidance

Guidance

Annual Long Term Goals

Revenue

Strategic Data Revenue

88.2

26.1

27.0 -

27.5

102.5-103.0

+ 15-20%

42.5%

50.2%

53.0%

50%

Legacy Voice Revenue

74.3

16.1

15.0 -

15.5

63.5 -

64.0

-10-15%

35.8%

31.0%

31.0%

31%

Access Revenue

44.9

9.7

9.0 -

9.0

39.0 -

39.0

-10-15%

21.6%

18.7%

16.0%

19%

Total

207.4

52.0

52.0

206.0

+ 5%

EBITDA

$

96.9

22.3

22.0

88.0

NA

%

46.7%

42.9%

42.3%

42.7%

47%+

Capital Expenditures

% Success Based

45%

75%

75%

75%

75%

Total

61.5

14.9

16.0

60.0

~30-35% of revenue |

23

2012 Financial Guidance

1

These estimates are based on management’s current expectations. These estimates are

forward-looking and actual results may differ materially. Please see “Special

Note from the Company Regarding Forward-Looking Statements" in the Lumos Networks

Corp. third quarter 2012 earnings release dated November 1, 2012.

Business Outlook

1

(as of November 1, 2012)

(In millions)

Operating Revenues

52

$

206

$

Adjusted EBITDA

22

$

88

$

Capital Expenditures

60

Reconciliation of Operating Income to Adjusted EBITDA

Operating Income

10

$

44

$

Depreciation and amortization

9

38

Equity based compensation charges

3

4

Amortization of actuarial losses

-

2

Adjusted EBITDA

22

$

88

$

Fourth Quarter 2012

2012 Annual

2012 Guidance

1

$

Approximately

Approximately

Approximately

Approximately

Approximately

Approximately

Approximately

Approximately

Approximately |

24

Key Success Factors

Revenue

Growth

•

Strong portfolio of Strategic Data products

•

Significant opportunity to grow in current markets

•

Meaningful edge-out opportunities

Leverage

Infrastructure

Solid

Execution

•

Sales force expansion and productivity

•

Installation streamlining and productivity

•

Automated customer interfaces

Financial

Performance

•

High margin product mix

•

Capital expenditure efficiency

•

Cash flow from operations

•

Current return to shareholders

•

Maximizing network efficiency

•

On-net or near-net customers

•

Focused capital deployment |

25

Reconciliation of Net Income Attributable to Lumos

Networks Corp. to Operating Income

($ in millions)

2007

2008

2009

2010

2011

Net income attributable to Lumos

Networks Corp.

$21

$23

$23

$21

($44)

Net income attributable to

noncontrolling interests

-

-

-

-

-

Net income

21

23

23

21

(44)

Interest expense

2

1

1

6

12

Loss on interest rate derivatives

-

-

-

-

-

Income tax expense (benefit)

14

15

16

14

(4)

Other income, net

(1)

-

1

-

-

Operating Income (Loss)

$36

$39

$41

$41

($36)

Year Ended

12/31/2010

3/31/2011

6/30/2011

9/30/2011

12/31/2011

3/31/2012

6/30/2012

9/30/2012

Net income attributable to Lumos

Networks Corp.

$4

$5

$7

$6

($62)

$5

$3

$6

Net income attributable to

noncontrolling interests

-

-

-

-

-

-

-

-

Net income

4

5

7

6

(62)

5

3

6

Interest expense

2

3

3

3

3

3

3

3

Loss on interest rate derivatives

-

-

-

-

-

-

-

-

Income tax expense (benefit)

3

4

4

4

(17)

3

3

4

Other income, net

-

-

-

-

-

-

-

-

Operating Income (Loss)

$9

$12

$13

$13

($75)

$12

$9

$13

Three Months Ended |

26

Adjusted EBITDA Reconciliation

($ in millions)

2007

2008

2009

2010

2011

Operating Income (Loss)

$36

$39

$41

$41

($36)

Depreciation and Amortization

27

27

29

31

43

Equity Based Compensation

1

1

-

2

2

Asset Impairment Charge

-

-

-

-

86

Business Separation Charges

-

-

-

-

2

Acquisition Related Charges

-

-

-

3

-

Voluntary Retirement and Workforce Reduction Plans

-

1

-

-

-

Adjusted EBITDA

$64

$68

$71

$77

$97

Year Ended

12/31/2010

3/31/2011

6/30/2011

9/30/2011

12/31/2011

3/31/2012

6/30/2012

9/30/2012

Operating Income (Loss)

$9

$12

$13

$13

($75)

$12

$9

$13

Depreciation and Amortization

9

11

11

11

10

9

9

10

Equity Based Compensation

1

1

1

1

-

1

1

1

Asset Impairment Charge

-

-

-

-

86

-

-

-

Business Separation Charges

-

-

-

-

2

-

-

-

Acquisition Related Charges

2

-

-

-

-

-

-

-

Employee Separation Charges

-

-

-

-

-

-

2

-

Gain on Settlements, net

-

-

-

-

-

-

-

(2)

Adjusted EBITDA

$21

$24

$25

$25

$23

$22

$21

$22

Three Months Ended |

27

Thank You |