Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - GAIN Capital Holdings, Inc. | d428389d8k.htm |

| EX-99.1 - PRESS RELEASE - GAIN Capital Holdings, Inc. | d428389dex991.htm |

3 Quarter 2012

Financial and Operating Results

November 1, 2012

Exhibit 99.2

rd |

Special Note Regarding Forward-Looking Information

In addition to historical information, this presentation contains

"forward-looking" statements that reflect management's

expectations for the future. A variety of important factors could cause

results

to

differ

materially

from

such

statements.

These

factors

are

noted

throughout

GAIN

Capital's annual report on Form 10-K, as filed with the Securities and Exchange

Commission on March 15, 2012, and include, but are not limited to, the

actions of both current and potential new competitors, fluctuations in

market trading volumes, financial market volatility, evolving industry

regulations, including changes in regulation of the futures companies, errors or

malfunctions in our systems or technology, rapid changes in technology, effects of

inflation, customer trading patterns, the success of our products and

service offerings, our ability to continue to innovate and meet the demands

of our customers for new or enhanced products, our ability to successfully

integrate assets and companies we have acquired, including the successful

integration of Open E Cry, our ability to effectively compete in the futures

industry, changes in tax policy or accounting rules, fluctuations in foreign

exchange rates and commodity prices, adverse changes or volatility in

interest rates, as well as general economic, business, credit and financial

market conditions, internationally or nationally, and our ability to

continue paying a quarterly dividend in light of future financial performance and

financing needs.

The

forward-looking

statements

included

herein

represent

GAIN

Capital's

views

as

of

the date of this presentation. GAIN Capital undertakes no obligation to revise or

update publicly any forward-looking statement for any reason unless

required by law. 2 |

Overview

Glenn Stevens, CEO |

3

rd

Quarter Summary

•

Solid profitability and margins despite challenging trading

conditions

•

Managed expenses in core retail FX business while launching

new products and services to diversify revenue

•

Introduced TRADE, a new retail platform featuring an

expanded portfolio of FX and CFD products

•

Expanded GTX specialty execution desk through addition of

new team

•

Entered online futures market with closing of OEC acquisition

4 |

3

rd

Quarter 2012 Results Overview

5

•

Financial Results

•

Net Revenue: $40.0 million

•

Net Income: $3.2 million

•

Adjusted Net Income

(2)

: $3.6 million

•

Adjusted EBITDA

(1)

: $6.2 million

•

EPS (Diluted): $0.08

•

Adjusted EPS (Diluted)

(3)

: $0.09

•

Strong Balance Sheet

•

$93.6mm of free cash available as of

September 30, 2012

(4)

•

$143.6mm of liquidity including revolver

•

Operating Metrics

(5)

•

Retail volume: $278.7 billion vs. $447.9 billion

•

Institutional volume:$503.7 billion vs. $260.0

billion

•

Client assets up 49% to $426.6 million as of

September 30, 2012

•

Retail FX: $316.9 million vs. $286.4 million

•

OEC: $109.7 million

43%

45%

48%

44%

48%

49%

48%

0%

10%

20%

30%

40%

50%

60%

1Q 11

2Q 11

3Q 11

4Q 11

1Q 12

2Q 12

3Q 12

Active Account Yield

All comparisons based on 3Q 2011

$164.2

$119.3

$123.1

$146.2

$118.9

$98.5

$0.0

$20.0

$40.0

$60.0

$80.0

$100.0

$120.0

$140.0

$160.0

$180.0

3Q 10

4Q 10

1Q 11

2Q 11

3Q 11

4Q 11

1Q 12

2Q 12

3Q 12

Retail Trading Revenue per Million

Retail Trading Revenue per Million (Quarterly)

Retail Trading Revenue per Million (Last Twelve Months)

(1)

Adjusted EBITDA is a non-GAAP financial measure that represents our earnings

before interest, taxes, depreciation, amortization and non-recurring expenses. A reconciliation of net income to adjusted EBITDA is available in

the appendix to this presentation.

(2)

in the appendix to this presentation.

(3)

Reconciliation of EPS to adjusted EPS is available in the appendix to this

presentation. (4)

Calculation of balance sheet liquidity is available in the appendix to this

presentation. (5)

Definitions for all our operating metrics are available in the appendix to this

presentation. Adjusted net income is a non-GAAP financial measure that represents our net

income excluding purchase intangible amortization. A reconciliation of net income to adjusted net income is available |

3

rd

Quarter

Trading

Conditions

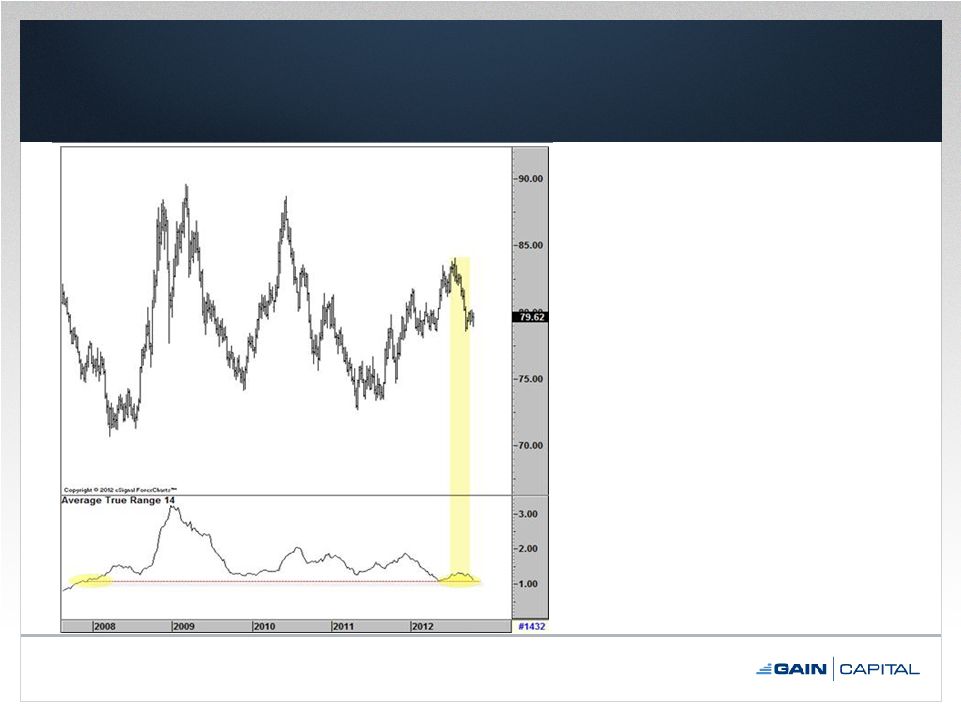

6

US Dollar Index Chart

•

Third quarter

volatility declined

back to 4-year lows

after modest uptick

in prior quarter

•

Average True

Range remains

significantly lower

than prior years

•

Trading conditions

translated into lower

retail volume |

Retail

Business •

Enhanced CFD offering

–

TRADE platform launched

–

Expands retail product offering to over 250 tradable markets

•

Indices, commodities & FX

–

Platform features innovative tools for market monitoring,

technical trading and strategy building

–

Future enhancements will add new asset classes, analytics,

community features and social trading tools

•

Opportunistic marketing spend

–

New marketing campaigns to promote TRADE

–

Positions GAIN to benefit from improved market conditions

•

Actively pursuing M&A opportunities

7 |

Open E

Cry (OEC) •

OEC acquisition closed on August 31

–

Purchase price: $12mm

•

Key Financial & Operating Metrics

–

Run-rate revenue: ~$15mm

–

Customers

(1)

: 8,100

–

Customer Assets

(1)

: $109.7mm

•

Quickly achieving operational synergies

•

Commission-based model will provide a stable

quarterly revenue stream

8

(1)

As of September 30, 2012. |

Institutional Business (GTX)

9

•

GTX demonstrated strong growth in revenue and volume:

–

3Q 2012 revenue: $4.2mm; average daily volume: $7.6bn

–

3Q 2011 revenue: $1.4mm; average daily volume: $2.6bn

•

Volumes continued to grow at a time many competitors are

reporting decreasing trading volumes

•

14-person specialty execution desk became operational in

September

•

Addition of new products and team expected to continue to

drive growth in volume and revenue |

Financial Review

Daryl

Carlough,

Interim

CFO |

$42.2

$35.6

$119.9

$110.3

$0

$20

$40

$60

$80

$100

$120

$140

2011

2012

2011

2012

Total Expenses

Comp & Benefits

Marketing

Trading

Purchase Intangible Amort.

All Other

$53.9

$40.0

$149.9

$118.9

$0.0

$20.0

$40.0

$60.0

$80.0

$100.0

$120.0

$140.0

$160.0

2011

2012

2011

2012

Net Revenue

3

rd

Quarter & 9 Months 2012 Financial Results

11

$9.3

$3.6

$23.0

$9.0

$7.6

$3.2

$19.0

$6.4

$0.0

$5.0

$10.0

$15.0

$20.0

$25.0

2011

2012

2011

2012

GAAP & Adjusted Net Income

(1)

Adjusted Net Income

GAAP Net Income

$15.6

$6.2

$39.7

$16.3

$0.0

$5.0

$10.0

$15.0

$20.0

$25.0

$30.0

$35.0

$40.0

$45.0

2011

2012

2011

2012

Adjusted EBITDA

(2)

3 Quarter

rd

9 Months

3 Quarter

rd

9 Months

3 Quarter

rd

9 Months

3 Quarter

rd

9 Months

Note: Dollars in millions.

(1)

Reconciliation of net income to adjusted net income available in appendix to this

presentation.

(2)

Adjusted EBITDA is a non-GAAP financial measure that represents our earnings before

interest, taxes, depreciation, amortization and non-recurring expenses. A reconciliation of

net income to Adjusted EBITDA is available in the appendix to this presentation. |

Quarterly Dividend & Share Buyback

•

$0.05 per share quarterly dividend approved

–

Record Date: December 12, 2012

–

Payment Date: December 21, 2012

•

Continue to repurchase shares pursuant to our

share buyback program

–

1.3mm shares repurchased through September 30

•

140k repurchased in 3Q 2012 at an average price of $4.64

–

$3mm remains available for additional repurchases

12 |

Expense Management…

•

3Q 2012 operating expenses of $33.8mm down

12.2% compared to 3Q 2011

–

Down 10.0% compared to 2Q 2011

•

Core retail expenses of $28.9mm declined 23.0%

compared to 3Q 2011

–

Core retail compensation & benefit expenses down

21.9% from 2Q 2012 and 5.2% from 3Q 2011

•

Savings of $4.5mm invested in institutional (GTX)

and futures (OEC) businesses

13 |

14

: Retail OTC

: Institutional

: Exchange

3%

97%

3Q

2011

10%

87%

3%

3Q

2012

8%

84%

8%

PF

2012

(1)

25%

50%

25%

Target

…Drives Revenue Diversification

(1) Pro forma data assumes OEC was acquired on January 1, 2012.

|

Closing Remarks

•

Solid profitability and margins despite challenging trading

conditions

•

Managing costs to facilitate investment in new areas

•

Successfully implementing strategy of investment in

retail and institutional businesses to grow and diversify

revenue sources

•

Well positioned to pursue organic and inorganic growth

opportunities

15 |

Appendix |

Condensed Consolidated Statements of Operations

17

Note: Unaudited. Dollars in millions, except per share data.

(1)

Non-recurring expenses relating to cost savings effected in 2Q 2012.

Three

Months

Ended

Sept.

30,

Nine

Months

Ended

Sept.

30,

Revenue

2012

2011

2012

2011

Retail trading revenue

34.3

$

52.2

$

104.6

$

146.1

$

Institutional trading revenue

4.2

1.4

12.2

3.3

Other revenue

1.4

0.6

2.1

1.3

Total non-interest revenue

39.9

54.2

118.9

150.7

Interest revenue

0.1

0.1

0.4

0.3

Interest expense

-

(0.4)

(0.4)

(1.1)

Total net interest revenue/(expense)

0.1

(0.3)

-

(0.8)

Net revenue

40.0

53.9

118.9

149.9

Expenses

Employee compensation and benefits

11.9

11.6

35.5

34.9

Selling and marketing

5.7

8.8

20.1

28.0

Trading expenses and commissions

8.9

9.9

26.9

25.5

Bank fees

0.8

1.3

2.5

3.4

Depreciation and amortization

1.2

1.0

3.2

2.9

Purchased intangible amortization

0.6

2.7

3.5

6.4

Communication and data processing

0.8

0.7

2.3

2.1

Occupancy and equipment

1.2

1.2

3.5

3.5

Bad debt provision

-

0.2

0.2

0.8

Professional fees

1.6

1.9

3.6

3.8

Product development, software and maintenance

1.1

1.0

3.3

3.0

Restructuring

(1)

-

-

0.6

-

Other

1.8

1.9

5.1

5.6

Total

35.6

42.2

110.3

119.9

Income before income tax expense

and equity in earnings of equity method

investment

4.4

11.7

8.6

30.0

Income tax expense

1.2

4.1

2.2

11.0

Net income

3.2

$

7.6

$

6.4

$

19.0

$

Earnings per common share:

Basic

0.09

$

0.22

$

0.18

$

0.55

$

Diluted

0.08

$

0.20

$

0.16

$

0.49

$

Weighted averages common shares outanding used

in computing earnings per common share:

Basic

35,250,404

34,625,525

34,893,622

34,313,987

Diluted

38,560,657

38,916,038

38,927,673

39,025,699 |

Consolidated Balance Sheet

18

Note: Unaudited. Dollars in millions.

September 30,

December 31,

2012

2011

ASSETS:

Cash

and

cash

equivalents

7.6

$

60.3

$

Cash and cash equivalents, held for customers

426.6

310.4

Short term investments

45.0

0.1

Receivables from banks and brokers

83.9

85.4

Property and

equipment -

net of accumulated depreciation

9.9

7.5

Prepaid assets

8.4

9.9

Goodwill

10.2

3.1

Intangible

assets,

net

10.7

10.8

Other

assets

17.3

18.1

Total

assets

619.6

$

505.6

$

LIABILITIES AND SHAREHOLDERS' EQUITY:

Payables to brokers, dealers, FCM'S and other regulated entities

12.6

$

17.3

$

Payable to customers

414.0

293.1

Accrued compensation & benefits payable

4.9

4.9

Accrued expenses and other liabilities

15.5

14.9

Income tax payable

2.6

2.6

Notes payable

-

7.9

Total

liabilities

449.6

$

340.7

$

Shareholders' Equity

170.0

$

164.9

$

Total

liabilities

and

shareholders'

equity

619.6

$

505.6

$

|

Current Liquidity

19

Note: Dollars in millions.

(1)

Reflects cash that would be received from brokers following the close-out of

all open positions. (2)

Excludes current liabilities of $21.3mm and capital charges associated with open

positions as of 9/30/2012. 9/30/2012

6/30/2012

12/31/2011

Cash & cash equivalents

$7.6

$22.4

$60.3

Cash & cash equivalents held for customers

426.6

320.2

310.4

Short term investments

45.0

0.1

0.1

Receivable

from

banks

and

brokers

(1)

83.9

115.7

85.4

Total Operating Cash

$563.1

$458.4

$456.2

Less: Cash & cash equivalents held for customers

(426.6)

(320.2)

(310.4)

Free Operating Cash

$136.5

$138.2

$145.8

Less: Minimum regulatory capital requirements

(42.9)

(42.6)

(35.8)

Less: Note payable

-

-

(7.9)

Free Cash Available

(2)

$93.6

$95.6

$102.1

Add: Available credit facility

50.0

50.0

50.0

Available Cash & Liquidity

$143.6

$145.6

$152.1 |

3

rd

Quarter

&

9

Months

2012

Financial

Summary

20

Note: Dollars in millions, except per share data.

(1)

See page 22 for a reconciliation of GAAP net income to adjusted EBITDA.

(2)

See page 21 for a reconciliation of GAAP net income to adjusted net income.

(3)

See page 23 for a reconciliation of GAAP EPS to adjusted EPS.

(4)

Adjusted

EBITDA

Margin

calculated

as

Adjusted

EBITDA/Net

Revenue

(ex.

Interest

expense).

3 Months Ended September 30,

9 Months Ended September 30,

'12 v '11 % Change

2012

2011

2012

2011

3rd Quarter

9 Months

Net Revenue

$40.0

$53.9

$118.9

$149.9

(26%)

(21%)

Interest Expense

-

0.2

0.4

0.4

(100%)

0%

Net Revenue (ex. Interest expense)

$40.0

$54.1

$119.3

$150.3

(26%)

(21%)

Operating Expenses

33.8

38.5

103.0

110.6

(12%)

(7%)

Adjusted EBITDA

(1)

$6.2

$15.6

$16.3

$39.7

(60%)

(59%)

GAAP Net Income

$3.2

$7.6

$6.4

$19.0

(58%)

(66%)

Adjusted Net Income

(2)

3.6

9.3

9.0

23.0

(61%)

(61%)

GAAP EPS (Diluted)

$0.08

$0.20

$0.16

$0.49

(60%)

(67%)

Adjusted EPS (Diluted)

(3)

0.09

0.24

0.23

0.59

(61%)

(61%)

Adjusted EBITDA Margin %

(1)(4)

15.5%

28.8%

13.7%

26.4%

(13 pts)

(13 pts)

Net Income Margin %

8.0%

14.1%

5.4%

12.7%

(6 pts)

(7 pts)

Adjusted Net Income Margin %

(2)

9.0%

17.3%

7.6%

15.3%

(8 pts)

(8 pts) |

Adjusted Net Income & Margin Reconciliation

21

Note: Dollars in millions, except per share data.

Three Months Ended September 30,

Nine Months Ended September 30

2012

2011

2012

2011

Net Revenue

40.0

$

53.9

$

118.9

$

149.9

$

Net income

3.2

7.6

6.4

19.0

Plus: Purchase intangible amortization (net of tax)

0.4

1.7

2.6

4.0

Adjusted Net Income

3.6

$

9.3

$

9.0

$

23.0

$

Adjusted Earnings per Share

Basic

0.10

$

0.27

$

0.26

$

0.67

$

Diluted

0.09

$

0.24

$

0.23

$

0.59

$

Net Income Margin %

8.0%

14.1%

5.4%

12.7%

Adjusted Net Income Margin %

9.0%

17.3%

7.6%

15.3% |

Adjusted EBITDA & Margin Reconciliation

22

Note: Dollars in millions.

(1)

Non-recurring

expenses

relating

to

cost

savings

effected

in

2Q

2012.

(2)

Adjusted

EBITDA

Margin

calculated

as

Adjusted

EBITDA/Net

Revenue

(ex.

Interest

expense).

Three Months Ended September 30,

Nine Months Ended September 30,

2012

2011

2012

2011

Net Revenue

40.0

$

53.9

$

118.9

$

149.9

$

Interest expense

-

0.2

0.4

0.4

Net Revenue (ex. Interest

expense) 40.0

$

54.1

$

119.3

$

150.3

$

Net income

3.2

$

7.6

$

6.4

$

19.0

$

Plus: Depreciation & amortization

1.2

1.0

3.2

2.9

Plus: Purchase intangible

amortization 0.6

2.7

3.5

6.4

Plus: Interest expense

-

0.2

0.4

0.4

Plus: Restructuring

(1)

-

-

0.6

-

Plus: Income tax expense

1.2

4.1

2.2

11.0

Adjusted EBITDA

6.2

$

15.6

$

16.3

$

39.7

$

Adjusted EBITDA Margin %

(2)

15.5%

28.8%

13.7%

26.4% |

Adjusted EPS (Diluted) Reconciliation

23

(1)

Net of tax.

Three Months Ended September 30,

Nine Months Ended September 30,

2012

2011

2012

2011

GAAP Earnings per Share (Diluted)

0.08

$

0.20

$

0.16

$

0.49

$

Plus: Purchase intangible amortization

(1)

0.01

0.04

0.07

0.10

Adjusted Earnings per Share (Diluted)

0.09

$

0.24

$

0.23

$

0.59

$

|

3

rd

Quarter & 9 Months 2012 Operating Metrics

(1)

24

Note: Dollars in millions, except retail trading revenue per million.

(1)

Definitions for all our operating metrics are available in the appendix to this

presentation. (2)

Includes 145 new OEC accounts.

(3)

Average calculated using excess net capital balance at each month-end during the

relevant period. (4)

Includes 8,100 OEC accounts.

3rd Quarter

9 Months

'12 v '11 % Change

2012

2011

2012

2011

3rd Quarter

9 Months

For Period Ending September 30,

Total Trading Volume (billions)

$782.4

$707.9

$2,418.8

$1,675.0

11%

44%

Retail

278.7

447.9

1,004.6

1,207.5

(38%)

(17%)

Institutional

503.7

260.0

1,414.2

467.5

94%

202%

Traded Retail Accounts (Period)

35,377

36,927

52,385

56,247

(4%)

(7%)

Traded Retail Accounts (Last 12 Months)

59,166

65,401

59,166

65,401

(10%)

(10%)

New Retail Accounts

(2)

6,121

7,852

19,855

24,764

(22%)

(20%)

Trades

8,059,238

10,949,800

26,326,970

29,339,268

(26%)

(10%)

Retail Trading Revenue per Million

$123.1

$116.4

$104.9

$121.0

6%

(13%)

Average Excess Net Capital

(3)

$56.3

$60.7

$60.7

$55.5

(7%)

9%

As of September 30,

Funded Retail Accounts

(4)

82,394

77,013

82,394

77,013

7%

7%

Client Assets

$426.6

$286.4

$426.6

$286.4

49%

49% |

$448

$279

$1,208

$1,005

$260

$504

$468

$1,414

$708

$782

$1,675

$2,419

$0

$500

$1,000

$1,500

$2,000

$2,500

$3,000

2011

2012

2011

2012

Total Trading Volume

(2)

Retail

Institutional

3

rd

Quarter & 9 Months 2012 Operating Metrics

(1)

(cont.)

25

3 Quarter

9 Months

$286.4

$316.9

$109.7

$426.6

$0.0

$50.0

$100.0

$150.0

$200.0

$250.0

$300.0

$350.0

$400.0

$450.0

2011

2012

Client Assets

(3)

Retail FX

Futures

65,401

59,166

-

10,000

20,000

30,000

40,000

50,000

60,000

70,000

2011

2012

Traded Retail Accounts (Last 12 Months)

77,013

74,294

8,100

82,394

0

10,000

20,000

30,000

40,000

50,000

60,000

70,000

80,000

90,000

2011

2012

Funded Retail Accounts

(3)

Retail FX

Futures

rd

(2)

Note: Trading volume in billions. Client assets in millions.

(1)

Definitions for all our operating metrics are available in the appendix to this

presentation. (2)

For periods ending September 30.

(3)

As of September 30. |

Monthly Operating Metrics

26

Funded

New Retail

Client

Month

Retail Accts.

(2)

Accounts

(3)

Assets

(2)

Oct 2011

76,496

2,372

$311.8

Nov 2011

76,647

2,330

319.3

Dec 2011

76,485

2,195

310.4

Jan 2012

76,847

2,145

313.6

Feb 2012

75,904

2,371

320.2

Mar 2012

73,844

2,356

325.9

Apr 2012

73,996

2,260

332.4

May 2012

74,452

2,463

300.5

June 2012

74,621

2,139

320.2

July 2012

74,962

2,127

320.7

Aug 2012

83,174

1,979

433.7

Sep 2012

82,394

2,015

426.6

(1)

Note: Dollars in millions.

(1)

Definitions for all our operating metrics are available in the appendix to this presentation.

(2)

As of period ended. August 2012 and September 2012 include 7,955 and 8,100 OEC accounts, respectively. (3)

For period ended. September 2012 includes 145 new OEC accounts. |

Quarterly

Operating

Metrics

(1)

27

Note: For period ended. Volume in billions.

(1)

Definitions for all our operating metrics are available in the appendix to this

presentation. Volume

Traded Retail

Quarter

Retail

Institutional

Accts. (Period)

Trades

4Q 11

$366.4

$386.4

34,019

9,852,951

1Q 12

385.1

468.0

36,041

9,291,722

2Q 12

340.8

442.5

36,660

8,976,010

3Q 12

278.7

503.7

35,377

8,059,238

|

Definition of Metrics

•

Total Trading Volume

–

Represents the U.S. dollar equivalent of notional amounts traded

•

Traded Retail Accounts

–

Retail accounts who executed a transaction during a given period

•

Funded Retail Accounts

–

Retail accounts who maintain a cash balance

•

Active Account Yield

–

Represents the percentage of average funded retail accounts who executed a

transaction during a given period •

Client Assets

–

Represents amounts due to clients, including customer deposits and unrealized

gains or losses arising from open positions

•

New Retail Accounts

–

The number of customer accounts that have initially opened and funded their

accounts •

Net Deposits from Retail Customers

–

Represents

customers’

deposits

less

withdrawals

for

a

given

period

•

Trades

–

The

number

of

transactions

retail

customers

have

completed

for

a

given

period

•

Retail Trading Revenue per Million

–

The revenue we realize from our forex, CFDs and metals trading activities per one

million of U.S. dollar-equivalent trading volume

•

Excess Net Capital

–

Represents the excess funds held over the regulatory minimum capital requirements,

as defined by the regulatory bodies that regulate our operating

subsidiaries 28 |

3

rd

Quarter 2012

Financial and Operating Results

November 1, 2012 |