Attached files

| file | filename |

|---|---|

| EX-99.3 - EX-99.3 - KEYCORP /NEW/ | d425043dex993.htm |

| EX-99.1 - EX-99.1 - KEYCORP /NEW/ | d425043dex991.htm |

| 8-K - 8-K - KEYCORP /NEW/ | d425043d8k.htm |

| KeyCorp

Third Quarter 2012 Earnings Review

October 18, 2012

Beth E. Mooney

Chairman and

Chief Executive Officer

Jeffrey B. Weeden

Chief Financial Officer

Exhibit 99.2 |

| 2

FORWARD-LOOKING STATEMENTS AND ADDITIONAL

INFORMATION DISCLOSURE

This presentation contains and we may, from time to time, make forward-looking

statements within the meaning of the Private Securities Litigation Reform Act of

1995, including statements about Key’s financial condition, results of

operations, earnings outlook, asset quality trends, capital levels and profitability. Forward-

looking statements are not historical facts but instead represent only

management’s current expectations and forecasts regarding future events, many of which, by

their nature, are inherently uncertain and outside of Key’s control.

Forward-looking statements usually can be identified by the use of words

such as “goal,”

“objective,”

“plan,”

“expect,”

“anticipate,”

“intend,”

“project,”

“believe,”

“estimate”

or other words of similar meaning.

Our forward-looking statements are subject to the following principal risks and

uncertainties: the economic recovery may face challenges causing its momentum to

falter or a further recession; the Dodd-Frank Wall Street Reform and Consumer

Protection Act and other reforms will subject us to a variety of new and more

stringent

legal

and

regulatory

requirements,

including

increased

scrutiny

from

our

regulators;

changes

in

local,

regional

and

international

business,

economic

or

political conditions in the regions where we operate or have significant assets;

changes in trade, monetary and fiscal policies of various governmental bodies and

central banks could affect the economic environment in which we operate; our

ability to effectively deal with an economic slowdown or other economic or market

difficulty; adverse changes in credit quality trends; our ability to determine

accurate values of certain assets and liabilities; adverse behaviors in foreign exchange

rates, securities, public debt, and capital markets, including changes in market

liquidity and volatility; our ability to anticipate interest rate changes correctly and

manage

interest

rate

risk

presented

through

unanticipated

changes

in

our

interest

rate

risk

position

and/or

short-

and

long-term

interest

rates;

unanticipated

changes

in our liquidity position, including but not limited to our ability to enter the

financial markets to manage and respond to any changes to our liquidity position; adequacy

of our risk management program; reduction of the credit ratings assigned to KeyCorp

and KeyBank; increased competitive pressure due to industry consolidation;

unanticipated adverse affects of acquisitions and dispositions of assets, business

units or affiliates; and operational or risk management failures due to technological,

cybersecurity threats or other factors.

We

provide

greater

detail

regarding

some

of

these

factors

in

our

2011

Form

10-K,

including

in

Item

1A.

Risk

Factors

and

in

Item

7.

Management’s

Discussion

and

Analysis

of

Financial

Condition

and

Results

of

Operation

under

the

heading

“Risk

Management,”

as

well

as

in

our

subsequent

SEC

filings,

all

of

which

are

accessible

on our website at www.key.com/ir and on the SEC’s website at

www.sec.gov. Key does not undertake any obligation to update the

forward-looking statements to reflect the impact of circumstances or events that may arise after the date of the

forward-looking statements. Actual results or future events could differ,

possibly materially, from those anticipated in forward-looking statements, as well as from

historical performance.

This

presentation

also

includes

certain

Non-GAAP

financial

measures

related

to

“tangible

common

equity,

“Tier

1

common

equity,”

“pre-provision

net

revenue,”

and

“cash efficiency ratio.”

Management believes these ratios may assist investors, analysts and regulators in

analyzing Key’s financials. Although Key has procedures in

place

to

ensure

that

these

measures

are

calculated

using

the

appropriate

GAAP

or

regulatory

components,

they

have

limitations

as

analytical

tools

and

should

not

be considered in isolation, or as a substitute for analysis of results under

GAAP. For more information on these calculations and to view the reconciliations to the

most comparable GAAP measures, please refer to the Appendix to this presentation or

our most recent earnings press release, which is accessible at

www.key.com/ir.

Web addresses referenced in this slide are inactive textual references only.

Information on these websites is not part of this document. |

3

Net interest income up 6% from prior quarter

Net interest margin up 17 bps from 2Q12 due to improved mix of earning

assets and lower funding cost

On track for expense reductions of $150 million to $200 million by

December 2013

Continued growth in average loans driven by C&I

Re-entered credit card business

Closed on western NY branch acquisition

Growing the

Franchise

Repurchased 9.6 million common shares

Redeemed $707 million of trust preferred securities

Maintained strong capital levels; positioned for Basel III

Execution of

Business Plan

Investor Highlights –

Third Quarter 2012

Execution of strategy and differentiated business model driving results

Disciplined

Capital

Management |

Slow

growth economy Low rate environment

Regulatory change

4

Positioned for Growth

Industry Challenges

Key Focus Areas

Optimize and Grow

Revenue

Improve Efficiency

Disciplined Capital

Management

Key: Refocused and Realigned

Improved balance sheet mix and

risk profile

Distinctive business model

Targeted client segments

Focused on core competencies

Achieve Targets for Success |

| 5

Financial Review

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

* |

6

Financial Summary –

Third Quarter 2012

Capital

(b)

Asset Quality

(a)

Financial

Performance

(a)

TE = Taxable equivalent, EOP = End of Period

(a)

From continuing operations

(b)

From consolidated operations

(c)

9-30-12 ratios are estimated

(d)

Non-GAAP measure: see slide 20 of Appendix for reconciliation

Income from continuing operations attributable to Key

$.23

$.23

$.24

common shareholders

Net interest margin (TE)

3.23%

3.06%

3.09%

Return on average total assets

1.08

1.12

1.14

Tier 1 common equity

(c), (d)

11.4%

11.6%

11.3%

Tier 1 risk-based capital

(c)

12.2

12.5

13.5

Tangible common equity to tangible assets

(d)

10.4

10.4

9.8

Book value per common share

$10.64

$10.43

$10.09

Net loan charge-offs to average loans

.86%

.63%

.90%

NPLs to EOP portfolio loans

1.27

1.32

1.64

NPAs to EOP portfolio loans + OREO + Other NPAs

1.39

1.51

1.89

Allowance for loan losses to period-end loans

1.73

1.79

2.35

Allowance for loan losses to NPLs

136.0

135.2

143.5

Metrics

3Q12

2Q12 3Q11 |

7

Average loan growth driven by C&I, while the exit

portfolio continues to run-off

Branch acquisition added $223 million in mostly

consumer loans to 3Q12

Acquired credit card portfolio Aug. 1; added $473

million to 3Q12 average loans

Originated $9 billion in new or renewed lending

commitments during 3Q12

Loan Growth

Highlights

Average Commercial & Industrial Loans

Average Loans

Exit Portfolios

Home Equity & Other

C&I & Leasing

Commercial Real Estate |

1.46%

.64%

.38%

1.94%

1.21%

.83%

0.00%

0.50%

1.00%

1.50%

2.00%

2.50%

8

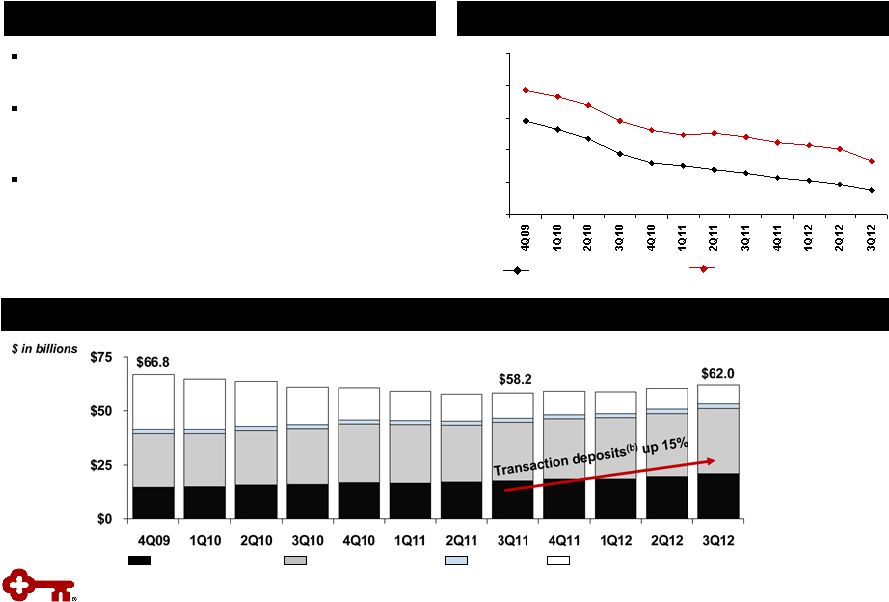

Improving Deposit Mix

Highlights

Funding Cost

Overall funding cost continues to improve, with

total deposit cost declining 26 bps from 3Q11

Western NY branch acquisition added $1.6

billion of mostly non-time consumer deposits to

3Q12 average balances

Total CD maturities and average cost

–

2012 Q4: $2.1 billion at 1.50%

–

2013: $3.9 billion at 1.49%

–

2014 & beyond: $2.2 billion at 3.03%

Average

Deposits

(a)

(a)

Excludes deposits in foreign office

(b)

Transaction deposits include noninterest-bearing, NOW and MMDA

Cost of total deposits

(a)

Interest-bearing liability cost

CDs and other time deposits

Savings

Noninterest-bearing

NOW and MMDA |

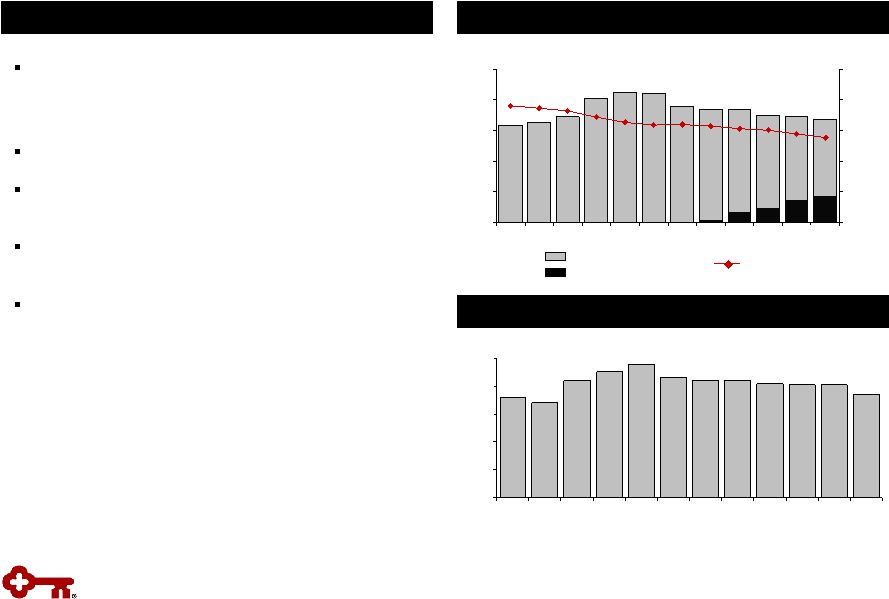

9

Total Revenue

TE = Taxable equivalent

Highlights

Net Interest Margin (TE) Trend

Net interest income improved, with net interest

margin up 17 bps from 2Q12 benefiting from:

–

Asset and funding mix improvement

–

Continued growth in C&I loans

–

Redemption of trust preferred securities

–

Maturities of higher cost CDs and debt

Higher noninterest income driven by leveraged

lease terminations and the redemption of trust

preferred securities

Total Revenue Mix

Noninterest income

$ in millions

$637

$555

$578

$469

$483

$544

$0

$400

$800

$1,200

4Q09

1Q10

2Q10

3Q10

4Q10

1Q11

2Q11

3Q11

4Q11

1Q12

2Q12

3Q12

Net interest income (TE)

$1,038

$1,122

$1,106 |

10

$400

$411

$471

$323

$382

$310

$0

$300

$600

$900

4Q09

1Q10

2Q10

3Q10

4Q10

1Q11

2Q11

3Q11

4Q11

1Q12

2Q12

3Q12

Focused Expense Management

Noninterest Expense

Personnel expense

$ in millions

Highlights

Noninterest expense increased $20 million from

2Q12

–

Elevated expenses from the acquisition of

branches and the credit card portfolio

•

Onetime expenses of $8 million

•

Intangible asset amortization of $8 million

–

Hiring of client-facing personnel

Focused on improving operating leverage

–

Targeting $150 million to $200 million in

expense reductions by December 2013, with

full-year impact expected in 2014

•

16 branch closures in 3Q12; 3 additional

planned for 4Q12

•

Consolidation of KEF operations

•

Headcount reduction

•

Strategic sourcing

Non-personnel expense

$871

$692

$734

$714

$16

$10

$(6)

$734

$600

$650

$700

$750

$800

2Q12

Branch

Acquisition

Credit Card

Other

3Q12

Q-o-Q Change in Noninterest Expense

(a)

(a)

Includes ongoing, onetime and amortization expenses |

11

Continued Improvement in Asset Quality

Highlights

Underlying credit trends continue to improve

Provision increased, primarily due to:

–

Acquisition of credit card portfolios and

branch loans (+$32 MM)

–

Updated regulatory guidance on

consumer loans (+$45 MM)

Net loan charge-offs increased $32 million from

prior quarter due to regulatory guidance

–

Impact on net charge-offs: $45 million or

35 bps of average loans

–

NCO ratio of 51 bps excluding impact of

regulatory guidance

Nonperforming assets continued to decline

including the impact of new guidance |

12

Strong capital position supports growth

Disciplined capital management process

–

Repurchased 9.6 million common shares

in 3Q12

–

Redeemed $707 million in trust preferred

securities during 3Q12 with a $54 million

gain from early swap termination

Estimated Basel III tier 1 common equity ratio of

10.5%

(a)

Tier 1 Common Equity

(b), (c)

Tangible Common Equity to Tangible Assets

(b)

Strong Capital Ratios

Highlights

Book Value per Share

10.4%

9.8%

7.6%

0.0%

3.0%

6.0%

9.0%

12.0%

4Q09

1Q10

2Q10

3Q10

4Q10

1Q11

2Q11

3Q11

4Q11

1Q12

2Q12

3Q12

$10.64

$10.09

$9.04

$8.00

$9.00

$10.00

$11.00

4Q09

1Q10

2Q10

3Q10

4Q10

1Q11

2Q11

3Q11

4Q11

1Q12

2Q12

3Q12

11.4%

11.3%

7.5%

0.0%

3.0%

6.0%

9.0%

12.0%

4Q09

1Q10

2Q10

3Q10

4Q10

1Q11

2Q11

3Q11

4Q11

1Q12

2Q12

3Q12

(a)

Based upon September 30, 2012 pro forma analysis; see slide 22 of Appendix for

further detail (b)

Non-GAAP measure: see slide 20 of Appendix for reconciliation

(c)

9-30-12 ratio is estimated |

| 13

Appendix

*

*

*

*

*

*

*

*

* |

14

(a)

Continuing operations, unless otherwise noted

(b)

Represents period-end consolidated total loans and loans held for sale

(excluding education loans in the securitization trusts) divided by

period-end consolidated total deposits (excluding deposits in foreign office)

Progress on Targets for Success

KEY Business

Model

KEY Metrics

(a)

KEY

3Q12

KEY

2Q12

Targets

Action Plans

Core funded

Loan to deposit ratio

(b)

86%

86%

90-100%

Leverage integrated model to grow

relationships and loans

Improve deposit mix

Returning to a

moderate risk

profile

NCOs to average loans

.86%

.63%

40-50 bps

Focus on relationship clients

Exit noncore portfolios

Limit concentrations

Focus on risk-adjusted returns

Growing high

quality, diverse

revenue streams

Net interest margin

3.23%

3.06%

>3.50%

Improve funding mix

Focus on risk-adjusted returns

Grow client relationships

Leverage Key’s total client solutions and

cross-selling capabilities

Noninterest income

to total revenue

48%

47%

>40%

Creating positive

operating

leverage

Efficiency ratio

65%

69%

60-65%

Improve efficiency and effectiveness

Leverage technology

Change cost base to more variable from

fixed

Executing our

strategies

Return on average

assets

1.08%

1.12%

1.00-1.25%

Execute our client insight-driven

relationship model

Focus on operating leverage

Improved funding mix with lower cost core

deposits |

15

$16.9

$18.5

$16.0

2.78%

3.15%

3.82%

$0

$5

$10

$15

$20

$25

4Q09

1Q10

2Q10

3Q10

4Q10

1Q11

2Q11

3Q11

4Q11

1Q12

2Q12

3Q12

0.00%

1.00%

2.00%

3.00%

4.00%

5.00%

Average Total Investment Securities

Highlights

Average AFS securities

$ in billions

High Quality Investment Portfolio

Portfolio composed of Agency or GSE backed:

GNMA, Fannie & Freddie

–

No private label MBS or financial paper

Average portfolio life at 9/30/12: 2.3 years

Unrealized net gain of $393 million on available-

for-sale securities portfolio at 9/30/12

Mortgage paydowns of $1.6 billion in 3Q12 and

$1.5 billion in 2Q12

Investment securities declined as paydowns were

reinvested for loan growth and acquired assets

Securities to Total Assets

(b)

(a) Yield is calculated on the basis of amortized cost

(b) Includes end of period held-to-maturity and

available-for-sale securities 19%

21%

18%

0%

5%

10%

15%

20%

25%

4Q09

1Q10

2Q10

3Q10

4Q10

1Q11

2Q11

3Q11

4Q11

1Q12

2Q12

3Q12

Average yield

(a)

Average HTM securities |

16

N/M = Not Meaningful

(a) Ending

and

average

loans

for

third

quarter

2012

include

commercial

credit

card

balances

of

$88

million

and

$54

million,

respectively

(b)

Net loan charge-off amounts are annualized in calculation. NCO ratios for

discontinued operations and consolidated Key exclude education loans in the

securitization trusts since valued at fair-market value (c)

9-30-12 allowance by portfolio is estimated. Allowance/period loans ratios

for discontinued operations and consolidated Key exclude education loans in

the securitization trusts since valued at fair-market value Credit

Quality Credit Quality by Portfolio |

Vintage (% of Loans)

Loan Balances

Average Loan

Size ($)

Average

FICO

Average

LTV

% of Loans

LTV>90%

2011 and

later

2010

2009

2008

2007 and

prior

Home equity loans and lines

First lien

5,293

$

62,873

$

757

66

%

.6

%

29

%

6

%

7

%

9

%

49

%

Second lien

4,475

46,561

755

75

3.0

19

5

6

16

54

Total home equity loans and lines

9,768

$

54,177

$

756

71

1.8

25

6

6

12

51

Nonaccrual loans

First lien

89

$

55,358

$

715

72

%

1.1

%

2

%

3

%

6

%

4

%

85

%

Second lien

82

36,397

709

79

2.9

1

1

3

16

79

Total home equity nonaccrual loans

171

$

44,338

$

712

75

1.9

2

2

5

9

82

Community Bank - Home Equity

Third quarter net charge-offs

62

$

1

%

1

%

2

%

21

%

75

%

Net loan charge-offs to average loans

2.53

%

17

(a)

Average LTVs are at origination. Current average LTVs for Community Bank total

home equity loans and lines is approximately 79%, which compares to 79% at

the end of the second quarter 2012. Community Bank –

Home Equity

Exit Portfolio –

Home Equity

$ in millions, except average loan size

$ in millions, except average loan size

(a)

(a)

Home Equity Loans –

9/30/12

Vintage (% of Loans)

Loan Balances

Average Loan

Size ($)

Average

FICO

Average

LTV

% of Loans

LTV>90%

2011 and

later

2010

2009

2008

2007 and

prior

Home equity loans and lines

First lien

18

$

22,571

$

745

34

%

.4

%

-

-

2

%

1

%

97

%

Second lien

391

23,782

730

82

32.3

-

-

-

2

98

Total home equity loans and lines

409

$

23,725

$

731

80

30.8

-

-

-

2

98

Nonaccrual loans

First lien

1

$

19,932

$

729

37

%

3

%

-

-

-

-

100

%

Second lien

17

19,259

704

83

36.1

-

-

-

2

%

98

Total home equity nonaccrual loans

18

$

19,288

$

705

82

34.7

-

-

-

2

98

Exit Portfolio - Home Equity

Third quarter net charge-offs

5

$

-

-

-

1

%

99

%

Net loan charge-offs to average loans

4.25

% |

18

Exit Loan Portfolio Trend (Excluding Discontinued Operations)

Exit Loan Portfolio

(a)

Includes (1) the business aviation, commercial vehicle, office products,

construction and industrial leases; (2) Canadian lease financing

portfolios; and (3) all remaining balances related to lease in, lease out; sale

in, lease out; service contract leases; and qualified technological

equipment leases

(b)

Includes loans in Key’s consolidated education loan securitization

trusts (c)

Credit amounts indicate recoveries exceeded charge-offs

$ in millions

Exit Loan Portfolio

Change

9-30-12 vs.

9-30-12

6-30-12

6-30-12

3Q12

(c)

2Q12

9-30-12

6-30-12

Residential properties –

homebuilder

$31

$33

$(2)

-

-

$6

$14

Marine and RV floor plan

35

39

(4)

$(1)

$2

12

15

Commercial lease financing

(a)

1,035

1,237

(202)

(3)

1

8

9

Total commercial loans

1,101

1,309

(208)

(4)

3

26

38

Home equity –

Other

409

479

(70)

5

7

18

17

Marine

1,448

1,542

(94)

6

7

31

19

RV and other consumer

98

101

(3)

(1)

2

2

1

Total consumer loans

1,955

2,122

(167)

10

16

51

37

Total exit loans in loan portfolio

$3,056

$3,431

$(375)

$6

$19

$77

$75

Discontinued operations -

education

lending business (not included in exit loans above)

(b)

$5,328

$5,483

$(155)

$12

$12

$22

$18

Balance on

Nonperforming

Status

Balance

Outstanding

Charge-offs

Net Loan |

19

Credit Quality Trends

Quarterly Change in Criticized Outstandings

(a)

Delinquencies to Period-end Total Loans

(a)

Loan and Lease Outstandings

.69%

.73%

.85%

.89%

.99%

.97%

.98%

.95%

1.29%

1.14%

1.14%

1.59%

.17%

.26%

.34%

.33%

.24%

.25%

.32%

.48%

.30%

.45%

.78%

.56%

0.00%

0.50%

1.00%

1.50%

2.00%

2.50%

4Q09

1Q10

2Q10

3Q10

4Q10

1Q11

2Q11

3Q11

4Q11

1Q12

2Q12

3Q12

30 –

89 days delinquent

90+ days delinquent

(10.9)%

(14.4)%

(6.8)%

(13.6)%

(10.2)%

(12.3)%

(11.2)%

(16.7)%

(14.3)%

(12.8)%

(1.0)%

(8.1)%

-20%

-16%

-12%

-8%

-4%

0%

4Q09

1Q10

2Q10

3Q10

4Q10

1Q11

2Q11

3Q11

4Q11

1Q12

2Q12

3Q12 |

GAAP

to Non-GAAP Reconciliation 20

(a)

September 30, 2012 number excludes $130 million of purchased credit card receivable intangible assets

that are not fully excludable for capital purposes. (b)

Includes net unrealized gains or losses on securities available for sale (except for net unrealized

losses on marketable equity securities), net gains or losses on cash flow hedges, and amounts

resulting from the December 31, 2006, adoption and subsequent application of the applicable accounting guidance for defined benefit and other

postretirement plans.

(c)

Other assets deducted from Tier 1 capital and net risk-weighted assets consist of disallowed

intangible assets (excluding goodwill) and deductible portions of nonfinancial equity

investments. There were no disallowed deferred tax assets at September 30, 2012, June 30, 2012, and September 30, 2011.

(d)

9-30-12 amount is estimated. |

GAAP

to Non-GAAP Reconciliation (continued) $ in millions

21

Three months ended

9-30-12

6-30-12

9-30-11

Return on tangible common equity from continuing operations Net income (loss) from continuing operations attributable to Key common shareholders

$

214

$

221

$

229

Tangible common equity (non-GAAP)

8,929

8,932

8,675

Return on tangible common equity from continuing operations (non-GAAP)

9.53

%

9.95

%

10.47

%

Return on tangible common equity consolidated Net income (loss) attributable to Key common shareholders

$

214

$

231

$

212

Tangible common equity (non-GAAP)

8,929

8,932

8,675

Return on tangible common equity consolidated (non-GAAP)

9.53

%

10.40

%

9.70

%

Cash efficiency ratio

Noninterest expense (GAAP)

$

734

$

714

$

692

Less:

Intangible asset amortization on credit cards

6

—

—

Other intangible asset amortization

3

1

1

Adjusted noninterest expense (non-GAAP)

$

725

$

713

$

691

Net interest income (GAAP)

$

572

$

538

$

549

Plus:

Taxable-equivalent adjustment

6

6

6

Noninterest income

544

485

483

Total taxable-equivalent revenue (non-GAAP)

$

1,122

$

1,029

$

1,038

Cash efficiency ratio (non-GAAP)

64.62

%

69.29

%

66.57

%

|

(1) Tier 1

common equity is a non-generally accepted accounting principle (GAAP) financial measure that is used by investors,

analysis and bank regulatory agencies to assess the capital position of financial services

companies. Management reviews Tier 1 common equity along with other measures of capital

as part of its financial analyses. (2) Includes AFS mark-to-market, cash flow

hedges on items recognized at fair value on the balance sheet, and defined benefit pension

liability. (3) Deferred tax asset subject to future taxable income for realization,

primarily tax credit carryforwards. (4) The amount of regulatory capital and risk-weighted

assets estimated under Basel III (as fully phased-in on January 1, 2019) is based upon the

federal banking agencies' notices of proposed rulemaking, which implement Basel III and the Standardized

Approach.

Tier 1 Common Equity under Basel III (estimated)

KeyCorp & Subsidiaries

22

TIER 1 COMMON EQUTIY UNDER BASEL III (ESTIMATES)

(1)

Quarter ended

Sept 30,

($'s in billions)

2012

Tier 1 Common Equity under Basel I

$9.0

Adjustments from Basel I to Basel III:

(0.1)

(0.1)

$8.8

Total risk-weighted assets under Basel I

$78.4

Adjustments from Basel I to Basel III:

Market Risk Impact

0.6

Loan Commitments < 1 Year

1.1

Residential Mortgage Loans & Home Equity

1.9

Other

1.1

Total risk-weighted assets under Basel III

$83.1

Tier 1 common equity to total risk-weighted assets

anticipated under Basel III

10.5%

Deferred Tax Assets

(3)

Cumulative Other Comprehensive Income

(2)

Tier 1 common equity anticipated under Basel III

(4) |