Attached files

As filed with the Securities and Exchange Commission on ___________________, 2012

Registration No. ______________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

Heavy Earth Resources, Inc.

(Exact name of registrant as specified in its charter)

|

Florida

|

1311

|

75-3160134

|

|

(State or other jurisdiction

of incorporation or organization)

|

(Primary Standard Industrial

Classification Code Number)

|

(I.R.S. Employer Identification No.)

|

|

625 Second Street, #280

San Francisco, California 94107

Tel: (415) 813-5079

|

||

|

(Address, including zip code, and telephone number, including area code, of registrant's principal executive offices)

|

||

Grant Draper

625 Second Street, #280

San Francisco, California 94107

Tel: (415) 813-5079

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies of all correspondence to:

Michael J. Muellerleile, Esq.

M2 Law Professional Corporation

500 Newport Center Drive, Suite 800

Newport Beach, CA 92660

Tel: (949) 706-1470/Fax: (949) 706-1475

Approximate date of proposed sale to the public: From time to time after this registration statement becomes effective.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box: x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer o

|

Accelerated filer o

|

|

Non-accelerated filer o (Do not check if a smaller reporting company)

|

Small reporting company T

|

1

CALCULATION OF REGISTRATION FEE

|

Title of each class

of securities

to be registered

|

Amount

to be

registered(1)

|

Proposed maximum

offering price

per share (7)

|

Proposed maximum

aggregate

offering price

|

Amount of

registration fee

|

|

Common Stock, $.001 par value per share, to be sold by selling shareholders.

|

10,157,373 (2)

|

$0.65

|

$6,602,292.45

|

$900.55

|

|

Common stock, $.001 par value per share, issuable upon exercise of warrants issued to investors with an exercise price of $1.25

|

270,833 (3)

|

$0.65

|

$176,041.45

|

$24.01

|

|

Common stock, $.001 par value per share, issuable upon conversion of convertible debentures issued to investors with a conversion price of $0.60

|

1,666,667 (4)

|

$0.65

|

$1,083,333.55

|

$147.77

|

|

Common Stock, $0.001 par value per share issuable as interest due on convertible debentures

|

900,000 (5)

|

$0.65

|

$585,000.00

|

$79.79

|

|

Common stock, $.001 par value per share, issuable upon exercise of warrants issued to investors with an exercise price of $0.85

|

1,666,667 (6)

|

$0.65

|

$1,083,333.55

|

$147.77

|

|

Total

|

14,661,540

|

$9,530,001.00

|

$1,299.89

|

|

(1)

|

Pursuant to Rule 416 of the Securities Act of 1933, as amended, this registration statement also covers such additional shares of common stock to be issued as the result of stock splits, stock dividends and similar transactions.

|

|

(2)

|

Represents shares of common stock offered by selling shareholders.

|

|

(3)

|

Represents shares of common stock that are issuable upon the exercise of common stock purchase warrants held by selling shareholders at an exercise price of $1.25 per share (the “First Warrants”).

|

|

(4)

|

Represents shares of common stock that are issuable upon the conversion of senior convertible debentures held by selling shareholders at a conversion price of $0.60 per share (the “Debentures”).

|

|

(5)

|

Represents a good faith estimate of the maximum number of shares of our $.001 par value common stock that may be issuable in the future if we elect to pay all interest due under the terms of the Debentures in shares of common stock. Under the terms of the Debentures, we may elect to pay, in lieu of paying accrued interest in cash, accrued interest on the convertible debentures by delivering by each interest payment date a number of registered shares equal to the quotient obtained by dividing the amount of such interest by the lesser of (a) the conversion price or (b) 85% of the lesser of (i) the average of the volume weighted average price for the 10 consecutive trading days on the trading day immediately prior to the applicable interest payment date, or (ii) the average of the volume weighted average price for the 10 consecutive trading days ending on the trading day that is immediately prior to the date the applicable interest conversion shares are issued and delivered if such delivery is after the interest payment date. We cannot predict the actual number of shares of common stock that will be issued as payment of interest, in part, because, among other things, the market price of the common stock will fluctuate based, among other things, on prevailing market conditions and we have not determined whether or not we will pay the interest due upon the Debentures in shares of our common stock. Nonetheless, we have estimated the number of shares of common stock that may be issuable in the future as payment of interest in common stock by dividing the total interest payable due under the convertible notes assuming no default by $0.50. In the event that additional shares are required to be issued to cover interest payments in excess of such upper limit of our good faith estimate, such additional shares will be registered on a new registration statement.

|

|

(6)

|

Represents shares of common stock that are issuable upon the exercise of common stock purchase warrants held by selling shareholders at an exercise price of $0.85 per share (the “Second Warrants”).

|

|

(7)

|

Estimated solely for the purpose of computing the amount of the registration fee pursuant to Rule 457(c). The proposed maximum offering price per share is based upon the average bid and asked price as reported by the OTCQB on October 10, 2012 (within 5 business days prior to filing this registration statement).

|

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until this Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

2

The information in this prospectus is not complete and may be changed. The selling shareholders will not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state or other jurisdiction where the offer or sale of these securities is not permitted.

Subject to completion, _________, 2012

Preliminary Prospectus

HEAVY EARTH RESOURCES, INC.

14,661,540 Shares of Common Stock

The selling stockholders identified in this prospectus are offering 14,661,540 shares of our common stock which includes: (i) 10,157,373 shares of our common stock held by the selling shareholders, (ii) 270,833 shares of common stock issuable upon the exercise of warrants with an exercise price of $1.25 per share, (iii) 1,666,667 shares of common stock issuable upon the conversion of senior convertible debentures with a conversion price of $0.60 per share , (iv) 900,000 shares of common stock issuable as interest due on the senior convertible debentures, and (v) 1,666,667 shares of common stock issuable upon the exercise of warrants with an exercise price of $0.85 per share. Our common stock is currently quoted on the OTCQB under the symbol “HEVI.” The last reported sales price of our common stock on the OTCQB on October 10, 2012, was $0.65 per share.

The selling stockholders may offer the shares of our common stock for resale on the OTCQB, in isolated transactions, or in a combination of such methods of sale. They may sell their shares at fixed prices that may be changed, at market prices prevailing at the time of sale, at prices related to prevailing market prices, or at negotiated prices with institutional or other investors, or, when permissible, pursuant to the exemption of Rule 144 under the Securities Act of 1933. There will be no underwriter’s discounts or commissions, except for the charges to a selling stockholder for sales through a broker-dealer. All net proceeds from a sale will go to the selling stockholder and not to us. We will pay the expenses of registering these shares.

The securities offered by this prospectus involve a high degree of risk. See “Risk Factors” beginning on Page 6 for factors to be considered before purchasing shares of our common stock.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is _________, 2012.

3

TABLE OF CONTENTS

|

Page

|

|

| 27 | |

| Executive Compensation | |

| 36 | |

| 79 | |

We have not authorized anyone to provide you with information different from that contained in this prospectus. The selling shareholders are offering to sell, and seeking offers to buy, shares of our common stock only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of the securities offered hereby.

4

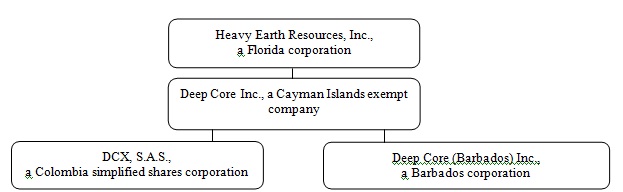

As used in this prospectus, unless otherwise indicated, the terms “Registrant,” “Heavy Earth,” “Company,” “we,” “us” and similar terms refer to Heavy Earth Resources, Inc., a Florida corporation and its wholly-owned subsidiary, Deep Core Inc., a Cayman Islands exempt company (“Deep Core”), and Deep Core’s majority owned subsidiaries, DCX S.A.S., a Colombia simplified shares corporation (“DCX”), and Deep Core (Barbados) Inc., a Barbados corporation (“Deep Core Barbados”).

You should read this summary together with the entire prospectus, including the more detailed information in our financial statements and related notes appearing elsewhere in this prospectus.

Business

We are an independent exploration stage company engaged in the exploration, development and production of oil and natural gas properties primarily in Central and South America through our subsidiaries. Through our subsidiaries, we are actively exploring our oil and gas properties consisting of a 50% participating interest in the Morichito Block of the Los Llanos Basin of Colombia (“Morichito Block”) and a 25% participating interest in the La Maye Block located in Lower Magdalena Basin of Colombia (“La Maye Block”). We currently devote a significant portion of our operations to the exploration and development of the Morichito Block.

Company History

Heavy Earth was incorporated in the State of Florida on June 25, 2004 as Swinging Pig Productions, Inc. We were previously a development stage company formed for purposes of developing, producing and marketing feature-length motion pictures. On May 12, 2011, our management changed and we entered into the oil and gas business to engage in the exploration, development, and production of oil and gas properties primarily in Central and South America. On October 13, 2011, we changed our name to Heavy Earth Resources, Inc.

On May 3, 2012, we entered into and closed a Share Exchange Agreement with Deep Core and the sole shareholder of Deep Core pursuant to which we issued 8,824,042 shares of common stock in exchange for all outstanding securities of Deep Core. Deep Core was incorporated in the Cayman Islands on March 29, 2011.

Prior to our acquisition of Deep Core, Deep Core purchased 99.68% of issued and outstanding common stock of DCX (formerly known as Petropuli SAS) for $1,750,000, the assumption of current and contingent liabilities and certain other terms and conditions. DCX was incorporated in Colombia on May 4, 1999.

Summary Financial Information

The summary financial information set forth below is derived from the more detailed financial statements appearing elsewhere in this prospectus. We have prepared our financial statements contained in this prospectus in accordance with accounting principles generally accepted in the United States. All information should be considered in conjunction with our financial statements and the notes contained elsewhere in this prospectus.

We are deemed a continuation of the business of Deep Core and its subsidiary, DCX as a result of our acquisition of Deep Core and Deep Core acquisition of DCX (as further described in this prospectus.) For accounting purposes, Deep Core (the legal acquirer) is deemed to be the accounting acquiree and DCX (the legal acquire) is considered the accounting acquirer. The assets and liabilities were transferred at DCX’s historical cost with our capital structure and the historical financial statements of DCX became our historical financial statements.

|

Statements of Operations

|

For six months ended

June 30, 2012

|

For Deep Core’s period from inception (March 29, 2011) through December 31, 2011

|

For DCX’s year ended

December 31, 2011

|

For DCX’s year ended

December 31, 2010

|

||||||||||||

| $ | $ | $ | ||||||||||||||

|

Revenue

|

- | - | - | - | ||||||||||||

|

Total Operating Expenses

|

616,362 | 55,600 | 891,705 | 371,791 | ||||||||||||

|

Other Income (Expense) (net)

|

(64,617 | ) | - | (256,312 | ) | 19,854 | ||||||||||

|

Net Income (Loss)

|

(680,979 | ) | (55,600 | ) | (1,151,386 | ) | (351,937 | ) | ||||||||

|

Net Loss Per Share

|

(0.01 | ) | (556.00 | ) | (0.37 | ) |

(0.11_)

|

|||||||||

|

Balance Sheets

|

June 30, 2012

|

December 31, 2011

|

December 31, 2011

|

December 31, 2010

|

||||||||||||

| $ | $ | $ | $ | |||||||||||||

|

Total Assets

|

20,990,728 | 805,204 | 12,649,143 | 7,304,476 | ||||||||||||

|

Total Liabilities

|

8,076,022 | 800,000 | 8,519,643 | 2,200,397 | ||||||||||||

|

Stockholders' Equity

(Deficit)

|

12,914,706 | 5,204 | 4,129,500 | 5,104,079 | ||||||||||||

5

The Offering:

|

Common stock offered by selling stockholders

|

The selling shareholders wish to sell up to 14,661,540 shares of our common stock, which includes: (i) 10,157,373 shares of our common stock, (ii) 270,833 shares issuable upon the exercise of the First Warrants held by selling shareholders, (iii) 1,666,667 shares issuable upon the conversion of Debentures held by selling shareholders, (iv) 900,000 shares issuable as interest due on the Debentures, and (v) 1,666,667 shares issuable upon the exercise of Second Warrants held by selling shareholders. All of these shares of our common stock are being offered for resale by the selling shareholders.

|

|

Offering Price

|

The selling shareholders may offer all or part of their shares for resale from time to time through public or private transactions, at either prevailing market prices or at privately negotiated prices.

|

|

Use of proceeds

|

We will not receive any proceeds from the sale of the common stock by the selling stockholders, except the proceeds, if any, from the exercise of First Warrants and Second Warrants held by selling shareholders, which could total $1,755,208.20.

|

|

Trading

|

Our common stock is traded on the OTCQB under the symbol “HEVI.”

|

Before you invest in our common stock by purchasing shares from a selling stockholder named in this prospectus, you should be aware that there are various risks involved in investing in our common stock. You should consider carefully these risk factors, together with all of the other information included in this prospectus and in the periodic reports we have filed with the Securities and Exchange Commission under the Securities Exchange Act of 1934, before you decide to purchase any shares of our common stock. A purchase of our common stock is speculative in nature and involves a lot of risks. Additional risks that we do not yet know of or that we currently think are immaterial may also impair our business operations. Any person who cannot afford the loss of his or her entire purchase price for the offered shares should not purchase the offered shares because such a purchase is highly speculative. Purchasers of the offered shares may not realize any return on their purchase of the offered shares. Purchasers may lose their investments in us completely.

We will need to raise additional capital to fund our operations. Our failure to raise additional capital will significantly affect our ability to fund our proposed activities.

To continue operations, we need to raise additional funds. We do not know if we will be able to acquire additional financing. We anticipate that we will need to spend significant funds on our new business. Our failure to obtain additional funds would significantly limit or eliminate our ability to fund our operations. If we are not able to raise additional capital or generate revenues that cover our estimated operating costs, our business may ultimately fail.

We have a limited operating history or revenue and minimal assets.

We began operating in the oil and gas business in May 2012. Our limited operating history makes it difficult for potential investors to evaluate our business or prospective operations. As of the date of this prospectus, we have received no revenues and have not earned a profit from operations. As an early stage company, we are subject to all the risks inherent in the financing, expenditures, operations, complications and delays inherent in a new business. Accordingly, our business and success faces risks from uncertainties faced by developing companies in a competitive environment. There can be no assurance that our efforts will be successful or that we will ultimately be able to attain profitability.

We have incurred a net loss since inception and expect to incur net losses for the foreseeable future.

As of June 30, 2012, our net loss since inception was $3,723,061. We expect to incur operating and capital expenditures for the next year and, as a result, we expect significant net losses in the future. We may not be able to generate sufficient revenues to achieve profitable operations.

Because we are an exploration stage company, we have no revenues to sustain our operations.

We are an exploration stage company that is currently developing our business. To date, we have not generated any revenues, and we cannot guaranty that any will be generated. We are not able to predict whether we will be able to develop and exploit our oil and gas interests and generate revenues. If we are not able to complete the successful development of our business, generate significant revenues and attain sustainable profitable operations, then our business will fail.

6

We will need additional financing to execute our business plan.

We do not have any revenues from our current operations. We will need substantial additional funds to:

|

·

|

effectuate our business plan;

|

|

·

|

fund the acquisition, exploration, development and production of oil and natural gas in the future;

|

|

·

|

fund future drilling programs; and

|

|

·

|

hire and retain key employees.

|

We may seek additional funds through public or private equity or debt financing, via strategic transactions, and/or from other sources. We cannot guarantee that future funding will be available on favorable terms or at all. If additional funding is not obtained, we may need to reduce, defer or cancel drilling programs, planned initiatives, or overhead expenditures to the extent necessary. The failure to fund our operating and capital requirements could have a material adverse effect on our business, financial condition and results of operations.

Our independent auditors have expressed substantial doubt about our ability to continue as a going concern.

In their report dated March 1, 2012, our current independent registered public accounting firm stated that our financial statements for the year ended December 31, 2011, were prepared assuming that we would continue as a going concern, and that they have substantial doubt about our ability to continue as a going concern. Our auditors’ doubts are based on our lack of producing assets and our ability to obtain sufficient working capital to fund future operations. If we are unable to raise additional capital, our efforts to continue as a going concern may not prove successful.

Oil and natural gas exploration and development activities are subject to many risks which may affect our ability to obtain any level of commercial success.

Oil and gas exploration may involve unprofitable efforts, not only from dry wells, but from wells that are productive but do not produce sufficient net revenues to return a profit after drilling, operating and other costs. Completion of a well does not assure a profit on the investment or recovery of drilling, completion and operating costs. In addition, drilling hazards or environmental damage could greatly increase the cost of operations, and various field operating conditions may negatively affect the production from successful wells. These conditions include delays in obtaining governmental approvals or consents, shut-ins of connected wells resulting from extreme weather conditions, insufficient storage or transportation capacity or other geological and mechanical conditions. While diligent well supervision and effective maintenance operations can contribute to maximizing production rates over time, production delays and declines from normal field operating conditions cannot be eliminated and can be expected to negatively affect revenue and cash flow levels to varying degrees.

Our commercial success depends on our ability to find, acquire, develop and commercially produce oil and natural gas reserves.

Without the continual addition of new reserves, any existing reserves and the production therefrom will decline over time as such existing reserves are depleted. A future increase in our reserves will depend not only on our ability to explore and develop any properties we may have from time to time, but also on our ability to select and acquire suitable producing properties or prospects. We cannot guaranty that we will be able to continue to locate satisfactory properties for acquisition or participation. Moreover, if such acquisitions or participations are identified, we may determine that current markets, terms of acquisition and participation or pricing conditions make such acquisitions or participations economically disadvantageous. We cannot guaranty that commercial quantities of oil will be discovered or acquired by us.

Our oil and gas operations are subject to operating hazards that may increase our operating costs to prevent such hazards, or may materially affect our operating results if any of such hazards were to occur.

Oil and natural gas exploration, development and production operations are subject to all the risks and hazards typically associated with such operations, including hazards such as fire, explosion, blowouts, cratering, unplanned gas releases and spills, each of which could result in substantial damage to our wells, production facilities, other property and the environment or in personal injury. Oil and gas production operations are also subject to all the risks typically associated with such operations, including encountering unexpected formations or pressures, premature decline of reservoirs and the invasion of water into hydrocarbon producing formations. Losses resulting from the occurrence of any of these risks could negatively affect our results of operations, liquidity and financial condition.

Our exploration and development activities will depend in part on the evaluation of data obtained through geophysical testing and geological analysis, as well as test drilling activity.

The results of geophysical testing and geological analysis are subjective, and we cannot guaranty that the exploration and development activities we conduct based on positive analysis will produce oil or gas in commercial quantities or costs. As we perform developmental and exploratory activities, further data required for evaluation of our oil and gas interests will become available. The exploration and development activities that will be undertaken by us are subject to greater risks than those associated with the acquisition and ownership of producing properties. The drilling of development wells, although generally consisting of drilling to reservoirs believed to be productive, may result in dry holes or a failure to produce oil or gas in commercial quantities. Moreover, any drilling of exploratory wells is subject to significant risk of dry holes.

7

If we are unable to successfully compete with the large number of oil and natural gas producers in our industry, we may not be able to achieve profitable operations.

Oil and natural gas exploration is intensely competitive in all its phases and involves a high degree of risk. We compete with numerous other participants in the search for and the acquisition of oil and natural gas properties and in the marketing of oil and natural gas. Our competitors include energy companies that have substantially greater financial resources, staff and facilities than us. Our ability to establish additional reserves in the future will depend not only on our ability to explore and develop our existing properties, but also on our ability to select and acquire suitable producing properties or prospects for exploratory drilling. Competitive factors in the distribution and marketing of oil and natural gas include price and methods and reliability of delivery. Competition may also be presented by alternate fuel sources.

As many of our properties are in the exploration stage, there can be no assurance that we will establish commercial discoveries on our properties.

Exploration for economic reserves of oil and gas is subject to a number of risk factors. Few properties that are explored are ultimately developed into producing oil and/or gas wells. Our properties are in the exploration stage only and are without proven reserves of oil and gas. Any profitability in the future from our business will be dependent upon locating and developing economic reserves of oil and gas, which itself is subject to numerous risk factors as set forth herein. We may not establish commercial discoveries on any of our properties.

Our operations in Colombia are subject to risks relating to political and economic instability.

We currently have interests in oil and gas concessions in Colombia and anticipate that operations in Colombia will constitute a substantial element of our strategy going forward. The political climate in Colombia is unstable and could be subject to radical change over a very short period of time. In the event of a significant negative change in the political or economic climate in Colombia, we may be forced to abandon or suspend our operations in Colombia.

A 40-year armed conflict between government forces and anti-government insurgent groups and illegal paramilitary groups—both funded by the drug trade—continues in Colombia. Insurgents continue to attack civilians and violent guerilla activity continues in many parts of the country. While our operators take measures to protect our assets, operations and personnel from guerilla activity, continuing attempts to reduce or prevent guerilla activity may not be successful and guerilla activity may disrupt our operations in the future. There can also be no assurance that we can maintain the safety of our operations and personnel in Colombia or that this violence will not affect our operations in the future. Continued or heightened security concerns in Colombia could also result in a significant loss to us.

Additionally, Colombia is among several nations whose eligibility to receive foreign aid from the United States is dependent on its progress in stemming the production and transit of illegal drugs, which is subject to an annual review by the President of the United States. Although Colombia is currently eligible for such aid, Colombia may not remain eligible in the future. A finding by the President that Colombia has failed demonstrably to meet its obligations under international counter-narcotics agreements may result in any of the following:

|

●

|

all bilateral aid, except anti-narcotics and humanitarian aid, would be suspended;

|

|

|

●

|

the Export-Import Bank of the United States and the Overseas Private Investment Corporation would not approve financing for new projects in Colombia;

|

|

|

●

|

United States representatives at multilateral lending institutions would be required to vote against all loan requests from Colombia, although such votes would not constitute vetoes; and

|

|

|

●

|

the President of the United States and Congress would retain the right to apply future trade sanctions.

|

Each of these consequences could result in adverse economic consequences in Colombia and could further heighten the political and economic risks associated with our operations there. Any changes in the holders of significant government offices could have adverse consequences on our relationship with the Colombian National Hydrocarbons Agency (“ANH”) and the Colombian government’s ability to control guerrilla activities and could exacerbate the factors relating to our foreign operations. Any sanctions imposed on Colombia by the United States government could threaten our ability to obtain necessary financing to develop the Colombian properties or cause Colombia to retaliate against us, including by nationalizing our Colombian assets. Accordingly, the imposition of the foregoing economic and trade sanctions on Colombia would likely result in a substantial loss and a decrease in the price of our common stock. The United States may impose sanctions on Colombia in the future, and we cannot predict the effect in Colombia that these sanctions might cause.

Our operations will be subject to environmental and other government laws and regulations that are costly and could potentially subject us to substantial liabilities.

Crude oil and natural gas exploration and production operations in Colombia are subject to extensive laws and regulations. Oil and gas companies are subject to laws and regulations addressing, among others, land use and lease permit restrictions, bonding and other financial assurance related to drilling and production activities, spacing of wells, unitization and pooling of properties, environmental and safety matters, plugging and abandonment of wells and associated infrastructure after production has ceased, operational reporting and taxation. Failure to comply with such laws and regulations can subject us to governmental sanctions, such as fines and penalties, as well as potential liability for personal injuries and property and natural resources damages. We may be required to make significant expenditures to comply with the requirements of these laws and regulations, and future laws or regulations, or any adverse change in the interpretation of existing laws and regulations, could increase such compliance costs. Regulatory requirements and restrictions could also delay or curtail our operations and could have a significant impact on our financial condition or results of operations.

8

Our oil and gas operations are subject to stringent laws and regulations relating to the release or disposal of materials into the environment or otherwise relating to environmental protection. These laws and regulations:

|

●

|

require the acquisition of authorizations, approvals and permits before drilling commences;

|

|

|

●

|

restrict the types, quantities and concentration of substances that can be released into the environment in connection with drilling and production activities;

|

|

|

●

|

limit or prohibit drilling activities on certain lands lying within wilderness, wetlands and other protected areas; and

|

|

|

●

|

impose substantial liabilities for pollution resulting from operations.

|

Failure to comply with these laws and regulations may result in:

|

●

|

the imposition of administrative, civil and/or criminal penalties;

|

|

|

●

|

incurring investigatory or remedial obligations; and

|

|

|

●

|

the imposition of injunctive relief.

|

Changes in environmental laws and regulations occur frequently, and any changes that result in more stringent or costly waste handling, storage, transport, disposal or cleanup requirements could require us to make significant expenditures to attain and maintain compliance and may otherwise have a material adverse effect on our industry in general and on our own results of operations, competitive position or financial condition. Although we intend to be in compliance in all material respects with all applicable environmental laws and regulations, we cannot assure you that we will be able to comply with existing or new regulations. In addition, the risk of accidental spills, leakages or other circumstances could expose us to extensive liability.

We are unable to predict the effect of additional environmental laws and regulations that may be adopted in the future, including whether any such laws or regulations would materially adversely increase our cost of doing business or affect operations in any area.

Under certain environmental laws that impose strict, joint and several liability, we may be required to remediate our contaminated properties regardless of whether such contamination resulted from the conduct of others or from consequences of our own actions that were or were not in compliance with all applicable laws at the time those actions were taken. In addition, claims for damages to persons or property may result from environmental and other impacts of our operations. Moreover, new or modified environmental, health or safety laws, regulations or enforcement policies could be more stringent and impose unforeseen liabilities or significantly increase compliance costs. Therefore, the costs to comply with environmental, health or safety laws or regulations or the liabilities incurred in connection with them could significantly and adversely affect our business, financial condition or results of operations. In addition, many countries have agreed to regulate emissions of “greenhouse gases.” Methane, a primary component of natural gas, and carbon dioxide, a byproduct of burning of natural gas and oil, are greenhouse gases. Regulation of greenhouse gases could adversely impact some of our operations and demand for some of our services or products in the future.

Our executive officers do not have extensive experience in oil and gas operations in Colombia which could impair our ability to comply with Colombia’s legal and regulatory requirements.

Although key personnel of our subsidiaries have oil and gas operational experience in Colombia, our executive officers have had limited oil and gas operational experience in Colombia which may impair our ability to comply with legal and regulatory requirements in Colombia. Our executive officers may not be able to implement and affect programs and policies in an effective and timely manner that adequately respond to increased legal, regulatory compliance and reporting requirements imposed by Colombia’s laws and regulations. Our failure to comply with such laws and regulations could lead to the imposition of fines and penalties and further result in the deterioration of our business.

Our executive officers are not physically located in Colombia which could impair our ability to effectively manage our operations in Colombia and, as a result, harm our operating results.

Our executive officers reside in the United States and may be unable to effectively oversee the day-to-day management of our foreign subsidiaries and operations in Colombia and timely respond to any emergencies or issues that may arise in Colombia. The inability or our failure to effectively and efficiently manage our operations in Colombia could have a negative impact on our business and adversely affect our operating results.

Colombia’s legal system may not provide for effective legal redress for foreign entities such as us.

As a civil law jurisdiction Colombia has a legal system which is different from the common law jurisdictions of the United States. Standard legal practices in civil law jurisdictions may result in risks such as (i) a higher degree of discretion on the part of governmental authorities; (ii) the lack of judicial or administrative guidance on interpreting applicable rules and regulations, particularly where those rules and regulations are the result of recent legislative changes or have been recently adopted; (iii) inconsistencies or conflicts between and within various laws, regulations, decrees, orders and resolutions; and (iv) relative inexperience of the judiciary and courts in such matters. In the case of foreign entities such as us doing business in a civil law jurisdiction such as Colombia, effective legal redress in the courts of these countries, whether in respect of a breach of law or regulation or in an ownership dispute, may be more difficult to obtain. As well, legislation and regulations may be susceptible to revision or cancellation and legal redress may be uncertain or delayed. There can be no assurance that joint ventures, licenses, license applications or other legal arrangements will not be adversely affected by changes in governments, the actions of government authorities or others, or the effectiveness and enforcement of such arrangements. It may not be possible to effect service of process upon us or our officers or directors or enforce court judgments against us.

Although we are subject to state and federal laws, we carry on all of our material operations in Colombia. Accordingly, we are subject to the legal systems and regulatory requirements of a number of jurisdictions with a variety of requirements and implications for our shareholders. Exploration and development activities outside the United States may require protracted negotiations with host governments, regulatory bodies and other third parties. If a dispute arises with foreign operations, we may be subject to the exclusive jurisdiction of foreign courts or may not be successful in subjecting foreign persons to the jurisdiction of the United States.

9

The condition of infrastructure and equipment in Colombia may disrupt our operations.

The physical infrastructure of Colombia has not been adequately funded and maintained. Particularly affected are the road networks, power generation and transmission, communication systems and building stock. The poor state of certain physical infrastructure could disrupt the transportation of goods, supplies and production and, accordingly, may add to the costs of doing business in these countries. Such additional costs or business interruption could materially adversely affect the timing of our plans and our business, financial condition, results of operations, and the value of our common stock. Colombia has limited refinery and pipeline capacity and may be insufficient to accommodate our production in the event of an oil discovery. If drilling activities increase in Colombia generally, shortage of drilling and completion rigs, field equipment and qualified personnel could develop. From time to time, associated costs have sharply increased in various areas around the world and could do so again. The demand for and wage rates of qualified drilling rig crews generally rise in response to the increased number of active rigs in service and could increase sharply in the event of a shortage. Shortages of drilling and completion rigs, field equipment or qualified personnel could delay, restrict or curtail our exploration and development operations, which could in turn negatively impact our operating results.

Our 25% participating interest in the La Maye Block in Colombia is subject to control by operators which may carry out transactions affecting our Colombian assets and operations without our consent.

Our participating interest in the La Maye Block in Colombia is subject to a substantial degree of control by the operator of the La Maye Block, which according to the ANH owns a 75% interest in the La Maye Block. The operator of the La Maye Block may sell their interests in the La Maye Block in the future and, as the operator, may determine that temporary shut-ins from production may be required. Our management intends to closely monitor the nature and progress of future transactions by the operator of the La Maye Block in order to protect our interests. However, we have no effective ability to alter or prevent a transaction and are unable to predict whether or not any such transactions will in fact occur or the nature or timing of any such transaction. As a result, our financial results in the La Maye Block are directly affected by the independent strategies and decisions of the operator of the La Maye Block.

Our ability to successfully market and sell oil and natural gas is subject to a number of factors that are beyond our control, and that may adversely impact our ability to produce and sell hydrocarbons, or to achieve profitability.

The marketability and price of oil and natural gas that may be acquired or discovered by us will be affected by numerous factors beyond our control. Our ability to market our oil and natural gas may depend upon our ability to acquire space on pipelines that deliver hydrocarbons to commercial markets. We may be affected by deliverability uncertainties related to the proximity of our reserves to pipelines and processing facilities, by operational problems with such pipelines and facilities, and by government regulation relating to price, taxes, royalties, land tenure, allowable production, the export of oil and gas and by many other aspects of the oil and gas business.

Our revenues, profitability and future growth and the carrying value of our oil and gas properties are substantially dependent on prevailing prices of oil and natural gas. Our ability to borrow and to obtain additional capital on attractive terms is also substantially dependent upon oil and natural gas prices. Prices for oil and natural gas are subject to large fluctuations in response to relatively minor changes in the supply of and demand for oil and natural gas, market uncertainty and a variety of additional factors beyond our control. These factors include economic conditions in the United States, the actions of the Organization of Petroleum Exporting Countries, governmental regulation, political stability in the Middle East and elsewhere, the foreign supply of oil, the price of foreign imports and the availability of alternative fuel sources. Any substantial and extended decline in the price of oil and natural gas would have an adverse effect on our borrowing capacity, revenues, profitability and cash flows from operations.

Volatile commodity prices make it difficult to estimate the value of producing properties for acquisition and often cause disruption in the market for producing properties, as buyers and sellers have difficulty agreeing on such value. Price volatility also makes it difficult to budget for and project the return on acquisitions and development and exploitation projects.

We cannot guarantee that title to our properties does not contain a defect that may materially affect our interest in those properties.

It is our practice in acquiring significant oil and gas leases or interest in oil and gas leases to retain lawyers to fully examine the title to the interest under the lease. In the case of minor acquisitions, we rely upon the judgment of oil lease brokers or land men who do the field work in examining records in the appropriate governmental office before attempting to place under lease a specific interest. We believe that this practice is widely followed in the energy industry. Nevertheless, there may be title defects which affect lands comprising a portion of our properties which may adversely affect us.

Our properties are held in the form of participating interests in exploration and production contracts and operating agreements. If the specific requirements of such contracts and agreements are not met, the instrument may terminate or expire.

All of our properties are held under participating interests in oil and gas exploration and production contracts and operating agreements. If we fail to meet the specific requirements of each contract or agreement, especially future drilling and production requirements, the contract or agreement may be terminated or otherwise expire. We cannot be assured that we will be able to meet our obligations under each contract and agreement. The termination or expiration of our participating interests relating to any contract or agreement would harm our business, financial condition and results of operations.

We have substantial capital requirements that, if not met, may hinder our operations.

We anticipate that we will make substantial capital expenditures for the acquisition, exploration, development and production of oil and natural gas in the future and for future drilling programs. If we have insufficient revenues, we may have limited ability to expend the capital necessary to undertake or complete future drilling programs. There can be no assurance that debt or equity financing, or cash generated by operations will be available or sufficient to meet these requirements or for other corporate purposes, or if debt or equity financing is available, that it will be on terms acceptable to us. Moreover, future activities may require us to alter our capitalization significantly. Our inability to access sufficient capital for our operations could have a material adverse effect on our financial condition, results of operations or prospects.

10

Additional capital may be costly or difficult to obtain.

Additional capital, whether through the offering of equity or debt securities, may not be available on reasonable terms or at all, especially in light of the recent downturn in the economy and dislocations in the credit and capital markets. If we are unable to obtain required additional capital, we may have to curtail our growth plans or cut back on existing business and, further, we may not be able to continue operating if we do not generate sufficient revenues from operations needed to stay in business. We may incur substantial costs in pursuing future capital financing, including investment banking fees, legal fees, accounting fees, securities law compliance fees, printing and distribution expenses and other costs. We may also be required to recognize non-cash expenses in connection with certain securities we issue, such as convertible notes and warrants, which may adversely impact our financial condition.

Because we are small and have limited access to additional capital, we may have to limit our exploration activity, which may result in a loss of investment.

We have a small asset base and limited access to additional capital. Accordingly, we must limit our exploration activity. As such, we may not be able to complete an exploration program that is as thorough as our management would like. In that event, existing reserves may go undiscovered. Without finding reserves, we cannot generate revenues and investors may lose their investment.

Our insurance may be inadequate to cover liabilities we may incur.

Oil and natural gas exploration, development and production operations are subject to all the risks and hazards typically associated with such operations, including hazards such as fire, explosion, blowouts, cratering, sour gas releases, and spills, each of which could result in substantial damage to oil and natural gas wells, production facilities, other property and the environment or in personal injury as well as general risks and hazards, including labor unrest, civil disorder, war, acts of terrorism, subversive activities or sabotage, fires, floods, explosions or other catastrophes, epidemics or quarantine restrictions. Although we have obtained insurance in accordance with industry standards to address certain of these risks, such insurance has limitations on liability that may not be sufficient to cover the full extent of such liabilities. In addition, such risks may not in all circumstances be insurable or, in certain circumstances, we may elect not to obtain insurance to deal with specific risks due to the high premiums associated with such insurance or for other reasons. The payment of such uninsured liabilities would reduce the funds available to us. The occurrence of a significant event that we are not fully insured against, or the insolvency of the insurer of such event, could have a material adverse effect on our business, financial condition, results of operations, and the value of our common stock.

Foreign currency exchange rate fluctuations may affect our financial results.

We expect to sell any future oil and natural gas production under agreements that will be denominated in United States dollars and foreign currencies. Many of the operational and other expenses we incur will be paid in the local currency of the country, mainly Colombia, where we perform our operations. As a result, fluctuations in the United States dollar against the Colombian peso and local currencies in jurisdictions where we operate could result in unanticipated and material fluctuations in our financial results. Local operations may require funding that exceeds operating cash flow and there may be restrictions on expatriating proceeds and/or adverse tax consequences associated with such funding.

We may not be able to repatriate our revenues from foreign subsidiaries.

We will be conducting all of our operations in Central and South America through our foreign subsidiaries. Therefore, we will be dependent on the cash flows of those subsidiaries to meet our obligations. Our ability to receive such cash flows may be constrained by taxation levels in the jurisdictions where our subsidiaries operate and by the introduction of exchange controls and/or repatriation restrictions in the jurisdictions where we intend to operate. Currently there are no such restrictions in Colombia on local revenues of foreign entities, but we cannot assure you that exchange or repatriation restrictions will not be imposed in the future.

Estimates of oil and gas reserves are uncertain.

The process of estimating oil and gas reserves is complex and requires significant judgment in the evaluation of available geological, engineering and economic data for each reservoir, particularly for new discoveries. Because of the high degree of judgment involved, different reserve engineers may develop different estimates of reserve quantities and related revenue based on the same data. In addition, the reserve estimates for a given reservoir may change substantially over time as a result of several factors including additional development activity, the viability of production under varying economic conditions and variations in production levels and associated costs. Consequently, material revisions to our future reserve estimates may occur as a result of changes in any of these factors. Such revisions to reserves could have a material adverse effect on our future estimates of future net revenue, as well as our financial condition and profitability.

Discoveries or acquisitions of additional reserves will be needed to avoid a material decline in future reserves and production.

The production rates from oil and gas properties generally decline as reserves are depleted, while related per unit production costs generally increase, due to decreasing reservoir pressures and other factors. Therefore, we anticipate our future estimated proved reserves and future oil and gas production will decline materially as future reserves are produced unless we conduct successful exploration and development activities or, unless we identify additional producing zones in existing wells, secondary or tertiary recovery techniques, or acquire additional properties containing proved reserves. Consequently, our future oil, gas and natural gas liquid production and related per unit production costs will be highly dependent upon our level of success in finding or acquiring additional reserves.

11

Future exploration and drilling results are uncertain and involve substantial costs.

Substantial costs are often required to locate and acquire properties and drill exploratory wells. Such activities are subject to numerous risks, including the risk that we will not encounter commercially productive oil or gas reservoirs. The costs of drilling and completing wells are often uncertain. In addition, oil and gas properties can become damaged or drilling operations may be curtailed, delayed or canceled as a result of a variety of factors including, but not limited to:

|

●

|

unexpected drilling conditions;

|

|

|

●

|

pressure or irregularities in reservoir formations;

|

|

|

●

|

equipment failures or accidents;

|

|

|

●

|

fires, explosions, blowouts and surface cratering;

|

|

|

●

|

adverse weather conditions;

|

|

|

●

|

lack of access to pipelines or other transportation methods;

|

|

|

●

|

environmental hazards or liabilities; and

|

|

|

●

|

shortages or delays in the availability of services or delivery of equipment.

|

A significant occurrence of one of these factors could result in a partial or total loss of our future investment in a particular property. In addition, drilling activities may not be successful in establishing proved reserves. Such a failure could have an adverse effect on our future results of operations and financial condition. While both exploratory and developmental drilling activities involve these risks, exploratory drilling involves greater risks of dry holes or failure to find commercial quantities of hydrocarbons.

Failure to generate revenues from our properties and other interests could hinder our ability to expand and to continue our current operations.

Unless we generate revenues from our properties in Colombia, or obtain additional funding, we may not be able to implement our business plan, or continue or expand our current operations. We estimated that our available cash is not sufficient for us to continue and expand our current operations for the next twelve months. Therefore, failure to generate revenues from our properties and other interests and failure to obtain additional funding could deter our ability to continue our existing operations.

Current global financial conditions have been characterized by increased volatility which could negatively impact on our business, prospects, liquidity and financial condition.

Current global financial conditions and recent market events have been characterized by increased volatility and the resulting tightening of the credit and capital markets has reduced the amount of available liquidity and overall economic activity. We cannot guaranty that debt or equity financing, the ability to borrow funds or cash generated by operations will be available or sufficient to meet or satisfy our initiatives, objectives or requirements. Our inability to access sufficient amounts of capital on terms acceptable to us for our operations will negatively impact our business, prospects, liquidity and financial condition.

The potential profitability of oil and gas properties depends upon factors beyond our control.

The potential profitability of oil and gas properties is dependent upon many factors beyond our control. For instance, world prices and markets for oil and gas are unpredictable, highly volatile, potentially subject to governmental fixing, pegging, controls, or any combination of these and other factors, and respond to changes in domestic, international, political, social, and economic environments. Additionally, due to worldwide economic uncertainty, the availability and cost of funds for production and other expenses have become increasingly difficult, if not impossible, to project. These changes and events may materially affect our financial performance. In addition, a productive well may become uneconomic in the event that water or other deleterious substances are encountered which impair or prevent the production of oil and/or gas from the well. In addition, production from any well may be unmarketable if it is impregnated with water or other deleterious substances. These factors cannot be accurately predicted and the combination of these factors may result in us not receiving an adequate return on invested capital.

Our officers and directors are engaged in other activities that could have conflicts with our business interests, which means our business may suffer if our officers and directors do not devote sufficient time to our operations or place their interests in other endeavors above our interests.

The potential for conflicts of interest exists among us and affiliated persons for future business opportunities that may not be presented to us. Our officers and directors may engage in other activities. Our officers and directors may have conflicts of interests in allocating time, services, and functions between the other business ventures in which those persons may be or become involved. We do not currently have employment contracts with our officers, nor are we able to pay them any compensation at our current and foreseeable levels of operations. Should Mr. Draper and Mr. Ives decide to devote less time to our operations, our business may fail.

Our executive officers have limited experience in the oil and gas industry.

Grant Draper, our President and Chief Executive Officer and Anthony Ives, our Chief Operations Officer and Chief Financial Officer, have limited experience in the oil and gas industry. We are unable to predict whether we will be able to succeed in our business because of our officers’ lack of experience in the oil and gas industry and we cannot be certain that our business will be successful based on our officers’ industry experience. Grant Draper has more than 13 years of experience in the management of public companies and participation in financial transactions, having previously served as a managing director with FTI Consulting Inc., a global business advisory firm, as the president and chief operating officer of The Element Agency Inc. and Affirm Americas Strategic Communications Inc. in New York City and as a Member of Thorium One’s Advisory Board. Anthony Ives has more than 20 years of investment experience in the capital markets, including Merrill Lynch, the City of Sacramento’s Treasurers’ Office, the California State Public Employees' Retirement System (CalPERS), the nation’s largest public pension fund firm, and mutual fund Jurika & Voyles. Mr. Ives served as the Chief Financial Officer of Banneker Ventures in Washington, D.C. and is the founder of the nonprofit Grupo de Apoyo al Desarrollo (GAD) in Honduras.

12

The loss or unavailability of our key personnel for an extended period of time could adversely affect our business operations and prospects.

Our success depends in large measure on certain key personnel, including Grant Draper, our President and Chief Executive Officer, and Anthony Ives, our Chief Operations Officer and Chief Financial Officer. The loss of the services of both of these officers could significantly hinder our operations. Although we are looking into acquiring key person insurance, we do not currently have such insurance in effect for Mr. Draper or Mr. Ives. In addition, the competition for qualified personnel in the oil and gas industry is intense and there can be no assurance that we will be able to continue to attract and retain all personnel necessary for the development and operation of our business.

We depend on the services of third parties for material aspects of our operations, including drilling operators, and accordingly if we cannot obtain certain third party services, we may not be able to operate.

We rely on third parties to operate some of the assets in which we possess an interest. The success of our operations, whether considered on the basis of drilling operations or production operations, will depend largely on whether the operator of the property properly fulfills their obligations. As a result, our ability to exercise influence over the operation of these assets or their associated costs may be limited. Our performance will therefore depend upon a number of factors that may be outside of our full control, including the timing and amount of capital expenditures, the operator’s expertise and financial resources, the approval of other participants, the selection of technology, and risk management practices. The failure of third party operators and their contractors to perform their services in a proper manner could adversely affect our operations.

Risks Related to our Common Stock:

We are subject to the reporting requirements of federal securities laws, which is expensive.

We are a public reporting company in the U.S. and, accordingly, subject to the information and reporting requirements of the Exchange Act and other federal securities laws, and the compliance obligations of the Sarbanes-Oxley Act. The costs of preparing and filing annual and quarterly reports, proxy statements and other information with the SEC, and furnishing audited reports to stockholders causes our expenses to be higher than they would be if we remained a privately-held company.

Our compliance with the Sarbanes-Oxley Act and SEC rules concerning internal controls is time consuming, difficult and costly.

We are a reporting company with the SEC and therefore must comply with Sarbanes-Oxley Act and SEC rules concerning internal controls. It is time consuming, difficult and costly for us to develop and implement the internal controls and reporting procedures required by Sarbanes-Oxley. In order to expand our operations, we will need to hire additional financial reporting, internal control, and other finance staff in order to develop and implement appropriate internal controls and reporting procedures.

Failure to maintain the adequacy of our internal controls could impair our ability to provide accurate financial statements and comply with the requirements of the Sarbanes-Oxley Act, which could cause our stock price to decrease substantially.

We have committed limited personnel and resources to the development of the external reporting and compliance obligations that are required of a public company. We have taken measures to address and improve our financial reporting and compliance capabilities and we are in the process of instituting changes to satisfy our obligations in connection with being a public company. We plan to obtain additional financial and accounting resources to support and enhance our ability to meet the requirements of being a public company. We will need to continue to improve our financial and managerial controls, reporting systems and procedures, and documentation thereof. If our financial and managerial controls, reporting systems, or procedures fail, we may not be able to provide accurate financial statements on a timely basis or comply with the Sarbanes-Oxley Act of 2002 as it applies to us. Any failure of our internal controls or our ability to provide accurate financial statements could cause the trading price of our common stock to decrease substantially.

Our stock price may be volatile, which may result in losses to our stockholders.

The stock markets have experienced significant price and trading volume fluctuations, and the market prices of companies quoted on the OTCQB, where our shares of common stock will be quoted, generally have been very volatile and have experienced sharp share-price and trading-volume changes. The trading price of our common stock is likely to be volatile and could fluctuate widely in response to many of the following factors, some of which are beyond our control:

|

●

|

variations in our operating results;

|

|

●

|

changes in expectations of our future financial performance, including financial estimates by securities analysts and investors;

|

|

●

|

changes in operating and stock price performance of other companies in our industry;

|

|

●

|

additions or departures of key personnel; and

|

|

●

|

future sales of our common stock.

|

Domestic and international stock markets often experience significant price and volume fluctuations. These fluctuations, as well as general economic and political conditions unrelated to our performance, may adversely affect the price of our common stock. In particular, following initial public offerings, the market prices for stocks of companies often reach levels that bear no established relationship to the operating performance of these companies. These market prices are generally not sustainable and could vary widely. In the past, following periods of volatility in the market price of a public company’s securities, securities class action litigation has often been initiated.

13

Our common shares are thinly-traded, and in the future, may continue to be thinly-traded, and you may be unable to sell at or near ask prices or at all if you need to sell your shares to raise money or otherwise desire to liquidate such shares.

We cannot predict the extent to which an active public market for our common stock will develop or be sustained due to a number of factors, including the fact that we are a small company that is relatively unknown to stock analysts, stock brokers, institutional investors, and others in the investment community that generate or influence sales volume, and that even if we came to the attention of such persons, they tend to be risk-averse and would be reluctant to follow an unproven company such as ours or purchase or recommend the purchase of our shares until such time as we became more seasoned and viable. As a consequence, there may be periods of several days or more when trading activity in our shares is minimal or non-existent, as compared to a seasoned issuer which has a large and steady volume of trading activity that will generally support continuous sales without an adverse effect on share price. We cannot give you any assurance that a broader or more active public trading market for our common stock will develop or be sustained, or that current trading levels will be sustained.

The market price for our common stock may be particularly volatile given our status as a relatively small company and lack of significant revenues that could lead to wide fluctuations in our share price. You may be unable to sell your common stock at or above your purchase price if at all, which may result in substantial losses to you.

The market for our common shares may be characterized by significant price volatility when compared to seasoned issuers, and we expect that our share price will be more volatile than a seasoned issuer for the indefinite future. The potential volatility in our share price is attributable to a number of factors. First, as noted above, our common shares may be sporadically and/or thinly traded. As a consequence of this lack of liquidity, the trading of relatively small quantities of shares by our stockholders may disproportionately influence the price of those shares in either direction. The price for our shares could, for example, decline precipitously in the event that a large number of our common shares are sold on the market without commensurate demand, as compared to a seasoned issuer that could better absorb those sales without adverse impact on its share price. Secondly, an investment in us is a speculative or “risky” investment due to our lack of revenues or profits to date. As a consequence of this enhanced risk, more risk-adverse investors may, under the fear of losing all or most of their investment in the event of negative news or lack of progress, be more inclined to sell their shares on the market more quickly and at greater discounts than would be the case with the stock of a seasoned issuer.

Because we became public by means of a “reverse merger,” we may not be able to attract the attention of major brokerage firm or investors in general.

Additional risks may exist since we will become public through a “reverse merger.” Securities analysts of major brokerage firms may not provide coverage of us since there is little incentive to brokerage firms to recommend the purchase of our common stock. No assurance can be given that brokerage firms will want to conduct any secondary offerings on behalf of our company in the future. In addition, the SEC has recently issued an investor bulletin warning investors about the risks of investing in companies that enter the U.S. capital markets through a “reverse merger.” The release of such information from the SEC may have the effect of reducing investor interest in companies, such as us, that enter the U.S. capital markets through a “reverse merger.”

Shareholders who hold unregistered shares of our common stock are subject to resale restrictions pursuant to Rule 144(i), due to our status as a former “shell company.”

Pursuant to Rule 144(i) of the Securities Act (“ Rule 144 ”), a “ shell company ” is defined as a company that has no or nominal operations; and, either no or nominal assets; assets consisting solely of cash and cash equivalents; or assets consisting of any amount of cash and cash equivalents and nominal other assets. As such, prior to the completion of the Asset Purchase Agreement and this filing, we were considered a “ shell company ” pursuant to Rule 144, and as such, sales of our securities pursuant to Rule 144 are not able to be made until 1) we have ceased to be a “ shell company ” (which we believe that we have in connection with the acquisition of the Assets and our change in business focus); 2) we are subject to Section 13 or 15(d) of the Securities Exchange Act of 1934, as amended, and have filed all of our required periodic reports for at least the previous one year period prior to any sale pursuant to Rule 144; and a period of at least twelve months has elapsed from the date “ Form 10 information ” has been filed with the Commission reflecting the Company’s status as a non-“ shell company ”, which information has been filed in our Current Report on Form 8-K on May 4, 2012. Because none of our non-registered securities can be sold pursuant to Rule 144, until at least a year after the date of the filing of Company’s Current Report on Form 8-K indicating the Company is no longer a shell company, any non-registered securities we sell in the next approximately 7 months or issue to consultants or employees, in consideration for services rendered or for any other purpose will have no liquidity until and unless such securities are registered with the Commission and/or until a year after the date of such Current Report. As a result, it may be harder for us to fund our operations and pay our consultants with our securities instead of cash. Furthermore, it will be harder for us to raise funding through the sale of debt or equity securities unless we agree to register such securities with the Commission, which could cause us to expend additional resources in the future. Our status as a former “ shell company ” could prevent us from raising additional funds, engaging consultants, and using our securities to pay for any acquisitions (although none are currently planned), which could cause the value of our securities, if any, to decline in value or become worthless.

Rule 144 will not be available for the outstanding shares issued by the Company for a period of at least one year after the filing of the Company’s Current Report on Form 8-K on May 4, 2012 indicating the Company is no longer a shell company, which means that these shareholders may not be able to sell such shares in the open market during this period.

Rule 144 does not permit reliance upon such rule for the resale of shares sold after the issuer first became a shell company, until the issuer meets certain requirements, including ceasing to be a shell company, the filing of Form 10-type information, and the filing for a period of one year periodic reports required under the Exchange Act. As a result, the holders of all of the restricted shares will not be able to sell their shares in reliance upon Rule 144 during this waiting period except pursuant to a registration statement filed by us which includes these shares for resale.

We do not anticipate paying any cash dividends.

We presently do not anticipate that we will pay any dividends on any of our capital stock in the foreseeable future. The payment of dividends, if any, would be contingent upon our revenues and earnings, if any, capital requirements, and general financial condition. The payment of any dividends will be within the discretion of our Board of Directors. We presently intend to retain all earnings, if any, to implement our business plan; accordingly, we do not anticipate the declaration of any dividends in the foreseeable future.

14

Our common stock may be subject to penny stock rules, which may make it more difficult for our stockholders to sell their common stock.

Broker-dealer practices in connection with transactions in “penny stocks” are regulated by certain penny stock rules adopted by the SEC. Penny stocks generally are equity securities with a price of less than $5.00 per share. The penny stock rules require a broker-dealer, prior to a purchase or sale of a penny stock not otherwise exempt from the rules, to deliver to the customer a standardized risk disclosure document that provides information about penny stocks and the risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction, and monthly account statements showing the market value of each penny stock held in the customer’s account. In addition, the penny stock rules generally require that prior to a transaction in a penny stock the broker-dealer make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction. These disclosure requirements may have the effect of reducing the level of trading activity in the secondary market for a stock that becomes subject to the penny stock rules.

Volatility in our common stock price may subject us to securities litigation.

The market for our common stock is characterized by significant price volatility when compared to seasoned issuers, and we expect that our share price will continue to be more volatile than a seasoned issuer for the indefinite future. In the past, plaintiffs have often initiated securities class action litigation against a company following periods of volatility in the market price of its securities. We may, in the future, be the target of similar litigation. Securities litigation could result in substantial costs and liabilities and could divert management’s attention and resources.

We may need additional capital, and the sale of additional shares or other equity securities could result in additional dilution to our stockholders.