Attached files

| file | filename |

|---|---|

| 8-K - PULSE ELECTRONICS CORPORATION 8-K 9-13-2012 - PULSE ELECTRONICS CORP | form8k.htm |

Exhibit 99.1

Pulse Electronics Corporation

CL King 10th Annual Best Ideas

Conference

CL King 10th Annual Best Ideas

Conference

Ralph Faison, Chairman, President & CEO

Drew Moyer, CFO

September 13, 2012

2

Administrative Items

Safe Harbor

This presentation contains statements, including projections of future business objectives and financial

results, that are "forward-looking" within the meaning of the Private Securities Litigation Reform Act of

1995 and involve a number of risks and uncertainties. These forward-looking statements are based on

the Company's current information and expectations. There can be no assurance the forward-looking

statements will be achieved. Actual results may differ materially due to the risk factors listed from time

to time in the Company's SEC reports including, but not limited to, those discussed in the Company's

Form 10-K for the year ended December 30, 2011 and Form 10-Q for the quarter ended June 29,

2012 in Item 1a under the caption "Factors That May Affect Our Future Results (Cautionary

Statements for Purposes of the "Safe Harbor" Provisions of the Private Securities Litigation Reform

Act of 1995)." All such risk factors are incorporated herein by reference as though set forth in full. The

Company undertakes no obligation to update any forward looking statement.

results, that are "forward-looking" within the meaning of the Private Securities Litigation Reform Act of

1995 and involve a number of risks and uncertainties. These forward-looking statements are based on

the Company's current information and expectations. There can be no assurance the forward-looking

statements will be achieved. Actual results may differ materially due to the risk factors listed from time

to time in the Company's SEC reports including, but not limited to, those discussed in the Company's

Form 10-K for the year ended December 30, 2011 and Form 10-Q for the quarter ended June 29,

2012 in Item 1a under the caption "Factors That May Affect Our Future Results (Cautionary

Statements for Purposes of the "Safe Harbor" Provisions of the Private Securities Litigation Reform

Act of 1995)." All such risk factors are incorporated herein by reference as though set forth in full. The

Company undertakes no obligation to update any forward looking statement.

Non-GAAP Measures

Throughout this presentation all references to operating profit (loss) and diluted earnings (loss) per

share are non-GAAP and exclude severance, impairment and associated costs; non-cash stock-based

compensation expenses; and costs associated with an unsolicited takeover attempt in the respective

fiscal periods. For a reconciliation of these non-GAAP measures to U.S. GAAP results, see slides 20-

21. For the Company’s rationale for its usage of non-GAAP measures, see slide 22.

share are non-GAAP and exclude severance, impairment and associated costs; non-cash stock-based

compensation expenses; and costs associated with an unsolicited takeover attempt in the respective

fiscal periods. For a reconciliation of these non-GAAP measures to U.S. GAAP results, see slides 20-

21. For the Company’s rationale for its usage of non-GAAP measures, see slide 22.

Not An Offer

This presentation shall not constitute an offer to sell nor the solicitation of an offer to buy any securities

of Pulse Electronics Corporation.

of Pulse Electronics Corporation.

3

Pulse Electronics:

A Leading Global Electronic Component Supplier

A Leading Global Electronic Component Supplier

CY2011 Sales by product group

Source: Company filings.

CY2011 Sales by geography

Source: Company filings.

n Global producer of precision-engineered electronic components and

modules

modules

− Approximately 1.5 billion devices produced annually

− Low cost / high value dynamics

n Differentiated, defensible position

− Highly customized,

engineering-intensive

engineering-intensive

− Broad IP portfolio

− “Globally local” design solutions

`

n Global, low cost operations with scale

− High-volume component

manufacturing expertise

manufacturing expertise

− OEM-driven

4

Executive Summary

n Improving liquidity and delevering the balance sheet

are the major near-term challenges

are the major near-term challenges

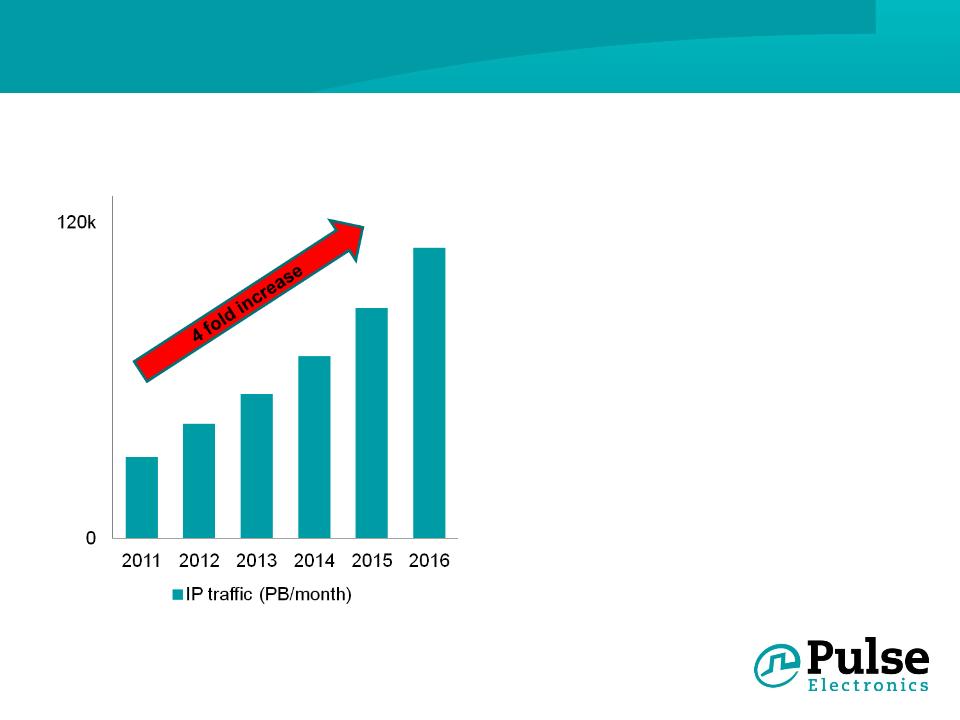

n Pulse markets represent opportunity

− Well positioned to reap benefits of IP traffic growth - infrastructure

and client side

and client side

− Industry leading products to broad industry leading customer base

n Solid progress on strategic turnaround plan

− Improve wireless

− Control operating expenses

− Optimize manufacturing footprint

− Implement ERP system

− Automate manufacturing

− Build on technology leadership

5

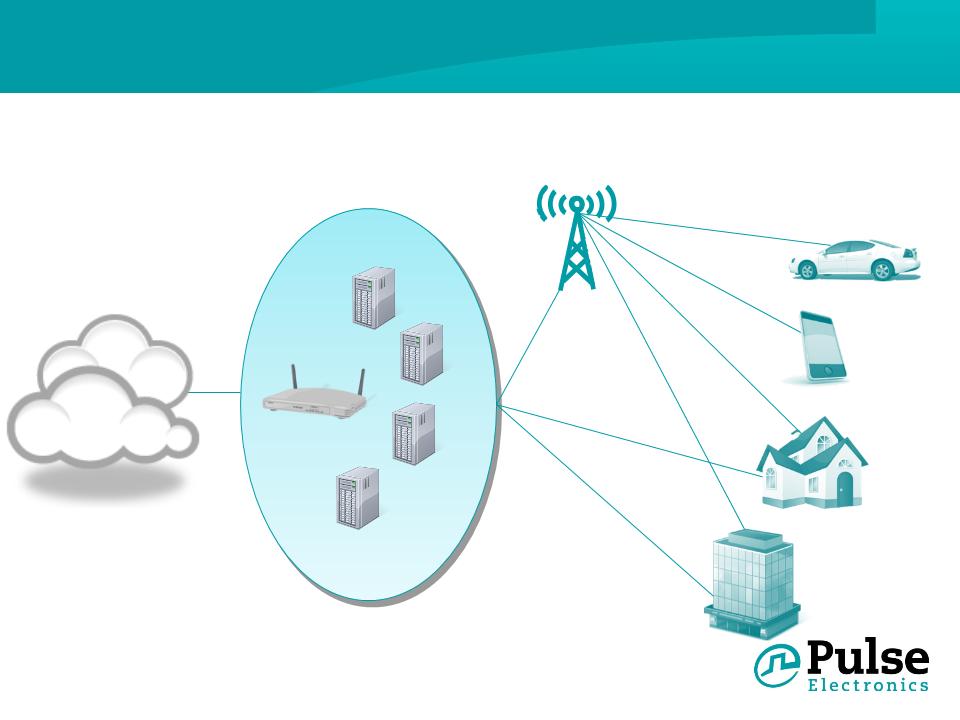

Wired, Wireless, Infrastructure and Client Devices - IP

Traffic Drives Our Growth

Traffic Drives Our Growth

IP Infrastructure

• Routers

• Switches

• Servers

• Storage

Client Devices

• Smartphones

• Tablets

• Laptops

• In-Car communications

Internet

Cloud

6

Internet Traffic Drives Our Growth In All Segments

• Network

– Global IP network providers

– Filtered connectors and

filters/chokes for network

switches, routers, hubs,

servers, PCs, game

consoles

filters/chokes for network

switches, routers, hubs,

servers, PCs, game

consoles

• Power

– Global IP providers

– Power management for high

efficiency computing

efficiency computing

• Wireless

– Major handset providers

– Antennas for handheld

internet access

internet access

Source: The Bishop Report 2012 and Cisco Visual Networking Index Forecasts

7

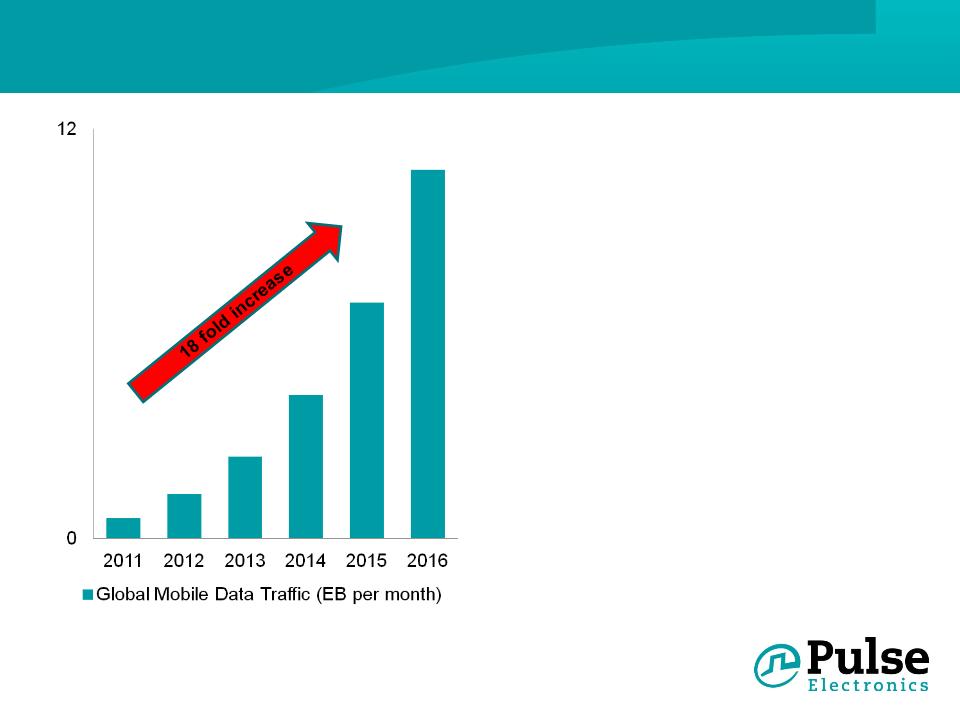

Mobile Data Traffic Drives Wireless Growth

• Mobile video content will

generate the majority of

growth

generate the majority of

growth

• Pulse well positioned with

leading global smartphone

OEMs

leading global smartphone

OEMs

• 2011 revenue to new

customers grew 314%

customers grew 314%

Source: Evercore partners “Trends in Mobile Communications and Technology” 3/2012,

Cisco Visual Networking Index Forecasts

8

Revenue

n Addressable market: Enterprise networks, wide

area networks, RF

area networks, RF

n Total TAM: $1.4 billion

n Key functions: Filter signal with different

frequencies, connect and balance lines, match

impedance and split signals

frequencies, connect and balance lines, match

impedance and split signals

n Growth Strategies:

• Leverage magnetic design expertise

• Build on leadership in filtered connectors

• Capitalize on global network / internet build

• Reduce dependence on labor

• Introduce new, higher margin products

Network:

Ongoing Industry Challenges

Ongoing Industry Challenges

9

Power:

Stability Across Product Lines

Stability Across Product Lines

Revenue

($ in millions)

n Addressable market: Datacomm, high-efficiency

computing, LED lighting, motor control

computing, LED lighting, motor control

n Total TAM: $1.4 billion

n Key functions: Modify voltage, limit signal

distortion, deliver power, regulate and control

electrical energy

distortion, deliver power, regulate and control

electrical energy

n Growth strategies:

• Grow sales for voltage and current sensing

products

products

• Extend in high-efficiency computing

• Grow revenues with auto manufacturers in

China

China

10

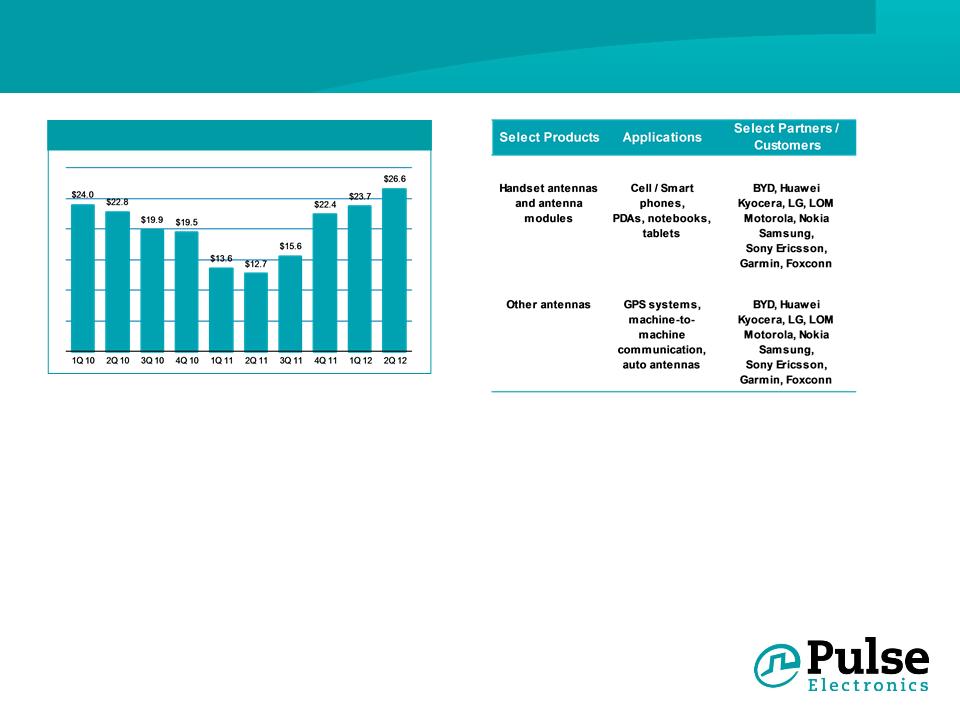

Wireless:

Return to Growth with New Antenna Customers

Return to Growth with New Antenna Customers

Revenue

($ in millions)

n Addressable market: Cellular, GPS, smart

grid, WLAN, LMR

grid, WLAN, LMR

n Total TAM: $1.5+ billion

n Key functions: Capture and transmit signal

n Growth Strategies:

• Rebuild cellular antenna sales

• Grow non-cellular sales

• Maintain technology leadership

• Capitalize on global mobility demand

11

Market Leading Positions with Diversified, Long-Term

Customer Relationships

Customer Relationships

Product leadership

n Pure-play electronics provider serving leading

companies across various industries for over

60 years

companies across various industries for over

60 years

n China-based expertise in design and

manufacturing deepens local relationships

manufacturing deepens local relationships

n Core strengths of each segment include:

− Network: high bandwidth in tightly

integrated designs

integrated designs

− Power: high frequency and high power in

challenging environmental conditions

challenging environmental conditions

− Wireless: multiple, complex frequency

management in small form factors

management in small form factors

n Expertise in advanced technology

− 420 patents

− Experienced core engineering team

− 3-D antenna - the new industry standard

− “Best & Brightest” Innovators & Qualifiers

MDB Capital Group, Feb 2011

Key customers

n Alcatel-Lucent

n Apple

n BMW

n Bosch

n Cisco

n Dell

n Ericsson

n Flextronics

n Foxconn

n Fujitsu

n Garmin

n Hewlett-Packard

n Honeywell

n Huawei

n IBM

n Intel

n Jabil

n Juniper

n Lenovo

n Nokia

n Nokia Siemens

n Microsoft

n Motorola

n Oracle

n Samsung

n Schneider

n Siemens

n Sony

n Vestel

n Volkswagen Audi

12

Strong Core Operating Skill Sets

Pulse Electronics’ principal

manufacturing facilities reduced

from 10 to 4

manufacturing facilities reduced

from 10 to 4

Design / engineering

n Demonstrated “globally local” design /

engineering and high-volume product launch

expertise

engineering and high-volume product launch

expertise

– Design / engineering teams embedded

with our key customers

with our key customers

n Strong relationships with leading OEMs

China-based manufacturing

expertise

expertise

n Low-cost and high-volume manufacturing

capability

capability

n Geographic proximity to customers’ production

with global channel relationships

with global channel relationships

n High labor content in Western China

n Pulse has been operating owned facilities in

China for 25 years

China for 25 years

− Over 12 years of average tenure for senior

in-region operations managers

in-region operations managers

Mianyang

Suzhou

Suzhou

Suining

Changan

13

Operating Outlook

§ Large addressable markets

§ Growth characteristics

§ Further cost reduction opportunities, particularly in G&A

§ Custom designs and engineering-driven

§ Cyclical demand

§ Continued investment in the core businesses throughout

the recent downturn

the recent downturn

14

Long-Term Financial Target

15

Significant Progress on Strategic Turnaround Plan

n Expect to achieve break-even profitability by the end of 2012

n Revenue growth ahead of that necessary to achieve $100m

annual run-rate at which break-even is sustainable

annual run-rate at which break-even is sustainable

Improve wireless

Lower operating

expenses

expenses

Optimize manufacturing

efficiencies

efficiencies

Implement new ERP

system

system

n Reduced approximately $16m on annualized basis

compared to $12m target

compared to $12m target

n Consolidated from 10 to 4 factories with 80+% of high labor

processes now in lower cost western China

processes now in lower cost western China

n Planned cutover of largest manufacturing facility completed

July 2012. Final facilities will likely go live in Q1 2013.

July 2012. Final facilities will likely go live in Q1 2013.

Increase automation

n Initiative underway to automate existing products as a

mitigation to rising labor costs

mitigation to rising labor costs

Build on technology

leadership

leadership

n New technology platforms introduced across all three groups:

LDS antennas, MagPac, Sidewinder

LDS antennas, MagPac, Sidewinder

16

Balance Sheet

($ in millions)

n Improving liquidity and delevering are the major challenges

facing Pulse due to ongoing industry challenges and overall

economic uncertainty.

facing Pulse due to ongoing industry challenges and overall

economic uncertainty.

17

Delevering Status

§ All options remain under consideration to increase

liquidity and reduce debt

liquidity and reduce debt

§ Asset sales

– Non-core asset sale process continues

– Strategic asset sales

– Retained advisors to assist with evaluation of all options

§ Financing alternatives

– Engaging with existing and potentially new financing partners

– Balance sheet restructuring

– Retained advisors to assist with evaluation of all options

18

Executive Summary

n Improving liquidity and delevering the balance sheet

are the major near-term challenges

are the major near-term challenges

n Pulse markets represent opportunity

− Well positioned to reap benefits of IP traffic growth - infrastructure

and client side

and client side

− Industry leading products to broad industry leading customer base

n Solid progress on strategic turnaround plan

− Improve wireless

− Control operating expenses

− Optimize manufacturing footprint

− Implement ERP system

− Automate manufacturing

− Build on technology leadership

Appendix

21

Non-GAAP Adjusted EBITDA Reconciliation

22

Non-GAAP Rationale

Non-GAAP operating profit or loss (operating profit or loss according to accounting principles generally accepted in the United States excluding

pre-tax severance, impairment and other associated costs; pre-tax non-cash stock-based compensation expenses; and other pre-tax

adjustments as described in the applicable period), non-GAAP diluted earnings (loss) per share (net earnings (loss) per share from continuing

operations according to principles generally accepted in the United States excluding after-tax severance, impairment and other associated costs;

after-tax non-cash stock-based compensation expenses; and other after-tax adjustments as described in the applicable period) and adjusted

EBITDA (net earnings attributable to Pulse Electronics Corporation plus net earnings from discontinued operations and non-controlling interest,

excluding income taxes; depreciation and amortization; interest expense/income; non-cash stock-based compensation expenses; other

expense/income; and severance, impairment and other associated costs and other adjustments as described in the applicable period), are not

measures of performance under accounting principles generally accepted in the United States. Non-GAAP operating profit or loss, non-GAAP

diluted earnings (loss) per share and adjusted EBITDA should not be considered a substitute for, and an investor should also consider, net

income, operating profit, cash flow from operations and other measures of performance as defined by accounting principles generally accepted

in the United States as indicators of our profitability or liquidity. Non-GAAP operating profit (loss) and non-GAAP diluted earnings (loss) per

share are often used by our shareholders and analysts as an additional measure of our operating performance. Adjusted EBITDA is often used

by our shareholders and analysts as an indicator of a company’s ability to service debt and fund capital expenditures. We believe these non-

GAAP measures enhance a reader’s understanding of our financial condition, results of operations and cash flow because they are unaffected

by capital structure and, therefore, enable investors to compare our operating performance to that of other companies. We understand that our

presentation of non-GAAP operating profit (loss), non-GAAP diluted earnings (loss) per share and adjusted EBITDA may not be comparable to

other similarly titled captions of other companies due to differences in the method of calculation.

pre-tax severance, impairment and other associated costs; pre-tax non-cash stock-based compensation expenses; and other pre-tax

adjustments as described in the applicable period), non-GAAP diluted earnings (loss) per share (net earnings (loss) per share from continuing

operations according to principles generally accepted in the United States excluding after-tax severance, impairment and other associated costs;

after-tax non-cash stock-based compensation expenses; and other after-tax adjustments as described in the applicable period) and adjusted

EBITDA (net earnings attributable to Pulse Electronics Corporation plus net earnings from discontinued operations and non-controlling interest,

excluding income taxes; depreciation and amortization; interest expense/income; non-cash stock-based compensation expenses; other

expense/income; and severance, impairment and other associated costs and other adjustments as described in the applicable period), are not

measures of performance under accounting principles generally accepted in the United States. Non-GAAP operating profit or loss, non-GAAP

diluted earnings (loss) per share and adjusted EBITDA should not be considered a substitute for, and an investor should also consider, net

income, operating profit, cash flow from operations and other measures of performance as defined by accounting principles generally accepted

in the United States as indicators of our profitability or liquidity. Non-GAAP operating profit (loss) and non-GAAP diluted earnings (loss) per

share are often used by our shareholders and analysts as an additional measure of our operating performance. Adjusted EBITDA is often used

by our shareholders and analysts as an indicator of a company’s ability to service debt and fund capital expenditures. We believe these non-

GAAP measures enhance a reader’s understanding of our financial condition, results of operations and cash flow because they are unaffected

by capital structure and, therefore, enable investors to compare our operating performance to that of other companies. We understand that our

presentation of non-GAAP operating profit (loss), non-GAAP diluted earnings (loss) per share and adjusted EBITDA may not be comparable to

other similarly titled captions of other companies due to differences in the method of calculation.

Based on discussions with investors and analysts, we believe that a reader’s understanding of the Company’s operating performance is

enhanced by references to these non-GAAP measures. Removing charges for severance, impairment and other associated costs, non-cash

stock-based compensation expenses and other adjustments may facilitate comparisons of operating performance among financial periods and

peer companies. These charges may result from facility closures, the exit of a product line, production relocations and capacity reductions and /

or restructuring of overhead and operating expenses to enhance or maintain profitability in an increasingly competitive environment. Removing

non-cash stock-based compensation expenses facilitates comparisons of the Company’s operating performance with that of other companies

with differing compensation structures and with the Company’s performance in periods during which its own compensation structure may have

been different. Impairment charges, accelerated depreciation and costs related to an unsolicited takeover attempt are not part of the normal

operating expense structure of the relevant business in the period in which the charge is recorded.

enhanced by references to these non-GAAP measures. Removing charges for severance, impairment and other associated costs, non-cash

stock-based compensation expenses and other adjustments may facilitate comparisons of operating performance among financial periods and

peer companies. These charges may result from facility closures, the exit of a product line, production relocations and capacity reductions and /

or restructuring of overhead and operating expenses to enhance or maintain profitability in an increasingly competitive environment. Removing

non-cash stock-based compensation expenses facilitates comparisons of the Company’s operating performance with that of other companies

with differing compensation structures and with the Company’s performance in periods during which its own compensation structure may have

been different. Impairment charges, accelerated depreciation and costs related to an unsolicited takeover attempt are not part of the normal

operating expense structure of the relevant business in the period in which the charge is recorded.