Attached files

| file | filename |

|---|---|

| EX-21 - EXHIBIT 21 - PULSE ELECTRONICS CORP | ex21.htm |

| EX-23 - EXHIBIT 23 - PULSE ELECTRONICS CORP | ex23.htm |

| EX-32.2 - EXHIBIT 32.2 - PULSE ELECTRONICS CORP | ex32_2.htm |

| EX-31.2 - EXHIBIT 31.2 - PULSE ELECTRONICS CORP | ex31_2.htm |

| EX-32.1 - EXHIBIT 32.1 - PULSE ELECTRONICS CORP | ex32_1.htm |

| EX-31.1 - EXHIBIT 31.1 - PULSE ELECTRONICS CORP | ex31_1.htm |

UNITED

STATES

SECURITIES

& EXCHANGE COMMISSION

Washington,

D. C. 20549

FORM

10-K

|

T

|

Annual

Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of

1934

|

For the

fiscal year ended December 25,

2009

or

|

£

|

Transition

Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of

1934

|

For the

transition period from _______________ to _______________

Commission

File No. 1-5375

TECHNITROL,

INC.

(Exact

name of registrant as specified in Charter)

|

PENNSYLVANIA

|

23-1292472

|

|

(State

of Incorporation)

|

(IRS

Employer Identification Number)

|

|

1210

Northbrook Drive, Suite 470, Trevose, Pennsylvania

|

19053

|

|

|

(Address

of principal executive

offices)

|

(Zip

Code)

|

|

|

Registrant’s

telephone number, including area code:

|

215-355-2900

|

Securities

registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Name of each Exchange on which

registered

|

|

Common

Stock par value $0.125 per share

|

New

York Stock Exchange

|

|

Common

Stock Purchase Rights

|

New

York Stock Exchange

|

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in

Rule 405 of the Securities Act Yes T No £

Indicate

by check mark if the registrant is not required to file reports pursuant to

Section 13 or Section 15(d) of the Act. Yes £ No T

Indicate

by check mark whether the registrant (1) has filed all reports required to be

filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the

preceding 12 months (or for such shorter period that the registrant was required

to file such reports), and (2) has been subject to the filing requirements for

at least the past 90

days. Yes T No £

Indicate

by check mark whether the registrant has submitted electronically and posted on

its corporate website, if any, every Interactive Data File required to be

submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding

12 months (or for such shorter period that the registrant was required to submit

and post such files). Yes £ No £

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of

Regulation S-K is not contained herein, and will not be contained, to the best

of registrant’s knowledge, in definitive proxy or information statements

incorporated by reference in Part III of this Form 10-K or any amendment to this

Form 10-K.T

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, or a non-accelerated filer (as defined in Rule 12b-2 of the

Act). Large accelerated filer £ Accelerated

filer T Non-accelerated

filer £ Smaller

reporting company £

Indicate

by check mark whether the registrant is a shell company (as defined in Rule

12b-2 of the Act). Yes £ No T

The

aggregate market value of voting stock held by non-affiliates as of June 26,

2009 is $266,535,000 computed by reference to the closing price on the New York

Stock Exchange on such date.

|

Number

of shares outstanding

|

|

|

Title of each class

|

February 24,

2010

|

|

Common

stock par value $0.125 per share

|

41,242,286

|

DOCUMENTS INCORPORATED BY

REFERENCE

Portions

of the Registrant’s definitive proxy statement to be used in connection with the

registrant’s 2009 Annual Shareholders Meeting are incorporated by reference into

Part III of this Form 10-K where indicated.

1

TABLE OF CONTENTS

|

PAGE

|

||

|

PART

I

|

||

|

Item

1.

|

3

|

|

|

Item

1a.

|

7

|

|

|

Item

1b.

|

15

|

|

|

Item

2.

|

15

|

|

|

Item

3.

|

15

|

|

| Item 4. | Submission of Matters to a Vote of Security Holders | 15 |

|

PART

II

|

||

|

Item

5.

|

16

|

|

|

Item

6.

|

18

|

|

|

Item

7.

|

19

|

|

|

Item

7a.

|

35

|

|

|

Item

8.

|

36

|

|

|

Item

9.

|

36

|

|

|

Item

9a.

|

37

|

|

|

Item

9b.

|

38

|

|

|

PART

III

|

||

|

Item

10.

|

39

|

|

|

Item

11.

|

39

|

|

|

Item

12.

|

39

|

|

|

Item

13.

|

40

|

|

|

Item

14.

|

40

|

|

|

PART

IV

|

||

|

Item

15.

|

41

|

|

Part

I

Item 1 Business

General

Technitrol,

Inc. is a global producer of precision-engineered electronic components and

modules. We sometimes refer to Technitrol, Inc. as “Technitrol”, “we” or

“our.” We believe we are a leading global producer of electronic

components and modules in the primary markets we serve, based on our estimates

of the annual revenues in our primary markets and our share of those markets

relative to our competitors. Our electronic components and modules

are used in virtually all types of electronic products to manage and regulate

electronic signals and power, making them critical to the functioning of our

customer’s end product.

During

2009, we announced our intention to explore monetization alternatives with

respect to our Electrical Contract Products Group or Electrical, as we refer to

it, or AMI Doduco, as it is known in its markets, which is now held for sale and

classified as a discontinued operations in our Consolidated Financial

Statements. As a result, we currently operate our business in a

single segment, our Electronic Components Group, which we refer to as

Electronics and is known as Pulse in its markets.

We

incorporated in Pennsylvania on April 10, 1947 and we are headquartered in

Trevose, Pennsylvania. Our mailing address is 1210 Northbrook Drive,

Suite 470, Trevose, PA 19053-8406, and our telephone number is

215-355-2900. Our website is www.technitrol.com.

Products

We design

and manufacture a wide variety of highly-customized electronic components and

modules. Many of these components and modules capture wireless

communication signals, filter and share signals on wireline communication

systems, convert communication signals into sound and video, filter out radio

frequency interference, adjust and ensure proper current and voltage and

activate certain automotive functions. These products are often referred to as

antennas, speakers, receivers, splitters, chokes, inductors, filters,

transformers and coils. Our primary customers are multinational original

equipment manufacturers, original design manufacturers, contract manufacturers

and distributors.

We have

three primary product groups. Our network group includes our integrated

connector modules, transformers, filters, splitters, chokes and other magnetic

components. Our wireless group produces our handset antenna products,

our non-cellular wireless and antenna products and our mobile speakers and

receivers. Our power group includes our power and signal transformers

and inductors, automotive coils, military and aerospace products and other power

magnetics products.

Net

sales of our primary product groups for the years ended December 25, 2009,

December 26, 2008 and December 27, 2007 were as follows (in millions):

|

2009

|

2008

|

2007

|

||||||||||

|

Network

|

$ | 152.7 | $ | 216.0 | $ | 226.4 | ||||||

|

Wireless

|

151.0 | 263.3 | 277.9 | |||||||||

|

Power

|

95.1 | 147.0 | 167.3 | |||||||||

|

Net

sales

|

$ | 398.8 | $ | 626.3 | $ | 671.6 | ||||||

Our

products are generally characterized by relatively short life cycles and rapid

technological change, allowing us to utilize our design, engineering and

production expertise to meet our customers’ evolving needs. We

believe that the industries we serve have been, and will continue to be,

characterized by ongoing product design and manufacturing innovation that will

drive growth in the electronic components industry.

The

following table contains a list of some of our key products:

|

Primary

Products

|

Function

|

Application

|

||

|

Internal

handset antenna and handset antenna modules

|

Capture

communication signals in mobile handsets, personal digital assistants and

notebook computers

|

Cell

phones, other mobile terminal and information devices

|

||

|

Speakers

and receivers

|

Convert

electronic signals into sound

|

Cell

phones, laptops, smart phones and other mobile terminal

devices

|

||

|

Mobile

and portable antennas

|

Capture

and transmit non-cellular signals

|

Global

positioning systems, automotive antennas and machine-to-machine

communication

|

||

|

Discrete

filter or choke

|

Separate

high and low frequency signals. Shares incoming and outgoing

signals to match industry templates.

|

Network

switches, routers, hubs and personal computers

Phone,

fax and alarm systems used with digital subscriber lines, or

DSL

|

||

|

Filtered

connectors, which combines a filter with a connector and stand alone

connector products

|

Remove

interference, or noise, from circuitry and connects electronic

applications

|

Local

area networks, or LANs, and wide area networks, or WANs, equipment for

personal computers and video game consoles

|

||

|

Inductor/chip

inductor

|

Regulate

electrical current under conditions of varying load

|

AC/DC

& DC/DC power supplies

Mobile

phones and portable devices

|

||

|

Power

transformer

|

Modify

circuit voltage

|

AC/DC

& DC/DC power supplies

|

||

|

Signal

transformer

|

Limit

distortion of signal as it passes from one medium to

another

|

Analog

circuitry, military/aerospace navigation and weapons guidance

systems

|

||

|

Automotive

ignition coils

|

Provide

power for automotive ignition

|

Ignition

systems for automotive gasoline engines

|

||

|

Other

automotive coils

|

Provide

power for a variety of automotive electronic functions

|

Automotive

management systems such as safety, communication, navigation, fuel

efficiency and emissions control

|

Sales,

Customers and Distribution

We sell

products predominantly through worldwide direct sales forces. Given the highly

technical nature of our customers’ needs, our direct salespeople typically team

up with members of our engineering staff to discuss a sale with a customer’s

purchasing and engineering personnel. During the sales process, there is close

interaction between our engineers and those in our customers’ organizations.

This interaction extends throughout a product’s life cycle, engendering strong

customer relationships. Also, we believe that our coordinated sales effort

provides a high level of market penetration and efficient coverage of our

customers on a cost-effective basis. As of December 25, 2009, we had

more than 60 salespeople in 11 sales offices worldwide.

We sell

our products and services to original equipment manufacturers, original design

manufacturers and contract equipment manufacturers, which design, build and

market end-user products. We refer to original equipment

manufacturers as “OEMs”, original design manufacturers as “ODMs” and contract

equipment manufacturers as “CEMs.” ODMs typically contract with OEMs

to design products, where as CEMs contract with OEMs to manufacture

products. Many OEMs use CEMs primarily or exclusively to build their

products. Independent distributors sell components and materials to

both OEMs and CEMs. While OEMs are often our design partners, most

sales are to CEMs, as OEMs have generally outsourced procurement and

manufacturing responsibilities to CEMs. In order to maximize our

sales opportunities, our engineering and sales teams maintain close

relationships with OEMs, ODMs, CEMs and other independent

distributors. We provide support for our multinational customer base

with local customer service and design centers in North America, Europe and

Asia.

For the

year ended December 25, 2009, a major cell phone manufacturer and a CEM for that

cell phone manufacturer each individually accounted for more than 10% of our

continuing operations net sales. In addition, a group of CEMs of a

major network infrastructure company also accounted for more than 10% of our

2009 continuing operations net sales. Sales to our ten largest

customers accounted for 61.9% of net sales for the year ended December 25, 2009,

64.4% of net sales for the year ended December 26, 2008 and 60.7% of net sales

for the year ended December 28, 2007.

A large

percentage of our sales in recent years has been outside of the United

States. For the years ended December 25, 2009, December 26, 2008 and

December 28, 2007, 89.9%, 91.3% and 89.4% of our net sales were outside of the

United States, respectively.

Manufacturing

We have

developed our manufacturing processes in ways intended to maximize our

profitability without sacrificing quality. The manufacturing of our

magnetic components, connectors, chokes and filters tend to be labor intensive

and highly variable. This model enables us to decrease production

rapidly to contain costs during slower periods, reflecting the often

unpredictable nature of these product lines. However, this model may

prevent us from rapidly increasing our production capacity in periods of intense

demand in tight labor markets. Conversely, the manufacturing of our

antennas, speakers, receivers, automotive and military/aerospace products is

highly mechanized or, in some cases, automated, which causes costs and

profitability related to these products to be sensitive to the volume of

production.

Generally,

once our engineers design products to meet the end users’ product needs and a

contract is awarded by, or orders are received from, the customer we begin to

mass-produce the products. To a much lesser extent, we also service

customers that design their own components and outsource production of these

components to us. In such case, we build the components to the

customer’s design. We also maintain a portfolio of catalog parts

which our customers can easily design into their own products.

We cannot

accurately estimate or forecast the utilization of our overall production

capacity at a given time. In any facility, maximum capacity and

utilization vary periodically depending on our manufacturing strategies, the

product being manufactured, current market conditions, customer demand and other

non-specific variables.

Research,

Development and Engineering

Our

research, development and engineering efforts are focused on the design and

development of innovative products in collaboration with our customers or their

ODM partners. We work closely with OEMs and ODMs to identify their design and

engineering requirements. We maintain strategically located design centers

throughout the world where proximity to customers enables us to better

understand and more readily satisfy their design and engineering needs. Our

design process is disciplined and orderly, using a product lifecycle management

system to track the level of design activity enabling us to manage and improve

how our engineers design products. We typically own the customized designs used

to make our products.

Research,

development and engineering expenditures from continuing operations were $28.2

million for the year ended December 25, 2009, $42.6 million for the year ended

December 26, 2008, and $35.1 million for the year ended December 28,

2007. The decrease over the past year is primarily due to tightened

spending controls initiated at the end of 2008 in response to the general

recession. In limited circumstances, we generate revenue as a result of

providing research, development and engineering services to our

customers. This revenue is not material to our Consolidated Financial

Statements.

Competition

We do not

believe that any one company competes with all of our product lines on a global

basis. However, we have strong competition within individual product

lines, both domestically and internationally. In addition, several OEMs

internally, or through CEMs, manufacture some of our product

offerings. We believe that this may represent an opportunity to

capture additional market share as OEMs continue to outsource their component

manufacturing. Therefore, we pursue opportunities to convince these OEMs that

our economies of scale, purchasing power and core competencies in manufacturing

enable us to produce these products more efficiently. Increasingly,

we compete against manufacturers located in inexpensive countries, many of which

sometimes aggressively seek market share at the detriment of

profits.

Competitive

factors in the markets for our products include:

|

|

·

|

product

quality and reliability;

|

|

|

·

|

global

design and manufacturing

capabilities;

|

|

|

·

|

breadth

of product line;

|

|

|

·

|

price;

|

|

|

·

|

customer

service;

|

|

|

·

|

delivery

time;

|

|

|

·

|

technology;

and

|

|

|

·

|

product

leadership and development.

|

We

believe we are adequately competitive with respect to each of these factors.

Product quality and reliability, as well as design and manufacturing

capabilities, are enhanced through our continuing commitment to invest in and

improve our manufacturing and designing resources and our close relationships

with our customers’ engineers. Also, the breadth of our product offering

provides customers with the ability to satisfy multiple needs through one

supplier. Our global presence enables us to deepen our relationship with our

customers and to better understand and more easily satisfy the needs of local

markets. In addition, our ability to purchase raw materials in large quantities

and our focus on continually reducing production expenses and maximizing

capacity lowers our manufacturing costs and enables us to price our products

competitively.

Employees

As of

December 25, 2009, we had approximately 19,400 full-time employees as compared

to 21,400 as of December 26, 2008. Employees related to our

continuing operations increased from approximately 17,100 at December 26, 2008

to 17,700 at December 25, 2009 due to a concentrated effort to increase capacity

in our operations in the People’s Republic of China (“PRC” or “China”) to

address the surging demand of our network group experienced during the second

half of 2009. The number of employees at year-end includes employees

of certain subcontractors that are integral to our operations in the

PRC. Such employees numbered approximately 6,400 and 8,200 as of

December 25, 2009 and December 26, 2008, respectively. In addition to

these employees, we began utilizing temporary staff to supplement our labor

capacity during 2009. Excluded from our total employment figures for

December 25, 2009 were approximately 3,000 temporary staff. None of

our employees were covered by collective-bargaining agreements during the year

ended December 25, 2009. Approximately 500 of our total 19,400

full-time employees were located in the United States. We did not

experience any major work stoppages during 2009 and consider our relations with

our employees to be good.

Raw

Materials

The

primary raw materials necessary to manufacture our products

include:

|

|

·

|

base

metals such as copper;

|

|

|

·

|

ferrite

cores; and

|

|

|

·

|

plastics

and plastic resins.

|

Currently,

we do not have significant difficulty obtaining any of our raw materials and do

not anticipate that we will face any significant difficulty in the near

future. However, some of these materials are produced by a limited

number of suppliers. We may be unable to obtain these raw materials

in sufficient quantities or in a timely manner to meet the demand for our

products. The lack of availability or a delay in obtaining any of the

raw materials used in our products could adversely affect our manufacturing

costs and profit margins. In addition, if the price of our raw

materials increases significantly over a short period of time due to increased

market demand or a shortage of supply, customers may be unwilling to bear the

increased price for our products and we may be forced to sell our products

containing these materials at lower prices causing a reduction in our profit

margins.

Our

discontinued operations at Electrical use silver and other precious metals in

manufacturing most of its electrical contacts, contact materials and contact

subassemblies. Historically, Electrical has leased or held these materials

through consignment-type arrangements with its suppliers, except in China where

leasing of such precious metals is prohibited. Leasing and consignment costs

have typically been lower than the costs to borrow funds to purchase the metals

and, more importantly, these arrangements eliminate the effects of fluctuations

in the market price of owned precious metal and enable Electrical to minimize

its inventories. Electrical’s terms of sale generally allow it to charge

customers for precious metal content based on the market value of precious metal

on the day after shipment to the customer. Suppliers invoice

Electrical based on the market value of the precious metal on the day after

shipment to the customer as well. Thus far, Electrical has been

successful in managing the costs associated with its precious metals. While

limited amounts are purchased for use in production, the majority of precious

metal inventory continues to be leased or held on consignment. If leasing or

consignment costs increase significantly in a short period of time, and

Electrical is unable to recover these increased costs through higher sales

prices, a negative impact on Electrical’s results of operations and liquidity

may result. Leasing and consignment fee increases are caused primarily by

increases in interest rates or volatility in the price of the consigned

material. Similarly, if Electrical is unable to maintain the

necessary bank commitments and credit limits for its precious metal leasing and

consignment facilities, or obtain alternative facilities on a timely basis,

Electrical may be required to finance the direct purchase of precious metals,

reduce its production volume or take other actions that could negatively impact

its financial condition and results of operations.

Backlog

Our

backlog of orders at December 25, 2009 was $76.3 million compared to $49.3

million at December 26, 2008. The significant increase in backlog

from 2008 to 2009 is the result of a substantial increase in demand in our

network group, which has recently been impacted by capacity

constraints. We expect to ship the majority of the backlog over the

next six months. We do not believe that our backlog is an accurate indicator of

near-term business activity because variability in lead times, capacity, demand

uncertainty on the part of our customers and increased use of vendor managed

inventory and similar consignment type arrangements tend to limit the

significance of backlog.

Intellectual

Property

We

utilize proprietary technology, often developed and protected by us or, to a

much lesser extent, licensed from others. Also, we require every

employee with access to proprietary technology to enter into confidentiality

agreements with us and we restrict access to our proprietary

information.

Existing

legal protections afford only limited advantage to us. For example,

others may independently develop similar or competing products or attempt to

copy or use aspects of our products that we regard as

proprietary. Furthermore, intellectual property law in certain areas

of the world may not fully protect our products or technology from such

actions.

While our

intellectual property is important to us in the aggregate, we do not believe any

individual patent, trademark, or license is material to our business or

operations.

Environmental

Our

manufacturing operations are subject to a variety of local, state, federal and

international environmental laws and regulations governing air emissions,

wastewater discharges, the storage, use, handling, disposal and remediation of

hazardous substances and wastes and employee health and safety. It is our policy

to meet or exceed the environmental standards set by these laws. We

also strive through planning and continual process improvements to protect and

preserve the environment through prevention of pollution and reduced consumption

of natural resources and materials. However, in the normal course of

business, environmental issues may arise. We may incur increased

costs associated with environmental compliance and cleanup projects necessitated

by the identification of new environmental issues or new environmental laws and

regulations.

Available

Information

We make

available free of charge on our website, www.technitrol.com, all materials that

we file electronically with the Securities and Exchange Commission (“SEC”),

including our annual reports on Form 10-K, quarterly reports on Form 10-Q,

current reports on Form 8-K and amendments to those reports and all Board and

Committee charters, as soon as reasonably practicable after we electronically

file or furnish such materials to the SEC.

Item

1a Risk Factors

Factors

That May Affect Our Future Results (Cautionary Statements for Purposes of the

“Safe Harbor” Provisions of the Private Securities Litigation Reform Act of

1995)

Our

disclosures and analysis in this report contain forward-looking

statements. Forward-looking statements reflect our current

expectations of future events or future financial performance. You

can identify these statements by the fact that they do not relate strictly to

historical or current facts. They often use words such as

“anticipate”, “estimate”, “expect”, “project”, “intend”, “plan”, “believe” and

similar terms. These forward-looking statements are based on our

current plans and expectations.

Any or

all of our forward-looking statements in this report may prove to be

incorrect. They may be affected by inaccurate assumptions we might

make or by risks and uncertainties which are either unknown or not fully known

or understood. Accordingly, actual outcomes and results may differ materially

from what is expressed or forecasted in this report.

We

sometimes provide forecasts of future financial performance. The

risks and uncertainties described under “Risk Factors” as well as other risks

identified from time to time in other Securities and Exchange Commission

reports, registration statements and public announcements, among others, should

be considered in evaluating our prospects for the future. We

undertake no obligation to release updates or revisions to any forward-looking

statement, whether as a result of new information, future events or

otherwise.

The

following factors represent what we believe are the major risks and

uncertainties in our business, including risks inherent in operations which we

are in the process of divesting. They are listed in no particular

order.

Cyclical

changes in the markets we serve could result in a significant decrease in demand

for our products, which may reduce our profitability and/or our cash

flow.

Our

components are used in various products sold in the electronics market. Markets

are cyclical. Generally, the demand for our components reflects the demand for

products in the electronics market. A contraction in demand would

result in a decrease in sales of our products, as our customers:

|

|

·

|

may

cancel existing orders;

|

|

|

·

|

may

introduce fewer new products;

|

|

|

·

|

may

discontinue current products; and

|

|

|

·

|

may

decrease their inventory levels.

|

A

decrease in demand for our products could have a significant adverse effect on

our operating results, profitability and cash flows which may adversely affect

our liquidity, our ability to retire debt or our ability to comply with debt

covenants. Accordingly, we may experience volatility in our revenues,

profits and cash flows.

Reduced

prices for our products may adversely affect our profit margins if we are unable

to reduce our cost structure.

The

average selling prices for our products tend to decrease over their life cycle.

In addition, foreign currency movements and the desire to retain market share

increase the pressure on our customers to seek lower prices from their

suppliers. As a result, our customers are likely to continue to demand lower

prices from us. To maintain our margins and remain profitable, we must continue

to meet our customers’ design needs while concurrently reducing costs through

efficient raw material procurement, process and product improvements and

focusing our operating expense levels. Our profit margins and cash flows may

suffer if we are unable to reduce our overall cost structure relative to

decreases in sales prices.

Rising

raw material and production costs may decrease our gross margin.

We use

commodities such as copper and plastic resins in manufacturing our

products. Prices of these and other raw materials have experienced

significant volatility in the past. Other manufacturing costs, such

as direct and indirect labor, energy, freight and packaging costs, also directly

impact the costs of our products. If we are unable to pass increased

costs through to our customers or recover the increased costs through production

efficiencies, our gross margins may suffer.

An

inability to adequately respond to changes in technology, applicable standards

or customer needs may decrease our sales.

We

operate in an industry characterized by rapid change caused by the frequent

emergence of new technologies and standards. Generally, we expect

life cycles for products in the electronic components industry to be relatively

short. This requires us to anticipate and respond rapidly to changes in industry

standards and customer needs and to develop and introduce new and enhanced

products on a timely and cost effective basis. Our engineering and

development teams place a priority on working closely with our customers to

design innovative products and improve our manufacturing

processes. Improving performance and reducing costs for our customers

requires continual development of new products and/or to the components of our

products. Our inability to react quickly and efficiently to changes

in technology, standards or customers’ needs may decrease our sales or

margins.

If

our inventories become obsolete, our future performance and operating results

will be adversely affected.

The life

cycles of our products depend heavily upon the life cycles of the end products

into which our products are designed. Products with short life cycles

require us to closely manage our production and inventory levels. Inventory may

become obsolete because of adverse changes in end market demand. During market

slowdowns, this may result in significant charges for inventory write-offs. Our

future operating results may be adversely affected by material levels of

obsolete or excess inventories.

An

inability to capitalize on our prior or future acquisitions or our decisions to

strategically divest our current businesses may adversely affect our

business.

We have

completed numerous acquisitions in the past and we continually seek acquisitions

to grow our businesses. We may fail to derive significant benefits from our

acquisitions. In addition, if we fail to achieve sufficient financial

performance from an acquisition, long-lived assets, such as property, plant and

equipment, goodwill and other intangibles, could become impaired and result in

the recognition of an impairment loss similar to the losses recorded in 2009 and

2008.

The

success of any of our acquisitions depends on our ability to:

|

|

·

|

successfully

execute the integration or consolidation of the acquired operations into

our existing businesses;

|

|

|

·

|

develop

or modify the financial reporting and information systems of the acquired

entity to ensure overall financial integrity and adequacy of internal

control procedures;

|

|

|

·

|

identify

and take advantage of cost reduction opportunities;

and

|

|

|

·

|

further

penetrate the markets for the product capabilities

acquired.

|

Integration

of acquisitions may take longer than we expect and may never be achieved to the

extent originally anticipated. This could result in lower than anticipated

business growth or higher than anticipated costs. In addition, acquisitions

may:

|

|

·

|

cause

a disruption in our ongoing

business;

|

|

|

·

|

distract

our managers;

|

|

|

·

|

increase

our debt and leverage;

|

|

|

·

|

unduly

burden our other resources; and

|

|

|

·

|

result

in an inability to maintain our historical standards, procedures and

controls, which may result

in non-compliance with external laws and

regulations.

|

Alternatively,

we may also consider making strategic divestitures, which may:

|

|

·

|

cause

a disruption in our ongoing

business;

|

|

|

·

|

distract

our managers;

|

|

|

·

|

unduly

burden our other resources; and

|

|

|

·

|

result

in an inability to maintain our historical standards, procedures and

controls, which may result in non-compliance with external laws and

regulations.

|

We may

record impairment losses in the future. We assess the impairment of

long-lived assets whenever events or changes in circumstances indicate the

carrying value may not be recoverable. Factors we consider important

that could trigger an impairment review include significant changes in the use

of any asset, changes in historical trends in operating performance, a

significant decline in the price of our common stock, changes in projected

operating performance and significant negative economic trends.

Integration

of acquisitions may limit the ability of investors to track the performance of

individual acquisitions and to analyze trends in our operating

results.

Our

historical practice has been to rapidly integrate acquisitions into our existing

business and to report financial performance on a company-wide

level. As a result of this practice, we do not separately track the

standalone performance of acquisitions after the date of the

transaction. Consequently, investors cannot quantify the financial

performance and success of any individual acquisition or our consolidated

financial performance and success excluding the impact of

acquisitions. In addition, our practice of rapidly integrating

acquisitions into our financial results may limit the ability of investors to

analyze any trends in our operating results over time.

An

inability to identify, consummate or integrate acquisitions may slow our future

growth.

We plan

to continue to identify and consummate additional acquisitions to further

diversify our businesses and to penetrate or expand important markets. We may

not be able to identify suitable acquisition candidates at reasonable prices.

Even if we identify promising acquisition candidates, the timing, price,

structure and success of future acquisitions are uncertain. An inability to

consummate or integrate attractive acquisitions may reduce our growth rate and

our ability to penetrate new markets.

If

any of our major customers terminates a substantial amount of existing

agreements, chooses not to enter into new agreements or elects not to submit

additional purchase orders for our products, our business may

suffer.

Most of

our sales are made on a purchase order basis. We have a concentration

of several primary customers that we rely on for a material amount of these

purchase orders. To the extent we have agreements in place with these

customers, most of these agreements are either short-term in nature or provide

these customers with the ability to terminate the arrangement. Such

agreements typically do not provide us with any material recourse in the event

of non-renewal or early termination.

We will

lose business and our revenues may decrease if one of these major

customers:

|

|

·

|

does

not submit additional purchase

orders;

|

|

|

·

|

does

not enter into new agreements with

us;

|

|

|

·

|

elects

to reduce or prolong their purchase orders;

or

|

|

|

·

|

elects

to terminate their relationship with

us.

|

If

we do not effectively manage our business in the face of fluctuations in the

size of our organization, our business may be disrupted.

We have

grown both organically and as a result of acquisitions. We have also

contracted as a result of declines in global demand and

divestitures. We may significantly reduce or expand our workforce and

facilities in response to rapid changes in demand for our products due to

prevailing global market conditions. These rapid fluctuations place strains on

our resources and systems. If we do not effectively manage our resources and

systems, our business may be adversely affected.

Uncertainty

in demand for our products may result in increased costs of production, an

inability to service our customers or higher inventory levels which may

adversely affect our results of operations and financial condition.

We have

very little visibility into our customers’ future purchasing patterns and are

highly dependent on our customers’ forecasts. These forecasts are non-binding

and often highly unreliable. Given the fluctuation in growth rates

and cyclical demand for our products, as well as our reliance on often imprecise

customer forecasts, it is difficult to accurately manage our production

schedule, equipment and personnel needs and our raw material and working capital

requirements.

Our

failure to effectively manage these issues may result in:

|

|

·

|

production

delays;

|

|

|

·

|

increased

costs of production;

|

|

|

·

|

excessive

inventory levels and reduced financial

liquidity;

|

|

|

·

|

an

inability to make timely deliveries;

and

|

|

|

·

|

a

decrease in profits or cash flows.

|

A

decrease in availability of our key raw materials could adversely affect our

profit margins.

We use

several types of raw materials in the manufacturing of our products,

including:

|

|

·

|

base

metals such as copper;

|

|

|

·

|

ferrite

cores; and

|

|

|

·

|

plastics

and plastic resins.

|

Some of

these materials are produced by a limited number of suppliers. We may

be unable to obtain these raw materials in sufficient quantities or in a timely

manner to meet the demand for our products. The lack of availability or a delay

in obtaining any of the raw materials used in our products could adversely

affect our manufacturing costs and profit margins. In addition, if the price of

our raw materials increases significantly over a short period of time due to

increased market demand or shortage of supply, customers may be unwilling to

bear the increased price for our products and we may be forced to sell our

products containing these materials at lower prices causing a reduction in our

profit margins.

Costs

associated with precious metals and base metals may not be

recoverable.

Some of

Electrical’s raw materials, such as precious metals and certain base metals, are

considered commodities and are subject to price volatility. Electrical attempts

to limit its exposure to fluctuations in the cost of precious materials,

including silver, by obtaining the majority of the precious metal in its

facilities through leasing or consignment arrangements with suppliers.

Electrical then typically purchases the precious metal from its supplier at the

current market price on the day after shipment to the customer and passes this

cost on to the customer. Electrical attempts to limit its exposure to base metal

price fluctuations by attempting to pass through the cost of base metals to

customers, typically by indexing the cost of the base metal, so that the cost of

the base metal closely relates to the price charged to customers, but Electrical

may not always be successful in indexing these costs or fully passing through

costs to its customers.

Leasing/consignment

fee increases are primarily caused by increases in interest rates or volatility

in the price of the consigned material. Fees charged by the consignor

are driven by interest rates and the market price of the consigned

material. The market price of the consigned material is determined by

its supply and demand. Consignment fees may increase if interest rates or the

price of the consigned material increase.

Electrical’s

results of operations and liquidity may be negatively impacted if it is unable

to:

|

|

·

|

enter

into new leasing or consignment arrangements with similarly favorable

terms after its existing agreements

terminate;

|

|

|

·

|

recover

increased leasing or consignment costs through an increase in

prices;

|

|

|

·

|

pass

through higher base metals’ costs to its customers;

or

|

|

|

·

|

comply

with existing leasing or consignment

obligations.

|

Competition

may result in reduced demand for our products and reduced sales.

We

frequently encounter strong competition within individual product lines from

various competitors throughout the world. We compete principally on the basis

of:

|

|

·

|

product

quality and reliability;

|

|

|

·

|

global

design and manufacturing

capabilities;

|

|

|

·

|

breadth

of product line;

|

|

|

·

|

price;

|

|

|

·

|

customer

service; and

|

|

|

·

|

delivery

time.

|

Our

inability to successfully compete on any or all of the above or other factors

may result in reduced sales.

Fluctuations

in foreign currency exchange rates may adversely affect our operating

results.

We

manufacture and sell our products in various regions of the world and export and

import these products to and from a large number of countries. Fluctuations in

exchange rates could negatively impact our cost of production and sales which,

in turn, could decrease our operating results and cash flow. In

addition, if the functional currency of our manufacturing costs strengthened

compared to the functional currency of our competitors’ manufacturing costs, our

products may become more costly than our competitors. Although we

engage in limited hedging transactions, including foreign currency exchange

contracts which may reduce our transaction and economic exposure to

foreign currency fluctuations, these measures may not eliminate or substantially

reduce our risk in the future.

Our

international operations subject us to the risks of unfavorable political,

regulatory, labor and tax conditions in other countries.

We

manufacture and assemble most of our products in locations outside the United

States, such as China, and a majority of our revenues are derived from sales to

customers outside the United States. Our future operations and earnings may be

adversely affected by the risks related to, or any other problems arising from,

operating in international locations and markets.

Risks

inherent in doing business internationally may include:

|

|

·

|

the

inability to repatriate or transfer cash on a timely or efficient

basis;

|

|

|

·

|

economic

and political instability;

|

|

|

·

|

expropriation

and nationalization;

|

|

|

·

|

trade

restrictions;

|

|

|

·

|

capital

and exchange control programs;

|

|

|

·

|

transportation

delays;

|

|

|

·

|

uncertain

rules of law;

|

|

|

·

|

foreign

currency fluctuations; and

|

|

|

·

|

unexpected

changes in the laws and policies of the United States or of the countries

in which we manufacture and sell our

products.

|

The

majority of our manufacturing occurs in the PRC. Although the PRC has

a large and growing economy, political, legal and labor developments entail

uncertainties and risks. For example, during the second half of 2009, we began

to encounter difficulties in attracting and retaining the level of labor

required to meet our customer’s demand. Also, wages have been

increasing rapidly over the last several years in southern

China. While China has been receptive to foreign investment, its

investment policies may not continue indefinitely into the future and future

policy changes may adversely affect our ability to conduct our operations in

these countries or the costs of such operations.

We have

benefited in prior years from favorable tax incentives and we operate in

countries where we realize favorable income tax treatment relative to the U.S.

statutory rate. We have been granted special tax incentives,

including tax holidays, in jurisdictions such as the PRC. This

favorable situation could change if these countries were to increase rates or

discontinue the special tax incentives, or if we discontinue our manufacturing

operations in any of these countries and do not replace the operations with

operations in other locations with similar tax incentives or policies.

Accordingly, in the event of changes in laws and regulations affecting our

international operations, we may not be able to continue to recognize or take

advantage of similar benefits in the future.

Shifting

our operations between regions may entail considerable expense, capital and

opportunity costs.

Within

countries in which we operate, particularly China, we sometimes shift our

operations from one region to another in order to maximize manufacturing and

operational efficiency. We may close one or more additional factories in the

future. This could entail significant earnings charges and cash payments to

account for severance, asset impairments, write-offs, write-downs, moving

expenses, start-up costs and inefficiencies, as well as certain adverse tax

consequences including the loss of specialized tax incentives, non-deductible

expenses or value-added tax consequences.

Liquidity

requirements could necessitate movements of existing cash balances which may be

subject to restrictions or cause unfavorable tax and earnings

consequences.

A

significant portion of our cash is held offshore by international subsidiaries

and may be denominated in currencies other than the U.S.

dollar. While we intend to use a significant amount of the cash held

overseas to fund our international operations and growth, if we encounter a

significant need for liquidity domestically or at a particular location that we

cannot fulfill through borrowings, equity offerings, or other internal or

external sources, we may experience unfavorable tax and earnings consequences

due to cash transfers. These adverse consequences would occur, for

example, if the transfer of cash into the United States is taxed and no

offsetting foreign tax credit is available to offset the U.S. tax liability,

resulting in lower earnings. In addition, we may be prohibited from

transferring cash from a country such as the PRC. Foreign exchange ceilings

imposed by local governments and the sometimes lengthy approval processes which

foreign governments require for international cash transfers may delay our

internal cash transfers from time to time. We have not experienced

any significant liquidity restrictions in any country in which we operate and

none are presently foreseen.

All of

our retained earnings are free from legal or contractual restrictions, with the

exception of approximately $30.2 million of retained earnings as of December 25,

2009, primarily in the PRC that are restricted in accordance with the PRC

Foreign Investment Enterprises Law. This law restricts 10% of our net

earnings in the PRC, up to a maximum amount equal to 50% of the total capital we

have invested in the PRC. The $30.2 million includes approximately $5.7 million

of retained earnings of a majority owned subsidiary and approximately $1.9

million of a discontinued operation.

Losing

the services of our executive officers or our other highly qualified and

experienced employees could adversely affect our businesses.

Our

success depends upon the continued contributions of our executive officers and

senior management, many of whom have numerous years of experience and would be

extremely difficult to replace. We must also attract and maintain experienced

and highly skilled engineering, sales and marketing, finance and manufacturing

personnel. Competition for qualified personnel is often intense, and

we may not be successful in hiring and retaining these people. If we lose the

services of these key employees or cannot attract and retain other qualified

personnel, our businesses could be adversely affected.

On

February 22, 2010 we announced that our board of directors has named Daniel M.

Moloney our next chief executive officer, replacing James M. Papada, III, who is

retiring, pursuant to a plan announced to the board in 2008. Mr.

Moloney comes to Technitrol from Motorola, Inc., where he served most recently

as Executive Vice President and President of its Home and Network Mobility

business, a leading provider of integrated and customized end-to-end media

solutions for cable, wireline, and wireless service providers. He

played a leading role in expanding the breadth and global presence of this

business. Mr. Moloney served nearly 10 years in senior-level

capacities at Motorola and, previously, 16 years in managerial positions of

increasing responsibility at General Instrument Corporation before its

acquisition by Motorola early in 2000. He holds a bachelor's degree

in electrical engineering from the University of Michigan and a master of

business administration from the University of Chicago. Mr. Moloney

is expected to join Technitrol at the end of March

2010.

Public

health epidemics (such as flu strains or severe acute respiratory syndrome) or

natural disasters (such as earthquakes or fires) may disrupt operations in

affected regions and affect operating results.

We

maintain extensive manufacturing operations in the PRC as do many of our

customers and suppliers. A sustained interruption of our

manufacturing operations, or those of our customers or suppliers, resulting from

complications caused by a public health epidemic or natural disasters could have

a material adverse effect on our business and results of

operations.

The

unavailability of insurance against certain business and product liability risks

may adversely affect our future operating results.

As part

of our comprehensive risk management program, we purchase insurance coverage

against certain business and product liability risks. However, not

all risks are insured, and those that are insured differ in covered amounts by

type of risk, end market and customer location. If any of our insurance carriers

discontinues an insurance policy, significantly reduces available coverage or

increases our deductibles and we cannot find another insurance carrier to write

comparable coverage at similar costs, or if we are not fully insured for a

particular risk in a particular place, then we may be subject to increased costs

of uninsured or under-insured losses which may adversely affect our operating

results.

Also, our

components, modules and other products are used in a broad array of

representative end products. If our insurance program does not

adequately cover liabilities arising from the direct use of our products or as a

result of our products being used in our customers’ products, we may be subject

to increased costs of uninsured losses which may adversely affect our operating

results.

Environmental

liability and compliance obligations may adversely affect our operations and

results.

Our

manufacturing operations are subject to a variety of environmental laws and

regulations as well as internal programs and policies governing:

|

|

·

|

air

emissions;

|

|

|

·

|

wastewater

discharges;

|

|

|

·

|

the

storage, use, handling, disposal and remediation of hazardous substances,

wastes and chemicals; and employee health and

safety.

|

If

violations of environmental laws should occur, we could be held liable for

damages, penalties, fines and remedial actions for contamination discovered at

our present or former facilities. Our operations and results could be

adversely affected by any material obligations arising from existing laws or new

regulations that may be enacted in the future. We may also be held

liable for past disposal of hazardous substances generated by our business or

businesses we acquire.

Our

debt levels could adversely affect our financial position, liquidity and

perception of our financial condition in the financial markets.

We were

in compliance with the covenants of our amended and restated credit agreement as

of December 25, 2009. Outstanding borrowings against this agreement,

which allows for a maximum facility of $100.0 million, were $81.0 million at

December 25, 2009. In addition to the debt outstanding under our

credit agreement, we issued $50.0 million of convertible senior notes during the

fourth quarter of 2009. We believe the severe economic and credit

crisis that began in late 2008 and continued into 2009 has resulted in these

borrowings having a significant adverse affect on our share

price. Our share price may continue to be depressed until our

leverage improves.

Covenants

with our lenders require compliance with specific financial ratios that may make

it difficult for us to obtain additional financing on acceptable terms for

future acquisitions or other corporate needs. Although we anticipate

meeting our covenants in the normal course of operations, our ability to remain

in compliance with the covenants may be adversely affected by future events

beyond our control. Violating any of these covenants could result in

being declared in default, which may result in our lenders electing to declare

our outstanding borrowings immediately due and payable and terminate all

commitments to extend further credit. If the lenders accelerate the

repayment of borrowings, we cannot provide assurance that we will have

sufficient liquid assets to repay our credit facilities and other

indebtedness. In addition, certain domestic and international

subsidiaries have pledged the shares of certain subsidiaries, as well as

selected accounts receivable, inventory, machinery and equipment and other

assets as collateral. If we default on our obligations, our lenders

may take possession of the collateral and may license, sell or otherwise dispose

of those related assets in order to satisfy our obligations.

Our

results may be negatively affected by changing interest rates.

We are

subject to market risk from exposure to changes in interest rates. To

mitigate the risk of changing interest rates, we may utilize derivatives or

other financial instruments. We do not expect changes in interest rates to have

a material effect on our income or cash flows for the foreseeable future,

although there can be no assurances that interest rates will not significantly

change or that our results would not be negatively affected by such

changes.

Our

intellectual property rights may not be adequately protected.

We may

not be successful in protecting our intellectual property through patent laws,

other regulations or by contract. As a result, other companies may be able to

develop and market similar products which could materially and adversely affect

our business. We may be sued by third parties for alleged infringement of their

proprietary rights and we may incur defense costs and possibly royalty

obligations or lose the right to use technology important to our

business.

From time

to time, we receive claims by third parties asserting that our products violate

their intellectual property rights. Any intellectual property claims,

with or without merit, could be time consuming and expensive to litigate or

settle and could divert management attention from administering our

business. A third party asserting infringement claims against us or

our customers with respect to our current or future products may materially and

adversely affect us by, for example, causing us to enter into costly royalty

arrangements or forcing us to incur settlement or litigation costs.

Our

stock price, like that of many technology companies, has been and may continue

to be volatile.

The

market price of our common stock may fluctuate as a result of variations in our

quarterly operating results and other factors, some of which may be beyond our

control. These fluctuations may be exaggerated if the trading volume

of our common stock is low.

In

addition, the market price of our common stock may rise and fall in response to

the following factors, or the perception or anticipation of the following

factors:

|

|

·

|

announcements

of technological or competitive

developments;

|

|

|

·

|

acquisitions

or strategic alliances by us or our

competitors;

|

|

|

·

|

divestitures

of core and non-core businesses;

|

|

|

·

|

the

gain or loss of a significant customer or

order;

|

|

|

·

|

the

existence of debt levels which significantly exceed our cash

levels;

|

|

|

·

|

changes

in our liquidity, capital resources or financial

position;

|

|

|

·

|

changes

in estimates or forecasts of our financial performance or changes

in recommendations by securities analysts regarding us or our

industry;

|

|

|

·

|

general

market or economic conditions; or

|

|

|

·

|

future

business prospects.

|

Worldwide

recession and disruption of financial markets.

The

slowdown in economic activity in 2008 and 2009 caused by the ongoing global

recession and the reduced availability of liquidity and credit has adversely

affected our business. Difficult financial and economic

conditions may adversely affect our customers’ ability to meet the terms of sale

or our suppliers’ ability to fully perform according to their commitments to

us.

Item

1b Unresolved Staff Comments

None

Item 2 Properties

We are

headquartered in Trevose, Pennsylvania where we lease approximately 8,000 square

feet of office space. We operated 22 manufacturing plants in 5 countries as of

December 25, 2009, of which 7 manufacturing plants in 3 of those countries only

manufacture products of Electrical. We sold 3 of Electrical’s plants

located in North America on January 4, 2010. We seek to maintain

facilities in those regions where we market our products in order to maintain a

local presence with our customers.

The

following is a list of the principal manufacturing locations of our continuing

operations as of December 25, 2009:

|

Approx.

Percentage

|

|||||||||

|

Location (1)

|

Approx. Square Ft. (2)

|

Owned/Leased

|

Used For Manufacturing

|

||||||

|

Zhuhai,

PRC

|

374,000 |

Leased

|

90 | % | |||||

|

Ningbo,

PRC

|

363,000 |

Owned

|

80 | % | |||||

|

Mianyang,

PRC

|

318,000 |

Leased

|

80 | % | |||||

|

Dongguan,

PRC

|

231,000 |

Leased

|

100 | % | |||||

|

Suzhou,

PRC

|

171,000 |

Leased

|

100 | % | |||||

|

Shenzhen,

PRC

|

68,000 |

Leased

|

100 | % | |||||

|

Vancouver,

Washington

|

25,000 |

Leased

|

60 | % | |||||

|

Bristol,

Pennsylvania

|

20,000 |

Leased

|

60 | % | |||||

|

Total

|

1,570,000 | ||||||||

|

(1)

|

In

addition to these manufacturing locations, we have 371,000 square feet of

space which is used for engineering, sales and administrative support

functions at various locations, including Electronics’ headquarters in San

Diego, California. In addition, we lease approximately 956,000 square feet

of space for dormitories, canteens and other employee-related facilities

in the PRC.

|

|

(2)

|

Consists

of aggregate square footage in each locality where manufacturing

facilities are located. More than one manufacturing facility may be

located within each locality.

|

Item 3 Legal Proceedings

We are a

party to various legal proceedings and other actions. See discussion

in Note 10 to the Consolidated Financial Statements. We expect litigation to

arise in the normal course of business. Although it is difficult to

predict the outcome of any legal proceeding, we do not believe that the outcome

of these proceedings and actions will, individually or in the aggregate, have a

material adverse effect on our consolidated financial condition or results of

operations.

Item 4 Submission of

Matters to a Vote of Security Holders

None

Part

II

Item 5 Market for Registrant’s Common

Equity and Related Stockholder Matters

Our

common stock is traded on the New York Stock Exchange under the ticker symbol

“TNL.” The following table reflects the highest and lowest sales

prices in each quarter of the last two years.

|

First Quarter

|

Second Quarter

|

Third Quarter

|

Fourth Quarter

|

|||||||||||||

|

2009

High

|

$ | 4.04 | $ | 6.80 | $ | 9.14 | $ | 10.43 | ||||||||

|

2009

Low

|

$ | 1.00 | $ | 1.71 | $ | 5.29 | $ | 4.18 | ||||||||

|

2008

High

|

$ | 28.99 | $ | 25.28 | $ | 17.37 | $ | 15.35 | ||||||||

|

2008

Low

|

$ | 19.51 | $ | 17.05 | $ | 12.16 | $ | 2.47 | ||||||||

On

December 25, 2009, there were approximately 921 registered holders of our common

stock, which has a par value of $0.125 per share and is the only class of stock

that we have outstanding. See additional discussion on restricted

retained earnings of subsidiaries in Item 7, Liquidity and Capital Resources,

and in Note 11 of our Consolidated Financial Statements.

We paid

dividends of approximately $6.7 million during the year ended December 25,

2009. We used $14.3 million for dividend payments during the years

ended December 26, 2008 and December 28, 2007, respectively. On

November 2, 2009, we announced a quarterly cash dividend of $0.025 per common

share, payable on January 15, 2010 to shareholders of record on January 1,

2010. This quarterly dividend resulted in a cash payment to

shareholders of approximately $1.0 million in the first quarter of

2010. We expect to continue making quarterly cash dividend payments

for the foreseeable future.

Information

as of December 25, 2009 concerning plans under which our equity securities are

authorized for issuance are as follows:

|

Plan

Category

|

Number of shares to be issued upon exercise of

options, grant of restricted shares or other incentive

shares

|

Weighted average exercise price of outstanding

options

|

Number of securities remaining

available

for future issuance

|

|||||||||

|

Equity

compensation plans approved by security holders

|

6,150,000 | $ | 17.53 | 2,779,789 | ||||||||

|

|

||||||||||||

|

Equity

compensation plans not approved by security holders

|

-- | -- | -- | |||||||||

|

|

||||||||||||

|

Total

|

6,150,000 | $ | 17.53 | 2,779,789 | ||||||||

On May

15, 1981, our shareholders approved an incentive compensation plan (“ICP”)

intended to enable us to obtain and retain the services of employees by

providing them with incentives that may be created by the Board of Directors

Compensation Committee under the ICP. Subsequent amendments to the

plan were approved by our shareholders including an amendment on May 23, 2001

which increased the total number of shares of our common stock which may be

granted under the plan to 4,900,000 shares. Our 2001 Stock Option

Plan and the Restricted Stock Plan II were adopted under the ICP. In

addition to the ICP, other plans approved include a 250,000 share Board of

Director Stock Plan and a 1,000,000 share Employee Stock Purchase Plan

(“ESPP”). During 2004, the operation of the ESPP was suspended

following an evaluation of its affiliated expense and perceived value by

employees. Of the 2,779,789 shares remaining available for future

issuance, 1,856,498 shares are attributable to our ICP, 812,099 shares are

attributable to our ESPP and 111,192 shares are attributable to our Board of

Director Stock Plan. Note 12 to the Consolidated Financial Statements contains

additional information regarding our stock-based compensation

plans.

|

|

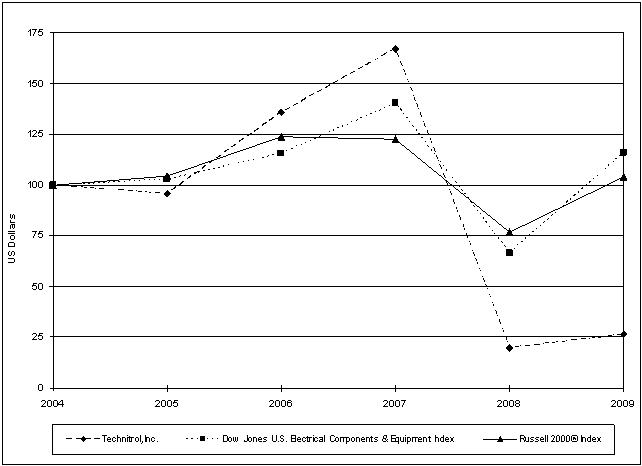

Comparison

of Five-Year Cumulative Total

Return

|

The

following graph compares the growth in value on a total-return basis of $100

investments in Technitrol,

Inc., the Russell 2000® Index and the Dow Jones U.S. Electrical Components

and Equipment Industry Group Index between December 31, 2004 and December

25, 2009. Total-return data reflect closing share prices on the final

day of each Technitrol fiscal year. Cash dividends paid are

considered as if reinvested. The graph does not reflect intra-year

price fluctuations.

The Russell 2000® Index consists

of approximately the 2,000 smallest companies and about 8% of the total market

capitalization of the Russell 3000® Index. The Russell 3000

represents about 98% of the investable U.S. equity market.

At

December 25, 2009, the Dow

Jones U.S. Electrical Components and Equipment Industry Group Index

included the common stock of American Superconductor Corp., Amphenol Corp.,

Anixter International, Inc., Arrow Electronics, Inc., Avnet, Inc., AVX Corp.,

Baldor Electric Co., Belden, Benchmark Electronics, Inc., Commscope, Inc.,

Cooper Industries Ltd. Class A, EnerSys, Flextronics International, Ltd.,

General Cable Corp., GrafTech International Ltd., Hubbell Inc. Class B, Jabil

Circuit, Inc., Littelfuse, Inc., Molex, Inc. and Molex, Inc. Class A, Plexus

Corp., Regal-Beloit Corp., Thomas & Betts Corp., Tyco Electronics

Ltd., Wesco International, Inc. and Vishay Intertechnology, Inc.

|

2004

|

2005

|

2006

|

2007

|

2008

|

2009

|

|||||||||||||||||||

|

Technitrol,

Inc.

|

$ | 100.00 | $ | 95.67 | $ | 135.72 | $ | 167.18 | $ | 19.78 | $ | 26.27 | ||||||||||||

|

Dow

Jones U.S. Electrical Components & Equipment Industry Group

Index

|

$ | 100.00 | $ | 102.64 | $ | 115.74 | $ | 140.19 | $ | 66.61 | $ | 116.15 | ||||||||||||

|

Russell

2000® Index

|

$ | 100.00 | $ | 104.55 | $ | 123.76 | $ | 122.73 | $ | 76.93 | $ | 103.94 | ||||||||||||

Item 6 Selected Financial

Data (in thousands, except per share

amounts)

|

2009(1)(2)(3)

|

2008(1)(2)(4)(5)

|

2007(2)

|

2006(2)(6)

|

2005(2)(7)

|

||||||||||||||||

|

Net

sales

|

$ | 398,803 | $ | 626,270 | $ | 671,569 | $ | 627,495 | $ | 361,552 | ||||||||||

|

(Loss)

earnings from continuing operations before cumulative effect of accounting

changes

|

$ | (72,859 | ) | $ | (123,553 | ) | $ | 42,173 | $ | 46,464 | $ | (28,550 | ) | |||||||

|

Cumulative

effect of accounting changes, net of income taxes

|

-- | -- | -- | 75 | (564 | ) | ||||||||||||||

|

Net

(loss) earnings from discontinued operations

|

(119,978 | ) | (151,467 | ) | 19,740 | 12,175 | 3,189 | |||||||||||||

|

Net

(loss) earnings

|

(192,837 | ) | (275,020 | ) | 61,913 | 58,714 | (25,925 | ) | ||||||||||||

|

Less:

Net earnings attributable to non-controlling interest

|

375 | 738 | 256 | 1,511 | 939 | |||||||||||||||

|

Net

(loss) earnings attributable to Technitrol, Inc.

|

$ | (193,212 | ) | $ | (275,758 | ) | $ | 61,657 | $ | 57,203 | $ | (26,864 | ) | |||||||

|

Basic

(loss) earnings per share:

|

||||||||||||||||||||

|

Net

(loss) earnings from continuing operations before cumulative effect of

accounting changes

|

$ | (1.79 | ) | $ | (3.05 | ) | $ | 1.03 | $ | 1.11 | $ | (0.74 | ) | |||||||

|

Cumulative

effect of accounting changes, net of income taxes

|

-- | -- | -- | 0.00 | (0.01 | ) | ||||||||||||||

|

Net

(loss) earnings from discontinued operations

|

(2.94 | ) | (3.72 | ) | 0.49 | 0.31 | 0.08 | |||||||||||||

|

Net