Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ASHFORD HOSPITALITY TRUST INC | d410976d8k.htm |

Exhibit 99.1 |

Safe

Harbor 2

In keeping with the SEC’s “Safe Harbor” guidelines,

certain statements made during this presentation could be

considered forward-looking and subject to certain risks and

uncertainties that could cause results to differ materially from

those projected. When we use the words “will likely result,” “may,” “anticipate,” “estimate,”

“should,” “expect,” “believe,”

“intend,” or similar expressions, we intend to identify forward-looking statements.

Such forward-looking statements include, but are not limited to,

our business and investment strategy, our understanding of our

competition, current market trends and opportunities, projected operating results, and

projected capital expenditures.

These forward-looking statements are subject to known and unknown

risks and uncertainties, which could cause actual results to

differ materially from those anticipated including, without limitation: general volatility of the

capital markets and the market price of our common stock; changes in

our business or investment strategy; availability, terms and

deployment of capital; availability of qualified personnel; changes in our industry and the

market in which we operate, interest rates or the general economy, and

the degree and nature of our competition. These and other

risk factors are more fully discussed in the Company’s filings with the Securities and Exchange

Commission.

EBITDA is defined as net income before interest, taxes, depreciation

and amortization. EBITDA yield is defined as trailing twelve

month EBITDA divided by the purchase price. EBITDA, FFO, AFFO, CAD and other terms are

non-GAAP measures, reconciliations of which have been provided in

prior earnings releases and filings with the SEC.

This overview is for informational purposes only and is not an offer to

sell, or a solicitation of an offer to buy or sell, any

securities of Ashford Hospitality Trust, Inc. and may not be relied upon in connection with the purchase or

sale of any such security.

|

Economic & Industry

Overview |

| Stock

Value

discussion

–

disclaimer

regarding

stock

price

projections

under

various

scenarios

–

it’s

all

math,

not

our

opinion of value |

U.S.

Starting to Deleverage 4

Source:

U.S.

Federal

Reserve

&

Historical

Statistics

of

the

United

States:

-

Cambridge

0%

50%

100%

150%

200%

250%

300%

350%

400%

450%

Home Mortgage

Other Household Debt

State & Local Government

Federal Government

Total U.S. Debt as a % of GDP

Nonfinancial Business

Consumer Credit

Domestic Financial |

| -

Now before we dive into the specifics of our industry or our company, I’d like to discuss

briefly the macroeconomic backdrop we’re dealing with

-

The U.S. is currently experiencing deleveraging and positive, but sluggish, growth

-

GDP is a measure of how much we SPEND |

Real

GDP Growth % 5

2011 Real GDP Growth: 1.7%

Source:

U.S.

Dept.

of

Commerce:

BEA&Historical

Statistics

of

the

United

States:

-

Cambridge |

| -

The U.S. left the gold standard in 1971

-

Most recessions are induced by the Fed through interest rate increases

-

Real growth has been in the 3-4% range

-

GDP is a measure of spending, not prosperity

-

Shocks, generally, have not caused recessions. These shocks include oil, war, financial,

etc. |

Hotel Demand Driven by Economy

Source: Smith Travel Research & U.S. Dept. of Commerce: BEA

Hotel Demand Growth % vs. Real GDP Growth

6

R-squared = 0.61 |

| -

Demand for more hotel room nights matches growth in GDP fairly closely

-

I believe that because of our deleveraging, GDP, and therefore room night demand, will grow

fairly modestly over the next 5 to 7 years |

U.S. Demand Will Outpace Supply

7

PKF Forecast

Source: Smith Travel Research & PKF |

Real RevPAR is Cyclical

Source: Smith Travel Research & U.S. Dept. of Labor: BLS

Seasonally-Adjusted Real RevPAR

(2012$, Trailing 3-Mo Average)

8

$52

$54

$56

$58

$60

$62

$64

$66

$68

$70

$72

$74 |

RevPAR Forecast -

PKF

Source: Smith Travel Research & PKF

9

5-Year RevPAR Growth CAGR: 5.8%

7.9%

6.1%

-2.0%

-16.7%

5.4%

8.2%

5.8%

6.6%

7.8%

5.9%

2.9%

-20.0%

-15.0%

-10.0%

-5.0%

0.0%

5.0%

10.0%

2006

2007

2008

2009

2010

2011

2012F

2013F

2014F

2015F

2016F

Historical RevPAR Growth

Forecasted RevPAR Growth |

| PKF’s 5-year RevPAR growth CAGR is about 5%, with PKF forecasting virtually

no growth in 2016 |

Potential Industry EBITDA Growth Rates

10

With strong potential RevPAR gains, those companies with reasonable

flow-throughs could experience significant EBITDA growth

PKF estimates 5-year cumulative EBITDA growth of about 55%*

*Based

on

PKF

RevPAR/ADR/Occupancy

projections

and

EBITDA

growth

resulting

from

PKF

EBITDA

change

regression

equation |

| -

Given the strong potential 5-year RevPAR CAGRs, significant hotel EBITDA growth is possible

-

Also note how sensitive these EBITDA numbers are to flow-throughs – those companies

that achieve the best flow-throughs will have a real advantage in EBITDA growth -

Note that about 500 bps of increased flow at the same RevPAR growth rate equates to about the

same EBITDA growth as 50 bps of increased RevPAR growth at the same flow % -

According to PKF assumptions, hotel EBITDA should grow by approximately 40% over the next five

years; this is based on PKF’s EBITDA change regression equation, which is:

EBITDA change = -0.02 + 2.07*ADR change + 1.38*Occupancy change, R^2 = 0.97

-

If Ashford’s EBITDA grew by 40-80%, its stock price would be

$27-$46 |

Advantages of Lodging REITs

11

Tax

benefits

High

-

quality

real estate

retains

value

Hard asset

Not a

financial

asset

Non

-

recourse

debt

Liquidity

Benefits

Inflation

hedge

Dividend

paying |

| -

Include double taxation issue as well as Bush tax cuts |

|

Attractive Dividend Yield & Coverage

13

Ashford has both a high dividend yield and strong dividend coverage

Source: Company filings, Bloomberg & First Call

|

| -

Ashford’s dividend yield AND dividend coverage exceed the peer average

-

Note that this TTM coverage will likely come down a bit due to the burning off of hedges, but

coverage will still remain strong |

Total Shareholder Return

14

Peer

average

includes:

BEE,

CHSP,

CLDT,

DRH,

FCH,

HST,

HT,

LHO,

PEB,

SHO

Trailing Total Shareholder Returns as of 9/4/12

Source: Bloomberg |

| -

Ashford outperforms the peer index on a trailing basis for the past 2, 3, 4, 5, 6, 7 & 8

years -

On an IRR basis, the 3-year Ashford IRR is 27% vs the peer average of 23%, the 5-year

Ashford IRR is -2% vs the peer average IRR of - 13%; over 8 years, Ashford’s

IRR is 5% vs the peer average of -0.1% |

Most Highly-Aligned Management

15

Insider ownership %

Source: Company Filings |

| -

Hersha’s insider ownership would be 4% when shares owned by a real estate company in

Argentina, attributed to one of their Board members, are excluded

-

EVERY employee at Ashford owns stock, and all the senior executives at REMINGTON, our property

manager affiliate, own material amounts of stock |

Upcoming Maturities & Debt Yields

16

Upcoming maturities through 2014 include:

TTM June 2012 weighted average debt yields on these maturities are

13.6%

Aareal Torrey Pines /

Capital Hilton

$143.7M

Matures Aug 2013

13.5% TTM Debt Yield

Highland Cigna Loans

$101.4M

Matures Jan-Apr 2013

17.2% TTM Debt Yield

UBS Pool 1

$105.8M

Matures Dec 2014

10.5% TTM Debt Yield

GEMSA Manchester

Courtyard

$5.4M

Matures May 2014

9.2% TTM Debt Yield |

| -

Through 2014 Ashford has $378 million of debt coming due

-

With the exception of the Hilton El Conquistador, which has negative NOI, which we are

currently trying to sell, all of this debt is fully refinanceable today based on the TTM

debt yields -

Prudential, two hotels, $144.7 million, comes due in Aug 2013, TTM debt yield of 12.7%

-

Cigna, three hotels, $101.9 million (AHT share), comes due in the first quarter of 2013, TTM

debt yield of 16.1%

-

UBS 1 Pool is a securitized loan with 8 properties, $106.3 million, comes due in Dec 2014, TTM

debt yield of 10.2%

-

GEMSA, 1 hotel, $5.4 million, comes due in May 2014, TTM debt yield of 9.0%

-

Through 2014 our debt is clearly refinanceable today and the fundamentals are getting better

with our quarterly property level EBITDA improvement |

Available Liquidity

17

Undrawn

$145m

credit

facility

$139m of

unrestricted

cash at end

of Q2 ‘12

Preferred

equity ATM

facility

Common

equity ATM

facility

Potential

refinancing

proceeds

Excess cash

flow

Available

Liquidity |

| -

We have many sources of liquidity should we need or choose to tap into

-

We currently have zero balance on our $145 million credit facility

-

We had $150 million in cash available to us at the end of the quarter

-

We have a preferred at the market facility currently in place. Last quarter we turned

this on and raised $9 million -

We also have in place a common at the market facility which we have not used, but could turn

on at any time -

We have potential excess refinancing proceeds for the 2013 and 2014 maturities that I walked

you through -

And we have excess cash flow. Last year we had $110 million of CAD or Cash Available for

Distribution. CAD is essentially our AFFO minus normal FF&E reserves.

And we only spent less than $35 million on dividends. Out of this we spend owner funded capex,

etc….but still have excess cash flow

-

All sources of available liquidity should we choose to tap into |

Safety & Optionality

18

Portfolio A: Safety

•

Approximately 100-120% of equity value

•

~$2.0 billion of debt

•

Positive cash flow

•

Weighted average maturity of 3.6 years

•

All debt non-recourse

Portfolio B: Optionality & Upside

•

Approximately 0-(20)% of equity value

•

$1.0 to $1.2 billion of debt

•

Positive cash flow

•

Weighted average maturity of 4.5 years

•

All debt non-recourse |

| We have a very unique value proposition for investors.

You could think of Ashford as two investments.

Portfolio A encompasses the lionshare of our equity value, or approximately 100-120%

-

This portfolio has about $2.0 billion of our debt.

-

This portfolio has positive cash flow and a weighted average maturity of 3.6 years.

-

And all the debt is non-recourse

Relative to the outstanding debt we are in a good position. This portfolio reflects a

steady growth opportunity. Portfolio B accounts for about 0-(20)% of our equity

value. -

It has about $1.0 -

$1.2 billion of debt and also positive cash flow.

-

This portfolio has a longer weighted average maturity of 4.5 years

-

And all this debt is non-recourse as well.

This portfolio provides significant optionality for upside from faster EBITDA growth along

with a reasonably long runway with respect to the debt maturity to see our plans come

to fruition. |

Highland Hospitality

Update |

Highland Opportunities

20

•

Looking for opportunities to create long-term value and operational efficiency

through Remington management

•

Hilton Back Bay, Hyatt Windwatch, Courtyard Savannah & Residence Inn

Tampa •

Right-sizing the cost structure

•

Bringing best practices to operations

•

Rebuilding base business on the books

•

Stabilizing and growing RevPAR share

•

Several

of

the

properties

had

been

neglected

from

a

capital

perspective

•

Revenues should benefit from capex

Franchise

properties

Operating

flow

throughs

Revenues

Strategic

Capex |

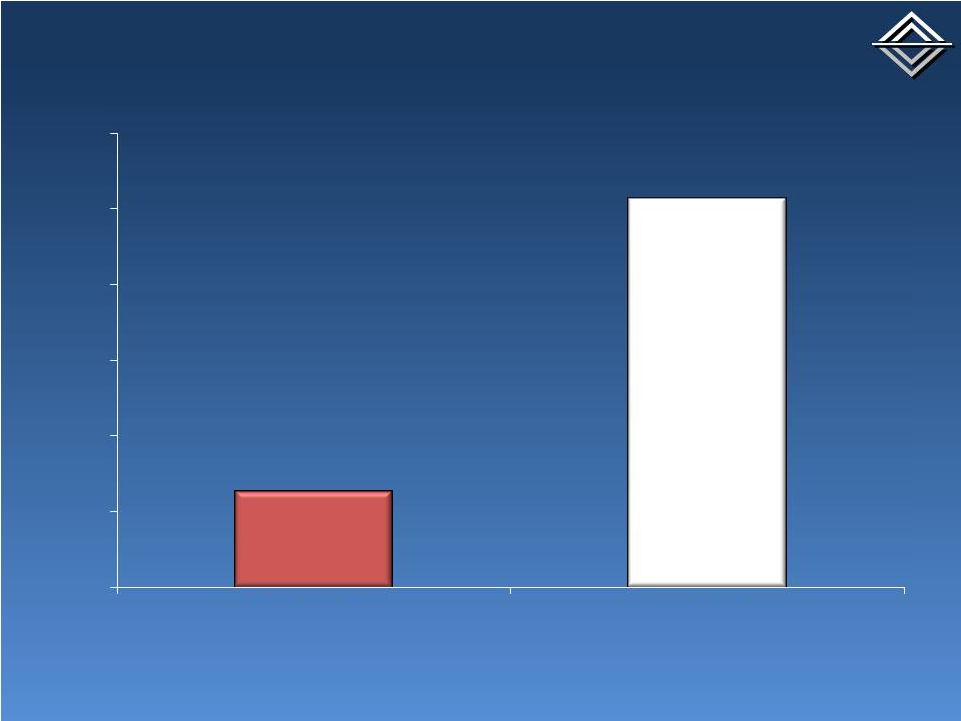

Highland Year One GOP Flows

21

0%

20%

40%

60%

80%

100%

120%

One Year Pre-Takeover

One Year Post-Takeover

25.20%

102.70% |

Highland NOI Exceeds Underwriting

22

$72

$74

$76

$78

$80

$82

$84

$86

$88

$90

$92

Mar 2011 TTM

Jun 2011 TTM

Sep 2011 TTM

Dec 2011 TTM

Mar 2012 TTM

U/W for Mar 2012 |

|

Next Steps for Ashford

24

Allow portfolio to naturally

delever

Diligently work the capital

markets

Thorough research &

quantitative analysis

Scour market for acquisition

opportunities

Grow cash balance

Intense operational focus to

grow EBITDA

Must be long-term accretive to stock price

Franchised, full-service preferred

Domestic & global opportunities

Proactive refinancings

Push out maturities

Selectively access the capital markets

Highland & MIP portfolio cash flow

$30 million+ of annual debt amortization

Investigate & execute risk management strategies

Expertise in capital allocation

Focus on creating long-term shareholder value

Build cash balance in preparation for next downturn

Focus on growing Highland revenues

Growing EBITDA is best way to create shareholder value

|

| -

Spend time walking through the types of assets we’re looking at: full-service,

franchised properties, both US & Europe |

|