Attached files

| file | filename |

|---|---|

| 8-K - FORM 8K - WEST PHARMACEUTICAL SERVICES INC | form8k.htm |

WEST PHARMACEUTICAL SERVICES, INC.

Solutions for Injectable Drug Delivery NYSE:WST www.westpharma.com

© 2012 by West Pharmaceutical Services, Inc., Lionville, PA.

All rights reserved. This material is protected by copyright. No part of it may be reproduced, stored in a retrieval system, or transmitted in any

form or by any means, electronic, mechanical, photocopying or otherwise, without written permission of West Pharmaceutical Services, Inc.. All

trademarks and registered trademarks are property of West Pharmaceutical Services, Inc., unless noted otherwise.

form or by any means, electronic, mechanical, photocopying or otherwise, without written permission of West Pharmaceutical Services, Inc.. All

trademarks and registered trademarks are property of West Pharmaceutical Services, Inc., unless noted otherwise.

CL King 10th Annual Best Ideas Conference

New York, NY

September 12, 2012

Safe Harbor Statement

Cautionary Statement Under the Private Securities Litigation Reform Act of 1995

This presentation and any accompanying management commentary contain “forward-looking statements”

as that term is defined in the Private Securities Litigation Reform Act of 1995. Such statements include,

but are not limited to statements about expected financial results for 2012 and future years.

as that term is defined in the Private Securities Litigation Reform Act of 1995. Such statements include,

but are not limited to statements about expected financial results for 2012 and future years.

Each of these estimates is based on preliminary information, and actual results could differ from these

preliminary estimates. We caution investors that the risk factors listed under “Cautionary Statement” in

our press releases, as well as those set forth under the caption "Risk Factors" in our most recent Annual

Report on Form 10-K as filed with the Securities and Exchange Commission and as revised or

supplemented by our quarterly reports on Form 10-Q, could cause our actual results to differ materially

from those estimated or predicted in the forward-looking statements. You should evaluate any statement

in light of these important factors. Except as required by law or regulation, we undertake no obligation to

publicly update any forward-looking statements, whether as a result of new information, future events, or

otherwise.

preliminary estimates. We caution investors that the risk factors listed under “Cautionary Statement” in

our press releases, as well as those set forth under the caption "Risk Factors" in our most recent Annual

Report on Form 10-K as filed with the Securities and Exchange Commission and as revised or

supplemented by our quarterly reports on Form 10-Q, could cause our actual results to differ materially

from those estimated or predicted in the forward-looking statements. You should evaluate any statement

in light of these important factors. Except as required by law or regulation, we undertake no obligation to

publicly update any forward-looking statements, whether as a result of new information, future events, or

otherwise.

Non-GAAP Financial Measures

Certain financial measures included in these presentation materials, and which may be referred to in

management’s discussion of the Company’s results and outlook, are Non-GAAP (Generally Accepted

Accounting Principles) financial measures. Please refer to the “Non-GAAP Financial Measures” and

“Notes to Non-GAAP Financial Measures” at the end of these materials for more information. Non-GAAP

financial measures should not be considered in isolation or as an alternative to such measures

determined in accordance with GAAP.

management’s discussion of the Company’s results and outlook, are Non-GAAP (Generally Accepted

Accounting Principles) financial measures. Please refer to the “Non-GAAP Financial Measures” and

“Notes to Non-GAAP Financial Measures” at the end of these materials for more information. Non-GAAP

financial measures should not be considered in isolation or as an alternative to such measures

determined in accordance with GAAP.

2

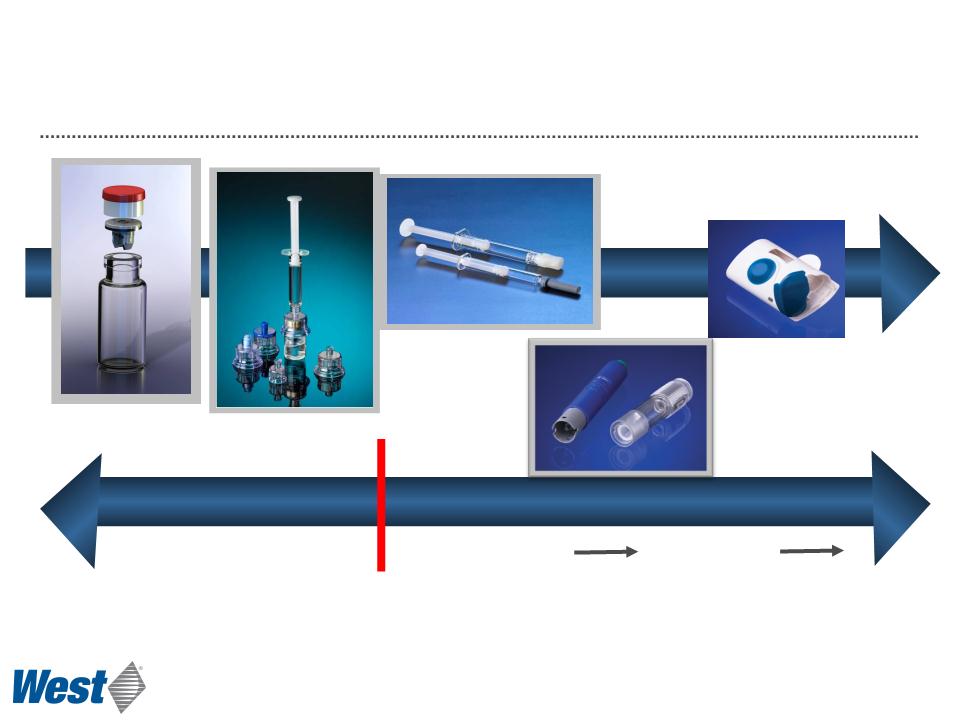

Pharmaceutical

Packaging Systems

Packaging Systems

Pharmaceutical

Delivery Systems

Delivery Systems

• A globally diverse manufacturer of

products used primarily in containing

and administering

small-volume parenteral drugs

products used primarily in containing

and administering

small-volume parenteral drugs

• Strong competitive position

§ Diversified customer base

§ Proprietary technology

§ Global footprint

§ Significant barriers to entry

• Stability with growth potential

§ Proprietary Products

§ Geographic Expansion

• Financial strength to invest

§ Reliable operating cash flow

§ Well capitalized

3

Who We Are

A Diverse, Stable Customer Base

(representative healthcare customers)

(representative healthcare customers)

PHARMACEUTICAL / BIOTECHNOLOGY

GENERIC

MEDICAL DEVICE

4

The West Transition

• Founded in Philadelphia (1923) and listed on NYSE since 1980

• Initiated strategic transformation in 2001 to become a leading global supplier

of value-added pharmaceutical packaging systems and components

of value-added pharmaceutical packaging systems and components

5

‘03 ‘04 ‘05 ‘06 ‘07 ‘08 ‘09 ‘10 ‘11

2001

$392 M

$392 M

2011

$1.2 B

$1.2 B

Kinston

recovery

Sale of

CCI

CCI

Sale of

Drug

Drug

Delivery

Acquired

Tech Group,

Medimop

Tech Group,

Medimop

Began

Eur/Asia

expansion

expansion

Acquired

Pharma

Pen

Pharma

Pen

Acquired

Normandy

Normandy

Acquired

LaModel

LaModel

China

plastics

completed

plastics

completed

Global

Quality

Initiative

Quality

Initiative

China

rubber

begun

rubber

begun

Business Segments

$857

$337

2011 Revenues

($ millions)

Delivery Systems

• Contract manufacturing base

• Multi-material

• Project management

• Automated assembly

• Regulated products

• Capabilities + IP = proprietary

delivery devices

delivery devices

• Proprietary devices are

expected to drive growth

expected to drive growth

Packaging Systems

• Established leadership

• Designed-in revenue base

• Diverse global capabilities

• High market shares

• Steady growth in base

• Increasing unit value of products

and geographic expansion are

expected to enhance growth

and geographic expansion are

expected to enhance growth

6

2012 Q2 Overview

•Second Quarter 2012 Sales Grew 5.5% (11.3% at constant

currency)

currency)

– High-value product growth and price were key components

– Backlog still growing: longer-lead times, customers building

inventories

inventories

•Pharmaceutical Packaging and Device markets:

– Customer’s new product pipelines showing signs of strength

– Patent cliff front and center

– Shift to large molecule products continues

– Global shift in product sourcing (e.g., India generic growth)

– More demanding regulatory environment

•Convertible Debenture Tender Offer Completed

7

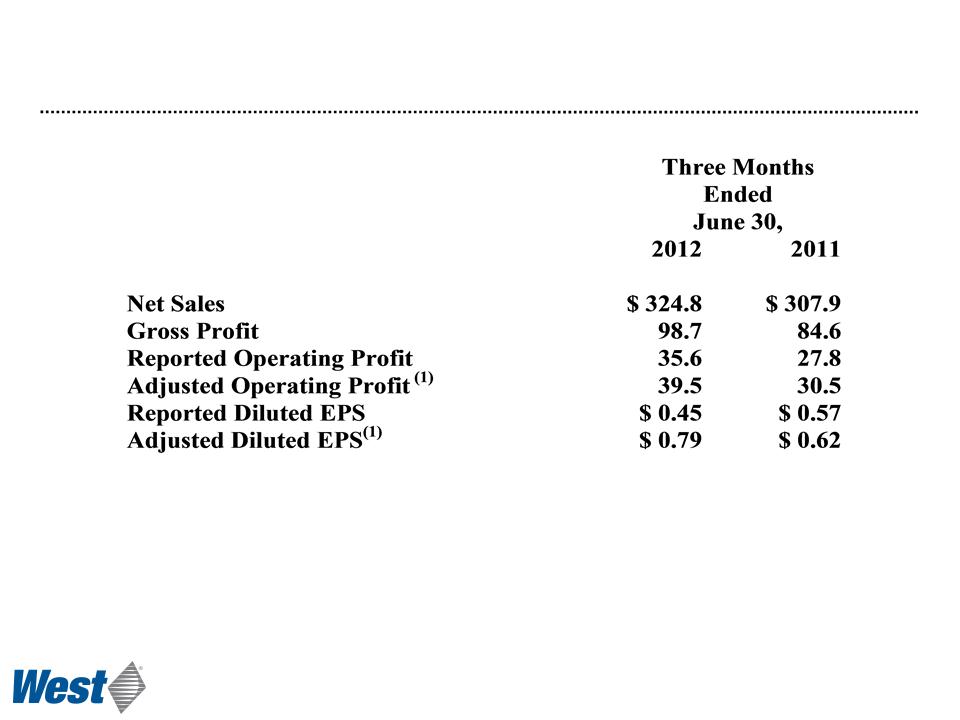

Q2 Summary Results

$ millions, except per-share data

$ millions, except per-share data

(1) These are Non-GAAP measurements. For an explanation and reconciliation of these items, see “Cautionary Statement”

(Slide 2) and “Non-GAAP Financial Measures” and “Notes to Non-GAAP Financial Measures” (Slides 30 - 32).

(Slide 2) and “Non-GAAP Financial Measures” and “Notes to Non-GAAP Financial Measures” (Slides 30 - 32).

8

Selected Factors Expected to Impact

Second-Half 2012 and Comparisons

Second-Half 2012 and Comparisons

See “Cautionary Statement” on slide 2. This is not an exclusive list of risks.

• Stronger US dollar impact on reported sales, profits from

international operations vs. first half and prior year

international operations vs. first half and prior year

• Pricing changes vs. prior year smaller than first half 2012

• Normal seasonality: West and customer shutdowns for

summer and holiday season impact sales and production

efficiency vs. first half

summer and holiday season impact sales and production

efficiency vs. first half

• First-half sales that are not expected to recur:

– Production in response to drug shortages / regulatory constraints

– Customer new product launches

• Expectations for new products and development

9

What will drive growth?

|

– Growth in emerging markets

– Escalating regulatory and

quality demands – Adding plants: China, India

– Expanding Westar® and

Envision® capacity, introducing NovaPure® components |

– Growth in combination products:

• safety, dosing accuracy, ease of

use • deliver cost savings

• product differentiation

– Daikyo Crystal Zenith® products:

• Increasing awareness of glass

quality issues – Delivery technology platforms:

• SmartDose® electronic patch

injector • ConfiDose® auto-injector

– Reconstitution products

– Safety syringes

|

Daikyo Crystal Zenith® is a registered trademark of Daikyo Seiko, Ltd.

Packaging Systems

Delivery Systems

10

|

Category

|

Key Customers

|

Projected

Growth |

|

Diabetes

|

|

> 10 %

|

|

Oncology

|

|

> 10 %

|

|

Vaccines

|

|

> 10 %

|

|

Autoimmune

|

|

> 8%

|

|

Generics

|

|

>10%

|

IMS April 2010 Report; Business Insights 2009; GBI Research 2009

Therapeutic Category Growth Drivers

11

Packaging Segment Overview

2011 Revenue

($ millions)

Packaging Systems

• Market leader

• Strong recurring revenue base

• Global manufacturing

• Steady growth in base

• Future growth will be driven by:

added value per unit sold;

geographic expansion; and

growth in key therapeutic

segments

added value per unit sold;

geographic expansion; and

growth in key therapeutic

segments

$857

12

Pharmaceutical Packaging Systems

Packaging Components for Small Volume Parenterals

Packaging Components for Small Volume Parenterals

Plungers, Tip caps,

Needle shields for Glass

Syringes

Needle shields for Glass

Syringes

Plungers, lined seals

for Glass Cartridges

for Pens

for Glass Cartridges

for Pens

Primary packaging components (those that touch the drug) are typically

proprietary to West and are “designed into” customers’ drug products

proprietary to West and are “designed into” customers’ drug products

13

Providing Solutions to a Changing Market

14

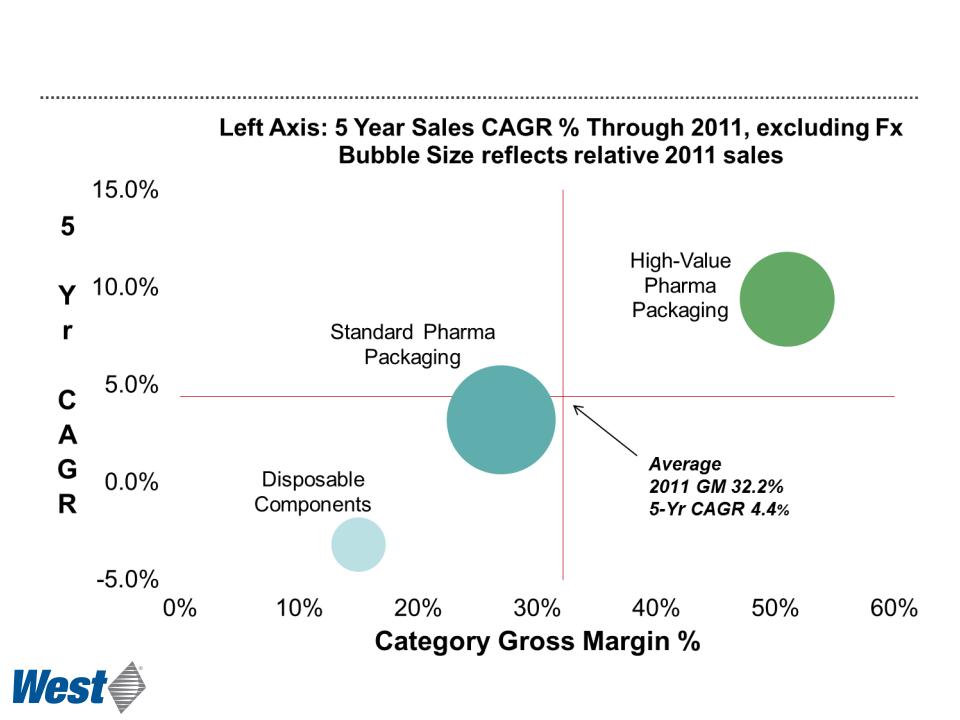

Faster Growth of High-Value Products

Pharmaceutical Packaging Systems

Pharmaceutical Packaging Systems

15

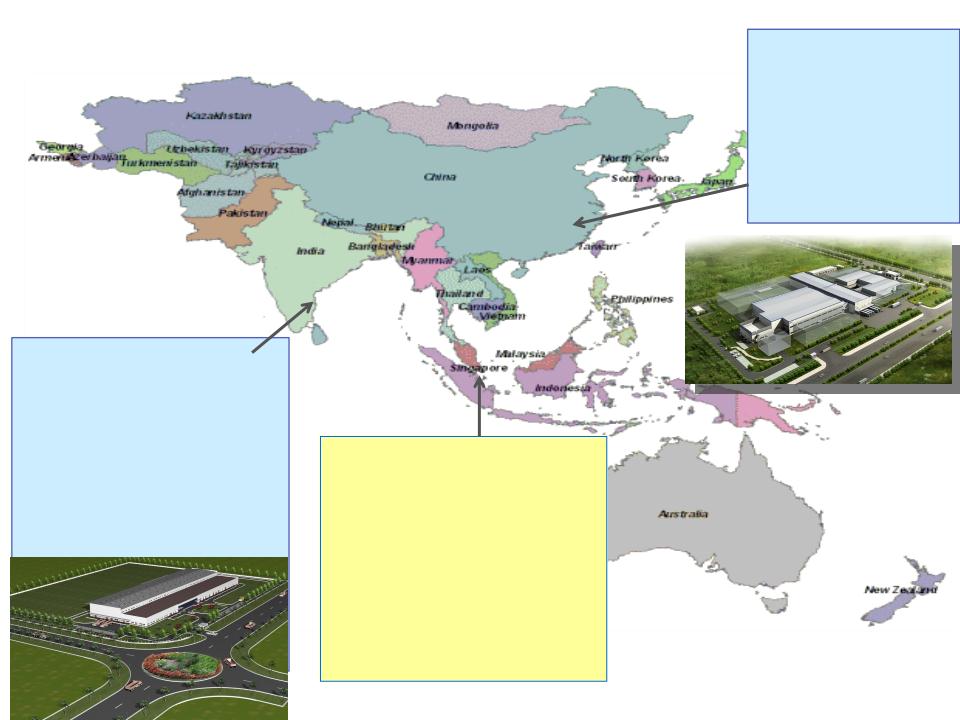

Asia-Pacific Region Operations

Strategy

Strategy

Singapore

1.High-value Product

Focus

Focus

2.A-P market & special

items

items

3.R&D hub & technical

center

center

China IV Plastic

Global supply

China Elastomer:

China Market,

Efficiency focus

Efficiency focus

India Elastomers for:

1.Domestic standard

products & local support

for multi-nationals

products & local support

for multi-nationals

2.Standard product for

export

export

16

Delivery Systems Segment Overview

$337

• Contract manufacturing base

• Customer owned IP

• Project management

• Automated assembly

• Regulated products

• Proprietary Product

Development

Development

2011 Revenue

($ millions)

17

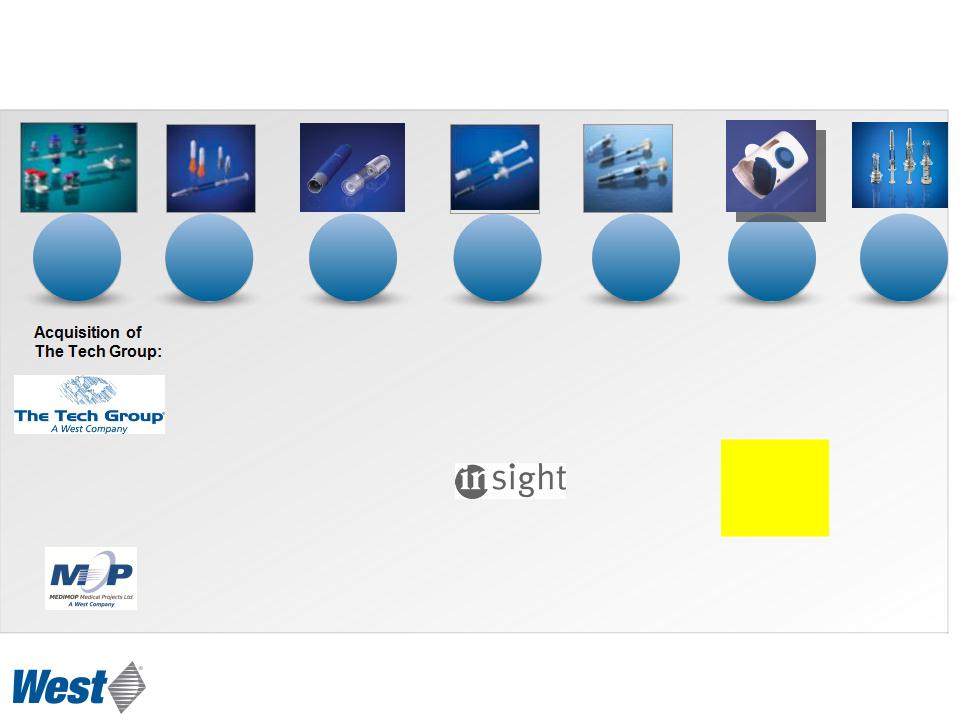

Acquisition of

Medimop:

Administration

Systems

Medimop:

Administration

Systems

2005

Licensing of

NovaGuard™:

Safety

System

NovaGuard™:

Safety

System

2006

Acquisition of

PharmaPen:

Auto-injector

PharmaPen:

Auto-injector

2007

Daikyo CZ

Insert

Needle

License:

Prefillable

Syringe

Systems

Insert

Needle

License:

Prefillable

Syringe

Systems

2008

Acquisition

of Plastef:

Prefillable

Syringe

Safety

of Plastef:

Prefillable

Syringe

Safety

2009

Acquisition

of LaModel:

Electronic

Patch

Injector

of LaModel:

Electronic

Patch

Injector

2010

Marketing

agreement

agreement

Product

Development

Development

Formation of

PDS division

PDS division

Portfolio Expansion to Meet Market Needs

Acquisition

of B.safe:

Prefilled

syringe

safety

of B.safe:

Prefilled

syringe

safety

2011

18

Pharma Industry Drug Life-Cycle

Management

Management

Phase I

Phase II

Phase III

Post-Market Life Cycle Management

8 - 10 years

2 - 3 years

2 - 3 years

Regulatory

Approval

Discovery

19

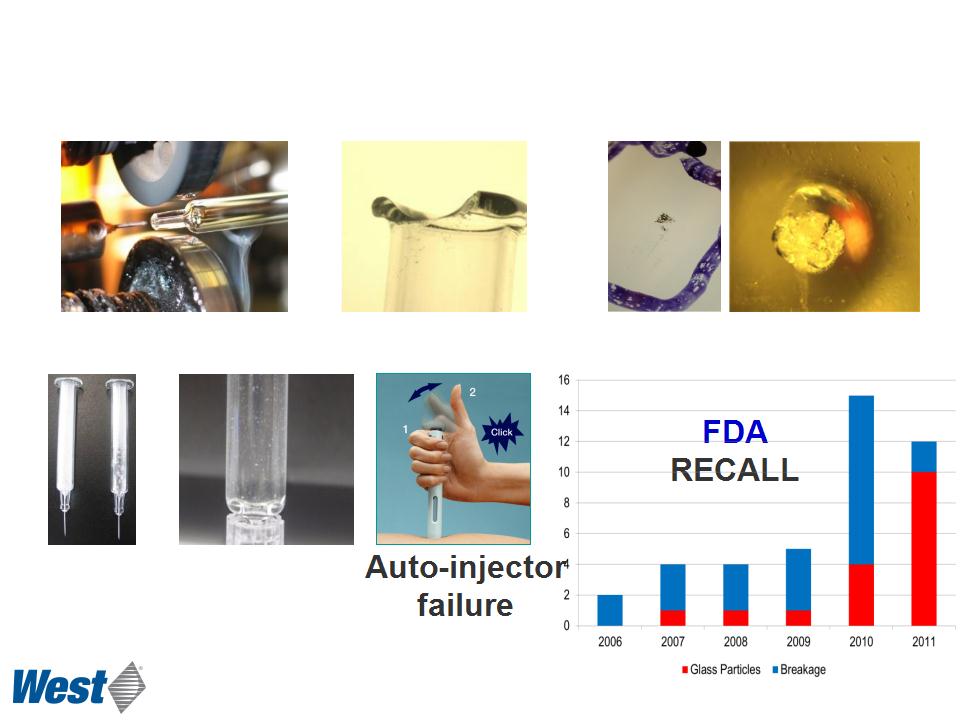

Tungsten residue

Breakage

Silicone oil

variability

variability

Cosmetic defects

Particles

Potential Glass Syringe Risk Areas

20

|

Action Associated with

Breakage Issue |

Associated Costs

|

Estimated Cost*

|

|

Investigation and

inspection of issues, complaints and syringe products |

· Field complaints inquiry

· Investigation and resources

· Inspection

|

> $50 Million

|

|

Loss of market share

|

Loss of sales until re-launch, and loss of

5% of share at market price post re- launch for year 1 |

> $50 Million

|

|

Replacement of drug

product, components and delivery system after re-launch |

2 million units at $100 each

|

> $200 Million

|

|

Pipeline Assessment:

Drugs in Phase II/III clinical trials |

200,000 units x approx. $100 each cost

(assuming 1/10 total production)

|

>$20 Million

|

|

Significant impacts on product supply, market confidence, brand

value |

Not estimable

|

|

* Source: Company estimates

Illustrative Estimates of Recall Costs

21

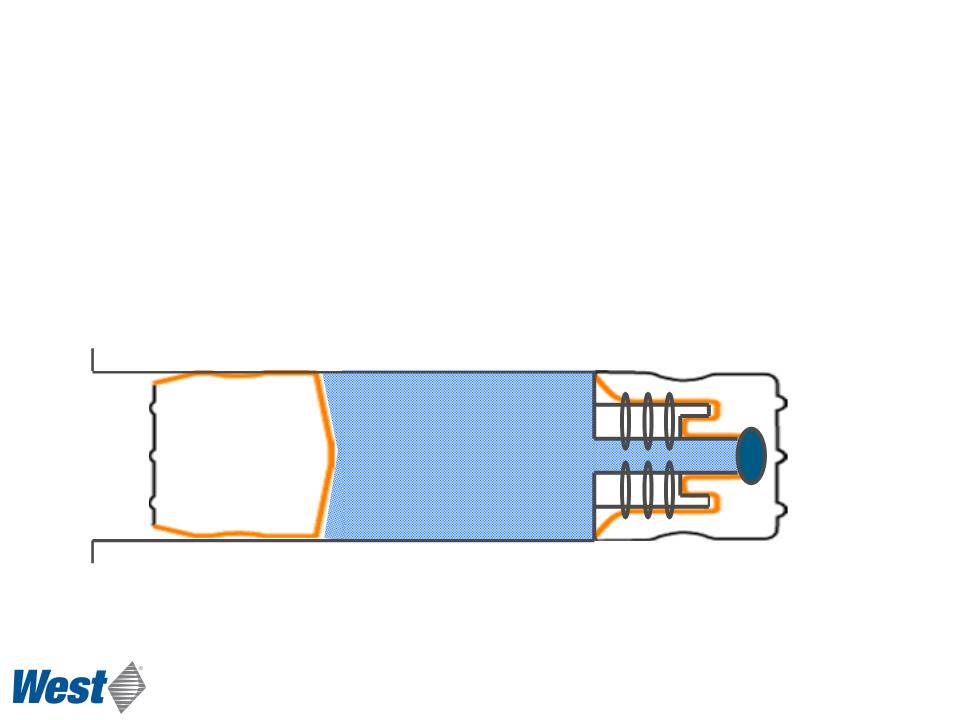

Daikyo CZ Solution

with Daikyo Flurotec® Barrier Film

with Daikyo Flurotec® Barrier Film

• Reduces:

– drug exposure to extractables

– risk of protein aggregation caused by silicone oil in the drug product

– returns and in-process clean-ups caused by broken glass

– risk of delamination and glass-particulate contamination

• Consistent piston release and travel forces without using silicone oil

Flurotec® is a registered trademark of Daikyo Seiko, Ltd.

22

Orange color indicates Flurotec® film coverage

Complete coverage with

inert film on drug

contact surfaces

inert film on drug

contact surfaces

Flurotec Film

• Patent Protection from Daikyo Seiko

• Trade Secret Molding / Processing

• Silicone-Free System

Daikyo Crystal Zenith Syringe Barrel

• Custom Formulated Resin exclusive

to Daikyo Seiko

to Daikyo Seiko

• IP Filed on CZ 1ml-IN Process

• Other IP on packaging / designs

Daikyo Crystal Zenith Competitive Advantage

Fully laminated

piston

piston

Inside-laminated

tip cap

tip cap

Products Approved in Daikyo Crystal Zenith

hyaluronic acid

MRI contrast

media

media

bone cement

6 Contrast Media

5 MRI

2 Hyaluronic Acid

1 Calcitonin

1 Proton Pump

Inhibitor

Inhibitor

fluconazole

oncology

anticoagulant

2 oncology

1 acyclovir

hyaluronic acid

3 oncology

API Container

Japan

MHLW

Europe

EMEA

US

FDA

Calcitonin

Bone

cement

Zometa

Hyaluronic

acid

24

SmartDose®

Electronic Patch Injector Technology Platform

Programmed by PDA or PC

Dose may be customized

Applied and activated by patient

• Controlled, subcutaneous, micro-infusion delivery

of high volumes and high viscosity drugs

of high volumes and high viscosity drugs

• Prefilled cartridge, no need for user filling

• Based on Daikyo CZ cartridge

• Compact

• Hidden needle for safety

• Single push-button operation

Prototype Operation

25

Revenue per-unit

Consumer product

manufacturing

manufacturing

Medical

device

manufacturing

device

manufacturing

Mix2Vial®

CZ vials

CZ Syringes

Effect of Increasing Proprietary Device Sales

Contract Manufacturing Proprietary Devices

Products

Auto-injector platform

technology

technology

Electronic patch

injector technology

injector technology

26

Our Long-Term Focus

• Pharmaceutical Packaging Systems

– Organic growth of 3-5% per year

– Margin expansion from efficiency, product mix

– Capital investments target enhanced quality and value

• Pharmaceutical Delivery Systems

– Deliver the potential of Daikyo CZ products

– Stronger mix of healthcare-consumable contract manufacturing

– Grow proprietary safety and delivery systems

• Financial discipline

– Operating cash flow supports R&D and capital spending

– Deliver returns (ROIC) that regularly exceed cost of capital (WACC)

– Maintain quarterly dividend

– Align incentives with financial performance and value creation

27

Pharmaceutical Packaging Systems

Pharmaceutical Delivery Systems

• Strong first half

• Established market leader

• Stability with growth potential

• New products well positioned to

meet future market needs

meet future market needs

• The financial strength to invest

Summary

28

Non-GAAP Financial Measures(3)

Three Months Ended March 31, 2012 and 2011

Three Months Ended March 31, 2012 and 2011

(in millions, except per share data)

(3) See “Notes to Non-GAAP Financial Measures” (Slides 31-32), “Cautionary Statement” (Slide 2) for an explanation and

reconciliation of these items.

reconciliation of these items.

|

|

As Reported

March 31,

2012

|

Restructuring

and related charges |

Acquisition-

related contingencies |

Discrete

tax items |

Non-GAAP

March 31,

2012

|

|

Operating profit

|

$41.7

|

$0.4

|

$0.2

|

$-

|

$42.3

|

|

Interest expense, net

|

3.9

|

-

|

-

|

-

|

3.9

|

|

Income before income taxes

|

37.8

|

0.4

|

0.2

|

-

|

38.4

|

|

Income tax expense

|

9.8

|

0.1

|

0.1

|

(0.3)

|

9.7

|

|

Equity in net income of affiliated companies

|

1.2

|

-

|

-

|

-

|

1.2

|

|

Net income

|

$29.2

|

$0.3

|

$0.1

|

$0.3

|

$29.9

|

|

|

|

|

|

|

|

|

Net income per diluted share

|

$0.81

|

$0.01

|

$-

|

$0.01

|

$0.83

|

|

|

As Reported

March 31,

2011

|

Restructuring

and related charges |

Discrete

tax items |

Non-GAAP

March 31,

2011

|

|

Operating profit

|

$28.8

|

$1.9

|

$-

|

$30.7

|

|

Interest expense, net

|

4.5

|

-

|

-

|

4.5

|

|

Income before income taxes

|

24.3

|

1.9

|

-

|

26.2

|

|

Income tax expense

|

6.1

|

0.6

|

(0.2)

|

6.5

|

|

Equity in net income of affiliated companies

|

1.4

|

-

|

-

|

1.4

|

|

Net income

|

$19.6

|

$1.3

|

$0.2

|

$21.1

|

|

|

|

|

|

|

|

Net income per diluted share

|

$0.56

|

$0.04

|

$-

|

$0.60

|

29

30

Non-GAAP Financial Measures(1)

Three Months Ended June 30, 2012 and 2011

Three Months Ended June 30, 2012 and 2011

(in millions, except per share data)

(1) See “Notes to Non-GAAP Financial Measures” (Slides 31-32) and “Cautionary Statement” (Slide 2) for an explanation and reconciliation of these

items.

items.

|

|

As Reported

June 30,

2012

|

Restructuring,

impairment & related charges |

Acquisition-

related contingencies |

Extinguishment

of debt |

Non-GAAP

June 30,

2012

|

|

Operating profit

|

$35.6

|

$3.7

|

$0.2

|

$-

|

$39.5

|

|

Loss on debt extinguishment

|

11.6

|

-

|

-

|

11.6

|

-

|

|

Interest expense, net

|

4.0

|

-

|

-

|

-

|

4.0

|

|

Income before income taxes

|

20.0

|

3.7

|

0.2

|

11.6

|

35.5

|

|

Income tax expense

|

6.5

|

1.4

|

-

|

1.8

|

9.7

|

|

Equity in net income of affiliated companies

|

2.1

|

-

|

-

|

-

|

2.1

|

|

Net income

|

$15.6

|

$2.3

|

$0.2

|

$9.8

|

$27.9

|

|

|

|

|

|

|

|

|

Net income per diluted share

|

$0.45

|

$0.06

|

$0.01

|

$0.27

|

$0.79

|

|

|

As Reported

June 30,

2011

|

Restructuring,

impairment & related charges |

Acquisition-

related contingencies |

Special separation

benefits |

Non-GAAP

June 30,

2011

|

|

Operating profit

|

$27.8

|

$1.3

|

($0.7)

|

$2.1

|

$30.5

|

|

Interest expense, net

|

4.3

|

-

|

-

|

-

|

4.3

|

|

Income before income taxes

|

23.5

|

1.3

|

(0.7)

|

2.1

|

26.2

|

|

Income tax expense

|

5.3

|

0.4

|

(0.1)

|

0.8

|

6.4

|

|

Equity in net income of affiliated companies

|

1.9

|

-

|

-

|

-

|

1.9

|

|

Net income

|

$20.1

|

$0.9

|

($0.6)

|

$1.3

|

$21.7

|

|

|

|

|

|

|

|

|

Net income per diluted share

|

$0.57

|

$0.02

|

($0.01)

|

$0.04

|

$0.62

|

31

NOTES TO NON-GAAP FINANCIAL MEASURES

For additional details, please see today’s press release and Safe Harbor Statement.

For additional details, please see today’s press release and Safe Harbor Statement.

(continued on following slide)

These presentation materials and associated presentation use the following financial measures that have not been calculated in accordance with

generally accepted accounting principles (GAAP) accepted in the U.S., and therefore are referred to as non-GAAP financial measures:

generally accepted accounting principles (GAAP) accepted in the U.S., and therefore are referred to as non-GAAP financial measures:

·Adjusted operating profit

·Adjusted net income

·Adjusted diluted EPS

·Net debt

·Net debt to total invested capital

West believes that these non-GAAP measures of financial results provide useful information to management and investors regarding business

trends, results of operations, and the Company’s overall performance and financial position. Our executive management team uses these

financial measures to evaluate the performance of the Company in terms of profitability and efficiency, to compare operating results to prior

periods, to evaluate changes in the operating results of each segment, and to measure and allocate financial resources to our segments. The

Company believes that the use of these non-GAAP financial measures provides an additional tool for investors to use in evaluating ongoing

operating results and trends in comparing its financial measures with other companies.

trends, results of operations, and the Company’s overall performance and financial position. Our executive management team uses these

financial measures to evaluate the performance of the Company in terms of profitability and efficiency, to compare operating results to prior

periods, to evaluate changes in the operating results of each segment, and to measure and allocate financial resources to our segments. The

Company believes that the use of these non-GAAP financial measures provides an additional tool for investors to use in evaluating ongoing

operating results and trends in comparing its financial measures with other companies.

Our executive management does not consider such non-GAAP measures in isolation or as an alternative to such measures determined in

accordance with GAAP. The principal limitation of these financial measures is that they exclude significant expenses and income that are

required by GAAP to be recorded. In addition, they are subject to inherent limitations as they reflect the exercise of judgment by management

about which items are excluded. In order to compensate for these limitations, non-GAAP financial measures are presented in connection with

GAAP results. We urge investors and potential investors to review the reconciliations of our non-GAAP financial measures to the comparable

GAAP financial measures, and not to rely on any single financial measure to evaluate the Company’s business.

accordance with GAAP. The principal limitation of these financial measures is that they exclude significant expenses and income that are

required by GAAP to be recorded. In addition, they are subject to inherent limitations as they reflect the exercise of judgment by management

about which items are excluded. In order to compensate for these limitations, non-GAAP financial measures are presented in connection with

GAAP results. We urge investors and potential investors to review the reconciliations of our non-GAAP financial measures to the comparable

GAAP financial measures, and not to rely on any single financial measure to evaluate the Company’s business.

In calculating adjusted operating profit, adjusted net income and adjusted diluted EPS, we exclude the impact of items that are not considered

representative of ongoing operations. Such items include restructuring and related costs, certain asset impairments, other specifically identified

gains or losses, and discrete income tax items. A reconciliation of these adjusted non-GAAP measures to the comparable GAAP financial

measures is included in the accompanying tables.

representative of ongoing operations. Such items include restructuring and related costs, certain asset impairments, other specifically identified

gains or losses, and discrete income tax items. A reconciliation of these adjusted non-GAAP measures to the comparable GAAP financial

measures is included in the accompanying tables.

The following is a description of the items excluded from adjusted operating profit, adjusted net income and adjusted diluted EPS for the three

- and six-month periods presented in the accompanying tables:

- and six-month periods presented in the accompanying tables:

Restructuring, impairment & related charges - During the three months ended June 30, 2012, we incurred restructuring, impairment and

related charges of $3.7 million, the majority of which related to impairment charges of $3.4 million, as we concluded that the estimated fair

related charges of $3.7 million, the majority of which related to impairment charges of $3.4 million, as we concluded that the estimated fair

32

NOTES TO NON-GAAP FINANCIAL MEASURES

For additional details, please see today’s press release and Safe Harbor Statement.

For additional details, please see today’s press release and Safe Harbor Statement.

value of one of our product lines no longer exceeded the carrying value of the related assembly equipment and intangible asset. The

remaining charges were restructuring and related charges associated with the restructuring plan announced in December 2010, primarily for

employee severance and benefits, as well as asset transfer and facility closure costs.

remaining charges were restructuring and related charges associated with the restructuring plan announced in December 2010, primarily for

employee severance and benefits, as well as asset transfer and facility closure costs.

Acquisition-related contingencies - During the three months ended June 30, 2012, we increased the liability for contingent consideration

related to our 2010 acquisition of technology used in our SmartDose™ electronic patch injector system by $0.2 million, due to accretion

expense. During the three months ended June 30, 2011, we eliminated $0.8 million of contingent consideration related to our July 2009 éris

safety syringe system acquisition. This reflected our assessment that none of the contractual operating targets will be achieved over the earn-

out period, which ends in 2014. Partially offsetting this reduction was accretion expense related to the SmartDose electronic patch injector

technology acquisition.

related to our 2010 acquisition of technology used in our SmartDose™ electronic patch injector system by $0.2 million, due to accretion

expense. During the three months ended June 30, 2011, we eliminated $0.8 million of contingent consideration related to our July 2009 éris

safety syringe system acquisition. This reflected our assessment that none of the contractual operating targets will be achieved over the earn-

out period, which ends in 2014. Partially offsetting this reduction was accretion expense related to the SmartDose electronic patch injector

technology acquisition.

Extinguishment of debt - During the three months ended June 30, 2012, we recognized a loss on debt extinguishment of $11.6 million

related to our repurchase of $158.4 million in aggregate principal amount of 4.00% Convertible Junior Subordinated Debentures Due 2047,

which included the purchase premium, transaction costs and a non-cash charge for unamortized debt issuance costs of the purchased

Convertible Debentures. The purchase of the Convertible Debentures results in a 2.9 million share, or 7.8%, prospective reduction in West

common shares included in the measurement of diluted earnings per share. Excluding the loss on debt extinguishment recognized in the

current quarter, the effect is expected to be accretive to earnings per diluted share going forward, after accounting for interest expense to be

incurred in connection with notes issued on July 5, 2012, the proceeds of which provided the permanent financing for the purchase of the

Convertible Debentures.

related to our repurchase of $158.4 million in aggregate principal amount of 4.00% Convertible Junior Subordinated Debentures Due 2047,

which included the purchase premium, transaction costs and a non-cash charge for unamortized debt issuance costs of the purchased

Convertible Debentures. The purchase of the Convertible Debentures results in a 2.9 million share, or 7.8%, prospective reduction in West

common shares included in the measurement of diluted earnings per share. Excluding the loss on debt extinguishment recognized in the

current quarter, the effect is expected to be accretive to earnings per diluted share going forward, after accounting for interest expense to be

incurred in connection with notes issued on July 5, 2012, the proceeds of which provided the permanent financing for the purchase of the

Convertible Debentures.

Special separation benefits - During the three months ended June 30, 2011, we incurred $2.1 million in special separation benefits related to

the retirement of our former President and Chief Operating Officer. These costs were primarily for the revaluation and acceleration of stock-

based compensation expense as a result of amendments to equity awards that allow certain of his awards to continue to vest over the original

vesting period instead of being forfeited upon separation.

the retirement of our former President and Chief Operating Officer. These costs were primarily for the revaluation and acceleration of stock-

based compensation expense as a result of amendments to equity awards that allow certain of his awards to continue to vest over the original

vesting period instead of being forfeited upon separation.

WEST PHARMACEUTICAL SERVICES, INC.

Solutions for Injectable Drug Delivery NYSE:WST www.westpharma.com

© 2012 by West Pharmaceutical Services, Inc., Lionville, PA.

All rights reserved. This material is protected by copyright. No part of it may be reproduced, stored in a retrieval system, or transmitted in any

form or by any means, electronic, mechanical, photocopying or otherwise, without written permission of West Pharmaceutical Services, Inc.. All

trademarks and registered trademarks are property of West Pharmaceutical Services, Inc., unless noted otherwise.

form or by any means, electronic, mechanical, photocopying or otherwise, without written permission of West Pharmaceutical Services, Inc.. All

trademarks and registered trademarks are property of West Pharmaceutical Services, Inc., unless noted otherwise.