Attached files

| file | filename |

|---|---|

| 8-K - 8-K - EMRISE Corp | emrise-form8xkseptember201.htm |

OTCQB: EMRI EMRISE CORPORATION An international manufacturer of electronic devices and communications equipment for the aerospace, defense and industrial markets in North America, Europe and Asia September 10, 2012 Rodman & Renshaw Annual Global Investment Conference New York, NY Growth/Special Situations Track

EMRISE CORPORATION Safe Harbor Statement The matters discussed in this presentation, including any oral comments that accompany the presentation or given in response to questions, may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include, but are not limited to, statements regarding orders, backlog, financial results, products, and/or other events that have not yet occurred. Actual results may differ materially from those forward-looking statements. Factors that could contribute to such differences include, but are not limited to, variations in forecasted growth rate of markets for the company’s products, changes in EMRISE’s financial condition and financial results, the company’s ability to distinguish itself and its products from current and future competitors and those factors contained in the “Risk Factors” section of the Company’s filings with the U.S. Securities and Exchange Commission on Forms 10-K, Forms 10-Q and Forms 8-K. 2 September 2012 Please Note: Unless otherwise indicated, the financial results of all EMRISE assets and businesses sold in 2011and in the comparative 2010 periods, which have been previously disclosed in the Company’s SEC filings, are included in EMRISE’s consolidated statements of operations and presented as discontinued operations.

EMRISE CORPORATION Overview: Turnaround Strategy ▶ Turnaround strategy implemented after major organizational, operational and financial changes in late 2010 and 2011 ♦ Strengthen balance sheet, reduce debt ♦ Cut operating costs, streamline operations ♦ Focus on organic growth driven by new product introductions, increased market penetration ♦ Seek strategic alliances/partners ♦ Position company for sustainable growth in revenue and profitability 3

EMRISE CORPORATION Overview: Progress ▶ Where we are today ♦ 2011 net sales up 14% year over year to $33.5 million ♦ 65% YOY decline in 2011 loss from continuing operations ♦ Profitable in 2011 Q4 and last half of year ♦ Cut operating costs, streamlined/improved organization ♦ Completed balance sheet overhaul, reduced debt ■ Paid off remaining PEM debt at a discount in 2012 Q2 ♦ Recently introduced and began shipping new Communications Equipment and Electronic Devices products 4

EMRISE CORPORATION Overview: Progress ▶ Where we are today (continued) ♦ 2012 Q2 net sales up 27% YOY; up 14% from 2012 Q1 net sales ■ Electronic Devices sales up 26% YOY ■ Communications Equipment sales up 28% YOY ♦ 2012 Q2 operating loss down 85% YOY ♦ Profitable in 2012 Q2, net income improved YOY by ~$1.3 million 5

EMRISE CORPORATION Financial Highlights1 – 2012 Q2, Six Months P & L Highlights ($ in thousands, except EPS) Quarter Ended Six Months Ended 6/30/12 6/30/11 6/30/12 6/30/11 Net sales $ 8,600 $ 6,787 $ 16,139 $ 14,663 Income (loss) before income tax $ 503 $ (1,269) $ (246) $ (2,302) Income net of tax from discontinued operations $ - $ 347 $ (9) $ 406 Net income (loss) $ 378 $ (879) $ (493) $ (1,838) Net income (loss) per fully diluted share $ 0.04 $ (0.08) $ (0.05) $ (0.17) Balance Sheet Highlights ($ in thousands) 6/30/12 12/31/11 Cash and equivalents $ 852 $ 805 Total assets $ 23,272 $ 24,668 Current ratio 1.68:1 1.74:1 Total debt $ 5,079 $ 5,741 Stockholders’ equity $ 10,261 $ 10,598 1Periods ended 6/30 are unaudited 6

EMRISE CORPORATION Overview: Growth ▶ Positioned for sustainable growth ♦ Excellent customer and business base in growth markets ♦ Focused on organic growth – existing and new markets ♦ Recent launch, qualification, acceptance and sales of new products ♦ Opportunities for strategic alliances ♦ Strong and growing backlog ♦ 2012 revenue expected to grow 11% to 14% from 2011 ♦ Forecasting profit for 2012 ♦ Undervalued with promising outlook 7

EMRISE CORPORATION Revenue Trend/Composition1 8 - $5,000 $10,000 $15,000 $20,000 $25,000 $30,000 $35,000 $40,000 $45,000 2010 A 2011 A 2012 E R ev e n u e ( $ i n 0 0 0' s ) Electronic Devices Communications Equipment 1Revenue Outlook/Composition based on organic growth and does not include impact of any future strategic alliances. Actual Guidance Estimate Revenue Up 11% to 14% (Mid-Point of Range Shown) Actual

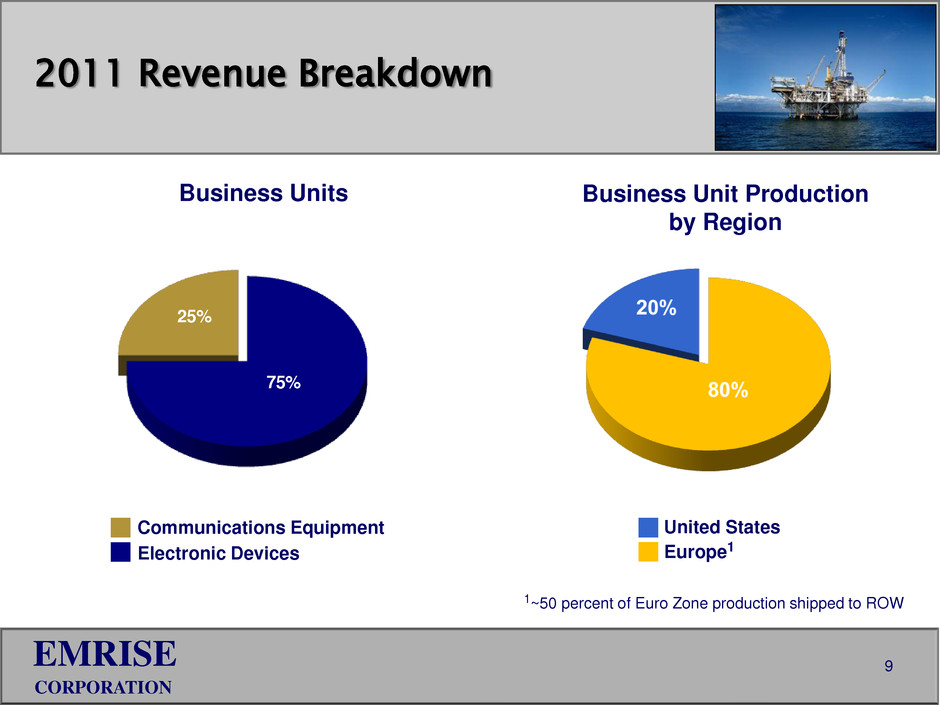

EMRISE CORPORATION 9 2011 Revenue Breakdown 75% 25% Business Unit Production by Region Communications Equipment Electronic Devices Business Units United States Europe1 1~50 percent of Euro Zone production shipped to ROW

EMRISE CORPORATION Electronic Devices ▶ International Aerospace, Defense & Industrial business ♦ Serving customers in North America, Europe and Asia ♦ Two manufacturing locations in the U.K. ♦ ~45% of Electronic Devices revenue from U.S. customers ■ Expected to drive organic growth and cash flow ♦ Power supply and RF devices and subsystems ■ Longstanding use in numerous military aerospace and other defense applications ■ Now also being used in growing number of commercial aerospace and industrial applications 10

EMRISE CORPORATION Electronic Devices ▶ International Aerospace, Defense & Industrial business ♦ European Military market gaining momentum ■ Long-term programs could drive faster growth in 2013 and beyond ♦ IFE&C market is a principal focus and primary growth driver ■ Anticipate ongoing growth in pipeline of IFE&C orders in U.S. and Europe, reflecting “Super Cycle” production forecast by Boeing and Air Bus ● Existing customers/new customers ● Existing products/new products ♦ Industrial market applications emerging in oil, natural gas, maritime and other sectors 11

EMRISE CORPORATION Electronic Devices: Strategy ▶ Focus on rapidly growing international commercial aerospace market ♦ IFE&C ♦ Cabin electronics ▶ Increase business in additional military aerospace programs ♦ Missile systems ♦ Unmanned vehicles ▶ Expand presence in harsh-environment commercial and industrial markets ▶ Enhance IFE&C products for commercial aerospace, COTS (Commercial Off-The-Shelf) products for military ▶ Capitalize on high quality, global customer base 12

EMRISE CORPORATION Electronic Devices: Key Customers Aerospace, Defense & Industrial IFE&C 13

EMRISE CORPORATION Communications Equipment ▶ Highly differentiated business with proprietary, marketable products in high growth industry ♦ Network access technologies and products ♦ CIP-ALL pseudo-wire Ethernet/IP product range that extends life of large base of analog telephony, data and video systems ♦ International customer base ■ Especially, public/private networks including telcos, utilities, military ▶ Based in U.S. and Europe ♦ Skills and technology to design, specify and produce complex network access products and systems 14

EMRISE CORPORATION Communications Equipment: Strategy ▶ Capitalize on product line, technology and customer base to drive sale of network access products ▶ Expanding mobile, backhaul, video, data and security needs driving industry growth ▶ Expand business through ♦ Organic growth ■ New and existing customers ■ New and existing products ● Concentrate on new CIP-ALL pseudo-wire product range – New focus on growing US market ♦ Strategic alliances/partnerships 15

EMRISE CORPORATION USA, Europe & Asia MOTOROLA North Africa Public Telephone Networks including: Tunisia, Libya, Algeria, Morocco, Gambia, Côte d’Ivoire, Cameroon, Mauritania Communications Equipment: Key Customers FAA 16

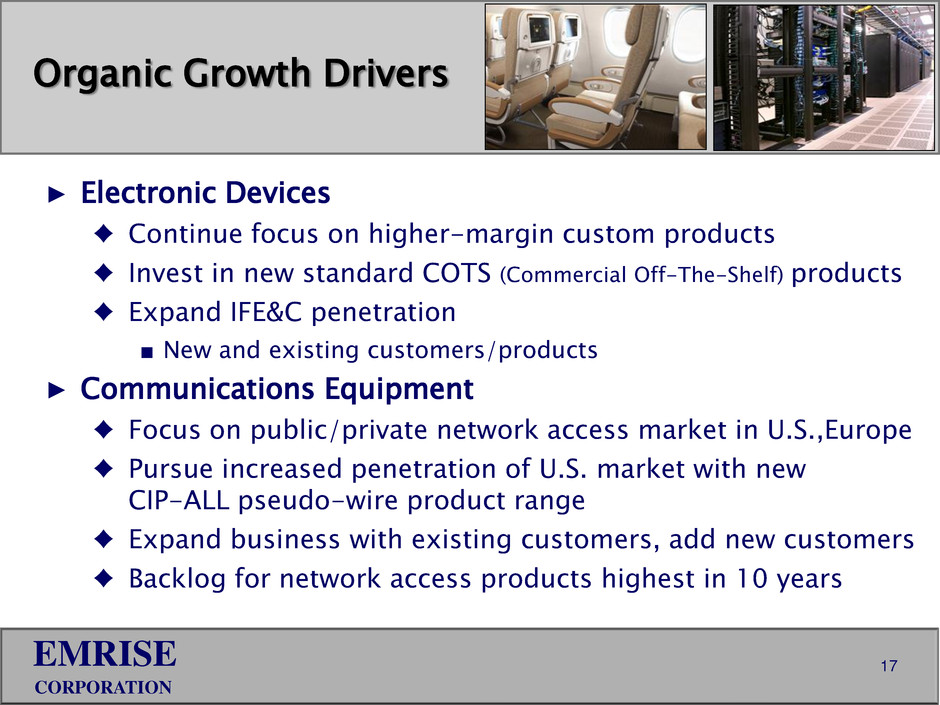

EMRISE CORPORATION Organic Growth Drivers ▶ Electronic Devices ♦ Continue focus on higher-margin custom products ♦ Invest in new standard COTS (Commercial Off-The-Shelf) products ♦ Expand IFE&C penetration ■ New and existing customers/products ▶ Communications Equipment ♦ Focus on public/private network access market in U.S.,Europe ♦ Pursue increased penetration of U.S. market with new CIP-ALL pseudo-wire product range ♦ Expand business with existing customers, add new customers ♦ Backlog for network access products highest in 10 years 17

EMRISE CORPORATION Stock Information Common shares OTC BB: EMRI 52-week closing price range $0.35 - $0.76 Recent price (8/28/12) $0.70 Average daily trading volume (90-day) 4,630 Common shares 10.7 million Market capitalization $7.47 million Insider ownership (officers, directors) 7.3%1 1Does not include the holdings of the CEO/Founder’s non-insider family members of ~5.5% 18

EMRISE CORPORATION ▶ Turnaround ▶ Focused on growing markets ▶ Experienced management/engineering ▶ World-class, global customer base ▶ Strategic alliances/partnerships ▶ New products ▶ Excellent brands and products, validated technologies ▶ Positioned for sustainable growth EMRISE Strengths 19

EMRISE CORPORATION Investment Thesis ▶ Turnaround ♦ Significantly improved balance sheet ♦ 2011 revenue up 14% YOY ♦ Profitable for last half 2011, profitable in 2012 Q2 ▶ Growth ♦ Growing backlog of customer orders for future shipment ♦ Continued multi-year, organic growth with revenue expected to increase 11% to 14% YOY in 2012 ♦ Projecting profitable year in 2012 ▶ Value ♦ EMRISE currently valued at ~0.21X TTM sales ♦ Peers valued at ~1.22X TTM sales 20

An international manufacturer of electronic devices and communications equipment for the aerospace, defense and industrial markets in North America, Europe and Asia OTCQB: EMRI EMRISE CORPORATION September 10, 2012 Rodman & Renshaw Annual Global Investment Conference New York, NY Growth/Special Situations Track