Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CNO Financial Group, Inc. | form8-k09052012deck.htm |

Overview of Recapitalization Plan September 5, 2012 Exhibit 99.1

CNO Financial Group | Investor Presentation | September 5, 2012 2 Forward-Looking Statements Certain statements made in this presentation should be considered forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995. These include statements about future results of operations and capital plans. We caution investors that these forward- looking statements are not guarantees of future performance, and actual results may differ materially. Investors should consider the important risks and uncertainties that may cause actual results to differ, including those included in our press release issued on September 4, 2012, our Quarterly Reports on Form 10-Q, our 2011 Annual Report on Form 10-K and other filings we make with the Securities and Exchange Commission. We assume no obligation to update this presentation, which speaks as of today’s date.

CNO Financial Group | Investor Presentation | September 5, 2012 3 Non-GAAP Measures This presentation contains the following financial measures that differ from the comparable measures under Generally Accepted Accounting Principles (GAAP): operating earnings measures; operating return measures; and debt to capital ratios, excluding accumulated other comprehensive income (loss). Reconciliations between those non-GAAP measures and the comparable GAAP measures are included in the Appendix, or on the page such measure is presented. While management believes these measures are useful to enhance understanding and comparability of our financial results, these non-GAAP measures should not be considered substitutes for the most directly comparable GAAP measures. Additional information concerning non-GAAP measures is included in our periodic filings with the Securities and Exchange Commission that are available in the “Investors – SEC Filings” section of CNO’s website, www.CNOinc.com.

CNO Financial Group | Investor Presentation | September 5, 2012 4 Strong Performance Sets Stage for Recapitalization Continued focus on the underserved and growing senior middle-income market – Profitable organic growth a priority Business continues to perform well – Sales grew 9% in 1H2012 over 1H2011 – Operating earnings for 1H2012 up 8% over 1H2011 Continue to generate and proactively deploy significant amounts of excess capital – Strong statutory earnings and cash flows sent to the holding company – Increased share buyback program and initiated common stock dividend in 2Q2012 – RBC* and debt to capital ratios have improved Performance and strategy recognized by ratings agencies – Moody’s upgraded senior secured credit rating to Ba3 – S&P updated senior secured rating outlook to positive (at B+) – A.M. Best upgraded financial strength rating to B++ CNO * Risk-Based Capital (“RBC”) requirements provide a tool for insurance regulators to determine the levels of statutory capital and surplus an insurer must maintain in relation to its insurance and investment risks. The RBC ratio is the ratio of the statutory consolidated adjusted capital of our insurance subsidiaries to RBC.

CNO Financial Group | Investor Presentation | September 5, 2012 5 CNO Recapitalization Plan Strategic Rationale CNO performance, ratings momentum, and favorable market conditions coming together – Market is open and attractively priced – Opportunity to lower run-rate cost of capital Pro forma EPS benefit of ~9% with stair step ROE increase of 40 bps – 12% reduction in diluted share count as of June 30, 2012 – No impact to statutory dividend and repurchase guidance; no impact to valuable tax asset Ratings profile offers opportunity to improve financial flexibility – Pushes out near-term debt maturities and balances fixed and floating capital structure – Reestablishes amortization rates aligned with capital structure optimization Reduces convertible overhang – Reduces uncertainty over conversion timing and concentrated ownership – Repurchase agreement executed with Paulson funds at discount to estimated market value CNO Raising $900 million to pay off senior secured debt and repurchase majority of the convertible debentures

CNO Financial Group | Investor Presentation | September 5, 2012 6 CNO Recapitalization Plan Capital Strategy Maintain capital cushion to absorb stress-test conditions – Leverage in the 20% range with consolidated RBC > 350% – Interest coverage of at least 5x – Holding company liquidity > $100 million Maintain positive ratings profile with goal of achieving investment grade – Recapitalization consistent with positive ratings actions – Pro forma key capital ratios consistent with investment grade standards Balanced use of free cash flow – Support new business growth rates through capital retention – Defend core capital ratios in primary insurance subsidiaries – Deliver capital back to the shareholders through disciplined repurchase strategy and common stock dividend – Continue to de-lever through ongoing debt pay downs CNO

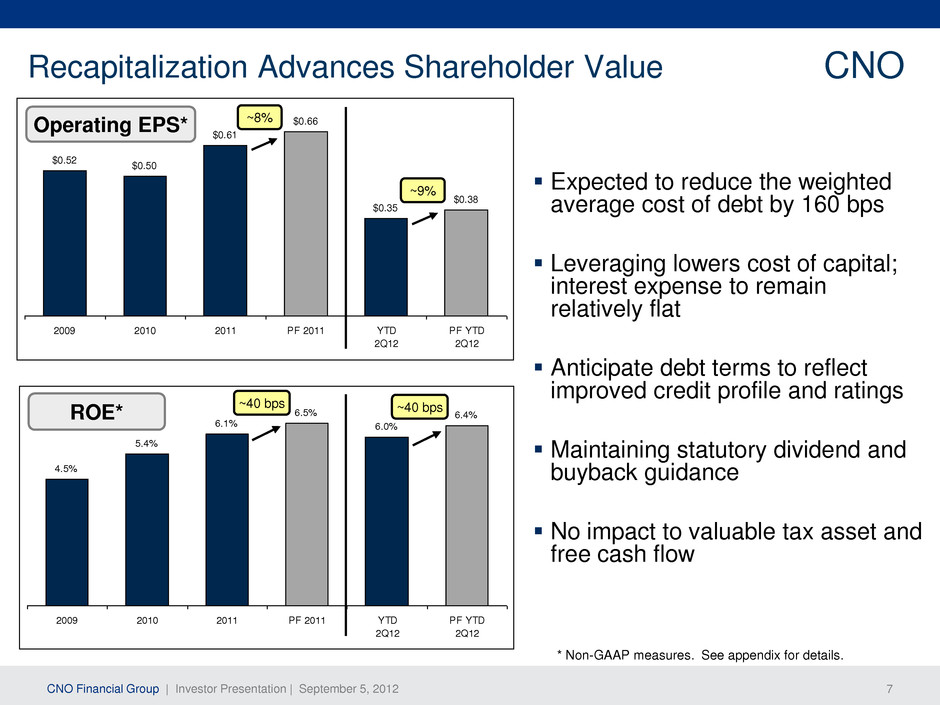

CNO Financial Group | Investor Presentation | September 5, 2012 7 4.5% 5.4% 6.1% 6.5% 6.0% 6.4% 2009 2010 2011 PF 2011 YTD 2Q12 PF YTD 2Q12 $0.52 $0.50 $0.61 $0.66 $0.35 $0.38 2009 2010 2011 PF 2011 YTD 2Q12 PF YTD 2Q12 Operating EPS* Recapitalization Advances Shareholder Value Expected to reduce the weighted average cost of debt by 160 bps Leveraging lowers cost of capital; interest expense to remain relatively flat Anticipate debt terms to reflect improved credit profile and ratings Maintaining statutory dividend and buyback guidance No impact to valuable tax asset and free cash flow ~8% ROE* CNO ~40 bps ~9% ~40 bps * Non-GAAP measures. See appendix for details.

CNO Financial Group | Investor Presentation | September 5, 2012 8 Strong and Improving Credit Profile Positive Ratings Momentum On September 4, 2012, A.M. Best announced an upgrade from B+ to B++ in the financial strength ratings of our core operating companies CNO Q2'10 Q3'10 Q4'10 Q1'11 Q2'11 Q3'11 Q4'11 Q1'12 Q2'12 Today B- B B+ BB- Dec. 21st, 2010 Improved financial flexibility: successful repayment of 2013 credit facility & replacement with 9.0% senior secured notes Aug. 4th, 2011 Improved capital position and a cushion against debt covenants, focus on low-risk life sectors and reinsurance for riskier products Today Positive Outlook S&P Senior Secured Rating Moody’s Senior Secured Rating 2'10 Q3'10 Q4'10 Q1'11 Q2'11 Q3'11 Q4'11 Q1'12 Q2'12 Today B3 2 B1 B 3 a2 Ma . 26th, 2010 Increased financial flexibility after convertible refinancing, issuance of new equ ty and revision of loan terms in 4Q09 Dec. 21st, 2010 Increased financial flexibility due to su ces ful refi ancing of CNO bank debt and better laddering debt maturities Aug29th , 2012 S bstantially strengthened its financial flexibility with the actions it has tak to reduce debt and improve holding comp y liquidity

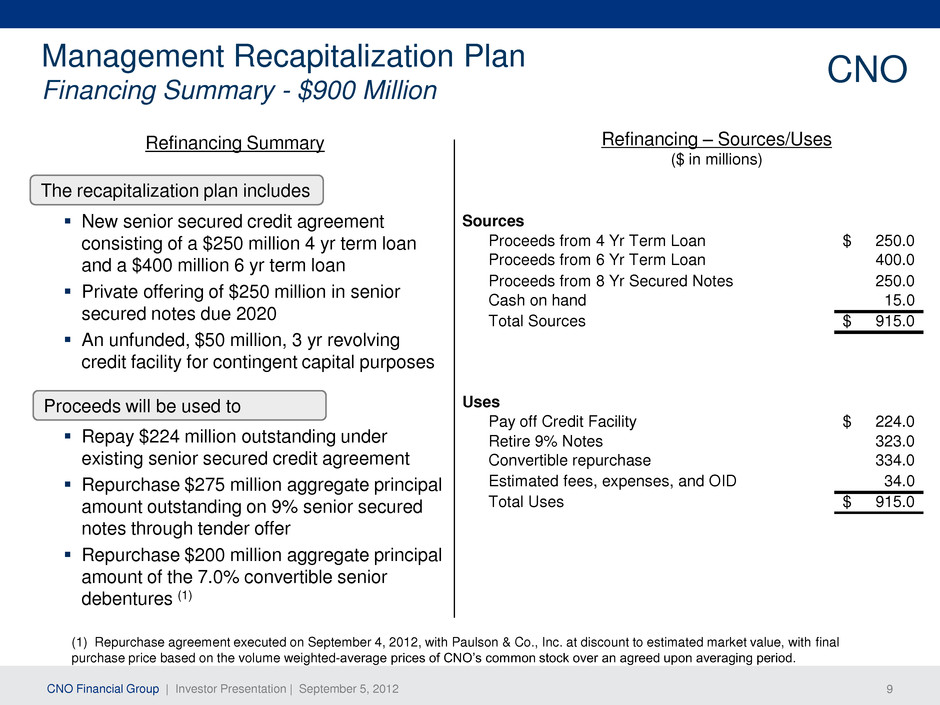

CNO Financial Group | Investor Presentation | September 5, 2012 9 Management Recapitalization Plan Financing Summary - $900 Million Refinancing Summary Refinancing – Sources/Uses ($ in millions) New senior secured credit agreement consisting of a $250 million 4 yr term loan and a $400 million 6 yr term loan Private offering of $250 million in senior secured notes due 2020 An unfunded, $50 million, 3 yr revolving credit facility for contingent capital purposes Repay $224 million outstanding under existing senior secured credit agreement Repurchase $275 million aggregate principal amount outstanding on 9% senior secured notes through tender offer Repurchase $200 million aggregate principal amount of the 7.0% convertible senior debentures (1) The recapitalization plan includes Proceeds will be used to CNO (1) Repurchase agreement executed on September 4, 2012, with Paulson & Co., Inc. at discount to estimated market value, with final purchase price based on the volume weighted-average prices of CNO’s common stock over an agreed upon averaging period. Sources Proceeds from 4 Yr Term Loan 250.0$ Proceeds from 6 Yr Term Loan 400.0 Proceeds from 8 Yr Secured Notes 250.0 Cash on hand 15.0 Total Sources 915.0$ Uses Pay off Credit Facility 224.0$ Retire 9% Notes 323.0 Convertible repurchase 334.0 Estimated fees, expenses, and OID 34.0 Total Uses 915.0$

CNO Financial Group | Investor Presentation | September 5, 2012 10 Indicative Pro Forma Capitalization As of June 30, 2012 ($ in millions) (1) Includes $76.0 million of cash and money market, $75.7 million of liquid fixed income investments and $46.0 million of alternative investments. (2) Change in equity calculated as sum of premium paid on repurchase of Convertible Senior Unsecured Debentures (assumed non-tax deductible), breakage of Senior Secured Notes (assumed tax deductible) and write-off of the unamortized discount / issue costs (a portion of which assumed tax deductible). (3) A non-GAAP measure. See appendix for details. CNO Amount Changes (+/-) Pro Forma Holding Company Cash and Investments (1) 198$ (15)$ 183$ Senior Secured Debt 499 (499) - New Senior Secured Debt - 900 900 Convertible Senior Unsecured Debentures 293 (200) 93 Unamortized Discount on Debt and Debentures (14) 10 (4) Total Debt 778$ 211$ 989$ Equity (ex. AOCI) (2) 3,902 (181) 3,721 Capitalization 4,680$ 4,710$ Debt to Capital (excluding AOCI) (3) 16.6% 21.0%

CNO Financial Group | Investor Presentation | September 5, 2012 11 $ 14 $ 54 $ 60 $ 79 $ 60 $ 4 $ 379 $250 $ 93 2012 2013 2014 2015 2016 2017 2018 2019 2020$20 $55 $75 $74 $275 $293 2012 2013 2014 2015 2016 2017 2018 2019 2020Improved Pro Forma Debt Profile ($ in millions) Extend maturities to 2020 Rebalance fixed and floating rate debt Lower weighted average coupon rate Reduce convertible overhang 1. As of June 30, 2012. Reflects principal amount of existing Convertible Unsecured Debentures. 2. Includes anticipated scheduled Term Loan amortization. CNO Pro Forma Maturity Profile2 Current Maturity Profile1 $ 14 $ 54 $ 60 $ 79 $ 60 $ 4 $ 382 $250 $ 93 20 2 2013 2014 2015 2016 2017 2018 2019 2020 Term Loan Senior Secured Notes Convertible Senior Unsecured Debentures

CNO Financial Group | Investor Presentation | September 5, 2012 12 Free Cash Flow Sources Building While Recurring Uses Moderating ($ in millions) Observations on 2011 RBC $97 million above 350% RBC target Over $100 million used to build RBC in 2011 Modest capital required to support business growth Recapitalization No material impact to Holdco liquidity position Interest expense expected to remain flat initially Structured for improved financial flexibility (1) Cash flow available for capital management and debt reduction (2) $360 million includes: (i) $256 million free cash flow, plus (ii) ~$100 million used to build RBC in 2011. Had we not retained these funds for RBC build, they would have been available for free cash flow. > $100mm retained for RBC Build in 2011 CNO 2011 Capital Generation & Free Cash Flow Fees and Interest to Holdco Net statutory dividends to Holdco Retained capital for growth and RBC build $501 ($61) ($29) ~ $360(2) Capital Upstreamed Interest Holdco Free Generated to Holdco Paid Expenses Cash Flow (1) (net) $256 $209 $138 $154 $347 ~ $104

CNO Financial Group | Investor Presentation | September 5, 2012 13 Q2 2012 Initiation of dividend program CNO – Track Record of Strong Execution Q4 2008 Separation of Closed Block LTC business 2007/2008 CIG sales & marketing rightsizing, and vacated excess Chicago space - $11 million annual expense reduction Q3 2007 Sale of $3 billion annuity block Q3 2009 Reinsurance of CIG Life policies to Wilton Re Q4 2010 Refinanced $650 million of debt Q4 2009 Refinanced convertible debentures putable in Sept 2010; issued new equity, paid down and renegotiated Sr. Credit Facility Q1 2011 Pre-paid $50 million on Senior Credit Facility Q1 2012 Retired early $50 million Senior Health Note Q2 2011 Began buying back stock under repurchase plan (and making commensurate prepayments on the Senior Credit Facility) Q3 2012 Launched recapitalization Reinsurance and separation transactions designed to reduce risk and improve capitalization Cost structure initiatives aligning distribution and operations to better serve our target market Lowering our cost of capital and improving financial flexibility as ratings improve Balanced capital deployment – investment in growth, maintaining strong capital ratios and returning capital to shareholders CNO Recapitalization plan continues a track record of strong execution

CNO Financial Group | Investor Presentation | September 5, 2012 14 Key Takeaways Strategic recapitalization plan – Opportunity to lower run-rate cost of capital – Market is open and attractively priced – Improved financial flexibility – Convertible overhang reduced – Meaningful “stair-step” for EPS and ROE Financial performance continues to improve punctuated with strong overall capital generation, cash flow and liquidity – Manage to investment grade capitalization – Statutory dividend and buyback guidance unchanged CNO franchise well positioned to grow with strong underlying catalysts and alignment of markets-distribution-products-shared services platform – Reinvestment back into expanded distribution driving sales growth with a stable earnings track record over the past 3 years CNO

CNO Financial Group | Investor Presentation | September 5, 2012 15 Q&A

CNO Financial Group | Investor Presentation | September 5, 2012 16 Appendix

CNO Financial Group | Investor Presentation | September 5, 2012 17 Information Related to Certain Non-GAAP Financial Measures A reconciliation of net income applicable to common stock to net operating income (and related per-share amounts) is as follows (dollars in millions, except per-share amounts). In addition, the pro forma amounts reflect the impact of our recapitalization plan. Pro forma Pro forma YTD YTD 2011 Adjustments 2011 6/30/2012 Adjustments 6/30/2012 Net income applicable to common stock 335.7$ -$ 335.7$ 124.8$ -$ 124.8$ Net realized investment (gains) losses, net of related amortization and taxes (36.7) - (36.7) (32.8) - (32.8) Fair value changes in embedded derivative liabilities, net of related amortization and taxes 13.3 - 13.3 2.4 - 2.4 Valuation allowance for deferred tax assets (143.0) - (143.0) - - - Loss on extinguishment of debt 2.2 - 2.2 0.4 - 0.4 Net operating income (a non-GAAP financial measure) 171.5$ -$ 171.5$ 94.8$ -$ 94.8$ Per diluted share: Net income 1.15$ 0.12$ 1.27$ 0.45$ 0.04$ 0.49$ Net realized investment (gains) losses, net of related amortization and taxes (0.12) (0.02) (0.14) (0.11) (0.01) (0.12) Fair value changes in embedded derivative liabilities, net of related amortization and taxes 0.04 0.01 0.05 0.01 - 0.01 Valuation allowance for deferred tax assets (0.47) (0.06) (0.53) - - - Loss on extinguishment of debt 0.01 - 0.01 - - - Net operating income (a non-GAAP financial measure) 0.61$ 0.05$ 0.66$ 0.35$ 0.03$ 0.38$

CNO Financial Group | Investor Presentation | September 5, 2012 18 Pro forma Pro forma YTD YTD 2011 Adjustments 2011 6/30/2012 Adjustments 6/30/2012 Operating income 171.5$ -$ 171.5$ 94.8$ -$ 94.8$ Add: interest expense on 7.0% Convertible Senior Debentures due 2016, net of income taxes 14.7 (10.0) 4.7 7.4 (5.0) 2.4 Total adjusted operating income 186.2$ (10.0)$ 176.2$ 102.2$ (5.0)$ 97.2$ Weighted average shares outstanding for basic earning per share 247,952 - 247,952 239,092 - 239,092 Effect of dilutive securities on weighted average shares: 7% Debentures 53,367 (36,428) 16,939 53,372 (36,431) 16,941 Stock option and restricted stock plan 2,513 - 2,513 2,475 - 2,475 Warrants 249 - 249 470 - 470 Weighted average shares outstanding for diluted earning per share 304,081 (36,428) 267,653 295,409 (36,431) 258,978 Operating earnings per diluted share 0.61$ 0.66$ 0.35$ 0.38$ A reconciliation of operating income and shares used to calculate basic and diluted operations earnings per share is as follows (dollars in millions, except per-share amounts, and shares in thousands). In addition, the pro forma amounts reflect the impact of our recapitalization plan. Information Related to Certain Non-GAAP Financial Measures

CNO Financial Group | Investor Presentation | September 5, 2012 19 Information Related to Certain Non-GAAP Financial Measures Operating return measures Management believes that an analysis of return before loss on extinguishment of debt, net realized gains or losses, fair value changes due to fluctuations in the interest rates used to discount embedded derivative liabilities related to our fixed index annuities and increases or decreases to our valuation allowance for deferred tax assets (“net operating income,” a non-GAAP financial measure) is important to evaluate the performance of the Company and is a key measure commonly used in the life insurance industry. Management uses this measure to evaluate performance because these items are unrelated to the Company’s continued operations. This non-GAAP financial measure also differs from return on equity because accumulated other comprehensive income (loss) has been excluded from the value of equity used to determine this ratio. Management believes this non-GAAP financial measure is useful because it removes the volatility that arises from changes in accumulated other comprehensive income (loss). Such volatility is often caused by changes in the estimated fair value of our investment portfolio resulting from changes in general market interest rates rather than the business decisions made by management. In addition, our equity includes the value of significant net operating loss carryforwards (included in income tax assets). In accordance with GAAP, these assets are not discounted, and accordingly will not provide a return to shareholders (until after it is realized as a reduction to taxes that would otherwise be paid). Management believes that excluding this value from the equity component of this measure enhances the understanding of the effect these non-discounted assets have on operating returns and the comparability of these measures from period-to- period. Operating return measures are used in measuring the performance of our business units and are used as a basis for incentive compensation.

CNO Financial Group | Investor Presentation | September 5, 2012 20 Information Related to Certain Non-GAAP Financial Measures The calculations of: (i) operating return on average capital, excluding accumulated other comprehensive income (loss) and net operating loss carryforwards (a non-GAAP financial measure); and (ii) return on equity are as follows (dollars in millions). In addition, the pro forma amounts reflect the impact of our recapitalization plan. Pro forma Proforma LTM LTM 2011 Adjustments 2011 6/30/2012 Adjustments 6/30/2012 Operating return for purposes of calculating operating return on average capital 171.5$ -$ 171.5$ 178.6$ -$ 178.6$ Net income 335.7$ -$ 335.7$ 368.7$ -$ 368.7$ Trailing 4 Quarter Average Average capital, excluding accumulated other comprehensive income and net operating loss carryforwards (a non-GAAP financial measure) 2,828.0$ (180.8)$ 2,647.2$ 2,968.0$ (180.8)$ 2,787.2$ C mm n shareholders' equity 4,166.2$ (180.8)$ 3,985.4$ 4,574.4$ (180.8)$ 4,393.6$ Operating return on average capital, excluding accumulated other comprehensive income and net operating loss carryforwards (a non-GAAP financial measure) 6.1% 6.5% 6.0% 6.4% Return on equity 8.1% 8.4% 8.1% 8.4% (Continued on next page)

CNO Financial Group | Investor Presentation | September 5, 2012 21 Information Related to Certain Non-GAAP Financial Measures A reconciliation of average capital excluding accumulated other comprehensive income (loss) and net operating loss carryforwards (a non-GAAP financial measure) to average common shareholders’ equity, is as follows (dollars in millions). In addition, the pro forma amounts reflect the impact of our recapitalization plan. Pro forma Pro forma LTM LTM 2011 Adjustments 2011 6/30/2012 Adjustments 6/30/2012 Trailing 4 Quarter Average Average capital excluding accumulated other omprehensive income and net operating loss carryforwards (a non-GAAP financial measure) 2,828.0$ (180.8)$ 2,647.2$ 2,968.0$ (180.8)$ 2,787.2$ Net operating loss carryforwards 854.0 - 854.0 848.0 - 848.0 Accumulated other comprehensive income 484.2 - 484.2 758.4 - 758.4 Common shareholders' equity 4,166.2$ (180.8)$ 3,985.4$ 4,574.4$ (180.8)$ 4,393.6$ (Continued on next page) (Continued from previous page)

CNO Financial Group | Investor Presentation | September 5, 2012 22 Information Related to Certain Non-GAAP Financial Measures A reconciliation of consolidated capital, excluding accumulated other comprehensive income (loss) and net operating loss carryforwards (a non- GAAP financial measure) to common shareholders’ equity, is as follows (dollars in millions). In addition, the pro forma amounts reflect the impact of our recapitalization plan. Pro forma 4Q10 1Q11 2Q11 3Q11 4Q11 Average Adjustments Average Consolidated capital, excluding accumulated other comprehensive income (loss) and net operating loss carryforwards (a non-GAAP financial measure) 2,705.8$ 2,777.1$ 2,830.2$ 2,868.7$ 2,966.3$ 2,828.0$ (180.8)$ 2,647.2$ Net operating loss carryforwards 853.1 829.1 810.6 916.6 865.9 854.0 - 854.0 Accumulated other comprehensive income 252.7 273.3 395.5 750.9 781.6 484.2 - 484.2 Common shareholders' equity 3,811.6$ 3,879.5$ 4,036.3$ 4,536.2$ 4,613.8$ 4,166.2$ (180.8)$ 3,985.4$ (Continued from previous page) (Continued on next page)

CNO Financial Group | Investor Presentation | September 5, 2012 23 Information Related to Certain Non-GAAP Financial Measures A reconciliation of consolidated capital, excluding accumulated other comprehensive income (loss) and net operating loss carryforwards (a non- GAAP financial measure) to common shareholders’ equity, is as follows (dollars in millions). In addition, the pro forma amounts reflect the impact of our recapitalization plan. Pro forma 2Q11 3Q11 4Q11 1Q12 2Q12 Average Adjustments Average Consolidated capital, excluding accumulated other comprehensive income (loss) and net operating loss carryforwards (a non-GAAP financial measure) 2,830.2$ 2,868.7$ 2,966.3$ 3,057.1$ 3,129.9$ 2,968.0$ (180.8)$ 2,787.2$ Net operating loss carryforwards 810.6 916.6 865.9 817.9 772.4 848.0 - 848.0 Accumulated other comprehensive income 395.5 750.9 781.6 808.0 990.8 758.4 - 758.4 Common shareholders' equity 4,036.3$ 4,536.2$ 4,613.8$ 4,683.0$ 4,893.1$ 4,574.4$ (180.8)$ 4,393.6$ (Continued from previous page)

CNO Financial Group | Investor Presentation | September 5, 2012 24 Information Related to Certain Non-GAAP Financial Measures A reconciliation of the debt to capital ratio to debt to capital, excluding AOCI is as follows (dollars in millions). In addition, the pro forma amounts reflect the impact of our recapitalization plan. Pro forma 2Q12 Adjustments 2Q12 Corporate notes payable 778.2$ 210.8$ 989.0$ Total shareholders' equity 4,893.1 (180.8) 4,712.3 Total capital 5,671.3 30.0 5,701.3 Corporate debt to capital 13.7% 17.3% Corporate notes payable 778.2$ 210.8$ 989.0$ Total sharehold rs' equity 4,893.1 (180.8) 4,712.3 Less accumulated other comprehensive income (990.8) - (990.8) Total capital 4,680.5$ 30.0$ 4,710.5$ Debt to total capital ratio, excluding AOCI (a non-GAAP financial measure) 16.6% 21.0% Debt to capital ratio, excluding accumulated other comprehensive income (loss) This non-GAAP financial measure differs from the debt to capital ratio because accumulated other comprehensive (income) loss has been excluded from the value of capital used to determine this measure. Management believes this non-GAAP financial measure is useful because it removes the volatility that arises from changes in accumulated other comprehensive income (loss). Such volatility is often caused by changes in the estimated fair value of our investment portfolio resulting from changes in general market interest rates rather than the business decisions made by management.