Attached files

| file | filename |

|---|---|

| 8-K - 8-K - WASHINGTON FEDERAL INC | wafdaug2020128k.htm |

Monday August 20, 2012

FOR IMMEDIATE RELEASE

Washington Federal Announces the Sale of Securities

and the Repayment of Debt

SEATTLE – Washington Federal, Inc. (Nasdaq: WAFD), parent company of Washington Federal, today announced that it has taken steps intended to reduce the Company’s interest rate risk and improve its future earnings potential. In the preceding ten days, the Company sold $2.4 billion of fixed rate mortgage-backed securities for a pre-tax gain of $95 million. The securities sold yielded an annualized 3.22% in the month of July, 2012. In the same period, the Company pre-paid $876 million of long term debt at a pre-tax loss of $95 million. The weighted average rate on the retired debt was 3.94%.

In related transactions, the Company also purchased a mix of short and longer term assets totaling $1.7 billion with an anticipated weighted average yield of 1.85%, and restructured an additional $100 million of long term debt to lengthen maturity and reduce the weighted average rate from 4.04% to 3.33%. An ongoing review of the investment portfolio and long-term debt likely will result in additional transactions of a similar nature.

“Given current interest rate conditions, we decided it prudent to harvest most of the steadily diminishing gain in the securities portfolio and prepay high-cost debt. Other balance sheet restructuring is intended to shorten asset duration and lengthen the maturity of liabilities to position the Company for continued long term success,” said Roy M. Whitehead, Chairman, President Chief and Executive Officer. “The transactions detailed above are not expected to have a material effect on net earnings this quarter, and will limit potential margin compression from prepayments on securities and provide more financial flexibility in the future.”

1

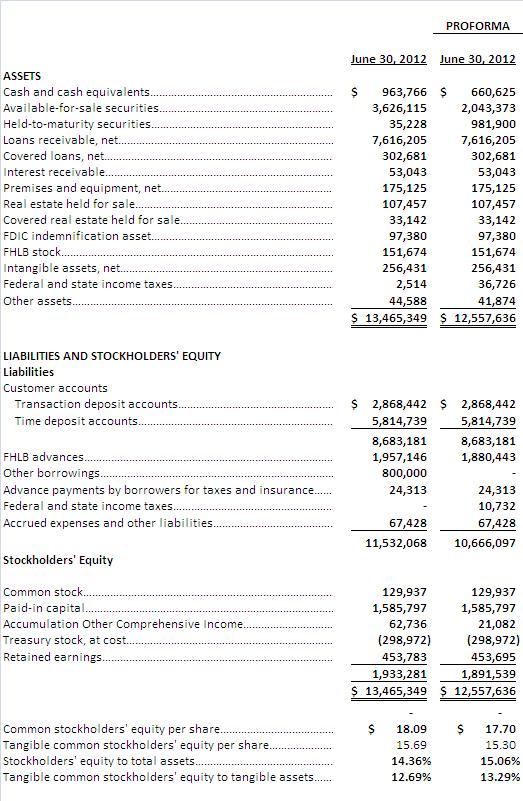

The following table shows the Company’s unaudited balance sheet as of June 30, 2012 and a proforma balance sheet taking into account the transactions identified above as if they had occurred on June, 30, 2012, and the updated valuation of available for sale securities not sold as of July 31, 2012.

Status of Proposed South Valley Bank and Trust Acquisition

2

Although final regulatory approval has not yet been received, the Company anticipates that its acquisition of South Valley Bank and Trust, which was announced on April 4, 2012, will close prior to its September 30, 2012 fiscal year-end. The transaction is expected to be immediately accretive to earnings.

About Washington Federal

Washington Federal, with headquarters in Seattle, Washington, has 165 offices in eight western states. To find out more about the Company, please visit our website. The Company uses its website to distribute financial and other material information about the Company, which is routinely posted on and accessible at www.washingtonfederal.com.

Important Cautionary Statements

The foregoing information should be read in conjunction with the financial statements, notes and other information contained in the Company’s 2011 Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K.

This press release contains statements about the Company’s future that are not statements of historical fact. These statements are “forward looking statements” for purposes of applicable securities laws, and are based on current information and/or management's good faith belief as to future events. The words “believe,” “expect,” “anticipate,” “project,” and similar expressions signify forward-looking statements. Forward-looking statements include projections and estimates of loan demand, revenue growth, credit costs, levels of problem assets, earnings, interest rates, regulatory actions or other financial or business items; statements of management's plans, strategies and objectives for future operations; the characterization of the future effects of the reposition transactions on the Company’s balance sheet and earnings prospects; and statements regarding future economic, industry or market conditions or performance. Forward-looking statements of this type speak only as of the date of this press release. The Company cautions against placing undue reliance on forward-looking statements, which reflect its good faith beliefs with respect to future events and are based on information currently available to it as of the date the forward-looking statement is made. Forward-looking statements should not be read as a guarantee of future performance or results and will not necessarily be accurate indications of the

3

timing when, or by which, such performance or results will be achieved.

By their nature, forward-looking statements involve inherent risk and uncertainties, which change over time, and actual performance or results, could differ materially from those anticipated by any forward-looking statements. The Company undertakes no obligation to update or revise any forward-looking statement. If the Company does update any forward-looking statement, no inference should be drawn that the Company will make additional updates with respect to that statement or any other forward-looking statements. The following important factors, in addition to those discussed or referenced in the Company’s periodic reports filed with the Securities and Exchange Commission (“SEC”), may cause actual results to differ materially from those contemplated by any forward-looking statements: including, but not limited to, general economic conditions; legislative and regulatory changes, including without limitation the potential effect of the Dodd-Frank Wall Street Reform and Consumer Protection Act and regulations to be promulgated thereunder; monetary fiscal policies of the federal government; changes in tax policies; rates and regulations of federal, state and local tax authorities; changes in interest rates; deposit flows; cost of funds; the level of success of the Company’s asset/liability management strategies; demand for loan products; demand for financial services; competition; changes in the quality or composition of the Company’s loan and investment portfolios; adequacy of the reserve for loan losses; the level of success in disposing of foreclosed real estate and reducing nonperforming assets; changes in accounting principles; policies or guidelines and other economic, competitive, governmental and technological factors affecting the Company’s operations, markets, products, services and fees, including without limitation Washington Federal’s ability to comply in a timely and satisfactory manner with the requirements of a memorandum of understanding entered into with the Office of the Comptroller of the Currency.

Notice to SouthValley Shareholders

This press release does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. In connection with the proposed merger transaction between the Company and South Valley Bancorp, Inc. (“South Valley”), a registration statement on Form S-4 was filed with the SEC by the Company. The registration statement contained a proxy statement/prospectus that was distributed to the shareholders of SouthValley

4

in connection with their vote on the merger. SHAREHOLDERS OF SOUTHVALLEYARE ENCOURAGED TO READ THE REGISTRATION STATEMENT AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, INCLUDING THE PROXY STATEMENT/PROSPECTUS THAT WAS PART OF THE REGISTRATION STATEMENT, BECAUSE THEY CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED MERGER. The final proxy statement/prospectus was mailed to shareholders of SouthValley. Investors and security holders are able to obtain the documents free of charge at the SEC’s website, www.sec.gov. In addition, documents filed with the SEC by the Company are available free of charge by accessing our website at www.washingtonfederal.com or by writing the Company at 425 Pike Street, Seattle, WA 98101, Attention: Investor Relations, or by writing South Valley at 803 Main Street, Klamath Falls, OR 97601, Attention: Corporate Secretary.

# # #

Contact:

Washington Federal, Inc.

425 Pike Street, Seattle, WA 98101

CathyCooper

206-777-8246

cathy.cooper@washingtonfederal.com

5