Attached files

| file | filename |

|---|---|

| 8-K/A - 8-K/A - Carey Watermark Investors Inc | a12-18418_28ka.htm |

| EX-99.2 - EX-99.2 - Carey Watermark Investors Inc | a12-18418_2ex99d2.htm |

| EX-99.3 - EX-99.3 - Carey Watermark Investors Inc | a12-18418_2ex99d3.htm |

Exhibit 99.1

CONSOLIDATED FINANCIAL STATEMENTS

AND INDEPENDENT AUDITORS’ REPORT

NUTMEG MAGNA GREEN, LLC

AND SUBSIDARIES

DECEMBER 31, 2011 AND 2010

Nutmeg Magna Green, LLC and Subsidiaries

TABLE OF CONTENTS

|

|

PAGE |

|

|

|

|

INDEPENDENT AUDITORS’ REPORT |

4 |

|

|

|

|

CONSOLIDATED FINANCIAL STATEMENTS |

|

|

|

|

|

CONSOLIDATED BALANCE SHEETS |

5 |

|

|

|

|

CONSOLIDATED STATEMENTS OF OPERATIONS |

6 |

|

|

|

|

CONSOLIDATED STATEMENTS OF MEMBERS’ EQUITY |

7 |

|

|

|

|

CONSOLIDATED STATEMENTS OF CASH FLOWS |

8 |

|

|

|

|

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS |

9 |

|

|

|

INDEPENDENT AUDITORS’ REPORT

To the Members

Nutmeg Magna Green, LLC and Subsidiaries

We have audited the accompanying consolidated balance sheets of Nutmeg Magna Green, LLC and Subsidiaries (the Company) as of December 31, 2011 and 2010, and the related consolidated statements of operations, members’ equity and cash flows for the years then ended. These consolidated financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these consolidated financial statements based on our audits.

We conducted our audits in accordance with auditing standards generally accepted in the United States of America. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the consolidated financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the consolidated financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall consolidated financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the financial position of the Nutmeg Magna Green, LLC and Subsidiaries as of December 31, 2011 and 2010, and the results of its operations, the changes in members’ equity and its cash flows for the years then ended, in conformity with accounting principles generally accepted in the United States of America.

/s/ Reznick Group, P.C.

Baltimore, Maryland

August 14, 2012

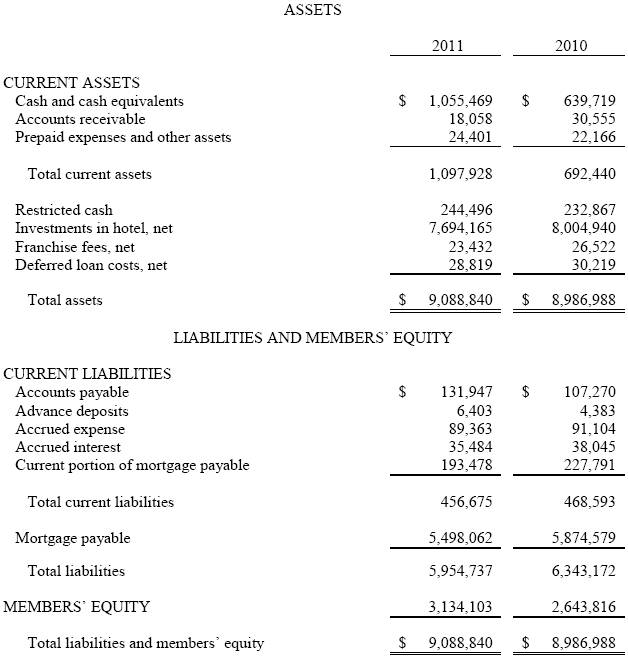

Nutmeg Magna Green, LLC and Subsidiaries

CONSOLIDATED BALANCE SHEETS

December 31, 2011 and 2010

See notes to consolidated financial statements

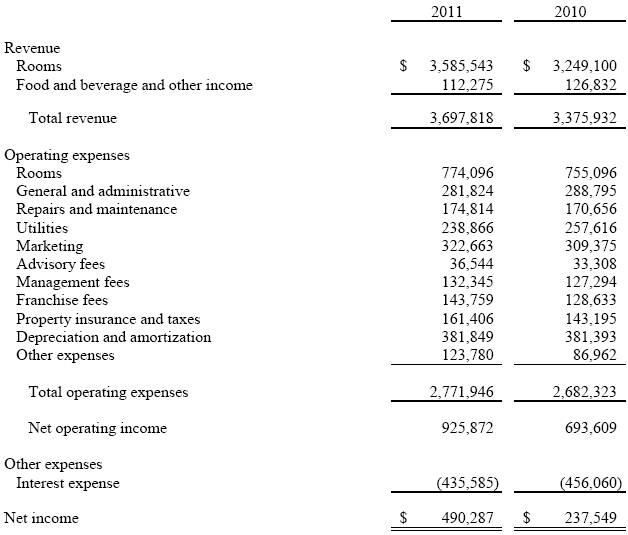

Nutmeg Magna Green, LLC and Subsidiaries

CONSOLIDATED STATEMENTS OF OPERATIONS

Years ended December 31, 2011 and 2010

See notes to consolidated financial statements

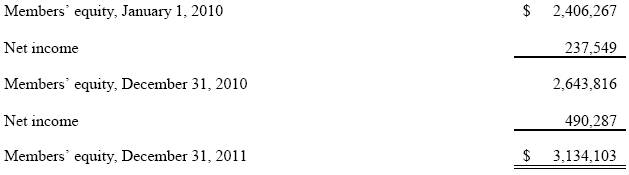

Nutmeg Magna Green, LLC and Subsidiaries

CONSOLIDATED STATEMENTS OF MEMBERS’ EQUITY

Years ended December 31, 2011 and 2010

See notes to consolidated financial statements

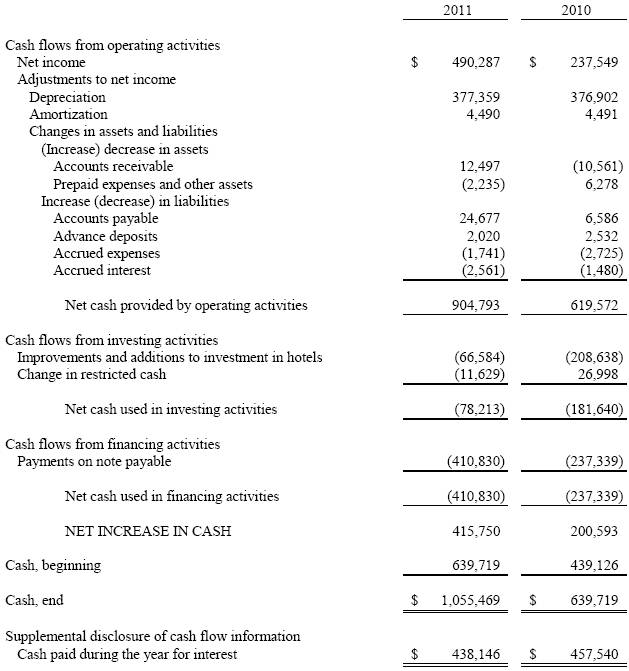

Nutmeg Magna Green, LLC and Subsidiaries

CONSOLIDATED STATEMENTS OF CASH FLOWS

Years ended December 31, 2011 and 2010

See notes to consolidated financial statements

Nutmeg Magna Green, LLC and Subsidiaries

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

December 31, 2011 and 2010

NOTE 1 - ORGANIZATION AND NATURE OF OPERATIONS

The consolidated financial statements of Nutmeg Magna Green, LLC (the “Company”), and its wholly owned subsidiaries NMG-Braintree, LLC and NMG-Braintree Operating, LLC, collectively, the subsidiaries were formed as separate entities under the laws of Delaware in July 2004.

The Company and its subsidiaries were formed to purchase and operate a select service 103 guest room hotel located in Braintree, Massachusetts operating as a Hampton Inn.

NOTE 2 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Principles of Consolidation

The consolidated financial statements include the accounts of the Company and its subsidiaries. All significant intercompany transactions and balances have been eliminated in the consolidation.

Use of Estimates

The preparation of consolidated financial statements in accordance with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the consolidated financial statements and the reported amounts of revenue and expenses during the reporting period. Actual results could differ from those estimates.

Nutmeg Magna Green, LLC and Subsidiaries

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED

December 31, 2011 and 2010

Accounts Receivable and Bad Debts

Accounts receivable are reported net of an allowance for doubtful accounts. Management’s estimate of the allowance is based on historical collection experience and a review of the current status of accounts receivable. It is reasonably possible that management’s estimate of the allowance will change. Management has not provided for an allowance since all amounts are expected to be collected.

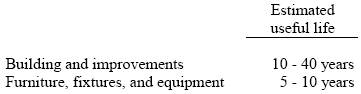

Investment in Hotel

Property and equipment are stated at cost. Depreciation is provided for using the straight-line and accelerated methods over the estimated useful lives of the assets.

Deferred Loan Fees

Deferred loan fees are being amortized over the life of the loan using the straight-line method. Accounting principles generally accepted in the United States of America require that the effective yield method be used to amortize deferred loan fees; however, the effect of using the straight-line method is not materially different from the results that would have been obtained under the effective yield method. Amortization expense for the years ended 2011 and 2010 was $1,400. Amortization expense for each of the next five years is expected to be $1,400.

Nutmeg Magna Green, LLC and Subsidiaries

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED

December 31, 2011 and 2010

Franchise Fees

Initial franchise fees of $46,360 are being amortized over the 15 year agreement on a straight-line basis beginning in July 2004. Amortization expense for the years ended 2011 and 2010 was $3,090. Amortization expense for each of the next five years and thereafter is expected to be $3,090.

Revenue Recognition

Room and other revenue are recognized as earned. Revenue received in advance is deferred until earned.

Selling and Marketing

Selling and marketing costs totaling $322,663 and $309,375 were expensed as incurred during 2011 and 2010, respectively, and are included in marketing expense.

Impairment of Long-Lived Assets

The Company and its subsidiaries review its property for impairment whenever events or changes in circumstances indicate that the carrying value of an asset may not be recoverable. For assets held and used, if the undiscounted cash flows estimated to be generated by those assets are less than their carrying amounts, an impairment loss has occurred. The amount of the impairment loss is equal to the excess of the asset’s carrying value over its estimated fair value. No impairment loss has been recognized during the years ended December 31, 2011 and 2010.

Nutmeg Magna Green, LLC and Subsidiaries

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED

December 31, 2011 and 2010

Income Taxes

The Company and its subsidiaries has elected to be treated as a pass-through entity for income tax purposes and, as such, is not subject to income taxes. Rather, all items of taxable income, deductions and tax credits are passed through to and are reported by its owners on their respective income tax returns. The Company and its subsidiaries Federal tax status as a pass-through entity is based on its legal status as a limited liability company. Accordingly, the Company is not required to take any tax positions in order to qualify as a pass-through entity. The Company is required to file and does file tax returns with the Internal Revenue Service and other taxing authorities. Accordingly, these consolidated financial statements do not reflect a provision for income taxes and the Company has no other tax positions which must be considered for disclosure.

Restricted Cash

Restricted cash consists of amounts held in reserve for taxes, insurance, and purchases of furniture, fixtures, and equipment.

Nutmeg Magna Green, LLC and Subsidiaries

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED

December 31, 2011 and 2010

NOTE 3 - INVESTMENTS IN HOTEL, NET

Property and equipment consist of the following at December 31, 2011 and 2010:

NOTE 4 - MORTGAGES PAYABLE

On July 28, 2004, the Company and its subsidiaries entered into a mortgage note with NCB, FSB in the original amount of $5,915,000. Beginning on September 1, 2004, monthly payments of interest only were due and payable on the first of each month, using an interest rate of LIBOR (one month rate) plus 3.5%. Beginning on September 1, 2006, monthly payments of principal and interest of $16,431 were required and remitted through the maturity date (August 1, 2029).

On August 1, 2007, the Company and its subsidiaries entered into an amended and restated mortgage note in the principal amount of $6,600,000. As a result of this amendment the maturity date was extended to August 1, 2032. Beginning on September 1, 2007, monthly payments of principal and interest were due in the amount of $47,663 through and including July 1, 2032 at the applicable interest rate of 7.24%.

Nutmeg Magna Green, LLC and Subsidiaries

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED

December 31, 2011 and 2010

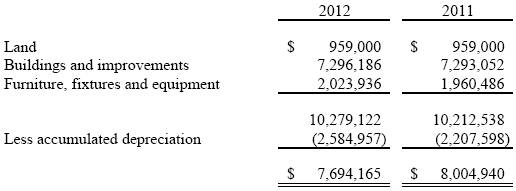

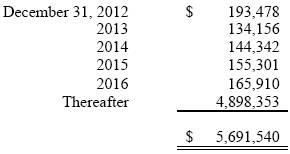

On August 31, 2009, the Company and its subsidiaries entered into an amended and restated mortgage note. In addition to the monthly principal and interest payment of $47,663 at the annual interest rate of 7.24%, commencing on the September 1, 2009 payment date and continuing through and on the anticipated repayment date (August 1, 2012), a supplemental principal payment of $10,000. In addition on September 1, 2010, 2011 and 2012, a payment in the amount equal to excess cash flow for the 12-month period immediately preceding each such date is due. As of December 31, 2011 and 2010, outstanding principal and accrued interest were $5,691,540 and $35,484, respectively, and $6,102,370 and $38,045, respectively.

Aggregate maturities of the mortgages payable for each of the next five years and thereafter following December 31, 2011, are as follows:

In May 2012, the mortgage note was paid off as a result of the subsequent event as discussed in note 9.

NOTE 5 - MANAGEMENT FEES

In accordance with the management agreements, a fee is paid to MHG Braintree LLC, an unaffiliated entity, for management services equal to 3.5% of total revenue. For the years

Nutmeg Magna Green, LLC and Subsidiaries

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED

December 31, 2011 and 2010

ended December 31, 2011 and 2010, management fees totaled $132,345 and $127,294, respectively.

NOTE 6 - FRANCHISE FEES

The Company and its subsidiaries entered into a franchise license agreement with Promus Hotels, Inc. (Promus), an unaffiliated entity, to license the hotel as a Hampton Inn. This agreement was effective on July 28, 2004 and will expire on November 11, 2020. The agreement provides for a monthly royalty fee of 4% of gross rooms revenue, as defined. Promus reserves the right to increase the fee but at no time shall the fee be greater than 5% of gross rooms revenue. As of December 31, 2011 and 2010, franchise fees totaled $143,759 and $128,633, respectively.

NOTE 7 - RELATED PARTY TRANSACTIONS

Advisory Fee

In accordance with the management agreements, a fee is paid to Nutmeg Magna Green, an investor of the Company, for advisory services equal to 1% of total revenue. For the years ended December 31, 2011 and 2010, $36,544 and $33,308, respectively, were incurred and $8,953 and $8,069, respectively, remain outstanding and are included in accrued expenses on the consolidated balance sheets.

NOTE 8 - CONCENTRATION OF CREDIT RISK

The Company maintains cash balances with major financial institutions. These cash balances are insured by the Federal Deposit Insurance Corporation (FDIC) up to $250,000 for interest bearing accounts and noninterest bearing accounts are insured in full with no limit. At December 31, 2011, the Company and its subsidiaries believe there is no significant concentration of credit risk that exists with respect to these balances.

Nutmeg Magna Green, LLC and Subsidiaries

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED

December 31, 2011 and 2010

NOTE 9 - SUBSEQUENT EVENTS

Events that occur after the consolidated balance sheet date but before the consolidated financial statements were available to be issued must be evaluated for recognition or disclosure. The effects of subsequent events that provide evidence about conditions that existed at the consolidated balance sheet date are recognized in the accompanying consolidated financial statements. Subsequent events which provide evidence about conditions that existed after the balance sheet date require disclosure in the accompanying notes. Management evaluated the activity of the Company through August 14, 2012 (the date the consolidated financial statements were available to be issued) and concluded that no subsequent events have occurred that would require recognition in the consolidated financial statements or disclosure in the notes to the consolidated financial statements, except as noted below.

On May 31, 2012, the Company and its subsidiaries were sold to CWI Braintree Hotel, LLC.