Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - HANCOCK WHITNEY CORP | d396735d8k.htm |

Raymond James

Bank Conference

August 14, 2012

Raymond James

Bank Conference

August 14, 2012

Exhibit 99.1 |

2

Carl Chaney

President & CEO |

Forward-Looking

Statements

Forward-Looking

Statements

Forward-looking statements provide projections of results of

operations or of financial condition or state other

forward-looking information, such as expectations about future

conditions and descriptions of plans and strategies for the future.

Hancock’s ability to accurately project results or predict

the effects of future plans or strategies is inherently

limited.

We believe that the expectations reflected in the forward-looking

statements are based on reasonable

assumptions,

but

actual

results

and

performance

could

differ

materially

from

those set forth in the forward-looking statements. Factors

that could cause actual results to differ from those expressed

in the Company's forward-looking statements include, but are

not limited to, those outlined in Hancock's SEC filings, including the “Risk Factors”

section of the Company’s form 10-K and 10-Q.

Hancock does not intend, and undertakes no obligation, to update

or revise any forward-

looking statements, and you are cautioned not to place undue reliance

on such forward- looking statements.

3 |

Second Quarter 2012

Earnings Summary

Second Quarter 2012

Earnings Summary

* A reconciliation of net income to operating income and pre-tax,

pre-provision income is included in the appendix. ** Noninterest

expense

as

a

percent

of

total

revenue

(TE)

before

amortization

of

purchased

intangibles,

securities

transactions

and

merger

expenses.

4

($s in millions; except per share data)

2Q12

1Q12

change

Operating Income*

(a)

$47.0

$40.5

+16%

Operating E.P.S.(diluted)

(a)

$.55

$.47

+17%

Return on

Assets (operating)

(a)

1.00%

0.85%

+15bps

Merger Costs

$11.9

$33.9

-65%

Net Income

$39.3

$18.5

+112%

Earnings Per Share

(diluted)

$.46

$.21

+119%

Pre-Tax, Pre-Provision Income*

$75.8

$69.2

+10%

Net Interest Margin

4.48%

4.43%

+5bps

Net Charge-offs non-covered

0.37%

0.25%

+12bps

Tangible Common Equity

8.72%

8.27%

+45bps

Efficiency Ratio**

65.67%

67.81%

-214bps

(a) Excludes tax-effected merger related expenses and securities

transactions. Management believes that this is a useful financial

measure because it enables investors to asses ongoing operations. |

•

Operating earnings $47 million or $.55 per diluted

common share

•

Up 17% linked-quarter on a per share basis

•

Fundamentals remain solid

•

Operating ROA 1.00%

•

Committed to enhancing ROA

•

Loan growth opportunities

•

Developing revenue synergies

•

Gaining additional efficiencies

•

In line with our expectations and guidance

Second Quarter

2012 Results

As of June 30, 2012

5 |

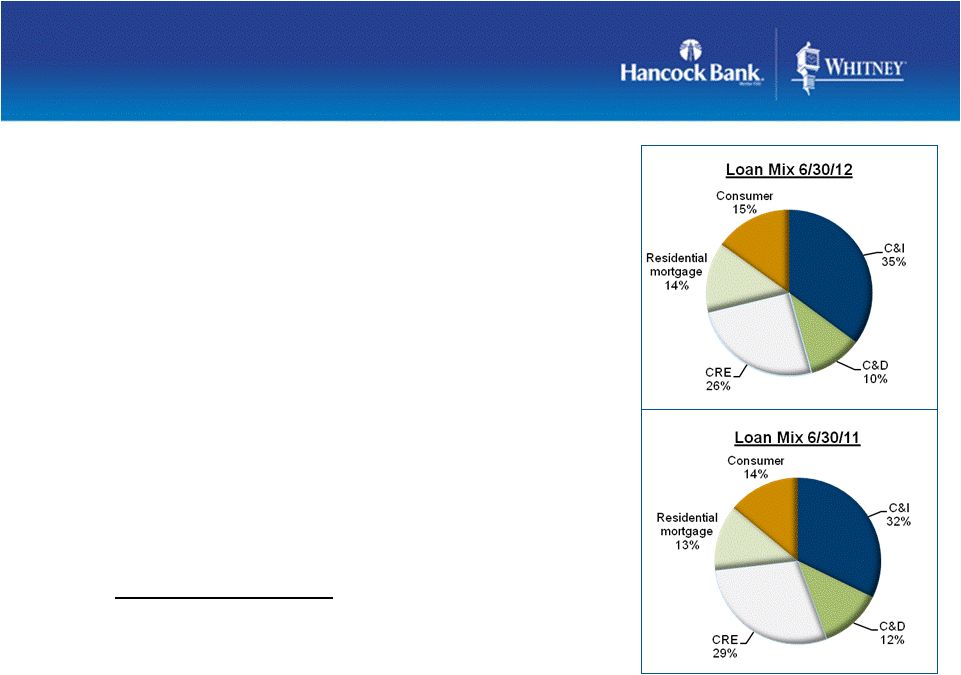

Better Mix, Less Risky

Loan Portfolio

•

Total loans $11 billion; virtually flat linked-quarter

(after adjusting for the decline in the covered Peoples First

portfolio) •

Compared to a year earlier loans are down

$171 million, or 1.5%

•

Growth in C&I (+7%), residential mortgage (+5%),

consumer loans (+6%) offset by declines in construction (-15%)

and commercial real estate (-13%)

•

Decline of $285 million from Whitney acquired-impaired portfolio;

$160 million from Peoples First covered portfolio; mainly

construction and CRE portfolios

•

Result is a better quality, more diverse portfolio

•

Cautiously optimistic there will be net loan growth

in the second half of 2012

Period-end balances. As of June 30, 2012

6 |

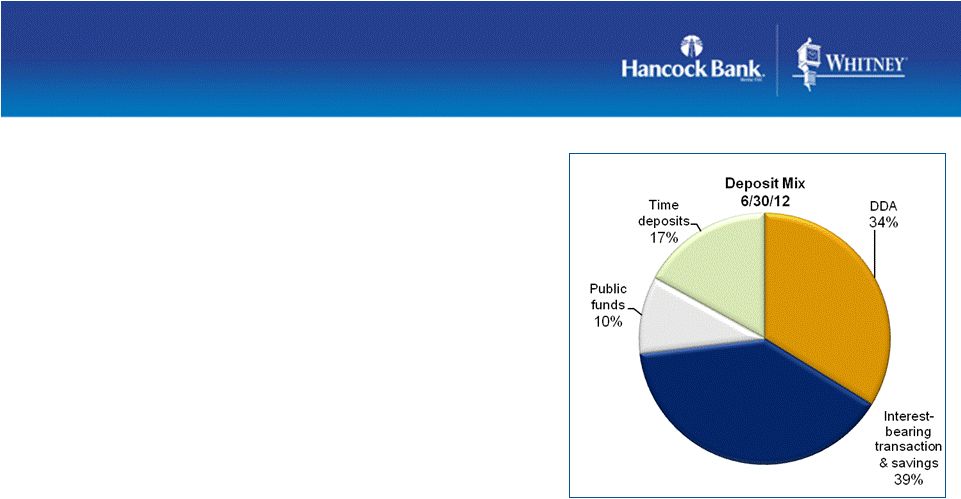

Strong Core Deposit

Funding

•

Total deposits $15 billion

•

Funding mix remained strong

–

Low cost of funds (32bps); down 6bps from 1Q12

–

Noninterest bearing demand deposits (DDA) comprised

34% of total period-end deposits

•

Linked-quarter decline related to expected CD

runoff, seasonal trends in public funds and

redeployment of temporary excess liquidity in a

few customer relationships

•

Opportunity to reprice CDs at significantly

lower rates has largely been eliminated

•

Approximately $1.0B in CDs maturing over the next 2 quarters

at average rate of .50%

Period-end balances. As of June 30, 2012

7 |

8

Michael Achary

Chief Financial Officer |

Strong, Stable

Net Interest Margin

•

Net interest margin (NIM) 4.48%, up 5bps linked-quarter

–

Reflects a favorable shift in funding sources, a decline in funding

costs, offset by a decline in the securities portfolio

yield –

Core margin basically unchanged

•

Quarterly reviews of accretion levels

and portfolio performance will

impact reported margin

•

Expect the reported

NIM will

remain relatively stable in the

near term

As of June 30, 2012

9

4.32%

4.39%

4.43%

4.48%

3Q11

4Q11

1Q12

2Q12

NIM -

reported |

Working To Enhance

Fee Growth

•

Noninterest income totaled $63.6 million, up 3%

linked-quarter •

New and standardized products and services offered across the footprint

after the systems conversion in March 2012

•

Conversion has enhanced opportunities for cross-selling

–

Private Banking

–

Treasury Management

–

International Banking

–

Insurance

•

Expect

the

overall

level

of

fee

income

to

decline

in

3Q12

reflecting,

in

part,

the

impact of the restrictions on interchange rates related to the Durbin

Amendment on Hancock Bank.

–

Expected

to

result

in

a

loss

of

fee

income

of

approximately

$2.5

million

from

current

levels

As of June 30, 2012

10 |

Focused On Realization

Of Remaining Cost Synergies

•

Operating expense totaled $168 million, down $3.5 million from

1Q12* –

Amortization of intangibles totaled $7.9 million

–

Personnel expense decreased $2.5 million, primarily from declines in

quarterly payroll taxes and the

reduction

in

force

associated

with

the

systems

conversion

in

March

2012;

offset

by

the

Company’s annual merit increase and recent strategic new

hires •

Merger-related expenses totaled $12 million QTD; $133 million in

total •

Cost savings projected for the Whitney acquisition totaled $134 million

or $33.5 million quarterly

•

Efficiency ratio 65.67% in 2Q12**

–

Short term target: 62-63%

–

Longer term target: less than 60%

As of June 30, 2012

* Excludes merger costs

** Noninterest

expense

as

a

percent

of

total

revenue

(TE)

before

amortization

of

purchased

intangibles

and

securities

transactions

and

merger

expenses

11 |

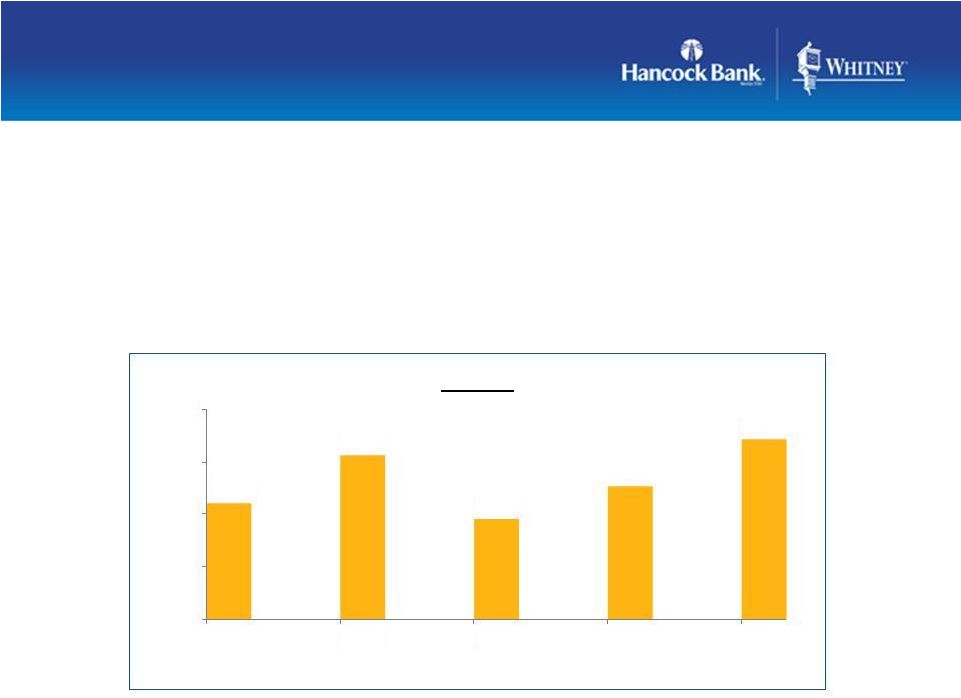

Reiterating Operating Expense

Guidance for 4Q12

•

Expect total operating expense, excluding amortization of intangibles,

of $149

million

-

$153

million

in

4Q12

•

Operating expense excludes merger costs

•

The

additional

$7

million

–

$11

million

in

cost

savings

are

expected

to

be

generated during second half of 2012

As of June 30, 2012

$s in millions

12

Operating expense (excluding amortization of intangibles)

|

•

Provision for loan losses was $8 million, down from $10 million in

1Q12 •

Net charge-offs totaled $10 million, or 0.37%, related to the

non-covered portfolio •

ALLL/loans was 1.40%

•

Excluding the impact of the Whitney acquired loans and FDIC covered

loans •

Total nonperforming assets declined $17 million

linked-quarter •

Legacy Hancock NPLs stabilized

•

Decline primarily related to a reduction in ORE and foreclosed

assets •

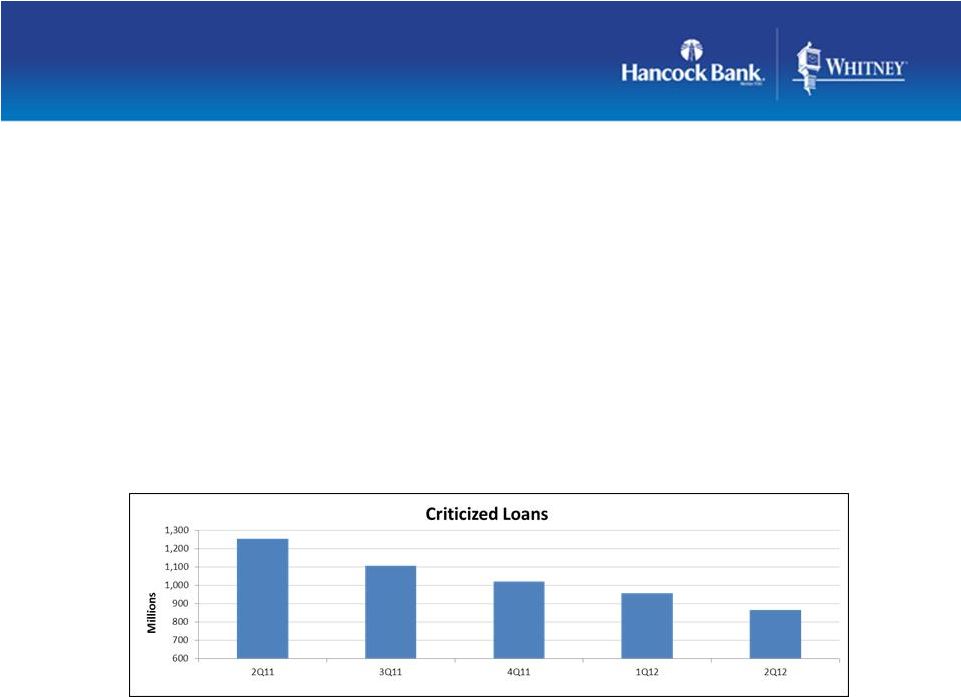

Total criticized loans down $390 million compared to a year ago

Asset Quality To Remain In Line

With Previous Quarters’

Range

As of June 30, 2012

13 |

•

Tangible Common Equity (TCE) ratio improved to 8.72%, up 45bps

linked-quarter –

Target: 8% minimum

•

Expect to continue building capital in the near term

•

Will

continue

to

look

for

opportunities

to

deploy

excess

capital

and

liquidity

in

the

best interest of the Company and the shareholders

As of June 30, 2012

14

Well-Capitalized

Company

8.11%

8.56%

7.96%

8.27%

8.72%

7.00%

7.50%

8.00%

8.50%

9.00%

11

Sep-11

Dec-

11

Mar-

12

Jun-

12

Jun-

Whitney

acquisition

TCE Ratio |

15

Carl Chaney

President & CEO

|

Whitney Subordinated

Notes Tender Offer

•

Capital position, combined with strong liquidity position allowed the

Company to initiate a tender offer on a portion of Whitney

subordinated notes •

Original issue by Whitney National Bank in March 2007 of $150 million

5.875% notes due 4-1-2017

•

Tender offer for up to 50% of the outstanding notes announced June 18,

2012 (expired July 16, 2012)

•

Repurchased approximately $52 million at a premium of $5.3 million

(pre-tax) •

Annual savings of approximately $3 million

•

The transaction will be included in 3Q12 results

16 |

17

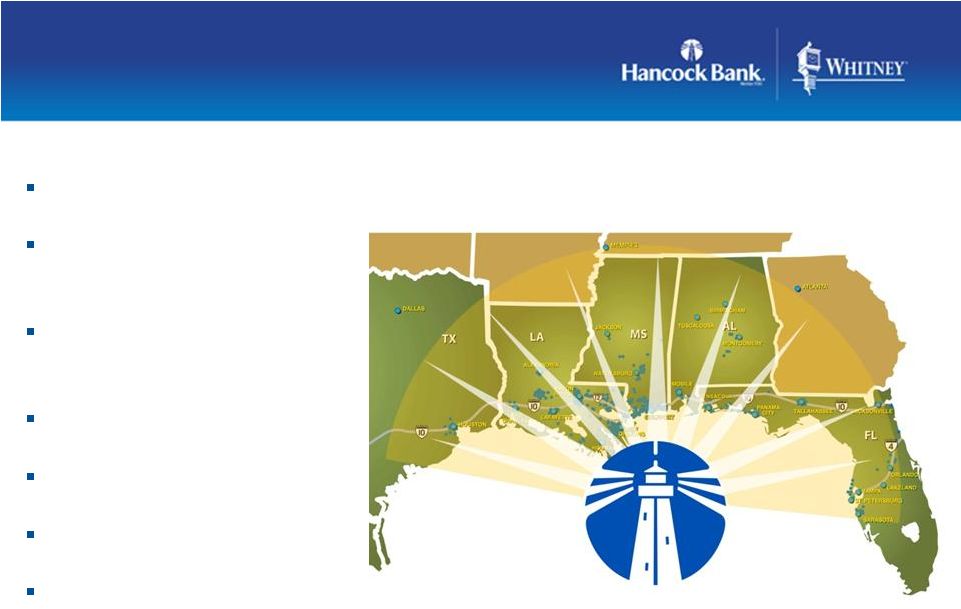

•

Diversified footprint across the Gulf South

•

2 well-known Gulf Coast brands

•

Loyal customer base and attractive deposit funding

•

Diversified revenue stream with strong earnings momentum

•

Leading market share in key MSAs

A Premier Gulf South

Financial Services Franchise

Whitney Bank

Hancock Bank |

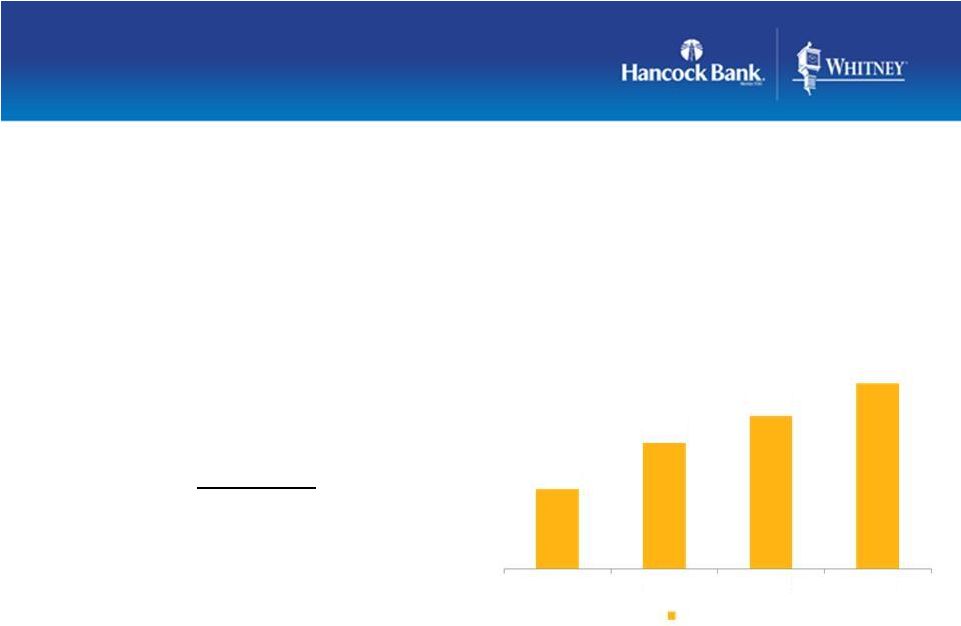

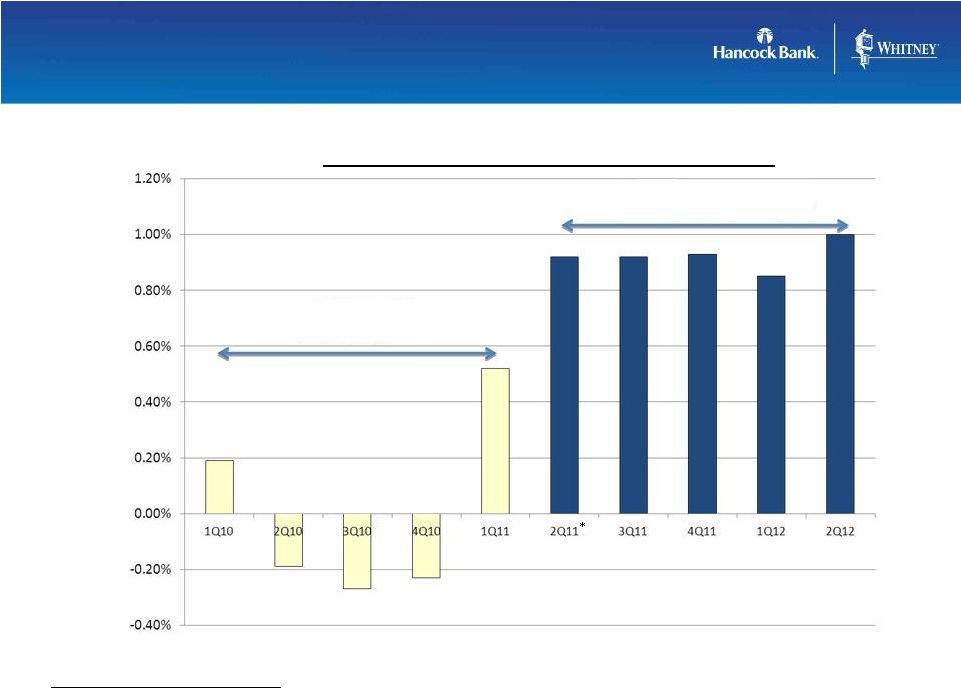

ROA Guidance of 1.10%

to 1.20% Within Reach

ROA Guidance of 1.10%

to 1.20% Within Reach

HBHC/WTNY

Proforma

HBHC post merger

*Whitney acquired June 4, 2011

*

Operating

ROA

(excludes

merger

costs)

18 |

Well Positioned For

The Future

Premier Gulf South franchise

Opportunities for future

growth

History of effective capital

management

Superior liquidity

Conservative credit culture

Enhanced earnings potential

Focused on shareholder

value creation

19 |

Raymond James

Bank Conference

August 14, 2012

Raymond James

Bank Conference

August 14, 2012 |

21

Appendix

|

Non-GAAP

Reconciliation

22

(d) Net income less tax-effected merger costs and securities gains/losses. Management believes

that this is a useful financial measure because it enables investors to assess ongoing

operations. (e) Pre-tax pre-provision profit (PTPP) is total revenue less noninterest

expense, merger items, and securities transactions. Management believes that PTPP profit is a

useful financial measure because it enables investors and others to assess the Company’s

ability to generate capital to cover credit losses through a credit cycle.

(amounts in thousands)

(unaudited)

6/30/2012

3/31/2012

06/30/011

6/30/2012

6/30/2011

Income Statement

Interest income

$190,489

$191,716

$115,477

$382,205

$198,010

Interest income (TE)

193,323

194,665

118,335

387,988

203,740

Interest expense

13,030

15,428

16,418

28,458

32,187

Net interest income (TE)

180,293

179,237

101,917

359,530

171,553

Provision for loan losses

8,025

10,015

9,144

18,040

17,966

Noninterest income excluding

securities transactions

63,552

61,494

46,715

125,046

80,899

Securities transactions gains/(losses)

-

12

(36)

12

(87)

Noninterest expense

179,972

205,463

121,366

385,435

194,385

Income before income taxes

53,014

22,316

15,228

75,330

34,284

Income tax expense

13,710

3,821

3,140

17,531

6,868

Net income

$39,304

$18,495

$12,088

$57,799

$27,416

Merger-related expenses

11,913

33,913

22,219

45,827

23,808

Securities transactions gains/(losses)

-

12

(36)

12

(87)

Taxes on adjustments

4,170

11,865

7,789

16,035

8,364

Operating income (d)

$47,047

$40,531

$26,554

$87,579

$42,947

Difference between interest income and interest income (TE)

$2,834

$2,949

$2,858

$5,783

$5,730

Provision for loan losses

8,025

10,015

9,144

18,040

17,966

Merger-related expenses

11,913

33,913

22,219

45,827

23,808

Less securities transactions gains/(losses)

-

12

(36)

12

(87)

Income tax expense

13,710

3,821

3,140

17,531

6,868

Pre-tax, pre-provision profit (PTPP) (e)

$75,786

$69,181

$49,485

$144,968

$81,875

Three Months Ended

Six Months Ended |