Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - NOVANTA INC | d397406d8k.htm |

CJS

Securities Summer Conference CJS Securities Summer Conference

August 14, 2012

August 14, 2012

Exhibit 99.1 |

2

Factors affecting future performance…

Factors affecting future performance…

Forward-Looking Statements

The statements in this presentation that relate to guidance, future plans, business

opportunities, events or performance are forward-looking statements that

involve risks and uncertainties, including risks associated with business and economic

conditions, customer and/or supplier contract cancellations, manufacturing risks,

competitive factors, ability to successfully introduce new products,

uncertainties pertaining to customer orders, demand for products and services, growth and

development of markets for the Company's products and services, and other risks

identified in our filings made with the Securities and Exchange Commission,

including, most recently, our Form 10-K for the year ended December 31, 2011. Actual

results, events and performance may differ materially. Readers are cautioned not to

place undue reliance on these forward- looking statements, which speak only

as of the date of this presentation, August 14, 2012. The Company disclaims any obligation

to update these forward-looking statements as a result of developments occurring

after the date of this presentation. Readers are

encouraged

to

refer

to

the

risk

disclosures

described

in

the

Company’s

Form

10-K for the year ended December 31, 2011

and subsequent filings

with

the

SEC,

as

applicable.

Please

see

“Safe

Harbor

and

Forward-Looking Information”

in the Appendix

to this presentation for more information.

Non-GAAP Measurement

The Company’s statements regarding its projected revenues, adjusted EBITDA, free

cash flow, and net debt are non-GAAP financial

measures.

Please

see

“Use

of

Non-GAAP

Financial

Measures”

and

the

subsequent

slides

in

the

Appendix

to

this

presentation for the reasons we use these measures, a reconciliation of these

measures to the most directly comparable GAAP measures and other information

relating to these measures. The Company neither updates nor confirms any

guidance regarding the future operating results of the Company which may have

been given prior to this presentation.

Discontinued Operations

In June 2012, the Company committed to a plan for the sale of its Semiconductor

Systems and Laser Systems businesses. As a result, the Company began

accounting for these businesses as discontinued operations beginning in the second quarter of

2012. Unless otherwise noted, all financial results in this presentation are GAAP

measures for continuing operations. …and use of Non-GAAP financial

measures …and use of Non-GAAP financial measures

|

We

are a leading supplier… …of precision motion and laser

technology 3

Capabilities to Innovate & Grow

Global Presence and Reach

Expertise to Drive Results

Leading Technology Franchises

Positioned in Growth Segments

•

Leading

provider

of

precision

laser,

optical

and

motion

control

technology

•

Founded in 1968, headquartered in Bedford, MA -

major presence in North America,

Europe, and Asia-Pacific

•

$304M in revenue and $56M in Adjusted EBITDA in 2011

•

Approximately 1200 employees for continuing operations

•

Trade on NASDAQ (GSIG) |

Our

aspirations… …are clear and achievable

Strategic Vision

•

Focus growth efforts on building out

key platforms (organic and M&A)

•

Improve mix (growth, volatility) –

more Medical, less Semiconductor

•

Simplify footprint and infrastructure

A leading provider of precision photonic and

A leading provider of precision photonic and

motion technologies for OEM’s in demanding

motion technologies for OEM’s in demanding

markets –

markets –

delivering attractive shareholder

delivering attractive shareholder

returns through sustained profitable growth

returns through sustained profitable growth

Strategic Priorities

Strategic Priorities

•

Organic growth mid to high

single digits

•

>20% EBITDA margins

•

Long term shareholder returns

above peer average

Performance Goals

Performance Goals

4 |

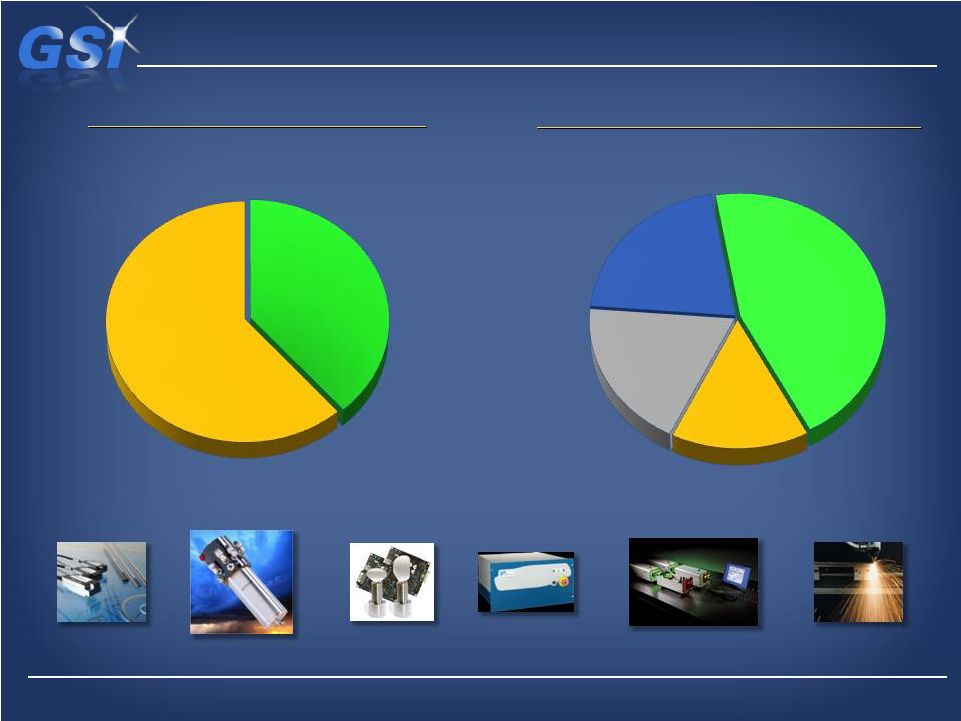

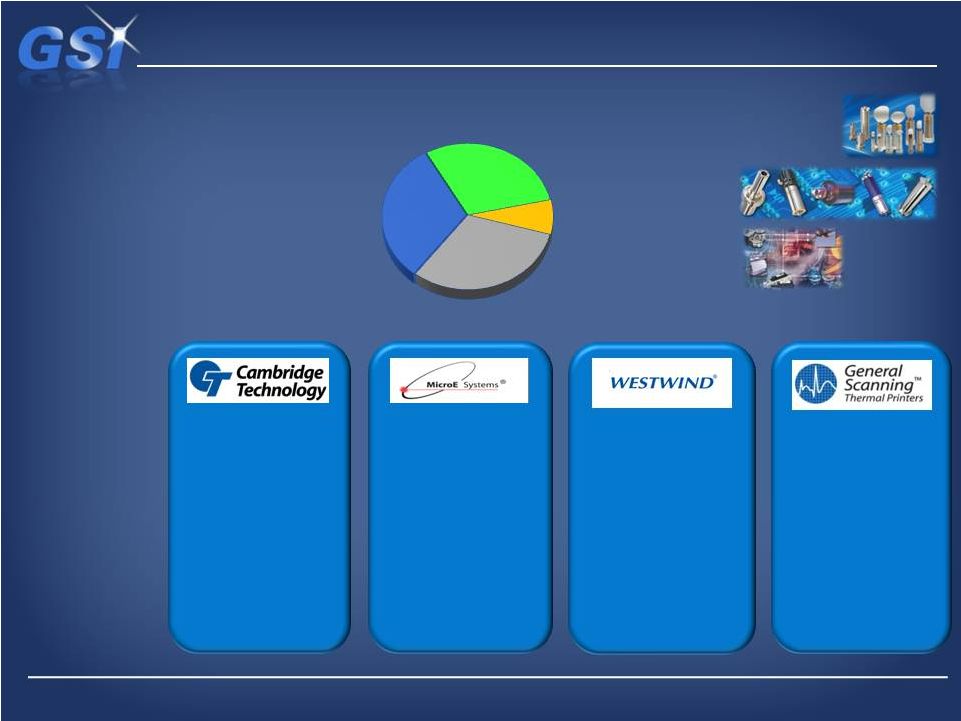

Medical revenue now makes up 19%…

…with Microelectronics down to 21%

Laser

Laser

Products

Products

End-Market Revenue*

End-Market Revenue*

Precision

Precision

Motion

Motion

5

* Continuing Operations, Last Twelve Months, ending Q2 2012

Industrial

Industrial

Scientific

Scientific

Medical

Medical

Microelectronics

Microelectronics

Segment Revenue*

Segment Revenue*

45%

15%

19%

21%

61%

39% |

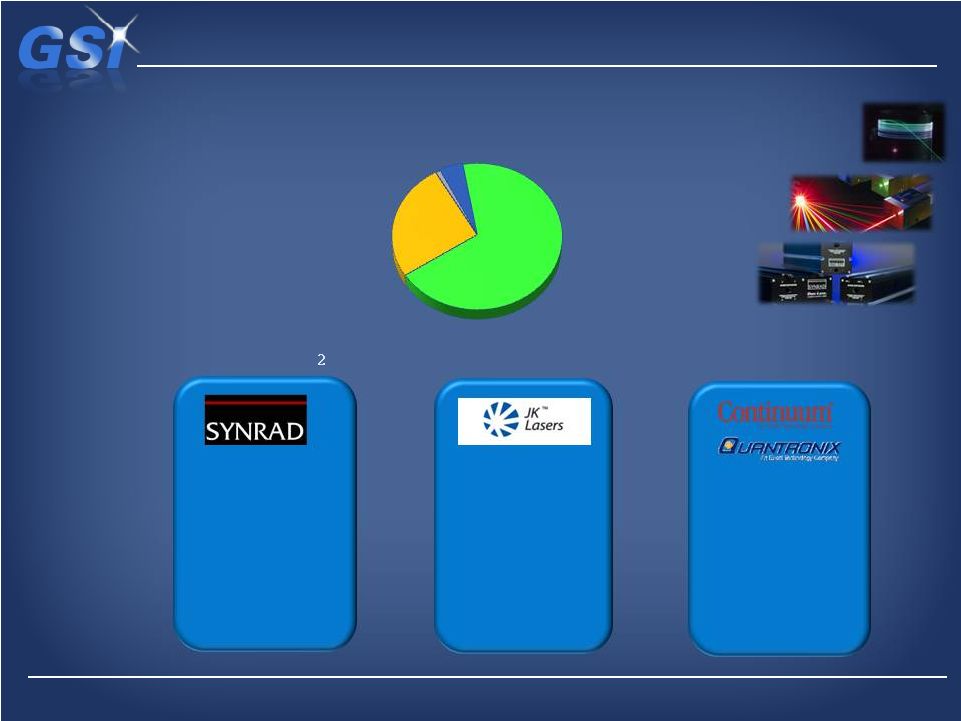

We

have a strong laser offering… …focused on industrial and scientific

markets Laser Products Overview

Laser Products Overview

Revenue*

Revenue*

$108M

$108M

Industrial

Industrial

Scientific

Scientific

Medical

Medical

Brands

Brands

Range

Range

Location

Location

Primary

Primary

Applications

Applications

Sealed CO

Sealed CO

Fiber Lasers

Fiber Lasers

50W to 2kW

50W to 2kW

Rugby, UK

Rugby, UK

Metal cutting,

Metal cutting,

welding, drilling

welding, drilling

Specialty

Specialty

High Speed/Power

High Speed/Power

Santa Clara, CA

Santa Clara, CA

Scientific Research

Scientific Research

Specialty Industrial

Specialty Industrial

6

Electronics

Electronics

* Continuing Operations, Last Twelve Months, ending Q2 2012

68%

26%

1%

5%

10W to 400W

10W to 400W

Mukilteo, WA

Mukilteo, WA

Marking, Engraving,

Marking, Engraving,

Date Coding of non

Date Coding of non

metals

metals

-

- |

We

have strong franchises… …in

the

Precision

Motion

space

Precision Motion Overview

Precision Motion Overview

Brand

Brand

Technology

Technology

Location

Location

Primary

Primary

Applications

Applications

Galvanometers

Galvanometers

Scan Heads

Scan Heads

Lexington, MA

Lexington, MA

Material

Material

Processing

Processing

Marking

Marking

Ophthalmology

Ophthalmology

PCB Drilling

PCB Drilling

Optical Encoders

Optical Encoders

Bedford, MA

Bedford, MA

Robotic Surgery

Robotic Surgery

DNA Sequencing

DNA Sequencing

Wire Bonding

Wire Bonding

Disk Drives

Disk Drives

Air Bearing Spindles

Air Bearing Spindles

Poole, UK

Poole, UK

Suzhou, China

Suzhou, China

PCB Drilling

PCB Drilling

Semiconductor

Semiconductor

Thermal Printers

Thermal Printers

Bedford, MA

Bedford, MA

Patient Monitoring

Patient Monitoring

Defibrillators

Defibrillators

EKG

EKG

Revenue*

$172M

Industrial

Industrial

Scientific

Scientific

Electronics

Electronics

Medical

Medical

Scanners

Encoders

Spindles

Recorders

7

* Continuing Operations, Last Twelve Months, ending Q2 2012

30%

8%

31%

31% |

We

are investing for growth… …in several attractive platforms

Attractive Growth Platforms

Attractive Growth Platforms

•

Beam

delivery

for

lasers

–

market

growth

~8%

•

•

Leverage our #1 position in Galvanometers to

Leverage our #1 position in Galvanometers to

enter Scan Head market (modules)

enter Scan Head market (modules)

•

•

Double addressable market up to ~$200M

Double addressable market up to ~$200M

•

Q2

growth

of

15%

-

numerous

new

design

wins

•

•

~$25M revenue opportunity by 2015

~$25M revenue opportunity by 2015

Scanning Solutions

Scanning Solutions

•

•

~$600M market growing ~20%

~$600M market growing ~20%

•

•

Products to 2kW, more 2012 releases planned

Products to 2kW, more 2012 releases planned

•

•

Converting our installed base to fiber

Converting our installed base to fiber

•

Q2 sales tripled year-over-year, $30M target by 2015

•

•

Major investments underway:

Major investments underway:

-

Multi-kilowatt products

-

-

Increased capacity

Increased capacity

-

-

BOM cost reductions

BOM cost reductions

-

-

New applications centers in U.S. and China

New applications centers in U.S. and China

Fiber Lasers

Fiber Lasers

•

•

~$50M business today

~$50M business today

•

•

Numerous design wins with leading

Numerous design wins with leading

OEM’s

•

•

Key Applications: Robotic Surgery, DNA Sequencing, OCT,

Key Applications: Robotic Surgery, DNA Sequencing, OCT,

Patient Monitoring, Defibrillation, EKG, Dermatology

Patient Monitoring, Defibrillation, EKG, Dermatology

•

•

Expansion into adjacent technologies & customer platforms

Expansion into adjacent technologies & customer platforms

•

•

Significant focus of our M&A efforts

Significant focus of our M&A efforts

Medical Components

Medical Components

8

Source: Strategies Unlimited, Management Estimates

|

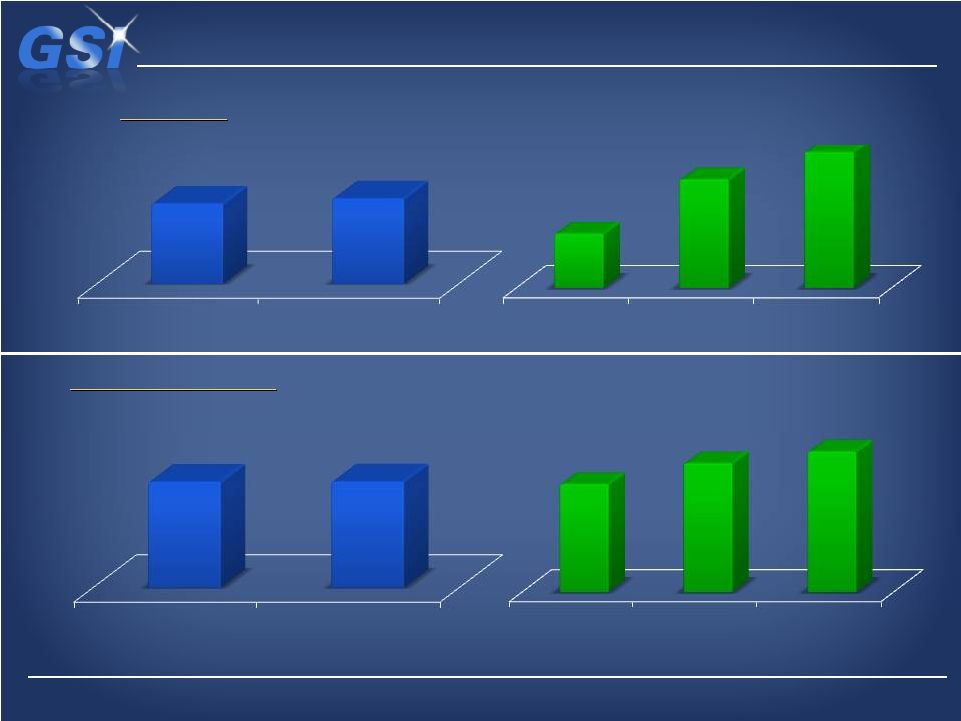

Delivering profitable revenue growth…

…despite the volatility in our markets & the economy

$304M

$304M

$286M

$286M

Revenue:

Revenue:

9

$56M

$56M

$56M

$56M

Adjusted EBITDA:

Adjusted EBITDA:

$65M

$65M

$70M

$70M

$10M

$10M

$12M

$12M

$68M $73M

$68M $73M

$10M $13M

$10M $13M

-

-

-

-

2010 A

2011 A

1Q12 A

2Q12 A

3Q12 F

2010 A

2011 A

1Q12 A

2Q12 A

3Q12 F |

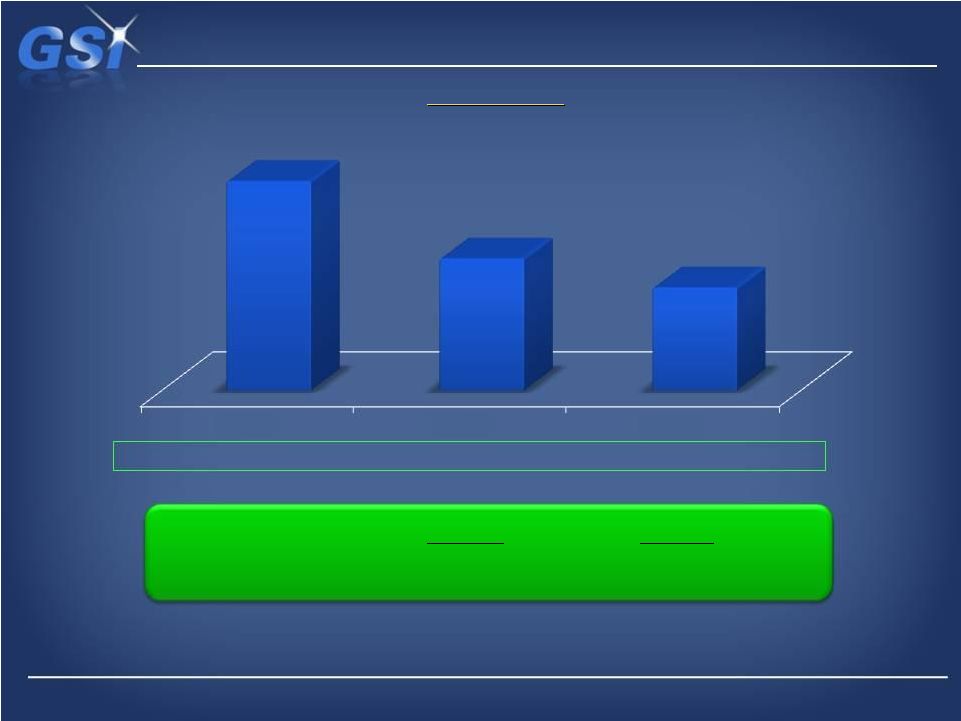

Demonstrated history of strong cash generation…

…demonstrate high quality of businesses

$108M

$108M

$68M

$68M

$53M

$53M

Gross Debt:

Gross Debt:

* See Non-GAAP Net Debt & Leverage Ratio Reconciliation

** Free Cash Flow includes the cash flows of Continuing and Discontinued

Operations 10

($50.8M)

($50.8M)

($13.2M)

($13.2M)

$2.8M

$2.8M

Net Debt*

Net Debt*

Free Cash Flow**

2011 A

2012 F

$41M

+$40M

2010A

2011A

2Q2012 |

We

are establishing a continuous improvement culture…

…through formalized productivity programs / initiatives

Current

Current

12 x 12 Integration and Realignment Program

Target:

Up

to

$5

million

in

annualized

cost

savings,

with

a

goal of eliminating up to 12 facilities, including facilities that

will be exited as a consequence to the expected sale of our

Systems businesses

Future

Future

Operational Excellence

Target:

Consistent

margin

expansion

Pricing

Volume

Leverage

Lean & Six

Sigma

Global

Sourcing

Low-cost

Regional

Manufac-

turing

11

C

C

o

o

n

n

t

t

i

i

n

n

u

u

o

o

u

u

s

s

I

I

m

m

p

p

r

r

o

o

v

v

e

e

m

m

e

e

n

n

t

t

C

C

u

u

l

l

t

t

u

u

r

r

e

e

|

We

have clear focus… …for success in 2012

Key Priorities for 2H of 2012

Key Priorities for 2H of 2012

•

•

Complete 12 X 12 plan

Complete 12 X 12 plan

•

•

2H 2012 Restructuring Plan

2H 2012 Restructuring Plan

•

•

Complete sale of Systems business lines

Complete sale of Systems business lines

•

•

Build momentum on Growth Platforms

Build momentum on Growth Platforms

•

•

Build pipeline of bolt-on acquisitions

Build pipeline of bolt-on acquisitions

•

•

Build core competencies (continuous improvement)

Build core competencies (continuous improvement)

12 |

Appendix

Appendix

13 |

Safe

Harbor and Forward Looking Information 14

Certain statements in this presentation are “forward-looking statements” within the

meaning of the Private Securities Litigation Reform Act of 1995 and are based on current

expectations and assumptions that are subject to risks and uncertainties. All statements contained in this presentation that do not relate to

matters of historical fact should be considered forward-looking statements, and are generally

identified by words such as “expect,” “intend,” “anticipate,”

“estimate,” “plan,” and other similar expressions. These forward-looking

statements include, but are not limited to, statements related to: the Company’s

anticipated future financial performance; expected future product releases; expected consolidation of

our Massachusetts operations; the expected impact of the 12x12 Program and related charges;

expected timing of the divestitures of our discontinued operations; management’s plans and objectives for future

operations; anticipated sales performance; industry trends; market conditions; changes in actual or

assumed tax liabilities; expectations regarding tax exposure; future acquisitions and

dispositions; the Company’s optimism regarding its prospects for the future; and other statements that are not historical facts.

These forward-looking statements are neither promises nor guarantees, but involve risks and

uncertainties that may cause actual results to differ materially from those contained in the

forward-looking statements. Our actual results could differ materially from those anticipated in these forward-looking statements for many

reasons, including, but not limited to, the following: economic and political conditions and the

effects of these conditions on our customers’ businesses and level of business activity;

our significant dependence upon our customers’ capital expenditures, which are subject to cyclical market fluctuations; our dependence upon

our ability to respond to fluctuations in product demand; our ability to continually innovate; delays

in our delivery of new products; our reliance upon third party distribution channels subject to

credit, business concentration and business failure risks beyond our control; fluctuations in our quarterly results and our failure to

meet or exceed the expectations of securities analysts or investors; customer order timing and other

similar factors beyond our control; changes in interest rates, credit ratings or foreign

currency exchange rates; risk associated with our operations in foreign countries; our increased use of outsourcing in foreign countries;

our failure to comply with local import and export regulations in the jurisdictions in which we

operate; our history of operating losses and our ability to sustain our profitability; our

exposure to the credit risk of some of our customers and in weakened markets; violations of our intellectual property rights and our ability to

protect our intellectual property against infringement by third parties; risk of losing our

competitive advantage; our ability to make acquisitions or divestitures that provide business

benefits; our failure to successfully integrate future acquisitions into our business; our ability to retain key personnel; our restructuring and

realignment activities and disruptions to our operations as a result of consolidation of our

operations; product defects or problems integrating our products with other vendors’

products; disruptions in the supply of or defects in raw materials, certain key components or other goods from our suppliers; production difficulties

and product delivery delays or disruptions; changes in governmental regulation of our business or

products; disruption in our information technology systems or our failure to implement new

systems and software successfully; our failure to realize the full value of our intangible assets; any requirement to make additional

tax payments and/or recalculate certain of our tax attributes depending on the resolution of the

complaint we filed against the U.S. government; our ability to utilize our net operating loss

carryforwards and other tax attributes; fluctuations in our effective tax rates and audit of our estimates of tax liabilities; being subject

to U.S. federal income taxation even though we are a non-U.S. corporation; being subject to the

Alternative Minimum Tax for U.S. federal income tax purposes; any need for additional capital

to adequately respond to business challenges or opportunities and repay or refinance our existing indebtedness, which may not be

available on acceptable terms or at all; volatility in the market for our common shares; our

dependence on significant cash flow to service our indebtedness and fund our operations; our

ability to access cash and other assets of our subsidiaries; the influence over our business of several significant shareholders; provisions

of our articles of incorporation may delay or prevent a change in control; our significant existing

indebtedness and restrictions in our new senior secured credit agreement that may limit our

ability to engage in certain activities; our intention not to pay dividends in the near future; and our failure to maintain appropriate

internal controls in the future.

Other important risk factors that could affect the outcome of the events set forth in this

presentation and that could affect the Company’s operating results and financial condition

are discussed in Item 1A of our Annual Report on Form 10-K for the fiscal year ended December 31, 2011, and in the Company’s subsequent

filings with the SEC made prior to or after the date hereof. Such statements are based on the

Company’s management’s beliefs and assumptions and on information currently available

to the Company’s management. The Company disclaims any obligation to update any forward-looking statements as a result of

developments occurring after the date of this presentation except as required by law. |

In

addition to the financial measures prepared in accordance with generally accepted accounting principles (GAAP), we use certain non-GAAP financial

measures, including adjusted EBITDA, free cash flow, and net debt. Non-GAAP

adjustments to adjusted EBITDA include: depreciation and amortization,

share-based compensation, restructuring and restatement costs, pre-petition

and post-emergence professional fees, Net income attributable to

noncontrolling interest, and other non-recurring items. Free cash flow is

defined as cash provided by (used in) operating activities less capital expenditures.

Net debt is defined as total debt less cash and cash equivalents.

Management believes non-GAAP financial measures provide meaningful supplemental

information regarding the Company’s operating results because it

excludes amounts that management does not consider part of operating results when

assessing and measuring the operational and financial performance of the

Company. Management believes non-GAAP measures allow a useful alternative for viewing operating trends and performing analytical comparisons.

Accordingly, the Company believes non-GAAP measures provide greater

transparency and insight into management’s method of analysis. While

management believes non-GAAP financial measures provide useful

information, these are not measures under U.S. GAAP, and therefore, should not be

considered in isolation from, or as a substitute for, GAAP financial measures such

as income from operations or net income. Non-GAAP

financial

measures

are

also

used

by

our

management

to

evaluate

our

operating

performance,

communicate

our

financial

results

to

our Board of

Directors, benchmark our operating results against our historical performance and

the performance of our peers, evaluate investment opportunities including

acquisitions and divestitures, and determine the bonus payments for senior

management and other employees. Use of Non-GAAP Financial Measures

15 |

16

Six Months ended

Twelve Months Ended

June 29, 2012

December 31, 2011

December 31, 2010

(in thousands of dollars)

Income from operations (GAAP)

$ 7,918

$ 35,848

$ 36,027

Depreciation and amortization

6,930

14,467

14,687

Share-based compensation

2,323

3,276

1,871

Restructuring, restatement and other nonrecurring costs (a)

4,668

2,406

3,319

Net income attributable to noncontrolling interest

(26)

(28)

(48)

Adjusted EBITDA (Non-GAAP)

$ 21,813

$ 55,969

$ 55,856

Non-GAAP Adjusted EBITDA Reconciliation

(a)

Restructuring,

restatement

and

other

nonrecurring

costs

Includes

restructuring

costs,

pre-petition

and

post-emergence

professional

fees

associated

with

our

bankruptcy proceedings and fees related to third parties for services performed in

connection with the review and investigation of revenue transactions examined and

the restatement of the Company’s 2004 through 2008 financial statements.

|

Non-GAAP Net Debt & Leverage Ratios Reconciliation

Six Months Ended

Six Months Ended

Twelve Months Ended

Twelve Months Ended

June 29, 2012

June 29, 2012

December 31, 2011

December 31, 2011

December 31, 2010

December 31, 2010

(in thousands of dollars, except ratio information)

(in thousands of dollars, except ratio information)

Debt

Debt

($53,000)

($53,000)

($68,000)

($68,000)

($107,575)

($107,575)

Less: cash and cash equivalents

Less: cash and cash equivalents

55,758

55,758

54,835

54,835

56,781

56,781

Net Debt (Non-GAAP) (a)

$2,758

$2,758

($13,165)

($13,165)

($50,794)

($50,794)

Total Debt

Total Debt

($53,000)

($53,000)

($68,000)

($68,000)

($107,575)

($107,575)

Adjusted EBITDA (non-GAAP) (b)

$21,813

$21,813

$55,969

$55,969

$55,856

$55,856

Total Debt/Adjusted EBITDA

Total Debt/Adjusted EBITDA

2.4

2.4

1.2

1.2

1.9

1.9

Total Equity

Total Equity

$218,280

$218,280

$209,360

$209,360

$178,678

$178,678

Total Debt/Total Equity

Total Debt/Total Equity

24%

24%

32%

32%

60%

60%

(a)

(a)

Net debt is defined as total debt less cash and cash equivalents.

(b)

(b)

For a definition of Adjusted EBITDA, refer to the Non-GAAP Adjusted EBITDA

Reconciliation page. 17 |

Non-GAAP Free Cash Flow Reconciliation*

18

Six Months Ended

Twelve Months Ended

June 29, 2012

December 31, 2011

December 31, 2010

(in thousands of dollars)

Cash provided by (used in) operating activities

$18,851

$45,173

($4,738)

Less: Capital expenditures

2,625

4,217

2,659

Free Cash Flow (Non-GAAP)

$16,226

$40,956

($7,397)

* Free Cash Flow includes the cash flows of Continuing and Discontinued

Operations |